Cloud Business Boosts Microsoft's Earnings -- 2nd Update

April 26 2018 - 6:29PM

Dow Jones News

By Jay Greene

Microsoft Corp. extended its streak of wins in the latest

quarter as the software giant moves into an era where its venerable

Windows franchise plays a supporting role to its burgeoning

cloud-computing operations.

The cloud business, called Azure, jumped 93% in the fiscal third

quarter, Microsoft reported Thursday. The business has never grown

slower than 90% since the company began reporting the metric in

October 2015. The other big piece of the company's cloud

operations, the commercial version of its Office 365

online-productivity service, grew 42%.

Microsoft doesn't disclose revenue for either business, but in

the preceding second quarter it said Azure jumped 98% and

commercial Office 365 grew 41%.

The two businesses combined accounted for $6 billion in revenue,

up 58% on what Microsoft financial chief Amy Hood said was

"better-than-expected demand."

Ms. Hood pointed to 20% growth in Microsoft's server-products

and cloud-services revenue as a reflection of its focus on the

so-called hybrid cloud, in which customers mix cloud services with

software running on servers in their own data centers.

Microsoft has capitalized on its legacy as a seller of server

software to win over its longtime customers who choose to gradually

move their operations to the cloud.

That growth has propelled Microsoft into the role of chief cloud

rival to Amazon.com Inc., which pioneered the business of renting

out computing power and storage a decade ago.

"Two years ago, there was a clear No. 1 with no clear No. 2,"

said Stifel Nicolaus & Co. analyst Brad Reback. "There is no

doubt that Microsoft has put significant distance between

themselves and all of the other" Amazon rivals.

The surging cloud business led Microsoft to post a profit

increase of 35% to $7.42 billion, or 95 cents a share. Revenue rose

16% to $26.82 billion. Analysts surveyed by S&P Global Market

Intelligence expected Microsoft to report per-share earnings of 85

cents on revenue of $25.78 billion.

Microsoft no longer reports adjusted figures, reflecting

accounting changes it adopted at the start of the fiscal year. The

year-ago figure reflects that change.

Microsoft's stock was down 0.3% in after-hours trading, after

finishing the day at $94.27, up 2.1%. Last month, Microsoft shares

hit an all-time high of $96.77, a gain of nearly 40% over the past

year. The company has jostled with Alphabet Inc. and Amazon for the

No. 2 spot behind Apple Inc. as the world's most valuable company

as measured by market capitalization.

Microsoft's Azure business is part of its Intelligent Cloud

segment. Revenue from that unit rose 17% to $7.9 billion. The

Office franchise is part of Microsoft's Productivity and Business

Processes segment, where revenue climbed 17% to $9.01 billion.

The company continues to dole out huge sums building massive

data centers around the globe to battle Amazon and others. In the

quarter, Microsoft had $3.5 billion in capital expenses, with much

of that money going toward its data-center expansion. A year ago,

Microsoft had $2.1 billion in capital expenditures

Microsoft doesn't break out revenue for its Windows business.

Earlier this month, International Data Corp. reported world-wide PC

shipments showed no growth in the most recent quarter.

Revenue in Microsoft's More Personal Computing segment, which

includes the company's slow-growing Windows franchise as well as

the mobile-phone and Xbox gaming businesses, gained 13% to $9.92

billion.

A month ago, Microsoft split the engineering group that develops

products under the Windows banner among two separate divisions. It

was a recognition that the product that had been synonymous with

Microsoft for most of its 43 years will now play a supporting role

to the company's cloud-computing efforts.

Even as Microsoft has shifted its focus away from Windows, the

operating system showed surprising resiliency. Revenue in the

version of Windows that Microsoft generally sells to corporate

customers, known as OEM Pro, grew 11%. And revenue from Microsoft's

Surface line of computers jumped 32% to $1.10 billion.

LinkedIn, the professional social network Microsoft bought for

$27 billion more than a year ago, grew rapidly, with revenue

climbing 37% to $1.34 billion.

Write to Jay Greene at Jay.Greene@wsj.com

(END) Dow Jones Newswires

April 26, 2018 18:14 ET (22:14 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

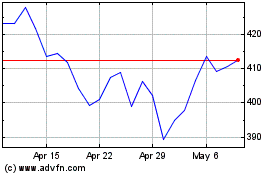

Microsoft (NASDAQ:MSFT)

Historical Stock Chart

From Mar 2024 to Apr 2024

Microsoft (NASDAQ:MSFT)

Historical Stock Chart

From Apr 2023 to Apr 2024