Major Banks Clearly Looking To Cryptocurrency

April 23 2018 - 12:50PM

ADVFN Crypto NewsWire

Bitcoin Global News

(BGN)

April 23, 2018 -- ADVFN Crypto

NewsWire

Major Banks Clearly Looking To

Cryptocurrency

Regulations are in the works, and

banks are beginning to see the possibility of cryptocurrencies as

real investment options, and secure asset holdings – as well as the

use of blockchain technology to improve upon their existing

business processes.

Citigroup Report Urges The

Importance To Keep Up

The organization recently released

a report, “Bank of the Future: The

ABCs of Digital Disruption in Finance” totaling 124 pages that all

point to the importance that existing financial institutions not be

left behind in this wave of technological change to the finance

industry. Their antiquated systems will simply not hold up to the

adaptability and scalability of things like smart contracts. The

report touches on the political implications, where growing groups

such as Libertarians will make a push for the fintech

revolution.

“If the Internet is a disruptive

platform designed to facilitate dissemination of information, then

Blockchain technology is a disruptive platform designed to

facilitate exchange of value.”

Goldman Sacks Hires A

Cryptocurrency Fund Manager

The head of digital asset markets

at Goldman Sacks is now Justin Schmidt, previously worked at

quantitative trading firms Seven Eight Capital LLC and WorldQuant

LLC and has computer science degrees from the Massachusetts

Institute of Technology. The new VP is only 38, and clearly has the

background of an individual who sees the potential in a fintech

revolution. The bank is not overtly active in the cryptocurrency

markets, but rather acts as a middleman to facilitate those with a

private interest in the space.

Former JP Morgan Exec. Says

Crypto Market Will grow

Chairman of digital investment bank

Coinshares and chief investment officer at Global Advisors Daniel

Masters manages nearly $800 Million in assets. He began his career

trading Oil in the 1980’s, and spent time working for JP Morgan as

the Global Head of Energy trading in the 1990’s. This diverse

experience in the finance industry has led Masters to the strong

belief in a growing cryptocurrency market as part of the world’s

asset holdings.

“I think even

if it’s only 5% at the end of the day, that market will then still

be much bigger than it is today.”

Becoming 5% would mean more than

multiplying times five from the current value.

By: BGN Editorial Staff

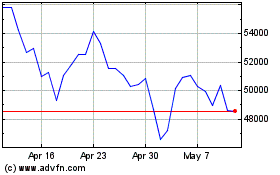

Bitcoin (COIN:BTCGBP)

Historical Stock Chart

From Mar 2024 to Apr 2024

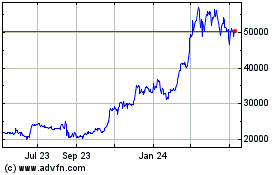

Bitcoin (COIN:BTCGBP)

Historical Stock Chart

From Apr 2023 to Apr 2024

Real-Time news about Bitcoin (Cryptocurrency): 0 recent articles

More Bitcoin News Articles