Hong Kong Rolls out New Listing Rules to Lure Giant Tech Companies

April 24 2018 - 6:56AM

Dow Jones News

By Joanne Chiu

Hong Kong Exchanges and Clearing Ltd.(0388.HK) approved new

rules for initial public offerings, as it competes with other

global bourse operators for some of the world's highly sought

companies.

The city's bourse operator said Tuesday that its new rules to

broaden Hong Kong's listing regime would take effect on April 30,

when it starts to take applications from companies in emerging and

innovative sectors seeking to list in Hong Kong.

The new rules, which permit IPOs that restrict shareholders'

voting rights, secondary listings by Chinese and international

companies already listed elsewhere and primary listings by

unprofitable biotech firms, mark the biggest overhaul of the bourse

operator's listing regime in more than two decades. The proposed

new rules were unveiled in December.

It comes after Chief executive Charles Li said last Friday that

he is confident the city would land some of the biggest listings in

the future, including Saudi Arabian Oil Co. (SOI.YY), known as

Aramco, tech giant Xiaomi Corp. (XIMI.YY) and, in time, a dual

listing for e-commerce titan Alibaba Group Holding Ltd. (BABA).

Smartphone maker Xiaomi is targeting an IPO in mainland China

and Hong Kong as soon as this summer that could value it at about

$100 billion, people familiar with the offering have said.

Write to Joanne Chiu at joanne.chiu@wsj.com

(END) Dow Jones Newswires

April 24, 2018 06:41 ET (10:41 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

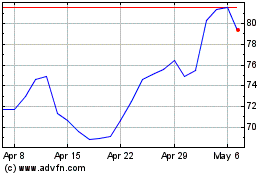

Alibaba (NYSE:BABA)

Historical Stock Chart

From Mar 2024 to Apr 2024

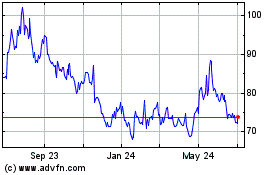

Alibaba (NYSE:BABA)

Historical Stock Chart

From Apr 2023 to Apr 2024