Route1 Inc. (OTCQB:ROIUF) (TSXV:ROI) (the “Company” or “Route1”), a

leader in secure data protection technologies and user

authentication for government and enterprise, today announced its

fourth quarter (Q4) and fiscal year (FY) financial results for the

period ended December 31, 2017

Fourth Quarter (Q4) 2017

| In 000s of

CAD dollars |

Q4 2017 |

|

Q3 2017 |

|

Q2 2017 |

|

Q1 2017 |

Q4 2016 |

Q3 2016 |

|

Revenue |

|

|

|

|

|

|

|

Recurring revenue and services |

109 |

|

1,177 |

|

1,347 |

|

1,911 |

1,865 |

1,808 |

|

Devices and appliances |

1,263 |

|

159 |

|

24 |

|

30 |

21 |

221 |

|

Other |

48 |

|

2 |

|

0 |

|

0 |

0 |

2 |

| Total

revenue |

1,420 |

|

1,338 |

|

1,371 |

|

1,941 |

1,886 |

2,031 |

| Cost of

revenue |

331 |

|

362 |

|

298 |

|

335 |

338 |

448 |

| Gross

profit |

1,089 |

|

976 |

|

1,073 |

|

1,606 |

1,548 |

1,583 |

|

Operating expenses |

1,164 |

|

1,131 |

|

1,151 |

|

1,289 |

1,356 |

1,243 |

|

Operating (loss) profit 1 |

(75 |

) |

(155 |

) |

(78 |

) |

317 |

192 |

340 |

| Total

other expenses 2 |

170 |

|

183 |

|

157 |

|

109 |

101 |

34 |

|

Comprehensive net (loss) gain |

(245 |

) |

(338 |

) |

(235 |

) |

208 |

91 |

306 |

1 Before stock based compensation and patent

litigation2 Includes AirWatch litigation expenses

| Recurring revenue and

services In CAD dollars |

Dec 312017 |

Sep 302017 |

Jun 302017 |

Mar 312017 |

Dec 312016 |

Sep 302016 |

| Closing number of

MobiKEY subscribers |

|

12,421 |

|

12,261 |

|

11,649 |

|

18,270 |

|

17,883 |

|

17,344 |

| Revenue per MobiKEY

subscriber |

$ |

408 |

$ |

393 |

$ |

391 |

$ |

389 |

$ |

388 |

$ |

383 |

| MobiKEY subscription

revenue 3 |

$ |

1,262 |

$ |

1,176 |

$ |

1,347 |

$ |

1,759 |

$ |

1,702 |

$ |

1,639 |

| Other recurring revenue

and services 3 |

$ |

1 |

$ |

1 |

$ |

0 |

$ |

152 |

$ |

163 |

$ |

169 |

| Total recurring revenue

and services 3 |

$ |

1,263 |

$ |

1,177 |

$ |

1,347 |

$ |

1,911 |

$ |

1,865 |

$ |

1,808 |

3 Figures are in thousands

| in 000s of CAD

dollars |

Q4 2017 |

|

Q3 2017 |

|

Q2 2017 |

|

Q1 2017 |

Q4 2016 |

Q3 2016 |

| Gross Profit |

1,089 |

|

976 |

|

1,073 |

|

1,606 |

1,548 |

1,583 |

| Adjusted EBITDA 4 |

24 |

|

(46 |

) |

16 |

|

406 |

307 |

447 |

| Amortization |

99 |

|

109 |

|

94 |

|

89 |

115 |

107 |

| Operating (loss)profit

before patent litigation expense and stock based compensation |

(75 |

) |

(155 |

) |

(78 |

) |

317 |

192 |

340 |

4 Adjusted EBITDA is defined as earnings before

interest, income taxes, depreciation and amortization, stock-based

compensation, patent litigation, restructuring and other costs.

Adjusted EBITDA does not have any standardized meaning prescribed

under IFRS and is therefore unlikely to be comparable to similar

measures presented by other companies. Adjusted EBITDA allows

Route1 to compare its operating performance over time on a

consistent basis.

Route1 used cash in operating activities of

approximately $0.4 million during Q4 2017 compared with cash used

in operating activities of $0.7 million in Q4 2016.

| Balance Sheet

ExtractsIn 000s of CAD dollars |

Dec 312017 |

Sep 302017 |

Jun 302017 |

Mar 312017 |

Dec 312016 |

Sep 302016 |

| Cash |

1,037 |

1,408 |

2,080 |

704 |

1,946 |

2,898 |

| Total current

assets |

2,035 |

2,856 |

2,924 |

1,890 |

2,910 |

3,938 |

| Total current

liabilities |

1,829 |

2,534 |

2,396 |

1,113 |

2,500 |

3,555 |

| Net working

capital |

206 |

322 |

528 |

777 |

410 |

383 |

| Total assets |

3,171 |

4,081 |

4,213 |

3,114 |

4,190 |

5,230 |

| Bank debt |

0 |

0 |

0 |

0 |

0 |

0 |

| Total shareholders’

equity |

1,236 |

1,432 |

1,720 |

1,904 |

1,600 |

1,574 |

Route1’s cash position historically has been at

its highest level during the second quarter of the fiscal year as a

direct result of the timing of annual enterprise user subscription

renewal payments. With the closing of the Group Mobile Int’l,

LLC (“Group Mobile”) acquisition in March 2018, this likely will

change and the highest level of cash on Route1’s balance sheet will

be tied to the timing of payments of larger hardware based

sales.

Fiscal Year 2017

The Company’s operating results in fiscal year

2017 with comparatives are as follows:

| In 000s of

CAD dollars |

FY2017 |

|

FY2016 |

FY2015 |

|

FY2014 |

|

FY2013 |

|

|

Revenue |

|

|

|

|

|

|

Device |

321 |

|

363 |

156 |

|

536 |

|

447 |

|

|

Services |

5,698 |

|

7,080 |

6,218 |

|

5,470 |

|

4,948 |

|

|

Other |

51 |

|

4 |

23 |

|

71 |

|

38 |

|

| Total

Revenue |

6,070 |

|

7,447 |

6,397 |

|

6,077 |

|

5,433 |

|

| Cost of

revenue |

1,325 |

|

1,475 |

1,164 |

|

1,145 |

|

1,137 |

|

| Gross

profit |

4,745 |

|

5,972 |

5,233 |

|

4,932 |

|

4,296 |

|

|

Operating expenses |

4,736 |

|

5,230 |

4,515 |

|

4,398 |

|

4,485 |

|

|

Operating profit 5 |

9 |

|

742 |

718 |

|

534 |

|

(189 |

) |

| Patent

litigation |

270 |

|

56 |

0 |

|

0 |

|

0 |

|

| Total

other expenses |

349 |

|

356 |

(10 |

) |

(103 |

) |

154 |

|

|

Comprehensive net income |

(610 |

) |

330 |

728 |

|

637 |

|

(343 |

) |

5 Before stock-based compensation

Group Mobile

Route1 acquired Group Mobile on March 22,

2018. The company is based in Chattanooga, TN and Chandler,

AZ. Under the terms of the Agreement, Route1 issued to the

seller 25 million common shares, and 30 million, three-year common

share purchase warrants with an exercise price of CAD 5 cents per

common share. Further details of the acquisition can be found

at

www.route1.com/route1-closes-the-acquisition-of-group-mobile/.

Group Mobile supplies rugged mobile technology

solutions to leading automotive manufacturing companies and

suppliers, other leading manufacturing and distribution companies,

as well as local and state governments in the southeastern and

southwestern United States.

“Based on historical results we expect Group

Mobile to generate quarterly revenue of USD $3.4 million to USD

$4.5 million and positive EBITDA”, said Tony Busseri, CEO of Route1

Inc. “During our first month of owning Group Mobile we have

invoiced approximately USD $1.1 million, we have orders in hand

that haven’t yet been fulfilled of approximately USD $2.5 million,

and we have a strong pipeline of quality opportunities in excess of

USD $10 million. This pipeline reflects traditional Group Mobile

products and services, and does not factor in the various

technology and sales crossover opportunities for ActionPLAN and

MobiKEY, which we identified during our recent company-wide

internal sales strategy meetings held on April 12 and 13.

These opportunities are now being initiated with existing and

prospective customers; this is truly an exciting time at

Route1.”

AirWatch Update

On April 19, 2018 AirWatch filed a Request for a

Rehearing of its original IPR petition (which was denied) with the

Patent Trial and Appeal Board (PTAB). The PTAB will make a

decision on the Request for the Hearing on no fixed timetable but

historical statistics suggest that a low percentage of Rehearing

Requests are granted, when responded to by PTAB.

The litigation process continues to run in

parallel to IPR process. A calendar of upcoming milestones

can be found at www.route1.com/investors/patent-litigation/.

Business Update

On March 26, 2018, Route1 held an investor call

and webcast to discuss the recently announced acquisition of Group

Mobile and the status of the AirWatch litigation. A copy of

the presentation can be found on Route1’s website:

www.route1.com/company-presentations/.

Route1 expects to announce its Q1 2018 results

in late May 2018. At that time, Route1 will hold a further

shareholder conference call and webcast.

About Route1 Inc.Route1 Inc. is

a world-leader in secure data protection technologies and user

authentication for government and enterprise. Route1

solutions enable the workforce to be more productive and more

flexible without compromising system access, data-at-rest, or

data-in-use. The Company’s suite of patented enterprise

security solutions combines best-in-class authentication, data

security and secure communications with streamlined administration

tools, running on a proven, trusted infrastructure. From

mobile access to business continuity to best-in-class full system

encryption, Route1 offers the most effective, affordable methods to

secure the digital fortress, while meeting or exceeding the highest

standards for government and industry. Route1 has Full

Authority to Operate from the U.S. Department of Defense, the U.S.

Department of the Navy, the U.S. Department of the Interior, and

other government agencies. The Company is also trusted by

enterprise security teams in the banking, healthcare, legal and

education sectors, among others. With offices in Washington, D.C.,

Boca Raton, FL and Toronto, Canada, Route1 serves public and

private sector clients around the world. Route1 is listed on

the OTCQB in the United States under the symbol ROIUF and in Canada

on the TSX Venture Exchange under the symbol ROI. For more

information, visit: www.route1.com.

For More Information Contact:

Tony BusseriCEO, Route1 Inc.+1 416

814-2635tony.busseri@route1.com

This news release, required by applicable

Canadian laws, does not constitute an offer to sell or a

solicitation of an offer to buy any of the securities in the United

States. The securities have not been and will not be registered

under the United States Securities Act of 1933, as amended (the

"U.S. Securities Act") or any state securities laws and may not be

offered or sold within the United States or to U.S. Persons unless

registered under the U.S. Securities Act and applicable state

securities laws or an exemption from such registration is

available.

Neither the TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in the

policies of the TSX Venture Exchange) accepts responsibility for

the adequacy or accuracy of this release.

This news release contains certain

forward-looking statements within the meaning of applicable

securities laws, including statements regarding Route1’s investment

plans, financial outlook and future financial performance. Words

such as “expects”, “anticipates” and “intends” or similar

expressions are intended to identify forward-looking

statements.

These forward-looking statements are based on

Route1’s current projections and expectations about future events

and financial trends that management believes might affect its

financial condition, operations, results of operations, business

strategy, prospects and financial needs, and on certain assumptions

and analysis made by Route1 in light of the experience and

perception of historical trends, current conditions and expected

future developments and other factors management believes are

appropriate. These projections, expectations, assumptions and

analyses are subject to known and unknown risks, uncertainties,

assumptions and other factors that could cause actual results,

performance, events and achievements to differ materially from

those anticipated in these forward-looking statements. Although

Route1 believes that the assumptions underlying these

forward-looking statements are reasonable, they may prove to be

incorrect, and readers cannot be assured that actual results will

be consistent with these forward-looking statements. Actual results

could differ materially from historical results and from those

projected in the forward-looking statements as a result of numerous

factors, including certain risk factors, many of which are beyond

Route1’s control, including but not limited to: (i) expected cash

position; (ii) integration of acquisitions; (iii) timing of

hardware based sales and related payments; (iv) ability to fulfil

orders; (v) ability to capitalize on opportunities and to realize

synergies across product lines; (vi) the costs and expected results

of the patent litigation process initiated by Route1; (vii)

exchange rate fluctuations; (ix) historical results not being

indicative of future results, (x) expected profit margins, and

(xii) other one-time events and other important factors disclosed

previously and from time to time in Route1’s public filings with

the securities commissions or similar securities regulatory

authorities in each of the provinces or territories of Canada. The

forward-looking statements contained in this news release represent

Route1’s expectations as of the date of this news release, or as of

the date they are otherwise stated to be made, and subsequent

events may cause these expectations to change. Route1 undertakes no

obligation to publicly update or revise any forward-looking

statements, whether as a result of new information, future events

or otherwise, except as may be required by law.

© 2018 Route1 Inc. All rights reserved. No part

of this document may be reproduced, transmitted or otherwise used

in whole or in part or by any means without prior written consent

of Route1 Inc. See

https://www.route1.com/terms-of-use/ for notice of Route1’s

intellectual property.

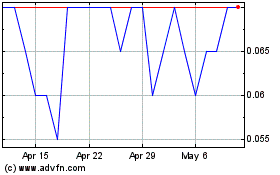

Route 1 (TSXV:ROI)

Historical Stock Chart

From Mar 2024 to Apr 2024

Route 1 (TSXV:ROI)

Historical Stock Chart

From Apr 2023 to Apr 2024