BASF Won't Book Savings From Bayer's Agricultural Assets

May 04 2018 - 5:25AM

Dow Jones News

By Olaf Ridder

BASF SE (BAS.XE) doesn't anticipate any significant savings

following the integration of Bayer AG's (BAYN.XE) agricultural

businesses, Chief Financial Officer Hans-Ulrich Engel said

Friday.

European regulators recently gave the green light for BASF to

buy a group of agricultural assets that Bayer is selling to gain

approval for its proposed takeover of Monsanto Co. (MON), in a deal

valued at around 7.6 billion euros ($9.11 billion).

The businesses are largely complementary to BASF's existing

portfolio so there are unlikely to be any cost synergies, although

there may be volume synergies, Mr. Engel said on a conference call

following BASF's first-quarter earnings release.

A total of 4,300 employees as well as several production sites

and various research stations will be transferred to BASF as part

of the deal.

Mr. Engel said he expects BASF to take over all businesses

except the vegetable-seeds unit by the middle of the year.

He declined to specify the projected costs for the subsequent

integration, but said they will mostly be booked in the second half

of the year.

For seasonal reasons, the new units are expected to weigh on

BASF's earnings before interest and taxes in the second half of the

year, he said.

Read more about Bayer's takeover of Monsanto at

https://on.wsj.com/2JHcxUW (WSJ paywall) or http://bit.ly/2JH7FiR

(NewsPlus).

Write to Olaf Ridder at olaf.ridder@dowjones.com

(END) Dow Jones Newswires

May 04, 2018 05:10 ET (09:10 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

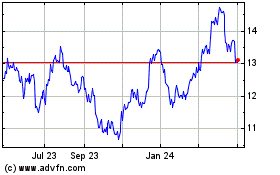

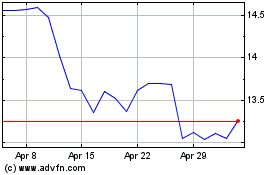

BASF (QX) (USOTC:BASFY)

Historical Stock Chart

From Mar 2024 to Apr 2024

BASF (QX) (USOTC:BASFY)

Historical Stock Chart

From Apr 2023 to Apr 2024