UNITED STATES

SECURITIES AND EXCHANGE

COMMISSION

Washington, D.C. 20549

SCHEDULE 14F-1

Information Statement

under Section 14(f)

of the Securities Exchange

Act of 1934 and Rule 14f-1 thereunder

Commission File Number

000-18730

Klever Marketing,

Inc.

(Exact Name of Registrant

as Specified in its Charter)

|

|

Delaware

|

|

36-3688583

|

|

|

|

(State or other jurisdiction

of incorporation or organization)

|

|

(I.R.S. Employer Identification No.)

|

|

|

|

|

|

|

|

|

|

1100 E. 6600 S. Suite 305

Salt Lake City, UT

|

|

84121

|

|

|

|

(Address of principal executive offices)

|

|

(Zip

Code)

|

|

(

801

)

847-6444

(Registrant’s

telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

None

Securities registered

pursuant to Section 12(g) of the Act:

Common Stock, $0.01 Par Value

FORWARD-LOOKING STATEMENTS

All descriptions of the

Merger (described below), anticipated terms, anticipated consequences and anticipated related events and transactions set forth

in this Information Statement are forward-looking statements as that term is defined in the Private Securities Litigation Reform

Act of 1995. These forward-looking statements involve substantial known and unknown risks, uncertainties and other factors which

may cause the proposed transactions relating to the Merger not to be consummated or may cause the actual terms and consequences

of the Merger and related events and transactions to be materially different from those anticipated in the descriptions in this

Information Statement, including the risks that (i) the closing conditions to the Merger are not satisfied, (ii) we are unable

to perform our closing obligations with respect to the Merger Agreement (described below).

You should not place undue

reliance on these forward-looking statements, which speak only as of the date that they were made. Except as required by applicable

law, including the securities laws of the United States, we do not intend to update any of the forward-looking statements to conform

these statements to reflect actual results, later events or circumstances or to reflect the occurrence of unanticipated events.

GENERAL

This

Information Statement on Schedule 14F-1 is being provided to holders of the Common Stock, par value $0.01, (the “

Common

Stock

”) of Klever Marketing, Inc. (the “

Compan

y,” “

we

,” “

our

”

or “

us

”) as of May 4, 2018, pursuant to Section 14(f) of the Securities Exchange Act, as amended, and Rule 14f-1

promulgated thereunder. You are receiving this Information Statement in connection with a change in control of our Company, including

a change in the composition of its Board of Directors.

This

Information Statement will be filed with the Securities and Exchange Commission (the “

SEC

”) and mailed concurrently

to our stockholders on or about May 4, 2018.

WE ARE NOT SOLICITING

YOUR PROXY. NO VOTE OR OTHER ACTION BY THE COMPANY’S STOCKHOLDERS IS REQUIRED WITH RESPECT TO THE MATTERS DISCUSSED HEREIN

BACKGROUND

On April 27, 2018, Klever Marketing, Inc.

a Delaware Corporation (“

Parent

”), DarkPulse Technologies Inc. a New Brunswick Corporation (“

Target

Company

”) and DPTH Acquisition Corporation, a Utah Corporation and wholly owned subsidiary of Parent (the “

Merger

Subsidiary

”) entered into an Agreement and Plan of Merger, (the “

Merger Agreement

”). Under the terms

of the Merger Agreement, Merger Subsidiary will merge with and into Target Company (the “

Merger

”), and Target

Company will be the surviving corporation to the Merger and become a wholly owned subsidiary of Parent. The Merger is expected

to close on or about May 30, 2018, subject to the satisfaction or waiver of customary closing conditions.

As of the effective time of the Merger

(the “

Merger Time

”), each share of Target Company common stock issued and outstanding immediately prior to the

Merger Time will be cancelled and extinguished and automatically converted into the right to receive 85,000 fully paid and non-assessable

shares of common stock (“

Common Stock

”) of Parent (the “

Merger Common Stock

”). Parent will

issue to each holder of Target Company common stock certificates or Book Entries (as defined in the Merger Agreement) evidencing

the number of shares of Merger Common Stock determined in accordance with the foregoing, being approximately 85,000,000 shares

of Common Stock. As of April 27, 2018, the Target Company had 1,000 shares of common stock issued and outstanding, and no shares

of preferred stock or other securities issued and outstanding.

Parent has made customary representations,

warranties and covenants in the Merger Agreement, including: (i) to conduct its business in the ordinary course during the

interim period between the execution of the Merger Agreement and the Merger Time, (ii) not to engage in certain kinds of transactions

or take certain actions during such interim period, and (iii) obtain all consents and approvals necessary to consummate the transactions

contemplated by the Merger Agreement.

Additionally, prior to the Merger, Parent

must (i) effect a reverse stock split of its outstanding common stock to ensure that there are no more than 15,000,000 shares of

Parent common stock issued and outstanding immediately prior to the Merger Time (the “

Reverse Stock Split

”),

and (ii) ensure that all outstanding options, preferred stock, or other securities convertible into common stock have been cancelled,

except that Parent shall be permitted to have outstanding a maximum of $150,000 in convertible promissory notes convertible into

common stock of Parent at the Merger Time, which shall be retained by Parent post-Merger (the “

Assumed Liabilities

”).

Prior to the Merger, Target Company must (i) ensure that there are not more than 1,000 shares of Target common stock issued and

outstanding. Accordingly, after issuance of the Parent Common Stock in connection with the Merger, it is anticipated that shareholders

of Parent immediately prior to the Merger will own approximately 15% of the issued and outstanding common stock of Parent immediately

after effecting the Merger. Finally, at closing of the Merger, Target Company shall pay $150,000 to Parent or certain of Parent’s

creditors or preferred shareholders as directed by Parent.

The foregoing description of the Merger

and Merger Agreement does not purport to be complete and is qualified in its entirety by reference to the complete text of the

Merger Agreement, a copy of which has been filed as Exhibit 2.1 to the Current Report on Form 8-K filed on May 2, 2018, and which

is incorporated herein by reference.

By the Merger Time, the new management

described below will be installed, the reverse stock split will be effected, and the Company will be engaged in the development

and marketing of Target Company’s technologies. Shortly after the Merger, the Company intends to change its name to DarkPulse

Technologies, Inc. or a similar name.

In connection with the Merger and Merger

Agreement, the Company agreed to the appointment of Dennis M. O’Leary and Dr. Thomas A. Cellucci (collectively, the “

New

Directors

”) to serve as directors of the Company as of the Merger Time. Separately, each of the Company’s current

directors and officers has tendered or will tender their resignation from all positions with the Company to be considered effective

as of the Merger Time.

VOTING SECURITIES AND PRINCIPAL HOLDERS

As

of May 3, 2018, we had issued and outstanding 61,322,567 pre-reverse split shares of Common Stock; and 28,358,000 pre-reverse

split issuable common shares. There were also 163,022 Class A Preferred Shares; 128,990 Class B Preferred Shares; and 217,362

Class C Preferred Shares all of which are issued and outstanding. Each Share of Common Stock is entitled to one vote per share,

and each share of each class of Preferred Stock is entitled to one vote per share. If the Merger Time had occurred as of the

same date, we would have had issued and outstanding 100,000,000 shares of Common Stock and no shares of any class

of Preferred Stock.

Security Ownership of Certain Beneficial Owners and Management

The

following table sets forth information regarding the beneficial ownership of our Common Stock as of May 3, 2018 (as if all securities

to be issued under the Merger Agreement were issued as of that date and the Reverse Stock Split had already been effected) by (i)

each of the persons expected to serve as executive officers after the Merger; (ii) each of the New Directors; (iii) all of those

executive officers and New Directors as a group, and (iv) other persons known or anticipated by us to hold more than 5% of our

outstanding shares of Common Stock after giving effect to the Merger and Reverse Stock Split.

Beneficial

ownership is determined in accordance with the rules of the SEC. To our knowledge and subject to applicable community property

laws, each of the holders of stock listed below will have sole voting and investment power as to the stock owned unless otherwise

noted. Except as otherwise noted below, the address for each director or officer listed in the table is c/o DarkPulse Technologies

Inc., 8760 Virginia Meadows Dr., Manassas, Virginia, 20109.

|

Name of Beneficial Owner

|

|

Amount and Nature of Beneficial Ownership

|

|

|

Percent of Outstanding Shares

|

|

|

Executive Officers and Directors

|

|

|

|

|

|

|

|

|

|

Dennis M. O’Leary, Chief Executive Officer & Director (1)

|

|

|

57,500,000

|

|

|

|

57.5%

|

|

|

Dr. Thomas A. Cellucci, Co-CEO & Director

|

|

|

8,000,000

|

|

|

|

8.0%

|

|

|

Stephen Goodman, Chief Financial Officer

|

|

|

1,000,000

|

|

|

|

1.0%

|

|

|

Dr. Mark Banash, Chief Technology Officer

|

|

|

1,000,000

|

|

|

|

1.0%

|

|

|

David Singer, Chief Marketing Officer

|

|

|

1,000,000

|

|

|

|

1.0%

|

|

|

|

|

|

|

|

|

|

|

|

|

Executive officers and directors as a group (5 persons)

|

|

|

|

|

|

|

68.5%

|

|

|

|

|

|

|

|

|

|

|

|

|

Other Beneficial Owners:

|

|

|

|

|

|

|

|

|

|

Dr. Anthony Brown (2)

|

|

|

5,000,000

|

|

|

|

5.0%

|

|

Footnotes to the preceding table

|

|

(1)

|

Mr. O’Leary will hold his shares in the name of his entity, Global System Dynamics Holdings Inc. f/k/a Fantastic North

America Inc.

|

|

|

(2)

|

Dr. Brown is the co-founder of the Target Company, DarkPulse Technologies Inc.

|

DIRECTORS AND EXECUTIVE OFFICERS

As of the Change of Control, our directors and executive

officers will be as follows.

|

Name

|

|

Age

|

|

Position

|

|

Dennis M. O’Leary

|

|

55

|

|

CEO & Chairman of the Board of Directors

|

|

Thomas A. Cellucci

|

|

60

|

|

Co-CEO & Director

|

|

Stephen Goodman

|

|

74

|

|

Chief Financial Officer

|

|

Mark Banash

|

|

57

|

|

Chief Technology Officer

|

|

David Singer

|

|

68

|

|

Chief Marketing Officers

|

The following summarizes the background of each

such executive officer and appointed director.

Dennis

M. O’Leary

Mr.

O’Leary is a serial entrepreneur with significant international experience having founded Sulu Electric Power and Light Corp

(Philippines), a firm with expertise in utility scale power generation and solar energy. He is the co-founder and Chairman of DarkPulse

Technologies Inc., a firm developing specialized devices that monitor activities along national borders and provide structural

health and safety monitoring of oil and gas pipelines. He holds extensive start-up experience including multiple exit strategies.

Mr. O’Leary is an Ambassador for the Province of New Brunswick, Canada, and a Research Member of the NATO Science and Technology

Organization. He served as a member of the Board at Arizona State University’s School of Engineering, Global Resolve as Chair

of the Impact Committee. His previous employment includes the NYPD where he worked as a member of the Manhattan North Tactical

Narcotics Team, which prosecuted establishments involved in the illegal distribution of narcotics. He was a member of a joint taskforce

working with the DEA and USINS in the execution of warrants related to narcotics trafficking. While at the NYPD, he was assigned

to the Department of Justice as a member of the FBI’s investigative team with internal designation C14. He is a licensed

private pilot with turbine experience. Mr. O’Leary is not, and has not been during the past 5 years, the director of any

other public companies.

Thomas

A. Cellucci, PhD, MBA

Dr.

Cellucci has been a senior executive in both the private and public sectors for over 36 years. He is the co-CEO and a Board member

of DarkPulse Technologies Inc., as well as the Chairman and CEO of Bravatek Solutions, Inc. [OTC-Pink: BVTK]. He founded and still

owns/operates Cellucci Associates, Inc. with headquarters at Harvard Square in Cambridge, Massachusetts. Dr. Cellucci served as

the US Government’s first-ever Chief Commercialization Officer after a very successful career managing high technology firms,

working for both President George W. Bush and President Obama from 2007-2012. He worked at both the White House, as well as the

US Department of Homeland Security. He also currently assists President Trump’s team when asked, most recently writing a

book on innovative, commercialization-based public-private partnerships for Critical Infrastructure/Key Resources. Dr. Cellucci

has authored or co-authored 25 scholarly books and over 211 high-tech and business articles, and he currently holds the highest

security levels in the US government and military. He earned a PhD in Physical Chemistry from the University of Pennsylvania (1984),

an MBA from Rutgers University (1991) and a BS in Chemistry from Fordham University (1980). He is on a number of Boards and served

as the Chairman of the World Bank’s International Science and Commercialization Board and is the Chairman of Eurasian Technological

University in Almaty, Kazakhstan. He currently holds two endowed Chairs at prestigious universities in Kazakhstan, and he has previously

taught at Harvard Business School, Princeton University and the University of Pennsylvania.

Stephen

Goodman, JD, MBA

Mr.

Goodman has over four decades of experience in the management and treasury function of both private and publicly owned companies.

After graduating from the Wharton School, he served three years active duty as a junior officer in the Coast Guard, assigned to

the supply center servicing all Coast Guard ships and stations throughout the world. He then was the Treasurer of a small international

public electronics company that manufactured a component employed in virtually all electronic equipment. He subsequently founded

several financial companies specializing in providing funding to both small and medium sized businesses, and to individuals using

real estate as collateral.

In

the early 90’s, he and two associates founded a pager and cellular distribution business, which led to his becoming a principal,

director, and the CFO for Prime Companies Inc., a publicly owned wireless telecommunications company. In that position, he developed

and implemented a business plan, including funding, for the buildout of fixed broadband wireless systems. He initiated a plan to

spin off a subsidiary, providing a dividend to the company’s 1300 shareholders. He developed the winning plan to jointly

develop and commercialize wireless licenses owned by a mid-Atlantic university. He developed a distribution network of retailers

for prepaid wireless and dial tone telephone services, for the company’s wholly owned California licensed Competitive Local

Exchange Carrier.

He

earned a BS degree from the Wharton School at the University of Pennsylvania, an MBA from New York University, and a Juris Doctor

degree from William Howard Taft University.

He

has been an adjunct professor at the University of Phoenix, teaching finance and communications in the graduate and undergraduate

schools, both online and in the classroom.

He

was a member and the Treasurer for the Maricopa County Sheriff’s North Valley Posse, and currently is the Commander of his

local American Legion Post.

Mark

Banash, PhD, MBA

Dr.

Banash has almost 30 years of experience in bringing advanced technology from the laboratory to the marketplace. His work covers

biocides, polymers, coatings, ceramics, and new forms of glass for laser optic applications. In 2003, he moved to Zyvex where he

oversaw production of the company’s nanopositioning systems for electron microscopes as well as its carbon nanotube resins

for advanced composites. In 2007, he went to Nanocomp Technologies, where as VP-Chief Scientist he was responsible for everything

for the company’s carbon nanotube materials from basic research to quality control to new product formats. Following Nanocomp’s

recent sale to Huntsman, he went to AvCarb where he now heads Engineering Development of new carbon materials for fuel cells, flow

batteries, hydrogen generators, and energy storage. He has also served as an operations and technical consultant to DarkPulse Technologies

Inc. since October 2017, working on transitioning the technology from prototype to a manufacturable design.

Dr.

Banash holds a BA with honors in Chemistry with minors in Mathematics and English from the University of Pennsylvania, and a Ph.D.

in Chemistry from Princeton University. He also holds an MBA from the University of Maryland, University College, where he was

subsequently a professor teaching Operations Management until 2012. He is a Six Sigma Black Belt and has worked with ISO and NIST

on metrology and quality standards related to new technologies.

David

Singer

Mr.

Singer brings over four decades of experience working with both national and international companies developing business relationships

and expanding new and existing business opportunities. He also brings a wealth of proven experience working in, and with, public

companies as he served as the Chairman, CEO and President of an American Stock Exchange company, as well as served in various positions

in OTC companies for over 20 years.

Currently,

Mr. David D. Singer serves as the Chief Marketing/Sales Officer for DarkPulse Technologies Inc. He served ten years as Vice President,

Project Manager for Hatzel & Buehler, Inc., the county's oldest electrical contractor. In this position he served as project

manager for several commercial and industrial projects, such as; Renaissance Center in downtown Detroit, Ford Motor Company assembly

facilities, University of Michigan building automation systems, Hyatt Regency Hotel life-safety systems, Michigan Bell facilities,

and Detroit Edison facilities.

He

joined CSL as Vice president of sales and marketing and became President at CSL Energy Controls. A shared energy savings company.

CSL provided shared energy savings opportunities for commercial customers, industrial and industrial customers national wide.

Mr.

Singer served as a special consultant to the General President of the Sheetmetal Workers International Association where he helped

establish the National Energy Management Institute, NEMI. The National Energy Management Institute is a not-for-profit organization

jointly funded and managed by the Sheet Metal and Air Conditioning Contractors’ National Association (SMACNA) and the International

Association of Sheet Metal, Air, Rail and Transportation Workers (SMART). NEMI develops programs seeking to create or expand employment

opportunities for SMART members and programs that assist SMACNA contractors.

Mr.

Singer served as Vice president of energy and environmental municipal financing of First Municipal Division at Banc One Leasing

Corporation, were he oversaw the financing for co-generation, trash-to-cash energy development projects; and energy conservation

programs for Federal, State and municipal projects, including the first Federal Energy Shared Savings project for the United States

Government.

Mr.

Singer served as President of Highland Energy Group., a national energy service company (ESCO) providing demand side management

(DSM) services to public utilities, such as the Public Service Company of Colorado, Duke Power, and Texas Utilities.

At

Navtech Industries, Mr. Singer worked with New Mexico Governor Gary Johnson, US Congressman Bill Richardson, US Senator Pete Domenici

and Navajo President Albert Hale to renovate a 50,000 SqFt manufacturing facility in Shiprock, NM, on the Navajo Reservation to

establish an electronic contract manufacturing facility. Navtech employed over 350 Navajo workers, were they provided all aspects

of electronic contractor assembly services. Navtech provided the assembly and electronics for the Freemont Street Experience in

downtown Las Vegas, in-room honor bars for Marriott Hotel worldwide and player tracking systems for casino slot machines for the

major manufactures.

World

Wireless Communications, Inc. was created in 1996, Mr. Singer became its President in 1997, and following that, he was appointed

its CEO and Chairman. World Wireless was a PINK sheet company, and in 2000, under Mr. Singer’s leadership. became an AMEX

traded company. World Wireless provided both wireless and electronic contract assembly services. It used its wireless technology

to provide companies such as The Williams Companies wireless SCADA technology to monitor its natural-gas pipelines through the

United States, and wireless remote data acquisition from natural gas meters at remote customers through-out the United States.

World also, worked with several electrical utilities nationwide to connect meters for near-real-time data monitor of actual energy

usage. World Wireless was selected by Matsushita Electric Industrial Co, Panasonic, to develop its spread-spectrum 2.4 GHz radio

platform for their cordless telephone, the Giga-Range, which was introduced in 1999. In 2000, World established Xtra-Web a standalone

platform to transfer information from a device to the Internet, which has now become widely known as “smart” technology.

Xtra-Web technology was incorporated in restaurant equipment for Wendy’s, McDonalds, and deployed in gathering real-time

operation information on HVAC systems and vending machines worldwide.

After

leaving World Wireless, he served as Interim Chief Financial Officer of the Company, Klever Marketing, Inc., and as its Interim

Chief Executive Officer where he worked with Klever to market its smart shopper technology to Fujitsu.

Before

joining DarkPulse, Mr. Singer served as President, CTO, and Director of Intelligent Highway Solutions, Inc. He directed the formation

of the Company from a private company to a public vehicle, overseeing the filing of its registration statement.

Board of Directors and Corporate Governance

The

Company’s Board of Directors is responsible for establishing broad corporate policies and for overseeing our overall management.

In addition to considering various matters which require board approval, the Board provides advice and counsel to, and ultimately

monitors the performance of, our executive officer(s). All directors hold office until the next annual meeting of stockholders

and until their successors are duly elected and qualified. Officers are elected to serve, subject to the discretion of the Board,

until their successors are appointed.

Mr.

O’Leary will become our Chief Executive Officer and Board Chairman, and Dr. Cellucci will become our Co-CEO and Director.

We do not intend to designate a lead independent director. We believe that this structure will be appropriate for the Company after

Merger Time until such time as the Board may be expanded. Specifically, we believe that the proposed leadership structure will

provide sufficient leadership and engagement in our operations.

Structure of the Board of Directors

Our board of directors will initially

consist of two directors upon completion of the Merger, each of whom will also all serve as officers as designated above.

Committees of Our Board of Directors

The

board of directors intends to establish three standing committees: an audit committee, a compensation committee and a nominating

committee.

The membership of each committee has not yet been

determined.

Our

board of directors expects to adopt written charters for each of its committees. Current copies of all committee charters will

appear on our website at

www.darkpulse.com

and will be available in printed form upon

written request delivered to the attention of our corporate secretary at Attn: Corporate Secretary, DarkPulse Technologies Inc.,

8760 Virginia Meadows Dr., Manassas, Virginia, 20109, after the Merger Time or approximately May 30, 2018.

Audit Committee

The

audit committee’s primary functions, among others will be to: (a) assist the board of directors in discharging its statutory

and fiduciary responsibilities with regard to audits of the books and records of our Company and the monitoring of its accounting

and financial reporting practices; (b) carry on appropriate oversight to determine that our Company and its subsidiaries have adequate

administrative and internal accounting controls and that they are operating in accordance with prescribed procedures and codes

of conduct; and (c) independently review our Company’s financial information that is distributed to stockholders and the

general public. We will not initially have an Audit Committee.

Compensation Committee

The

compensation committee will review and approve on an annual basis the goals and objectives relevant to our Chief Executive Officer’s

compensation and the annual compensation of our executive officers in light of their respective performance evaluations. Our compensation

committee will be responsible for administering our equity plans, including approval of individual grants of stock options and

other awards. The company does not presently have a compensation committee

.

Nominating Committee

The

nominating committee will be primarily responsible for identifying individuals qualified to serve as members of our board of directors,

recommending individuals to our board of directors for nomination as directors and committee membership, reviewing the compensation

paid to our non-employee directors and recommending adjustments in director compensation, as necessary, in addition to overseeing

the annual evaluation of our board of directors. We will not initially have a Nominating Committee

.

Code of Conduct

Our

board of directors will adopted a code of business conduct and ethics relating to the conduct of our business by our employees,

officers and directors, which will be posted on our Company website after the Merger Time.

Role of the Board in Risk Oversight

One

of the key functions of our board of directors will be to inform oversight of our risk management process. The board of directors

will not have a standing risk management committee, but rather will administer this oversight function directly through the board

of directors as a whole, as well as through various standing committees of our board of directors that will address risks inherent

in their respective areas of oversight. In particular, our board of directors will be responsible for monitoring and assessing

strategic risk exposure and our audit committee will have the responsibility to consider and discuss our major financial risk exposures

and the steps our management has taken to monitor and control these exposures, including guidelines and policies to govern the

process by which risk assessment and management is undertaken. The audit committee will also monitor compliance with legal and

regulatory requirements. Our nominating committee will monitor the effectiveness of our corporate governance practices, including

whether they are successful in preventing illegal or improper liability-creating conduct. Our compensation committee will assess

and monitor whether any of our compensation policies and programs has the potential to encourage excessive risk-taking.

Compensation Committee Interlocks and Insider Participation

None

of the expected members of the compensation committee nor any new director expected to become a member of the compensation committee

will have at any time during the last completed fiscal year been an officer or employee of our Company. None of our executive officers

will have served as a member of the board of directors or as a member of the compensation or similar committee, of any entity that

has one or more executive officers who served on our board of directors during the last completed fiscal year.

None

of the members of the compensation committee will have at any time during the last completed fiscal year been an officer or employee

of our Company. None of our executive officers will have served as a member of the board of directors, or as a member of the compensation

or similar committee, of any entity that has one or more executive officers who served on our board of directors or compensation

committee during the last completed fiscal year. We do not currently have a compensation committee.

Family Relationships

There is no family relationship among the New Directors

or new executive officers.

Legal Proceedings

There

are no material proceedings pursuant to which any of the New Directors or any of the persons expected to serve as executive officers

is a party adverse to the Company.

Code of Ethics

We do

not currently have a code of ethics. We believe this approach is appropriate in light of the Company’s current capital structure

and level of operations, but we expect to continue to evaluate the appropriateness of adopting a code of ethics as our Company

continues to develop.

Communication to the Board of Directors

After

the Merger Time, you may contact our Board of Directors or any director by mail addressed to the attention of our entire Board

or the specific director identified by name or title, at c/o DarkPulse Technologies Inc. at 8760 Virginia Meadows Dr., Manassas,

Virginia, 20109. All communications will be submitted to our Board or the specified director on a periodic basis.

EXECUTIVE COMPENSATION

The

following table sets forth information concerning the annual and long-term compensation awarded to, earned by, or paid to the named

executive officer for all services rendered in all capacities to the Target Company for the years ended December 31, 2017, 2016,

and 2015:

|

Name & Principal Position

|

|

Year

|

Salary

($)

|

Bonus

($)

|

Stock

Awards

|

Non-Equity

Compensation

|

Total

|

|

Dennis O’Leary

|

|

2017

|

0

|

0

|

0

|

0

|

0

|

|

CEO & Chairman

|

|

2016

|

0

|

0

|

0

|

0

|

0

|

|

|

|

2015

|

0

|

0

|

0

|

0

|

0

|

|

Thomas Cellucci

|

|

2017

|

0

|

0

|

0

|

0

|

0

|

|

Co-CEO & Director

|

|

2016

|

0

|

0

|

0

|

0

|

0

|

|

|

|

2015

|

0

|

0

|

0

|

0

|

0

|

|

Stephen Goodman

|

|

2017

|

0

|

0

|

0

|

0

|

0

|

|

CFO

|

|

2016

|

0

|

0

|

0

|

0

|

0

|

|

|

|

2015

|

0

|

0

|

0

|

0

|

0

|

|

Mark Banash

|

|

2017

|

0

|

0

|

0

|

0

|

0

|

|

CTO

|

|

2016

|

0

|

0

|

0

|

0

|

0

|

|

|

|

2015

|

0

|

0

|

0

|

0

|

0

|

|

David Singer

|

|

2017

|

0

|

0

|

0

|

0

|

0

|

|

CMO

|

|

2016

|

0

|

0

|

0

|

0

|

0

|

|

|

|

2015

|

0

|

0

|

0

|

0

|

0

|

Footnotes to preceding table-none

RELATED PARTY TRANSACTIONS

Our

predecessor board of directors adopted a written policy regarding transactions with related persons, which we refer to as our related

party transaction approval policy. Our related party transaction approval policy requires that any executive officer proposing

to enter into a transaction with a “related party” generally must promptly disclose to our audit committee the proposed

transaction and all material facts with respect thereto. In reviewing a transaction, our audit committee will consider all relevant

facts and circumstances, including (1) the commercial reasonableness of the terms, (2) the benefit and perceived benefits, or lack

thereof, to us, (3) the opportunity costs of alternate transactions and (4) the materiality and character of the related party’s

interest, and the actual or apparent conflict of interest of the related party.

Our

audit committee will not approve or ratify a related party transaction unless it determines that, upon consideration of all relevant

information, the transaction is beneficial to our Company and stockholders and the terms of the transaction are fair to our Company.

No related party transaction will be consummated without the approval or ratification of our audit committee. It will be our policy

that a director will recuse his or her self from any vote relating to a proposed or actual related party transaction in which they

have an interest. Under our related party transaction approval policy, a “related party” includes any of our directors,

director nominees, executive officers, any beneficial owner of more than 5% of our common stock and any immediate family member

of any of the foregoing. Related party transactions exempt from our policy include transactions available to all of our employees

and stockholders on the same terms and transactions between us and the related party that, when aggregated with the amount of all

other transactions between us and the related party or its affiliates, involve less than $120,000 in a fiscal year.

COMPLIANCE WITH SECTION 16(a) OF THE SECURITIES

EXCHANGE ACT OF 1934

After

the Merger closing we will file certain reports as recognized by the

Securities Exchange Act of 1934

, as amended. Section

16(a) of the

Securities Exchange Act of 1934

, as amended, which requires our executive officers and directors, and persons

who beneficially own more than 10% of a registered class of our equity securities to file with the Securities and Exchange Commission

initial statements of beneficial ownership, reports of changes in ownership and annual reports concerning their ownership of our

common shares and other equity securities, on Forms 3, 4 and 5 respectively. Executive officers, directors and greater than 10%

shareholders are required by the Securities and Exchange Commission regulations to furnish us with copies of all Section 16(a)

reports they file.

WHERE YOU CAN FIND

ADDITIONAL INFORMATION

We will

be required to file annual, quarterly and special reports, proxy statements and other information with the SEC. You may read and

copy any document we file at the SEC’s public reference rooms at 100 F Street, N.E., Washington, D.C. 20549. You may also

obtain copies of the documents at prescribed rates by writing to the Public Reference Section of the SEC at 100 F Street, N.E.,

Room 1580, Washington, D.C. 20549. Please call the SEC at 1- 800-SEC-0330 for more information on the operation of the public reference

rooms. Copies of our SEC filing are also available to the public from the SEC’s website at www.sec.gov and, after the Merger

Time, will be posted on the company website at www.darkpulse.com.

SIGNATURE

Pursuant

to the requirements of Section 13 or 15(d) of the Securities Exchange Act of 1934, the Registrant has duly caused this Information

Statement to be signed on its behalf by the undersigned, thereunto duly authorized, on May 4, 2018.

|

|

Klever Marketing, Inc.

By:

/s/

Paul G. Begum

Paul G. Begum

Chief

Executive Officer

|

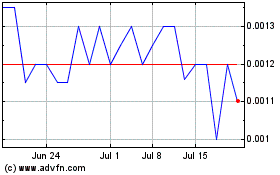

DarkPulse (PK) (USOTC:DPLS)

Historical Stock Chart

From Mar 2024 to Apr 2024

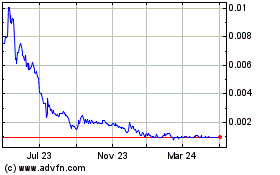

DarkPulse (PK) (USOTC:DPLS)

Historical Stock Chart

From Apr 2023 to Apr 2024