Recent Acquisitions and Traditional Business

Drive Growth

American Vanguard Corporation (NYSE:AVD) today announced

financial results for the quarter ended March 31, 2018.

Financial Highlights Fiscal 2018 First Quarter – versus

Fiscal 2017 First Quarter

- Net sales of $104.1 million in 2018,

compared to $70.7 million in 2017

- Net income of $4.66 million in 2018,

compared to $3.45 million in 2017

- EBITDA1 of $13.3 million in 2018,

compared to $10.5 million in 2017

- Earnings per diluted share of $0.16 in

2018, compared to $0.12 in 2017

Eric Wintemute, Chairman and CEO of American Vanguard commented,

“Our overall financial performance for this year’s first quarter

improved significantly, aided by our 2017 product and company

acquisitions as well as our diversified participation in many

markets. Net sales rose 47%, driven by a 41% increase attributable

to acquisitions and a 6% gain in AMVAC’s traditional base business.

Our domestic sales experienced solid performance from granular soil

insecticides, herbicides, and soil fumigants. Further, our

international business grew significantly with the inclusion of

AgriCenter’s Central American franchise.”

Mr. Wintemute continued, “Gross profit increased as a result of

improved factory performance, organic growth in the Company’s sales

and the addition of products and businesses acquired during 2017.

As we anticipated in our last conference call, gross margins

decreased slightly due to a product mix influenced by the

AgriCenter distribution business. Our operating expenses declined

as a percentage of sales, but rose on an absolute basis, as we

integrated acquired businesses, made new product introductions,

funded regulatory defense of important products, incurred bulk

freight costs to meet strong soil fumigant demand and advanced the

development of our SIMPAS precision application technology. With

modest interest expenses and a reduced tax rate, we posted a 35%

year-over-year increase in net income and a 27% increase in

EBITDA,2 as compared to the first quarter of 2017.”

Mr. Wintemute concluded, “During the balance of 2018, we expect

continued growth in our herbicide products, our Central American

region and our non-crop business. We also anticipate strong demand

for our products in cotton, fruit and vegetables, strong sales of

our Dibrom® mosquito adulticide in light of predicted Gulf Coast

hurricane activity and stable demand for our corn products in spite

of weather-related delays in Midwest planting. In addition, we are

scheduled to introduce several new products from our development

pipeline. We look forward to providing further detail on our

financial performance, market outlook and future initiatives during

our upcoming conference call.”

Conference Call

Eric Wintemute, Chairman & CEO, Bob Trogele EVP & COO

and David T. Johnson, VP & CFO, will conduct a conference call

focusing on the financial results at 4:30 pm ET / 1:30 pm PT on

Tuesday, May 8, 2018. Interested parties may participate in the

call by dialing (201) 493-6744 – please dial in 10 minutes before

the call is scheduled to begin, and ask for the American Vanguard

call. The conference call will also be webcast live via the News

and Media section of the Company’s web site at

www.american-vanguard.com. To listen to the live webcast, go to the

web site at least 15 minutes early to register, download and

install any necessary audio software. If you are unable to listen

live, the conference call will be archived on the Company’s web

site.

About American Vanguard

American Vanguard Corporation is a diversified specialty and

agricultural products company that develops and markets products

for crop protection and management, turf and ornamentals management

and public and animal health. American Vanguard is included on the

Russell 2000® and Russell 3000® Indexes and the Standard &

Poor’s Small Cap 600 Index. To learn more about American Vanguard,

please reference the Company’s web site at

www.american-vanguard.com.

The Company, from time to time, may discuss forward-looking

information. Except for the historical information contained in

this release, all forward-looking statements are estimates by the

Company’s management and are subject to various risks and

uncertainties that may cause results to differ from management’s

current expectations. Such factors include weather conditions,

changes in regulatory policy and other risks as detailed from

time-to-time in the Company’s SEC reports and filings. All

forward-looking statements, if any, in this release represent the

Company’s judgment as of the date of this release.

____________

1 Earnings before interest, taxes, depreciation and amortization.

EBITDA is not a financial measure calculated and presented in

accordance with U.S. generally accepted accounting principles

(GAAP) and should not be considered as an alternative to net income

(loss), operating income (loss) or any other financial measures so

calculated and presented, nor as an alternative to cash flow from

operating activities as a measure of liquidity. The items excluded

from EBITDA are detailed in the reconciliation attached to this

news release. Other companies (including the Company’s competitors)

may define EBITDA differently. 2 The Company believes that use of

EBITDA is useful to investors in that it is one of the primary

bases upon which borrowing capacity is calculated under the

Company’s senior credit facility, it gives investors a sense of the

Company’s financial condition and results of operations without

giving effect to the cost of increased acquisition activity in 2017

and it is commonly used by investors and others as a basis for

supporting overall business valuations. Nevertheless, investors

should not consider EBITDA in isolation or as a substitute for

analysis of the Company’s results as reported in accordance with

GAAP.

AMERICAN VANGUARD CORPORATION AND

SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE

SHEETS

(In thousands, except share

data)

(Unaudited)

ASSETS

March

31,

December 31, 2018 2017 Current assets: Cash

and cash equivalents $ 13,018 $ 11,337 Receivables: Trade, net of

allowance for doubtful accounts of $298 and $46, respectively

111,638 102,534 Other 10,765 7,071 Total receivables,

net 122,403 109,605 Inventories 143,231 123,124 Prepaid expenses

11,390 10,817 Total current assets 290,042 254,883

Property, plant and equipment, net 48,579 49,321 Intangible assets,

net of applicable amortization 178,283 180,950 Goodwill 22,983

22,184 Other assets 26,906 28,254 Total assets $

566,793 $ 535,592

LIABILITIES AND STOCKHOLDERS’

EQUITY Current liabilities: Current installments of other

liabilities $ 5,475 $ 5,395 Accounts payable 63,820 53,748 Deferred

revenue 11,858 14,574 Accrued program costs 43,688 39,054 Accrued

expenses and other payables 9,011 12,061 Income taxes payable

880 1,370 Total current liabilities 134,732 126,202

Long-term debt, net 90,325 77,486 Other liabilities, excluding

current installments 10,328 10,306 Deferred income tax liabilities

17,250 16,284 Total liabilities 252,635

230,278 Commitments and contingent liabilities Stockholders'

equity: Preferred stock, $.10 par value per share; authorized

400,000 shares; none issued — — Common stock, $.10 par value per

share; authorized 40,000,000 shares; issued 32,668,923 shares at

March 31, 2018 and 32,241,866 shares at December 31, 2017 3,267

3,225 Additional paid-in capital 77,735 75,658 Accumulated other

comprehensive loss (3,835 ) (4,507 ) Retained earnings 245,056

238,953 Less treasury stock at cost, 2,450,634 shares at March 31,

2018 and

December 31, 2017

(8,269 ) (8,269 ) American Vanguard Corporation

stockholders’ equity 313,954 305,060 Non-controlling interest

204 254 Total stockholders’ equity 314,158

305,314 Total liabilities and stockholders' equity $ 566,793

$ 535,592

AMERICAN VANGUARD CORPORATION AND

SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF

OPERATIONS

(In thousands, except per share

data)

(Unaudited)

For the three months

ended March 31

2018 2017 Net sales $ 104,108 $ 70,673

Cost of sales 63,057 40,589 Gross profit 41,051

30,084 Operating expenses 33,700 24,951 Operating

income 7,351 5,133 Interest expense, net 837 298

Income before provision for income taxes and loss on equity method

investments 6,514 4,835 Income tax expense 1,692

1,380 Income before loss on equity method investments 4,822 3,455

Loss from equity method investments 217 42 Net income

4,605 3,413 Loss attributable to non-controlling interest 50

39 Net income attributable to American Vanguard $ 4,655 $

3,452 Earnings per common share—basic $ 0.16 $ 0.12 Earnings per

common share—assuming dilution $ 0.16 $ 0.12 Weighted average

shares outstanding—basic 29,282 28,947 Weighted

average shares outstanding—assuming dilution 29,972

29,654

ANALYSIS OF SALES

For the three months ended March 31,

2018 and 2017

(In thousands)

(Unaudited)

Three Months Ended

March 31

2018 2017 Net sales: Crop: Insecticides

$ 41,293 $ 37,942 Herbicides/soil fumigants/fungicides 32,185

20,021 Other, including plant growth regulators and distribution

17,840 3,392 91,318 61,355 Non-crop, including

distribution 12,790 9,318 Total net sales: $ 104,108

$ 70,673 Net sales: US $ 69,815 $ 52,244 International

34,293 18,429 Total net sales: $ 104,108 $ 70,673

AMERICAN VANGUARD CORPORATION AND

SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF

CASH FLOWS

(In thousands)

(Unaudited)

For the three months

ended March 31

2018 2017 Cash flows from operating

activities: Net income $ 4,605 $ 3,413 Adjustments to reconcile net

income to net cash provided by (used in) operating

activities:

Depreciation and amortization of fixed and intangible assets 4,983

3,939 Amortization of other long term assets 1,163 1,423

Amortization of discounted liabilities 102 6 Stock-based

compensation 1,309 1,080 Increase in deferred income taxes — 8

Operating loss from equity method investment 217 42 Changes in

assets and liabilities associated with operations: (Increase)

decrease in net receivables (9,303 ) 11,422 Increase in inventories

(19,558 ) (1,366 ) Increase in prepaid expenses and other assets

(562 ) (1,126 ) (Increase) decrease in income tax

receivable/payable, net (497 ) 793 Increase (decrease) in accounts

payable 9,613 (3,025 ) Decrease in deferred revenue (2,740 ) (394 )

Increase in accrued program costs 4,634 6,612 Decrease in other

payables and accrued expenses (3,201 ) (5,657 ) Net

cash (used in) provided by operating activities (9,235 )

17,170 Cash flows from investing activities: Capital

expenditures (1,553 ) (3,080 ) Acquisitions of businesses and

intangible assets (815 ) (300 ) Net cash used in

investing activities (2,368 ) (3,380 ) Cash flows

from financing activities: Payments under line of credit agreement

(23,000 ) (27,000 ) Borrowings under line of credit agreement

35,800 16,000 Net payments from the issuance of common stock (sale

of stock under ESPP,

exercise of stock options, and shares

purchased for tax withholdings)

810 303 Payment of cash dividends (438 ) (289 ) Net

cash provided by (used in) financing activities 13,172

(10,986 ) Net increase in cash and cash equivalents 1,569

2,804 Cash and cash equivalents at beginning of period 11,337 7,869

Effect of exchange rate changes on cash and cash equivalents

112 119 Cash and cash equivalents at end of period $ 13,018

$ 10,792

Unaudited Reconciliation of Net Income

to EBITDA

For the three months ended March 31,

2018 and March 31, 2017

(Unaudited)

March 31, 2018 March 31, 2017

Net income attributable to American Vanguard, as reported $ 4,655 $

3,452 Provision for income taxes 1,692 1,380 Interest expense, net

837 298 Depreciation and amortization 6,146 5,362

EBITDA3

$ 13,330 $ 10,492

____________

3 Earnings before interest, taxes, depreciation and amortization.

EBITDA is not a financial measure calculated and presented in

accordance with U.S. generally accepted accounting principles

(GAAP) and should not be considered as an alternative to net income

(loss), operating income (loss) or any other financial measures so

calculated and presented, nor as an alternative to cash flow from

operating activities as a measure of liquidity. The items excluded

from EBITDA are detailed in the reconciliation attached to this

news release. Other companies (including the Company’s competitors)

may define EBITDA differently.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20180508006561/en/

Company:American Vanguard CorporationWilliam A. Kuser,

949-260-1200Director of Investor

Relationswilliamk@amvac-chemical.comorInvestor

Representative:The Equity Group Inc.Lena Cati,

212-836-9611Lcati@equityny.comwww.theequitygroup.com

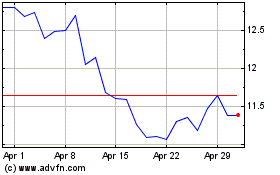

American Vanguard (NYSE:AVD)

Historical Stock Chart

From Mar 2024 to Apr 2024

American Vanguard (NYSE:AVD)

Historical Stock Chart

From Apr 2023 to Apr 2024