Innovative Solutions & Support, Inc. (“IS&S” or the

“Company”) (ISSC) today announced its financial results for the

second quarter of fiscal 2018 ended March 31, 2018.

For the second quarter of fiscal 2018, the Company reported net

sales of $3.7 million, compared to second quarter fiscal 2017 sales

of $4.7 million. The Company reported a net loss of $1.3 million,

or ($0.08) per share, for the second quarter of 2018 compared to

net income of $5.9 million, or $0.35 per share, in the second

quarter a year ago. Second quarter 2017 profitability benefitted

from a $3.6 million reduction to selling, general and

administrative expenses as well as $4.1 million in other income,

both arising from the settlement of a lawsuit.

Geoffrey Hedrick, Chairman and Chief Executive Officer of

IS&S, said, “We continue to invest in new product research and

development which we believe will enable the Company to sustain

growth over the long term. These efforts yielded our second STC in

just the last few quarters; a standalone Autothrottle for the PC-12

that can be installed and operated without upgrading the cockpit

display system, thereby proving a highly cost-effective upgrade

solution. Work has begun on the development of a standalone

Autothrottle for the King Air, which we believe can greatly expand

our total market opportunity for Autothrottle. We expect that it

should be a straightforward task to complete the development and

obtain an STC on the King Air, which would then make IS&S the

sole source for a standalone Autothrottle for this aircraft. In the

near term we continue to focus on our strategy to increase both

revenues and backlog.”

Subsequent to March 31, 2018, the company intends to use $2.4

million of cash to acquire a King Air airplane to be used in

research and development activities.

At March 31, 2018, the Company had $23.4 million of cash on

hand.

New orders in the second quarter of fiscal 2018 were $4.2

million and backlog as of March 31, 2018 was $3.8 million. Backlog

excludes potential future sole-source production orders from

products in development under the Company’s engineering development

contracts, including the Pilatus PC-24, and the KC-46A, all of

which the Company expects to remain in production for a decade

following completion of their respective development phases. The

Company expects that these contracts will add to production sales

already in backlog.

Shahram Askarpour, President of IS&S, added, "The increase

in both revenues and backlog in the second quarter is consistent

with our expectation for steady improvement compared to the first

quarter. The number of aircraft benefitting from our many products

is increasing. Consequently, we continue to see an increase in

repeat, intra-quarter book-and-ship business from customers, as

well as solid demand for customer service arising as our installed

base of products expands. Over the last several quarters we have

maintained our commitment to research and development, which has

enabled us to introduce a number of new products, including the

first Autothrottle for turboprops integrated with our display

system, and now a standalone Autothrottle. We are confident that

our strategy to develop innovative technologies that improve

safety, situational awareness and reduce the cost of operation is

building long-term shareholder value.”

Six Months Results

Total sales for the six months ended March 31, 2018 were $6.8

million, compared to $ 8.0 million for the six months ended March

31, 2017. For the six months ended March 31, 2018, the net loss was

$2.2 million compared to net income of $4.7 million for the first

half of fiscal 2017. Six months results for fiscal 2017 reflect the

unusual items recognized in the second quarter as described

above.

Conference Call

The Company will be hosting a conference call on Thursday, May

10, 2018 at 10:00 a.m. ET to discuss these results and its business

outlook. Please use the following dial in number to register your

name and company affiliation for the conference call: 877-883-0383

and enter the PIN Number 2478592. The call will also be carried

live on the Investor Relations page of the Company web site at

www.innovative-ss.com.

About Innovative Solutions & Support, Inc.

Headquartered in Exton, Pa., Innovative Solutions & Support,

Inc. (www.innovative-ss.com) is a systems integrator that designs

and manufactures flight guidance and cockpit display systems for

Original Equipment Manufacturers (OEMs) and retrofit applications.

The company supplies integrated Flight Management Systems (FMS) and

advanced GPS receivers for precision low carbon footprint

navigation.

Certain matters contained herein that are not descriptions of

historical facts are “forward-looking” (as such term is defined in

the Private Securities Litigation Reform Act of 1995). Because such

statements include risks and uncertainties, actual results may

differ materially from those expressed or implied by such

forward-looking statements. Factors that could cause results to

differ materially from those expressed or implied by such

forward-looking statements include, but are not limited to, those

discussed in filings made by the Company with the Securities and

Exchange Commission. Many of the factors that will determine the

Company’s future results are beyond the ability of management to

control or predict. Readers should not place undue reliance on

forward-looking statements, which reflect management’s views only

as of the date hereof. The Company undertakes no obligation to

revise or update any forward-looking statements, or to make any

other forward-looking statements, whether as a result of new

information, future events or otherwise.

Innovative Solutions and Support, Inc.

Consolidated Balance Sheets March 31,

September 30, 2018 2017 (unaudited)

ASSETS

Current assets Cash and cash equivalents $ 23,438,543 $ 24,680,301

Accounts receivable 2,373,627 2,748,597 Unbilled receivables

926,629 1,480,822 Inventories 4,440,542 4,179,654 Prepaid expenses

and other current assets 951,249 1,092,064 Total

current assets 32,130,590 34,181,438 Property and equipment,

net 6,588,808 6,669,011 Other assets 185,700 187,315

Total assets $ 38,905,098 $ 41,037,764

LIABILITIES AND

SHAREHOLDERS' EQUITY

Current liabilities Accounts payable $ 1,390,535 $ 1,321,251

Accrued expenses 1,554,859 1,760,037 Deferred revenue 220,245

280,354 Total current liabilities 3,165,639 3,361,642

Non-current deferred income taxes 129,574 67,742

Total liabilities 3,295,213 3,429,384

Commitments and contingencies (See Note 6)

Shareholders' equity

Preferred stock, 10,000,000 shares

authorized, $.001 par value, of which 200,000 shares are authorized

as Class A Convertible stock. No shares issued and outstanding at

March 31, 2018 and September 30, 2017

$ - $ -

Common stock, $.001 par value: 75,000,000

shares authorized, 18,937,050 and 18,879,580 issued at March 31,

2018 and September 30, 2017, respectively

18,937 18,880 Additional paid-in capital 51,783,779

51,583,841 Retained earnings 5,175,706 7,374,196

Treasury stock, at cost, 2,096,451 shares

at March 31, 2018 and September 30, 2017

(21,368,537 ) (21,368,537 ) Total shareholders'

equity 35,609,885 37,608,380 Total liabilities and

shareholders' equity $ 38,905,098 $ 41,037,764

Innovative Solutions and Support, Inc.

Consolidated Statements of Operations (unaudited)

Three months ended Six months ended March 31, March 31,

2018 2017 2018

2017 Gross sales $ 3,727,204 $ 4,751,731 $ 6,815,188

$ 8,575,778 Returns and allowances - (97,829 )

- (556,009 ) Net Sales 3,727,204 4,653,902

6,815,188 8,019,769 Cost of sales 2,082,347

2,302,431 3,675,616 4,130,483

Gross profit 1,644,857 2,351,471 3,139,572 3,889,286

Operating expenses: Research and development 1,031,622

1,069,009 1,955,343 2,154,997 Selling, general and administrative

1,756,746 (1,703,456 ) 3,379,301

343,666 Total operating expenses 2,788,368 (634,447 )

5,334,644 2,498,663 Operating (loss) income (1,143,511 )

2,985,918 (2,195,072 ) 1,390,623 Interest income 11,681

9,947 21,305 19,823 Other income 15,664

4,140,210 37,096 4,159,326

(Loss) income before income taxes (1,116,166 ) 7,136,075 (2,136,671

) 5,569,772 Income tax expense 200,705

1,205,650 61,819 834,319

Net (loss) income $ (1,316,871 ) $ 5,930,425 $ (2,198,490 )

$ 4,735,453 Net loss per common share: Basic $ (0.08

) $ 0.35 $ (0.13 ) $ 0.28 Diluted $ (0.08 ) $ 0.35

$ (0.13 ) $ 0.28 Weighted average shares

outstanding: Basic

16,800,244

16,735,503 16,791,687

16,725,759 Diluted

16,800,244 16,847,059

16,791,687

16,835,756

View source

version on businesswire.com: https://www.businesswire.com/news/home/20180509006467/en/

Innovative Solutions & Support, Inc.Relland WinandChief

Financial Officer610-646-0350rwinand@innovative-ss.com

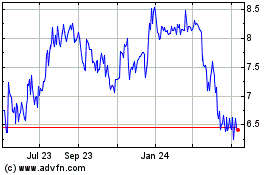

Innovative Solutions and... (NASDAQ:ISSC)

Historical Stock Chart

From Mar 2024 to Apr 2024

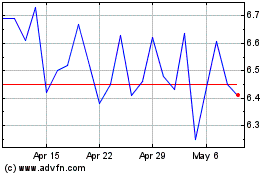

Innovative Solutions and... (NASDAQ:ISSC)

Historical Stock Chart

From Apr 2023 to Apr 2024