Continued Generation of Increasing Free

Cash Flow Opportunistic Capital Deployment and

Shareholder Returns

For the year ended December 31, 2017, Omni-Lite Industries Canada

Inc. (the "Company") (TSXV:OML) (OTCQX:OLNCF) is pleased to

announce audited annual revenue of US$6,539,934. Total

bookings for fiscal year 2017 were US$6,726,533, yielding a book-to

bill ratio of 1.03. In the 2017 fiscal period, cash flow from

operations increased to US$2,083,701 versus US$1,965,273 in fiscal

year 2016, a gain of 6%. Free Cash Flow generated in fiscal

year 2017 increased 13% to US$954,366. Gross margin, as

adjusted, for fiscal year 2017 increased approximately 400 basis

points, to 58.3% (excluding one-time provisions).

In 2017, the Company successfully received 4 new

aerospace component approvals from one of our largest aerospace

customers and is in active design and initial production on 8

additional components. All 12 components will be added to our

current multiyear contract with this customer. “These orders

complement the family of parts mentioned in two previous press

releases during 2017. These new orders are indicative of the trend

of large integrated tier one aerospace suppliers outsourcing to

nimble, high technology companies like Omni-Lite,” stated Allen W.

Maxin, President.

In addition, during the fiscal year, the Company

continued to receive a number of military contracts that continue

the important U.S. Department of Defense programs that began in

2014. These are the fourth and fifth set of contiguous orders in

this program. These aerospace and military contracts continue to

represent a tremendous vote of confidence in the state of the art

engineering and manufacturing facility that the Company has built

in Southern California and point towards growth in 2018 and beyond

as the Company becomes more strategic to the customers it is

servicing. The Company will continue its efforts to

focus growth in these higher margin Aerospace and Military

areas.

The Company is also pleased to announce it has

received new contract orders worth in excess of US$721,000 since

our last press release on February 20, 2018. Of these orders,

52% are in the Aerospace Division, 34% are in the Specialty

Automotive Division, and 14% are in the Sports and Recreational

Division. Of significant note, in the Aerospace Division, the

Company received its second Titanium component order to be produced

on its new Hot Forging system.

The Company would also like to note that the

white reflective roof coating and the large solar energy system has

been completed and is operational. The solar energy system was

brought online approximately 30 days ago and have experienced a

significant decrease in power usage with a resulting 30% savings in

our utility cost.

Finally, in fiscal year 2017, the Company

repurchased 353,600 shares of our common stock under its Normal

Course Issuer Bid, representing in excess of 3% of the Company’s

issued and outstanding shares.

Financial Highlights

Revenue : For the fiscal year

ended December 31, 2017, Omni-Lite reported revenue of

US$6,539,934.

Sales by division are summarized below:

|

Division |

|

Aerospace |

|

Military |

|

Specialty Automotive |

|

Sports &Recreation |

|

2017 |

|

37% |

|

24% |

|

25% |

|

14% |

|

2016 |

|

40% |

|

15% |

|

34% |

|

11% |

Earnings Per Share: Basic

earnings per share were US$0.07 compared to US$0.07 generated in

fiscal year 2016 based on the weighted average shares outstanding

of 10,255,472 in fiscal year 2017 and 10,911,638 in fiscal year

2016. During the year, pursuant to a Normal Course Issuer Bid under

applicable securities legislation, the Company acquired 353,600 of

its issued and outstanding common shares at a cost of

US$518,429.

The diluted earnings per share were US$0.07

compared to US$0.07 in fiscal year 2016.

| SUMMARY OF FINANCIAL HIGHLIGHTS |

| All figures in US dollars unless noted. |

| |

|

|

For the yearendedDecember 31,2017 |

For the yearendedDecember 31,2016 |

%Increase(Decrease) |

|

Revenue |

|

$6,539,934 |

|

$7,179,808 |

(9 |

%) |

|

Cash Flow from Operations (1) |

|

2,083,701 |

|

1,965,273 |

6 |

% |

|

Free Cash Flow (1) |

|

954,366 |

|

851,855 |

13 |

% |

|

EBITDA (1) |

|

1,327,240 |

|

2,056,566 |

(36 |

%) |

|

Adjusted EBITDA (1) |

|

1,688,751 |

|

1,985,769 |

(15 |

%) |

|

Net Income |

|

737,824 |

|

762,595 |

(3 |

%) |

|

Diluted EPS (US) |

|

0.07 |

|

0.07 |

0 |

% |

(1) Please see 2017 Management Discussion and

Analysis for detailed notes and definitions

Omni-Lite Industries Canada Inc. is a rapidly

growing high technology company that develops and manufactures

mission critical, precision components utilized by Fortune 500

companies including Boeing, Airbus, Bombardier, Embraer, Arconic,

Ford, Borg Warner, Chrysler, the U.S. Military, and Nike.

Except for historical information contained

herein this document contains forward-looking statements. These

statements contain known and unknown risks and uncertainties that

may cause the Company's actual results or outcomes to be materially

different from those anticipated and discussed herein.

For further information, please

contact:Mr. Allen Maxin, PresidentTel. No.

(562) 404-8510 or (800) 577-6664Email: a.maxin@omni-lite.com

Website: www.omni-lite.com

Reader Advisory

Except for statements of historical fact, this

news release contains certain "forward-looking information" within

the meaning of applicable securities law. Forward-looking

information is frequently characterized by words such as "plan",

"expect", "project", "intend", "believe", "anticipate", "estimate"

and other similar words, or statements that certain events or

conditions "may" or "will" occur. In particular, forward-looking

information in this press release includes, but is not limited to

the expected future performance of the Company. Although we believe

that the expectations reflected in the forward-looking information

are reasonable, there can be no assurance that such expectations

will prove to be correct. We cannot guarantee future results,

performance or achievements. Consequently, there is no

representation that the actual results achieved will be the same,

in whole or in part, as those set out in the forward-looking

information. Forward-looking information is based on the opinions

and estimates of management at the date the statements are made,

and are subject to a variety of risks and uncertainties and other

factors that could cause actual events or results to differ

materially from those anticipated in the forward-looking

information. Some of the risks and other factors that could cause

the results to differ materially from those expressed in the

forward-looking information include, but are not limited to:

general economic conditions in Canada, the United States and

globally; industry conditions, governmental regulation, including

environmental regulation; unanticipated operating events or

performance; failure to obtain industry partner and other third

party consents and approvals, if and when required; the

availability of capital on acceptable terms; the need to obtain

required approvals from regulatory authorities; stock market

volatility; competition for, among other things, capital, skilled

personnel and supplies; changes in tax laws; and the other risk

factors disclosed under our profile on SEDAR at www.sedar.com.

Readers are cautioned that this list of risk factors should not be

construed as exhaustive. The forward-looking information contained

in this news release is expressly qualified by this cautionary

statement. We undertake no duty to update any of the

forward-looking information to conform such information to actual

results or to changes in our expectations except as otherwise

required by applicable securities legislation. Readers are

cautioned not to place undue reliance on forward-looking

information.

Neither TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in policies

of the TSX Venture Exchange) accepts responsibility for the

adequacy or accuracy of this release.

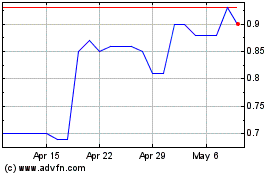

Omni Lite Industries Can... (TSXV:OML)

Historical Stock Chart

From Mar 2024 to Apr 2024

Omni Lite Industries Can... (TSXV:OML)

Historical Stock Chart

From Apr 2023 to Apr 2024