FirstEnergy Strikes Creditor Deal -- WSJ

April 24 2018 - 3:02AM

Dow Jones News

Proposed agreement would extricate parent firm from coal,

nuclear plant restructuring

By Andrew Scurria

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (April 24, 2018).

FirstEnergy Corp. has reached a settlement with creditors of its

bankrupt power-generation businesses that would simplify their

restructuring while extricating the parent company from the chapter

11 case.

The proposed deal with the nonbankrupt parent company requires

approval from subsidiary FirstEnergy Solutions, or FES, and its

affiliates and from the Ohio chapter 11 judge overseeing their

restructuring.

If approved, the agreement covers potential claims surrounding

FirstEnergy's obligations toward unprofitable coal and nuclear

power plants in Ohio and Pennsylvania that are under bankruptcy

protection. Research firm CreditSights said the settlement provides

15 cents on the dollar for holders of unsecured FES debt, some of

which rallied nearly 20% Monday, according to FactSet.

The two largest bondholder groups in the bankruptcy support the

agreement, according to a securities filing. FirstEnergy said it

would try to bring the court-appointed committee of unsecured FES

creditors on board with the terms.

Recoveries for creditors also depend on whether the Trump

administration intercedes to keep the FES plants open. FES has

sought an emergency lifeline from the U.S. Department of Energy to

prop up those facilities, which have been unable to compete in

unregulated markets with plentiful natural gas and state-subsidized

renewables.

The settlement provides a combination of cash payments and tax

notes from the parent designed to deliver $628 million in value to

creditors, according to a securities filing. FirstEnergy agreed to

take on pension payments, deferred compensation and retiree life

insurance and medical claims arising from FES.

In return FirstEnergy would share in any bondholder recoveries

above 60 cents on the dollar. FES and its affiliates are

negotiating a restructuring of three nuclear plants while putting

four fossil fuel operations and a retail power business on the

block.

CreditSights analysts said the potential upside for FirstEnergy

would incentivize the parent to continue pressing federal and state

regulators for a bailout of FES facilities. The potential closure

of FES facilities is testing the Trump administration's commitment

to coal and nuclear as it weighs compelling the nation's largest

grid operator to favor those fuel sources over alternatives.

FES has few allies in its campaign, which experts say would

effectively end America's largest competitive electricity market.

The bailout request is opposed by several power companies supplying

the market and by industrial customers facing higher electricity

costs.

The deal would also swing ownership of the coal-fired Pleasants

Point power station in West Virginia to the chapter 11 estate from

FirstEnergy's non-bankrupt affiliate Allegheny Energy Supply Co.

AES said in February it would close Pleasants Point next year

unless a buyer is found.

Creditors of the Bruce Mansfield coal-plant in Pennsylvania

would receive a $787 million allowed unsecured claim in the

bankruptcy that would be partially satisfied upon court approval of

a restructuring plan.

Write to Andrew Scurria at Andrew.Scurria@wsj.com

(END) Dow Jones Newswires

April 24, 2018 02:47 ET (06:47 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

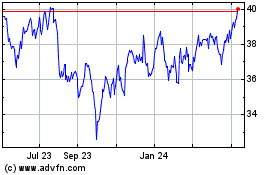

FirstEnergy (NYSE:FE)

Historical Stock Chart

From Mar 2024 to Apr 2024

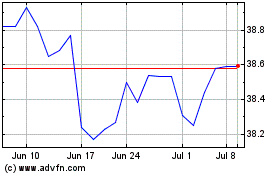

FirstEnergy (NYSE:FE)

Historical Stock Chart

From Apr 2023 to Apr 2024