The Northern Pool to Partner with Northern Trust for £46bn Mandate

April 19 2018 - 4:38AM

Business Wire

Mandate for UK Local Government Pension Pool

includes Services to Support Governance and Transparency

The Northern Pool has appointed Northern Trust (Nasdaq: NTRS),

subject to contract, to provide a broad range of custodial and

administration services, including securities lending, private

equity fund administration, compliance monitoring and carbon

reporting.

The appointment follows a very competitive process which was

supported by the global post-trade risk and custody specialists,

Thomas Murray.

The newly-created pool, comprising Greater Manchester Pension

Fund, West Yorkshire Pension Fund and Merseyside Pension Fund, is

one of the largest of eight local government pension pools in the

UK, and has £46bn (approx. $65.8bn) of assets under management.

As the Northern Pool implements its operating infrastructure,

this appointment underlines its commitment to ensuring the highest

levels of asset safety, governance and transparency in reporting,

and includes specialist private equity fund administration

solutions for its allocation to alternative assets.

“Northern Trust is delighted to support the Northern Pool with a

range of services, including reporting solutions to meet their

requirements for heightened investment governance and transparency

over investments,” said James Wright, head of Northern Trust’s

Institutional Investor Group, for the UK, Middle East and Africa.

“We are excited to be working alongside them to deliver tailored

solutions that match the scale of their ambitions.”

Northern Trust is a leading private equity fund administrator

and recently expanded its capabilities in the UK, responding to

increasing client allocations to this asset class. It is also a

leading asset servicing provider of alternative investments more

broadly, servicing more than US$1 trillion of assets worldwide on

behalf of leading asset managers and asset owners.

Ian Greenwood, chair of the Northern Pool, said: “We appointed

Northern Trust based on their proven experience in the UK pensions

market and their ability to offer us a range of holistic reporting,

custody and alternative administration solutions, in accordance

with the government’s requirements of putting the highest and most

expedient levels of regulation and asset safety at the heart of the

Northern Pool.

“Their collaborative approach and willingness to support our

evolving requirements with bespoke solutions were key factors in

their appointment.”

Northern Trust has an ongoing commitment to pension schemes,

with clients including some of the UK’s largest and most

sophisticated investors. It offers an extensive range of services

to UK schemes, from assisting with their challenges around risk,

regulation, transparency and governance, to meeting requirements

for heightened investment oversight and control through data

aggregation and book of record solutions.

About The Northern Pool

The Northern Pool is one of Britain’s largest public investment

funds. It has been formed from the combined assets of the Greater

Manchester, West Yorkshire and Merseyside local government pension

scheme (LGPS) funds, and represents about a fifth of total LPGS

assets with £46bn of funds under management.

About Thomas Murray

TM is a unique provider of insights into the various risks to

which investors are exposed through their arrangements with global

custodians and depositary banks, and their subsequent network

exposures to sub-custodians, capital market infrastructures and

central securities depositories. Founded in 1994, TM has offices in

the UK (London - its headquarters), Australia (Melbourne) and

Canada (Toronto), and it also has representation in New York.

www.thomasmurray.com

About Northern Trust

Northern Trust Corporation (Nasdaq: NTRS) is a leading provider

of wealth management, asset servicing, asset management and banking

to corporations, institutions, affluent families and individuals.

Founded in Chicago in 1889, Northern Trust has offices in the

United States in 19 states and Washington, D.C., and 23

international locations in Canada, Europe, the Middle East and the

Asia-Pacific region. As of March 31, 2018, Northern Trust had

assets under custody/administration of US$10.8 trillion, and assets

under management of US$1.2 trillion. For more than 125 years,

Northern Trust has earned distinction as an industry leader for

exceptional service, financial expertise, integrity and innovation.

Visit northerntrust.com or follow us on Twitter @NorthernTrust.

Northern Trust Corporation, Head Office: 50 South La Salle

Street, Chicago, Illinois 60603 U.S.A., incorporated with limited

liability in the U.S. Global legal and regulatory information can

be found at https://www.northerntrust.com/disclosures.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20180419005553/en/

Northern TrustEurope, Middle East, Africa &

Asia-Pacific Contact:Camilla Greene+44 (0) 207 982

2176Camilla_Greene@ntrs.comorMat Barling+44 (0) 207 982

1445Mathew_Barling@ntrs.comorUS & Canada Contact:John

O’Connell+1 312 444 2388John.O'Connell@ntrs.com

Northern (NASDAQ:NTRS)

Historical Stock Chart

From Mar 2024 to Apr 2024

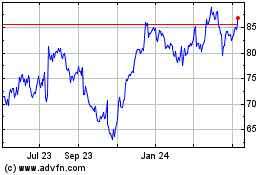

Northern (NASDAQ:NTRS)

Historical Stock Chart

From Apr 2023 to Apr 2024