Table of Contents

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Issuer

Pursuant to Rule 13a-16 or 15d-16

of the Securities Exchange Act of 1934

For the month of April 2018

Commission File Number: 001-13464

Telecom

Argentina S.A.

(Translation of registrant’s name into English)

Alicia Moreau de Justo, No. 50, 1107

Buenos Aires, Argentina

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

Indicate by check mark whether by furnishing the information contained in this Form, the Registrant is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934:

If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b):

N/A

Table of Contents

Telecom Argentina S.A.

Cablevisión S.A.

You should carefully review the information contained herein before making an investment decision. However, this information is provided for informational purposes only in order to illustrate Cablevisión S.A.’s financial results and operations prior to its merger and integration into Telecom Argentina S.A. (“TEO”) and to illustrate, on a pro forma basis, the financial effects attributable to the Merger on TEO’s audited consolidated financial statements as of and for the fiscal year ended December 31, 2017, which are included in TEO’s annual report on Form 20-F for the fiscal year ended December 31, 2017 filed with the SEC on April 20, 2018 (the “

TEO 2017 20-F”)

.

We have not authorized anyone to provide information that is different or additional to the information contained in this 6-K. We do not take responsibility for any other information about Cablevisión that others may give you. If anyone provides you with different or additional information, not included in this 6-K you should not rely on it. You should assume that the information in this 6-K relating to Cablevisión is accurate only as of January 1, 2018 (the “Merger Effective Date”), regardless of the time it is delivered. All defined terms not otherwise defined herein will have the meaning assigned to them in the

TEO 2017 20-F

.

Table of Contents

ABOUT THIS 6-K

References in this 6-K to “Cablevisión,” are to Cablevisión S.A. and its subsidiaries, unless the context requires otherwise prior to the Merger Effective Date. References in this 6-K to the “Company,” “TEO,” “we,” “us” and “our” are to Telecom Argentina S.A after the Merger Effective Date. References to “Multicanal” are to Multicanal S.A. References to “Adesol” are to Adesol S.A. All defined terms not otherwise defined herein will have the meaning assigned to them in the TEO 2017 20-F.

In this 6-K, references to “Pesos,” “pesos” or “Ps.” are to Argentine pesos, and references to “U.S. Dollars,” “dollars” or “U.S.$” are to U.S. dollars. A “billion” is a thousand million.

The information provided in this 6-K that relates to Argentina and its economy is based upon publicly available information, and we do not make any representation or warranty with respect to such information. Argentina, and any governmental agency or political subdivision thereof, does not in any way guarantee, and their credit does not otherwise back our obligations in respect of the notes.

Certain amounts shown in this 6-K are subject to rounding. Accordingly, figures shown as totals in certain tables may not be an exact arithmetic aggregate of the other figures in such table.

2

Table of Contents

PRESENTATION OF FINANCIAL AND OTHER INFORMATION

The financial information included herein is prepared and presented in accordance with the International Financial Reporting Standards (“IFRS”), as issued by the International Accounting Standards Board (“IASB”).

Cablevisión maintained its financial books and records and published financial statements in Argentine Pesos up to December 31, 2017 (the merger and integration into TEO became effective on January 1, 2018). This 6-K contains Cablevisión’

s

consolidated financial statements as of December 31, 2017 and 2016 and for the years ended December 31, 2017, 2016 and 2015, which have been prepared in accordance with IFRS (the “Cablevisión 2017 Audited Financial Statements”) and have been audited by Price Waterhouse & Co. S.R.L. (a member firm of the PricewaterhouseCoopers network) (“PwC”) independent accountants, as stated in their report included herein.

PwC issued an opinion on the Cablevisión 2017 Audited Financial Statements dated March 7, 2018 that contains an emphasis of matter paragraph describing the following factors that affected Cablevisión’

s

activities and the activities of certain of its subsidiaries as of December 31, 2017: (i) the resolution No. 50 issued by the

Argentine Secretariat of Internal Commerce

(Secretaría de Comercio Interior)

(“SCI”) including the formula to calculate the monthly fees to be paid by cable television subscribers, which effects are uncertain as of the date of issuance of said opinion; and (ii) the absorption of Cablevisión by TEO on January 1, 2018 pursuant to the Merger. In accordance with IFRS, the financial information set forth in this 6-K has not been adjusted to reflect inflation. Inflation could therefore affect the comparability of the different periods presented herein.

Certain figures included in this 6-K and in the Cablevisión 2017 Audited Financial Statements have been rounded for ease of presentation. Percentage figures included in this 6-K have in some cases been calculated on the basis of such figures prior to rounding. For this reason, certain percentage amounts in this 6-K may vary from those obtained by performing the same calculations using the figures in the Financial Statements. Certain other amounts that appear in this 6-K may not add up due to rounding.

Exchange Rates

Some of the Peso amounts contained in this 6-K have been translated into U.S. Dollars at specified rates for convenience purposes only. Unless otherwise indicated, Cablevisión has translated the Argentine Peso amounts using a rate of P$18.65 to U.S.$1.00, the U.S. dollar ask rate published by the

Banco de la Nación Argentina

(Argentine National Bank) on December 31, 2017

.

The Federal Reserve Bank of New York does not report a noon buying rate for Pesos. The U.S. Dollar equivalent information presented in this 6-K is provided solely for the convenience of the reader and should not be construed to represent that the Peso amounts in question have been, or could have been or could be converted into, U.S. Dollars at such rates or at any other rate.

Customer Data

The operational and statistical data set forth in this 6-K, including metrics such as average revenue per user, or ARPU, penetration rates and churn rates are determined by management, are not part of the Cablevisión 2017 Audited Financial Statements and have not been audited or otherwise reviewed by an outside auditor, consultant or expert. For more information, see “Discussion and Analysis of Financial Condition and Results of Operations.”

“

Clientes únicos

,” or active customer relationships, are defined as customers that receive at least one of Cablevisión’s main services — cable services or broadband. As of December 31, 2017, 60% of Cablevisión’s total customers received broadband services, 89% received cable services and 49% received both services.

“ARPU” is defined as average monthly revenue per active customer (including revenue earned from cable and broadband subscription fees, cable premium services, pay-per-view fees, installation fees, fixed telephony, additional outlets and magazine revenues) for the indicated period, divided by the average of the opening and closing active customer relationships, as applicable, for the period.

3

Table of Contents

“Churn” refers to the termination of a customer’s account. The churn rate is determined by calculating the total number of disconnected customers over a given period as a percentage of the initial number of relevant customers for the same period.

Third-Party Information

The information set forth in this 6-K with respect to the market environment, market developments, growth rates, trends and competition in the markets and segments in which Cablevisión operates are based on information published by the Argentine federal and local governments through the

Instituto Nacional de Estadísiticas y Censos

(the National Statistics and Census Institute, or “INDEC”) and the Ministry of Public Works, the Central Bank (defined below), the

Dirección General de Estadística y Censos de la Ciudad de Buenos Aires

(General Directorate of Statistics and Census of the City of Buenos Aires) and the

Dirección Provincial de Estadística y Censos de la Provincia de San Luis

(Provincial Directorate of Statistics and Census of the Province of San Luis), as well as on independent third-party data, statistical information and reports produced by unaffiliated entities such as Dataxis, International Data Corporation (“IDC”), SNL Kagan Media-Communications (“Kagan”) and Pyramid Research Inc. (“Pyramid”), as well as on our own internal estimates.

Market studies are frequently based on information and assumptions that may not be exact or appropriate, and their methodology is by nature forward looking and speculative. This 6-K also contains estimates made by us based on third-party market data, which in turn is based on published market data or figures from publicly available sources.

We have not verified the figures, market data or other information on which third parties have based their studies nor have such third parties verified the external sources on which such estimates are based. Therefore we do not guarantee, nor do we assume responsibility for, the accuracy of the information from third-party studies presented in this 6-K or for the accuracy of the information on which such third party estimates are based.

This 6-K also contains estimates of market data and information derived therefrom which cannot be gathered from publications by market research institutions or any other independent sources. Such information is based on our internal estimates. In many cases there is no publicly available information on such market data, for example from industry associations, public authorities or other organizations and institutions. We believe that these internal estimates of market data and information derived therefrom are helpful in order to give investors a better understanding of the industry in which we operate as well as our position within this industry. Although we believe that our internal market observations are reliable, such estimates are not reviewed or verified by any external sources. In addition, such estimates reflect various assumptions made by us that may or may not prove accurate, as well as the exercise of a substantial degree of judgment by management as to the scope and presentation of such information. No representations or warranties can be made concerning the accuracy of our estimates of market data and the information received therefrom. These may deviate from market data estimates made by our competitors or future statistics provided by market research institutes or other independent sources. We cannot assure you that our market data estimates or the assumptions are accurate or correctly reflect the state and development of, or our position in, the industry.

Pro Forma Summarized Financial Information of TEO

This 6-K includes, to illustrate the financial effects attributable to the Merger for informational purposes only, unaudited pro forma summarized financial information. Telecom’s unaudited pro forma consolidated statement of financial position assumes that the Merger was consummated on December 31, 2017, and Telecom’s unaudited pro forma consolidated income statements assume that the Merger was consummated on January 1, 2017 (together, the “Unaudited Pro Forma Information”).

The Unaudited Pro Forma Information has been prepared using certain of Telecom’s and Cablevisión’s respective historical financial statements as more particularly described in the notes to the consolidated financial statements of Telecom as of December 31, 2017 and 2016 and for the years ended December 31, 2017, 2016 and 2015, which are included in the

TEO 2017 20-F filed with the SEC on April 20, 2018 (the “Telecom 2017 Audited Financial Statements”) and the Cablevisión 2017 Audited Financial Statements. Further, the Unaudited Pro Forma Information is not intended to be indicative of the results that would actually have occurred, or the results expected in future periods, had the events reflected therein materialized on the dates indicated. Actual amounts recorded upon the finalization of the purchase price allocation under the Merger may differ from the amounts reflected in the Telecom Unaudited Pro Forma Consolidated Financial Information. The Unaudited Pro Forma Information has been

4

Table of Contents

developed to retroactively show the effect of a transaction that materialized at a later date (even though this was accomplished by following generally accepted practice using reasonable assumptions); however, there are limitations inherent in the very nature of pro forma data. The data contained in the Unaudited Pro Forma Information represents only a simulation of the potential financial impact of the Merger. We believe that the underlying assumptions for the pro forma adjustments provide a reasonable basis for presenting the significant financial effect directly attributable to the Merger. These pro forma adjustments are tentative and are based on currently available financial information and certain estimates and assumptions.The actual adjustments to Telecom’s consolidated financial statements will depend on a number of factors and additional information that is not yet available. Therefore, it is expected that the actual adjustments will differ from the pro forma adjustments, and the differences may be material. For further information on the Merger, see “Item 4. Information on the Company—The Merger” of the

TEO 2017 20-F.

The unaudited pro forma consolidated statement of financial position as of December 31, 2017 and the unaudited pro forma consolidated statement of income for the year ended December 31, 2017 are based upon, derived from, and should be read in conjunction with (i) the Telecom 2017 Audited Financial Statements, which are included in the TEO 2017 20-F filed with the SEC on April 20, 2018, and (ii) the Cablevisión 2017 Audited Financial Statements, which are included in this 6-K.

5

Table of Contents

SELECTED FINANCIAL AND OPERATING DATA OF CABLEVISIÓN

The following tables set forth Cablevisión’s summary consolidated financial information as of December 31, 2017 and 2016 and for the fiscal years ended December 31, 2017, 2016 and 2015. You should read this information in conjunction with the Cablevisión 2017 Audited Financial Statements and their respective related notes, and the information under “Discussion and Analysis of Financial Condition and Results of Operations” included elsewhere in this 6-K.

Selected Financial and Operating Data

|

|

|

For the year ended December 31,

|

|

|

|

|

2017

|

|

2016

|

|

2015

|

|

|

|

|

(in millions of Pesos)

|

|

|

Statement of Comprehensive Income Data:

|

|

|

|

|

|

|

|

|

Revenues

|

|

40,952

|

|

30,571

|

|

20,125

|

|

|

Cost of sales

(1)

|

|

(19,109

|

)

|

(14,190

|

)

|

(9,244

|

)

|

|

Gross income

|

|

21,843

|

|

16,381

|

|

10,881

|

|

|

Selling expenses

(1)

|

|

(5,992

|

)

|

(4,398

|

)

|

(2,525

|

)

|

|

Administrative expenses

(1)

|

|

(4,682

|

)

|

(3,641

|

)

|

(2,628

|

)

|

|

Other income and (expenses), net

|

|

29

|

|

(11

|

)

|

2

|

|

|

Results of acquisition of associates

|

|

—

|

|

114

|

|

—

|

|

|

Financial costs

|

|

(2,242

|

)

|

(2,597

|

)

|

(2,785

|

)

|

|

Other financial income and (expenses), net

|

|

(370

|

)

|

222

|

|

(28

|

)

|

|

Financial results

|

|

(2,612

|

)

|

(2,374

|

)

|

(2,813

|

)

|

|

Equity in earnings from associates

|

|

168

|

|

131

|

|

505

|

|

|

Net income before income tax

|

|

8,754

|

|

6,202

|

|

3,422

|

|

|

Income tax

|

|

(2,859

|

)

|

(2,095

|

)

|

(909

|

)

|

|

Net income for the year

|

|

5,895

|

|

4,107

|

|

2,513

|

|

(1)

Includes amortization of intangible assets and depreciation of property, plant and equipment of Ps. 3,987 million,

Ps.

2,588 million and

Ps.

1,566 million in aggregate fiscal years December 31, 2017, 2016 and 2015, respectively

.

|

|

|

As of and for the year ended December 31,

|

|

|

|

|

2017

|

|

2016

|

|

|

|

|

(in millions of Pesos)

|

|

|

Statement of Financial Position:

|

|

|

|

|

|

|

Non-current assets

|

|

29,088

|

|

23,113

|

|

|

Current assets

|

|

7,188

|

|

5,822

|

|

|

Total assets

|

|

36,276

|

|

28,935

|

|

|

Non-current liabilities

|

|

11,402

|

|

10,024

|

|

|

Current liabilities

|

|

12,613

|

|

7,203

|

|

|

Total liabilities

|

|

24,015

|

|

17,227

|

|

|

Total shareholders’ equity

|

|

12,260

|

|

11,708

|

|

Selected Operating Data

|

|

|

For the year ended December 31,

|

|

|

|

|

2017

|

|

2016

|

|

2015

|

|

|

Active Customer Relationships

(2)

|

|

3.92

|

|

3.91

|

|

3.87

|

|

|

Cable Television Subscribers

(3)

|

|

89

|

%

|

90

|

%

|

91

|

%

|

|

Broadband Customers

(3)

|

|

60

|

%

|

55

|

%

|

52

|

%

|

|

ARPU (excluding Nextel)

(1)

|

|

797

|

|

566

|

|

420

|

|

|

Churn Ratio:

|

|

|

|

|

|

|

|

|

Cable TV

(3)

|

|

14.6

|

%

|

13.8

|

%

|

12.6

|

%

|

|

Broadband

(3)

|

|

17.1

|

%

|

16.2

|

%

|

15.6

|

%

|

(1) In Pesos.

(2) Figures in millions.

(3) Subscribers as a percentage of total active customer relationships.

6

Table of Contents

UNAUDITED PRO FORMA CONSOLIDATED FINANCIAL INFORMATION OF TEO

The following unaudited pro forma consolidated financial information is presented to illustrate the Merger. For further information, see “Item 4. Information on the Company—The Merger” of the

TEO 2017 20-F. The unaudited pro forma consolidated statement of financial position as of December 31, 2017 and the unaudited pro forma consolidated statement of income for the year ended December 31, 2017 (together, the “Unaudited Pro Forma Information”) are based upon, derived from, and should be read in conjunction with (i) the Telecom 2017 Audited Financial Statements, which are included in the TEO 2017 20-F filed with the SEC on April 20, 2018, and (ii) the Cablevisión 2017 Audited Financial Statements, which are included in this 6-K.

The accompanying Unaudited Pro Forma Information give effect to adjustments that are (i) directly attributable to the Merger, (ii) factually supportable, and (iii) with respect to the unaudited pro forma consolidated statement of income, expected to have a continuing impact on the consolidated results. The unaudited pro forma consolidated statement of financial position assumes that the Merger was consummated on December 31, 2017 and the unaudited pro forma consolidated income statements assume that the Merger was consummated on January 1, 2017.

The Merger will be accounted for by the Company as a business combination using the acquisition method of accounting under the provisions of IFRS 3 “Business Combinations” (“IFRS 3”), with Cablevisión selected as the accounting acquirer under this guidance.

Under IFRS 3, all assets acquired and liabilities assumed are generally recorded at their acquisition date fair value. For the purposes of preparing the Unaudited Pro Forma Information, the fair value of Telecom’s identifiable tangible and intangible assets acquired and liabilities assumed are based on a preliminary estimate of fair value. Certain preliminary estimates were used which will be updated upon finalization of the purchase accounting in our historical financial statements for periods reflecting the acquisition. Management believes the estimated fair values used for the assets to be acquired and liabilities to be assumed are based on reasonable assumptions. Preliminary fair value estimates may change as additional information becomes available and such changes could be material.

The Unaudited Pro Forma Information has been prepared by management in accordance with the bases outlined herein and is not necessarily indicative of the consolidated financial position or results of operations that would have been realized had the Merger occurred as of the dates indicated, nor is it meant to be indicative of any anticipated consolidated financial position or future results of operations that we will experience after the Merger. In addition, the accompanying unaudited pro forma consolidated statements of income do not include any expected cost savings or operating synergies, which may be realized subsequent to the Merger or the impact of any non-recurring activity and one-time transaction-related or integration-related items.

We prepared the following Unaudited Pro Forma Information by applying certain pro forma adjustments to Telecom and Cablevisión’s historical consolidated financial statements. We have based the pro forma adjustments on available information and certain assumptions that we believe are reasonable under the circumstances. The actual adjustments to the Telecom consolidated

financial statements for future periods will depend upon a number of factors and additional information that is not yet available. Accordingly, the actual adjustments that will appear in the Telecom consolidated financial statements for future periods will differ from these pro forma adjustments, and those differences may be material.

Unaudited Pro Forma Consolidated Statement of Financial Position as of December 31, 2017

(in millions of pesos)

|

|

|

Column I

|

|

Column II

|

|

Column III

|

|

Column IV

|

|

Column V

|

|

|

|

|

|

|

|

|

Telecom

Argentina S.A.

|

|

Cablevisión

S.A.

|

|

Reclassifications

|

|

Elimination

of balances

|

|

Pro Forma

Adjustments

|

|

Ref.

|

|

Pro Forma

Consolidated

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ASSETS

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Current Assets

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents

|

|

2,831

|

|

4,414

|

|

—

|

|

—

|

|

—

|

|

|

|

7,245

|

|

|

Investments

|

|

3,426

|

|

110

|

|

—

|

|

—

|

|

—

|

|

|

|

3,536

|

|

|

Trade receivables

|

|

8,636

|

|

1,753

|

|

—

|

|

(60

|

)

|

—

|

|

|

|

10,329

|

|

|

Other receivables

|

|

1,491

|

|

828

|

|

—

|

|

—

|

|

—

|

|

|

|

2,319

|

|

7

Table of Contents

|

Inventories

|

|

1,854

|

|

83

|

|

—

|

|

—

|

|

32

|

|

|

|

1,969

|

|

|

Total current assets

|

|

18,238

|

|

7,188

|

|

—

|

|

(60

|

)

|

32

|

|

|

|

25,398

|

|

|

Non-Current Assets

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Trade receivables

|

|

12

|

|

—

|

|

—

|

|

—

|

|

—

|

|

|

|

12

|

|

|

Other receivables

|

|

419

|

|

237

|

|

—

|

|

—

|

|

—

|

|

|

|

656

|

|

|

Income taxes assets

|

|

626

|

|

44

|

|

—

|

|

—

|

|

(624

|

)

|

2.I.(c) 3)

|

|

46

|

|

|

Investments

|

|

2,657

|

|

—

|

|

250

|

|

—

|

|

3

|

|

|

|

2,910

|

|

|

Investments in associates

|

|

—

|

|

250

|

|

(250

|

)

|

—

|

|

—

|

|

|

|

—

|

|

|

Goodwill

|

|

—

|

|

4,109

|

|

—

|

|

—

|

|

59,293

|

|

2.I.(d)

|

|

63,402

|

|

|

Property, plant and equipment

|

|

28,538

|

|

22,080

|

|

—

|

|

—

|

|

34,209

|

|

2.I.(c) 1)

|

|

84,827

|

|

|

Intangible assets

|

|

7,098

|

|

2,368

|

|

—

|

|

—

|

|

33,090

|

|

2.I.(c) 2)

|

|

42,556

|

|

|

Total non-current assets

|

|

39,350

|

|

29,088

|

|

—

|

|

—

|

|

125,971

|

|

|

|

194,409

|

|

|

TOTAL ASSETS

|

|

57,588

|

|

36,276

|

|

—

|

|

(60

|

)

|

126,003

|

|

|

|

219,807

|

|

|

LIABILITIES

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Current Liabilities

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Trade payable

|

|

11,483

|

|

5,637

|

|

(1,751

|

)

|

(60

|

)

|

—

|

|

|

|

15,309

|

|

|

Deferred revenues

|

|

515

|

|

—

|

|

99

|

|

—

|

|

(20

|

)

|

2.I.(c) 4)

|

|

594

|

|

|

Financial debt

|

|

3,194

|

|

937

|

|

—

|

|

—

|

|

27

|

|

|

|

4,158

|

|

|

Salaries and social security payable

|

|

2,051

|

|

—

|

|

1,751

|

|

—

|

|

—

|

|

|

|

3,802

|

|

|

Income tax payable

|

|

2,748

|

|

—

|

|

1,437

|

|

—

|

|

—

|

|

|

|

4,185

|

|

|

Other taxes payable

|

|

1,505

|

|

1,858

|

|

(1,437

|

)

|

—

|

|

—

|

|

|

|

1,926

|

|

|

Dividends payable

|

|

—

|

|

—

|

|

4,080

|

|

—

|

|

—

|

|

|

|

4,080

|

|

|

Other liabilities

|

|

85

|

|

4,181

|

|

(4,178

|

)

|

—

|

|

—

|

|

|

|

88

|

|

|

Provisions

|

|

406

|

|

—

|

|

—

|

|

—

|

|

—

|

|

|

|

406

|

|

|

Total Current Liabilities

|

|

21,987

|

|

12,613

|

|

—

|

|

(60

|

)

|

7

|

|

|

|

34,547

|

|

|

Non-Current Liabilities

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Trade payable

|

|

101

|

|

—

|

|

—

|

|

—

|

|

—

|

|

|

|

101

|

|

|

Deferred revenues

|

|

425

|

|

—

|

|

134

|

|

—

|

|

18

|

|

2.I.(c) 4)

|

|

577

|

|

|

Financial debt

|

|

9,041

|

|

9,907

|

|

—

|

|

—

|

|

—

|

|

|

|

18,948

|

|

|

Salaries and social security payable

|

|

259

|

|

—

|

|

—

|

|

—

|

|

—

|

|

|

|

259

|

|

|

Deferred income tax liabilities

|

|

48

|

|

266

|

|

—

|

|

—

|

|

16,822

|

|

2.I.(c) 3)

|

|

17,136

|

|

|

Income tax payable

|

|

2

|

|

3

|

|

—

|

|

—

|

|

—

|

|

|

|

5

|

|

|

Other liabilities

|

|

220

|

|

134

|

|

(134

|

)

|

—

|

|

—

|

|

|

|

220

|

|

|

Provisions

|

|

1,626

|

|

1,092

|

|

—

|

|

—

|

|

—

|

|

|

|

2,718

|

|

|

Total Non-Current Liabilities

|

|

11,722

|

|

11,402

|

|

—

|

|

—

|

|

16,840

|

|

|

|

39,964

|

|

|

TOTAL LIABILITIES

|

|

33,709

|

|

24,015

|

|

—

|

|

(60

|

)

|

16,847

|

|

|

|

74,511

|

|

|

EQUITY

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Capital nominal - outstanding shares

|

|

969

|

|

1,200

|

|

—

|

|

—

|

|

(15

|

)

|

2.I.(e)

|

|

2,154

|

|

|

Inflation adjustment - outstanding shares

|

|

2,646

|

|

—

|

|

—

|

|

—

|

|

—

|

|

|

|

2,646

|

|

|

Capital nominal - treasury shares

|

|

15

|

|

—

|

|

—

|

|

—

|

|

—

|

|

|

|

15

|

|

|

Inflation adjustment - treasury shares

|

|

42

|

|

—

|

|

—

|

|

—

|

|

—

|

|

|

|

42

|

|

|

Treasury shares acquisition cost

|

|

(461

|

)

|

—

|

|

—

|

|

—

|

|

—

|

|

|

|

(461

|

)

|

|

Contributed surplus

|

|

—

|

|

—

|

|

—

|

|

—

|

|

109,597

|

|

2.I.(e)

|

|

109,597

|

|

|

Legal reserve

|

|

734

|

|

240

|

|

—

|

|

—

|

|

—

|

|

|

|

974

|

|

|

Special reserve for IFRS implementation

|

|

351

|

|

43

|

|

—

|

|

—

|

|

—

|

|

|

|

394

|

|

|

Voluntary reserve for capital investments

|

|

461

|

|

—

|

|

—

|

|

—

|

|

—

|

|

|

|

461

|

|

|

Voluntary reserve for future dividends payments

|

|

9,730

|

|

73

|

|

—

|

|

—

|

|

—

|

|

|

|

9,803

|

|

|

Other comprehensive income

|

|

972

|

|

1,575

|

|

—

|

|

—

|

|

(972

|

)

|

2.I.(f)

|

|

1,575

|

|

|

Cost of equity interest increase in controlled companies

|

|

(3

|

)

|

—

|

|

—

|

|

—

|

|

3

|

|

2.I.(f)

|

|

—

|

|

|

Voluntary reserve to maintain the level of investments in fixed assets and the current level of solvency

|

|

—

|

|

2,748

|

|

—

|

|

—

|

|

—

|

|

|

|

2,748

|

|

|

Retained earnings

|

|

7,630

|

|

5,815

|

|

—

|

|

—

|

|

—

|

|

|

|

13,445

|

|

|

Equity attributable to Parent

|

|

23,086

|

|

11,693

|

|

—

|

|

—

|

|

108,613

|

|

|

|

143,392

|

|

|

Equity attributable to non-controlling interest

|

|

793

|

|

567

|

|

—

|

|

—

|

|

543

|

|

|

|

1,903

|

|

|

TOTAL EQUITY

|

|

23,879

|

|

12,260

|

|

—

|

|

—

|

|

109,156

|

|

|

|

145,295

|

|

|

TOTAL LIABILITIES AND EQUITY

|

|

57,588

|

|

36,276

|

|

—

|

|

(60

|

)

|

126,003

|

|

|

|

219,807

|

|

We provide the unaudited pro forma consolidated income statements for informational purposes only. The unaudited pro forma consolidated income statements do not purport to represent what our results of operations would have been had the Merger actually occurred on the assumed dates or project our results of operations for any future period or future date.

8

Table of Contents

Unaudited Pro Forma Consolidated Income Statement for the year ended December 31, 2017

(in millions of pesos, except per share data in Argentine pesos)

|

|

|

Column I

|

|

Column II

|

|

Column III

|

|

Column IV

|

|

Column V

|

|

|

|

|

|

|

|

|

Telecom

Argentina S.A.

|

|

Cablevisión

S.A.

|

|

Reclassifications

|

|

Elimination

of

transactions

|

|

Pro Forma

Adjustments

|

|

Ref.

|

|

Pro Forma

Consolidated

|

|

|

Revenues

|

|

65,186

|

|

40,952

|

|

—

|

|

(188

|

)

|

(20

|

)

|

2.II.(a)

|

|

105,930

|

|

|

Other income

|

|

133

|

|

29

|

|

(29

|

)

|

—

|

|

—

|

|

|

|

133

|

|

|

Total revenues and other income

|

|

65,319

|

|

40,981

|

|

(29

|

)

|

(188

|

)

|

(20

|

)

|

|

|

106,063

|

|

|

Employee benefit expenses and severance payments

|

|

(12,718

|

)

|

—

|

|

(7,186

|

)

|

—

|

|

—

|

|

|

|

(19,904

|

)

|

|

Interconnection costs and other telecommunication charges

|

|

(3,148

|

)

|

—

|

|

(812

|

)

|

188

|

|

—

|

|

|

|

(3,772

|

)

|

|

Fees for services, maintenance, materials and supplies

|

|

(6,600

|

)

|

—

|

|

(4,593

|

)

|

—

|

|

(113

|

)

|

2.II.(b)

|

|

(11,306

|

)

|

|

Taxes and fees with the Regulatory Authority

|

|

(6,107

|

)

|

—

|

|

(2,367

|

)

|

—

|

|

13

|

|

2.II.(c)

|

|

(8,461

|

)

|

|

Commissions

|

|

(3,631

|

)

|

—

|

|

(1,065

|

)

|

—

|

|

—

|

|

|

|

(4,696

|

)

|

|

Cost of equipments and handsets

|

|

(6,684

|

)

|

—

|

|

(300

|

)

|

—

|

|

(32

|

)

|

2.II.(d)

|

|

(7,016

|

)

|

|

Programming costs

|

|

—

|

|

—

|

|

(5,615

|

)

|

—

|

|

—

|

|

|

|

(5,615

|

)

|

|

Advertising

|

|

(1,218

|

)

|

—

|

|

(869

|

)

|

—

|

|

—

|

|

|

|

(2,087

|

)

|

|

Cost of Value-Added Services

|

|

(874

|

)

|

—

|

|

—

|

|

—

|

|

—

|

|

|

|

(874

|

)

|

|

Provisions

|

|

(590

|

)

|

—

|

|

(226

|

)

|

—

|

|

—

|

|

|

|

(816

|

)

|

|

Bad debt expenses

|

|

(1,113

|

)

|

—

|

|

(557

|

)

|

—

|

|

—

|

|

|

|

(1,670

|

)

|

|

Cost of sales

|

|

—

|

|

(19,109

|

)

|

19,109

|

|

—

|

|

—

|

|

|

|

—

|

|

|

Selling expenses

|

|

—

|

|

(5,992

|

)

|

5,992

|

|

—

|

|

—

|

|

|

|

—

|

|

|

Administrative expenses

|

|

—

|

|

(4,682

|

)

|

4,682

|

|

—

|

|

—

|

|

|

|

—

|

|

|

Other operating expenses

|

|

(3,280

|

)

|

—

|

|

(1,479

|

)

|

—

|

|

—

|

|

|

|

(4,759

|

)

|

|

Depreciation and amortization

|

|

(6,928

|

)

|

—

|

|

(3,987

|

)

|

—

|

|

(5,118

|

)

|

2.II.(e)

|

|

(16,033

|

)

|

|

Impairment of property, plant and equipment

|

|

(316

|

)

|

—

|

|

(73

|

)

|

—

|

|

(266

|

)

|

2.II.(e)

|

|

(655

|

)

|

|

Operating income

|

|

12,112

|

|

11,198

|

|

626

|

|

—

|

|

(5,536

|

)

|

|

|

18,400

|

|

|

Equity in earnings from associates

|

|

—

|

|

168

|

|

—

|

|

—

|

|

—

|

|

|

|

168

|

|

|

Finance income

|

|

3,115

|

|

—

|

|

277

|

|

—

|

|

(3

|

)

|

|

|

3,389

|

|

|

Finance expenses

|

|

(3,601

|

)

|

(2,612

|

)

|

(903

|

)

|

—

|

|

27

|

|

|

|

(7,089

|

)

|

|

Income before income tax expense

|

|

11,626

|

|

8,754

|

|

—

|

|

—

|

|

(5,512

|

)

|

|

|

14,868

|

|

9

Table of Contents

|

Income tax expense

|

|

(3,902

|

)

|

(2,859

|

)

|

—

|

|

—

|

|

1,929

|

|

2.II.(f)

|

|

(4,832

|

)

|

|

Net income for the year

|

|

7,724

|

|

5,895

|

|

—

|

|

—

|

|

(3,583

|

)

|

|

|

10,036

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Attributable to:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Controlling Company

|

|

7,630

|

|

5,815

|

|

—

|

|

—

|

|

(3,535

|

)

|

|

|

9,910

|

|

|

Non-controlling interest

|

|

94

|

|

80

|

|

—

|

|

—

|

|

(48

|

)

|

|

|

126

|

|

|

|

|

7,724

|

|

5,895

|

|

—

|

|

—

|

|

(3,583

|

)

|

|

|

10,036

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average number of ordinary shares outstanding

|

|

969,159,605

|

|

120,000

|

|

|

|

|

|

|

|

2.II.(g)

|

|

2,153,688,011

|

|

|

Earnings per share (Basic and Diluted)

|

|

7.87

|

|

48,456.27

|

|

|

|

|

|

|

|

|

|

4.60

|

|

Accounting for the Merger

The Unaudited Pro Forma Information has been prepared using the acquisition method of accounting under the provisions of IFRS 3 and is based on the historical financial information of Telecom and Cablevisión. Acquisition accounting is dependent upon certain valuations and other studies that have yet to be completed. Accordingly, the purchase price allocation included herein is preliminary and has been presented solely for the purpose of providing pro forma financial information. The actual purchase price allocation used by Telecom in the preparation of its financial statements will be revised as additional information becomes available and as additional analyses are performed. The process for estimating the fair values of identifiable intangible assets and certain tangible assets requires the use of judgment in determining the appropriate assumptions and estimates. Differences between preliminary estimates in the

Unaudited Pro Forma Information and the final acquisition accounting will materialize and could have a material impact on the accompanying pro forma consolidated financial information and the merged company’s future consolidated financial statements.

The Merger will be accounted for as a business combination using the acquisition method of accounting under the provisions of IFRS 3, with Cablevisión selected as the accounting acquirer under this guidance.

The factors that were considered in determining that Cablevisión should be treated as the accounting acquirer in the Merger were (i) the relative voting rights in the surviving entity (55% for the former shareholders of Cablevisión and 45% for the former shareholders of Telecom), (ii) the composition of the board of directors in the surviving entity and other committees (audit, supervisory and executive), (iii) the relative fair value assigned to Cablevisión and Telecom, and (iv) the composition of senior management of the surviving entity.

Reclassifications / Eliminations of balances and transactions / Pro forma adjustments

I.

Unaudited pro forma consolidated statement of financial position as of December 31, 2017

Column I shows the historical audited consolidated financial data of Telecom derived from the Telecom 2017 Audited Financial Statements. Accordingly, the cumulative effects of the initial application of IFRS 9 and IFRS 15 on retained earnings of Telecom have not been reflected in the Unaudited Pro Forma Information.

Column II shows the historical audited consolidated financial data of Cablevisión derived from the Cablevisión 2017 Audited Financial Statements. Accordingly, the cumulative effects of initial application of IFRS 9 on retained earnings of Cablevisión have not been reflected in the Unaudited Pro Forma Information.

Column III shows certain reclassifications made to the historical statements of financial position in order to conform to presentation standards to be used after the Merger, consisting of the following: (1) investments in associates have been reclassified from Non-Current “Investments in associates” to Non-Current “Investments”; (2) salaries and other short-term benefits payable have been reclassified from Current “Trade payable” to Current “Salaries and social security payable”; (3) income tax payable has been reclassified from Current “Other taxes payable” to Current “Income tax payable”; (4) dividends payable have been reclassified from Current “Other liabilities” to Current “Dividends payable”; and (5) deferred revenues have been reclassified from Current and Non-Current “Other liabilities” to Current and Non-Current “Deferred revenues”, respectively.

10

Table of Contents

Column IV provides for the elimination of certain reciprocal balances held between Telecom and Cablevisión as of December 31, 2017, mainly arising from the telecommunication interconnection operations.

Column V shows the pro forma adjustments derived from accounting for the Merger under the following assumptions:

(a)

The Merger has been accounted for as a reverse acquisition under IFRS 3. Under this accounting method, Telecom (the surviving entity) has been considered the accounting acquiree and Cablevisión (the legally absorbed entity) has been considered the accounting acquirer.

(b)

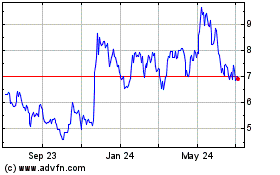

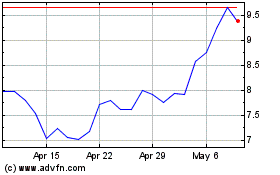

Consideration paid for the business combination amounted to U.S.$7,100 million (equivalent to Ps. 131,699 million). Consideration paid has been determined on the basis of the quoted market price of Telecom’s ADS at December 29, 2017, as this is considered a more reliable measure of the consideration effectively transferred to effect the business combination. The closing market price of Telecom’s ADS in the New York Stock Exchange at December 29, 2017 amounted to U.S.$36.63 per ADS.

(c)

Consideration paid has been allocated to identifiable assets and liabilities of Telecom (the accounting acquiree) based on their estimated fair value. Adjustments to book value as a result of the purchase price allocation is as follows:

1)

Ps. 34,209 million to “Property, plant and equipment” based on the market comparative method for real estate properties and vehicles, and the estimated replacement cost, as adjusted to reflect physical deterioration for telecommunications-specific fixed assets. The purchase price has been allocated mainly to land and building (Ps. 11,808 million), transmission equipment (Ps. 4,120 million) and mobile network access and external wiring (Ps. 10,026 million).

2)

Ps. 33,090 million to “Intangible assets” as follows: mobile licenses (Ps. 14,933 million) based on the market comparative method, customer relationships (Ps. 9,195 million) based on the discounted cash flow method, trademarks (Ps. 8,825 million) based on comparative royalties over gross sales and miscellaneous (Ps. 137 million).

3)

Ps. 17,446 million to “Deferred income tax liabilities” (of which Ps. 624 million have been offset by “Deferred income tax assets” corresponding to the companies to be merged) as a result of applying the enacted tax law as of the end of 2017 using the statutory income tax rate to be in force in Argentina (30% for fiscal years 2018 and 2019 and 25% for fiscal year 2020 and thereafter) to temporary differences arising from the pro forma adjustments.

4)

Ps. (20) million and Ps. 18 million to Current and Non-Current “Deferred revenues” on connection fees and capacity rental, respectively, based on the estimated fair value of the obligation assumed.

(d)

Goodwill (totaling Ps. 59,293 million) has been recognized for the excess of consideration paid (Ps. 131,699 million) over the fair value of net identifiable assets attributable to Telecom, net of the related tax effect, amounting to Ps. 72,406 million. Under Argentine Law, goodwill is not deductible for income tax purposes.

(e)

The amount recognized as issued equity instruments after the Merger results from the sum of (i) the fair value of the equity instruments issued to effect the business combination after deducting the carrying values immediately before the business combination corresponding to reserves and retained earnings of Telecom to be carried forward after the Merger, as approved by the shareholders of both companies, and (ii) the accounting acquirer’s issued equity immediately before the business combination. However, the equity structure shown reflects the accounting acquiree’s equity structure, including the equity instruments issued by the accounting acquiree to effect the Merger.

(f)

The retained earnings and other equity balances recognized after the Merger result from the sum of their carrying values by Telecom and Cablevisión immediately before the business combination, except for the elimination of other comprehensive income and cost of equity interest increase in controlled companies of Telecom, as approved by the shareholders of both companies.

11

Table of Contents

II.

Unaudited pro forma consolidated income statements for the year ended December 31, 2017

Column I shows the historical audited consolidated financial data of Telecom for the year ended December 31, 2017 derived from Telecom 2017 Audited Financial Statements. Accordingly, the effects of the initial application of IFRS 9 and IFRS 15 on results of Telecom have not been reflected in the Unaudited Pro Forma Information.

Column II shows the historical audited consolidated financial data of Cablevisión for the year ended December 31, 2017 derived from the Cablevisión 2017 Audited Financial Statements. Accordingly, the effects of the initial application of IFRS 9 on results of Cablevisión have not been reflected in the Unaudited Pro Forma Information.

Column III shows certain reclassifications made to the historical income statements in order to conform to presentation standards to be used after the Merger. Mainly, the “Cost of sales” and selling and administrative expenses have been reclassified to each operating expense by nature and the “Taxes” on deposits to and withdrawals from bank accounts have been reclassified from “Taxes” and fees with the Regulatory Authority to “Finance expenses”.

Column IV provides for the elimination of certain transactions between Telecom and Cablevisión for the year ended December 31, 2017 mainly related to telecommunication interconnection.

Column V shows the pro forma adjustments, which comprise mainly the following:

(a)

Lower revenues from the decrease in recognition of “Deferred revenues” on connections fees as a consequence of the purchase price allocation.

(b)

Higher consumption of materials resulting from the increase in their value as a consequence of the purchase price allocation.

(c)

Lower tax charges and regulatory fees derived from the elimination of billings between Telecom and Cablevisión following the Merger.

(d)

Higher cost of sales of handsets resulting from the increase in value of “Inventories” at the beginning of the year as a consequence of the purchase price allocation.

(e)

Higher depreciation and impairment charges resulting from the increase in value of Telecom’s fixed assets and higher amortization charges resulting from the increase in value of Telecom’s “Intangible assets”, both as a consequence of the purchase price allocation. Useful lives of Telecom’s fixed assets are the same as those disclosed in the Telecom 2017 Audited Financial Statements. Useful lives of “Intangible assets” recorded as a consequence of the purchase price allocation are mainly as follows: indefinite lives for trademarks and some licenses, other licenses between 12 and 15 years, and customer relationships between 5 and 10 years.

(f)

The related income tax effects on the adjustments described in (a) to (e) above based on the enacted tax law in effect as of the end of 2017.

(g)

Weighted average number of ordinary shares outstanding has been calculated assuming that changes in issued share capital described in 2.I.(e) above materialized on January 1, 2017.

The unaudited pro forma earnings per share data is computed by dividing the unaudited pro forma consolidated net income for the year attributable to the controlling shareholder by the number of Telecom’s outstanding shares after giving effect to the Merger, including 1,184,528,406 ordinary shares to be issued by Telecom to effect the Merger.

12

Table of Contents

Discussion and Analysis of Financial Condition and Results of Operations

The following discussion and analysis is based on, and should be read in conjunction with, the Cablevisión 2017 Audited Financial Statements and related notes, included elsewhere in this 6-K. Actual results relating to the Cablevisión business could differ materially from those discussed herein. Factors that could cause or contribute to these differences include those discussed below and elsewhere in this 6-K or TEO’s annual report on Form 20-F for the year ended December 31, 2017, filed with the SEC on April 20, 2018 (“TEO 2017 20-F”), particularly in “Risk Factors.”

Overview

Prior to January 1, 2018 (the “Merger Effective Date”), Cablevisión was an Argentine

sociedad anónima

(corporation), subject to the laws of Argentina and the regulations of the local authorities. The Cablevisión 2017 Audited Financial Statements were prepared in accordance with IFRS as issued by the IASB. See “Selected Financial and Operating Data” and other financial information contained elsewhere in this 6-K.

Factors Affecting

Cablevisión’s

Results of Operations

The Argentine Economy

Substantially all of Cablevisión’

s

assets and operations and its customers were located in Argentina. Accordingly, Cablevisión’

s

financial condition and results of operations depend to a significant extent on macroeconomic and political conditions prevailing from time to time in Argentina. For more information on these macroeconomic and political conditions, see “Item 5—Operating and Financial Review and Prospects—Years ended December 31, 2017, 2016 and 2015—Factors Affecting Results of Operations” and “

Risk Factors—Risks Relating to Argentina” in the TEO 2017 20-F. Further, for information regarding the reliability of this data see “Risk Factors—Risks Related to Argentina—Inflation could accelerate, causing adverse effects on the economy and negatively impacting Telecom’s margins” in the TEO 2017 20-F.

Source and Mix of Revenues and Costs

Cablevisión

derives substantially all of its revenue from subscriptions for basic cable and broadband access services. Between 2013 and 2017, Cablevisión

’s

broadband service subscribers increased by 36%, from 1,711,600 to 2,334,900. During that period, the portion of Cablevisión’

s

packages subscriber base increased by 33%, representing 49% of the total subscriber base as of December 31, 2017. Other sources of revenue include premium cable services, installation charges, charges for additional outlets, additional packages, DVR and the selling of Cablevisión’

s

magazine, “Miradas.” Cablevisión’

s

revenue from subscriptions is primarily a function of the number of subscribers served by it

s

networks during the relevant period. Cable and broadband subscribers are added through the expansion of Cablevisión’s network and marketing of its services to homes passed by its networks.

Cablevisión

principally generates its revenues through monthly fees charged to its subscribers that are payable in Pesos. Cablevisión generally seeks to increase its revenues through the growth of its customer base and through the introduction of value-added services and products aimed at different customer needs. Further, Cablevisión expects to increase its revenue through new product launches and the expansion of its broadband customer base. Cablevisión’

s

results of operations are therefore dependent on its customer base and the number of services that each customer uses. Overall revenue and costs are also affected by the mix of services Cablevisión provides, with broadband generally being associated with higher margins relatively to cable television. In 2015, 2016 and 2017, 62.0%, 52.7% and 49.4% of Cablevisión’s revenues, respectively, was generated by its cable subscriptions (pay TV services excluding sales for premium content, high definition digital services and video on demand packages) while 23.9%, 25.2% and 31.4%, respectively, was generated by its broadband subscriptions. Cablevisión expects that the broadband subscriptions’ percentage share of its revenues will continue to increase.

Cablevisión’s

cost of sales, selling expenses and administrative expenses consist primarily of (i) programming costs; (ii) payroll and social security charges and other personnel expenses; (iii) property, plant and equipment depreciation, maintenance and leases; and (iv) public utilities and tax rates. Between 2013 and 2017, more than 90% of its total operating costs were Peso-denominated. The portion of operating costs that are U.S.

13

Table of Contents

Dollar-denominated is mainly comprised of programming costs related to special events, data transfer costs and maintenance of property, plant and equipment and network expenses, among others.

Programming costs are among the largest component of these expenses, and mainly consist of the fees that Cablevisión pays to certain programming suppliers.

Cablevisión’s programming costs are primarily correlated with fee increases charged to its customers and growth in the number of its enhanced cable subscribers.

Effects of Inflation

Argentina has faced and continues to face inflationary pressures. For more information,

see “Item 5—Operating and Financial Review and Prospects—Years ended December 31, 2017, 2016 and 2015—Factors Affecting Results of Operations” and “Risk Factors—Risks Relating to Argentina” in the TEO 2017 20-F.

Significant changes such as those observed in the past few years in the prices of relevant economic variables affecting our business, such as salary and wages costs, interest rates and exchange rates affect our financial position, financial performance and cash flows and, therefore, the information provided in

Cablevisión’s Financial Audited Consolidated Financial Statements.

Effects of Fluctuations in Exchange Rates between the Argentine Peso and the U.S. Dollar

Although almost 100% of our financial obligations are denominated in U.S. Dollars, as of December 31, 2017,

Cablevisión uses financial instruments to hedge currency risk for only a limited portion of interest payments for its consolidated U.S. Dollar denominated debt. Any significant devaluation of the Peso, such as the devaluation in early 2014 and in December 2015, results in an increase in the cost of servicing our debt and, therefore, may have a material adverse effect on our results of operations. See “Item 3—Key Information—Exchange Rates”, and “Item 3—Key Information—Risk Factors—Risks Relating to Argentina—Devaluation of the peso may adversely affect our results of operations, our capital expenditure program and the ability to service our liabilities and transfer funds abroad” in the TEO 2017 20-F.

Acquisition and Internal Growth

Cablevisión

has focused on increasing its broadband internet penetration by providing and offering bandwidth connectivity to its existing cable television subscribers and to new customers. Cablevisión has also grown its broadband subscriber base by emphasizing its bandwidth capabilities and expanding the products and services that it offers with a focus on launching products and services with faster speed options tailored to its customers’ evolving needs. The diversification of Cablevisión’

s

product mix to increase its broadband offerings, coupled with an increase in the portion of total revenues represented by broadband services have, in turn, resulted in an increased ARPU. Total ARPU (in Pesos) increased by 35% between 2015 and 2016 primarily due to an increase in the penetration of broadband services, an 8% increase in Cablevisión’

s

broadband customers, and due to the effect of inflation. Total ARPU (in Pesos) increased by 40.8% between 2016 and 2017 primarily due to an increase in the penetration of broadband and Pay TV digital services, an 7% increase in aggregate number of Cablevisión’

s

broadband customers, and due to the effect of inflation.

T

otal Active Customer Relationships and Churn

The number of

Cablevisión’

s

customers is dependent upon the number of new customers it obtains for its services and the number of customers that terminate its services, or churn. Cablevisión has consistently achieved customer growth across its operations. Cablevisión’s total customer base grew 4% from approximately 3.76 million customers as of December 31, 2013, to approximately 3.92 million customers as of December 31, 2017.

Certain Events Affecting Comparability of

Cablevisión’s

Operating Results

Acquisition of Nextel

Although

Cablevisión acquired control of Nextel on January 27, 2016, its financial and operating information reflects the consolidation of Nextel as from January 1, 2016 (Nextel’s results from January 1 through January 26, 2016 were not considered material when compared with Nextel’s results for the same period). Therefore, financial and operating information for the year ended December 31, 2016 may not be directly

14

Table of Contents

comparable with financial and operating information for prior periods. Between September 30, 2015 and December 31, 2015,

Cablevisión accounted for Nextel under the equity method. IDEN telephony and other services revenues for the year ended December 31, 2017, totalled Ps. 2,791 million, representing 6.8% of Cablevisión’

s

total revenues.

Key Business Measures

Average Revenue per User

Cablevisión’

s

results of operations are dependent on its customer base and the number of services that each customer uses. Total monthly ARPU of Cablevisión’

s

active customer relationships was Ps. 211 in 2013, Ps. 300 in 2014, Ps. 420 in 2015, Ps. 566 in 2016, and Ps. 797 in 2017. The 40.8% increase in total ARPU during the year ended December 31, 2017, compared to 2016, was due to the increased penetration of broadband and digital Pay TV services, faster speed options offered to Cablevisión’

s

customers and inflation.

Churn Rate

Churn refers to the termination of a customer’s account. The churn rate is determined by calculating the total number of disconnected customers over a given period as a percentage of the initial number of relevant customers for the same period.

Cablevisión’s cable customer churn rate for the year ended December 31, 2017 was 14.6%, compared to 13.8% and 12.6% in 2016 and 2015, respectively.

Cablevisión’s broadband customer churn rate for the year ended December 31, 2017 was 17.1%, compared to 16.2% and 15.6% in 2016 and 2015, respectively.

To reduce its churn rate,

Cablevisión pursues a vigorous customer service and retention policy. See “Business Description—Billing and Subscriber Management.”

Critical Accounting Policies

The Cablevisión 2017 Audited Financial Statements

are prepared in conformity with IFRS. IFRS requires management to make estimates that affect the reported amounts of assets and liabilities, and the reported amounts of revenues and expenses. Cablevisión evaluates its estimates, including those related to tangible and intangible assets, bad debts, inventories, provisions and income taxes, on an ongoing basis. Cablevisión bases its estimates on historical experience and on various other assumptions that management believes to be reasonable under the circumstances. These estimates form the basis for making judgments about the carrying values of assets and liabilities that are not readily apparent from other sources. Actual results may differ from these estimates under different assumptions or conditions.

Cablevisión

management believes that the following accounting policies used in preparation of the Cablevisión 2017 Audited Financial Statements prepared in accordance with IFRS were its critical accounting policies as they require management to make estimates that affect the reported amounts of assets and liabilities, and the reported amounts of revenues and expenses. For more information, see note 3 of the Cablevisión 2017 Audited Financial Statements.

Fair value measurement of certain financial instruments

The fair value of a financial instrument is the amount for which it could be purchased or sold between knowledgeable willing parties, in an arm’s length transaction. If there is a quoted market price available for an instrument in an active market the fair value is calculated based on that price.

If there is no quoted market price available for a financial instrument, its fair value is estimated on the basis of the price established in recent transactions involving the same or similar instruments, or, otherwise, on the basis of valuation techniques regularly used in financial markets. The Company uses its judgment to select a variety of methods and makes assumptions on the basis of market conditions at closing.

15

Table of Contents

The methodology used for the measurement of the fair value of certain financial instruments is more fully described in Note 2.19 to

the Cablevisión 2017 Audited Financial Statements.

Allowance for bad debts

Cablevisión

reviews its doubtful accounts on a monthly basis for estimated losses resulting from the inability of its subscribers to make the required payments. The subscriber base in cable television and Internet services is primarily residential in nature.

Cablevisión invoices most of its subscribers in advance. A majority of Argentine cable television and broadband subscribers pay their invoices by automatic credit card or bank account debits. Cablevisón seeks to enforce a strict disconnection policy, which provides for the disconnection of cable television services after a three-month period of non-payment and delivery of a notice of disconnection. With respect to broadband services,

Cablevisión disconnects its services after a two-month period of non-payment and delivery of a corresponding notice of disconnection.

In calculating the allowance for bad debts with respect to debt instruments that are not measured at fair value,

Cablevisión takes into account historic collectability records and other factors known at the time of the calculation. If the financial condition of its subscribers were to deteriorate, actual write offs could exceed management’s expectations.

Cablevisión

believes that the accounting estimate relating to doubtful accounts is a critical accounting estimate because changes in the level of doubtful debts may materially affect net income.

Provision for lawsuits and contingencies

Cablevisión

is involved in legal, fiscal and administrative disputes in the normal course of business. The outcome of these claims may have a material impact on Cablevisión’

s

balance sheet as well as on its net income. See “Legal Proceedings.” The factors taken into account for the calculation of the provisions for lawsuits and contingencies are based on the present value of the estimated costs arising from the lawsuits brought against us. In estimating its obligations, Cablevisión takes into consideration the opinion of its legal advisors. Due to the uncertain nature of these issues, these estimates change as additional information becomes available and could result in material changes to the financial statements in subsequent periods. As of December 31, 2017, Cablevisión had provisions totalling Ps. 855.5 million for pending disputes.

Impairment losses of certain assets other than receivables (including property, plant and equipment and intangible assets except goodwill)

Certain assets, including property, plant and equipment and intangible assets are tested for impairment. Cablevisión records impairment losses when it estimates that there is objective evidence thereof or when the cost of such losses will not be recovered through future cash flows. The evaluation of what constitutes impairment is a matter of significant judgment. Impairment of the value of non-financial assets is more fully described in Note 2.15 to the

Cablevisión 2017 Audited Financial Statements.

Impairment of goodwill

Cablevisión