Current Report Filing (8-k)

April 25 2018 - 8:01AM

Edgar (US Regulatory)

UNITED

STATES

SECURITY

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities and Exchange Act of 1934

Date

of Report (Date of earliest event reported): March 1, 2018

NUSTATE

ENERGY HOLDINGS, INC.

(Exact

name of Registrant as specified in its charter)

|

Florida

|

|

000-25753

|

|

87-04496677

|

|

(State

or other jurisdiction

of

incorporation)

|

|

(Commission

File

Number)

|

|

(IRS

Employer

Identification

No.)

|

401

East Olas Blvd Suite 1400

Ft.

Lauderdale, Florida 33301

(Address

of principal executive offices, including zip code)

(954)

712-7487

(Registrant’s

telephone number, including area code)

Check

the appropriate box below if the 8-K filing is intended to simultaneously satisfy the filing obligations of the registrant under

any of the following provisions:

|

[ ]

|

Written

communication pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

[ ]

|

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

[ ]

|

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

[ ]

|

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)).

|

CAUTIONARY

NOTE REGARDING FORWARD-LOOKING STATEMENTS

This

Current Report contains forward-looking statements, including, without limitation, in the sections captioned “Description

of Business,” “Risk Factors,” and “Management’s Discussion and Analysis of Financial Condition and

Plan of Operations,” and elsewhere. Any and all statements contained in this Report that are not statements of historical

fact may be deemed forward-looking statements. Terms such as “may,” “might,” “would,” “should,”

“could,” “project,” “estimate,” “pro-forma,” “predict,” “potential,”

“strategy,” “anticipate,” “attempt,” “develop,” “plan,” “help,”

“believe,” “continue,” “intend,” “expect,” “future,” and terms of

similar import (including the negative of any of the foregoing) may be intended to identify forward-looking statements. However,

not all forward-looking statements may contain one or more of these identifying terms. Forward-looking statements in this Report

may include, without limitation, statements regarding (i) the plans and objectives of management for future operations, including

plans or objectives relating to the development of commercially viable pharmaceuticals, (ii) a projection of income (including

income/loss), earnings (including earnings/loss) per share, capital expenditures, dividends, capital structure or other financial

items, (iii) our future financial performance, including any such statement contained in a discussion and analysis of financial

condition by management or in the results of operations included pursuant to the rules and regulations of the Securities and Exchange

Commission (the “SEC”), and (iv) the assumptions underlying or relating to any statement described in points (i),

(ii) or (iii) above.

The

forward-looking statements are not meant to predict or guarantee actual results, performance, events or circumstances and may

not be realized because they are based upon our current projections, plans, objectives, beliefs, expectations, estimates and assumptions

and are subject to a number of risks and uncertainties and other influences, many of which we have no control over. Actual results

and the timing of certain events and circumstances may differ materially from those described by the forward-looking statements

as a result of these risks and uncertainties. Factors that may influence or contribute to the inaccuracy of the forward-looking

statements or cause actual results to differ materially from expected or desired results may include, without limitation, our

inability to obtain adequate financing, the significant length of time associated with drug development and related insufficient

cash flows and resulting illiquidity, our inability to expand our business, significant government regulation of pharmaceuticals

and the healthcare industry, lack of product diversification, volatility in the price of our raw materials, existing or increased

competition, results of arbitration and litigation, stock volatility and illiquidity, and our failure to implement our business

plans or strategies. A description of some of the risks and uncertainties that could cause our actual results to differ materially

from those described by the forward-looking statements in this Report appears in the section captioned “Risk Factors”

and elsewhere in this Report.

Readers

are cautioned not to place undue reliance on forward-looking statements because of the risks and uncertainties related to them

and to the risk factors. We disclaim any obligation to update the forward-looking statements contained in this Report to reflect

any new information or future events or circumstances or otherwise.

Readers

should read this Report in conjunction with the discussion under the caption “Risk Factors,” our financial statements

and the related notes thereto in this Report, and other documents which we may file from time to time with the SEC.

Item

5.03 Amendments to Articles of Incorporation or Bylaws; Change in Fiscal Year.

As

described in the Company’s Information Statement which was filed with the Securities and Exchange Commission on March 8,

2018, the Company’s stockholders authorized the Company’s Board of Directors to:

|

|

(i)

|

reverse

the Common stock by a ratio of three thousand for one (3,000:1). The board of directors was authorized to implement the reverse

stock split. The reverse stock split adjusts the currently issued and outstanding Common shares of the company from 4,457,470,456

Common Shares to a total of 1,485,824 Common Shares. This action will have no effect on the number of Authorized common shares

of the Company; and to

|

|

|

|

|

|

|

(ii)

|

change

the name of the Company to Visium Technologies, Inc.

|

|

|

|

|

|

|

(iii)

|

amendment

our Amended and Restated Articles of Incorporation to designate Series AA Convertible Preferred Stock which provides that

the Holder shall vote on all matters as a class with the holders of the Company’s Common Stock and shall be entitled

to 51% of the common votes on any matters requiring a shareholder vote of the Company.

|

On March 5, 2018 the Company filed an amendment to its Articles of Incorporation with the State Department

of Corporations in the State of Florida to effect these changes, effective March 1, 2018.

As

a result of the Reverse Stock Split, each 3,000 shares of the Company’s issued and outstanding Common Stock automatically,

and without any action on the part of the respective holders, will become one (1) issued and outstanding share of Common Stock.

No fractional share certificates will be issued in connection with the Reverse Stock Split. The final amount of outstanding common

stock after the Reverse Stock Split shall be determined after any fractional shares are rounded up to one share. The Company intends

that there will not be a mandatory exchange of certificates; rather, new certificates will be provided in the ordinary course

of business.

Section

9- Financial Statements and Exhibits

Item

9.01. Financial Statements and Exhibits.

(d)

Exhibits.

Set

forth below is a list of exhibits to this Current Report on Form 8-K:

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf

by the undersigned hereunto duly authorized.

|

|

NUSTATE

ENERGY HOLDINGS, INC.

|

|

|

|

|

Date:

April 25, 2018

|

By:

|

/s/

Mark Lucky

|

|

|

|

Mark

Lucky

|

|

|

|

Chief

Executive Officer

|

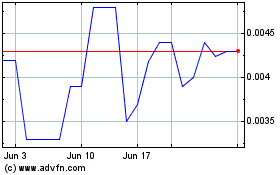

Visium Technologies (PK) (USOTC:VISM)

Historical Stock Chart

From Mar 2024 to Apr 2024

Visium Technologies (PK) (USOTC:VISM)

Historical Stock Chart

From Apr 2023 to Apr 2024