UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER THE

SECURITIES EXCHANGE ACT OF 1934

For the month of April, 2018.

Commission File Number 33-65728

CHEMICAL

AND MINING COMPANY OF CHILE INC.

(Translation of registrant’s

name into English)

El Trovador 4285, Santiago,

Chile (562) 2425-2000

(Address of principal executive

office)

Indicate by check mark whether the registrant files

or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F:

x

Form 40-F

¨

Indicate by check mark if the registrant is submitting

the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ____

Note: Regulation S-T Rule 101(b)(1) only permits

the submission in paper of a Form 6-K if submitted solely to provide an attached annual report to security holders.

Indicate by check mark if the registrant is submitting

the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ____

Note: Regulation S-T Rule 101(b)(7) only permits

the submission in paper of a Form 6-K if submitted to furnish a report or other document that the registrant foreign private issuer

must furnish and make public under the laws of the jurisdiction in which the registrant is incorporated, domiciled or legally organized

(the registrant’s “home country”), or under the rules of the home country exchange on which the registrant’s

securities are traded, as long as the report or other document is not a press release, is not required to be and has not been distributed

to the registrant’s security holders, and, if discussing a material event, has already been the subject of a Form 6-K submission

or other Commission filing on EDGAR.

Santiago, Chile, April 23, 2018 –

Sociedad Química y Minera de Chile S.A. (SQM) (NYSE: SQM; Santiago Stock Exchange: SQM-A, SQM-B), presents below a free

translation of the following original documents: Official Letter No. 10078 sent by CMF on April 17, 2018, SQM’s reply to

the Official Letter sent to CMF on April 20, 2018 and the letter sent by Sociedad de Inversiones Pampa Calichera S.A. and Potasios

de Chile S.A. on April 19, 2018, all related to the matters of the Extraordinary Shareholders’ Meeting called for April 27,

2018.

|

|

Ord. Official Letter:

|

No. 10078

|

|

|

Background Doc.:

|

- Presentation of April 9, 2018 and Essential Event of April 3, 2018.

|

|

|

|

- Off. Letter No. 9616 of April 13, 2018

|

|

|

|

- Response to Off. Letter No. 9616 of April 13, 2018

|

|

|

RE:

|

Summons to Extraordinary Shareholders’ Meeting to approve reform of bylaws.

|

|

|

SGD:

|

No. 2018040069626

|

|

|

|

Santiago, April 17, 2018

|

|

From:

|

Financial Market Commission

|

|

|

To:

|

CHAIRMAN OF THE BOARD

|

|

|

|

SOCIEDAD QUIMICA Y MINERA DE CHILE S.A.

|

|

With respect to your response

to Ordinary Official Letter No. 9616 of April 13, 2018, in which you reported background information to support the modification

of the bylaws to be discussed at the next extraordinary shareholders’ meeting, this Commission clarifies, reiterates and

requests the following:

1) Regarding the “Letter”

sent by the shareholders Sociedad de Inversiones Pampa Calichera S.A. and Potasios de Chile S.A, on April 2, 2018, which at the

moment constitutes, according to your response, the only background information to support the modification of the statutes proposed

for the shareholders’ consideration, it should be noted that said information does not include the support referred to in

article 59 of Law 18,046 on Corporations, but only refers to the request submitted by the shareholders to this Board of Directors

to summon an extraordinary shareholders’ meeting, to inform and resolve the reforms indicated in said letter and in accordance

with article 58 No. 3 of the abovementioned Law.

2) In consideration of what is

indicated in number 1) above, this Board of Directors must present to the shareholders, as soon as possible, the grounds to justify

the option to be submitted to the decision of the next extraordinary shareholders’ meeting and perform the corresponding

proceedings.

3) Additionally, the Board of

Directors is asked to issue a pronouncement on whether or not the proposed modification to the bylaws contributes to corporate

interest, which must be reported to this Service prior to holding said shareholders’ meeting.

4) Finally, it must confirm the

authority of General Counsel, Mr. Gonzalo Aguirre Toro, to respond to Ordinary Official Letter No. 9616 of April 13, 2018, which

must be reported to the Commission within 1 business day of the date of the present Ordinary Official Letter.

The above requirements shall be

met as soon as possible, considering that the shareholders must have this information in sufficient advance of the date of extraordinary

shareholders’ meeting in which they must make a decision on the matter.

jag / DCFV

Sincerely,

CRISTIAN ALVAREZ CASTILLO

SECURITIES MARKET SUPERVISOR

ON THE BEHALF OF THE PRESIDENT

OF

THE FINANCIAL MARKET COMMISSION

Electronic official letter, accessible at: http://www.cmfchile.cl/validar_oficio/

|

SVS ELECTRONIC FLOW OF DOCUMENTS

|

https://www.svs.cl/sitio/seil/pagina/pufed/pufed_respuesta_ofiicio.php?....

|

File: 20180078846695LaXiYeFRRTqaHOLDYuPzsuoWMeoRoD

Santiago, April 20, 2018

To:

Cristian Alvarez Castillo

Securities Market Supervisor

Financial Market Commission

RE: Ordinary Official Letter No. 10078 of April 17, 2018

Dear Mr. Alvarez:

With respect to the ordinary official letter

in reference (the “

Official Letter

”), I am writing to inform you that the Board of Directors of Sociedad Quimica

y Minera de Chile S.A. (the “

Board

” and the “

Company

”, respectively) at an extraordinary

meeting held today has read said letter and unanimously resolved to respond as follows.

Prior to the abovementioned extraordinary

meeting, the shareholders Sociedad de Inversiones Pampa Calichera S.A. and Potasios de Chile S.A., who have proposed the modification

to the Company’s bylaws as informed by essential fact of April 3, 2018 (the “

Proposal

”), have been asked

to present the background information to support the Proposal. These shareholders responded under the terms of the enclosed letter,

which shall be available on the Company’s website (the “

Website

”) as of today.

Regarding number 3 of the Official Letter,

on whether or not the Proposal contributes to corporate interest, the Board states that:

|

|

1.

|

The modifications to Articles

Twenty-seven, Twenty-eight, Twenty-nine, Thirty-six and Forty-one,

contribute to corporate interest

in that their purpose is to adapt the text to the creation of the Financial Market

Commission (the “

CMF

”) which substituted the Superintendency of Securities and Insurance.

|

|

|

2.

|

The modification to Article

Twenty-seven bis

may not contribute to corporate interest

in that it would prevent the Pension Fund Administrators (the “AFPs”) from being able to invest the 10% increase over

percentages established in letter c.13 of section III.3 of the Pension Fund Investment System published by the Superintendency

of Pensions, effective as of November 2017. In fact, given that the companies subject to the provisions of Title XII of Decree

Law No. 3,500 must annually designate account inspectors, pursuant to article 118 of said Law, under the Investment System, the

AFP may invest resources from Pension Funds in the Company’s shares up to 3% of the value of the respective pension funds,

and this amount may increase by 10% by the mere fact that the Company is subject to abovementioned Title XII. As of April 18, 2018,

the AFP hold between 0.039% and 0.108% in their respective funds

1

.

|

|

|

3.

|

The modification to article

Thirty-six bis

contributes to corporate interest

as it

allows the Company to send the information indicated therein to its shareholders through its incorporation on the Website, thus

avoiding the expense involved in the physical delivery of said documentation.

|

|

|

4.

|

The modification of the title of the current transitory article to the

First Transitory

article

contributes to corporate interest

as long as the incorporation of the new Second Transitory article, referred to

below, is approved, as it would contribute to a better reading and order of the corporate bylaws.

|

|

|

5.

|

With respect to the new proposed transitory article to be added, which would become the

Second

Transitory

article, the Board

considers, consistent with its response to ordinary official letter No. 9911 of the CMF, that

it is prudent to wait to issue a pronouncement in this respect until clarification is received by the shareholders who requested

the Proposal

.

|

Sincerely,

(Signature illegible)

Eugenio Ponce Lerou

Chairman of the Board

Sociedad Quimica y Minera de Chile S.A.

1

As of April

18, 2018, the AFPs held the following investments in the Company:

|

|

(a)

|

AFP Cuprum S.A. held the following B-series shares, which represent the percentage indicated for

each fund: (i) 110,000 shares for Fund A, representing 0.071% of said fund, (ii) 44,695 shares for Fund B, representing 0.039%

of said fund, (iii) 153,000 shares for Fund C, representing 0.057% of said fund, (iv) 59,000 shares for Fund D, representing 0.058%

of said fund, and (v) 38,886 shares for Fund E, representing 0.029% of said fund.

|

|

|

(b)

|

AFP Planvital S.A. held the following B-series shares, which represent the percentage indicated

for each fund: (i) 13,846 shares for Fund A, representing 0.097% of said fund, (ii) 28,528 shares for Fund B, representing 0.093%

of said fund, (iii) 21,515 shares for Fund C, representing 0.047% of said fund, (iv) 26,820 shares for Fund D, representing 0.103%

of said fund, and (v) 22,824 shares for Fund E, representing 0.108% of said fund

|

Note: The percentages have been calculated

according to the value of the pension funds published in the website of the Superintendency of Pensions on April 17, 2018, and

the Company’s investment value corresponds to the closing price as of April 18, 2018.

Santiago, April 19, 2018

Mr. Luis Eugenio Ponce Lerou

Chairman

SOCIEDAD QUIMICA Y MINERA DE CHILE S.A.

RE:

Response to letter dated April 17, 2018

.

Dear Mr. Ponce,

We confirm receipt of your letter

dated this past April 17

th

and copy of the Ordinary Official Letter No. 10,078 of the Financial Market Commission (“CMF”),

and in response to which we can state the following:

The background information to

support the request to summon an extraordinary shareholders’ meeting, sent by the boards of directors of Sociedad de Inversiones

Pampa Calichera S.A. (“Pampa Calichera”) and Potasios de Chile S.A. (“Potasios de Chile”) last April 2

nd

,

refers primarily to the incorporation of a new Second Transitory article which prevents a groups of shareholders from voting over

the limit established in article Thirty-One of the bylaws of Sociedad Quimica y Minera de Chile S.A. (“SQM”), which

in the case of the A-series, gives the right to elect no more than 3 of the 7 directors of said series. Likewise, as explained

below, SQM was asked to take the opportunity to present other additional modifications to the bylaws to the consideration of the

extraordinary shareholders’ meeting.

Within this context, the boards

of directors Pampa Calichera and Potasios de Chile consider it appropriate to request the modification of the bylaws of SQM for

the purposes of maintaining this provision after Nutrien (formerly PCS) sells its shareholders in its sale process, which is of

public knowledge. Specifically, the proposal is to modify the bylaws of SQM so that the other SQM A-series shareholders have the

capacity to react if the buyers of the SQM-A shares presently owned by Nutrien have the intention to vote more than the 37.5% established

in the bylaws, such that they may match (but under no circumstances exceed) the effective voting capacity. According to these shareholders,

this would help avoid circumstances in which any shareholders or group of shareholders may acquire the control of the company against

the present spirit of the bylaws, without first undergoing a public offering of shares and the necessary reform to the bylaws.

Regarding the other bylaw modifications,

the boards of directors of my represented companies consider it appropriate to make the other modifications to the bylaws in order

to update their text according to the latest legal modifications that govern open corporations. Specifically, the modification

of articles Twenty-seven, Twenty-eight, Twenty-nine, Thirty-six and Forty-on are aimed at adapting to the creation of the new Financial

Market Commission which substituted the Superintendency of Securities and Insurance.

The modification to article Twenty-seven

bis corresponds to the idea that, in the opinion of these shareholders, since the Company has external auditors, the additional

hiring of account inspectors would appear to be unnecessary.

The modification to article Thirty-six

bis would allow SQM to present certain information to its shareholders by its incorporation on the Company’s Website, thus

avoiding the bureaucracy implied by the physical delivery of said documentation.

On the other hand, the modification

of the title of the current transitory article to “First Transitory Article”, is a consequence of the new Second Transitory

article, which has been proposed for incorporation into the bylaws of SQM.

Finally, and consistent with the

agreements signed by my represented companies in favor of CORFO, which allowed SQM to obtain a substantial increase in its lithium

extraction quota, the boards of directors of Pampa Calichera and Potasios de Chile understand that the modifications proposed contribute

to the corporate interest of SQM, and in particular, the incorporation of the new Second Transitory article, as it is aimed at

broadening the meaning and scope of the current article Thirty-one of the bylaws, by preventing any shareholder or group of shareholders

from acquiring under these circumstances, directly or indirectly, the control of the Company without first (i) modifying the bylaws

with respect to the quorums required thereby, and (ii) performing a public offering of shares pursuant to Title XXV of the Securities

Market Law.

The authority must note that,

in the interest of allowing SQM to terminate the litigations it presently has with CORFO and, at the same time, signing the agreements

referred to in the previous paragraph, Pampa Calichera and Potasios de Chile agreed to relinquish their participation in the control

of SQM during the entire effective term of said agreements. However, this was not the cause but rather the result of the express

petition by CORFO that SQM have no controller until December 31, 2030, and that my represented companies refrain from signing a

joint action agreement with third parties in order to acquire the role of sole controller or joint controller with other shareholders

for the entire abovementioned term.

It is without question that the

proposed reform is in the corporate interest of SQM, and my represented companies are driven by no other motive than that of protecting

the benefits provided by the agreements signed with CORFO and the equality of rights that, in the interest of corporate harmony,

must exist in the company for the entire period in which the established restrictions are in place. It is for that reason that

upon termination of the agreements, that is, on December 31, 2030, the effects of the new transitory article proposed shall cease

and the corporate bylaws in their entirety shall once again go into effect.

We hereby send you this information

for your own knowledge and that of the SQM shareholders prior to the extraordinary shareholders’ meeting.

Sincerely,

(Signature Illegible)

Patricio Contesse Pica

p.p. SOCIEDAD DE INVERSIONES PAMPA

CALICHERA S.A.

p.p. POTASIOS DE CHILE S.A.

About SQM

SQM´s business strategy is to be

a global company, with people committed to excellence, dedicated to the extraction of minerals and selectively integrated in the

production and sale of products for the industries essential for human development (e.g. food, health, technology). This strategy

was built on the following five principles:

|

|

•

|

ensure availability of key resources required to support current goals and medium and long-term

growth of the business;

|

|

|

•

|

consolidate a culture of lean operations (M1 excellence) through the entire organization, including

operations, sales and support areas;

|

|

|

•

|

significantly increase nitrate sales in all its applications and ensure consistency with iodine

commercial strategy;

|

|

|

•

|

maximize the margins of each business line through appropriate pricing strategy;

|

|

|

•

|

successfully develop and implement all lithium expansion projects of the Company, acquire more

lithium and potassium assets to generate a competitive portfolio.

|

These principles are based on the following

key concepts:

|

|

•

|

strengthen the organizational structure to supports the development of the Company's strategic

plan, focusing on the development of critical capabilities and the application of the corporate values of Excellence, Integrity

and Safety;

|

|

|

•

|

develop a robust risk control and mitigation process to actively manage business risk;

|

|

|

•

|

improve our stakeholder management to establish links with the community and communicate to Chile

and worldwide our contribution to industries essential for human development.

|

For further information, contact:

Gerardo

Illanes 56-2-24252022 /

gerardo.illanes@sqm.com

Kelly O’Brien 56-2-24252074 / kelly.obrien@sqm.com

Irina Axenova 56-2-24252280 / irina.axenova@sqm.com

For media inquiries, contact:

Carolina García Huidobro / carolina.g.huidobro@sqm.com

Alvaro Cifuentes / alvaro.cifuentes@sqm.com

Tamara Rebolledo / tamara.rebolledo@sqm.com (Northern

Region)

Cautionary Note Regarding Forward-Looking

Statements

This news release contains “forward-looking

statements” within the meaning of the safe harbor provisions of the U.S. Private Securities Litigation Reform Act of 1995.

Forward-looking statements can be identified by words such as: “anticipate,” “plan,” “believe,”

“estimate,” “expect,” “strategy,” “should,” “will” and similar references

to future periods. Examples of forward-looking statements include, among others, statements we make concerning the Company’s

business outlook, future economic performance, anticipated profitability, revenues, expenses, or other financial items, anticipated

cost synergies and product or service line growth.

Forward-looking statements are neither

historical facts nor assurances of future performance. Instead, they are estimates that reflect the best judgment of SQM management

based on currently available information. Because forward-looking statements relate to the future, they involve a number of risks,

uncertainties and other factors that are outside of our control and could cause actual results to differ materially from those

stated in such statements. Therefore, you should not rely on any of these forward-looking statements. Readers are referred to the

documents filed by SQM with the United States Securities and Exchange Commission, specifically the most recent annual report on

Form 20-F, which identifies important risk factors that could cause actual results to differ from those contained in the forward-looking

statements. All forward-looking statements are based on information available to SQM on the date hereof and SQM assumes no obligation

to update such statements, whether as a result of new information, future developments or otherwise.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act

of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

CHEMICAL AND MINING COMPANY

OF CHILE INC.

(Registrant)

|

Date: April 23, 2018

|

/s/ Ricardo Ramos

|

|

|

By: Ricardo Ramos

|

|

|

CFO & Vice-President of Development

|

Persons who are to respond to the collection

of information contained SEC 1815 (04-09) in this form are not required to respond unless the form displays currently valid OMB

control number.

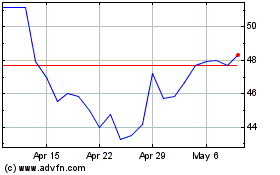

Sociedad Quimica y Miner... (NYSE:SQM)

Historical Stock Chart

From Mar 2024 to Apr 2024

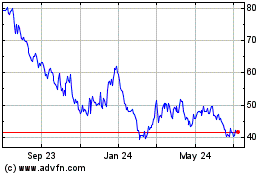

Sociedad Quimica y Miner... (NYSE:SQM)

Historical Stock Chart

From Apr 2023 to Apr 2024