First Quarter 2018 Highlights:

- GAAP earnings per diluted share (EPS)

of $1.13 compared to $1.05 last year; excluding Special Items, EPS

of $1.31 increased 25% compared to 2017.

- Raising 2018 GAAP EPS guidance to a

range of $4.75-$4.95 vs. prior range of $4.65-$4.85; excluding

Special Items, raising 2018 EPS guidance to a range of $5.45-$5.65

vs. prior range of $5.35-$5.55.

- Revising 2018 free cash flow guidance

(cash provided by operating activities less capital spending) to

$240-$270 million vs. prior range of $220-$250 million.

Crane Co. (NYSE: CR), a diversified manufacturer of highly

engineered industrial products, reported first quarter 2018

earnings per diluted share (EPS) of $1.13, compared to $1.05 per

diluted share in the first quarter of 2017. Excluding Special

Items, first quarter 2018 EPS increased 25% to $1.31. (Please see

the attached Non-GAAP Financial Measures tables.)

First quarter sales were a record $799 million, an increase of

19% compared to $673 million in the first quarter of 2017. The

sales increase was comprised of a $103 million, or 15%, benefit

from acquisitions, and a $28 million, or 4%, benefit from favorable

foreign exchange, partially offset by a core sales decline of $5

million, or 1%.

Operating profit in the first quarter was $94 million, up

slightly compared to $93 million in the first quarter of 2017.

Excluding Special Items, operating profit in the first quarter was

$112 million, an increase of 16% compared to $97 million in the

first quarter of 2017. (Please see the attached Non-GAAP Financial

Measures tables.)

The effective tax rate in the first quarter was 18.6%, down from

28.1% in the first quarter of 2017. Excluding Special Items, the

effective tax rate in the first quarter was 18.9%. The lower tax

rate in the first quarter of 2018 was a result of the 2017 Tax Cuts

and Jobs Act.

Max Mitchell, Crane Co. President and Chief Executive Officer

commented: "On the heels of record results last year, we are off to

a solid start in 2018. At Fluid Handling, end markets continue to

gradually improve, and we are executing well and gaining market

share. Core margins improved at Payment & Merchandising

Technologies, and sales were in-line with our expectations on

challenging comparisons. Aerospace & Electronics also started

the year strong, with growth across the segment driving good

operating leverage. Overall, we are tracking modestly ahead of the

midpoint of our previously issued guidance, and we continue to

pursue opportunities that could provide further upside."

Mr. Mitchell continued, "beyond the core business, our

repositioning activities and the Crane Currency acquisition

integration are progressing as expected, and we are making good

progress on our growth initiatives. We are pleased with our results

year-to-date and we remain excited about our multi-year earnings

growth outlook, although our optimism is tempered somewhat by

heightened uncertainty related to the global trade environment.

Balancing these factors, we are raising our 2018 EPS guidance,

excluding Special Items, to $5.45-$5.65, from our prior range of

$5.35-$5.55." (Please see the attached Non-GAAP Financial Measures

tables.)

Cash Flow and Other Financial Metrics

Cash provided by operating activities in the first quarter of

2018 was $74 million, compared to $4 million in the first quarter

of 2017. Free cash flow (cash provided by operating activities less

capital spending) was $47 million in the first quarter of 2018,

compared to a use of ($6) million in the first quarter of 2017.

(Please see the attached Non-GAAP Financial Measures tables.)

The Company's cash position was $642 million at March 31, 2018,

compared to $706 million at December 31, 2017. Total debt was

$1,411 million at March 31, 2018, compared to $743 million at

December 31, 2017. The increase in total debt reflects the

financing associated with the January 10, 2018 acquisition of Crane

Currency.

Segment Results

All comparisons detailed in this section refer to operating

results for the first quarter 2018 versus the first quarter

2017.

Fluid Handling

First Quarter Change (dollars in millions) 2018

2017 Sales $

267 $ 240 $ 27 11

% Operating Profit $ 28 $ 24 $ 4 15 % Operating Profit,

before Special Items* $ 32 $ 27 $ 5 19 % Profit Margin 10.5

% 10.2 % Profit Margin, before Special Items* 12.1 % 11.3 %

*Please see the attached Non-GAAP Financial Measures tables

Sales increased $27 million, driven by $14 million, or 6%, of

favorable foreign exchange, $7 million, or 3%, core growth, and a

$6 million, or 2.5%, contribution from acquisitions. Operating

margin increased to 10.5%, compared to 10.2% last year, primarily

reflecting leverage on higher volumes and productivity, partially

offset by unfavorable mix. Excluding Special Items, operating

margin was 12.1%, compared to 11.3% last year. Fluid Handling order

backlog was $281 million at March 31, 2018, $262 million at

December 31, 2017, and $250 million at March 31, 2017.

Payment & Merchandising Technologies

First Quarter Change (dollars in millions) 2018

2017 Sales $ 292 $

196 $ 97 50 %

Operating Profit $ 37 $ 38 $ (2 ) (5 %) Operating Profit, before

Special Items* $ 49 $ 39 $ 10 26 % Profit Margin 12.5 % 19.6

% Profit Margin, before Special Items* 16.8 % 20.0 % *Please

see the attached Non-GAAP Financial Measures tables

Sales increased $97 million, or 50%, driven by sales from

acquisitions, with $13 million of favorable foreign exchange

offsetting a $13 million decline in core sales. The decline in core

sales was primarily a result of extraordinarily challenging

comparisons to the prior year, with core sales up 18% in the first

quarter of 2017. Operating margin declined to 12.5%, from 19.6%

last year, reflecting the impact of the Crane Currency acquisition,

restructuring and integration related charges, and the impact of

lower volumes. Excluding Special Items, operating margins of 16.8%

declined from 20.0% last year.

Aerospace & Electronics

First Quarter Change (dollars in millions) 2018

2017 Sales $

170 $ 163 $ 7 4 %

Operating Profit $ 34 $ 32 $ 2 8 % Operating Profit, before

Special Items* $ 35 $ 32 $ 3 8 % Profit Margin 20.1 % 19.4 %

Profit Margin, before Special Items* 20.3 % 19.6 % *Please

see the attached Non-GAAP Financial Measures tables

Sales increased $7 million, or 4%, primarily driven by $7

million of higher core sales with a slight benefit from favorable

foreign exchange. Operating margin increased to 20.1%, from 19.4%

last year, primarily as a result of higher volumes and

productivity. Excluding Special Items, operating margin increased

70 basis points to 20.3%. Aerospace & Electronics order backlog

was $381 million at March 31, 2018, $374 million at December 31,

2017, and $352 million at March 31, 2017.

Engineered Materials

First Quarter Change (dollars in

millions) 2018 2017 Sales $

70 $ 75 $

(5 ) (7 %) Operating Profit $ 12 $ 14 $ (2 ) (11 %)

Profit Margin 17.8 % 18.7 %

Sales decreased $5 million, or 7%, driven primarily by lower

sales to the Recreational Vehicle market. Operating margin declined

90 basis points to 17.8%, primarily reflecting lower volumes,

partially offset by strong productivity.

Raising 2018 Guidance

We are raising our 2018 full year GAAP EPS guidance to a range

of $4.75-$4.95, compared to the prior range of $4.65-$4.85. We now

expect 2018 full year EPS, excluding Special Items, of $5.45-$5.65,

compared to the prior range of $5.35-$5.55. Full year 2018 free

cash flow (cash provided by operating activities less capital

spending) is now expected to be in a range of $240-$270 million,

compared to the prior range of $220-$250 million. (Please see the

attached Non-GAAP Financial Measures tables.)

Additional Information

Additional information with respect to the Company’s asbestos

liability and related accounting provisions and cash requirements

is set forth in the Current Report on Form 8-K filed with a copy of

this press release.

Conference Call

Crane Co. has scheduled a conference call to discuss the first

quarter financial results on Tuesday, April 24, 2018 at 10:00 A.M.

(Eastern). All interested parties may listen to a live webcast of

the call at http://www.craneco.com. An

archived webcast will also be available to replay this conference

call directly from the Company’s website. Slides that accompany the

conference call will be available on the Company’s website.

Crane Co. is a diversified manufacturer of highly engineered

industrial products. Founded in 1855, Crane provides products and

solutions to customers in the hydrocarbon processing,

petrochemical, chemical, power generation, unattended payment,

banknote design and production, automated merchandising, aerospace,

electronics, transportation and other markets. The Company has four

business segments: Fluid Handling, Payment & Merchandising

Technologies, Aerospace & Electronics and Engineered Materials.

Crane has approximately 12,000 employees in the Americas, Europe,

the Middle East, Asia and Australia. Crane Co. is traded on the New

York Stock Exchange (NYSE:CR). For more information, visit

www.craneco.com.

This press release may contain forward-looking statements as

defined by the Private Securities Litigation Reform Act of 1995.

These statements present management’s expectations, beliefs, plans

and objectives regarding future financial performance, and

assumptions or judgments concerning such performance. Any

discussions contained in this press release, except to the extent

that they contain historical facts, are forward-looking and

accordingly involve estimates, assumptions, judgments and

uncertainties. There are a number of factors that could cause

actual results or outcomes to differ materially from those

addressed in the forward-looking statements. Such factors are

detailed in the Company’s Annual Report on Form 10-K for the fiscal

year ended December 31, 2017 and subsequent reports filed with the

Securities and Exchange Commission.

(Financial Tables Follow)

CRANE CO. Income Statement Data

(in millions, except per share data)

Three Months Ended March 31, 2018 2017

Net sales: Fluid Handling $ 266.6 $ 239.6 Payment &

Merchandising Technologies 292.4 195.5 Aerospace & Electronics

170.4 163.4 Engineered Materials 69.7 74.9

Total

net sales $ 799.1 $ 673.4

Operating

profit (loss): Fluid Handling $ 28.1 $ 24.4 Payment &

Merchandising Technologies 36.5 38.4 Aerospace & Electronics

34.2 31.7 Engineered Materials 12.4 14.0 Corporate (16.9 ) (15.2 )

Total operating profit 94.3 93.3 Interest income 0.8

0.5 Interest expense (14.6 ) (9.0 ) Miscellaneous income 3.9

3.1 Income before income taxes 84.4 87.9 Provision for

income taxes 15.7 24.6 Net income before allocation

to noncontrolling interests 68.7 63.3 Less: Noncontrolling interest

in subsidiaries' earnings — 0.2 Net income

attributable to common shareholders $ 68.7 $ 63.1

Share Data: Earnings per diluted share $ 1.13 $ 1.05

Average diluted shares outstanding 61.0 60.3 Average basic

shares outstanding 59.7 59.3

Supplemental

Data:

Cost of sales $ 521.2 $ 429.5 Selling, general & administrative

177.6 150.6 Acquisition related charges 5.2 — Repositioning charges

0.8 — Depreciation and amortization * 27.9 17.4 Stock-based

compensation expense * 5.6 5.6 *Amount included within Cost

of sales and Selling, general & administrative costs.

CRANE CO. Condensed Balance Sheets

(in millions)

March 31,

2018

December 31,

2017

ASSETS Current assets Cash and cash equivalents $

642.3 $ 706.2 Accounts receivable, net 493.5 418.4 Current

insurance receivable - asbestos 25.0 25.0 Inventories, net 406.5

349.3 Other current assets 69.6 19.6 Total current assets

1,636.9 1,518.5 Property, plant and equipment, net 600.8

282.4 Long-term insurance receivable - asbestos 83.3 90.1 Other

assets 726.6 495.6 Goodwill 1,442.9 1,206.9

Total

assets $ 4,490.5 $ 3,593.5

LIABILITIES AND EQUITY Current liabilities Short-term

borrowings and current maturities of long-term debt $ 272.7 $ 249.4

Accounts payable 252.4 247.4 Current asbestos liability 85.0 85.0

Accrued liabilities 300.5 252.1 Income taxes 1.4 3.6 Total

current liabilities 912.0 837.5 Long-term debt 1,138.5 494.1

Long-term deferred tax liability 100.8 44.9 Long-term asbestos

liability 510.6 520.3 Other liabilities 380.5 348.2 Total

equity 1,448.1 1,348.5

Total liabilities and

equity $ 4,490.5 $ 3,593.5

CRANE CO. Condensed Statements of Cash

Flows

(in millions)

Three Months Ended

March 31,

2018 2017

Operating activities: Net income

attributable to common shareholders $ 68.7 $ 63.1

Noncontrolling interest in subsidiaries' earnings — (0.2 )

Net income before allocations to noncontrolling interests 68.7 63.3

Depreciation and amortization 27.9 17.4 Stock-based compensation

expense 5.6 5.6 Defined benefit plans and postretirement credit

(3.9 ) (2.1 ) Deferred income taxes 12.7 (0.1 ) Cash used for

operating working capital (18.6 ) (62.8 ) Defined benefit plans and

postretirement contributions (4.5 ) (2.1 ) Environmental payments,

net of reimbursements (2.3 ) (2.0 ) Other (8.5 ) 1.0

Subtotal 77.1 18.2 Asbestos related payments, net of insurance

recoveries (2.9 ) (14.7 )

Total provided by operating

activities 74.2 3.5

Investing

activities: Capital expenditures (27.5 ) (9.6 ) Proceeds from

disposition of capital assets 0.3 — Payment for acquisition, net of

cash acquired (672.3 ) —

Total used for investing

activities (699.5 ) (9.6 )

Financing activities:

Dividends paid (20.9 ) (19.6 ) Stock options exercised - net of

shares reacquired 4.5 12.8 Proceeds received from issuance of

commercial paper 272.7 — Proceeds received from issuance of

long-term debt 550.0 — Proceeds received from issuance of

short-term debt 100.0 — Repayment of long-term debt (250.0 ) —

Repayment of short-term debt (100.0 ) — Debt issuance costs (5.4 )

—

Total provided by (used for) financing activities

550.9 (6.8 ) Effect of exchange rate on cash and cash

equivalents 10.5 8.0 Decrease in cash and cash

equivalents (63.9 ) (4.9 ) Cash and cash equivalents at beginning

of period 706.2 509.7 Cash and cash equivalents at

end of period $ 642.3 $ 504.8

CRANE CO. Order Backlog

(in millions)

March 31,

2018

December 31,

2017

September 30,2017 June 30,2017

March 31,2017

Fluid Handling $ 281.2 * $ 262.1 * $ 268.8 * $

258.9 * $ 249.8 Payment & Merchandising

Technologies 301.0 ** 76.4 ** 87.6 ** 87.0 ** 85.8 Aerospace &

Electronics 381.2 373.6 348.4 328.2 352.4 Engineered Materials 13.4

13.6 13.9 14.9 17.8

Total

Backlog $ 976.8 $ 725.7 $

718.7 $ 689.0 $ 705.8 * Includes

$4.2 million, $3.4 million, $3.5 million and $4.1 million as of

each of March 31, 2018, December 31, 2017, September 30, 2017 and

June 30, 2017, respectively, of backlog pertaining to the Westlock

business acquired in April 2017. ** Includes $211.2 million

as of March 31, 2018 of backlog pertaining to the Crane Currency

business acquired in January 2018 and $0.2 million, $0.2 million,

$0.2 million and $0.3 million as of March 31, 2018, December 31,

2017, September 30, 2017 and June 30, 2017, respectively, of

backlog pertaining to the Microtronic business acquired in June

2017.

CRANE CO. Non-GAAP Financial

Measures

(in millions, except per share data)

Three Months EndedMarch 31,

PercentChangeMarch 31,2018

2018 2017

ThreeMonths

INCOME

ITEMS

Net sales $ 799.1 $ 673.4 18.7 % Operating profit 94.3 93.3

1.0 % Percentage of sales 11.8 % 13.9 %

Special items

impacting operating profit:

Inventory step-up and backlog amortization 6.6 — Acquisition

related charges 5.2 — Repositioning charges 0.8 — Impact from

change in accounting principle* 5.2 3.3 Operating

profit before special items $ 112.1 $ 96.6 16.0 %

Percentage of sales 14.0 % 14.3 % Net income attributable to

common shareholders $ 68.7 $ 63.1 Per share $ 1.13 $ 1.05 7.7 %

Special items

impacting net income attributable to common

shareholders:

Inventory step-up and backlog amortization - net of tax 5.1 — Per

share $ 0.08 Acquisition related charges - net of tax 4.0 —

Per share $ 0.06 Repositioning charges - net of tax 0.6 —

Per share $ 0.01 Incremental financing costs associated with

acquisition - net of tax 1.4 — Per share $ 0.02 Impact of

tax law change 0.3 — Per share $ 0.00 Net

income attributable to common shareholders before special items $

80.1 $ 63.1 Per diluted share $ 1.31 $ 1.05 25.5 %

Special items

impacting provision for income taxes

Provision for income taxes - GAAP Basis $ 15.7 $ 24.6 Tax effect of

inventory step-up and backlog amortization 1.5 — Tax effect of

acquisition related charges 1.2 — Tax effect of repositioning

charges 0.2 — Tax effect of incremental financing costs associated

with acquisition 0.4 — Impact of tax law change (0.3 ) —

Provision for income taxes - non-GAAP basis $ 18.7 $ 24.6

Segment

Information:

For the three months ended March 31, 2018

FluidHandling

Payment &MerchandisingTechnologies

Aerospace&Electronics

EngineeredMaterials

Corporate

TotalCompany

Net sales $ 266.6 $ 292.4 $ 170.4 $ 69.7 $ 799.1 Operating

profit - GAAP 28.1 36.5 34.2 12.4 (16.9 ) 94.3 Inventory step-up

and backlog amortization 0.2 6.4 6.6 Acquisition related charges

5.2 5.2 Repositioning charges, net of gain on property sale 0.4 0.2

0.2 0.8 Impact from change in accounting principle* 3.6 0.7

0.2 0.7 5.2 Operating profit

before special Items 32.3 49.0 34.6 12.4 (16.2 ) 112.1 Percentage

of sales 12.1 % 16.8 % 20.3 % 17.8 % 14.0 %

Segment

Information:

For the three months ended March 31, 2017

FluidHandling

Payment &MerchandisingTechnologies

Aerospace&Electronics

EngineeredMaterials

Corporate

TotalCompany

Net sales $ 239.6 $ 195.5 $ 163.4 $ 74.9 $ 673.4 Operating

profit - GAAP 24.4 38.4 31.7 14.0 (15.2 ) 93.3 Impact from change

in accounting principle* 2.7 0.6 0.3

(0.3 ) 3.3 Operating profit before special items 27.1 39.0

32.0 14.0 (15.6 ) 96.6 Percentage of sales 11.3 % 20.0 % 19.6 %

18.7 % 14.3 % * Represents the impact from the change in

presentation of net periodic pension and postretirement benefit

costs.

CRANE CO. Guidance

(in millions, except per share data)

2018 Full Year Guidance 2018 earnings per share

guidance Low High Earnings per share - GAAP basis $

4.75 $ 4.95 Repositioning costs 0.15 0.15 Acquisition

integration costs 0.55 0.55 Earnings per share -

non-GAAP basis $ 5.45 $ 5.65

Three Months EndedMarch

31,

2018 Full Year Guidance

2018 2017 Low High

Cash provided by operating activities

before asbestos-related payments

$ 77.1 $ 18.2 $ 425.0 $ 455.0 Asbestos-related payments, net of

insurance recoveries (2.9 ) (14.7 ) (60.0 ) (60.0 ) Cash provided

by operating activities 74.2 3.5 365.0 395.0 Less: capital

expenditures (27.5 ) (9.6 ) (125.0 ) (125.0 ) Free cash flow $ 46.7

$ (6.1 ) $ 240.0 $ 270.0 Certain

non-GAAP measures have been provided to facilitate comparison with

the prior year. The Company reports its financial results in

accordance with U.S. generally accepted accounting principles

(GAAP). However, management believes that non-GAAP financial

measures which exclude certain non-recurring items present

additional useful comparisons between current results and results

in prior operating periods, providing investors with a clearer view

of the underlying trends of the business. Management also uses

these non-GAAP financial measures in making financial, operating,

planning and compensation decisions and in evaluating the Company's

performance. In addition, Free Cash Flow provides

supplemental information to assist management and investors in

analyzing the Company’s ability to generate liquidity from its

operating activities. The measure of Free Cash Flow does not take

into consideration certain other non-discretionary cash

requirements such as, for example, mandatory principal payments on

the Company's long-term debt. Non-GAAP financial measures, which

may be inconsistent with similarly captioned measures presented by

other companies, should be viewed in addition to, and not as a

substitute for, the Company’s reported results prepared in

accordance with GAAP.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20180423006499/en/

Crane Co.Jason D. Feldman, 203-363-7329Director, Investor

Relationswww.craneco.com

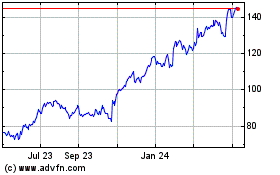

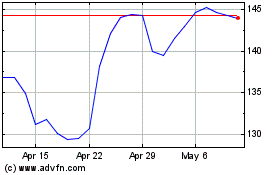

Crane (NYSE:CR)

Historical Stock Chart

From Mar 2024 to Apr 2024

Crane (NYSE:CR)

Historical Stock Chart

From Apr 2023 to Apr 2024