Current Report Filing (8-k)

May 15 2018 - 4:23PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported):

May 9, 2018

Ekso Bionics Holdings, Inc.

(Exact Name of Registrant as specified in

its charter)

|

Nevada

|

|

001-37854

|

|

99-0367049

|

|

(State or Other Jurisdiction

of Incorporation)

|

|

(Commission File Number)

|

|

(IRS Employer

Identification No.)

|

1414 Harbour Way South, Suite 1201

Richmond, California 94804

(Address of principal executive offices,

including zip code)

(510) 984-1761

(Registrant’s telephone number, including

area code)

Not Applicable

(Registrant’s former name or former

address, if changed since last report)

Check the appropriate box below if the

Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions

(

see

General Instruction A.2. below):

|

|

¨

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

¨

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

¨

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

¨

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2

of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company

¨

If an emerging growth company, indicate

by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial

accounting standards provided pursuant to Section 13(a) of the Exchange Act.

¨

|

Item 5.02

|

Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

|

Departure of Chief Marketing Officer

Effective May 15, 2018, Gregory Davault

resigned as the Chief Marketing Officer of Ekso Bionics Holdings, Inc. (the “Company”) and from all other positions

with the Company and its subsidiaries.

In connection with Mr. Devault’s resignation,

the Company has entered into a Separation Agreement and Full Release of All Claims dated May 9, 2018 (the “Separation Agreement”)

with Mr. Davault to memorialize the parties’ mutual and full agreement with respect to Mr. Davault’s separation.

The Separation Agreement provides, among

other things, that (a) Mr. Davault resigned from his position as the Chief Marketing Officer of the Company and from all other

positions he had with the Company or any of its subsidiaries; (b) the Company will pay Mr. Davault $27,922.40, less applicable

withholdings and deductions, as final payment of all wages, salary, bonuses, commissions, reimbursable expense, accrued vacation

and any similar payments due to Mr. Davault; (c) the Company will pay Mr. Davault an aggregate lump sum cash amount of $85,950

in severance on the effective date of his separation, which amount represents continued base salary and reimbursement for insurance

premiums for four months and the partial current value of equity awards that would have otherwise vested through April 20, 2019

had Mr. Davault continued to provide services to the Company through such date; (d) the Company will accelerate the vesting of

Mr. Davault’s previously-granted stock options such that the portion that would have become vested or exercisable during

the Separation Period will vest and become exercisable on May 15, 2018, and all exercisable stock options will remain exercisable

until May 15, 2023 or, if earlier, until the latest date that such stock options could have been exercised under the terms of the

original award; (e) Mr. Davault will remain subject to the restrictions concerning interference with business, use of confidential

and proprietary information, assignment of inventions and patents and confidentiality provided in written agreements with the Company;

(f) Mr. Davault will cooperate with the Company and its accountants and legal advisors during the Separation Period in order to

facilitate a smooth transition; (g) Mr. Davault will not disparage the Company, its subsidiaries or any of their products, services,

officers or directors; and (h) Mr. Davault releases and waives any claims against the Company, its subsidiaries and their representatives

related to his employment by and his separation from the Company.

The foregoing summary of the Separation

Agreement does not purport to be complete and is subject to, and qualified in its entirety by, the full text of the Separation

Agreement, which is attached as Exhibit 99.1 and incorporated herein by reference.

|

Item 9.01

|

Financial Statements and Exhibits

|

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto

duly authorized.

|

|

EKSO BIONICS HOLDINGS, INC.

|

|

|

|

|

|

|

|

|

|

|

By:

|

/s/ Maximilian Scheder-Bieschin

|

|

|

Name:

|

Maximilian Scheder-Bieschin

|

|

|

Title:

|

Chief Financial Officer

|

Dated: May 15, 2018

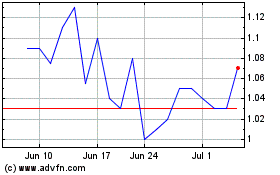

Ekso Bionics (NASDAQ:EKSO)

Historical Stock Chart

From Mar 2024 to Apr 2024

Ekso Bionics (NASDAQ:EKSO)

Historical Stock Chart

From Apr 2023 to Apr 2024