CVD Equipment Corporation (NASDAQ:CVV), a leading provider of

chemical vapor deposition systems, today announced its first

quarter 2018 financial results.

“In the first quarter, we continued to execute on the core

segment of our growth strategy by increasing our investment in the

development of our new CVD Materials facility,” said Len Rosenbaum,

President and Chief Executive Officer. “The new facility will

provide a cost-effective infrastructure to utilize the latest

technology to produce high quality materials for aerospace, medical

and electronic applications. We also further strengthened our

senior leadership team and increased our focus on sales to expand

and commercialize our exciting new technologies.”

Revenue for the first quarter was $9.2 million, compared to $9.8

million in the prior quarter and $9.7 million from the same period

last year. Net income for the first quarter was $0.6 million

compared to $1.6 million in the prior quarter and $1.0 million a

year ago. The reduction in net income is primarily a result of the

ongoing investment in the Materials business, the development of

the new facility, and shifting some engineering and production

personnel to the planning, outfitting and building of equipment for

the new facility. Net earnings per diluted share were $0.09

compared to $0.24 in the fourth quarter of 2017 and $0.16 a year

ago. Backlog as of March 31, 2018 was $9.8 million compared to

$15.5 million on December 31, 2017.

CVD’s significant investment in the Materials facility will

transform the Company over the long term: 1) CVD holds the

proprietary knowledge and has the capability to build the

production systems required to meet demand; 2) CVD possesses the

intimate knowledge necessary to operate the systems in a

cost-effective manner, providing a significant operational and

financial competitive advantage; and 3) CVD is well capitalized to

invest in the overhead and capital expenses required to take the

Company to the next level. Execution of this growth strategy should

provide an additional, diverse and stable revenue stream that

should significantly improve growth and profitability over the

long-term.

The Company will hold a conference call to discuss its results

today at 4:30 pm (Eastern Time). To participate in the live

conference call, please dial toll free (877) 407-0784 or

International (201) 689-8560. A telephone replay will be available

for 7 days following the call. To access the replay, dial (844)

512-2921 or (412) 317-6671. The replay passcode is 13679606. A live

and archived webcast of the call is also available on the Company’s

website at:

www.cvdequipment.com/event/first-quarter-2018-earnings-conference-call/.

About CVD Equipment Corporation

CVD Equipment Corporation (NASDAQ:CVV) designs, develops, and

manufactures a broad range of chemical vapor deposition, gas

control, and other state-of-the-art equipment and process solutions

used to develop and manufacture materials and coatings for research

and industrial applications. This equipment is used by its

customers to research, design, and manufacture these materials or

coatings for aerospace engine components, medical implants,

semiconductors, solar cells, smart glass, carbon nanotubes,

nanowires, LEDs, MEMS, and other applications. Through its

application laboratory, the Company provides process development

support and process startup assistance with the focus on enabling

tomorrow’s technologies™. It’s wholly owned subsidiary CVD

Materials Corporation provides advanced materials and metal surface

treatments and coatings to serve demanding applications in the

electronic, biomedical, petroleum, pharmaceutical, and many other

industrial markets.

The Private Securities Litigation Reform Act of 1995 provides a

“safe harbor” for forward-looking statements. Certain information

included in this press release (as well as information included in

oral statements or other written statements made or to be made by

CVD Equipment Corporation) contains statements that are

forward-looking. All statements other than statements of historical

fact are hereby identified as “forward-looking statements, “as such

term is defined in Section 27A of the Securities Exchange Act of

1933, as amended, and Section 21E of the Securities Exchange Act of

1934, as amended. Such forward looking information involves a

number of known and unknown risks and uncertainties that could

cause actual results to differ materially from those discussed or

anticipated by management. Potential risks and uncertainties

include, among other factors, conditions, success of CVD Equipment

Corporation’s growth and sales strategies, the possibility of

customer changes in delivery schedules, cancellation of orders,

potential delays in product shipments, delays in obtaining

inventory parts from suppliers and failure to satisfy customer

acceptance requirements.

CVD Equipment Corporation and

Subsidiaries

Condensed Consolidated Statements of

Operations

(In thousands)

Three Months Ended March 31

2018

2017

Revenue $ 9,154 $ 9,651 Gross profit 3,761 5,480

Operating expenses

2,850

2,454

Operating income 911 1,717 Net income 558 1,708 Diluted earnings

per share $ 0.09 $ 0.16

CVD Equipment Corporation and

Subsidiaries

Condensed Consolidated Balance Sheets

(In thousands)

March 31, 2018 December 31, 2017

Assets Current assets: Cash and cash equivalents $

13,135

$

14,211

Accounts Receivable, net 8,979 2,059 Contract assets 3,719 8,397

Inventories 2,730 2,966 Other current assets 221

167 Total current assets 28,784 27,800

Property, plant and equipment, net 29,504 28,839 Deferred taxes

1,611 1,690 Other assets 206 68 Intangible assets 536

662

Total assets $ 60,641

$ 58,978

Liabilities and stockholders'

equity Current liabilities: Accounts payable $ 1,104 $ 1,175

Accrued expenses and other current liabilities 2,563 2,739 Current

portion of long-term debt 651 647 Current portion acquisition

related contingent payments 100 100 Contract liabilities 1,515 466

Deferred revenue 533 292 Total current liabilities

6,466

5,419

Long-term acquisition related contingent payments

200 200 Long-term debt,

net of current portion 12,540

12,705 Long-term debt 12,740

12,905

Total liabilities 19,206 18,324

Total stockholders' equity 41,435

40,654

Total liabilities and stockholders'

equity $ 60,641 $ 58,978

Earnings release should be read in conjunction

with Company’s Annual Report on Form 10-K for fiscal year ended

December 31, 2017

View source

version on businesswire.com: https://www.businesswire.com/news/home/20180515006311/en/

For further information about CVD Equipment Corporation:Gina

Franco, 631-981-7081Fax:

631-981-7095investorrelations@cvdequipment.com

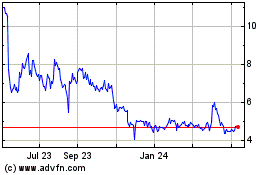

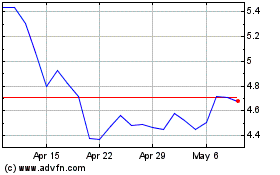

CVD Equipment (NASDAQ:CVV)

Historical Stock Chart

From Mar 2024 to Apr 2024

CVD Equipment (NASDAQ:CVV)

Historical Stock Chart

From Apr 2023 to Apr 2024