H&E Equipment Services, Inc. (NASDAQ: HEES) today announced

results for the first quarter ended March 31, 2018.

FIRST QUARTER 2018

SUMMARY

- Revenues increased 14.8% to $260.5

million versus $226.8 million a year ago. Included in total

revenues was $11.7 million from the legacy CEC business (“CEC”)

which we acquired on January 1, 2018.

- Net income was $9.5 million in the

first quarter compared to net income of $5.4 million a year ago.

The effective income tax rate was 27.5% in the first quarter of

2018 and 36.8% in the first quarter of 2017.

- Adjusted EBITDA increased 17.7% to

$80.9 million in the first quarter compared to $68.8 million a year

ago, yielding a margin of 31.1% of revenues compared to 30.3% a

year ago. CEC contributed EBITDA of $7.7 million with a margin of

66.5%.

- Rental revenues increased 20.5% to

$129.4 million in the first quarter compared to $107.3 million a

year ago.

- New equipment sales increased 35.7% to

$46.5 million in the first quarter compared to $34.3 million a year

ago.

- Used equipment sales decreased 13.9% to

$24.9 million in the first quarter compared to $28.9 million a year

ago.

- Gross margin was 35.5% compared to

34.2% a year ago.

- Rental gross margins were 47.6% in the

first quarter of 2018 compared to 44.8% a year ago.

- Average time utilization (based on

original equipment cost) was 70.4% compared to 68.5% a year

ago.

- Average rental rates increased 2.1%

compared to a year ago and 0.2% sequentially.

- Dollar utilization was 34.7% in the

first quarter compared to 32.4% a year ago.

- Average rental fleet age at March 31,

2018, was 34.9 months compared to an industry average age of 44.8

months.

- Acquired Rental Inc. on April 1, 2018,

increasing branch count to 88.

John Engquist, H&E Equipment Services’ chief executive

officer, said, “The momentum in our rental business continued

during the first quarter with revenues increasing 20.5% and margins

increasing 280 basis points to 47.6% compared to the first quarter

of last year. Physical utilization remained above year-ago levels,

increasing to 70.4% compared to 68.5%, while rates increased 2.1%.

The strong demand in our non-residential markets resulted in growth

in the size of our rental fleet.”

Engquist concluded, “We are excited about 2018 for our business

and industry. Demand in the non-residential construction markets we

serve is above year-ago levels and broad-based throughout our

geographic footprint. In addition to solid general project

activity, energy-related work in our Gulf Coast region is strong,

benefitting both our rental and distribution businesses. With our

recent acquisitions of CEC and Rental Inc., we have added eight

branches thus far this year. Rapidly executing on our stated growth

strategy is a high priority and we are continuing to explore

additional acquisitions and market expansion through Greenfields

and warm starts.”

FINANCIAL DISCUSSION FOR FIRST QUARTER

2018:

Revenue

Total revenues increased 14.8% to $260.5 million in the first

quarter of 2018 from $226.8 million in the first quarter of 2017.

Equipment rental revenues increased 20.5% to $129.4 million

compared with $107.3 million in the first quarter of 2017. CEC

contributed $10.7 million in rental revenue during the quarter. New

equipment sales increased 35.7% to $46.5 million from

$34.3 million a year ago. Used equipment sales decreased 13.9%

to $24.9 million compared to $28.9 million a year ago. Parts sales

increased 4.3% to $28.2 million from $27.0 million in the first

quarter of 2017. Service revenues were $15.0 million compared to

$15.1 million a year ago.

Gross Profit

Gross profit increased 19.2% to $92.6 million from $77.7 million

in the first quarter of 2017. Gross margin was 35.5% for the

quarter ended March 31, 2018, as compared to 34.2% for the quarter

ended March 31, 2017. On a segment basis, gross margin on rentals

was 47.6% in the first quarter of 2018 compared to 44.8% in the

first quarter of 2017. On average, rental rates were 2.1% higher

than rates in the first quarter of 2017. Time utilization (based on

original equipment cost) was 70.4% in the first quarter of 2018

compared to 68.5% a year ago.

Gross margins on new equipment sales increased to 12.1% in the

first quarter compared to 11.4% a year ago. Gross margins on used

equipment sales were 31.9% compared to 31.2% a year ago. Gross

margins on parts sales decreased to 26.8% in the first quarter of

2018 compared to 28.0% in the first quarter of 2017. Gross margins

on service revenues were 66.4% for the first quarter of 2018

compared to 66.9% in the first quarter of 2017.

Rental Fleet

At the end of the first quarter of 2018, the original

acquisition cost of the Company’s rental fleet was $1.5 billion, an

increase of $175.3 million from the end of the first quarter of

2017. Dollar utilization was 34.7% compared to 32.4% for the first

quarter of 2017.

Selling, General and Administrative

Expenses

SG&A expenses for the first quarter of 2018 were $65.9

million compared with $57.3 million the prior year, an $8.6

million, or 14.9% increase. SG&A expenses in the first quarter

of 2018 as a percentage of total revenues were 25.3%, the same as a

year ago. The increase in SG&A was largely attributable to

higher labor, wages, incentives and other employee benefits costs

of $4.1 million. Also, our results for the first quarter of 2018

included three months of CEC’s operations totaling $2.2 million in

SG&A expenses combined with $0.7 million of amortization of

intangibles associated with the purchase price allocation of CEC.

Expenses related to Greenfield branch expansions increased $1.1

million compared to a year ago.

Income from Operations

Income from operations for the first quarter of 2018 increased

28.1% to $27.3 million, or 10.5% of revenues, compared to $21.3

million, or 9.4% of revenues, a year ago.

Interest Expense

Interest expense was $14.7 million for the first quarter of 2018

compared to $13.2 million a year ago.

Net Income

Net income was $9.5 million, or $0.26 per diluted share, in the

first quarter of 2018 compared to net income of $5.4 million, or

$0.15 per diluted share, in the first quarter of 2017. Our

effective income tax rate was 27.5% in the first quarter of 2018

compared to 36.8% in the year ago period.

Adjusted EBITDA

Adjusted EBITDA for the first quarter of 2018 increased 17.7% to

$80.9 million compared to $68.8 million in the first quarter of

2017. Adjusted EBITDA as a percentage of revenues was 31.1%

compared with 30.3% in the first quarter of 2017.

Non-GAAP Financial Measures

This press release contains certain Non-GAAP measures (EBITDA

and Adjusted EBITDA). Please refer to our Current Report on Form

8-K for a description of these measures and of our use of these

measures. These measures as calculated by the Company are not

necessarily comparable to similarly titled measures reported by

other companies. Additionally, these Non-GAAP measures are not a

measurement of financial performance or liquidity under GAAP and

should not be considered as alternatives to the Company's other

financial information determined under GAAP.

Conference Call

The Company’s management will hold a conference call to discuss

first quarter results today, April 26, 2018 at 10:00 a.m. (Eastern

Time). To listen to the call, participants should dial 719-457-0349

approximately 10 minutes prior to the start of the call. A

telephonic replay will become available after 1:00 p.m. (Eastern

Time) on April 26, 2018, and will continue through May 5, 2018, by

dialing 719-457-0820 and entering the confirmation code

7988744.

The live broadcast of the Company’s quarterly conference call

will be available online at www.he-equipment.com on April 26, 2018,

beginning at 10:00 a.m. (Eastern Time) and will continue to be

available for 30 days. Related presentation materials will be

posted to the “Investor Relations” section of the Company’s web

site at www.he-equipment.com prior to the call. The presentation

materials will be in Adobe Acrobat format.

About H&E Equipment Services, Inc.

The Company is one of the largest integrated equipment services

companies in the United States with 88 full-service facilities

throughout the West Coast, Intermountain, Southwest, Gulf Coast,

Mid-Atlantic and Southeast regions. The Company is focused on heavy

construction and industrial equipment and rents, sells and provides

parts and services support for four core categories of specialized

equipment: (1) hi-lift or aerial platform equipment; (2) cranes;

(3) earthmoving equipment; and (4) industrial lift trucks. By

providing equipment rental, sales, on-site parts, repair and

maintenance functions under one roof, the Company is a one-stop

provider for its customers' varied equipment needs. This full

service approach provides the Company with multiple points of

customer contact, enabling it to maintain a high quality rental

fleet, as well as an effective distribution channel for fleet

disposal and provides cross-selling opportunities among its new and

used equipment sales, rental, parts sales and services

operations.

Forward-Looking Statements

Statements contained in this press release that are not

historical facts, including statements about H&E’s beliefs and

expectations, are “forward-looking statements” within the meaning

of the federal securities laws. Statements that are not historical

facts, including statements about our beliefs and expectations are

forward-looking statements. Statements containing the words “may”,

“could”, “would”, “should”, “believe”, “expect”, “anticipate”,

“plan”, “estimate”, “target”, “project”, “intend”, “foresee” and

similar expressions constitute forward-looking statements.

Forward-looking statements involve known and unknown risks and

uncertainties, which could cause actual results to differ

materially from those contained in any forward-looking statement.

Such factors include, but are not limited to, the following: (1)

general economic conditions and construction and industrial

activity in the markets where we operate in North America; (2) our

ability to forecast trends in our business accurately, and the

impact of economic downturns and economic uncertainty in the

markets we serve; (3) the impact of conditions in the global credit

and commodity markets and their effect on construction spending and

the economy in general; (4) relationships with equipment suppliers;

(5) increased maintenance and repair costs as we age our fleet and

decreases in our equipment’s residual value; (6) our indebtedness;

(7) risks associated with the expansion of our business and any

potential acquisitions we may make, including any related capital

expenditures, or our inability to consummate such acquisitions; (8)

our possible inability to integrate any businesses we acquire; (9)

competitive pressures; (10) security breaches and other disruptions

in our information technology systems; (11) adverse weather events

or natural disasters; (12) compliance with laws and regulations,

including those relating to environmental matters and corporate

governance matters; and (13) other factors discussed in our public

filings, including the risk factors included in the Company’s most

recent Annual Report on Form 10-K. Investors, potential investors

and other readers are urged to consider these factors carefully in

evaluating the forward-looking statements and are cautioned not to

place undue reliance on such forward-looking statements. Except as

required by applicable law, including the securities laws of the

United States and the rules and regulations of the Securities and

Exchange Commission, we are under no obligation to publicly update

or revise any forward-looking statements after the date of this

release. These statements are based on the current beliefs and

assumptions of H&E’s management, which in turn are based on

currently available information and important, underlying

assumptions. H&E is under no obligation to publicly update or

revise any forward-looking statements after this press release,

whether as a result of any new information, future events or

otherwise. Investors, potential investors, security holders and

other readers are urged to consider the above mentioned factors

carefully in evaluating the forward-looking statements and are

cautioned not to place undue reliance on such forward-looking

statements.

H&E EQUIPMENT SERVICES,

INC.

CONSOLIDATED STATEMENTS OF INCOME

(unaudited)

(Amounts in thousands, except per share

amounts)

Three Months Ended

March 31,

2018

2017

Revenues: Equipment rentals $ 129,361 $ 107,317 New

equipment sales 46,493 34,274 Used equipment sales 24,853 28,863

Parts sales 28,151 27,000 Service revenues 15,036 15,080 Other

16,588 14,294 Total revenues 260,482 226,828 Cost of

revenues: Rental depreciation 46,469 40,903 Rental expense 21,272

18,374 New equipment sales 40,845 30,381 Used equipment sales

16,937 19,861 Parts sales 20,617 19,436 Service revenues 5,050

4,999 Other 16,707 15,202 Total cost of revenues 167,897 149,156

Gross profit 92,585 77,672

Selling, general, and administrative

expenses

65,880 57,318 Merger costs 152 -

Gain on sales of property and equipment,

net

(773) (971) Income from operations 27,326 21,325

Interest expense (14,653) (13,232) Other income, net 395 437

Income before provision for income

taxes

13,068 8,530 Provision for income taxes 3,590 3,140

Net income $ 9,478 $ 5,390 NET INCOME PER SHARE Basic – Net

income per share $ 0.27 $ 0.15

Basic – Weighted average number of common

shares outstanding

35,592 35,465 Diluted – Net income per share $ 0.26 $ 0.15

Diluted – Weighted average number of

common shares outstanding

35,879 35,621 Dividends declared per common share $ 0.275 $ 0.275

H&E EQUIPMENT SERVICES,

INC.

SELECTED BALANCE SHEET DATA

(unaudited)

(Amounts in thousands)

March 31,

December 31,

2018

2017

Cash $ 38,084 $ 165,878 Rental equipment, net 954,080

904,824 Total assets 1,517,298 1,467,717 Total debt (1) 951,430

951,486 Total liabilities 1,299,553 1,250,924 Stockholders’ equity

217,745 216,793 Total liabilities and stockholders’ equity $

1,517,298 $ 1,467,717

(1)

Total debt consists of the aggregate amounts outstanding on

the senior unsecured notes and capital lease obligations.

H&E EQUIPMENT SERVICES,

INC.

UNAUDITED RECONCILIATION OF NON-GAAP

FINANCIAL MEASURES

(Amounts in thousands)

Three Months Ended

March 31,

2018

2017

Net income $ 9,478 $ 5,390 Interest expense 14,653 13,232

Provision for income taxes 3,590 3,140 Depreciation and

amortization of intangibles 53,058 46,998 EBITDA $ 80,779 $

68,760 Merger costs 152 - Adjusted EBITDA $ 80,931 $

68,760

View source

version on businesswire.com: https://www.businesswire.com/news/home/20180426005546/en/

H&E Equipment Services, Inc.Leslie S. Magee,

225-298-5261Chief Financial Officerlmagee@he-equipment.comorKevin

S. Inda, 225-298-5318Vice President of Investor

Relationskinda@he-equipment.com

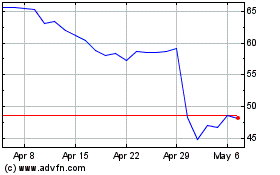

H and E Equipment Services (NASDAQ:HEES)

Historical Stock Chart

From Mar 2024 to Apr 2024

H and E Equipment Services (NASDAQ:HEES)

Historical Stock Chart

From Apr 2023 to Apr 2024