Sotherly Hotels Inc. (NASDAQ:SOHO), (“Sotherly” or

the “Company”), a self-managed and self-administered lodging real

estate investment trust (a “REIT”), today reported its consolidated

results for the first quarter ended March 31, 2018. The Company’s

results include the following*:

| |

|

|

| |

Three Months Ended |

|

| |

March 31, 2018 |

|

|

March 31, 2017 |

|

| |

($ in thousands except per share data) |

|

| Total

Revenue |

$ |

41,736 |

|

|

$ |

38,695 |

|

| Net (loss)

income available to common stockholders |

|

(238 |

) |

|

|

1,851 |

|

| |

|

|

|

|

|

|

|

| EBITDA |

|

10,345 |

|

|

|

9,751 |

|

| Hotel

EBITDA |

|

11,879 |

|

|

|

11,479 |

|

| |

|

|

|

|

|

|

|

| FFO |

|

4,499 |

|

|

|

5,000 |

|

| Adjusted FFO

available to common stockholders |

|

4,746 |

|

|

|

5,134 |

|

| |

|

|

|

|

|

|

|

| Net (loss)

income per share available to common stockholders |

$ |

(0.02 |

) |

|

$ |

0.13 |

|

| FFO per share

and unit |

$ |

0.29 |

|

|

$ |

0.32 |

|

| Adjusted FFO

available to common holders per share and unit |

$ |

0.31 |

|

|

$ |

0.32 |

|

| |

|

|

|

|

|

|

|

(*) Earnings before interest, taxes, depreciation and

amortization (“EBITDA”), hotel EBITDA, funds from operations

(“FFO”), adjusted FFO, FFO per share and unit and adjusted FFO per

share and unit are non-GAAP financial measures. See further

discussion of these non-GAAP measures, including definitions

related thereto, and reconciliations to net income (loss) later in

this press release. The Company is the sole general partner of

Sotherly Hotels LP, a Delaware limited partnership (the “Operating

Partnership”), and all references in this release to the “Company”,

“Sotherly”, “we”, “us” and “our” refer to Sotherly Hotels Inc., its

Operating Partnership and its subsidiaries and predecessors, unless

the context otherwise requires or where otherwise indicated.

HIGHLIGHTS:

- Revenue and RevPAR. For the three-month

period ending March 31, 2018, Total Revenue increased 7.9% over the

three-month period ending March 31, 2017. Room revenue per

available room (“RevPAR”) for the Company’s composite portfolio,

which includes the performance of the rooms participating in our

rental program at the Hyde Resort & Residences, during the

three-month period ending March 31, 2018, increased 6.6% over the

three months ended March 31, 2017, to $112.03 reflecting a 4.6%

decrease in occupancy and an 11.8% increase in average daily rate

(“ADR”).

- Common Dividends. As previously reported on

May 1, 2018, the Company announced its quarterly dividend

(distribution) on its common stock (and units) of $0.12 per share

(and unit) to stockholders (and unitholders) of record as of June

15, 2018.

- Hotel EBITDA. The Company generated hotel

EBITDA of approximately $11.9 million during the three-month period

ending March 31, 2018, an increase of 3.5%, or approximately $0.4

million, from the three months ended March 31, 2017.

- EBITDA. The Company generated EBITDA of

approximately $10.3 million during the three-month period ending

March 31, 2018, an increase of 6.1% or approximately $0.6 million

compared to the three months ended March 31, 2017.

- Adjusted FFO. For the three-month period

ending March 31, 2018, Adjusted FFO decreased 7.5% or approximately

$0.4 million from the three months ended March 31, 2017.

Andrew M. Sims, Chairman and Chief Executive Officer of Sotherly

Hotels Inc., commented, “The first quarter of 2018 started out

slow, with January showing weakness, followed by a steady increase

in business volume during February and March. With Easter

week occurring in the first quarter this year, some revenue

migrated to the second quarter. We believe the first half of

2018 will be strong in terms of performance for the Company.

The acquisition of the Hyatt Centric Arlington is a nice addition

to the Company’s upper upscale portfolio.”

Balance Sheet/Liquidity

At March 31, 2018, the Company had approximately $35.6 million

of available cash and cash equivalents, of which approximately $4.9

million was reserved for real estate taxes, insurance, capital

improvements and certain other expenses or otherwise restricted.

The Company had approximately $380.7 million in outstanding debt at

a weighted average interest rate of approximately 4.94%.

On February 1, 2018, the Company drew down the final $5.0

million of loan proceeds available on the Hilton Wilmington

Riverside mortgage loan after completing a significant portion of

the renovation of the hotel and meeting certain other requirements

under the loan documents.

On February 12, 2018, the Company and the Operating Partnership

closed on a sale and issuance by the Operating Partnership of an

aggregate $25.0 million of the 7.25% senior unsecured notes of the

Operating Partnership, unconditionally guaranteed by the Company

(the “7.25% Notes”), for net proceeds after estimated expenses of

approximately $23.3 million. The Operating Partnership used

the net proceeds from this offering, together with existing cash on

hand and $57.0 million of first and second lien asset-level

mortgage indebtedness, to finance the acquisition of the Hyatt

Centric Arlington hotel located in Arlington, Virginia (the

“Arlington Hotel”) and for working capital.

On February 26, 2018, we entered into a First Amendment to the

Loan Agreement, Amended and Restated Promissory Note, and other

related documents with International Bank of Commerce to amend the

terms of the mortgage loan on The Whitehall hotel located in

Houston, TX. Pursuant to the amended loan documents, the

maturity date is extended until February 26, 2023, the loan

amortizes on a 25-year schedule with payments of principal and

interest beginning immediately, and the loan has an initial

principal balance of $15.0 million, with no additional principal

available.

On April 5, 2018, the Company drew down an additional $3.30

million of loan proceeds available on the Crowne Plaza Tampa

Westshore mortgage loan.

Portfolio Update

On March 1, 2018, we acquired the Arlington Hotel from RP/HH

Rosslyn Hotel Owner, LP for an aggregate purchase price of

approximately $79.7 million. Concurrent with the closing, we

entered into an agreement with Highgate Hotels L.P. to manage the

Arlington Hotel. The management agreement has an initial term

of three years commencing on March 1, 2018. In connection

with the acquisition, we entered into a loan agreement, a first and

second promissory note (“Note A” and “Note B”,

respectively), and other loan documents, including a

guarantee by the Operating Partnership, to secure an aggregate

$57.0 million mortgage (the “Mortgage Loan”) on the Arlington Hotel

with Fifth Third Bank. Pursuant to the Mortgage Loan

documents, Note A is in the amount of $50.0 million; has a term of

3 years, with two 1-year extension options, each of which is

subject to certain criteria and bears a floating interest rate of

one-month LIBOR plus 3.00%. Pursuant to the Mortgage

Loan documents, Note B is in the amount of $7.0 million; has a term

of 1-year, with two 1-year extension options, each of which is

subject to certain criteria; bears a floating interest rate of

three-month LIBOR plus 5.00%; and requires monthly principal

payments of $100,000 during the initial 1-year term, $150,000

during the first 1-year extended term, and $250,000 during the

second 1-year extended term, with interest payments due monthly on

the outstanding principal amount during all three terms.

On April 2, 2018, the Company’s hotel in Wilmington, North

Carolina was converted to the Hotel Ballast, a member of the

Tapestry Collection by Hilton, following the completion of a $10.0

million renovation of the guest rooms and public space, which

included the addition of two new food and beverage outlets the

Board & Barrel Coastal Kitchen and the Buffalo Bayou.

At the Company’s hotel in Tampa, Florida, renovations are

underway for an estimated $11.0 million renovation project in

anticipation of a planned conversion in March 2019 from the Crowne

Plaza Tampa Westshore to Hotel Alba, which we expect to become a

member of the Tapestry Collection by Hilton. As of March 31,

2018, we incurred costs totaling approximately $1.3 million toward

this renovation.

2018 Outlook

As previously disclosed, set forth below is the Company’s

guidance for 2018, which accounts for the impact of renovations at

the Company’s hotels in Wilmington and Tampa, the issuance of the

7.25% Notes, and the acquisition of the Arlington Hotel. The

guidance is predicated on estimates of occupancy and ADR that are

consistent with the most recent 2018 calendar year forecasts by STR

for the market segments in which the Company operates.

The table below reflects the Company’s projections, within a

range, of various financial measures for 2018, in thousands of

dollars, except per share and RevPAR data:

| |

|

|

| |

2018 Guidance |

|

| |

Low Range |

|

|

High Range |

|

| |

|

|

| Total

revenue |

$ |

167,750 |

|

|

$ |

169,095 |

|

| Net loss |

|

(2,804 |

) |

|

|

(2,352 |

) |

| |

|

|

|

|

|

|

|

| EBITDA |

|

40,997 |

|

|

|

41,481 |

|

| Hotel

EBITDA |

|

46,997 |

|

|

|

47,581 |

|

| |

|

|

|

|

|

|

|

| FFO |

|

15,843 |

|

|

|

16,352 |

|

| Adjusted FFO

available to common stockholders |

|

15,873 |

|

|

|

16,493 |

|

| |

|

|

|

|

|

|

|

| Net loss per

share available to common stockholders |

$ |

(0.21 |

) |

|

$ |

(0.17 |

) |

| FFO per share

and unit |

$ |

1.04 |

|

|

$ |

1.07 |

|

| Adjusted FFO

available to common holders per share and unit |

$ |

1.04 |

|

|

$ |

1.08 |

|

| Rev PAR |

$ |

106.23 |

|

|

$ |

107.09 |

|

| Hotel EBITDA

margin |

|

31.4 |

% |

|

|

31.6 |

% |

| |

|

|

|

|

|

|

|

Earnings Call/Webcast

The Company will conduct its first quarter 2018 conference call

for investors and other interested parties at 10:00 a.m. Eastern

Time on Tuesday, May 8, 2018. The conference call will be

accessible by telephone and through the Internet. Interested

individuals are invited to listen to the call by telephone at

888-339-0107 (United States) or 855-669-9657 (Canada) or +1

412-902-4188 (International). To participate on the webcast, log on

to www.sotherlyhotels.com at least 15 minutes before the call

to download the necessary software. For those unable to listen to

the call live, a taped rebroadcast will be available beginning one

hour after completion of the live call on May 8, 2018 through May

7, 2019. To access the rebroadcast, dial 877-344-7529 and enter

conference number 10118957. A replay of the call also will be

available on the Internet at www.sotherlyhotels.com until May

7, 2019.

About Sotherly Hotels Inc.

Sotherly Hotels Inc. is a self-managed and self-administered

lodging REIT focused on the acquisition, renovation, upbranding and

repositioning of upscale to upper-upscale full-service hotels in

the Southern United States. Currently, the Company’s portfolio

consists of investments in twelve hotel properties, comprising

3,156 rooms, and an interest in the Hyde Resort & Residences, a

luxury condo hotel. Most of the Company’s properties operate under

the Hilton Worldwide, InterContinental Hotels Group and Marriott

International, Inc. brands. Sotherly Hotels Inc. was organized in

2004 and is headquartered in Williamsburg, Virginia. For more

information, please visit www.sotherlyhotels.com.

Contact at the Company:

Scott KucinskiVice President – Operations & Investor

RelationsSotherly Hotels Inc.410 West Francis StreetWilliamsburg,

Virginia 23185757.229.5648

Forward-Looking Statements

This news release includes “forward-looking statements” within

the meaning of Section 27A of the Securities Act of 1933, as

amended, and Section 21E of the Securities Exchange Act of

1934, as amended. Although the Company believes that the

expectations and assumptions reflected in the forward-looking

statements are reasonable, these statements are not guarantees of

future performance and involve certain risks, uncertainties and

assumptions which are difficult to predict and many of which are

beyond the Company’s control. Therefore, actual outcomes and

results may differ materially from what is expressed, forecasted or

implied in such forward-looking statements. Factors which could

have a material adverse effect on the Company’s future results,

performance and achievements, include, but are not limited to:

national and local economic and business conditions that affect

occupancy rates and revenues at the Company’s hotels and the demand

for hotel products and services; risks associated with the hotel

industry, including competition and new supply of hotel rooms,

increases in wages, energy costs and other operating costs; risks

associated with adverse weather conditions, including hurricanes;

the availability and terms of financing and capital and the general

volatility of the securities markets; the Company’s intent to

repurchase shares from time to time; risks associated with the

level of the Company’s indebtedness and its ability to meet

covenants in its debt agreements and, if necessary, to refinance or

seek an extension of the maturity of such indebtedness or modify

such debt agreements; management and performance of the Company’s

hotels; risks associated with maintaining our system of internal

controls; risks associated with the conflicts of interest of the

Company’s officers and directors; risks associated with

redevelopment and repositioning projects, including delays and cost

overruns; supply and demand for hotel rooms in the Company’s

current and proposed market areas; risks associated with our

ability to maintain our franchise agreements with our third party

franchisors; the Company’s ability to acquire additional properties

and the risk that potential acquisitions may not perform in

accordance with expectations; the Company’s ability to successfully

expand into new markets; legislative/regulatory changes, including

changes to laws governing taxation of REITs; the Company’s ability

to maintain its qualification as a REIT; and the Company’s ability

to maintain adequate insurance coverage. These risks and

uncertainties are described in greater detail under “Risk Factors”

in the Company’s Annual Report on Form 10-K and subsequent reports

filed with the Securities and Exchange Commission. The Company

undertakes no obligation to and does not intend to publicly update

or revise any forward-looking statement, whether as a result of new

information, future events or otherwise. Although the Company

believes its current expectations to be based upon reasonable

assumptions, it can give no assurance that its expectations will be

attained or that actual results will not differ materially.

Financial Tables Follow…

| |

| SOTHERLY HOTELS INC. |

| CONSOLIDATED BALANCE SHEETS |

| |

| |

|

March 31, 2018 |

|

|

December 31, 2017 |

|

|

|

|

(unaudited) |

|

|

|

|

|

|

ASSETS |

|

|

|

|

|

|

|

|

|

Investment in hotel properties, net |

|

$ |

438,649,721 |

|

|

$ |

357,799,512 |

|

| Cash and

cash equivalents |

|

|

30,673,556 |

|

|

|

29,777,845 |

|

|

Restricted cash |

|

|

4,901,392 |

|

|

|

3,651,197 |

|

| Accounts

receivable, net |

|

|

9,424,697 |

|

|

|

5,587,077 |

|

| Accounts

receivable - affiliate |

|

|

307,351 |

|

|

|

394,026 |

|

| Prepaid

expenses, inventory and other assets |

|

|

6,207,626 |

|

|

|

7,292,565 |

|

| Deferred

income taxes |

|

|

5,190,855 |

|

|

|

5,451,118 |

|

| TOTAL

ASSETS |

|

$ |

495,355,198 |

|

|

$ |

409,953,340 |

|

|

LIABILITIES |

|

|

|

|

|

|

|

|

| Mortgage

loans, net |

|

$ |

357,170,859 |

|

|

$ |

297,318,816 |

|

| Unsecured

notes, net |

|

|

23,530,323 |

|

|

|

- |

|

| Accounts

payable and accrued liabilities |

|

|

16,534,533 |

|

|

|

13,813,623 |

|

| Advance

deposits |

|

|

2,570,635 |

|

|

|

1,572,388 |

|

| Dividends

and distributions payable |

|

|

3,229,002 |

|

|

|

3,073,483 |

|

| TOTAL

LIABILITIES |

|

$ |

403,035,352 |

|

|

$ |

315,778,310 |

|

|

Commitments and contingencies |

|

|

— |

|

|

|

— |

|

|

EQUITY |

|

|

|

|

|

|

|

|

| Sotherly

Hotels Inc. stockholders’ equity |

|

|

|

|

|

|

|

|

| Preferred

stock, $0.01 par value, 11,000,000 shares authorized; |

|

|

|

|

|

|

|

|

| 8.0%

Series B cumulative redeemable perpetual preferred stock, |

|

|

|

|

|

|

|

|

|

liquidation preference $25 per share, 1,610,000 shares issued |

|

|

|

|

|

|

|

|

| and

outstanding at March 31, 2018 and December 31, 2017,

respectively |

|

|

16,100 |

|

|

|

16,100 |

|

| 7.875%

Series C cumulative redeemable perpetual preferred stock, |

|

|

|

|

|

|

|

|

|

liquidation preference $25 per share, 1,300,000 shares issued |

|

|

|

|

|

|

|

|

| and

outstanding at March 31, 2018 and December 31, 2017,

respectively |

|

|

13,000 |

|

|

|

13,000 |

|

| Common

stock, par value $0.01, 49,000,000 shares authorized,

14,121,081 |

|

|

|

|

|

|

|

|

| shares

and 14,078,831 shares issued and outstanding at March 31, 2018 |

|

|

|

|

|

|

|

|

| and

December 31, 2017, respectively |

|

|

141,211 |

|

|

|

140,788 |

|

|

Additional paid-in capital |

|

|

146,360,268 |

|

|

|

146,249,339 |

|

| Unearned

ESOP shares |

|

|

(4,572,942 |

) |

|

|

(4,633,112 |

) |

|

Distributions in excess of retained earnings |

|

|

(50,558,067 |

) |

|

|

(48,765,860 |

) |

| Total

Sotherly Hotels Inc. stockholders’ equity |

|

|

91,399,570 |

|

|

|

93,020,255 |

|

|

Noncontrolling interest |

|

|

920,276 |

|

|

|

1,154,775 |

|

| TOTAL

EQUITY |

|

|

92,319,846 |

|

|

|

94,175,030 |

|

| TOTAL

LIABILITIES AND EQUITY |

|

$ |

495,355,198 |

|

|

$ |

409,953,340 |

|

| |

| |

| SOTHERLY HOTELS INC. |

| CONSOLIDATED STATEMENTS OF

OPERATIONS |

| (unaudited) |

| |

|

|

|

Three Months Ended |

|

|

Three Months Ended |

|

|

|

|

March 31, 2018 |

|

|

March 31, 2017 |

|

|

|

|

|

|

|

|

|

|

|

| REVENUE |

|

|

|

|

|

|

|

|

| Rooms

department |

|

$ |

28,285,445 |

|

|

$ |

27,366,634 |

|

| Food and

beverage department |

|

|

8,351,983 |

|

|

|

8,323,759 |

|

| Other

operating departments |

|

|

5,098,128 |

|

|

|

3,004,493 |

|

| Total

revenue |

|

|

41,735,556 |

|

|

|

38,694,886 |

|

| EXPENSES |

|

|

|

|

|

|

|

|

| Hotel

operating expenses |

|

|

|

|

|

|

|

|

| Rooms

department |

|

|

6,700,381 |

|

|

|

6,682,279 |

|

| Food and

beverage department |

|

|

6,395,076 |

|

|

|

5,728,473 |

|

| Other

operating departments |

|

|

1,528,327 |

|

|

|

600,020 |

|

|

Indirect |

|

|

15,233,256 |

|

|

|

14,205,231 |

|

| Total

hotel operating expenses |

|

|

29,857,040 |

|

|

|

27,216,003 |

|

| Depreciation

and amortization |

|

|

5,634,190 |

|

|

|

4,061,097 |

|

| Loss on

disposal of assets |

|

|

3,739 |

|

|

|

- |

|

| Corporate

general and administrative |

|

|

1,546,300 |

|

|

|

1,712,082 |

|

| Total

operating expenses |

|

|

37,041,269 |

|

|

|

32,989,182 |

|

| NET OPERATING

INCOME |

|

|

4,694,287 |

|

|

|

5,705,704 |

|

| Other income

(expense) |

|

|

|

|

|

|

|

|

| Interest

expense |

|

|

(4,177,019 |

) |

|

|

(3,813,717 |

) |

| Interest

income |

|

|

81,704 |

|

|

|

39,705 |

|

|

Unrealized gain (loss) on hedging activities |

|

|

12,730 |

|

|

|

(15,945 |

) |

| Gain on

sale of assets |

|

|

— |

|

|

|

100,407 |

|

| Gain on

involuntary conversion of assets |

|

|

870,741 |

|

|

|

1,041,815 |

|

| Net income

before income taxes |

|

|

1,482,443 |

|

|

|

3,057,969 |

|

| Income

tax provision |

|

|

(305,955 |

) |

|

|

(171,937 |

) |

| Net

income |

|

|

1,176,488 |

|

|

|

2,886,032 |

|

| Less: Net

loss (income) attributable to the noncontrolling interest |

|

|

30,013 |

|

|

|

(229,942 |

) |

| Net income

attributable to the Company |

|

|

1,206,501 |

|

|

|

2,656,090 |

|

|

Distributions to preferred stockholders |

|

|

(1,444,844 |

) |

|

|

(805,000 |

) |

| Net (loss)

income available to common stockholders |

|

$ |

(238,343 |

) |

|

$ |

1,851,090 |

|

| Net (loss)

income per share available to common stockholders |

|

|

|

|

|

|

|

|

| Basic

& Diluted |

|

$ |

(0.02 |

) |

|

$ |

0.13 |

|

| Weighted

average number of common shares outstanding |

|

|

|

|

|

|

|

|

| Basic

& Diluted |

|

|

13,472,221 |

|

|

|

14,025,489 |

|

|

|

|

|

|

|

|

|

|

|

SOTHERLY HOTELS INC.KEY

OPERATING METRICS(unaudited)

The following tables illustrate the key operating metrics for

the three months ended March 31, 2018 and 2017, respectively, for

the Company’s wholly-owned properties (“actual” portfolio metrics),

as well as the ten wholly-owned properties in the portfolio that

were under the Company’s control during the three months ended

March 31, 2018 and the corresponding periods in 2017 (“same-store”

portfolio metrics). Accordingly, the same-store data does not

reflect the performance of the Crowne Plaza Hampton Marina which

was sold in February 2017, our interest in the Hyde Resort &

Residences which was acquired on January 30, 2017, or the Hyatt

Centric Arlington which we acquired in March 2018. The

composite portfolio metrics represent all of the Company’s

wholly-owned properties and the participating condominium hotel

rooms at the Hyde Resort & Residences during the three months

ended March 31, 2018 and the corresponding periods in 2017.

|

|

|

Three Months Ended |

|

|

Three Months Ended |

|

|

|

|

March 31, 2018 |

|

|

March 31, 2017 |

|

| Actual

Portfolio Metrics |

|

|

|

|

|

|

|

|

| Occupancy

% |

|

|

67.6 |

% |

|

|

70.1 |

% |

| ADR |

|

$ |

157.80 |

|

|

$ |

149.08 |

|

|

RevPAR |

|

$ |

106.63 |

|

|

$ |

104.52 |

|

| Same-Store

Portfolio Metrics |

|

|

|

|

|

|

|

|

| Occupancy

% |

|

|

66.8 |

% |

|

|

69.8 |

% |

| ADR |

|

$ |

155.53 |

|

|

$ |

150.08 |

|

|

RevPAR |

|

$ |

103.84 |

|

|

$ |

104.80 |

|

| Composite

Portfolio Metrics |

|

|

|

|

|

|

|

|

| Occupancy

% |

|

|

66.5 |

% |

|

|

69.8 |

% |

| ADR |

|

$ |

168.37 |

|

|

$ |

150.65 |

|

|

RevPAR |

|

$ |

112.03 |

|

|

$ |

105.10 |

|

SOTHERLY HOTELS

INC.SUPPLEMENTAL

DATA(unaudited)

The following tables illustrate the key operating metrics for

the three months ended March 31, 2018 and 2017, respectively, for

each of the Company’s wholly-owned properties during each

respective reporting period, irrespective of ownership percentage

during any period.

Occupancy

| |

|

|

|

|

|

|

|

|

| |

Q1 2018 |

|

|

Q1 2017 |

|

|

Q1 2016 |

|

| Crowne Plaza

Tampa Westshore |

90.6 |

% |

|

85.7 |

% |

|

83.7 |

% |

| Tampa,

Florida |

| The

DeSoto |

56.7 |

% |

|

66.8 |

% |

|

74.5 |

% |

| Savannah,

Georgia |

| DoubleTree by

Hilton Jacksonville Riverfront |

84.3 |

% |

|

80.9 |

% |

|

76.8 |

% |

| Jacksonville,

Florida |

| DoubleTree by

Hilton Laurel |

50.6 |

% |

|

50.2 |

% |

|

44.5 |

% |

| Laurel,

Maryland |

| DoubleTree by

Hilton Philadelphia Airport |

71.1 |

% |

|

69.1 |

% |

|

73.1 |

% |

| Philadelphia,

Pennsylvania |

| DoubleTree by

Hilton Raleigh Brownstone – University |

71.4 |

% |

|

74.2 |

% |

|

69.4 |

% |

| Raleigh,

North Carolina |

| DoubleTree

Resort by Hilton Hollywood Beach |

77.8 |

% |

|

83.0 |

% |

|

88.5 |

% |

| Hollywood,

Florida |

| Georgian

Terrace |

63.6 |

% |

|

74.6 |

% |

|

70.2 |

% |

| Atlanta,

Georgia |

| Hotel Ballast

(1) |

51.4 |

% |

|

64.1 |

% |

|

58.6 |

% |

| Wilmington,

North Carolina |

| Hyatt Centric

Arlington (2) |

72.2 |

% |

|

80.2 |

% |

|

79.1 |

% |

| Arlington,

Virginia |

| Sheraton

Louisville Riverside |

51.6 |

% |

|

57.5 |

% |

|

51.1 |

% |

|

Jeffersonville, Indiana |

| The

Whitehall |

57.6 |

% |

|

65.5 |

% |

|

64.8 |

% |

| Houston,

Texas |

| Hyde Resort

& Residences (3) |

52.3 |

% |

|

39.3 |

% |

|

N/A |

|

| Hollywood

Beach, Florida |

| All

properties weighted average (2) |

66.9 |

% |

|

71.6 |

% |

|

70.8 |

% |

|

|

| 1 |

Property undergoing

renovation during the current quarter. |

| 2 |

Includes operating

results under previous ownership. Results for periods prior

to the Company’s ownership were provided by prior owners of the

hotel and have not been audited or confirmed by the Company. |

| 3 |

Reflects only the

condominium units at the Hyde Resort & Residences participating

in our rental program for the period those units participated in

our rental program. |

| |

|

ADR

| |

|

|

|

|

|

|

|

|

|

| |

Q1 2018 |

|

Q1 2017 |

|

Q1 2016 |

|

| Crowne Plaza

Tampa Westshore |

$ |

140.82 |

|

$ |

136.95 |

|

$ |

130.90 |

|

| Tampa,

Florida |

| The

DeSoto |

$ |

178.65 |

|

$ |

162.04 |

|

$ |

157.34 |

|

| Savannah,

Georgia |

| DoubleTree by

Hilton Jacksonville Riverfront |

$ |

144.30 |

|

$ |

132.16 |

|

$ |

122.43 |

|

| Jacksonville,

Florida |

| DoubleTree by

Hilton Laurel |

$ |

109.13 |

|

$ |

113.28 |

|

$ |

100.06 |

|

| Laurel,

Maryland |

| DoubleTree by

Hilton Philadelphia Airport |

$ |

128.84 |

|

$ |

120.02 |

|

$ |

121.90 |

|

| Philadelphia,

Pennsylvania |

| DoubleTree by

Hilton Raleigh Brownstone – University |

$ |

133.58 |

|

$ |

135.59 |

|

$ |

134.87 |

|

| Raleigh,

North Carolina |

| DoubleTree

Resort by Hilton Hollywood Beach |

$ |

226.52 |

|

$ |

216.61 |

|

$ |

221.48 |

|

| Hollywood,

Florida |

| Georgian

Terrace |

$ |

191.17 |

|

$ |

171.32 |

|

$ |

160.52 |

|

| Atlanta,

Georgia |

| Hotel Ballast

(1) |

$ |

131.36 |

|

$ |

126.66 |

|

$ |

128.12 |

|

| Wilmington,

North Carolina |

| Hyatt Centric

Arlington (2) |

$ |

166.91 |

|

$ |

174.40 |

|

$ |

153.51 |

|

| Arlington,

Virginia |

| Sheraton

Louisville Riverside |

$ |

120.39 |

|

$ |

121.10 |

|

$ |

141.14 |

|

|

Jeffersonville, Indiana |

| The

Whitehall |

$ |

147.11 |

|

$ |

161.18 |

|

$ |

149.40 |

|

| Houston,

Texas |

| Hyde Resort

& Residences (3) |

$ |

357.72 |

|

$ |

397.16 |

|

N/A |

|

| Hollywood

Beach, Florida |

| All

properties weighted average (2) |

$ |

166.77 |

|

$ |

154.02 |

|

$ |

148.54 |

|

| |

|

|

|

|

|

|

|

|

|

| 1 |

Property undergoing

renovation during the current quarter. |

| 2 |

Includes operating

results under previous ownership. Results for periods prior

to the Company’s ownership were provided by prior owners of the

hotel and have not been audited or confirmed by the Company. |

| 3 |

Reflects only the

condominium units at the Hyde Resort & Residences participating

in our rental program for the period those units participated in

our rental program. |

| |

|

RevPAR

| |

|

|

|

|

|

|

|

|

|

| |

Q1 2018 |

|

Q1 2017 |

|

Q1 2016 |

|

| Crowne Plaza

Tampa Westshore |

$ |

127.56 |

|

$ |

117.43 |

|

$ |

109.57 |

|

| Tampa,

Florida |

| The

DeSoto |

$ |

101.36 |

|

$ |

108.29 |

|

$ |

117.29 |

|

| Savannah,

Georgia |

| DoubleTree by

Hilton Jacksonville Riverfront |

$ |

121.65 |

|

$ |

106.92 |

|

$ |

94.08 |

|

| Jacksonville,

Florida |

| DoubleTree by

Hilton Laurel |

$ |

55.26 |

|

$ |

56.83 |

|

$ |

44.53 |

|

| Laurel,

Maryland |

| DoubleTree by

Hilton Philadelphia Airport |

$ |

91.59 |

|

$ |

82.90 |

|

$ |

89.12 |

|

| Philadelphia,

Pennsylvania |

| DoubleTree by

Hilton Raleigh Brownstone – University |

$ |

95.36 |

|

$ |

100.63 |

|

$ |

93.60 |

|

| Raleigh,

North Carolina |

| DoubleTree

Resort by Hilton Hollywood Beach |

$ |

176.17 |

|

$ |

179.81 |

|

$ |

196.11 |

|

| Hollywood,

Florida |

| Georgian

Terrace |

$ |

121.49 |

|

$ |

127.77 |

|

$ |

112.74 |

|

| Atlanta,

Georgia |

| Hotel Ballast

(1) |

$ |

67.48 |

|

$ |

81.18 |

|

$ |

75.13 |

|

| Wilmington,

North Carolina |

| Hyatt Centric

Arlington (2) |

$ |

120.57 |

|

$ |

139.78 |

|

$ |

121.38 |

|

| Arlington,

Virginia |

| Sheraton

Louisville Riverside |

$ |

62.12 |

|

$ |

69.61 |

|

$ |

72.19 |

|

|

Jeffersonville, Indiana |

| The

Whitehall |

$ |

84.74 |

|

$ |

105.55 |

|

$ |

96.86 |

|

| Houston,

Texas |

| Hyde Resort

& Residences (3) |

$ |

187.03 |

|

$ |

155.97 |

|

N/A |

|

| Hollywood

Beach, Florida |

| All

properties weighted average (2) |

$ |

111.52 |

|

$ |

110.23 |

|

$ |

105.24 |

|

| |

|

|

|

|

|

|

|

|

|

| 1 |

Property undergoing

renovation during the current quarter. |

| 2 |

Includes operating

results under previous ownership. Results for periods prior

to the Company’s ownership were provided by prior owners of the

hotel and have not been audited or confirmed by the Company. |

| 3 |

Reflects only the

condominium units at the Hyde Resort & Residences participating

in our rental program for the period those units participated in

our rental program. |

| |

|

| |

| SOTHERLY HOTELS INC. |

| RECONCILIATION OF NET INCOME (LOSS)

TO |

| FFO, Adjusted FFO, EBITDA and Hotel

EBITDA |

| (unaudited) |

| |

| |

|

Three Months Ended |

|

|

Three Months Ended |

|

| |

|

March 31, 2018 |

|

|

March 31, 2017 |

|

| Net

(loss) income available to common stockholders |

|

$ |

(238,343 |

) |

|

$ |

1,851,090 |

|

| Add: Net

(loss) income attributable to noncontrolling interest |

|

|

(30,013 |

) |

|

|

229,942 |

|

|

Depreciation and amortization |

|

|

5,634,190 |

|

|

|

4,061,097 |

|

| Gain on

involuntary conversion of assets |

|

|

(870,741 |

) |

|

|

(1,041,815 |

) |

| Loss

(gain) on disposal and/or sale of assets |

|

|

3,739 |

|

|

|

(100,407 |

) |

|

FFO |

|

$ |

4,498,832 |

|

|

$ |

4,999,907 |

|

| Decrease

in deferred income taxes |

|

|

260,262 |

|

|

|

118,050 |

|

|

Unrealized (gain) loss on hedging activities |

|

|

(12,730 |

) |

|

|

15,945 |

|

|

Adjusted FFO available to common stockholders |

|

$ |

4,746,364 |

|

|

$ |

5,133,902 |

|

|

|

|

|

|

|

|

|

|

|

| Weighted

average number of shares outstanding, basic |

|

|

13,472,221 |

|

|

|

14,025,489 |

|

|

|

|

|

|

|

|

|

|

|

| Weighted

average number of non-controlling units |

|

|

1,778,140 |

|

|

|

1,778,140 |

|

|

|

|

|

|

|

|

|

|

|

| Weighted

average number of shares and units outstanding, basic |

|

|

15,250,361 |

|

|

|

15,803,629 |

|

|

|

|

|

|

|

|

|

|

|

| FFO per

share and unit |

|

$ |

0.29 |

|

|

$ |

0.32 |

|

|

|

|

|

|

|

|

|

|

|

| Adjusted

FFO per share and unit |

|

$ |

0.31 |

|

|

$ |

0.32 |

|

| |

| |

|

|

|

|

|

|

| |

|

Three Months Ended |

|

|

Three Months Ended |

|

| |

|

March 31, 2018 |

|

|

March 31, 2017 |

|

| Net

(loss) income available to common stockholders |

|

$ |

(238,343 |

) |

|

$ |

1,851,090 |

|

| Add: Net

(loss) income attributable to noncontrolling interest |

|

|

(30,013 |

) |

|

|

229,942 |

|

| Interest

expense |

|

|

4,177,019 |

|

|

|

3,813,717 |

|

| Interest

income |

|

|

(81,704 |

) |

|

|

(39,705 |

) |

| Income

tax provision |

|

|

305,955 |

|

|

|

171,937 |

|

|

Depreciation and amortization |

|

|

5,634,190 |

|

|

|

4,061,097 |

|

| Loss

(gain) on disposal and/or sale of assets |

|

|

3,739 |

|

|

|

(100,407 |

) |

| Gain on

involuntary conversion of assets |

|

|

(870,741 |

) |

|

|

(1,041,815 |

) |

|

Distributions to preferred stockholders |

|

|

1,444,844 |

|

|

|

805,000 |

|

|

EBITDA |

|

|

10,344,946 |

|

|

|

9,750,856 |

|

| Corporate

general and administrative |

|

|

1,546,300 |

|

|

|

1,712,082 |

|

|

Unrealized (gain) loss on hedging activities |

|

|

(12,730 |

) |

|

|

15,945 |

|

| Hotel

EBITDA |

|

$ |

11,878,516 |

|

|

$ |

11,478,883 |

|

| |

Non-GAAP Financial Measures

The Company considers the non-GAAP measures of FFO (including

FFO per share), EBITDA and hotel EBITDA to be key supplemental

measures of the Company’s performance and could be considered along

with, not alternatives to, net income (loss) as a measure of the

Company’s performance. These measures do not represent cash

generated from operating activities determined by generally

accepted accounting principles (“GAAP”) or amounts available for

the Company’s discretionary use and should not be considered

alternative measures of net income, cash flows from operations or

any other operating performance measure prescribed by GAAP.

FFO

Industry analysts and investors use Funds from Operations

(“FFO”), as a supplemental operating performance measure of an

equity REIT. FFO is calculated in accordance with the definition

adopted by the Board of Governors of the National Association of

Real Estate Investment Trusts (“NAREIT”). FFO, as defined by

NAREIT, represents net income or loss determined in accordance with

GAAP, excluding extraordinary items as defined under GAAP and gains

or losses from sales of previously depreciated operating real

estate assets, plus certain non-cash items such as real estate

asset depreciation and amortization, and after adjustment for any

noncontrolling interest from unconsolidated partnerships and joint

ventures. Historical cost accounting for real estate assets in

accordance with GAAP implicitly assumes that the value of real

estate assets diminishes predictably over time. Since real estate

values instead have historically risen or fallen with market

conditions, many investors and analysts have considered the

presentation of operating results for real estate companies that

use historical cost accounting to be insufficient by itself.

The Company considers FFO to be a useful measure of adjusted net

income (loss) for reviewing comparative operating and financial

performance because we believe FFO is most directly comparable to

net income (loss), which remains the primary measure of

performance, because by excluding gains or losses related to sales

of previously depreciated operating real estate assets and

excluding real estate asset depreciation and amortization, FFO

assists in comparing the operating performance of a company’s real

estate between periods or as compared to different companies.

Although FFO is intended to be a REIT industry standard, other

companies may not calculate FFO in the same manner as we do, and

investors should not assume that FFO as reported by us is

comparable to FFO as reported by other REITs.

Adjusted FFO

The Company presents adjusted FFO, including adjusted FFO per

share and unit, which adjusts for certain additional items

including changes in deferred income taxes, any unrealized gain

(loss) on hedging instruments or warrant derivative, loan

impairment losses, losses on early extinguishment of debt, aborted

offering costs, loan modification fees, franchise termination

costs, costs associated with the departure of executive officers,

litigation settlement, over-assessed real estate taxes on appeal,

change in control gains or losses and acquisition transaction

costs. We exclude these items as we believe it allows for

meaningful comparisons between periods and among other REITs and is

more indicative than FFO of the on-going performance of our

business and assets. Our calculation of Adjusted FFO may be

different from similar measures calculated by other REITs.

EBITDA

The Company believes that excluding the effect of non-operating

expenses and non-cash charges, and the portion of those items

related to unconsolidated entities, all of which are also based on

historical cost accounting and may be of limited significance in

evaluating current performance, can help eliminate the accounting

effects of depreciation and financing decisions and facilitate

comparisons of core operating profitability between periods and

between REITs, even though EBITDA also does not represent an amount

that accrued directly to shareholders.

Hotel EBITDA

The Company defines Hotel EBITDA as net income or loss

excluding: (1) interest expense, (2) interest income, (3) income

tax provision or benefit, (4) equity in the income or loss of

equity investees, (5) unrealized gains and losses on derivative

instruments not included in other comprehensive income, (6) gains

and losses on disposal of assets, (7) realized gains and losses on

investments, (8) impairment of long-lived assets or investments,

(9) loss on early debt extinguishment, (10) gains or losses on

change in control, (11) corporate general and administrative

expense, (12) depreciation and amortization, (13) gains and losses

on involuntary conversions of assets, (14) distributions to

preferred stockholders and (15) other operating revenue not related

to our wholly-owned portfolio. We believe this provides a

more complete understanding of the operating results over which our

wholly-owned hotels and its operators have direct control. We

believe Hotel EBITDA provides investors with supplemental

information on the on-going operational performance of our hotels

and the effectiveness of third-party management companies operating

our business on a property-level basis. The Company’s calculation

of hotel EBITDA may be different from similar measures calculated

by other REITs.

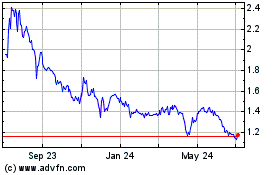

Sotherly Hotels (NASDAQ:SOHO)

Historical Stock Chart

From Mar 2024 to Apr 2024

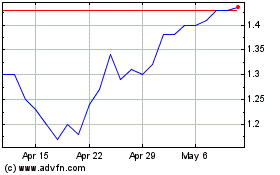

Sotherly Hotels (NASDAQ:SOHO)

Historical Stock Chart

From Apr 2023 to Apr 2024