UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934

Filed by the Registrant [X] Filed by a Party other than the Registrant [ ]

Check the appropriate Box:

[ ]

Preliminary Proxy Statement

[ ]

Confidential for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

[ ]

Definitive Proxy Statement

[ ]

Definitive Additional Materials

[X]

Soliciting Material Pursuant to §240.14a-12

HomeStreet, Inc.

(Name of Registrant as Specified In Its Charter)

Payment of Filing Fee (Check the appropriate box):

[X] No fee required.

[ ]Fee computed on table below per Exchange Act Rules 14a-6(i)(l) and 0-11.

1) Title of each class of securities to which transaction applies:

2) Aggregate number of securities to which transaction applies:

3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11

(Set forth the amount on which the filing is calculated and state how it was determined):

4) Proposed maximum aggregate value of transaction:

5) Total Fee Paid:

[ ]Fee paid previously with preliminary materials.

[ ]Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

1) Amount Previously Paid:

2) Form, Schedule or Registration Statement No.:

3) Filing Party:

4) Date Filed:

On April 18, 2018, HomeStreet, Inc. (the “Company”) sent an annual report to its shareholders, together with its definitive proxy statement with respect to the 2018 Annual Meeting of Shareholders. The annual report contained the following material, in addition to a copy of Annual Report on Form 10-K, which was filed with the Securities and Exchange Commission on March 6, 2018:

To our fellow Shareholders,

Thank you for your investment in HomeStreet. 2017 was a year of meeting challenges: we grew our Commercial and Consumer Banking business in a very competitive environment, further diversifying our earnings; and we restructured our mortgage operations to better align origination capacity and our cost structure with falling demand for mortgages, as interest rates rose and housing inventories in our primary markets contracted.

We are proud of the results our strategic plan has shown to date. This plan has transformed HomeStreet from a troubled thrift into a regional community bank with a diversified array of products and services and has produced substantial growth and shareholder value since our IPO in 2012.

The primary components of our strategic plan are to:

|

|

|

|

•

|

Grow and diversify earnings by expanding our Commercial and Consumer Banking business;

|

|

|

|

|

•

|

Focus growth in major western metropolitan markets;

|

|

|

|

|

•

|

Maintain strong credit quality through strict underwriting guidelines and actively monitoring the economic health of our markets; and

|

|

|

|

|

•

|

Invest in profitable growth through growing revenues faster than operating expenses.

|

Our Commercial and Consumer Banking business grew in 2017, primarily through organic growth but also through our acquisition of a retail deposit branch and related deposits in El Cajon, California, which brought approximately $21.5 million in customer deposits. During 2017, we also opened three de novo retail deposit branches in Baldwin Park, California and Spokane and Redmond, Washington. These branches should aid us in continuing to fund our growth and increase market share for our products and services.

HomeStreet’s Mortgage Banking business remains an important part of our heritage and the Company’s business strategy going forward. We believe that our 2017 restructuring has aligned our cost structure with our current production opportunities and will allow the Mortgage Banking Segment to achieve levels of expected profitability available in our markets today. Our retail focus, broad product mix, and competitive pricing have continued to attract some of the best retail originators in our markets and reinforce our position as a market-leading mortgage originator and servicer.

Highlights from 2017 include:

|

|

|

|

•

|

Our Commercial and Consumer Banking Segment increased net income from $30.8 million in 2016 to $42.1 million in 2017 driven primarily by an 18% increase in loans held for investment as compared to 2016, all of which was from organic growth.

|

|

|

|

|

•

|

Loans held for investment grew to $4.53 billion, an increase of $680.2 million from $3.85 billion at year-end 2016.

|

|

|

|

|

•

|

Increased net gain on the sale of commercial real estate and SBA loans contributed to 19% growth in non-interest income in our Commercial and Consumer Banking Segment during the year.

|

|

|

|

|

•

|

Asset quality continued to be strong, with nonperforming assets decreasing to 0.23% of total assets, representing our lowest absolute and relative levels of problem assets since 2006.

|

|

|

|

|

•

|

While the results of our Mortgage Banking Segment continued to be adversely impacted by rising interest rates and the limited supply of new and resale housing in our primary markets, we began to see the benefits of the restructuring we implemented in 2017.

|

|

|

|

|

•

|

Direct origination expenses are lower, and the successful implementation of our new loan origination system during 2017 should create opportunities for additional operating efficiencies going forward.

|

|

|

|

|

•

|

We continue to focus on optimizing our mortgage banking capacity within our existing geographic footprint and remain committed to being a leading mortgage originator and servicer in our markets.

|

|

|

|

|

•

|

The Tax Cuts and Jobs Act legislation enacted in December 2017 resulted in the recognition of a one-time, non-cash tax benefit of $23.3 million for 2017; our 2018 estimated consolidated effective tax rate is projected to be between 21% and 22%.

|

|

|

|

|

•

|

We placed 80

th

on Fortune Magazine’s 100 Fastest Growing Companies list of 2017.

|

Looking forward, the Board of Directors and management team at HomeStreet are focused on ensuring that we have sound corporate governance policies in place to protect the interests of all shareholders. As part of this commitment, the Board regularly reviews the skills, experience, and performance of its members and management to ensure that they are well-positioned to lead the Company for the benefit of all shareholders. To this end, we recently appointed a new director, Mark Patterson. Mark brings valuable perspectives as a sophisticated institutional investor with extensive operational experience in the financial services sector, as well as intimate knowledge of HomeStreet as a substantial individual shareholder.

We have also commenced a public search for an additional qualified candidate for the Board who meets the stated diversity goals set out in the Company’s Principles of Corporate Governance. We have met with some highly qualified candidates and expect to be able to appoint that additional director this year.

We are very proud of the hard work and dedication of our employees in achieving many of our strategic goals in 2017. The Board of Directors, management, and our great employees are excited to work together to enhance shareholder value through continuing our growth, maintaining low credit risk, improving operating efficiency, serving our clients, giving back to our communities, and being a great place to work.

Finally, I want to thank you, our shareholders, for your continued support and confidence in our company.

Mark K. Mason

Chairman, President, & Chief Executive Officer

HomeStreet, Inc.

FORWARD-LOOKING STATEMENTS

Certain statements contained in this letter are “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, including statements relating to the impact of new branches on our growth and market share, the effects of our 2017 restructuring, the effects of implementation of our new loan origination system, our 2018 estimated tax rate and the expected timing of the appointment of a new director to our board. When used in this letter, terms such as “anticipates,” “believes,” “continue,” “could,” “estimates,” “expects,” “intends,” “may,” “plans,” “potential,” “predicts,” “should” or “will” or the negative of those terms or other comparable terms are intended to identify forward-looking statements. These statements involve known and unknown risks, uncertainties and other factors that may cause us to fall short of our expectations or may cause us to deviate from our current plans, as expressed or implied by these statements. The known risks that could cause our results to differ, or may cause us to take actions that are not currently planned or expected, are described in the Company’s reports and filings with the Securities and Exchange Commission including, without limitation, the Company’s Annual Report on Form 10-K for the year ended December 31, 2017, under the heading Item 1A- “Risk Factors.” Unless required by law, the Company does not intend, and undertakes no obligation, to update or publicly release any revision to any forward-looking statements, whether as a result of the receipt of new information, the occurrence of subsequent events, the change of circumstance or otherwise. Each forward-looking statement contained in this letter is specifically qualified in its entirety by the aforementioned factors. Readers are cautioned not to place undue reliance on these forward-looking statements, which apply only as of the date of this letter.

* * * * *

IMPORTANT ADDITIONAL INFORMATION AND WHERE TO FIND IT

On April 17, 2018, the Company filed a definitive proxy statement on Schedule 14A and form of associated WHITE proxy card with the Securities and Exchange Commission (“SEC”) in connection with the solicitation of proxies for its 2018 Annual Meeting of Shareholders (the “Definitive Proxy Statement”). The Company, its directors and certain of its executive officers will be participants in the solicitation of proxies from shareholders in respect of the 2018 Annual Meeting of Shareholders. Information regarding the names of the Company’s directors and executive officers and their respective interests in the Company by security holdings or otherwise is set forth in the Definitive Proxy Statement. BEFORE MAKING ANY VOTING DECISION, INVESTORS AND SHAREHOLDERS OF THE COMPANY ARE URGED TO READ ALL RELEVANT DOCUMENTS FILED WITH OR FURNISHED TO THE SEC, INCLUDING THE COMPANY’S DEFINITIVE PROXY STATEMENT AND ANY SUPPLEMENTS THERETO AND ACCOMPANYING WHITE PROXY CARD, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. The Definitive Proxy Statement is first being sent to the shareholders of the Company on or about April 17, 2018 and is accompanied by a WHITE proxy card. Shareholders may also obtain a free copy of the Definitive Proxy Statement and other relevant documents that the Company files with the SEC from the SEC’s website at www.sec.gov or the Company’s website at www.homestreet.com/proxy as soon as reasonably practicable after such materials are electronically filed with, or furnished to, the SEC.

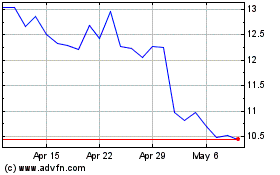

HomeStreet (NASDAQ:HMST)

Historical Stock Chart

From Mar 2024 to Apr 2024

HomeStreet (NASDAQ:HMST)

Historical Stock Chart

From Apr 2023 to Apr 2024