Budweiser, Bud Light Volumes Fall Sharply in U.S. but AB InBev Squeezes Costs -- Update

May 09 2018 - 6:41AM

Dow Jones News

By Nick Kostov

Big brewers are losing their grip on America's beer belly.

Anheuser-Busch InBev SA, which makes Budweiser, Bud Light and

Stella Artois, said Wednesday overall sales volume in North America

fell 4.1% over the first three months of the year from a year

earlier, due largely to declines in Bud Light and Budweiser. Molson

Coors Brewing Co. said last week that it also struggled, losing

3.8% in brand volume in the U.S., while beer volume at Heineken

NV's U.S. unit declined by a high single-digit percentage in the

first quarter.

The U.S. has been turning away from big beer for years, but

brewers say demand was even more anemic than expected in the first

quarter.

Sales to wholesalers in the U.S. at AB InBev were down 4.4%,

with revenue decreasing 2.5% in the first quarter. The brewer

estimated that sales to retailers declined 2.3% across the industry

in the first quarter.

The silver lining for AB InBev in North America is that its

revenue per hectoliter grew 1.9% over the period as management kept

a tight lid on costs and consumers paid more for their brews.

Shares rose 3% in morning trading in Europe.

"While we acknowledge we still have work to do in the U.S., we

are moving in the right direction," Chief Financial Officer Felipe

Dutra told reporters.

Michelob Ultra -- marketed as the beer for people with an active

lifestyle -- continued to perform well, AB InBev said, as did

Stella Artois, which continued to gain share in the so-called

"above premium category." The company said its portfolio of beers

it markets as craft beer also performed well.

But the brewer's Budweiser and Bud Light brands continued to

lose market share in the U.S. Overall, the company estimated it

lost half a percentage point of market share in the quarter.

Speaking on a call with reporters, Mr. Dutra said AB InBev had

lost market share because a large part of its business is in

declining categories, rather than growing segments of the market

like craft beer. Executives at the company have been trying to

boost profits and margins by persuading consumers to buy more

expensive beers. The company recently rolled out Michelob Ultra

Pure Gold, made with organic grains, as well as Bud Light Orange

and a "refreshed" Bud Light Lime, which are both brewed with real

citrus peels.

Globally, AB InBev said earnings before interest, taxes,

depreciation and amortization -- a key measure watched by analysts

-- rose 6.6% to $4.99 billion in the first quarter, topping analyst

expectations of a 4.7% rise.

In the U.S., a rise in the price of hedging aluminum and

increased freight costs led to margin contraction and a 5% decline

in Ebitda, although Mr. Dutra said that "underlying beer trends

remain unchanged."

The Leuven, Belgium-based brewer said beer volumes grew strongly

in Mexico, Colombia and Argentina, but declined in Brazil, its

second-largest market, as well as the U.S. The brewer had flagged

that the first quarter was likely to be weak, in part because of an

early end to Carnival season in the Latin American country and

increased sales and marketing spending tied to the coming soccer

World Cup in Russia.

Revenue increased to $13.07 billion from $12.92 billion. Net

profit decreased to $1.02 billion from $1.40 billion.

Mr. Dutra said that the first quarter "was better than we

initially expected" and that growth should accelerate through the

rest of the year, particularly in the second half.

The company said it found another $160 million of cost savings

tied to its almost $100 billion acquisition of SABMiller, bringing

the total to $2.29 billion since it completed the deal in October

2016.

Write to Nick Kostov at Nick.Kostov@wsj.com

(END) Dow Jones Newswires

May 09, 2018 06:26 ET (10:26 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

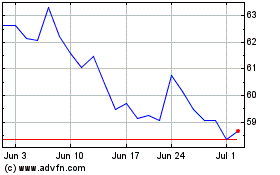

Anheuser Busch Inbev SA NV (NYSE:BUD)

Historical Stock Chart

From Mar 2024 to Apr 2024

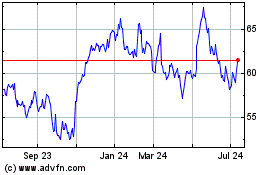

Anheuser Busch Inbev SA NV (NYSE:BUD)

Historical Stock Chart

From Apr 2023 to Apr 2024