(*) Eel:

each and every loss. Agg: Aggregate

(**) USD250M

but USD400M Maximum Loss limit and in the aggregate in respect of earthquakes.

(****)

0.25, except for Drilling/Workover wells for which the deductible is 0.5.

(*) Eel:

each and every loss. Agg: Aggregate

Our third-party liability insurance policies

cover Ecopetrol S.A., our subsidiaries and affiliates in excess of local underlying policy limits for claims made against them

by third parties. Our commercial general liability coverage will pay on behalf of or indemnify amounts for which an insured becomes

legally obligated to pay, including damages in respect of bodily injury, property, pollution and product liability. Coverage of

bodily injury and property damage is subject to coverage territory during the policy period.

Until last year, this Group included coverages

for midstream (assets and operations). However, since second semester 2017 Ecopetrol’s midstream subsidiaries (Cenit, Ocensa,

ODL, Bicentenario and ODC) started an independent program looking for the optimization of coverages for the Oil Transportation.

*Each

company has its own limit of 200M and an aggregated excess shared limit of 500m

With respect to offshore operations in

the U.S. Gulf Coast, Ecopetrol America Inc. is party to Operating Agreements, or OAS, that include customary conditions and which

contain similar terms and provisions to those in the Model Form of Offshore Deepwater Operating Agreement of the American Association

of Professional Landmen. In general, pursuant to these OAs, the obligations, duties, and liabilities of the contract parties are

several, and not joint or collective, for all operations covered by the OAs.

Ecopetrol S.A. has a contract with two

local insurance companies for domestic operations. The local policies relate to transit, accidents, mandatory policies, liability

mandatory policies, and personal accidents policies, among others. Additional policies are requested from the insurers as they

are needed.

As of December 31, 2017, the Ecopetrol

Corporate Group had 11,682 employees, an increase of 7.0% from 2016. Most of our employees are located in Colombia. The table below

presents the breakdown of Ecopetrol employees according to the business segments where they work, and the personnel of our subsidiaries

for the years ended December 31, 2017, 2016 and 2015.

To improve the quality of life of our employees,

Ecopetrol S.A. extends various types of loans to its employees, including housing loans and general-purpose loans. The principal

amount of the loan depends on the applicant’s tenure. Ecopetrol S.A. does not guarantee any loans made by third parties.

In 2017, Ecopetrol S.A. extended 1,201 housing loans for a total of COP$219.44 billion and 1,794 general-purpose loans for a total

of COP$14.86 billion. Ecopetrol S.A. also provided on-site and external training and development, which total to COP$21.1 billion,

and it extended a total of COP$182.6 billion in subsidies for education.

We have not provided loans (including housing

loans), extended or maintained credit lines, arranged for the extension of credit by third parties, materially modified or renewed

an extension of credit lines, in the form of a personal loan to or for any of our executive officers since our ADSs were registered

under the Exchange Act.

There are no executive officers with housing

loans from Ecopetrol.

In accordance with article 123 of the Colombian

Constitution and the article 7th of the Law 1118 of 2006, our employees are considered “public servants”; even though

they are subject to the common labor law. As such, their behavior is subject to the rules to those who handle public interests

and goods and could be held liable for their illegal actions and omissions pursuant to the following regimes: (i) disciplinary

(Law 734 of 2002), (ii) criminal or (iii) civil.

A collective bargaining agreement between

us and our main labor unions governs labor relations with our unionized employees, which amounted to 4,609 employees as of January

1, 2018. The agreement also governs our labor relations with the 2,593 non-unionized employees who, according to current labor

legislation, have been beneficiaries of the collective bargaining agreement.

We currently have seven industry-wide labor

unions and seven company labor unions:

Any employee working for any company in

the oil and gas industry may join the USO, ADECO SINDISPETROL, UTEN, ASTIP, SINATRINHI or SINTRAMANPETROL. Only our employees may

join the company labor unions.

Ecopetrol S.A. relations with unions are

based on a permanent dialogue and communication sessions where different matters are discussed in order to solve and prevent any

labor conflict.

Our current collective bargaining agreement

has been in effect since 2014 and has a term of four years, expiring on June 30, 2018. In 2016, the agreement was reviewed on application

matters, except for monetary expenses (including wages and benefits). This review ended with a mutual arrangement document, signed

on December 10, 2016.

There will be no changes to these terms

until June 2018 or till the end of the eventual negotiation process. This agreement currently covers all workers benefiting from

the Collective Labor Convention, regardless of whether they are part of any labor union.

Our consolidated financial statements for

the years ended December 31, 2015, 2016 and 2017 were prepared in accordance with IFRS.

IFRS differs in certain significant aspects

from the current Colombian IFRS (which is the accounting standard we use for local statutory reporting purposes). As a result,

our financial information presented under IFRS is not directly comparable to certain of our financial information presented under

Colombian IFRS. A description of the differences between Colombian IFRS and IFRS is presented under

Summary of Differences between

Internal Reporting (Colombian IFRS and IFRS)

below.

Our consolidated financial statements were

consolidated line by line and all transactions and significant balances between affiliates have been eliminated. These financial

statements include the financial results of all subsidiaries companies controlled, directly or indirectly, by Ecopetrol S.A. See

Exhibit 1—Consolidated companies, associates and joint ventures, to our consolidated financial statements included in this

annual report.

Our operating results were affected mainly

by international prices of crude oil and, to a somewhat lesser extent, international prices for refined products and local prices

for natural gas, as well as sales volumes, product mix, exchange rate and our operational performance. Crude oil prices and volumes

are particularly important to the results of our exploration and production segment. This is because as export volumes or export

prices of crude oil and products decrease or increase, our revenues do also. Results from our refining activities are also affected

by the price of crude oil used as raw material, changes in product prices in the international market, change in environmental

regulations, conversion ratios and utilization rates and refining capacity, all of which affect our refining margins. Changes in

the value of foreign currencies, particularly the U.S. dollar against the Colombian Peso, can also have a significant effect on

our financial statements. Finally, terrorist attacks by guerillas against our pipelines and other facilities or social unrest can

lead to loss of revenues by restricting the availability of transport systems for exports or sales of crude oil and products and/or

production activities, in addition to the direct costs of repairing and cleaning.

Our results from the exploration and production

segment depend mainly on our sales volumes and average local and international prices for crude oil, petrochemicals and natural

gas. Additionally, sales volumes also reflect the purchase of crude oil and natural gas that we make from third parties and the

ANH.

We sell crude oil and natural gas in the

local and the international market. We also process crude oil at the Barrancabermeja and Cartagena refineries and sell refined

and other petrochemical products in the local and international markets.

We have a number of crude oil short-term

commercial agreements with local customers, and natural gas short and long-term supply contracts with gas-fired power plants and

local natural gas distribution companies. Local sale prices are determined in accordance with existing regulations, contractual

arrangements and the spot market linked to international benchmarks. Local sales represent 50.4% of our total revenues, on average,

for the past three years.

Our foreign sales represented 49.6% of

our total revenues, on average, for the past three years.

International sale prices are determined

in accordance with contractual arrangements and the spot market linked to international benchmarks primarily ICE Brent benchmark.

A market diversification strategy has allowed

us to capture markets where we have been able to obtain higher prices for our crudes and refined products. We sell our crudes and

refined products in various regions, such as the U.S., Central America and the Caribbean, Asia and Europe. In our negotiations

with potential customers, we seek to use the most liquid benchmark reference prices in each region.

We account for exploratory drilling costs

using the successful efforts method, whereby all costs associated with the exploration and drilling of productive wells are initially

capitalized. Costs incurred in exploring and drilling dry or unsuccessful wells are expensed in the period in which the well is

determined to be a dry or unsuccessful well and are accounted for under “Exploration and Project expenses.” Consequently,

an increase in the number of exploratory wells we declare as dry or unsuccessful will negatively affect our results and may cause

volatility in our operating expenses.

Each of our production contracts has its

own royalty arrangement in accordance with applicable law. Law 141 of 1994 established a royalty fixed rate equivalent to 20% of

total production. In 1999, a modification to the royalty system established a sliding scale for royalty percentage linked to the

production level of crude oil and natural gas to fields discovered after July 29, 1999, depending on whether the production

is crude oil or natural gas, and on the quality of the crude oil produced. Since 2002, as a result of the enactment of Law 756

of 2002, the royalty percentage has ranged from 8% for fields producing up to five thousand bpd to 25% for fields producing an

excess of 600 thousand bpd. Producing fields pay royalties in accordance with the applicable royalty rate at the time of the

discovery. Also, Law 756 of 2002 establishes that in the fields of the association contracts that finalize or revert back, an additional

royalty rate of 12% of the basic production applies.

Since January 2014, the ANH has collected

natural gas production royalties from producers settled in cash based on a formula, regardless of whether a producer has sold the

gas. As a result, we no longer commercialize this gas on behalf of the ANH. In addition, because the royalties are now payable

to the ANH in cash, all the gas we produce is considered part of our reserves and production, without any deduction for royalties.

The cost of natural gas royalties totaled COP$449,959 million in 2017.

We purchase all crude oil delivered to

the ANH as royalties by us and by third parties. The purchase price is calculated according to a formula set forth in a contract

between Ecopetrol and the ANH that reflects our export sales prices (crudes and products), a quality adjustment for API gravity

and sulfur content, transportation rates from the wellhead to the Coveñas or Tumaco ports and a marketing fee. We sell the

physical product purchased from the ANH as part of our ordinary business. In June 2016, the contract between the ANH and us was

extended until June 30, 2018.

Since 2016, we have imported crude oil

for Reficar feedstock when such imports result in better operational or economic performance of the Ecopetrol Group.

In December 2016, the Colombian Congress

adopted Law 1819, which introduced changes to the Colombian tax system as follows:

The 2016 Tax Reform included two tax benefits

that are expected to improve the operations of the oil and gas industry:

The functional currency of each of the

companies of Ecopetrol Group is determined in relation to the main economic environment where each company operates; however our

consolidated financial results are reported in Colombian Pesos, which is the Ecopetrol Group’s functional and presentation

currency. A substantial part of our consolidated revenues coming from Ecopetrol Group companies whose functional currency is the

Colombian Peso, the U.S. dollar-Colombian Peso is derived from local sales and exports of crude oil, natural gas and refined products

sold at prices referenced to benchmarks quoted in U.S. dollars. Therefore, they are exposed to foreign currency exchange risk on

revenues, capital expenditures and financial instruments that are denominated in a currency other than its functional currency.

Fluctuations in the U.S. dollar-Colombian

Peso exchange rate have effects on our consolidated financial statements. As crude oil is priced in U.S. dollars, fluctuations

in the exchange rate of the Colombian Peso against the U.S. dollar may have a significant impact on revenues, cost, assets and

liabilities held in foreign currency.

An appreciation of the Colombian Peso has

a negative impact on our results of operations because our revenues from exports of crude oil, natural gas and refined products

are primarily expressed in U.S. Dollars. Costs of imported goods and contracted services expressed in U.S. dollars will also be

lower when expressed in Colombian Pesos, but on balance, our operating income in Colombian Pesos tends to decline when the Colombian

Peso appreciates, other factors being equal. The appreciation of the Colombian peso against the U.S. dollar also decreases the

debt service requirements of our Companies with the Colombian peso as their functional currency, as the amount of the Colombian

pesos necessary to pay principal and interest on foreign currency debt decreases with the appreciation of the Colombian peso.

Conversely, when the Colombian Peso depreciates

against the U.S. dollar, our reported revenues, costs related to imported goods and services, interest costs, and operating income,

all tend to increase.

During 2017, the Colombian peso appreciated

on average 3.35% against the U.S. dollar. In 2016 and 2015, the Colombian Peso depreciated on average 11.18%, and 37.28%, respectively,

against the U.S. dollar. Additionally, as of December 31, 2017 and December 31, 2016 the Colombian Peso/U.S. dollar exchange rate

appreciated 0.56% and 4.72%, respectively from the rate a year earlier. As of December 31, 2015, in contrast, the Colombian Peso

depreciated 31.64%, from the rate a year earlier.

In 2017, our consolidated debt in foreign

currency decreased by a total of US$2,582 million mainly as a result of prepayments of foreign currency denominated loans of US$2,400

million and amortization of foreign currency capital expenditures. In 2016, our consolidated debt in foreign currency increased

by a total of US$975 million as Ecopetrol S.A. raised US$475 million through international loans and US$500 million through an

international bond issuance. In 2015, our consolidated debt in foreign currency increased by a total of US$3,425 million as Ecopetrol

S.A. raised US$1,925 million through an international loan and US$1,500 million through an international bond issuance.

As of December 31, 2017 our U.S. dollar

denominated total debt was US$12,590 million, which we recognize in our financial statements at its amortized cost, which corresponds

to the present value of cash flows, discounted at the effective interest rate. Out of this total, US$11,985 million relates to

Ecopetrol S.A., whose functional currency is the Colombian Peso. Therefore, when the Colombian Peso depreciates against the U.S.

dollar, Ecopetrol S.A. is exposed to an exchange rate loss. In contrast, when the Colombian Peso appreciates against the U.S. dollar,

Ecopetrol S.A. has an exchange rate gain. Some of the Ecopetrol Group companies have the U.S. dollar as their functional currency

and are not exposed to a material exchange rate risk resulting from fluctuations in the Colombian Peso against the U.S. dollar.

On the asset side, when the financial statements of the Group are consolidated, the exchange rate differential of the subsidiaries’

assets and liabilities whose functional currency is the U.S. dollar is recognized directly in equity, as part of Other comprehensive

income.

In 2015, Ecopetrol S.A. adopted hedge accounting,

using two types of natural hedges with its U.S. dollar debt as a financial instrument: i) a cash flow hedge for exports of crude

oil and ii) a hedge of the net investment in foreign operations. As a result of the implementation of both hedges 71.2% ($8,532

million) of Ecopetrol S.A.’s debt in U.S. dollars, as of December 31, 2017, was designated as a hedge. With the adoption

of hedge accounting, the effect of the volatility of the foreign exchange rate on the hedged portion of the debt is recognized

directly in equity, as part of Other comprehensive income.

The remaining portion of Ecopetrol S.A.’s

U.S. dollar-denominated debt, as well as the financial assets and liabilities denominated in foreign currency, continues to be

exposed to the fluctuation in the exchange rate, which means that an appreciation of the Colombian peso against the U.S. dollar

could generate a loss for companies whose functional currency is the Colombian peso that have a net position in U.S. dollars or

a gain if they have a net liability position in U.S. dollars. Conversely, a depreciation of the Colombian peso against the U.S.

dollar could generate a gain for companies whose functional currency is the Colombian peso that have a net position in U.S. dollars

or a loss if they have a net liability position in U.S. dollars.

As of December 31, 2017, Ecopetrol Group

companies with the Colombian peso as their functional currency have a net U.S. dollar position close to zero after the implementation

of the natural hedging previously mentioned above, neutralizing the effect of exchange rate fluctuations in their results for the

year. The companies with the U.S. dollar as their functional currency have a net U.S. dollar position of US$1,699 million and are

not exposed to a material exchange rate risk resulting from fluctuations in the Colombian peso against the U.S. dollar, as discussed

above.

The average annual rate of inflation in

Colombia for the past ten years is 4.3%. It decreased in 2017 as compared to 2016. As measured by the general consumer price index,

average annual inflation in Colombia for the years ended December 31, 2017, 2016 and 2015 was 4.09%, 5.75%, and 6.77%, respectively.

The decrease in inflation in 2017 is mainly explained by the recovery of the agricultural sector given the end of the “El

Niño” weather phenomenon and the nonoccurrence of agricultural and freight transport stoppages that occurred in 2016.

The decrease in inflation is also related to the weakness of consumer demand and the monetary policy applied by the central bank.

Cost inflation in the prices of goods, raw materials, interest cost of debt in local currency indexed to inflation and services

for operation of oil and gas producing assets can vary over time and between each market segment.

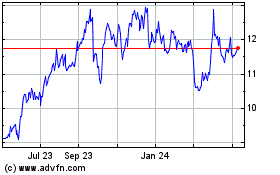

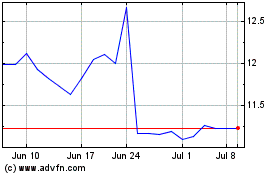

The average price of ICE Brent crude was

US$54.7 per barrel in 2017 as compared to US$45.10 per barrel in 2016 and US$53.60 per barrel in 2015. (

See section Strategy

and Market Overview

). In addition, Ecopetrol’s average crude oil basket price relative to ICE Brent reported a discount

of US$6.90 in 2017, a lower discount than the US$9.40 and US$9.70 observed in 2016 and 2015, respectively, due to an active commercial

strategy, including seeking more valuable markets for our crude oil, and strengthening the demand for our heavy crude oil in the

international market. Therefore, our average price crude oil basket was US$47.80 per barrel in 2017 as compared to US$35.70 per

barrel in 2016 and US$43.90 per barrel in 2015, which represents an increase of US$12.10 per barrel in 2017 compared to 2016.

Additionally, fluctuations in the price

of oil had an impact on the value of our oil and gas reserves. Reserves valuation is made in accordance with SEC price regulations.

Volatility in hydrocarbon prices, refining margins and reserves, as well as changes in environmental regulations may lead to the

recognition of impairment or recovery of assets.

In 2015, the adverse economic context faced

by the hydrocarbons sector resulted in a reduction in forecasted oil prices and an increase in market and country risk reflected

in the discount rate, as well as a reduction in the recoverable reserves amount and refining margin, among other factors, Ecopetrol

recognized an impairment of non-current assets of COP$7,864,875 million before taxes.

In 2016, in connection with our evaluation

of the recoverable amount of the assets value, which includes the variation in estimations of future prices under the current scenarios

of OPEC’s oil quota agreements and the impact resulting from changes on specifications issued by the International Marine

Organization agreement regarding marine pollution -Marpol- on crude and fuels with high sulfur content, Ecopetrol recognized an

impairment of non-current assets of COP$928,747 million before taxes.

In 2017, Ecopetrol had a COP$1,311,138

million net reversal of prior year impairments primarily as a result an improved hydrocarbon prices outlook, incorporation of new

reserves. Ecopetrol’s crude an improved oil basket price discount as compared to the ICE Brent crude oil price, favorable

refining margins outlook and technical operational capacity, among other factors.

For additional information about impairment

charges and reversals, see section

Operating Results—Consolidated Results of Operations—Impairment of non-current

assets

and Note 18 to our consolidated financial statements.

Our consolidated financial statements for

the years ended December 31, 2015, 2016 and 2017 were prepared in accordance with IFRS. The detail of the accounting policies

is described in Note 4 to our consolidated financial statements.

Critical accounting policies are those

policies that require us to exercise judgment or involve a higher degree of complexity in the application of the accounting policies

that currently affect our financial condition and results of operations. The accounting judgments and estimates we make in these

contexts require us to calculate variables and make assumptions about matters that are highly uncertain. In each case, if we had

made other estimates, or if changes in the estimates occur from period to period, our financial condition and results of operations

could be materially affected.

See Note 3 to our consolidated financial

statements for a summary of the critical accounting judgments and estimates applicable to us. There are many other areas in which

we use estimates about uncertain matters, but we believe the reasonably likely effect of changed or different estimates would not

be material to our financial presentation.

The following discussion is based on information

contained in our audited consolidated financial statements and should be read in conjunction therewith.

The following table sets forth components

of our income statement for the years ended December 31, 2017, 2016 and 2015.

The following table sets forth our principal

sources of third-party revenues by business segment for the years ended December 31, 2017, 2016 and 2015. An explanation of

how we classify our operations into business segments is included in Section 4.5.2 below.

In 2017, total revenues increased by 15.4%

as compared to 2016, primarily as a result of a COP$$10,971,709 million increase in revenues mainly due to the 33.9%, or US$12.1

per barrel increase of our average crude oil basket price and a smaller discount of Ecopetrol’s average crude oil basket

price from international prices. This increase was partially offset by: (i) a COP$$1,894,819 million decrease in revenues attributable

to the decrease in our sales volume and a COP$261,200 decrease in services provided by our transportations and logistics segment

and (ii) the 3.35% appreciation of the Colombian Peso against the U.S. dollar, from an average exchange rate of COP$3,053.42/US$1.00

in 2016 to an average exchange rate of COP$$2,951.15 /US$1.00 in 2017, resulting in a decrease in sales revenue from exports, which

represented a decrease of COP$1,347,023 million.

The decrease of our sales volume in 2017

as compared to 2016 was the result of (i) the 3.7%, or 6 mbe, decrease in our crude sales volume caused mainly by lower crude exports

due to a greater allocation of domestic crudes to supply Reficar in order to replace imports, (ii) the 6.7%, or 10.7 mbe, decrease

in refined products volumes due to lower exports of diesel, primarily due to: (a) our commercial strategy of focusing on allocating

higher volumes to the domestic market to supply local demand and replace imports which resulted in lower cost of sales and better

gross margin, (b) lower exports of fuel oil, and (c) a decrease in production at the Barrancabermeja refinery as a result of reliance

on more efficient alternative sources, and (iii) the 3%, or 0.86 mbe, decrease in natural gas sales volume due to continued lower

thermal demand as a result of no effect of the “El Niño” weather phenomenon that ended in the middle of 2016.

In 2016, total revenues decreased by 7.4%

as compared to 2015, primarily as a result of: (i) a COP$6,456,917 million decrease in revenues mainly due to the 18.6%, or US$8.2

per barrel reduction of our average crude oil basket price, (ii) a COP$1,572,854 million decrease in revenues attributable to the

decrease in our sales volume and lower services provided by our transportations and logistics segment. This decrease

was partially offset by the 11.2% devaluation of the Colombian Peso against the U.S. dollar, from an average exchange rate of COP$2,746.47/US$1.00

in 2015 to an average exchange rate of COP$3,053.42/US$1.00 in 2016, resulting in an increase in sales revenue from exports,

which represented an increase of COP$4,168,061 million.

The decrease of our sales volume

in 2016 as compared to 2015 was the result of (i) the 18.1%, or 36.4 mbe, decrease in our crude sales volume caused mainly

by lower crude exports due to production decline, reduced purchases by third parties and lower availability of crude due to its

use for feedstock at Reficar, and (ii) the 15.6%, or 5.3 mbe, decrease in natural gas sales volume due to lower thermal

demand as a result of the end of the “El Niño” weather phenomenon and the termination of our sales contract

to Venezuela on June 30, 2015. This decrease in sales volume was partially offset by the 20.2%, or 26.8 mbe, increase

in sales of refined products given the increase of operations at Reficar and higher demand due to the growth in the number

of motor vehicles in Colombia.

Our cost of sales was principally affected

by the factors described below. See Note 26 to our consolidated financial statements for more detail.

Cost of sales in 2017 was COP$36,908,325

million, representing a COP$2,656,902 million or 7.8% increase as compared to 2016, primarily as a result of the following factors:

The factors mentioned

above were partially offset by a COP$231,222 million increase in inventories and an increase in unit costs associated with the

increase of the Brent price of crude oils and products.

Cost of sales in 2016 was COP$34,251,423

million, representing a COP$2,743,093 million or 7.4% decrease as compared to 2015, primarily as a result of the following factors:

The factors mentioned above were partially

offset by a (i) COP$784,266 million increase in the amortization, depletion and depreciation of property, plant and equipment in

connection with the start-up of the Reficar units and capitalization of major maintenance costs at the Barrancabermeja refinery

and (ii) a COP$70,515 million decrease in other minor items.

Operating expenses and selling, general and

administrative expenses before taking into account the impairment of non-current assets, amounted to COP$4,185,186 million in 2017,

a COP$215,657 million or 4.9% decrease as compared to 2016, mainly as a result of the following factors (see Notes 27 and 28 to

our consolidated financial statements for more detail).

Operating expenses and selling, general and

administrative expenses before taking into account the impairment of non-current assets, amounted to COP$4,400,843 million in 2016,

a COP$ 955,872 million (17.8%) decrease as compared to 2015, mainly as a result of the following factors (see Notes 27 and 28 to

our consolidated financial statements for more detail).

Each of our operating segments bears the

costs and expenses incurred for product use and marketing and each segment assumes administrative expenses and all non-operational

transactions related to its activity. Discussion of operating expenses by business segment is included in the section

Financial

Review—Operating Results—Consolidated Results of Operations—Segment Performance and Analysis

.

The impairment of our non-current assets includes

expenses (or recovery) of impairment of property, plant and equipment and natural resources, investments in companies, goodwill

and other non-current assets. The Company is exposed to future risks derived mainly from variations in: (i) oil prices outlook,

(ii) refining margins and profitability, (iii) cost profile, (iv) investment and maintenance expenses, (v) amount of recoverable

reserves, (vi) market and country risk assessments reflected in the discount rate, and (vii) changes in domestic and international

regulations, among others.

Any change in the foregoing variables used

to calculate the recoverable amount of a non-current asset can have a material effect on the recognition of either losses or recovery

of impairment charges in the profit or loss statement. In our business segments highly sensitive variables can include among others:

(i) in the exploration and production segment, variations of the hydrocarbon prices outlook; (ii) in the refining segment, changes

in product and crude oil prices, discount rate, refining margins, changes in environmental regulations, cost structure and the

level of capital expenditures; (iii) in the transportation and logistics segment, changes in tariffs regulation and volumes transported.

(See Notes 3.2, 4.12 and 18 to our consolidated financial statements for more detail).

In 2017, we had a COP$1,311,138 million net

reversal of impairment of non-current assets, as compared to impairment losses of COP$928,747 million in 2016 and COP$7,864,875

million in 2015. These impairments are a non-cash accounting effect and consequently they do not involve any disbursement or income.

Further, any cumulative impairment amount of non-current assets is susceptible to reversion when the fair value of the asset exceeds

its book value. On the contrary, in the event that the book value exceeds the fair value of the asset, an additional impairment

expense could be recognized.

The partial reversal of the impairment recorded

in previous years is primarily the result of an improved hydrocarbon prices outlook, incorporation of new reserves, Ecopetrol’s

crude oil basket price discounts as compared to the ICE Brent crude price, favorable refining margins outlook, market conditions

affecting the discount rate and technical operational capacity, among other factors.

The impairment losses recognized in 2016 and

2015 were mainly due to lower estimates of the outlook for oil prices given the oil price environment during those years, operational

variables in the exploration and production and refining segments, market and country risk assessments reflected in the discount

rate, and a reduction in the amount of recoverable reserves, among others.

Finance results, net, mainly includes exchange

rate gains or losses, interest expense, yields and interest from our investments and non-current liabilities financial costs (asset

retirement obligation and post-benefits plan).

Finance results, net, amounted to a loss of

COP$2,495,731 million in 2017 as compared to a loss of COP$1,175,367 million in 2016. This increase in loss was mainly due to:

This increase in our

financial loss was partially offset by: (i) the use of cash flow and net investment hedge accounting, which has allowed us to neutralize,

overall, the effect of the exchange rate fluctuation on 71.2% of the U.S. dollar debt of Ecopetrol S.A., since exchange rate changes

are recognized under other comprehensive income within equity, (ii) the efficient allocation of debt within the companies that

make up the Ecopetrol Group, thereby achieving an approximately zero net position in U.S. dollars as of December 31, 2017, and

(iii) a COP$379,030 million decrease in interest expenses as a result of: (i) the use of cash surpluses to pre-pay foreign currency-denominated

loans totaling US$1,925 million in June 2017 and US$475 million in December 2017 and (ii) a decrease in interest on local currency-denominated

loans with a lower interest rate indexed to the Consumer Price Index (CPI) and a decrease in interest on capital payments.

Finance results, net, amounted to a loss

of COP$1,175,367 million in 2016 as compared to a loss of COP$7,663,104 million in 2015. This decrease in loss was mainly due to:

This decrease in our financial loss was partially

offset by a COP$996,406 million increase in interest expenses as a result of (i) the recognition of Reficar’s interest expenses

which, up to 2015, had been capitalized (ii) the aggregate US$475 million international loans we entered into in February and May

2016 and the US$500 million international bond we issued in June 2016, and (iii) the negative effect the Colombian Peso had on

our exchange rate on interest due on our foreign debt.

For more details on our financial income and

expenses see Note 29 to our consolidated financial statements for more details.

Income taxes amounted to COP$5,800,268

million in 2017, COP$4,543,046 million in 2016 and COP$710,353 million in 2015. The above is equivalent to an effective tax rate

of 42.1%, 58.3% and -12.7% in 2017, 2016 and 2015, respectively.

The decrease in the effective tax rate

from 2016 to 2017 was mainly due to: (i) the better financial performance of the exploration and production segment, (ii) the reduction

of losses at Reficar and Ecopetrol America Inc, which also resulted in lower tax rates and (iii) the reduction of the wealth tax

rate from 1% in 2016 to 0.4% in 2017.

The increase in the effective tax rate

from 2015 to 2016 was mainly due to: (i) lower recovery of deferred tax asset, (ii) the effect of the adjustment in deferred tax

resulting from the application of the Colombian tax reform described above, and (iii) the recognition of the presumptive tax on

subsidiaries reporting tax losses.

See Note 10 to our consolidated financial

statements for more details.

As a result of the foregoing, in 2017,

net income attributable to owners of Ecopetrol was COP$7,178,539 million whereas, in 2016, net income attributable to owners of

Ecopetrol was COP$2,447,881 million and, in 2015, net loss attributable to owners of Ecopetrol was COP$7,193,859 million.

In this section, including the tables below,

we present our financial information by segment: Exploration and Production, Refining and Petrochemicals and Transportation and

Logistics. See the section

Business Overview

for a description of each segment.

The following tables present our revenues

and net income by business segment for the years ended December 31, 2017, 2016 and 2015:

Total revenues by segment include exports

and local sales to third-parties and inter-segment sales. See the section

Financial Review—Operating Results—Consolidated

Results of Operations—Total Revenues

for prices and volumes to third parties.

In 2017, exploration and production segment

sales were COP$36,494,934 million, compared to COP$28,221,210 million in 2016. In 2017, our segment sales increased by 29.3% as

compared with 2016 mainly as a result of:

In 2016, exploration

and production segment sales were COP$28,221,210 million, compared to COP$31,732,611 million in 2015. In 2016, our segment sales

decreased by 11.1% as compared with 2015 mainly as a result of:

Cost of sales affecting our exploration

and production segment is mainly related to: (i) the amortization and depletion of our production assets, (ii) contracted services

and (iii) costs related to maintenance, operational services, electric power, projects and labor in the exploration and production

segment. In addition, this segment’s costs are impacted by the purchases of crude oil from ANH and third parties, naphtha

for dilution and transportation services.

In 2017, the cost of sales for this segment

increased by 14.5% as compared with 2016, due to the net effect of:

In 2016, the cost of sales for this segment

decreased by 10.6% as compared with 2015, due to the net effect of:

In 2017, operating expenses before impairment

of non-current assets increased by 7.8% in 2017 as compared to 2016, primarily as a result of (i) higher expenses related to our

exploratory activity as we engaged in more seismic activity and recorded expenses related to exploratory activity at the Kronos-1,

Parmer-1, Warrior 2, Lunera-1, Brama-1, Molusco-1, Godric, Dumbo and Pollera wells, (ii) the termination in 2016 of the deferred

income amortization we had been recognizing since 2007 for the advance payment by the Ministry of Finance and Public Credit of

the obligations under Ecogas, in relation to the Built, Operate and Transfer contracts (BOMT's) for the construction, operation,

maintenance and transfer of gas pipelines. This increase was partially offset by (i) increased income due to the acquisition of

an additional 11.6% interest at the K2 field in the Gulf of Mexico which generated a gain due to the increase in the book value

of the asset above the value paid for the additional interest and (ii) the reduction of the wealth tax rate from 1% in 2016 to

0.4% in 2017.

In 2016, operating expenses before impairment

of non-current assets decreased by 70.1% in 2016 as compared to 2015, primarily as a result of (i) lower expenses related to our

exploratory activity as we engaged in less seismic activity and exploratory drilling, (ii) minor commissions, fees, freight and

services as a result of the savings obtained in the implementation of our transformation plan, and (iii) a lower wealth tax. This

decrease was partially offset by an increase in labor expenses due to the implementation of the voluntary retirement plan.

The net reversal of impairment of non-current

assets recognized in the exploration and production segment in 2017 totaled COP$183,718 million as compared to an impairment loss

of COP$196,448 million in 2016. The net reversal of the impairment was primarily due to the increased value of offshore oil fields,

partially offset by an impairment of onshore fields, both as a result of calculating their valuation taking into account market

variables, reserves, price spreads as compared to the ICE Brent price, and available technical and operational information.

The segment recorded net income attributable

to owners of Ecopetrol of COP$3,820,501 million in 2017 as compared to net income attributable to owners of Ecopetrol of COP$1,322,370

million in 2016 and net loss attributable to owners of Ecopetrol of COP$5,851,619 million in 2015.

The aggregate average production cost,

on a Colombian Peso basis, has increased to COP$23,684 per boe during 2017 from COP$20,993 per boe during 2016. On a dollar basis,

our aggregate average production cost increased to US$8.02 per boe in 2017 from US$6.88 per boe in 2016, due partially to a 3.27%

appreciation of the average exchange rate of the Colombian Peso against the U.S. dollar in 2017.

The aggregate average lifting cost, on

a Colombian Peso basis, increased to COP$22,585 per boe during 2017 from COP$19,799 per boe during 2016. On a dollar basis, it

increased to US$7.65 per boe in 2017 from US$6.49 per boe in 2016 also due partially to the 3.27% appreciation of the average exchange

rate of the Colombian Peso against the U.S. dollar in 2017.

The difference between the aggregate average

lifting cost and aggregate average production cost is that lifting cost does not include the costs related to hydrocarbon self-consumption

required in the production process or the deliveries we make to our refineries and natural gas liquid plants.

The following table sets forth crude oil

and natural gas average sales prices, the aggregate average lifting costs and aggregate average unit production cost for the years

ended December 31, 2017, 2016 and 2015.

In 2017, our transportation and logistics

segment sales were COP$10,598,064 million compared to COP$10,648,776 million in 2016. The 0.5% decrease in 2017 as compared with

2016 was mainly due to (i) a 5% decrease in the volume of crude oil transported by our pipelines, which was primarily due to the

production decrease at the national level and (ii) the negative effect on our U.S. dollar-indexed transportation fees resulting

from the appreciation of the Colombian Peso against the U.S. dollar. This decrease was almost offset by a 1.9% increase in the

volume of refined products transported primarily due to the increase in demand for refined products in Colombia and the elimination

of restrictions in the Pozos Colorados - Galán system. Sales to third parties decreased in 2017 as compared to 2016 primarily

due to the fact that the segment received income from the transportation services to Frontera Energy for its participation in the

Rubiales field, and once the field returned to us in July 2016, these services were recognized as inter-segment sales.

In 2016, our transportation and logistics

segment sales were COP$10,648,776 million compared to COP$10,844,550 million in 2015. The 1.8% decrease in 2016 as compared with

2015 was mainly due to an 11.3% decrease in the volume of crude oil transported by our pipelines, which was primarily due to the

production decrease at the national level, in spite of (i) the positive effect on our U.S. dollar-indexed transportation fees resulting

from the devaluation of the Colombian Peso against the U.S. dollar and (ii) a 3.7% increase in the volume of refined products transported

in the Galán-Sebastopol system to meet the demand for fuel in Colombia and the start-up of Reficar. Sales to third parties

decreased in 2016 as compared to 2015 primarily due to the fact that the segment received income from the transportation services

to Pacific Rubiales for its participation in the Rubiales field, and once the field returned to us in July 2016, these services

were recognized as inter-segment sales.

The cost of sales for our transportation and

logistics segment is mainly related to: (i) project costs associated with the maintenance of transportation networks and (ii) operating

costs related to these systems, including the costs of labor, energy, fuels and lubricants and others.

The cost of sales amounted to COP$3,271,835

million in 2017 as compared to COP$3,349,791 million in 2016. The cost of sales for this segment decreased by 2.3% in 2017 as compared

with 2016 mainly due to a decrease in costs associated with maintenance, operating supplies and materials due to the

continuity of our efficiency program to optimize our operating costs. This decrease was partially offset by (i) an increase

in material processing costs needed for power generation in three new pumping stations to operate Ocensa’s P135 project and

(ii) an increase in depreciation resulting from the start of P135.

The cost of sales amounted to COP$3,349,791

million in 2016 as compared to COP$3,744,422 million in 2015. The cost of sales for this segment decreased by 10.5% in 2016 as

compared with 2015 mainly due to a decrease in costs associated with maintenance, operating supplies and materials due to the continuity

of our efficiency program to optimize our operating costs. This decrease was partially offset by an increase in material processing

costs needed for power generation in pumping stations and an increase in depreciation due to a higher level of investments in the

segment.

In 2017, operating expenses before the

impairment of non-current assets decreased by 15.1% as compared to 2016 due to lower administrative expenses mainly as a result

of the consolidation of administration areas within the segment and a decrease in taxes because of the reduction of the wealth

tax rate discussed previously.

In 2016, operating expenses before the impairment

of non-current assets increased by 30.7% as compared to 2015 due to a recovery of environmental provisions in 2015, no similar

recoveries in 2016 and an increase in labor costs as a result of the implementation of the voluntary retirement plan. This increase

was partially offset by lower wealth and industry taxes.

The net reversal of impairment of non-current

assets recognized in the segment in 2017, totaled COP$59,455 million in 2017 as compared to an impairment recovery of COP$41,062

million in 2016. The net reversal of the impairment was due to the inclusion, in the assessment of the recovery amount of this

segment’s assets, of flows associated with the Port of Tumaco that positively affects the recoverable amount of the southern

transportation unit (See Note 18.3 to our consolidated financial statements for more detail).

The impairment recovery of non-current assets

recognized in the segment in 2016 totaled COP$41,062 million in 2016 as compared to COP$81,388 million loss in 2015, a decrease

of 150.5% as compared to 2015 mainly due to the incorporation, in the assessment of the recovery amount of this segment’s

assets, of flows associated to the San Fernando - Apiay system project that affects the recoverable amount of the Llanos transportation

line, partially offset by an increase in impairment of assets related to the southern transportation line.

The segment recorded net income attributable

to owners of Ecopetrol of COP$2,999,978 million in 2017 as compared to net income of COP$2,960,449 million in 2016 and COP$2,819,759

million in 2015.

In 2017, the refining and petrochemical

segment sales were COP$28,644,016 million compared to COP$24,823,714 million in 2016. In 2017, sales of refined products and petrochemicals

increased by 15.4% as compared with 2016, mainly due to an increase of our average products basket price due to the increase in

the international prices. This increase was partially offset by (i) a decrease in exports of fuel oil primarily due to reduced

production at the Barrancabermeja refinery as a result of reliance on more efficient alternative sources and stabilization of the

coker unit at Reficar and (ii) a decrease in exports of diesel due to our commercial strategy of focusing on selling to the domestic

market due to better commercial conditions, replacing lace imports of such products.

In 2016, the refining and petrochemical segment

sales were COP$24,823,714 million compared to COP$23,245,676 million in 2015. In 2016, sales of refined products and petrochemicals

increased by 6.8% as compared with 2015, mainly due to an increase in the volume of domestic and export sales mainly in mid-distillates

due to the startup of operations at Reficar. This increase was partially offset by a decrease of our average products basket price

due to the decrease in the international price of crude oil.

The cost of sales for our refined products

and petrochemicals segment is mainly related to the purchase of crude oil and natural gas for our refineries, imported products

to supply local demand, feedstock transportation services, services contracted for maintenance of the refineries and the amortization

and depreciation of refining assets. Cost of sales amounted COP$26,855,395 million in 2017, compared to COP$22,843,987 million

in 2016 and COP$20,758,808 million in 2015.

In 2017, the cost of sales for this segment

increased 18% as compared with 2016, principally due to (i) an increase in purchases of crude oil at increased international benchmark

prices and (ii) higher volumes of imports of crude oil and inter-segment purchases of crude oil for Reficar. This increase was

partially offset by lower imports of other fuels, especially diesel and gasoline, due to the use of products produced by Reficar

rather than imported products.

In 2016, the cost of sales for this segment

increased 10% as compared with 2015, principally due to the operation of Reficar’s units in 2016 which led to (i) an increase

in crude oil purchases through import and inter-segment transactions as Reficar required a special feedstock during the stabilization

and performance testing period which increased production cost, (ii) an increase in the depreciation of Reficar’s units (iii)

inventory consumption that had been in stock in December 2015, and (iv) higher costs for services contracted, materials of process,

maintenance and electrical power. This increase was partially offset by lower imports of products and the excellent operational

performance of the Barrancabermeja refinery.

In 2017, operating expenses before the impairment

of non-current assets decreased by 17.2% as compared to 2016, due a decrease of stabilization expenses of Reficar and a decrease

in taxes because of the reduction of the wealth tax rate.

In 2016, operating expenses before the impairment

of non-current assets increased by 27.3% as compared to 2015, due to an increase in labor expenses related to our voluntary retirement

plan in 2016 and other expenses related to the start-up of operations at Reficar.

The net reversal of impairment of

non-current assets recognized in the segment in 2017, which totaled COP$1,067,965 million in 2017 as compared to an

impairment loss of COP$773,361 million in 2016, decreased as compared to 2016 as a result of (i) a net reversal of the

impairment of Reficar as a result of an improved outlook in refining margins due to the anticipated effects of the

ratification of the International Convention for the Prevention of Pollution from Ships (Marpol), which goes into effect in

2020, (ii) a lower discount rate resulting from the application of WACC methodology and (iii) operational and financial

optimization due to the stabilization of the refinery. This reversal was partially offset by Bioenergy’s impairment

related to the change of the project start date, the process of stabilization of the industrial plant, the updating of

operational variables and the financial expenses of the Barracabermeja refinery’s modernization project, which is

currently postponed.

The impairment losses of non-current assets

recognized in the segment in 2016, which totaled COP$773,361 million as compared to COP$3,278,993 million in 2015, decreased by

76.4% as compared to 2015. The 2016 scenario incorporated refining margins including the effect of Marpol in 2016 compared to 2015,

partially offset by the effect of adjustment of operational variables based on that observed during Reficar’s stabilization

period and new ethanol prices on Bioenergy’s impairment (See Note 18.2 to our consolidated financial statements for more

details).

As mentioned earlier, the refining segment

is highly sensitive to changes in product prices and feedstock in the international market, the discount rate, the refining margins,

changes in environmental regulations and cost structure and the level of capital expenditures.

The refining and petrochemicals segment

recorded net income attributable to owners of Ecopetrol of COP$358,859 million in 2017, as compared to a net loss attributable

to owners of Ecopetrol of COP$1,823,020 million in 2016 and COP$4,016,050 million in 2015.

Our principal source of liquidity in 2017

was cash flows from our operations amounting to COP$16,973,626 million.

Our principal uses of cash in 2017 were

(i) COP$11,259,492 million in debt payments through the pre-payment of foreign currency-denominated loans totaling US$1,925 million

in June 2017 and US$475 million in December 2017, (ii) COP$$5,965,556 million in capital expenditures, which included investments

in property, plant and equipment and natural and environmental resources, (iii) dividend payments for the fiscal year 2016 amounting

to COP$1,504,647 million, which includes dividends relating to fiscal year 2016 for COP$945,661 million and the payment of dividends

to non-controlling interest in 2017 for COP$558,986 million.

Net cash provided by operating activities

increased by 19.3% in 2017 as compared to 2016, mainly as a result of (i) a 32.7% increase in our operational income before depreciation,

depletion and amortization (DD&A) and impairment of non-current assets and efficiency gains and cost-savings generated by our

corporate strategy. This increase was partially offset by (i) higher working capital needs mainly due to increase in accounts receivable

from the FEPC and commercial receivables accounts and (ii) an increase in our costs due to the effect of recovery in international

crude oil prices on our purchases and an increase in maintenance activities, contracted services and operating supply needs associated

with an increase in our operational activities.

Net cash provided by operating activities

increased by 21.9% in 2016 as compared to 2015, mainly as a result of (i) lower working capital needs mainly due to the higher

oil prices observed at the end of 2016 versus the end of 2015, (ii) a 4% increase in our operational income before depreciation,

depletion and amortization (DD&A) and impairment of non-current assets resulting from a decrease in our costs and operational

expenses (before DD&A and impairment) due to our savings generated by the transformation plan. This increase was partially

offset by (i) the decrease in international prices of crude oil during 2016, and (ii) an increase in income tax paid by the transportation

and logistics segment due to the better results in 2015.

In 2017, net cash used in investing activities

decreased by 53.3% as compared to 2016, mainly as a result of a 110.4% decrease in our investment portfolios as a result of pre-payments

of foreign currency-denominated loans totaling US$2,400 million in 2017. This decrease was partially offset by (i) cash proceeds

from the sale of our shares in Empresa de Energía de Bogotá, which totaled COP$56,930 million in the aggregate and

(ii) a 4.6% increase in investments in capital expenditures, which was driven mainly by the reactivation of activity in our Castilla

and Rubiales fields, the development of improved recovery projects in fields such as La Cira and Chichimene, and an increase in

exploration activities.

In 2016, net cash used in investing activities

decreased by 26.8% as compared to 2015, mainly as a result of: (i) a 62.4% decreased investment in capital expenditures due to

the effect of decreasing oil prices and the conclusion of the Reficar modernization project, and (ii) additional cash proceeds

from the sale of our investments in Empresa de Energía de Bogotá and Interconexión Electrica S.A., which totaled

COP$966,715 million in the aggregate. This decrease was partially offset by increased investments of our excess liquidity in our

investment portfolios, which in turn resulted from the savings we achieved and the recovery of the price of oil during the second

half of 2016.

Net cash used in financing activities increased

by 362% in 2017, as compared to 2016, due to (i) prepayments of foreign currency-denominated loans totaling US$2,400 million and

(ii) an increase in dividends payments to the shareholders of Ecopetrol of COP$255,484 million in 2017 as compared to 2016, which

was partially offset by a COP$463,135 million decrease in dividend payments made by certain of our subsidiaries to their non-controlling

shareholders.

Net cash used in financing activities increased

by 98.5% in 2016, as compared to 2015, due to a decrease in cash from borrowings of COP$5,151,937 million which was partially offset

by a decrease in dividends payments of COP$3,781,099 million in 2016 as compared to 2015.

Our consolidated capital expenditures in

2017, 2016 and 2015 were COP$6,107,506 million, COP$5,837,477 million and COP$15,517,949 million, respectively. These investments

were distributed by business segment on average, for the past three years as follows: 64.9% for the exploration and production

segment, 17.4% for refining and petrochemicals and 17.7% for the transportation and logistics segment. See Note 33.3 to our consolidated

financial statements for more detail about capital expenditures by segment.

Our investment plan approved for 2018 is

a range of between US$3,500 million and US$4,000 million. The investments will be distributed approximately as follows: 85% for

exploration and production, 14% for refining, petrochemicals, and transportation and logistics, and 1% for other investments.

The resources required for the investment

plan will be funded through internal cash generation with no need to raise additional net financing.

In 2017, we paid dividends of COP$945,661

million to Ecopetrol’s shareholders, including the Nation, and dividends paid to non-controlling shareholders of our subsidiaries

totaling COP$558,986 million.

In 2016, we paid the last installment of

dividends relating to 2014 net income to the Nation for COP$690,177 million and our transportation and logistics subsidiaries paid

dividends to their non-controlling shareholders for COP$1,022,121 million. Given the net loss we reported in 2015, our shareholders

at the ordinary general shareholder’s meeting did not approve distribution of dividends for 2015.

On March 23, 2018, our shareholders at

the ordinary General Shareholders Assembly approved a distribution of dividends for the fiscal year ended December 31, 2017 amounting

to COP$3,659,386 million, or COP$89 per share, based on the number of outstanding shares as of December 31, 2017. The dividend

payment was approved to be made in one installment for the minority shareholders of Ecopetrol on April 19, 2018 and two installments

for the Nation, the first paid on April, 19 2018 and the second installment to be paid on September, 17 2018.

We prepare our interim and annual statutory

financial information in accordance with our internal reporting policies, which follow Colombian IFRS and differ in certain significant

aspects from IFRS. The following table sets forth our consolidated net income and equity for years ended December 31, 2017, 2016

and 2015, in accordance with Colombian IFRS and IFRS:

As noted above, certain differences exist

between our net income and equity as determined in accordance with our internal reporting policies, which follow Colombian IFRS,

which are used for management reporting purposes, as presented in the business segment information, and our net income and equity

as determined under IFRS, as presented in our consolidated financial statements.

The primary differences between Colombian

IFRS and IFRS as they apply to our results of operations are summarized below:

Under Colombian IFRS, the General

Accounting Office of the Nation (CGN for its acronym in Spanish) issued Resolution 509, which allows companies to apply hedge

accounting for non-derivative financial instruments from any date within the transition period or the first period of

application of International Accounting Standards in Colombia, even if such company has not yet formally documented the

hedging relationship, the objective or the risk management strategy. Under these rules, Ecopetrol applied cash flow hedge

accounting from January 1, 2015 in its financial statements under Colombian IFRS.

As a result of this accounting policy difference,

for the year ended December 31, 2017, our net income as reported under IFRS was COP$366,048 million higher than our net income

as reported under Colombian IFRS.

Ecopetrol’s functional currency is

the Colombian Peso and it consolidates some subsidiaries whose functional currency is the U.S. dollar but who settled their taxes

in Colombian Pesos. As a result of the application of paragraph 41 – IAS 12, such subsidiaries are required to calculate

deferred taxes under IFRS.

As a result of this accounting policy difference,

for the year ended December 31, 2017, our net income attributable to owners of Ecopetrol as reported under IFRS was COP$192,079

million higher than our net income attributable to owners of Ecopetrol as reported under Colombian IFRS.

The application of IAS12.41 also generated

adjustments to our goodwill and investments in companies impairments of COP$61,893 million in 2017, COP$86,781 million in 2016

and COP$418,872 million in 2015 in connection with our purchase of subsidiaries whose functional currency is the U.S. dollar as

well as adjustments to our revenue from the equity method of COP$60,748 million in 2017, COP$71,056 million in 2016 and COP$81,808

million in 2015 in connection with our associates and joint ventures whose functional currency is the U.S. dollar.

As a result of these accounting policy

differences described above, for the year ended December 31, 2017, we reported net income attributable to the owners of Ecopetrol

under IFRS of COP$7,148,539 million as opposed to a net income attributable to the owners of Ecopetrol of COP$6,620,412 million

reported under Colombian IFRS for the same period. For the year ended December 31, 2016, these same accounting differences led

us to report net income attributable to the owners of Ecopetrol under IFRS of COP$2,447,881 million as opposed to a net income

attributable to the owners of Ecopetrol of COP$1,564,709 million reported under Colombian IFRS for the same period. For the year

ended December 31, 2015, these same accounting differences led us to report a net loss under IFRS of COP$7,193,859 million as opposed

to a net loss of a COP$3,987,726 million reported under Colombian IFRS for the same period.

As of December 31, 2017, we had outstanding

consolidated indebtedness of COP$43.5 trillion, which corresponded primarily to the following long-term transactions:

* Reopening

of bond due to 2023.

** Bank

loans refinanced from their original conditions.

*** Debt

obtained by Reficar for the Refinery modernization voluntarily assumed by Ecopetrol.

On April 13, 2018, Ecopetrol

redeemed all of its outstanding 4.250% notes due September 18, 2018 in an aggregate principal amount of US$350 million. The notes

were issued in September 2013.

We enter into various commitments and contractual

obligations that may require future cash payments. The following table summarizes our contractual obligations as of December 31,

2017.

The table does not include the contractual

obligations of Equion, Savia and Ecodiesel, which do not consolidate within the Ecopetrol’s Group.

As of December 31, 2017, we did not have

off-balance sheet arrangements of the type that is required to be disclosed under Item 5.E of Form 20-F.

Ecopetrol updated its 2020 Business Plan

on September 29, 2016. This Plan is based on three fundamental pillars: i) protection of cash and cost efficiency; ii) strict capital

discipline; and iii) growth in reserves and production; these pillars will strengthen the Company’s financial sustainability

and afford it opportunities for both organic and inorganic growth, generating value and profitability for its shareholders.

According to this business plan, during

2018 the Company will continue to pursue its transformation to ensure operational and financial sustainability. It will focus on

multi-year fields development plans; improved return on assets; committing ourselves to integrity, safe operations, environment

consciousness and joint prosperity with communities in which we operate and execute projects.

We believe that our strategy of diversifying

our export destinations and sales under term contracts with fixed discounts to reference prices will help to mitigate the impact

of crude oversupply over the spread of our export basket.

Furthermore, with the full operation of

all of the units of Reficar since 2016 and shifting from stabilization to optimization, Ecopetrol’s trade balance is expected

to continue improving due to the reduction of gasoline imports and incremental exports of fuels. Reficar’s fuels production

is expected to continue being allocated primarily in the domestic market, with a surplus to be exported.

Adding profitable reserves and maintaining

the pace of production are the Company’s priorities. The exploration campaign will be focused in regions with strong prospects.

Investment in exploration will be approximately US$400-US$450 million, allocated mainly to the evaluation and appraisal of discoveries

and ongoing exploration efforts of Ecopetrol S.A., Hocol, Ecopetrol America Inc., Ecopetrol Mexico, Ecopetrol Costa Afuera and

Ecopetrol Brazil.

We stress that a strong cash position allows

us to assess opportunities for inorganic growth of Ecopetrol’s reserves.

The following table provides information

about the sensitivity analysis conducted on our oil and gas reserves as of December 31, 2017, taking into account ICE Brent

crude oil prices that reasonably reflect management’s view of crude oil prices given prevailing market conditions.

The conversion

rate used is 5,700 cf = 1 boe.

The following table provides information

about the sensitivity of our results as of December 31, 2017, due to variations of US$1 in the price of ICE Brent crude and

of 1% in the COP$/US$ exchange rate.

The table below sets forth the line items

that are being affected by the variation on the reference prices or the average exchange rate.

Table 55

|

VARIATION ON ICE BRENT REFERENCE PRICE

|

VARIATION ON AVERAGE EXCHANGE RATE

|

|

|

REVENUE

|

|

|

|

|

Sales of crude oil

|

Sales of crude oil

|

|

Sales of refined products

|

Sales of refined products

|

|

Sales of natural gas

|

Sales of natural gas

|

|

|

COST OF SALES

|

|

Local purchases from business partners

|

Local purchases from business partners

|

|

Local purchases of hydrocarbons from the ANH

|

Local purchases of hydrocarbons from the ANH

|

|

Local purchases of natural gas

|

Local purchases of natural gas

|

|

Imports of products

|

Imports of products

|

5.1

Risk

Factors

The risks discussed below could have a

material adverse effect, separately or in combination, on our business’s operating results, cash flows, liquidity and financial

condition. Investors should carefully consider these risks.

5.1.1

Risks

Related to Our Business

This section describes the most significant

potential risks to our business.

Our crude oil and natural gas

reserve estimates involve some degree of uncertainty and may prove to be incorrect over time, which could adversely affect our

ability to generate revenue.

Reserves estimates are prepared using generally

accepted geological and engineering evaluation methods and procedures. Estimates are based on geological, topographical and engineering

facts. Actual reserves and production may vary materially from estimates shown in this annual report, and downward revisions in

our reserve estimates could lead to lower future production which could affect our results of operations and financial condition.

Hydrocarbon reserves presented in this

annual report were calculated in accordance with SEC regulations. As required by those regulations, reserves were valued based

on the unweighted average of closing prices for the first day of each month in the 12-month periods ended December 31, 2017, 2016

and 2015, as well as other conditions in existence at those dates. The average of closing prices of ICE Brent crude oil for the

first day of each month in the 12-month period was US$55.57 per barrel in 2015, US$44.49 per barrel in 2016 and US$54.93 per

barrel in 2017. In 2016, the Company recognized a reduction in oil and gas proven reserves of 14% in 2016 as compared to 2015,

to 1,598 mmboe in 2016 from 1,849 mmboe in 2015. In 2017, the Company recognized an increase in oil and gas proven reserves of

4% as compared to 2016, to 1,659 mmboe in 2017 from 1,598 mmboe in 2016. For more information, see the section

Business Overview—Exploration

and Production—Reserves

.

Furthermore, at least once a year, or more

frequently if the circumstances require, the Company ascertains whether there are signs of impairment to its assets or cash-generating

units (CGUs) due to the difference between the carrying amount of such assets or CGUs as opposed to their recoverable amounts,

using reasonable assumptions, based on internal and external factors, which reflect market conditions. The recoverable amount is

considered to be the higher of the fair value minus costs of disposal and value in use, based on the free cash flow method, discounted

at the weighted average capital cost (WACC). Whenever the recoverable amount of an asset or CGU is lower than its net carrying

amount, such amount is reduced to its recovery amount, recognizing a loss for impairment as an expense in the consolidated statement

of profit or loss. External and internal sources of information may indicate that an impairment loss recognized for an asset, other

than goodwill, may no longer exist or may have decreased, in this case, the reversal is recognized a gain for impairment in the

consolidated statement of profit or loss.

In 2017, Ecopetrol had a COP$1,311,138

million net reversal of impairments recorded in previous years primarily as a result of improved hydrocarbon prices outlook, incorporation

of new reserves, Ecopetrol’s crude oil basket price discount as compared to the ICE Brent crude oil price, improved refining

margins outlook and technical operational capacity, among other factors. For additional information about this impairment charges,

see Note 18 to our consolidated financial statements.

Any significant change in estimates and

judgments could have a material effect on the quantity and present value of our proved reserves and subsequently on the recognition

or recovery of impairment charges. Changes to estimations of reserves are applied prospectively to the amounts of depreciation,

depletion and amortization charged and, consequently, the carrying amounts of exploration and production assets.

In order to assess the possible impact

of current expected oil price scenarios and market conditions, as well as of further developments driven by the economic environment

for the oil and gas industry, the Company has performed a sensitivity analysis over its proved reserve balance as of December 31,

2017. Based on these calculations, assuming an average price per barrel of ICE Brent crude oil of US$55 per barrel in 2018, US$60

per barrel in 2019, US$65 in 2020, US$70 in 2021 and US$75 per barrel for later years, Ecopetrol could recognize an increase in

oil and gas proved reserves of approximately 3.3%. This analysis takes into account Ecopetrol’s estimates and expectations

regarding the main assumptions used in its proven reserve calculation, which final actual result may fluctuate and differ substantially

from those provided herein due to several factors outside of the control of the Company. For additional information see the section

Financial Review—Trend Analysis and Sensitivity Analysis

.

On the contrary, any downward revision

in our estimated quantities of proved reserves would indicate lower future production volumes, which could result in higher expenses

for depreciation, depletion and amortization for properties to which we apply the units of production method for calculating these

expenses. These higher expenses, and any lower revenues as a result of actual production volumes and realized prices, could adversely

impact our results of operations and financial condition.

Achieving our long-term growth depends

on our ability to execute our strategic plan — specifically, the discovery and successful development of additional reserves.

Our long-term growth objectives depend

largely on our ability to discover and/or acquire new reserves, and in turn developing them successfully and improving the recovery

factor in our mature oil fields. Our exploration activities expose us to the inherent geological and drilling risks including the

risk of not discovering commercially viable crude oil or natural gas reserves; and the risk that some exploratory wells initially

budgeted for may be drilled at a later stage or not be drilled at all. Despite the effort we make to control costs associated with

drilling, these are often uncertain, and numerous factors beyond our control may cause drilling operations to be curtailed, delayed

or cancelled.

Our ability to add and develop reserves

also depends on our capacity to structurally reduce costs to maintain the profitability of oil fields already being exploited.

If we are unable to successfully discover

and develop additional reserves, or if we do not acquire properties having proved reserves, our reserves portfolio will decline.

Failure to secure additional reserves may impede us from achieving or maintaining production targets, and may have a negative impact

on our results of operations and financial condition.

See the section

Strategy and Market

Overview—Our Corporate Strategy

for a discussion of our strategic plan.

Our business depends substantially

on international prices for crude oil and refined products. The prices for these products are volatile; a sharp decrease could

adversely affect our business prospects and results of operations.

In 2017, in Ecopetrol, approximately 92.4%

of the revenues came from sales of crude oil, natural gas and refined products and 87% of the total volume sold of these products

is indexed to international reference prices or benchmarks such as ICE Brent. Consequently, fluctuations in those international

indexes have a direct effect on our financial condition and results of operations.

Prices of crude oil, natural gas and refined

products have traditionally fluctuated as a result of a variety of factors including, among others, competition within the international

oil and natural gas industry; long-term changes in the demand for crude oil (as further explained below), natural gas and refined

products; the economic policies in the United States, China and the European Union; regulatory changes; changes in global supply,

such as the current market conditions shifting from oversupply to a balanced crude oil market; inventory levels; changes in the