By Telis Demos

Technology giants and big banks have been warily circling each

other, especially in the payments arena. So far, they are more

frenemies than rivals.

The reason: Banks are rapidly emerging as big potential

customers for the fast-growing, cloud-computing businesses of

Amazon.com Inc., Alphabet Inc., and Microsoft Corp. That is making

technology companies think twice about alienating them by becoming

direct competitors.

"We are very intentionally approaching banking customers with an

opportunity to empower them rather than to be in their space," said

Judson Althoff, executive vice president of world-wide commercial

business at Microsoft. "Banks see other cloud providers investing

in mobile payment capabilities, and there is a concern about

disintermediation."

With consumers increasingly turning to their mobile devices for

money transfers and financial advice, some analysts have predicted

that tech companies will supplant traditional banks as providers of

many banking services.

But the dynamic emerging is not so straightforward. The biggest

banks, such as JPMorgan Chase & Co. and UBS Group AG, are

themselves investing billions of dollars in new technology and, for

the first time, starting to use public cloud-computing platforms,

in which computing power and storage are purchased over the

web.

The leading providers of those fast and sophisticated shared

computing services include Amazon's AWS, Alphabet's Google Cloud

and Microsoft's Azure.

For years, banks had resisted moving sensitive data or processes

to the cloud, citing the security concerns of allowing data outside

of their leased or owned data centers. Financial firms also had

already invested billions into their own internal data platforms,

including so-called private clouds.

But recently, momentum shifted after regulators began using the

cloud for data storage and reporting, including the Financial

Industry Regulatory Authority, which works with Amazon's AWS. That

has led many banks to start doing the same.

Moving from traditional mainframes to the cloud also makes it

easier for banks to use artificial intelligence and other new

technologies that consume huge computing resources. This is used to

create better mobile products and trading tools.

"The ability of the banks to get out from under their legacy

cost pile is limited," said Jason Gurandiano, head of financial

technology banking at RBC Capital Markets. "So banks moving to the

cloud gives them leverage with the tech providers."

Cloud spending by banks is expected to skyrocket. By 2021, banks

globally are forecast to spend more than $12 billion on public

cloud infrastructure and data services, up from $4 billion last

year, according to market research firm International Data Corp.'s

public cloud spending guide.

By many metrics, the cloud business offers better opportunities

to tech firms than, say, retail banking. Overall cloud-industry

revenues are growing at about 60% year-over-year, Jefferies

estimates. Meanwhile, retail-banking revenue, comprising products

such as checking accounts and cards, at most big banks is growing

at a fraction of that rate. And any real foray into banking or

financial products could also entail substantial regulatory issues

and expense.

"Tech companies are going to get far more consistent and

repeatable revenue being infrastructure providers than by being in

banking," said Ami Grewal, head of digital strategy at GFT Group,

an engineering services firm that works with banks and partners

tech firms including Amazon and Google.

A handful of banks, such as Capital One Financial Corp., are

already significant cloud customers. Capital One began working with

Amazon in 2013, and made AWS its predominant cloud provider in

2016.The bank's deal has incentives for it to spend at least $150

million a year on the service, people familiar with the agreement

said. A spokesman for the bank declined to comment.

The upshot is that while big tech firms continue to dabble in

banking services, they tend to do so almost entirely through

banking partners.

For example, Amazon, Google and Microsoft offer digital wallets

that allow users to link their bank-issued credit and debit cards.

Citigroup Inc. enables its credit-card customers to pay for goods

at Amazon using credit-card rewards points.

Amazon's AWS, says working with banks is a top priority. Frank

Fallon, vice president for global financial services at AWS, told

the Journal that "interest has grown exponentially over the last

few years" in cloud services in the financial-services industry.

Rather than competing with banks, he said AWS was instead focused

on making sure it was offering the best security, performance, and

function. AWS's team "keep financial services customers at the core

of everything we do," he said.

Tariq Shaukat, president for global alliances and industry

platforms at Google Cloud, said Google begins meetings with banks

by assuring them they aren't interested in gathering banking data

for its own sake.

"We see ourselves as an enabler and platform for many of those

institutions, as opposed to in any way trying to compete with them

in their core businesses," he said. "We start cloud conversations

with an ironclad rule: A customer's data is a customer's data."

Microsoft said last year it had partnered with Bank of America

Corp. to work on public-cloud applications for the bank. As

recently as 2016, top Bank of America executives said they didn't

see a way to use the public cloud, due to security risks.

Cathy Bessant, the bank's chief operations and technology

officer, said the lender was still only spending a small part of

its $3 billion annual computing infrastructure budget on public

cloud. The bank now plans to increase that, following a rapid

improvement in security technology, and with a variety of

partners.

Ms. Bessant added that the firm takes into consideration the

possibility of tech partners someday seeking to compete with banks,

in part by learning from banks' own data. "We're not naive to that

potential," she said. "We're sensitive to making sure that...we

work with infrastructure providers that are like-minded and have

our best interests at heart."

Write to Telis Demos at telis.demos@wsj.com

(END) Dow Jones Newswires

April 26, 2018 12:18 ET (16:18 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

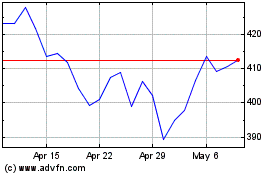

Microsoft (NASDAQ:MSFT)

Historical Stock Chart

From Mar 2024 to Apr 2024

Microsoft (NASDAQ:MSFT)

Historical Stock Chart

From Apr 2023 to Apr 2024