UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

SCHEDULE 14A

(RULE

14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the

Registrant ☐ Filed by a Party other than the Registrant ☒

Check the appropriate box:

|

|

|

|

|

☐

|

|

Preliminary Proxy Statement

|

|

|

|

|

☐

|

|

Confidential, for Use of the Commission Only (as permitted by Rule

14a-6(e)(2))

|

|

|

|

|

☐

|

|

Definitive Proxy Statement

|

|

|

|

|

☒

|

|

Definitive Additional Materials

|

|

|

|

|

☐

|

|

Soliciting Material Pursuant to

§ 240.14a-12

|

Whitestone REIT (“Whitestone”)

(Name of Registrant as Specified in its Charter)

KBS SOR Properties LLC

KBS SOR (BVI) Holdings, Ltd.

KBS Strategic Opportunity Limited Partnership

KBS Strategic Opportunity REIT, Inc.

KBS Capital Advisors LLC

Keith D. Hall

Peter

McMillan III

Kenneth H. Fearn, Jr.

David E. Snyder

(Name of

Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

|

|

|

|

|

|

|

|

|

|

☒

|

|

No fee required.

|

|

|

|

|

☐

|

|

Fee computed on table below per Exchange Act Rules

14a-6(i)(1)

and

0-11.

|

|

|

|

|

|

|

|

(1)

|

|

Title of each class of securities to which transaction applies:

|

|

|

|

(2)

|

|

Aggregate number of securities to which transaction applies:

|

|

|

|

(3)

|

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule

0-11

(set forth the amount on which the filing fee is calculated and state how it was determined):

|

|

|

|

(4)

|

|

Proposed maximum aggregate value of transaction:

|

|

|

|

(5)

|

|

Total fee paid:

|

|

|

|

|

☐

|

|

Fee paid previously with preliminary materials.

|

|

|

|

|

☐

|

|

Check box if any part of the fee is offset as provided by Exchange Act

Rule 0-11(a)(2)

and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its

filing.

|

|

|

|

(1)

|

|

Amount Previously Paid:

|

|

|

|

(2)

|

|

Form, Schedule or Registration Statement No.:

|

|

|

|

(3)

|

|

Filing Party:

|

|

|

|

(4)

|

|

Date Filed:

|

Dear Fellow Shareholders:

We, KBS,

1

are one of the largest shareholders in Whitestone REIT (“Whitestone”), with approximately 9.61% of the outstanding shares. We believe Whitestone has an attractive business and is worthy of a

substantial investment. We also believe, however, that Whitestone’s executive compensation, G&A and governance is seriously misaligned with shareholder interests. As we see it, shareholder values can be meaningfully enhanced by Whitestone

bringing these practices into line.

In the past year, we have had a number of conversations with Whitestone in an effort to convince it to adjust its

policies. We did not seem to make any headway and felt our efforts fell on deaf ears. We then considered other ways Whitestone might be made responsive to our concerns, which we believe are shared by other shareholders as well. We decided our best

way forward was to nominate individuals to Whitestone’s Board of Trustees who are independent and not picked by the current Board.

Accordingly, we have announced our nomination of Kenneth H. Fearn, Jr. and David E. Snyder to fill two of the three trustee seats up for election at this

year’s Annual Meeting. Messrs. Fearn and Snyder are highly competent real estate professionals who we believe will bring badly needed oversight on matters of compensation, G&A and governance. Though they would be only two of

Whitestone’s seven trustees, they would be advocates for getting the Board to implement our request that it declassify itself, as well as overall governance reform.

In response, Whitestone has produced a number of glossy letters and presentations claiming that it has reigned in executive compensation and costs, provided

extraordinary shareholder returns and reformed its governance. As we show in this letter, however, its claims do not stand up to scrutiny. We believe that Whitestone’s executive compensation and G&A costs remain significantly above its

peers, its performance is mediocre and its governance scores remain as poor as ever. Whitestone needs strong shareholder voices on its Board. It needs trustees who have neither been picked by nor owe their jobs to approval by the current Board.

Please join us in voting for Kenneth Fearn and David Snyder as trustees and our recommendation that the Board declassify itself

.

Under the current Board, management compensation has historically been excessive, not properly tied to performance and not aligned with shareholder

interests.

|

|

•

|

|

According to the Institutional Shareholder Services (“ISS”)

2

proxy analysis from last year,

Whitestone’s CEO’s compensation in 2016 was 2.67 times the peer group median

. Over a longer period, from 2014-2016, his pay was higher than any

other company in the ISS selected peer group, while

Whitestone’s performance was worse than most of the companies in the peer group

.

|

|

1

|

“KBS” consists of KBS SOR Properties LLC, KBS SOR (BVI) Holdings, Ltd., KBS Strategic Opportunity Limited Partnership, KBS Strategic Opportunity REIT, Inc., KBS Capital Advisors LLC, Keith D. Hall and Peter

McMillan III.

|

|

2

|

Permission to use quotations from ISS reports was neither sought nor obtained.

|

|

|

•

|

|

According to the Glass Lewis & Co. (“Glass Lewis”)

3

proxy analysis of executive compensation from last year, “[o]verall, the Company paid more than its peers, but performed moderately worse than its peers.”

|

|

|

•

|

|

Although Whitestone claimed in last year’s proxy statement that the bulk of management compensation consists of long-term performance-based equity awards that have “difficult to achieve performance

targets,” the reality is that

in 2015 and 2016, 100% of the CEO’s approximately $4.6 million award grants and 100% of the CFO’s approximately $2.1 million award grants had no performance requirements at all, and were fully

vested after just 18 months

.

|

|

|

•

|

|

Over the past several years, when a performance target has been used with long-term incentive awards, the performance target has been an absolute, company-wide “funds from operations” (“FFO”)

performance metric, which management can grow simply by making more and more acquisitions, regardless of whether they are accretive investments, as opposed to a per share metric that would actually demonstrate good performance on a per share basis.

We believe the absolute FFO performance metric encourages management to seek growth for the sake of growth, rather than to improve shareholder returns.

|

|

|

•

|

|

Whitestone received a “high concern” grade from ISS on its pay for performance evaluation over 2014-2016. Glass Lewis gave Whitestone’s pay for performance grades of “F” for 2016, “F”

for 2015, and “D” for 2014.

|

|

|

•

|

|

Shareholders gave a resounding vote of over 55% of the shares voted against Whitestone’s “say on pay” proposal at last year’s Annual Meeting.

|

Whitestone’s response to its failed “say on pay” vote from last year has not been sufficient.

|

|

•

|

|

In Whitestone’s 2018 proxy statement (the “Whitestone Proxy Statement”), Whitestone claims that, as a result of the failed say on pay vote from last year, it engaged in “valuable discussions with

many of [its] shareholders,” and “considered and incorporated the feedback” resulting in “significant changes” to both their executive compensation program and corporate governance programs. However,

we note that:

|

|

|

•

|

|

We have been one of their most significant shareholders since the spring of 2017 and tried on numerous occasions to have discussions with the Board and management regarding our concerns with executive compensation. As

described in our own proxy statement for the 2018 Annual Meeting (the “KBS Proxy Statement”), we found the Board and management to be unreceptive to our concerns. Not once did they ever admit that their executive compensation was a

problem. On the contrary, during our

in-person

meeting, when Peter McMillan stated that Whitestone executives are paid more than similar companies, James Mastandrea, Whitestone’s Chairman of the Board and

CEO, replied “[Y]ou knew that when you bought the stock, why did you want this battle?”

|

|

|

•

|

|

Looking back at the past four years, and forward for 2018 (based on disclosures regarding expected compensation for 2018 from the Whitestone Proxy Statement), it seems the only year in which executive compensation was

in line with Whitestone’s peers was 2017. Whitestone’s own disclosures regarding its plans for 2018 executive compensation suggest that it will, once again, be grossly overpaying its executives relative to its peers.

|

|

3

|

Permission to use quotations from Glass Lewis reports was neither sought nor obtained.

|

2

Source: SNL, Public Filings, Bloomberg

|

(1)

|

Pay of Top 3 Named Executives is the addition of total compensation for the CEO and up to two other top executives as reported in the proxy statements.

|

|

(2)

|

Size of Company is the enterprise value at the end of the period.

|

|

(3)

|

The Peer Set Average is derived by dividing 2017 named executive compensation of the peer companies into their respective

end-of-year

2017

enterprise values. SNL Peer Set includes the 16 other strip-center focused companies used by Whitestone to benchmark its return: REG, WRI, ROIC, FRT, UE, RPAI, KRG, AKR, BRX, KIM, DDR, WHLR, CDR, BFS, RPT, UBA. Proxy Peer Set includes the 14 diverse

companies used by Whitestone to benchmark its executive compensation: CDR, BFS, RPT, UBA, ADC, CUZ, GOV, GOOD, GPT, IRET, MNR, OLP, PSB, STAG. The following companies didn’t report compensation for the stated years and are not included within

the affected averages: UE (2014), GOV (2014), RPT (2017), GPT (2017), OLP (2017). Advisory fees were used in place of executive compensation for GOOD, which is externally advised and has no employees. GOV was used in place of FPO, because FPO was

acquired by GOV in 2017.

|

|

(4)

|

Compensation scenarios, as set forth by Whitestone, represent 2018 potential compensation, as a percentage of its

end-of-year

2017

enterprise value. Worst, base and best case scenarios represent different levels of annual cash bonus. Grant date fair value is used for equity awards.

|

|

|

•

|

|

During Whitestone’s recent earnings call, management noted on several occasions that its compensation program was recently changed to become more shareholder friendly. However, when looking at Whitestone’s own

disclosure regarding its plans for 2018 executive compensation, we see that management will be earning less performance-based compensation and more time-based compensation, suggesting 2017 is an anomaly.

|

3

Source: Public Filings

|

|

•

|

|

Even taking into consideration 2017, over the past four years, Whitestone’s executive compensation is clearly excessive.

|

Source: SNL, Public Filings, Bloomberg

|

(1)

|

Pay of Top 3 Named Executives is the addition of total compensation for the CEO and up to two other top executives as reported in the proxy statements. The analysis was performed for the periods from 2014 to 2017, and

the results were derived using a weighted average calculation based on the peer companies’ enterprise values at the end of each period. FRT reporting for 2014 included two executives; adjustments were not made as it was deemed immaterial to the

broader analysis.

|

|

(2)

|

Size of Company is the straight average of last four years enterprise value. SNL Peer Set includes the 16 other strip-center focused companies used by Whitestone to benchmark its return: REG, WRI, ROIC, FRT, UE, RPAI,

KRG, AKR, BRX, KIM, DDR, WHLR, CDR, BFS, RPT, UBA. Proxy Peer Set includes the 14 diverse companies used by Whitestone to benchmark its executive compensation: CDR, BFS, RPT, UBA, ADC, CUZ, GOV, GOOD, GPT, IRET, MNR, OLP, PSB,

STAG. The following companies didn’t report compensation for the stated years and are not included within the affected averages: UE (2014), GOV (2014), RPT (2017), GPT (2017), OLP (2017). Advisory fees were used in place

of executive compensation for GOOD, which is externally advised and has no employees. GOV was used in place of FPO, because FPO was acquired by GOV in 2017.

|

4

|

|

•

|

|

Compensation for the top three executives at Whitestone constitutes about 35% of their overall general and administrative (“G&A”) expenses, which sits at the

higher-end

of the peer sets. Viewing the CEO’s compensation as a percentage of net operating income (“NOI”) shows that his relative compensation has been far in excess of all Whitestone’s

peers over the last four years.

|

Source: SNL, Public Filings, Bloomberg

|

(1)

|

Pay of Top 3 Named Executives is the addition of total compensation for the CEO and up to two other top executives as reported in the proxy statements from the periods from 2014 to 2017.

|

|

(2)

|

Reported G&A is as of the end of year 2017.

|

|

(3)

|

Reported CEO compensation and NOI are as of the end of year 2017.

|

|

|

FRT reporting for 2014 included two executives; adjustments were not made as it was deemed immaterial to the broader analysis. SNL Peer Set includes the 16 other strip-center focused companies used by Whitestone to

benchmark its return: REG, WRI, ROIC, FRT, UE, RPAI, KRG, AKR, BRX, KIM, DDR, WHLR, CDR, BFS, RPT, UBA. Proxy Peer Set includes the 14 diverse companies used by Whitestone to benchmark its executive compensation except GOOD: CDR, BFS, RPT, UBA, ADC,

CUZ, GOV, GPT, IRET, MNR, OLP, PSB, STAG. The following companies didn’t report compensation for the stated years and are not included within the affected averages: UE (2014), GOV (2014), RPT (2017), GPT (2017), OLP (2017). GOOD is excluded

from this analysis as its compensation format (externally-advised) is not comparable. GOV was used in place of FPO, because FPO was acquired by GOV in 2017.

|

|

|

•

|

|

Whitestone is extremely inefficient as it relates to overhead expenses, and has admitted its ratio of G&A expenses relative to its size should be reduced. In recent letters to shareholders, it stated its goal to

improve its G&A expense to revenue ratio to

8-10%

by scaling its operating infrastructure over a larger base of revenue and assets, and that it expects to achieve this over the next five years.

Whitestone’s overhead burden of ~18% of total revenue is nearly 2.5x higher than both its strip center REIT peers and its peer set selected for compensation. More troubling are management’s goals to overcome that issue: in order to

“grow out” of this excess G&A and achieve a ratio more

in-line

with peers

(8-10%),

Whitestone would need to increase its asset base by ~2x in the near

future, which would be meaningfully value-destructive at the current cost of capital.

Whitestone’s executive compensation has been grossly excessive in relation to peer group norms and should be significantly reduced to meet those norms

as part of the effort of improving the G&A expense ratio

.

|

5

Source: SNL and Public Filings

|

(1)

|

Reported G&A as of the end of the period.

|

|

(2)

|

Total assets is calculated using the “Mean Consensus NAV per share” at the end of the period, multiplied by the total diluted shares (including OP units).

|

|

|

SNL Peer Set includes the 16 other strip-center focused companies used by Whitestone to benchmark its return: REG, WRI, ROIC, FRT, UE, RPAI, KRG, AKR, BRX, KIM, DDR, WHLR, CDR, BFS, RPT, UBA. Proxy Peer Set includes the

14 diverse companies used by Whitestone to benchmark its executive compensation: CDR, BFS, RPT, UBA, ADC, CUZ, GOV, GOOD, GPT, IRET, MNR, OLP, PSB, STAG. GOV was used in place of FPO, because FPO was acquired by GOV in 2017.

|

Under the current Board, Whitestone’s recent performance has been average and its dividend is not supported by its operations.

|

|

•

|

|

Whitestone likes to tout its total shareholder return as being a standout among shopping center REITs, but the reality is that Whitestone’s total returns since its listing in 2010 have been average amongst its

peers and almost entirely consisted of dividends, which are not supported by cash flow after adjusting for capital expenditures and not sustainable.

|

6

Source: Bloomberg

Note: Total return figures as of 8/25/2010 and are displayed monthly until 4/10/2018.

Source: Bloomberg, SNL, Public Filings

CAD/Share is derived by subtracting reported capital expenditure (not including development expenses) from reported core FFO/Share.

|

(1)

|

CAD Dividend Coverage is derived by dividing dividend/share into CAD/share.

|

7

|

(2)

|

Peer average is derived using a weighted average calculation of the results based on the peer companies’ enterprise values at the end of each period. Peer Set includes WSR, REG, WRI, CDR, FRT, BFS, RPT, KRG, BRX,

KIM, DDR, UE and excludes WHLR, ROIC, UBA, RPAI, AKR as these companies did not report capital expenditures consistently. FY 2013 excludes UE, RPT, BRX and FY 2014 excludes UE and RPT as these companies were not publicly-traded and/or did not report

capital expenditures.

|

Under the current Board, Whitestone’s long-term incentive plan is excessive and overly dilutive.

|

|

•

|

|

Both ISS and Glass Lewis called the cost of the plan excessive and recommended “no” votes on the proposal to approve the plan last year.

|

|

|

•

|

|

According to Glass Lewis last year, (a) the dilutive overhang with the plan is 18.59% compared to a peer median of 9.82% and a peer average of 10.25% and (b) the anticipated three-year burn rate is 4.07%

compared to a peer median of 0.80% and a peer average of 1.20%.

|

Under the current Board, Whitestone has corporate governance policies

that serve to entrench the Board and management, while being harmful to shareholders.

|

|

•

|

|

Whitestone has a staggered board, which shields directors from annual

re-election.

Proxy advisory firms ISS and Glass Lewis both favor the repeal of staggered boards and the

annual election of directors. According to Glass Lewis’s 2018 proxy guidelines, empirical studies have shown: (i) staggered boards are associated with a reduction in a firm’s valuation; and (ii) in the context of hostile

takeovers, staggered boards operate as a takeover defense, which entrenches management, discourages potential acquirers, and delivers a lower return to target shareholders.

|

|

|

•

|

|

Whitestone’s bylaws can only be amended by the Board, and not by the shareholders. This protects the incumbent Board and management and was considered a “material governance failure” by ISS in their proxy

report last year. ISS recommended a “withhold” vote for Board member Donald Keating as a result of this material governance failure.

|

|

|

•

|

|

Last year, ISS rated their governance score as a “10” on a scale from 1 to 10, with 10 being the

worst

. In particular, Whitestone scored a worst score “10” on the subcategories of

compensation and shareholder rights.

|

|

|

•

|

|

We estimate that Whitestone would score a 38 on Green Street’s corporate governance scorecard – worst among its peers.

|

8

Source: Green Street Advisors, KBS

|

(1)

|

Corporate governance scores for the strip center REITs are based on Green Street assessment of the defined peer set. Whitestone is not covered by Green Street Advisors. Peer Set includes the pure-play strip center REITs

in Green Street coverage universe: UE, KIM, RPAI, ROIC, DDR, FRT, WRI, REG, AKR, BRX.

|

|

*

|

Past Conduct and Divergent Tax Basis are subjective metrics that assess track record, reputation and insider tax basis. In this analysis, average sector scores were ascribed.

|

Under the current Board, management severance packages are excessive and unreasonable.

|

|

•

|

|

According to the Whitestone Proxy Statement, Whitestone would be obligated to pay its CEO

$11.51 million

if he terminates his employment for “good reason,” which would include him no longer

serving as Chairman of the Board.

|

|

|

•

|

|

According to the Whitestone Proxy Statement, Whitestone would be obligated to pay its CFO

$6.29 million

if he is terminated without cause, and he will be deemed to have been terminated without cause if the

current CEO, James Mastandrea, is not nominated and/or

re-elected

as a member of the Board.

|

|

|

•

|

|

According to the Whitestone Proxy Statement, Whitestone’s named executive officers are collectively entitled to

$24.64

million

in payments upon a change of control

even if none of

them are terminated

.

|

|

|

•

|

|

In 2017, following the failed say on pay vote, Whitestone granted 625,000 change in control or “CIC” restricted stock units,

with a reported grant date fair value of $8.15 million in the

aggregate

, to its named executive officers that will vest immediately prior to change in control on or before September 30, 2024.

|

9

The current Board, in particular Jack Mahaffey, cannot be trusted to fix these problems.

|

|

•

|

|

The Chairman of the Board and CEO, Mr. Mastandrea, has been unreceptive and unresponsive to our concerns.

|

|

|

•

|

|

The failure of proper Board oversight on compensation and corporate governance has been occurring at Whitestone for many years.

|

|

|

•

|

|

Jack Mahaffey must be replaced after his long history of oversight and approval of executive compensation, particularly for his work on the Compensation Committee where he served as Chairman from 2006 until recently and

even now continues as a member. Mr. Mahaffey has been on this Board since 2000, and after 18 years, should be recognized de facto as an inside director.

|

|

|

•

|

|

We believe our nominees are highly qualified and, if elected, will bring a new and badly needed shareholder voice to the Board and will provide sorely needed oversight and accountability on compensation matters.

|

|

|

•

|

|

The Chairman of the Board and CEO, Mr. Mastandrea, and his wife (who is also a named executive officer of Whitestone) are collectively, by far, the greatest beneficiaries of the excessive and misaligned executive

compensation. You should be highly skeptical of any information provided by Mr. Mastandrea and the Board on these matters.

|

We

are not seeking control or change in management; we want effective oversight of management compensation and good corporate governance.

|

|

•

|

|

We are seeking only two of the seven seats on the Board, for the purpose of giving shareholders like ourselves a voice on the issues summarized above.

|

|

|

•

|

|

If elected, our nominees will advocate increasing the size of the Board to reappoint Nandita Berry, who was just appointed to the Board in September 2017.

|

Our nominees are extremely qualified.

|

|

•

|

|

We believe that the nominees have impressive qualifications and that their experience would be extremely beneficial to Whitestone and to its shareholders.

|

|

|

•

|

|

Kenneth H. Fearn has a strong background in commercial real estate investment, operations and management, having founded and led his own private equity real estate firm, having acted as Managing Director for another,

and having served on public and private boards, including Ashford Hospitality Prime, Inc. (NYSE: AHP).

|

|

|

•

|

|

David E. Snyder has extensive experience in finance and accounting, substantial knowledge of capital markets and significant commercial real estate business experience in roles with various public companies, including

presently as Chief Executive Officer of

Keppel-KBS

US REIT Management Pte. Ltd., a company that manages a publicly listed REIT in Singapore, and previously as Chief Financial Officer of seven separate

KBS-sponsored

public REITs.

|

As more fully described in the KBS Proxy Statement, we had several phone

conversations with management in which we expressed our concern about the misalignment of executive compensation with shareholder interests. Ultimately, we had an in person meeting with Mr. Mastandrea and Paul Lambert, the new Chairman of the

Compensation Committee.

10

We do not believe that Whitestone ever took our concerns seriously. Their responses were a mixture of claiming to

not understand our concerns, that we do not understand their business model, or that we do not understand the beneficial changes they have made with respect to executive compensation. To the extent they did communicate changes to their executive

compensation program to us, we were not convinced that the changes were sufficient. After reviewing their executive compensation disclosure in the Whitestone Proxy Statement, we can now confirm that the changes are simply not enough to address the

misalignment between executive compensation and shareholder interests, and do not give us confidence that the current Board is willing or able to reign in executive compensation to appropriate levels.

There are other aspects of Whitestone’s management compensation and corporate governance that we believe do not serve shareholders’ best interests.

These include (i) unreasonable and excessive severance terms for management if Mr. Mastandrea is not

re-nominated

or

re-elected

to the Board, (ii) a

classified Board, (iii) requiring a majority of the voting power to call a shareholder meeting, (iv) not permitting shareholders to remove a trustee except for cause and with a

two-thirds

vote, and

even then the vacancy may only be filled by the remaining trustees, and (v) not permitting shareholders to amend the bylaws. Based on the lack of responsiveness by the Chairman of the Board to our compensation concerns expressed to him, the

current Board’s history of approving excessive executive compensation, the other corporate governance concerns expressed above and our evaluation of how shareholder values might best be enhanced, we decided to seek a more effective shareholder

voice on the Board by electing trustees who were both independent and not selected by the current Board. We believe the nominees we chose and who have agreed to run and serve, if elected, are highly qualified and will bring a new and badly needed

shareholder voice to the Board and will provide oversight and accountability on compensation and governance matters. We also decided to seek greater shareholder accountability from the Board by requesting that it declassify itself so that all

trustees come up for election annually.

We are not seeking control or any change in management. We want effective oversight of management compensation

and good corporate governance. We are seeking only two of the seven seats on the Board, for the purpose of giving shareholders like ourselves a voice on the issues summarized above. We also would prefer not to run against Nandita Berry. She was

appointed to the Board only recently in September 2017. The current Board, however, chose to assign her the shortest of terms from among the staggered three year terms to which trustees are elected and subjected her to election at this year’s

Annual Meeting of shareholders. If our nominees are elected, they will advocate increasing the size of the Board for the reappointment of Ms. Berry. Jack Mahaffey, however, must be replaced after his long history of oversight and approval of

executive compensation, particularly for his work on the Compensation Committee where he served as Chairman from 2006 until recently and even now continues as a member. Mr. Mahaffey has been on this Board since 2000, and after nearly 18 years

we believe he should be recognized de facto as an inside director.

While Whitestone added three new trustees to the Board in 2017, these new trustees

were handpicked by existing trustees who for a long time have served as the core group of the Board. We welcome the new trustees but have no reason to believe they will be any more effective than the core group that picked them in reigning in

executive compensation or redressing Whitestone’s other governance weaknesses. David Taylor, one of their new trustees, was on the Board for the 2017 Annual Meeting of shareholders. He joined the rest of the Board in unanimously recommending

that shareholders vote FOR Board proposals on the (i) 2018 Long Term Equity Incentive Ownership Plan, (ii) Advisory Vote on Executive Compensation and (iii) Advisory Vote on the Frequency of the Advisory Vote on Executive Compensation.

Each of these proposals was extremely unpopular with shareholders and, despite there being no organized opposition, shareholders roundly defeated two of these Board proposals and for the other proposal, more than 40% of shareholders casting votes

expressed their displeasure by voting AGAINST.

11

The current Board sidestepped any recommendation on our proposal that it

de-stagger

itself. In the Whitestone Proxy Statement, the Board states instead that they believe there are valid arguments for and against staggered boards, and that it wants to allow shareholders to express

their views on this subject without being influenced by a Board recommendation. We think they are wrong. There is widespread recognition that staggered boards are highly disfavored by investors.

We therefore are seeking your support to elect our nominees, Kenneth H. Fearn, Jr. and David E. Snyder, to two of the three seats on Whitestone’s

staggered Board that are up for election this year by voting

FOR

the nominees on the

BLUE

proxy card furnished with this letter. We also are asking you to use the

BLUE

proxy card to vote

FOR

our advisory shareholder

proposal that requests the Board declassify itself so that all trustees are elected annually instead of, as is currently the case, for three-year terms that are staggered so that as close as possible only approximately one third (1/3) of the Board

is up for election each year. Our proposal that the Board be declassified is made as a request to the Board rather than an amendment to Whitestone’s Declaration of Trust because under Whitestone’s Declaration of Trust and bylaws,

shareholders do not have any power or authority to make the change on their own.

VOTE FOR OUR HIGHLY QUALIFIED NOMINEES AND SHAREHOLDER

PROPOSAL TO BETTER ALIGN WHITESTONE WITH SHAREHOLDER INTERESTS

PLEASE SIGN, DATE AND MAIL THE ENCLOSED

BLUE

PROXY CARD TODAY

Thank you for your support,

Peter McMillan

Chairman of

the Board and President

KBS Strategic Opportunity REIT, Inc.

If you have any questions or require any assistance with your vote, please contact:

509 Madison Avenue

Suite 1608

New York, NY 10022

Stockholders Call Toll Free: (800)

662-5200

E-mail:

KBS@morrowsodali.com

REMEMBER:

We urge you NOT to sign any White proxy card sent to you by Whitestone. If you have already done so, you have every right to change

your vote by signing, dating and returning the enclosed

BLUE

proxy card

TODAY

in the postage-paid envelope provided. If you hold your shares in Street-name, your custodian may also enable voting by telephone or by Internet—please

follow the simple instructions provided on your

BLUE

proxy card.

12

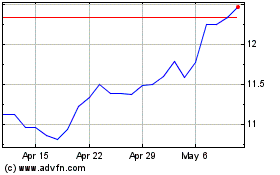

Whitestone REIT (NYSE:WSR)

Historical Stock Chart

From Mar 2024 to Apr 2024

Whitestone REIT (NYSE:WSR)

Historical Stock Chart

From Apr 2023 to Apr 2024