UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

SCHEDULE

14A

(Rule

14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

The Securities Exchange Act of 1934

(Amendment No. 1)

Filed by the Registrant ☐

Filed by a Party other than the Registrant ☒

Check the appropriate box:

|

|

☒

|

Preliminary Proxy Statement

|

|

|

☐

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

|

|

☐

|

Definitive Proxy Statement

|

|

|

☐

|

Definitive Additional Materials

|

|

|

☐

|

Soliciting Material Under Rule 14a-12

|

|

AQUA METALS, INC.

|

|

(Name of Registrant as Specified in Its Charter)

|

|

|

|

PHILOTIMO FUND, LP

KANEN WEALTH MANAGEMENT, LLC

DAVID L. KANEN

ANTHONY AMBROSE

ALAN B. HOWE

SUSHIL (“SAM”) KAPOOR

PADNOS

JEFFREY S. PADNOS

S. SHARIQ YOSUFZAI

|

|

(Name of Persons(s) Filing Proxy Statement, if Other Than the Registrant)

|

Payment of Filing Fee (Check the appropriate box):

|

|

☐

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

|

|

(1)

|

Title of each class of securities to which transaction applies:

|

|

|

(2)

|

Aggregate number of securities to which transaction applies:

|

|

|

(3)

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on

which the filing fee is calculated and state how it was determined):

|

|

|

(4)

|

Proposed maximum aggregate value of transaction:

|

|

|

☐

|

Fee paid previously with preliminary materials:

|

☐ Check

box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting

fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of

its filing.

|

|

(1)

|

Amount previously paid:

|

|

|

(2)

|

Form, Schedule or Registration Statement No.:

|

REVISED PRELIMINARY COPY SUBJECT

TO COMPLETION

DATED APRIL 20, 2018

KANEN WEALTH MANAGEMENT, LLC

_________________, 2018

Dear Fellow Aqua Metals Stockholders:

Kanen Wealth Management,

LLC, (together with its affiliates, “Kanen” or “we”) is one of the largest stockholders of Aqua Metals,

Inc. (“Aqua Metals,” or the “Company”) (NASDAQ: AQMS), with aggregate ownership of approximately 8.0% of

the Company’s outstanding shares. Our interests are aligned with the interests of all Aqua Metals stockholders, and, after

years of substantial underperformance by the Company, our goal is to help drive value creation for the benefit of all stockholders.

We believe opportunities

exist within the control of management and the Company’s Board of Directors (the “Board”) to substantially improve

value for stockholders, but such opportunities can only be achieved through a substantial change to the composition of the Board.

We are appreciative of the dialogue we have had with the Board, but unfortunately we remain skeptical that our thoughts have been

fully heard and that stockholder interests are being appropriately prioritized in the boardroom.

We are also incredibly

disappointed by the prolonged and severe underperformance at Aqua Metals. The Company's stock price has precipitously declined

by more than 85% in the past year alone. We believe that meaningful Board change is required to protect the best interests of all

unaffiliated stockholders. Until recently, forty percent of the Company’s Board was composed of non-independent, management

co-founders. While the Board’s recent plan to implement a transition of Dr. Clarke from his current position as President,

CEO and Chairman of the Board of Aqua Metals represents progress, it is disappointing that Aqua Metals’ Board acted only

in response to our nomination of director candidates. We have lost confidence in their ability to enhance or maximize stockholder

value. Our proxy contest will seek to refresh the Board with highly-qualified independent directors and provide just the type of

pressure and impetus this Company needs to try to get back on track. Aqua Metals must now prove commitment to stockholders by adding

qualified Board candidates with stockholder input to insure stockholder voices are truly heard in the boardroom.

The Board’s primary

responsibilities to stockholders are to set the Company’s strategy, select a management team, oversee management in operating

the Company’s business, and, in particular, hold management accountable for driving stockholder value. It is our strong belief

that the current Aqua Metals Board is failing stockholders in these tasks. As such, we believe that substantial change to the Board

is required in order to provide the investment management skills desperately needed for proper oversight, establish renewed accountability

to stockholders, introduce the objectivity necessary to make decisions without attachment to past practices and people, and, importantly,

eliminate the apparent priority of self-preservation over stockholders’ interests.

The upcoming

election

is

a critical opportunity to ensure that we, as stockholders, have the best

possible Board to drive the level of change necessary to improve performance and value at Aqua Metals.

We urge you to carefully

consider the information contained in the attached Proxy Statement and then support our efforts by signing, dating and returning

the enclosed

WHITE

proxy card today. The attached Proxy Statement and the enclosed

WHITE

proxy card are first being

mailed to stockholders on or about _____, 2018.

If you have already

voted a proxy card furnished by the Company’s management, you have every right to change your votes by signing, dating and

returning a later dated

WHITE

proxy card or by voting in person at the Annual Meeting.

If you have

any questions or require any assistance with your vote, please contact Alliance Advisors LLC, which is assisting us, at its address

and toll-free numbers listed below.

|

Thank you for your support.

|

|

|

|

/s/ David L. Kanen

|

|

|

|

David L. Kanen

|

|

Kanen Wealth Management, LLC

|

If you have any questions, require assistance

in voting your

WHITE

proxy card, or need additional copies of Kanen’s proxy materials, please contact Alliance Advisors

at the phone number or email address listed below.

Alliance Advisors LLC

200 Broadacres Drive, 3rd floor

Bloomfield, NJ 07003

Toll Free:

833.786.5514

Email

: info@allianceadvisorsllc.com

REVISED PRELIMINARY COPY SUBJECT

TO COMPLETION

DATED APRIL 20, 2018

2018 ANNUAL MEETING OF STOCKHOLDERS

OF

AQUA METALS, INC.

_________________________

PROXY STATEMENT

OF

KANEN WEALTH MANAGEMENT, LLC

_________________________

PLEASE SIGN, DATE AND MAIL THE ENCLOSED WHITE PROXY CARD TODAY

Philotimo Fund,

LP (“Philotimo”), Kanen Wealth Management, LLC (“KWM”), David L. Kanen, Anthony Ambrose, Alan B. Howe,

Sushil (“Sam”) Kapoor, PADNOS, Jeffrey S. Padnos, and S. Shariq Yosufzai (collectively, “Kanen” or

“we”) are significant stockholders of Aqua Metals, Inc., a Delaware corporation (“AQMS” or the “Company”),

who, together with the other participants in this solicitation, beneficially own approximately 9.1% of the outstanding shares

of common stock, par value $0.001 per share (the “Common Stock”), of the Company. We are seeking representation on

the Company’s Board of Directors (the “Board”) because our involvement at AQMS over the past year has made it

clear to us that the Board must be reconstituted to ensure that the interests of the stockholders, the true owners of the Company,

are appropriately represented in the boardroom. We have nominated highly qualified and capable candidates with relevant

backgrounds and who are committed to fully exploring all opportunities to unlock stockholder value. We are seeking your

support at the Company’s 2018 Annual Meeting of Stockholders scheduled to be held on June 5, 2018, at 10:00 a.m. local time,

at the Waterfront Hotel, 10 Washington Street, Oakland, California 94607 (including any adjournments or postponements thereof

and any meeting which may be called in lieu thereof, the “Annual Meeting”), for the following:

|

|

1.

|

To

elect Kanen’s director nominees, Anthony Ambrose, Alan B. Howe, Sushil (“Sam”)

Kapoor, Jeffrey S. Padnos, and S. Shariq Yosufzai, (each a “Nominee” and,

collectively, the “Nominees”) to hold office until the 2019 Annual Meeting

of Stockholders (the “2019 Annual Meeting”) and until their respective successors

have been duly elected and qualified;

|

|

|

2.

|

To ratify the appointment of Armanino LLP as the independent registered public accounting firm

of the Company for the fiscal year ending December 31, 2018; and

|

|

|

3.

|

To transact such other business as may properly come before the meeting or any adjournment or postponement

thereof.

|

This Proxy Statement

is soliciting proxies to elect only our Nominees. Accordingly, the enclosed

WHITE

proxy card may only be voted for our Nominees

and does not confer voting power with respect to any of the Company’s director nominees. See “Voting and Proxy Procedures”

on page [__] for additional information. You can only vote for the Company’s director nominees by signing and returning a

proxy card provided by the Company. Stockholders should refer to the Company’s proxy statement for the names, backgrounds,

qualifications, and other information concerning the Company’s nominees.

As of the date

hereof, the members of Kanen and the Nominees collectively beneficially own 2,610,878 shares of Common Stock, (the “Kanen

Group Shares”). We intend to vote all of the Kanen Group Shares that are eligible to vote

FOR

the election of the

Nominees and [

FOR

] the ratification of the appointment of Armanino LLP as the Company’s independent registered public

accounting firm.

The Company has

set the close of business on April 25, 2018 as the record date for determining stockholders entitled to notice of and to vote

at the Annual Meeting (the “Record Date”). The mailing address of the principal executive offices of the Company is

1010 Atlantic Avenue, Alameda, California 945101. Stockholders of record at the close of business on the Record Date will be entitled

to vote at the Annual Meeting. According to the Company, as of the Record Date, there were 28,694,210 shares of Common Stock outstanding.

We urge you to carefully

consider

the information contained in this Proxy Statement and then support our efforts

by signing, dating and returning the enclosed

WHITE

proxy card today. This Proxy Statement and the enclosed

WHITE

proxy card are first being mailed to stockholders on or about [____________], 2018.

THIS SOLICITATION IS BEING MADE BY KANEN

AND NOT ON BEHALF OF THE BOARD OF DIRECTORS OR MANAGEMENT OF THE COMPANY. WE ARE NOT AWARE OF ANY OTHER MATTERS TO BE BROUGHT BEFORE

THE ANNUAL MEETING OTHER THAN AS SET FORTH IN THIS PROXY STATEMENT. SHOULD OTHER MATTERS, WHICH KANEN IS NOT AWARE OF A REASONABLE

TIME BEFORE THIS SOLICITATION, BE BROUGHT BEFORE THE ANNUAL MEETING, THE PERSONS NAMED AS PROXIES IN THE ENCLOSED

WHITE

PROXY CARD WILL VOTE ON SUCH MATTERS IN OUR DISCRETION.

KANEN URGES YOU TO SIGN, DATE AND RETURN

THE

WHITE

PROXY CARD IN FAVOR OF THE ELECTION OF THE NOMINEES.

IF YOU HAVE ALREADY SENT A PROXY CARD

FURNISHED BY COMPANY MANAGEMENT OR THE BOARD, YOU MAY REVOKE THAT PROXY AND VOTE ON EACH OF THE PROPOSALS DESCRIBED IN THIS PROXY

STATEMENT BY SIGNING, DATING AND RETURNING THE ENCLOSED

WHITE

PROXY CARD. THE LATEST DATED PROXY IS THE ONLY ONE THAT COUNTS.

ANY PROXY MAY BE REVOKED AT ANY TIME PRIOR TO THE ANNUAL MEETING BY DELIVERING A WRITTEN NOTICE OF REVOCATION OR A LATER DATED

PROXY FOR THE ANNUAL MEETING OR BY VOTING IN PERSON AT THE ANNUAL MEETING.

Important Notice Regarding the

Availability of Proxy Materials for the Annual Meeting—This Proxy Statement and our WHITE proxy card are available at

http://viewproxy.com/AQMS/kanenwealthmanagement/2018

______________________________

IMPORTANT

Your vote is

important, no matter how few shares of Common Stock you own. Kanen urges you to sign, date, and return the enclosed WHITE proxy

card today to vote FOR the election of the Nominees and in accordance with Kanen’s recommendations on the other proposals

on the agenda for the Annual Meeting.

|

|

·

|

If

your shares of Common Stock are registered in your own name, please sign and date the enclosed

WHITE

proxy card and return

it to Kanen, c/o Alliance Advisors LLC (“Alliance Advisors”) in the enclosed postage-paid envelope today.

|

|

|

·

|

If your shares of Common Stock are held in a brokerage account or bank, you are considered the

beneficial owner of the shares of Common Stock, and these proxy materials, together with a

WHITE

voting form, are being

forwarded to you by your broker or bank. As a beneficial owner, you must instruct your broker, trustee or other representative

how to vote. Your broker cannot vote your shares of Common Stock on your behalf without your instructions.

|

|

|

·

|

Depending upon your broker or custodian, you may be able to vote either by toll-free telephone

or by the Internet. Please refer to the enclosed voting form for instructions on how to vote electronically. You may also vote

by signing, dating and returning the enclosed voting form.

|

Since only your

latest dated proxy card will count, we urge you not to return any proxy card you receive from the Company. Even if you return the

management proxy card marked “withhold” as a protest against the incumbent directors, it will revoke any proxy card

you may have previously sent to us. Remember, you can vote for our five (5) Nominees only on our

WHITE

proxy card. So please

make certain that the latest dated proxy card you return is the

WHITE

proxy card.

If you have any questions, require assistance

in voting your

WHITE

proxy card, or need additional copies of Kanen’s proxy materials, please contact Alliance Advisors

at the phone number or email address listed below.

Alliance Advisors LLC

200 Broadacres Drive, 3rd floor

Bloomfield, NJ 07003

Toll Free:

833.786.5514

Email

: info@allianceadvisorsllc.com

Background to the Solicitation

The following is a chronology of material events leading

up to this proxy solicitation:

|

|

·

|

On

February 22, 2018, Kanen filed an initial statement on Schedule 13D with the Securities and Exchange Commission (the “SEC”)

disclosing its and its affiliates’ beneficial ownership of approximately 6.5% of the Company’s outstanding shares

stating that it intends to consider plans and/or make proposals with respect to, among other things, the Company’s operations,

Board composition, strategy and plans, and to communicate with the Company’s management and Board about a broad range of

operational and strategic matters.

|

|

|

·

|

On

March 6, 2018, a representative of Kanen, David L. Kanen, expressed his intent to work constructively and amicably with management

and the Board. Mr. Kanen scheduled a telephone call with Stephen Clarke, the Company’s CEO, and Thomas Murphy, the Company’s

CFO, to discuss a transition for Dr. Clarke and a search for a new CEO. Mr. Kanen mentioned Stephen Cotton, the Company’s

former CCO, as a potential successor to Dr. Clarke, and Dr. Clarke abruptly hung up on Mr. Kanen.

|

|

|

·

|

On March 7, 2018, Mr. Kanen called and left a voicemail for Vincent DiVito, an independent board

member

of the Company. In his message, Mr. Kanen requested an opportunity to speak with

Mr. DiVito.

|

|

|

·

|

On March 8, 2018, Mr. Kanen discussed with Mr. DiVito the need for a new CEO and

expressed

concern regarding the excessive director compensation. Mr. Kanen reiterated that he would like to work amicably to reconstitute

the board.

|

|

|

·

|

On

March 12, 2018, Mr. Kanen received an email from Dr. Clarke, which specified that Dr. Clarke and Mr. Murphy would be Mr. Kanen’s

“point of contact” moving forward.

|

|

|

·

|

On

March 16, 2018, Mr. Kanen emailed Dr. Clarke and Mr. Murphy stating that he would like to continue their conversations. Dr. Clarke

responded via email, and a brief conversation occurred with Mr. Kanen, Mr. Murphy, Greg Falesnik, the Company’s IR representative,

and Jason C. Smith, an equity analyst for KWM, where the parties discussed the new CEO search and Kanen gaining representation

on the Board.

|

|

|

·

|

On

March 20, 2018, Mr. Kanen received an email from Mr. DiVito and Mark Slade, a board member of the Company, stating that while

the Board agreed to Dr. Clarke and Mr. Murphy serving as Mr. Kanen’s point of contacts for further negotiations, upon further

reflection the Board decided Mr. DiVito and Mr. Slade would now be a joint point of communication for Mr. Kanen.

To

the representatives of Kanen, this again demonstrated that the Board had procrastinated in diminishing the authority of Dr. Clarke

and searching for a new CEO

.

|

|

|

·

|

On March 22, 2018, Mr. Kanen had a telephone call with Mr. DiVito and Mr. Slade, reiterating the

need for a new CEO and a reconstitution of the Board. Mr. Kanen expressed his concern that the Board should be moving on the matter

with a sense of urgency in light of the performance of the Company.

|

|

|

·

|

On March

23

, 2018, Kanen delivered a letter (the “Nomination

Letter”) to the Company nominating four (4) highly qualified director candidates, including Mr. Kanen, for election to the

Board at the Annual Meeting.

|

|

|

·

|

On

March

23, 2018, the Company’s counsel privately

confirmed receipt of the Nomination Letter.

|

|

|

·

|

On

March 26, 2018, Kanen issued a press release announcing that it had nominated four highly qualified director candidates for election

to the Board at the Annual Meeting in opposition to the Board’s director nominees.

|

|

|

·

|

On March 27, 2018, the Company issued a press release announcing that the Board has approved and is implementing

a plan to transition Dr. Clarke from his current position as President, CEO and Chairman of the Board.

Given

the information Mr. Kanen received on March 12, 2018, the announcement perplexed Kanen because just a week and a half prior, Dr.

Clarke was the “point of contact” in negotiations. To Kanen, it seemed that the Company’s management was contradicting

themselves by saying a “transition was in the works from late 2017.” Furthermore, it begs the question as to whether

or not the incumbent Board would have affected the needed change absent the pressure from Kanen.

|

|

|

·

|

On March 27, 2018, Dr. Clarke, informed the Board that he does not intend to stand for re-election

at the Annual Meeting. On March 28, 2018, Mr. Selwyn Mould, the Company’s Chief Operating Officer and a Director, informed

the Board that he does not intend to stand for re-election at the Annual Meeting. Based upon the recommendation of the Nominating

and Corporate Governance Committee, the Board has nominated Thomas Murphy, the Company’s Chief Financial Officer, and Eric

A. Prouty for election to the Board at the Annual Meeting to replace Dr. Clarke and Mr. Mould as directors of the Company.

|

|

|

·

|

On

March 28, 2018, Mr. Kanen requested a brief meeting with Mr. DiVito and Mr. Slade where they discussed Dr. Clarke’s transition

and the urgency of appointing an interim CEO. Mr. Kanen also expressed his belief that Mr. Cotton would be highly capable of succeeding

Dr. Clarke and that Mr. Cotton would institute quick measures that will better align the Company’s interest with stockholder

values.

|

|

|

·

|

On April 3, 2018, Kanen delivered a supplemental notice to the Company notifying the Company of

its additional nomination of former Chevron executive and proven business leader S. Shariq Yosufza for election to the Board at

the Annual Meeting.

|

|

|

·

|

On April 10, 2018, Kanen initiated a phone call with Mr. DiVito and Mr. Slade where Mr. Kanen expressed his

view towards an amicable resolution. Mr. Kanen indicated a need for leadership and problem solving and reiterated that Mr. Cotton

should be appointed interim CEO. Mr. Kanen expressed flexibility in the reconstitution of the Board to retain some of the incumbents

to maintain continuity and shared his view that if the Board and Kanen are unable to reach a resolution and avoid a proxy contest

that it would reflect poorly on the incumbents.

|

|

|

·

|

On April 11,

2018, Kanen filed its preliminary proxy in connection with the Annual Meeting.

|

|

|

·

|

On

April 12, 2018, the Company announced the appointment Frank Knuettel II as Chief Financial

Officer. Thomas Murphy, who was named interim CFO in March 2018, will continue as a consultant

to the Company and the Board will continue to seek his nomination at the Annual Meeting,

despite no longer serving as an officer of the Company.

|

|

|

·

|

On April 13,

2018, Kanen issued a press release questioning the decision by the Board to appoint Mr.

Knuettel as the CFO.

|

|

|

·

|

On April 17,

2018, the Company filed its definitive proxy statement in connection with the Annual

Meeting.

|

|

|

·

|

On April 18,

2018, Kanen issued a statement urging the Company’s stockholders to wait until

they receive Kanen’s proxy materials before voting.

|

|

|

·

|

On April 20,

2018, Mr. Kanen removed himself as a Nominee and Sushil (“Sam”) Kapoor

will be his replacement. In addition, Mr. Kapoor entered into a Joinder Agreement to

the Group Agreement.

|

|

|

·

|

On April 20,

2018, Kanen filed amendment no. 1 to its preliminary proxy statement in connection with

the Annual Meeting.

|

REASONS FOR THE SOLICITATION

WE BELIEVE THE TIME FOR CHANGE

IS

NOW

We are concerned

that the Board, as currently composed, will not take the necessary steps to reverse Aqua Metals’ underperformance and maximize

its opportunities for value creation. Notwithstanding recent changes at Aqua Metals, we believe further change is needed on the

Board to ensure that the interests of all stockholders are appropriately represented in the boardroom. Therefore, we are soliciting

your support at the Annual Meeting to elect our Nominees, who we believe would bring significant and relevant experience to the

Board along with a commitment to work with their fellow Board members, if elected, to realize Aqua Metals’ true potential.

We are Concerned with the

Destruction of Stockholder Value

We believe stockholders

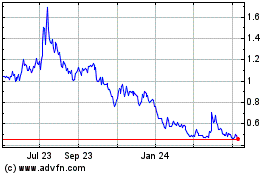

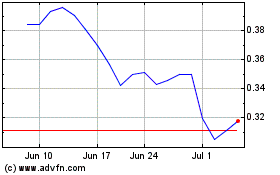

should be seriously concerned with the Company’s poor stock price performance. The Company’s stock price has precipitously

declined by more than 85% in the past year alone. It is evident to us that the significant destruction of stockholder value that

has persisted over the near and long term under the leadership of the incumbent Board warrants an overhaul in the boardroom. (see

figure 1)

|

Figure 1

|

Source: Aqua Metals website and Bloomberg

|

We are Concerned

by Aqua Metals’ Unusual and Excessive Compensation Practices

We

believe that the Board’s failure to provide effective oversight on behalf of stockholders is reflected in excessive and

unconventional compensation arrangements for insiders. Compensation for each of the two (2) incumbent directors, Vincent DiVito

and Mark Slade, has increased

100%

despite the Company’s continued under-performance. We believe that the Board is

earning too much for a tiny, unprofitable company. The Company’s independent Board members are currently earning approximately

$150,000 (including grants of options). In our experience, board members at public companies this size would typically earn less

than $75,000 and we believe between $25,000 and $40,000 would be more appropriate for director compensation at Aqua Metals.

1

As such, we believe that substantial change is required and warranted on the Board in order to provide renewed accountability

to stockholders.

1

The Company currently has a market capitalization of approximately $72 million. By way of two examples, Rocky Mountain Chocolate

Factory, Inc., a company with a market capitalization of approximately $71 million, and Tandy Leather Factory, Inc., a company

with a market capitalization of approximately $71 million, directors earn less than the Company’s directors. 80% of Rocky

Mountain Chocolate Factory’s directors made less than $40,000 and the highest paid director earned $55,630; and according

to the 2017 definitive proxy statement filed by Tandy Leather Factory, 80% of its directors made less than $40,000 and the highest

paid director earned $50,500.

We are Concerned by Aqua

Metals’ Operational Failures

Highlighted

below is a list of the Company’s guidance from various Company presentations and earnings calls:

Pre-IPO Presentation dated July 2015

|

|

·

|

Management

projecting 80 tonnes per day (“T/day”), 40T/day ultra pure lead and 40T/day

of grid lead. (see figure 2)

|

|

|

·

|

Modules designed to refine 2.5T/day

|

|

|

·

|

AquaRefineries are profitable at 40T/day output

|

|

|

·

|

Roll-out

plan - 5-10 regional AquaRefineries Facilities.

|

|

|

·

|

Profitability

reached in year 2 (see figure 3).

|

|

Figure 2

|

Source: Aqua Metals website and Bloomberg

|

|

Figure 3

|

Source: Aqua Metals website and Bloomberg

|

March 7, 2016 Press Release

|

|

·

|

“Upon

completion of our first AquaRefinery in the second quarter of 2016, we will begin recycling

lead-acid batteries and plan to increase production to 80 metric tons of lead per day

by the end of 2016,” Dr. Stephen Clarke, Chairman and CEO of Aqua Metals, continued.

|

August 10, 2016 Press Release

|

|

·

|

“Our

key focus has remained on commercializing the world’s first AquaRefinery, which

is now largely complete,” said Dr. Clarke.

|

|

|

·

|

2016

Milestone Update – Four (4) AquaRefining modules shipped and in place and twelve

(12) currently in production and lead production projected to scale quickly during the

Fourth (4

th

) Quarter, reaching 80 metric tons per day by the of 2016.

|

November 7, 2016 Press Release

|

|

·

|

“While

working to bring the AquaRefinery online, we incorporated several process and other improvements,

and consequently, we now expect to ramp to a capacity of 120 T/day in early 2017, which

will provide greater revenue and earnings potential.”

|

|

|

·

|

Upcoming Milestones - Initial sales of lead in the 4th Quarter of 2016 and providing AquaRefining

technology and equipment on a serviced licensing model, which is expected to commence in 2017

|

|

|

·

|

Aqua Metals will begin selling lead in the fourth quarter of 2016. Due to process and other improvements,

the Company expects to reach initial capacity of 120 T/day in early 2017, representing a 50% increase to the previously announced

capacity of 80 T/day of lead output.

|

Q4 2016 Earnings Presentation and Call

|

|

·

|

Went from 80T/day to now being able to do 120T-160T/day (see figure 4).

|

|

|

·

|

The

Company plans on five (5) facilities that can do 160T/day for a total capacity of 800T/day.

|

|

|

·

|

Dr.

Clarke stated, “One of the headlines today is that the first-ever AquaRefinery

located at the Tahoe-Reno Industrial Center has moved from commissioning to operational.

That means that we are breaking batteries and making lead from the batteries that we've

broken both from – both metallic lead and AquaRefined lead. It's continuing to

ramp up. We're not at full scale yet, and there's more work to be done.”

|

|

|

·

|

“So,

AquaRefinery, number one at Tahoe-Reno Industrial Complex is starting out with a plant

capacity of 120 tonnes of lead per day. And we're expecting to expand that to 160 tonnes

a day.”

|

|

|

·

|

“

We’ve

mentioned in the last earnings call that we have expanded that potential capacity from

80 tonnes to 120 tonnes a

day. And we're now looking at expanding from 120 tonnes

to 160 tonnes a day. We're producing validated 99.99% pure lead.”

|

|

Figure 4

|

Source: Aqua Metals website and Bloomberg

|

Roth Conference March

2017 Presentation

|

|

·

|

“Successfully commissioned and in the process of scaling up production of AquaRefined lead

at Aquarefinery 1 in McCarran, NV at the Tahoe Reno Industrial Center (TRIC), capacity to produce >120T/day of lead which we

plan to expand to 160T/day”

|

|

|

·

|

Evaluating

non-dilutive debt financing for four to five (4 –5) facilities totaling ~800T/day.

|

Q1 2017 Earnings

Presentation and Call

|

|

·

|

Ramping production to >120mT/day of lead by the end of 2017 (see figure 5)

|

|

Figure 5

|

Source: Aqua Metals website and Bloomberg

|

|

|

·

|

Moving away from stand-alone facilities and evaluating “clusters” centered on logistics

nodes

|

|

|

·

|

Working

with Johnson Controls International PLC (“JCI”) on retrofitting an existing

facility.

|

|

|

·

|

“And what we'll be talking about is that, we're making a little

bit of a departure, and we're moving away from the

opportunistic build out a small standalone facilities that we started

out with, if you recall, those here and at the beginning of our IPO, we were talking and -- talking about and contemplating the

build out of 10 or more 40 tonne to 80 tonne a day facilities located in various parts around the US.”

|

|

|

·

|

“I'm going to start off with an update

on our AquaRefinery

1, where we are, lessons learned, what it all means. Then I'm going to talk about the planning for AquaRefineries 2 through 5 and

our licensing rollout.” (see figure 6)

|

|

|

·

|

“So,

if you look at AquaRefinery number 1, we're planning on having a production capacity of 120 metric tonnes a day by the end of

the year and then expanding it to a 160 metrics tonnes a day in 2018. And that essentially means that we will have 60 in AquaRefining

Modules on-site and operational at a 120 tonnes a day, and 32 modules on-site and operational, a 160 tonnes a day and so the mathematicians

among you, that does not help, and I'll show you why in a couple of slides time.”

|

|

Figure 6

|

Source: Aqua Metals website and Bloomberg

|

|

|

·

|

“We started production in Q1, and we have started actually

moving out into sales in Q2, that

few weeks later then we wanted we'd set a target to actually ship some of that product

in Q1 but for a number of reasons we weren't able to do that shipped and we're continuing to produce and are continuing to ship.”

(see figure 7)

|

|

Figure 7

|

Source: Aqua Metals website and Bloomberg

|

|

|

·

|

“So that process is now operating. We are adding capacity to

it and streamlining operations. AquaRefining itself, module

1 is operating, modules 2 to 4 are on-site and in startup mode

and modules 5 to 16 are being updated to latest specifications and will be installed over the coming weeks and months. Ingot production,

where we take metallic lead, melt it, pour it into ingots and ship as ingots is currently being commissioned. So our sales now

don't include ingots, they do include metallic lead that hasn't been through the ingoting stage.”

|

|

|

·

|

“And last but not least, again, same theme here, we were struggling

to commission the ingot casting process, because,

again, of intermittent supply of processed lead that – we've now

got all of that and the ingot commissioning is underway.”

|

|

|

·

|

Explosive growth in 2018 and explosive build outs

|

June 2017 Corporate Presentation

|

|

·

|

The

world’s first AquaRefinery is now in commercial production

|

|

|

·

|

Ramping production to >120mT/day of lead by the end of 2017

|

|

|

·

|

On track

for 120mT/day by Dec 2017

|

Q3 2017 Earnings Presentation and Call

|

|

·

|

“

Limited production of AquaRefined lead is underway and expected

to continue with initial quantities produced in 2017 and ramp-up continue into 2018.”

|

|

|

·

|

Capacity now 80T/day (see figure 8)

|

|

|

·

|

“The fifth and final stage of production involves processing AquaRefined lead and the metallic

lead recovered from batteries through an ingot production line. As we've noted previously, we have successfully produced our first

ingots.”

|

|

Figure 8

|

Source: Aqua Metals website and Bloomberg

|

|

|

·

|

Capacity at 40T/day (see figure 9)

|

|

|

·

|

Revenue

in Fourth (4

th

) Quarter 2017 expected to come from metallic lead, lead compounds,

recovered plastic, and shipping lead ingots.

|

|

Figure 9

|

Source: Aqua Metals website and Bloomberg

|

December 2017 Corporate Presentation

|

|

·

|

On track to

reach full-scale production in 2018

|

|

|

·

|

Encountered

“sticky” lead issue.

|

|

|

·

|

Increases AquaRefined

lead production from 40mT/day to 80mT/day

|

Q4 2017 Earnings Presentation and Call

|

|

·

|

Still

ramping production. (see figure 10)

|

|

|

·

|

Bring

four (4) modules online.

|

|

|

·

|

The

Company plans to bring 16 retro-fitted modules on-line in groups of four (4). The first

group is expected to begin initial operation by the end of March 2018 and the plan is

to ramp up AquaRefining production during Q2.

|

|

Figure 10

|

Source: Aqua Metals website and Bloomberg

|

To date management has made either insignificant or no progress

on the aforementioned!

We Are Concerned about

the Company’s Poor Corporate Governance

We are also

concerned with the poor corporate governance that severely limits the ability of stockholders to seek effective change at Aqua

Metals. Stockholders are prohibited from calling special meetings and cannot act by written consent, which effectively prevents

stockholders from seeking Board change between annual meetings. Furthermore, the Company has a plurality voting standard for directors

in uncontested elections. This is not only unfair but undemocratic as it prevents meaningful stockholder suffrage and turns the

director elections into a ceremonial act.

While Aqua Metals

has recently instituted a plan to transition Dr. Clarke from his current position as President, CEO and Chairman of the Board,

the Company had not previously separated the roles of Chairman and CEO, which we believe has contributed to the Board’s

apparent ineffective oversight of the Company. According to Institutional Shareholder Services Inc. (“ISS”), a leading

independent proxy voting advisory firm, separating the roles of Chairman and CEO is broadly considered governance best practice

as it promotes oversight of risk, curbs conflicts of interests and more effectively manages the relationship between the Board

and management.

Importantly,

ISS appears to share our concerns with the Company’s governance profile. In its 2018 report, ISS assigned Aqua Metals a

Governance QuickScore of “9” in the “Board Structure” category, indicating a high level of concern. In

its report, ISS notes that not only has the Company not disclosed sufficient information on the classification of the Chairman

of the Nomination Committee, but also Aqua Metals has also not disclosed sufficient information on whether there is a lead director.

Additionally, until recently, 60% of the Board was considered independent.

If elected,

we believe our Nominees will work hard to improve corporate governance at Aqua Metals by seeking to eliminate these anti-stockholder

provisions and implement more stockholder friendly provisions in line with corporate governance best practices. We believe that

the Board should not be able to utilize the Company’s corporate machinery to insulate itself and prevent change that would

benefit all stockholders.

PROPOSAL NO. 1

ELECTION OF DIRECTORS

The Board is

currently composed of five (5) directors, each with terms expiring at the Annual Meeting. We are seeking your support at

the Annual Meeting to elect our five (5) Nominees in opposition to the Company’s director nominees. Your vote to elect the

Nominees will have the legal effect of replacing five (5) incumbent directors with the Nominees. If at least three (3) of the

Nominees are elected, such Nominees will represent a majority of the members of the Board. In the event that our director Nominees

comprise less than a majority of the Board following the Annual Meeting, there can be no assurance that any actions or changes

proposed by our Nominees will be adopted or supported by the full Board.

THE NOMINEES

The following information

sets forth the name, age, business address, present principal occupation, and employment and material occupations, positions, offices,

or employments for the past five years of each of the Nominees. The nominations were made in a timely manner and in compliance

with the applicable provisions of the Company’s governing instruments. The specific experience, qualifications, attributes,

and skills that led us to conclude that the Nominees should serve as directors of the Company are set forth below. This information

has been furnished to us by the Nominees. All of the Nominees are citizens of the United States.

Anthony Ambrose

,

age 56, joined Data I/O Corporation (NASDAQ: DAIO) on October 2012 and has served as President and Chief Executive Officer. Prior

to Data I/O Corporation, Mr. Ambrose was Owner and Principal of Cedar Mill Partners, LLC, a strategy consulting firm from 2011

to 2012. From 2007 to 2011, he was Vice President and General Manager at RadiSys Corporation (NASDAQ: RSYS), a leading provider

of embedded wireless infrastructure solutions, where he led three product divisions and worldwide engineering. At RadiSys Corporation,

he established the telecom platform business and grew it to over $125M in annual revenues. Until 2007, he was general manager

and held several other progressively responsible positions at Intel Corporation (NASDAQ: INTC), a technology company, where he

led development and marketing of standards based telecommunications platforms, and grew the industry standard server business to

over $1B in revenues. Mr. Ambrose was appointed a director of Data I/O Corporation effective October 2012. He is a member

of the EvergreenHealth Foundation Board of Trustees. Mr. Ambrose has a B.S. in Chemical Engineering from Princeton University.

Mr. Ambrose’s extensive operating experience coupled with his significant executive experience in strategy development, business

management, marketing, engineering, and new product development would make him a well-qualified addition to the Board.

Alan B. Howe

,

age 57, has served as co-founder and managing partner of Broadband Initiatives, LLC, a boutique corporate advisory and consulting

firm, since 2001, and provides various strategic and operational consulting services to multiple corporate clients in that role.

He served as Vice President of Strategic and Wireless Business Development for Covad Communications, Inc., a national broadband

telecommunications company from May 2005 to October 2008. He served as Chief Financial Officer and Vice President of Corporate

Development for Teletrac, Inc., a software as a service company and subsidiary of Fortive Corporation (NYSE: FTV) from April 1995

to April 2001. Previously, he held various executive management positions for Sprint Corporation (NYSE: S), a telecommunications

company (from December 1991 to April 1995), and Manufacturers Hanover Trust Company (n/k/a JPMorgan Chase & Co.) (NYSE: JPM),

a banking and financial services company (from June 1987 to November 1991). He has served on the board of directors of Magicjack

Vocaltec Ltd. (NASDAQ: CALL), an internet services provider, since April 2017; Chairman of Data I/O Corporation (NASDAQ: DAIO),

a manufacturer of programming and automated device handling systems for programmable circuits, since 2013; Vice Chairman of the

board of directors of Determine, Inc. (NASDAQ: DTRM), a software as a service, source-to-pay and enterprise contract lifecycle

management (ECLM) solutions provider, since 2009; a board member of Widepoint (NYSE MKT: WYY), a provider of telecommunications

solutions, since 2017, and a board member of CafePress (NASDAQ: PRSS), a provider of online customizable products, since 2018.

He has also served on a number of private and public boards including in the past five years former reporting companies Qualstar

Corporation (NASDAQ: QBAK), a manufacturer of magnetic tape data storage products, from June 2013 to June 2014, and Urban Communications

(TSE.V: UBN), a fiber telecommunications company, from June 2016 to November 2017. He has a M.B.A. in Finance from Indiana University

and a B.S. – Business Administration and Marketing from University of Illinois. Mr. Howe’s experience in providing

board and C-level leadership working with small-cap and micro-cap companies (both public and private) particularly in turnaround

situations would make him a well-qualified addition to the Board.

Sushil (“Sam”)

Kapoor

, age 71, was the Chief Global Operations Officer of Equinix, Inc. (NASDAQ: EQIX), a multinational company that specializes

in internet connection and related services, since January 2008 until March 2018. As the Chief Operations executive at Equinix,

Inc. since early 2001, Mr. Kapoor played a major role in steering the company from near bankruptcy to its current industry leading

position During this period Equinix, Inc. grew from 7 data centers in 6 markets in one country with annual revenue of less

than $20 million to more than 180 data centers in 44 metros across 25 major countries spread over 4 continents with annual revenues

exceeding $5 Billion. During the same period, the stock price grew from a split adjusted low of around $5 to its current price

of more than $400. Mr. Kapoor served as Vice President of Operations of Equinix, Inc., from March 2001 to December 2006 and also

served as its Senior Vice President of IBX Operations from December 2006 to January 2008. Prior to joining Equinix, Mr. Kapoor

served as Vice President of hosting operations at UUNET Technologies, Inc., the Internet division of MCI (formerly known as WorldCom)

from November 1999 to February 2001. He was responsible for the build-out and day-to-day operations of six hosting centers. From

May 1995 to November 1999, he served as Vice President, Global Network Technology for Compuserve Network Services, an Internet

access provider. Mr. Kapoor served as Senior Director of Telecommunications for over 10 years at Lexis-Nexis in Miamisburg. Mr.

Kapoor holds an M.B.A. (Operations Research) from Miami University of Ohio and an M.S. in Electrical Engineering from the University

of Cincinnati. Mr. Kapoor’s executive experience at a public company including his operational expertise would make him

a well-qualified addition to the Board.

Jeffrey S. Padnos

,

age 69, has served as the Chairman of PADNOS, a provider of scrap processing and management services, since 2016. He joined the

family-owned scrap processing and recycling business in 1979 and was promoted to President in 1988. Prior to his service at PADNOS,

Mr. Padnos worked as a consultant for McKinsey and Company, a management consulting firm, from 1974 to 1978 where he spent four

years with the international management consulting company in the Chicago and New York offices, working on a broad variety of engagements

for leading US clients of the firm. He also worked at the New York City Environmental Protection Administration, from 1970 to 1972,

where he worked with others to develop practical policies and legislation very early in the environmental movement and implemented

the first trial runs in what has become the nation’s largest municipally-run recycling program. He has served

on the boards of numerous organizations, including Wausau Insurance, Grand Rapids Symphony, the World Affairs Council, the Alliance

for Health, and the Holland Chamber of Commerce. Mr. Padnos received his M.B.A. from Harvard Business School and his A.B. from

Harvard College. Mr. Padnos’ extensive experience in operations, including his experience as President of PADNOS, where he

helped build the company from one location in Holland, Michigan, to 20 locations in Michigan and northern Indiana, with over 600

employees and sales which have exceeded $500M, would make him a valuable addition to the Board.

S. Shariq Yosufzai,

age 65, was most recently the Vice President, Global Diversity for the Chevron Corporation (“Chevron”)(NYSE: CVX),

a multinational energy corporation, from 2013 to March 2018. He held a number of positions at Chevron and its various affiliates,

including Vice President (from 2010 to 2013); President of Chevron Global Marketing, a business unit within Chevron (from 2004

to 2010); Co-President of Chevron Products Company, North America, Chevron’s North America Refining & Marketing operations

(from 2003 to 2004); and President of Chevron Texaco Global Lubricants (from 2001 to 2003). Prior to that, he worked at Caltex

Corporation, a joint venture between Chevron and Texaco, Inc., as the Corporate Vice President, Caltex Corporation & President,

Caltex Lubricants & New Business Development (from 2000 to 2001) and held a number of other senior level management positions

at Caltex Corporation from 1998 to 2000. From 1991 to 1998, he worked at Texaco Inc., a subsidiary of Chevron, and served as the

President of Texaco Lubricants Company from 1994 to 1998. As part of a joint enterprise between Texaco, Inc. and Saudi Aramco,

Mr. Yosufzai was employed at Star Enterprise from 1988 to 1991 where he held a number of positions and prior to that began his

career at Texaco, Inc., from 1975 to 1983. His past board memberships include Chairman of the Board of Directors of Caltex Lubricants

Lanka Ltd.; Member of the Board of Directors of Caltex Australia Limited; and Member of the Management Committee of Star Enterprise.

Mr. Yosufzai currently serves as Chair of the AIChE Foundation (The American Institute of Chemical Engineers) since November 2017,

Chair of the Board of Directors of the California Chamber of Commerce and is an Executive Committee Member of the San Francisco

Opera’s Board of Directors. He previously served as Chair of the Board of the Association of Former Students of Texas A&M.

Mr. Yosufzai also serves as Executive Sponsor of Chevron’s University Partnership Program for the University of California,

Berkeley, and Texas A&M University, and on the Advisory Board of Texas A&M’s Dwight Look College of Engineering and

on the Chancellor’s Century Council of the Texas A&M University System. Named a Distinguished Graduate of the Chemical

Engineering Department of Texas A&M University in 1998, in 1999 he became the first person to be honored by the school as both

an Outstanding International Alumnus and a Distinguished Alumnus. In 2011, he served as Chair of the Board of the California Chamber

of Commerce and was named an Outstanding Alumnus of the Dwight Look College of Engineering at Texas A&M. He attended Extensive

Education schools at both Columbia University, Graduate School of Business at Arden House and McIntire School of Commerce, University

of Virginia and received his B.S. in Chemical Engineering from Texas A&M University. Mr. Yosufzai’s extensive managerial,

operational and financial experience makes him a well-qualified addition to the Board.

The principal business

address of Mr. Ambrose is c/o Data I/O Corporation, 6645 185th Ave. N.E., Suite 100, Redmond, Washington 98052. The principal

business address of Mr. Howe is 10755 Scripps Poway Pkwy, #302, San Diego, California 92131. The principal business address of

Mr. Kapoor is 5850 Coral Ridge Drive, Suite 309, Coral Springs, Florida 33076. The principal business address of each of PADNOS

and Mr. Padnos is 185 W. 8th Street, Holland, Michigan 49423. The principal business address of Mr. Yosufzai is 171 Alpine Terrace,

Oakland, California 94618.

As of the date

hereof, Messrs. Ambrose, Howe and Yosufzai do not directly or beneficially own any securities of the Company and have not entered

into any transactions in securities of the Company during the past two (2) years.

As of the date

hereof, Mr. Kapoor beneficially owns 4,000 shares of Common Stock of the Company. For information regarding transactions in securities

of the Company during the past two (2) years by Mr. Kapoor, see

Schedule I

.

As of the date

hereof, Mr. Padnos beneficially owns 323,200 shares of Common Stock of the Company. Mr. Padnos directly beneficially owns 118,000

shares of Common Stock of the Company. PADNOS beneficially owns 205,200 shares of Common Stock of the Company. Mr. Padnos, as

the Chairman of PADNOS, may be deemed the beneficial owner of the 205,200 shares of Common Stock of the Company owned by PADNOS.

For information regarding transactions in securities of the Company during the past two (2) years by Mr. Padnos and PADNOS, see

Schedule I

.

On April 3,

2018, Philotimo, KWM, PADNOS, and Messrs. Kanen, Ambrose, Howe, Padnos, and Yosufzai (collectively the “Group”) entered

into a Joint Filing and Solicitation Agreement in which, among other things, (a) the Group agreed to the joint filing on behalf

of each of them of statements on Schedule 13D, and any amendments thereto, with respect to the securities of the Company, and

(b) the Group agreed to solicit proxies or written consents for the election of the persons nominated by the Group to the Board

at the Annual Meeting (the “Solicitation”). On April 20, 2018, Mr. Kapoor entered into a Joinder Agreement to the

Group Agreement, pursuant to which he agreed to be bound by the terms and conditions set forth therein, including the obligations

of a member of the group and the joint filing on behalf of each of them of statements on Schedule 13D, and any amendments thereto,

with respect to the securities of the Company.

Other than as stated

herein, there are no arrangements or understandings between members of Kanen and any of the Nominees or any other person or persons

pursuant to which the nomination of the Nominees described herein is to be made, other than the consent by each of the Nominees

to be named in this Proxy Statement and to serve as a director of the Company if elected as such at the Annual Meeting. None of

the Nominees is a party adverse to the Company or any of its subsidiaries or has a material interest adverse to the Company or

any of its subsidiaries in any material pending legal proceedings.

Kanen believes that each

Nominee presently is, and if elected as a director of the Company, each of the Nominees would be, an “independent director”

within the meaning of (i) applicable NASDAQ listing standards applicable to board composition, including Rule 5605(a)(2), and (ii)

Section 301 of the Sarbanes-Oxley Act of 2002. No Nominee is a member of the Company’s Board or any committee thereof.

Based on a review

of publicly available information, if Kanen is successful in electing at least three (3) of the Nominees to the Board, no change

of control provisions appear to be triggered under the Company’s material contracts and agreements other than pursuant to

the Credit Agreement, and the Form of Indemnification Agreement.

We do not expect

that any of the Nominees will be unable to stand for election, but, in the event any Nominee is unable to serve or for good cause

will not serve, the shares of Common Stock represented by the enclosed

WHITE

proxy card will be voted for substitute nominee(s),

to the extent this is not prohibited under the Company’s Amended and Restated Bylaws, as amended (the “Bylaws”)

and applicable law. In addition, we reserve the right to nominate substitute person(s) if the Company makes or announces any changes

to the Bylaws or takes or announces any other action that has, or if consummated would have, the effect of disqualifying any Nominee,

to the extent this is not prohibited under the Bylaws and applicable law. In any such case, shares of Common Stock represented

by the enclosed

WHITE

proxy card will be voted for such substitute nominee(s). We reserve the right to nominate additional

person(s), to the extent this is not prohibited under the Bylaws and applicable law, if the Company increases the size of the Board

above its existing size or increases the number of directors whose terms expire at the Annual Meeting. Additional nominations made

pursuant to the preceding sentence are without prejudice to the position of Kanen that any attempt to increase the size of the

current Board or to reconstitute or reconfigure the classes on which the current directors serve constitutes an unlawful manipulation

of the Company’s corporate machinery.

WE URGE YOU TO VOTE “FOR”

THE ELECTION OF THE NOMINEES ON THE ENCLOSED WHITE PROXY CARD.

PROPOSAL NO. 2

RATIFICATION OF APPOINTMENT OF THE INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

As discussed in

further detail in the Company’s proxy statement, the Audit Committee has appointed Armanino LLP (“Armanino”)

as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2018 and the Board

has directed that management submit the appointment of Armanino as the Company’s independent registered public accounting

firm for ratification by the stockholders at the Annual Meeting.

Stockholder ratification

of the selection of Armanino as the Company’s independent registered public accountants is not required by the Company’s

Bylaws or otherwise. However, the Board is submitting the appointment of Armanino to the stockholders for ratification as a matter

of corporate practice. If the stockholders fail to ratify the appointment, the Audit Committee will reconsider whether or not to

retain Armanino. Even if the selection is ratified, the Audit Committee, in its discretion, may direct the appointment of a different

independent registered public accountant at any time during the year if the Audit Committee determines that such a change would

be in the Company’s and the stockholders’ best interests.

[WE MAKE NO RECOMMENDATION

WITH RESPECT TO THE RATIFICATION OF THE APPOINTMENT OF ARMANINO LLP AS THE INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM OF THE

COMPANY FOR ITS FISCAL YEAR ENDING DECEMBER 31, 2018 AND INTEND TO VOTE OUR SHARES “FOR” THIS PROPOSAL.]

VOTING AND PROXY PROCEDURES

Stockholders are

entitled to one vote for each share of Common Stock held of record on the Record Date with respect to each matter to be acted on

at the Annual Meeting. Only stockholders of record on the Record Date will be entitled to notice of and to vote at the Annual Meeting.

Stockholders who sell their shares of Common Stock before the Record Date (or acquire them without voting rights after the Record

Date) may not vote such shares of Common Stock. Stockholders of record on the Record Date will retain their voting rights in connection

with the Annual Meeting even if they sell such shares of Common Stock after the Record Date. Based on publicly available information,

Kanen believes that the only outstanding class of securities of the Company entitled to vote at the Annual Meeting is the Common

Stock.

Shares of Common

Stock represented by properly executed

WHITE

proxy cards will be voted at the Annual Meeting as marked and, in the absence

of specific instructions, will be voted

FOR

the election of the Nominees, [

FOR]

the ratification of Armanino LLP

as the Company’s independent registered public accounting firm, and in the discretion of the persons named as proxies on

all other matters as may properly come before the Annual Meeting, as described herein.

According to the

Company’s proxy statement for the Annual Meeting, the current Board intends to nominate five (5) candidates for election

at the Annual Meeting. This Proxy Statement is soliciting proxies to elect only our Nominees. Accordingly, the enclosed

WHITE

proxy card may only be voted for our Nominees and does not confer voting power with respect to the Company’s nominees. The

participants in this solicitation intend to vote the Kanen Group Shares in favor of the Nominees. Stockholders should refer to

the Company’s proxy statement for the names, backgrounds, qualifications and other information concerning the Company’s

nominees. In the event that some of the Nominees are elected, there can be no assurance that the Company nominee(s)

who get the most votes and are elected to the Board will choose to serve as on the Board with the Nominees who are elected.

QUORUM; DISCRETIONARY VOTING

A quorum is the

minimum number of shares of Common Stock that must be represented at a duly called meeting in person or by proxy in order to legally

conduct business at the meeting. For the Annual Meeting, the presence, in person or by proxy, of the holders of at least a majority

in voting power of all of the shares entitled to vote at the Annual Meeting must be present in person or represented by proxy at

the Annual Meeting. Shares that abstain from voting on any proposal will be treated as shares that are present and entitled to

vote at the Annual Meeting for purposes of determining whether a quorum is present.

If you are a stockholder

of record, you must deliver your vote by mail or attend the Annual Meeting in person in order to be counted in the determination

of a quorum.

If you are a beneficial

owner, your broker will vote your shares pursuant to your instructions, and those shares will count in the determination of a quorum.

Brokers do not have discretionary authority to vote on any of the proposals at the Annual Meeting. Accordingly, unless you vote

via proxy card or provide instructions to your broker, your shares of Common Stock will count for purposes of attaining a quorum,

but will not be voted on the proposals.

VOTES REQUIRED FOR APPROVAL

Election of Directors

─ The Company has adopted a majority vote standard for non-contested director elections and a plurality standard for contested

director elections. As a result of our nomination of the Nominees, the director election at the Annual Meeting will be contested,

so the five (5) nominees for director receiving the highest vote totals will be elected as directors of the Company. With respect

to the election of directors, only votes cast “FOR” a nominee will be counted. Proxy cards specifying that votes should

be withheld with respect to one or more nominees will result in those nominees receiving fewer votes but will not count as a vote

against the nominees. An abstention will not count as a vote cast “FOR” or “AGAINST” a director nominee.

Therefore, abstentions will have no direct effect on the outcome of the election of directors.

Ratification

of the Selection of Accounting Firm

─ According to the Company’s proxy statement, assuming that a quorum is present,

for the ratification of Armanino LLP, the affirmative vote of the holders of a majority of the shares present in person or represented

by proxy and entitled to vote at the Annual Meeting is required for approval. The Company has indicated that abstentions will not

be counted either for or against this proposal.

REVOCATION OF PROXIES

Stockholders of the Company

may revoke their proxies at any time prior to exercise by attending the Annual Meeting and voting in person (although, attendance

at the Annual Meeting will not in and of itself constitute revocation of a proxy) or by delivering a written notice of revocation.

The delivery of a subsequently dated proxy which is properly completed will constitute a revocation of any earlier proxy. The revocation

may be delivered either to Kanen in care of Alliance Advisors at the address set forth on the back cover of this Proxy Statement

or to the Company at 1010 Atlantic Avenue, Alameda, California 94501 or any other address provided by the Company. Although a revocation

is effective if delivered to the Company, we request that either the original or photostatic copies of all revocations be mailed

to Kanen in care of Alliance Advisors at the address set forth on the back cover of this Proxy Statement so that we will be aware

of all revocations and can more accurately determine if and when proxies have been received from the holders of record on the Record

Date of a majority of the shares entitled to be voted at the Annual Meeting. Additionally, Alliance Advisors may use this information

to contact stockholders who have revoked their proxies in order to solicit later dated proxies for the election of the Nominees.

IF YOU WISH TO VOTE FOR THE ELECTION

OF THE NOMINEES TO THE BOARD, PLEASE SIGN, DATE AND RETURN PROMPTLY THE ENCLOSED WHITE PROXY CARD IN THE POSTAGE-PAID ENVELOPE

PROVIDED.

SOLICITATION OF PROXIES

The solicitation

of proxies pursuant to this Proxy Statement is being made by Kanen. Proxies may be solicited by mail, facsimile, telephone, telegraph,

Internet, in person and by advertisements.

KWM has entered

into an agreement with Alliance Advisors for solicitation and advisory services in connection with this solicitation, for which

Alliance Advisors will receive a fee not to exceed $[_____], together with reimbursement for its reasonable out-of-pocket expenses,

and will be indemnified against certain liabilities and expenses, including certain liabilities under the federal securities laws.

Alliance Advisors will solicit proxies from individuals, brokers, banks, bank nominees, and other institutional holders. Kanen

has requested banks, brokerage houses, and other custodians, nominees and fiduciaries to forward all solicitation materials to

the beneficial owners of the shares of Common Stock they hold of record. Kanen will reimburse these record holders for their reasonable

out-of-pocket expenses in so doing. It is anticipated that Alliance Advisors will employ approximately [__] persons to solicit

stockholders for the Annual Meeting.

The entire expense

of soliciting proxies is being borne by Kanen. Costs of this solicitation of proxies are currently estimated to be approximately

$[_____] (including, but not limited to, fees for attorneys, solicitors and other advisors, and other costs incidental to the

solicitation). Kanen estimates that through the date hereof its expenses in connection with this solicitation are approximately

$[_____]. Kanen intends to seek reimbursement from the Company of all expenses it incurs in connection with this solicitation.

Kanen does not intend to submit the question of such reimbursement to a vote of security holders of the Company.

ADDITIONAL PARTICIPANT INFORMATION

Philotimo, KWM,

David L. Kanen, PADNOS and the Nominees are the participants in this proxy solicitation. The principal business of Philotimo is

investing in securities. The principal business of KWM is investing in securities and serving as the general partner of Philotimo.

The principal occupation of Mr. Kanen is serving as the managing member of KWM. The principal occupation of Mr. Ambrose is serving

as Chief Executive Officer of Data I/O Corporation. The principal occupation of Mr. Howe is serving as Managing Partner of Broadband

Initiatives, LLC. Mr. Kapoor is retired. The principal business of PADNOS is as

a recycling company. The principal occupation of Mr. Padnos is serving as Chairman of PADNOS. Mr. Yosufzai is retired.

The address

of the principal office of each of Philotimo, KWM and Mr. Kanen is 5850 Coral Ridge Drive, Suite 309, Coral Springs, Florida 33076.

The address of the principal office of PADNOS is 185 W. 8th Street, Holland, Michigan 49423.

As of the date hereof,

Mr. Kanen beneficially owns 2,283,678 shares of Common Stock of the Company. Mr. Kanen directly beneficially owns 116,082 shares

of Common Stock of the Company. Philotimo beneficially owns 300,000 shares of Common Stock of the Company. Kanen Wealth Management,

LLC beneficially owns 1,867,596 shares of Common Stock of the Company. Kanen Wealth Management, LLC as the general partner of

Philotimo, may be deemed the beneficial owner of the 300,000 shares of Common Stock owned by Philotimo. Mr. Kanen, as the managing

member of Kanen Wealth Management, LLC may be deemed the beneficial owner of the 1,867,596 shares of Common Stock owned by Kanen

Wealth Management, LLC and the 300,000 shares of Common Stock owned by Philotimo. As of the date hereof, Mr. Padnos beneficially

owns 318,000 shares of Common Stock of the Company. Mr. Padnos directly beneficially owns 118,000 shares of Common Stock of the

Company. PADNOS beneficially owns 205,200 shares of Common Stock of the Company. Mr. Padnos, as the Chairman of PADNOS, may be

deemed the beneficial owner of the 205,200 shares of Common Stock of the Company owned by PADNOS. As of the date hereof, Messrs.

Ambrose, Howe, Kapoor and Yosufzai do not directly or beneficially own any securities of the Company. For information regarding

purchases and sales of securities of the Company during the past two (2) years by the participants in this solicitation, see

Schedule

I

.

The shares of Common

Stock purchased by each of Philotimo, KWM, Mr. Kanen, PADNOS, and Jeffrey S. Padnos were purchased with working capital (which

may, at any given time, include margin loans made by brokerage firms in the ordinary course of business).

The shares of

Common Stock purchased by Mr. Kapoor were purchased with personal funds (which may, at any given time, include margin loans made

by brokerage firms in the ordinary course of business).

Except as set forth

in this Proxy Statement (including the Schedules hereto), (i) during the past 10 years, no participant in this solicitation has

been convicted in a criminal proceeding (excluding traffic violations or similar misdemeanors); (ii) no participant in this solicitation

directly or indirectly beneficially owns any securities of the Company; (iii) no participant in this solicitation owns any securities

of the Company which are owned of record but not beneficially; (iv) no participant in this solicitation has purchased or sold any

securities of the Company during the past two years; (v) no part of the purchase price or market value of the securities of the

Company owned by any participant in this solicitation is represented by funds borrowed or otherwise obtained for the purpose of

acquiring or holding such securities; (vi) no participant in this solicitation is, or within the past year was, a party to any

contract, arrangements or understandings with any person with respect to any securities of the Company, including, but not limited

to, joint ventures, loan or option arrangements, puts or calls, guarantees against loss or guarantees of profit, division of losses

or profits, or the giving or withholding of proxies; (vii) no associate of any participant in this solicitation owns beneficially,

directly or indirectly, any securities of the Company; (viii) no participant in this solicitation owns beneficially, directly or

indirectly, any securities of any parent or subsidiary of the Company; (ix) no participant in this solicitation or any of his or

its associates was a party to any transaction, or series of similar transactions, since the beginning of the Company’s last

fiscal year, or is a party to any currently proposed transaction, or series of similar transactions, to which the Company or any

of its subsidiaries was or is to be a party, in which the amount involved exceeds $120,000; (x) no participant in this solicitation

or any of his or its associates has any arrangement or understanding with any person with respect to any future employment by the

Company or its affiliates, or with respect to any future transactions to which the Company or any of its affiliates will or may

be a party; and (xi) no participant in this solicitation has a substantial interest, direct or indirect, by securities holdings

or otherwise, in any matter to be acted on at the Annual Meeting.

There are no material

proceedings to which any participant in this solicitation or any of his or its associates is a party adverse to the Company or

any of its subsidiaries or has a material interest adverse to the Company or any of its subsidiaries. With respect to each of the

Nominees, none of the events enumerated in Item 401(f)(1)-(8) of Regulation S-K of the Exchange Act occurred during the past 10

years.

OTHER MATTERS AND ADDITIONAL INFORMATION

Kanen is unaware

of any other matters to be considered at the Annual Meeting. However, should other matters, which Kanen is not aware of a reasonable

time before this solicitation, be brought before the Annual Meeting, the persons named as proxies on the enclosed

WHITE

proxy card will vote on such matters in their discretion consistent with Rule 14a-4(c)(3) promulgated under the Exchange Act.

STOCKHOLDER PROPOSALS

Proposals of stockholders

intended to be presented at the 2018 Annual Meeting of Stockholders (the “2019 Annual Meeting”) must, in order to be

included in the Company’s proxy statement and the form of proxy for the 2018 Annual Meeting, be delivered to the Company’s

Corporate Secretary at 1010 Atlantic Avenue, Alameda, California 94501 on or before January 1, 2018.

The information

set forth above regarding the procedures for submitting stockholder proposals for consideration at the 2018 Annual Meeting is based

on information contained in the Company’s proxy statement and the Bylaws. The incorporation of this information in this proxy

statement should not be construed as an admission by Kanen that such procedures are legal, valid or binding.

INCORPORATION BY REFERENCE

WE HAVE OMITTED

FROM THIS PROXY STATEMENT CERTAIN DISCLOSURE REQUIRED BY APPLICABLE LAW THAT IS INCLUDED IN THE COMPANY’S PROXY STATEMENT

RELATING TO THE ANNUAL MEETING. THIS DISCLOSURE INCLUDES, AMONG OTHER THINGS, CURRENT BIOGRAPHICAL INFORMATION ON THE COMPANY’S

DIRECTORS, INFORMATION CONCERNING EXECUTIVE COMPENSATION, AND OTHER IMPORTANT INFORMATION. SEE SCHEDULE II FOR INFORMATION REGARDING

PERSONS WHO BENEFICIALLY OWN MORE THAN 5% OF THE SHARES AND THE OWNERSHIP OF THE SHARES BY THE DIRECTORS AND MANAGEMENT OF THE

COMPANY.

The information

concerning the Company contained in this Proxy Statement and the Schedules attached hereto has been taken from, or is based upon,

publicly available information.

|

KANEN WEALTH MANAGEMENT, LLC

|

|

|

|

|

|

____________ __, 2018

|

SCHEDULE I

TRANSACTIONS IN SECURITIES OF

the Company

DURING THE PAST TWO YEARS

|

Nature of the Transaction

|

Amount of Securities

Purchased/(Sold)

|

Date of

Purchase/Sale

|

PHILOTIMO FUND, LP

|

Purchase of Common Stock

|

150,000

|

02/12/2018

|

|

Purchase of Common Stock

|

73,961

|

02/13/2018

|

|

Purchase of Common Stock

|

26,039

|

02/14/2018

|

|

Purchase of Common Stock

|

50,000

|

02/15/2018

|

KANEN WEALTH MANAGEMENT, LLC

|

Purchase of Common Stock

|

27,895

|

02/12/2018

|

|

Purchase of Common Stock

|

1,402,355

|

02/13/2018

|

|

Purchase of Common Stock

|

3,500

|

02/20/2018

|

|

Purchase of Common Stock

|

1,600

|

02/28/2018

|

|

Purchase of Common Stock

|

371,456

|

03/05/2018

|

|

Sale of Common Stock

|

(42,831)

|

03/05/2018

|

|

Purchase of Common Stock

|

13,400

|

03/06/2018

|

|

Purchase of Common Stock

|

33,849

|

03/07/2018

|

|

Purchase of Common Stock

|

24,000

|

03/16/2018

|

|

Purchase of Common Stock

|

7,130

|

04/02/2018

|

DAVID L. KANEN

|

Purchase of Common Stock

|

41,984

|

02/12/2018

|

|

Purchase of Common Stock

|

27,645

|

02/13/2018

|

|

Purchase of Common Stock

|