WHIRLPOOL CORPORATION

(Exact name of registrant as Specified in Charter)

|

|

|

|

|

|

|

Delaware

|

|

1-3932

|

|

38-1490038

|

|

(State or Other Jurisdiction

of Incorporation)

|

|

(Commission

File Number)

|

|

(IRS Employer

Identification No.)

|

|

|

|

|

2000

M-63

North, Benton Harbor, Michigan

|

|

49022-2692

|

|

(Address of Principal Executive Offices)

|

|

(Zip Code)

|

(269)

923-5000

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form

8-K

filing is intended to simultaneously satisfy the filing obligation of

the registrant under any of the following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to rule

14a-12

under the Exchange Act (17 CFR

240.14a-12)

|

|

☐

|

Pre-commencement

communications pursuant to Rule

14d-2(b)

under the Exchange Act (17 CFR

240.14d-2(b))

|

|

☒

|

Pre-commencement

communications pursuant to Rule

13e-4(c)

under the Exchange Act (17 CFR

240.13e-4(c))

|

Indicate by check mark whether the registrant is an emerging growth company as

defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule

12b-2

of the Securities Exchange Act of 1934

(§240.12b-2

of this chapter).

Emerging growth company ☐

If an emerging

growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange

Act. ☐

Item 1.01 Entry Into a Material Definitive Agreement

On April 24, 2018, Whirlpool Corporation (the “Company”) and certain Company subsidiaries entered into an agreement (the “Purchase

Agreement”) with Nidec Corporation (the “Buyer”), a leading manufacturer of electric motors incorporated under the laws of Japan, to sell the Company’s Embraco business unit (“Embraco”) by means of a sale of all of the

issued and outstanding equity interests in a number of subsidiaries which will hold and sell Embraco pursuant to the Purchase Agreement. Embraco is a leading manufacturer of hermetic compressors for refrigeration.

Pursuant to the Purchase Agreement, at the closing of the transaction (“Closing”), the Buyer will pay a purchase price of $1.08 billion (the

“Purchase Price”) in consideration for the sale of Embraco. The Purchase Price is subject to customary adjustments including for indebtedness, cash and working capital of Embraco at Closing.

The Purchase Agreement contains customary representations, warranties and covenants of the parties. The representations and warranties contained in the

Purchase Agreement were made solely for purposes of the Purchase Agreement, were made solely for the benefit of the parties to the Purchase Agreement and may not have been intended to be statements of fact but, rather, as a method of allocating risk

and governing the contractual rights and relationships among the parties to the Purchase Agreement. The assertions embodied in those representations and warranties may be subject to important qualifications and limitations agreed to by the parties

in connection with negotiating their terms and may be subject to a contractual standard of materiality that may be different from what may be viewed as material to shareholders. For the foregoing reasons, the representations and warranties contained

in the Purchase Agreement should not be relied upon as factual information at the time they were made or otherwise.

Each party’s obligations to

consummate the transaction pursuant to the Purchase Agreement is subject to customary conditions as set out therein, including, among others, (i) subject to certain exceptions, the accuracy of the representations and warranties of the parties;

(ii) performance in all material respects by each of the parties of its obligations and conditions; (iii) absence of any change, event, state of facts, development, occurrence or effect that has or would reasonably be expected to have a

Material Adverse Effect, as defined in the Purchase Agreement; (iv) regulatory approvals, including competition approvals in the United States, Europe, and other jurisdictions, and all applicable approvals or review required under applicable

law; and (v) completion of certain restructuring steps relating to Embraco.

Closing of the transaction is expected to occur by early 2019.

The Purchase Agreement contains certain customary termination rights for both the Company and the Buyer.

The foregoing description of the Purchase Agreement does not purport to be complete and is qualified in its entirety by reference to the Purchase Agreement,

which is filed as Exhibit 2.1 hereto, and is incorporated herein by reference.

Item 8.01 Other Events

On April 24, 2018, the Company issued a press release regarding the entry into the Purchase Agreement and anticipated commencement of an issuer tender

offer for the Company’s shares. The press release is filed herewith as Exhibit 99.1 and is incorporated herein by reference.

Item 9.01. Financial Statements and Exhibits.

(d): The following exhibits are being filed herewith:

|

*

|

Schedules (or similar attachments) to the Purchase Agreement have been omitted from this filing pursuant to Item 601(b)(2) of

Regulation S-K.

The Company will

furnish supplementally copies of such omitted schedules (or similar attachments) to the Securities and Exchange Commission upon request; provided, however, that the Company may request confidential treatment pursuant to Rule

24b-2

of the Exchange Act for any document so furnished.

|

Whirlpool Corporation Additional Information

Certain statements in this current report relating to the Company’s expectations for closing constitute “forward-looking statements”

within the meaning of the U.S. federal securities laws. These statements reflect management’s current expectations regarding future events and speak only as of the date of this current report. Forward-looking statements involve significant

risks and uncertainties, should not be read as guarantees of future performance and will not necessarily be accurate indications of whether or not, or the times at or by which, events will occur. Actual performance may differ materially from that

expressed or implied in such statements.

Reference should also be made to the factors discussed under “Risk Factors” in the Company’s

periodic filings with the Securities and Exchange Commission. Although the forward-looking statements contained in this current report are based upon what are believed to be reasonable assumptions, investors cannot be assured that actual results

will be consistent with these forward-looking statements, and the differences may be material. These forward-looking statements are made as of the date of this current report and, except as expressly required by applicable law, the Company assumes

no obligation to update or revise them to reflect new events or circumstances.

Website Disclosure

We routinely post important information for investors on our website, whirlpoolcorp.com, in the “Investors” section. We intend to use this webpage as

a means of disclosing material,

non-public

information and for complying with our disclosure obligations under Regulation FD. Accordingly, investors should monitor the Investors section of our website, in

addition to following our press releases, SEC filings, public conference calls, presentations and webcasts. The information contained on, or that may be accessed through, our webpage is not incorporated by reference into, and is not a part of, this

document.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned

hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

WHIRLPOOL CORPORATION

|

|

|

|

|

|

|

Date: April 24, 2018

|

|

|

|

By:

|

|

/s/ BRIDGET K. QUINN

|

|

|

|

|

|

|

|

Name: Bridget K. Quinn

|

|

|

|

|

|

|

|

Title: Assistant General Counsel and Corporate Secretary

|

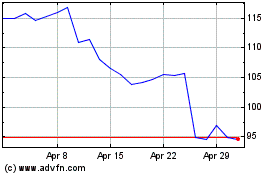

Whirlpool (NYSE:WHR)

Historical Stock Chart

From Mar 2024 to Apr 2024

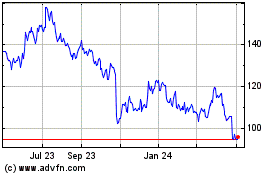

Whirlpool (NYSE:WHR)

Historical Stock Chart

From Apr 2023 to Apr 2024