Current Report Filing (8-k)

April 20 2018 - 3:34PM

Edgar (US Regulatory)

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): April 16, 2018

MEXUS GOLD US

(Exact name of registrant as specified in its charter)

|

Nevada

|

|

000-52413

|

|

20-4092640

|

|

(State or other jurisdiction

|

|

(Commission File Number)

|

|

(IRS Employer

|

|

of Incorporation)

|

|

|

|

Identification Number)

|

|

|

|

1805 N. Carson Street, #150

|

|

|

|

|

|

Carson City, NV 89701

|

|

|

|

|

|

(Address of principal executive offices)

|

|

|

|

|

|

|

|

|

|

|

|

(916) 776-2166

|

|

|

|

|

|

(Registrant’s Telephone Number)

|

|

|

N/A

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

[ ] Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

[ ] Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

[ ] Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

[ ] Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 1.02 Termination of a Material Definitive Agreement.

On April 16, 2016, Mexus Gold US (“Mexus” or the “Company”) announced that Mexus Gold Mining SA De CVA, a subsidiary of Mexus, terminated its joint venture agreement with MarMar Holdings (the “JV Agreement”). The JV Agreement outlined the contractual obligations of the parties at the Santa Elena project in Caborca, Sonora State, Mexico.

The decision to terminate the JV Agreement was made due to MarMar’s failure to provide agreed funding, equipment and general operations for the project, as well as MarMar’s inability to meet environmental standards at the site.

The Company does not anticipate any early termination penalties associated with the JV Agreement.

Item 7.01 Regulation FD Disclosure

On April 16, 2018, Mexus issued a press release which announced that it had terminated its JV Agreement with MarMar Holdings. A copy of the press release issued by Mexus is attached as Exhibit 99.1 and incorporated herein by reference solely for purposes of this Item 7.01 disclosure.

Exhibit 99.1 contains forward-looking statements. These forward-looking statements are not guarantees of future performance and involve risks, uncertainties and assumptions that are difficult to predict. Forward-looking statements are based upon assumptions as to future events that may not prove to be accurate. Actual outcomes and results may differ materially from what is expressed in these forward-looking statements.

The information set forth under this Item 7.01, including Exhibit 99.1, is being furnished and, as a result, such information shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of such Section, nor shall such information be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly set forth by specific reference in such a filing.

Item 8.01 Other Events.

Mexus intends to move forward with the Santa Elena project with proper equipment and personnel. Due to the lack of funding by MarMar, the Santa Elena site, a disappointing 8.5oz Au was produced in the last 22 months.

Mexus President Paul Thompson states that Mexus has contracted with a security firm to provide 24-hour services at the Santa Elena site. Currently, there is equipment on site sufficient to produce an anticipated 500 tons a day and plans are in place to begin hiring staff with production beginning shortly thereafter. In addition, safety fencing will be installed and required site clean-up will occur that will satisfy any environmental concerns at the property. Two separate parties are running tests on the heap leach pad to determine the next steps to allow for recovery of gold and silver within the system.

Using previously developed geological mapping the company plans to mine the Julio quartz vein and the adjacent shear zone via open pit mining. The existing Julio vein, with depths to 30 meters and widths from 1 to 4 meters, has values ranging from 1.5 to 186 grams Au per ton. The adjacent shear zone carries values from .5 to 17 grams Au per ton. Mexus estimates that the shear zone will average 2.5 grams per ton gold equivalent with the Julio vein values being much higher. Additional equipment will be purchased which will enable the company to increase production to 1000 tons a day and beyond. Mexus intends to announce a non-dilutive capital raise plan in the very near future.

Lead geologist for Mexus MX, Cesar Lemas, announced that progress at the 8 Brothers project has slowed due to holidays in Mexico and the recent developments at the Santa Elena mine. All the necessary equipment has arrived at the mine site including the large VAT gold recovery tank. It is expected that installation and set-up of all systems will be completed by June 1

st

, 2018. Mr. Lemas continues to assay material from the mine site showing 3 to 12 grams per ton Au and 30 grams Ag which should equate to excellent returns once the system is operational.

Item 9.01 - Financial Statements and Exhibits

(d) Exhibits

99.1

Press Release

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, hereunto duly authorized.

|

|

Mexus Gold US

|

|

/s/

|

Paul D. Thompson

|

|

By:

|

Paul D. Thompson

|

|

Its:

|

President

|

Mexus Gold US (CE) (USOTC:MXSG)

Historical Stock Chart

From Mar 2024 to Apr 2024

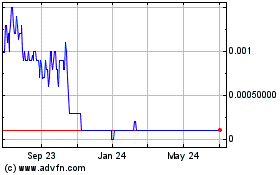

Mexus Gold US (CE) (USOTC:MXSG)

Historical Stock Chart

From Apr 2023 to Apr 2024