Matador Resources Company (NYSE: MTDR) (“Matador” or the

“Company”) and its midstream affiliate, San Mateo Midstream, LLC

(“San Mateo”), today announced the completion and successful

start-up of the expansion of San Mateo’s Black River cryogenic

natural gas processing plant (the “Black River Processing Plant”)

in Matador’s Rustler Breaks asset area in Eddy County, New Mexico.

The expansion of the Black River Processing Plant adds an

incremental designed inlet capacity of 200 million cubic feet of

natural gas per day to the previously existing designed inlet

capacity of 60 million cubic feet of natural gas per day for a

total designed inlet capacity of 260 million cubic feet of natural

gas per day. The expanded Black River Processing Plant supports

Matador’s exploration and development activities in the Delaware

Basin and, with the expanded capacity, is expected to offer

processing opportunities for other producers’ development efforts

as well. Prior to this expansion, the Black River Processing Plant

had been full of Matador’s natural gas even though San Mateo had

been operating the plant at approximately 10% above its designed

inlet capacity of 60 million cubic feet of natural gas per day.

In addition, San Mateo has completed a natural gas liquids

(“NGL”) pipeline connection at the Black River Processing Plant to

the NGL pipeline owned by EPIC Y Grade Pipeline LP. This NGL

connection provides several significant benefits to Matador and

other San Mateo customers compared to trucking the NGLs out of the

area. San Mateo’s customers receive (i) firm NGL takeaway out of

the Delaware Basin, (ii) increased NGL recoveries, (iii) improved

pricing realizations through lower transportation and fractionation

(T&F) costs and (iv) increased optionality through San Mateo’s

ability to operate the Black River Processing Plant in ethane

recovery mode, if desired. In addition, San Mateo expects the NGL

connection to lower operating costs at the Black River Processing

Plant and provide operational advantages as transportation by

pipeline rather than by truck reduces operational risks, such as

weather-related interruptions or insufficient trucking

capacity.

Joseph Wm. Foran, Chairman and Chief Executive Officer of

Matador, said, “We are excited to announce that the expansion of

the Black River Processing Plant was completed both on time and on

budget. Along with the addition of the NGL connection, the Black

River Processing Plant and associated residue gas pipeline provide

Matador reliable transportation for its Rustler Breaks natural gas

and NGLs out of the basin.

“The Board and I congratulate the members of our midstream team

for the significant value they have created thus far through their

efforts and strong execution, and we also appreciate the support

from our San Mateo joint venture partner, Five Point Energy LLC.

These efforts ensure firm takeaway capacity for Matador’s natural

gas and NGLs coming from our Rustler Breaks and Wolf asset areas,

provide reliable transportation for Matador’s oil production from

those asset areas by the third quarter of 2018 and establish core

assets for the strategic relationship with a subsidiary of Plains

All American Pipeline, L.P. (NYSE: PAA) announced earlier this

year.”

Please direct any commercial inquiries about the Black River

Processing Plant and related gathering and processing services

provided in Eddy County, New Mexico or San Mateo’s other services,

including salt water gathering and disposal services and oil

gathering, transportation and blending services, to: Corey

Lothamer, San Mateo’s Vice President of Business Development, at

(972) 371-5203 or info@sanmateomidstream.com.

About Matador Resources Company

Matador is an independent energy company engaged in the

exploration, development, production and acquisition of oil and

natural gas resources in the United States, with an emphasis on oil

and natural gas shale and other unconventional plays. Its current

operations are focused primarily on the oil and liquids-rich

portion of the Wolfcamp and Bone Spring plays in the Delaware Basin

in Southeast New Mexico and West Texas. Matador also operates in

the Eagle Ford shale play in South Texas and the Haynesville shale

and Cotton Valley plays in Northwest Louisiana and East Texas.

Additionally, Matador conducts midstream operations, primarily

through its midstream joint venture, San Mateo Midstream, LLC, in

support of its exploration, development and production operations

and provides natural gas processing, oil transportation services,

natural gas, oil and salt water gathering services and salt water

disposal services to third parties.

For more information, visit Matador Resources Company at

www.matadorresources.com.

About San Mateo Midstream, LLC

San Mateo is a strategic joint venture formed in February 2017

by a subsidiary of Matador and a subsidiary of Five Point Energy

LLC. San Mateo provides an all-inclusive approach to midstream

services for the three main product streams produced by oil and

natural gas activities, including salt water gathering and disposal

services, natural gas gathering, compression, treating and

processing services, and oil gathering, transportation and blending

services. San Mateo owns and operates oil, natural gas and water

gathering and transportation systems in Eddy County, New Mexico and

Loving County, Texas, the Black River Processing Plant in Eddy

County, New Mexico with a designed inlet capacity of 260 million

cubic feet of natural gas per day and six commercial salt water

disposal wells in Eddy County, New Mexico and Loving County, Texas.

San Mateo serves as one of the primary midstream solutions for

multiple customers across the northern Delaware Basin, including

its anchor customer, Matador Resources Company.

For more information, visit San Mateo Midstream, LLC at

www.sanmateomidstream.com.

Forward-Looking Statements

This press release includes “forward-looking statements” within

the meaning of Section 27A of the Securities Act of 1933, as

amended, and Section 21E of the Securities Exchange Act of 1934, as

amended. “Forward-looking statements” are statements related to

future, not past, events. Forward-looking statements are based on

current expectations and include any statement that does not

directly relate to a current or historical fact. In this context,

forward-looking statements often address expected future business

and financial performance, and often contain words such as “could,”

“believe,” “would,” “anticipate,” “intend,” “estimate,” “expect,”

“may,” “should,” “continue,” “plan,” “predict,” “potential,”

“project,” “hypothetical,” “forecasted” and similar expressions

that are intended to identify forward-looking statements, although

not all forward-looking statements contain such identifying words.

Such forward-looking statements include, but are not limited to,

statements about guidance, projected or forecasted financial and

operating results, results in certain basins, objectives, project

timing, expectations and intentions and other statements that are

not historical facts. Actual results and future events could differ

materially from those anticipated in such statements, and such

forward-looking statements may not prove to be accurate. These

forward-looking statements involve certain risks and uncertainties,

including, but not limited to, the following risks related to

financial and operational performance: general economic conditions;

the Company’s ability to execute its business plan, including

whether its drilling program is successful; changes in oil, natural

gas and natural gas liquids prices and the demand for oil, natural

gas and natural gas liquids; its ability to replace reserves and

efficiently develop current reserves; costs of operations; delays

and other difficulties related to producing oil, natural gas and

natural gas liquids; delays and other difficulties related to

regulatory and governmental approvals and restrictions; its ability

to make acquisitions on economically acceptable terms; its ability

to integrate acquisitions; availability of sufficient capital to

execute its business plan, including from future cash flows,

increases in its borrowing base and otherwise; weather and

environmental conditions; the operating results of the Company’s

midstream joint venture’s expansion of the Black River cryogenic

processing plant; the timing and operating results of the buildout

by the Company’s midstream joint venture of oil, natural gas and

water gathering and transportation systems and the drilling of any

additional salt water disposal wells; and other important factors

which could cause actual results to differ materially from those

anticipated or implied in the forward-looking statements. For

further discussions of risks and uncertainties, you should refer to

Matador’s filings with the Securities and Exchange Commission

(“SEC”), including the “Risk Factors” section of Matador’s most

recent Annual Report on Form 10-K and any subsequent Quarterly

Reports on Form 10-Q. Matador undertakes no obligation and does not

intend to update these forward-looking statements to reflect events

or circumstances occurring after the date of this press release,

except as required by law, including the securities laws of the

United States and the rules and regulations of the SEC. You are

cautioned not to place undue reliance on these forward-looking

statements, which speak only as of the date of this press release.

All forward-looking statements are qualified in their entirety by

this cautionary statement.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20180419006423/en/

Matador Resources CompanyMac Schmitz, 972-371-5225Capital

Markets Coordinatorinvestors@matadorresources.com

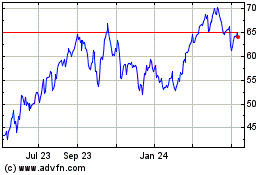

Matador Resources (NYSE:MTDR)

Historical Stock Chart

From Mar 2024 to Apr 2024

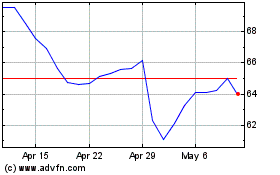

Matador Resources (NYSE:MTDR)

Historical Stock Chart

From Apr 2023 to Apr 2024