Amended Statement of Beneficial Ownership (sc 13d/a)

April 18 2018 - 1:31PM

Edgar (US Regulatory)

|

SECURITIES AND EXCHANGE COMMISSION

|

|

|

Washington, D.C. 20549

|

|

|

|

|

|

SCHEDULE 13D/A

|

|

|

|

Under the Securities Exchange Act of 1934

|

|

(Amendment No. 7)*

|

|

|

|

Riot Blockchain,

Inc.

|

|

(Name of Issuer)

|

|

|

|

Common Stock,

no par value per share

|

|

(Title of Class of Securities)

|

|

|

|

767292105

|

|

(CUSIP Number)

|

|

|

|

Barry Honig

|

|

555 South Federal Highway #450

|

|

Boca Raton, FL 33432

|

|

(561) 307-2287

|

|

(Name, Address and Telephone Number of Person

|

|

Authorized to Receive Notices and Communications)

|

|

|

|

See Footnote

1

|

|

(Date of Event Which Requires Filing of This Statement)

|

|

|

If the filing person has previously filed a statement on Schedule

13G to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because of Rule 13d-1(e), Rule

13d-1(f) or Rule 13d-1(g), check the following box. [ ]

(Page 1 of 9 Pages)

______________________________

* The remainder of this cover page shall be filled out for a reporting

person's initial filing on this form with respect to the subject class of securities, and for any subsequent amendment containing

information which would alter disclosures provided in a prior cover page.

The information required on the remainder of this cover page shall

not be deemed to be "filed" for the purpose of Section 18 of the Securities Exchange Act of 1934 ("Act") or

otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act (however,

see the Notes).

(1) This Amendment No. 7 is being filed to restate Amendment No.

6 filed with the Securities and Exchange Commission on February 13, 2018. The first date of event which required the filing of

an amendment to the Schedule 13D after Amendment No. 5 was March 15, 2017.

|

CUSIP No. 767292105

|

SCHEDULE 13D/A

|

Page

2

of 9 Pages

|

|

1

|

NAME OF REPORTING PERSON

Barry Honig

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

|

(a)

¨

(b)

¨

|

|

3

|

SEC USE ONLY

|

|

4

|

SOURCE OF FUNDS

PF, WC

|

|

5

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDING IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e)

|

¨

|

|

6

|

CITIZENSHIP OR PLACE OF ORGANIZATION

New York

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON WITH:

|

7

|

SOLE VOTING POWER

200,154 shares of Common Stock (including 151,210 shares

of Common Stock issuable upon conversion of shares of Series B Convertible Preferred Stock and 22,222 shares of Common Stock issuable

upon exercise of the December 2017 Warrants)*

|

|

8

|

SHARED VOTING POWER

-0-

|

|

9

|

SOLE DISPOSITIVE POWER

200,154 shares of Common Stock (including 151,210 shares

of Common Stock issuable upon conversion of shares of Series B Convertible Preferred Stock and 22,222 shares of Common Stock issuable

upon exercise of the December 2017 Warrants)*

|

|

10

|

SHARED DISPOSITIVE POWER

-0-

|

|

11

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH PERSON

200,154 shares of Common Stock (including 151,210 shares

of Common Stock issuable upon conversion of shares of Series B Convertible Preferred Stock and 22,222 shares of Common Stock issuable

upon exercise of the December 2017 Warrants)*

|

|

12

|

CHECK IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

|

¨

|

|

13

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

1.69%*

|

|

14

|

TYPE OF REPORTING PERSON

IN

|

|

|

|

|

|

|

* This Amendment No. 7 reflects the Reporting Person's holdings

as of February 13, 2018.

|

CUSIP No. 767292105

|

SCHEDULE 13D/A

|

Page

3

of 9 Pages

|

This Amendment No. 7

("

Amendment No. 7

") amends and supplements the statement on Schedule 13D filed with the Securities and Exchange

Commission (the "

SEC

") on September 8, 2016, as amended, supplemented and restated from time to time (as amended,

including, without limitation, pursuant to this Amendment No. 7, the "

Schedule 13D

") with respect to the

shares

of Common Stock, no par value per share

(the "

Common Stock

"), of

Riot

Blockchain, Inc., a Nevada corporation

(the "

Issuer

"). This Amendment No.

7 is being filed to restate Amendment No. 6 filed with the SEC on February 13, 2018. The first date of event which required the

filing of an amendment to the Schedule 13D after Amendment No. 5 was March 15, 2017. Capitalized terms used herein and not otherwise

defined in this Amendment No. 7 shall have the meanings set forth in the Schedule 13D. This Amendment No. 7 amends Items 2, 3,

5, 6 and 7 as set forth below. This is the final amendment to the Schedule 13D and constitutes an "exit filing" for the

Reporting Person.

|

Item 2.

|

IDENTITY AND BACKGROUND.

|

|

|

|

|

Item 2 of the Schedule 13D is hereby amended and restated in its entirety as follows:

|

|

|

|

|

(a)

|

This statement is filed by Barry Honig, ("

Mr. Honig

" or the "

Reporting Person

"), with respect to the shares of Common Stock held by himself and through GRQ Consultants, Inc. 401K (of which Mr. Honig is Trustee) and GRQ Consultants, Inc. Roth 401K FBO Barry Honig (of which Mr. Honig is Trustee) (collectively, the "

Honig Entities

").

|

|

|

|

|

|

Any disclosures herein with respect to persons other than the Reporting Person are made on information and belief after making inquiry to the appropriate party.

|

|

|

|

|

|

The filing of this statement should not be construed in and of itself as an admission by the Reporting Person as to beneficial ownership of the securities reported herein.

|

|

|

|

|

(b)

|

The address of the business office of the Reporting Person is 555 South Federal Highway #450, Boca Raton, Florida 33432.

|

|

|

|

|

(c)

|

The principal business of the Reporting Person is investing in securities for his personal account.

|

|

|

|

|

(d)

|

The Reporting Person has not, during the last five years, been convicted in a criminal proceeding (excluding traffic violations or similar misdemeanors).

|

|

|

|

|

(e)

|

The Reporting Person has not, during the last five years, been a party to a civil proceeding of a judicial or administrative body of competent jurisdiction and, as a result of such proceeding, was, or is subject to, a judgment, decree or final order enjoining future violations of, or prohibiting or mandating activities subject to, Federal or State securities laws or finding any violation with respect to such laws.

|

|

|

|

|

(f)

|

Mr. Honig is a citizen of the United States.

|

|

CUSIP No. 767292105

|

SCHEDULE 13D/A

|

Page

4

of 9 Pages

|

|

Item 3.

|

SOURCE AND AMOUNT OF FUNDS OR OTHER CONSIDERATION.

|

|

|

|

|

Item 3 of the Schedule 13D is hereby amended and restated in its entirety as follows:

|

|

|

|

|

|

The Reporting Person used a total of $499,995 to acquire the Private Placement Shares (as defined below) and

the December 2017 Warrants (as defined below). The additional 4,500 shares of Common Stock held by the Reporting Person were acquired

upon conversion of 45 Series A Preferred Shares (as defined below) at a conversion price of $2.50. Such Series A Preferred Shares

were acquired for $11,250. The sources of the funds used to acquire the Private Placement Shares, the December 2017 Warrants and

the Series A Preferred Shares are the personal funds of Mr. Honig and the working capital of the Honig Entities. The Series B Preferred

Shares (as defined below) reported herein were acquired in exchange for 151,210 shares of common stock of Kairos Global Technology,

Inc. ("

Kairos

") as described in Item 6.

|

|

Item 5.

|

INTEREST IN SECURITIES OF THE ISSUER.

|

|

|

|

|

Items 5 of the Schedule 13D is hereby amended and restated in its entirety as follows:

|

|

|

|

|

(a)

|

See rows (11) and (13) of the cover pages to this Schedule 13D for the aggregate number of shares of Common Stock and percentages of the shares of Common Stock beneficially owned by the Reporting Person as of February 13, 2018

.

The percentages used in this Schedule 13D are calculated based upon 11,652,270 shares of Common Stock issued and outstanding as of February 5, 2018, as reported in the Issuer's Registration Statement on Amendment No. 1 to Form S-3 filed with the SEC on February 7, 2018 and assumes the conversion of the shares of Series B Convertible Preferred Stock and the exercise of the December 2017 Warrants.

|

|

|

|

|

(b)

|

See rows (7) through (10) of the cover pages to this Schedule 13D for the number of shares of Common Stock as to which the Reporting Person has the sole or shared power to vote or direct the vote and sole or shared power to dispose or to direct the disposition as of February 13, 2018.

|

|

|

|

|

(c)

|

Information concerning all transactions in the shares of Common Stock effected by the Reporting Person from the filing of Amendment No. 5 to the filing of Amendment No. 6 is set forth on

Schedule A

hereto and is incorporated herein by reference.

|

|

|

|

|

(d)

|

No person other than the Reporting Person and the Honig Entities is known to have the right to receive, or the power to direct the receipt of dividends from, or proceeds from the sale of, the shares of Common Stock held by Mr. Honig and the Honig Entities.

|

|

|

|

|

(e)

|

November 20, 2017.

|

|

CUSIP No. 767292105

|

SCHEDULE 13D/A

|

Page

5

of 9 Pages

|

|

Item 6.

|

CONTRACTS, ARRANGEMENTS, UNDERSTANDINGS OR RELATIONSHIPS WITH RESPECT TO SECURITIES OF THE ISSUER.

|

|

|

|

|

Item 6 of the Schedule 13D is hereby amended and supplemented by the addition of the following:

|

|

|

|

|

|

On March 15, 2017, the Issuer entered into separate securities purchase agreements (the "

Note Purchase Agreements

") pursuant to which it agreed to sell to the Reporting Person and a certain Hong Entity $2,250,000 of principal amount of promissory notes (the "

Notes

") and three year warrants (the "

March 2017 Warrants

") to purchase up to 700,000 shares of Common Stock. The Notes are convertible into shares of Common Stock at an initial conversion price of $2.50. Each March 2017 Warrant is exercisable into shares of Common Stock at an exercise price equal to $3.56 per share (such sale and issuance of the Notes and March 2017 Warrants, the "

Note Private Placement

").

|

|

|

|

|

|

On March 16, 2017, the Issuer satisfied all closing conditions and closed the Note Private Placement.

|

|

|

|

|

|

The Notes and the March 2017 Warrants, as well as the proceeds from the sale therefrom, were placed in escrow pending the occurrence or non-occurrence of a Qualified Transaction (as defined in the governing purchase agreements). On August 18, 2017, the lead investor in the transaction waived the requirement for the occurrence of a Qualified Transaction and gross proceeds of the Note Private Placement were released to the Issuer and the Notes and the March 2017 Warrants were released to the Reporting Person and the applicable Honig Entity.

|

|

|

|

|

|

Under the terms of the Note Purchase Agreement, the

Notes were automatically, and without any further action on the part of the investors, exchanged for shares of Series A

c

onvertible

p

referred

s

tock of the Issuer

(the "

Series A Preferred Shares

"). The terms of the Series A Preferred Shares are set forth in the certificate

of designations for such shares (the "

Certificate of Designations of the Series A Preferred Shares

"). As

such, and pursuant to the Note Purchase Agreements, on September 20, 2017, the Issuer issued an aggregate of 7,071.74 Series

A Preferred Shares, convertible into an aggregate of 707,174 shares of Common Stock, in exchange for the Notes issued in the

Note Private Placement.

|

|

|

|

|

|

In connection with the Note Private Placement, the Issuer entered

into a Registration Rights Agreement (the "

March 2017 Registration Rights Agreement

"), with the Reporting Person

and the applicable Honig Entity which required the Issuer to file a registration statement under the Securities Act of 1933, as

amended (the "

Securities Act

"), to register the resale of the shares of Common Stock issuable upon (i) conversion

of the Notes; (ii) exercise of the March 2017 Warrants and (iii) conversion of the Series A Preferred Shares.

|

|

CUSIP No. 767292105

|

SCHEDULE 13D/A

|

Page

6

of 9 Pages

|

|

|

The terms of the Note Purchase Agreement, the Notes, the March 2017 Warrant, the Certificate of Designations of the Series A Preferred Shares and the March 2017 Registration Rights Agreement are incorporated herein by reference to the texts of the agreements, which are filed as Exhibit 10.1, Exhibit 4.1. Exhibit 4.2, Exhibit 3.1 and Exhibit 10.2, respectively, of the Issuer's Current Report on Form 8-K filed by the Issuer with the SEC on March 17, 2017 (the "

March 17, 2017 Form 8-K

"). The Form of Note, the Form of March 2017 Warrant, the Certificate of Designations of the Series A Preferred Shares and the Form of March 2017 Registration Rights Agreement are referenced as Exhibit 1, Exhibit 2, Exhibit 3 and Exhibit 4, respectively, to this Amendment No. 7.

|

|

|

|

|

|

On November 1, 2017, the Issuer entered into a share exchange agreement (the "

Exchange Agreement

") with Kairos, the Reporting Person and the other shareholders of Kairos. On November 3, 2017, pursuant to the Exchange Agreement, the shareholders of Kairos, including the Reporting Person, exchanged all outstanding shares of Kairos' common stock for shares of Series B Convertible Preferred Stock of the Issuer (the "

Series B Preferred Shares

"). The Reporting Person received 151,210 Series B Preferred Shares pursuant to the Exchange Agreement. The terms of the Series B Preferred Shares are set forth in the certificate of designations for such shares (the "

Certificate of Designations of the Series B Preferred Shares

"). The terms of the Series B Preferred Shares are incorporated herein by reference to the text of such document, which is filed as Exhibit 3.1 to the Current Report on Form 8-K filed by the Issuer with the SEC on November 3, 2017 (the "

November 3, 2017 Form 8-K

"). The Certificate of Designations of the Series B Preferred Shares is referenced as Exhibit 5 to this Amendment No. 7.

|

|

|

|

|

|

On December 18, 2017, a Honig Entity entered into a securities purchase agreement (the "

Securities Purchase Agreement

") with the Issuer pursuant to which the Issuer issued 22,222 shares of Common Stock (the "

Private Placement Shares

") and warrants exercisable into 22,222 shares of Common Stock (the "

December 2017 Warrants

") to such Honig Entity for a purchase price of $22.50 per combined Private Placement Share and December 2017 Warrant. The December 2017 Warrants have an exercise price of $40.00 per share, subject to adjustment in certain events as set forth therein, and may be exercised from time to time at any time on or after June 21, 2018 through June 21, 2021.

|

|

|

|

|

|

The closing of the transactions contemplated by the Securities Purchase Agreement occurred on December 21, 2017.

|

|

|

|

|

CUSIP No. 767292105

|

SCHEDULE 13D/A

|

Page

7

of 9 Pages

|

|

|

In connection with the purchase of the Private Placement Shares and the December 2017 Warrants, the Issuer entered into a Registration Rights Agreement, effective as of the closing (the "

December 2017 Registration Rights Agreement

"), with the Honig Entity party to the Securities Purchase Agreement and other investors which required the Issuer to file a registration statement under the Securities Act to register the resale of the Private Placement Shares and the shares of Common Stock underlying the December 2017 Warrants.

|

|

|

|

|

|

The foregoing summaries of the Securities Purchase Agreement, the December 2017 Warrant and December 2017 Registration Rights Agreement are incorporated herein by reference to the texts of the agreements, which are filed as Exhibit 10.1, Exhibit 4.1 and Exhibit 10.2, respectively, of the Issuer's Current Report on Form 8-K filed by the Issuer with the SEC on December 19, 2017 (the "

December 19, 2017 Form 8-K

"). The Form of December 2017 Warrant and the Form of December 2017 Registration Rights Agreement are referenced as Exhibit 6 and Exhibit 7, respectively, to this Amendment No. 7.

|

|

Item 7.

|

MATERIAL TO BE FILED AS EXHIBITS.

|

|

|

|

|

Item 7 of the Schedule 13D is hereby amended and supplemented by the addition of the following:

|

|

|

|

|

Exhibit 1

:

|

Form of Note (incorporated by reference to Exhibit 4.1 to the March 17, 2017 Form 8-K).

|

|

|

|

|

Exhibit 2

:

|

Form of March 2017 Warrant (incorporated by reference to Exhibit 4.2 to the March 17, 2017 Form 8-K).

|

|

|

|

|

Exhibit 3

:

|

Certificate of Designations of the Series A Preferred Shares (incorporated by reference to Exhibit 3.1 to the March 17, 2017 Form 8-K).

|

|

|

|

|

Exhibit 4

:

|

Form of March 2017 Registration Rights Agreement (incorporated by reference to Exhibit 10.2 to the March 17, 2017 Form 8-K).

|

|

|

|

|

Exhibit 5

:

|

Certificate of Designations of the Series B Preferred Shares (incorporated by reference to Exhibit 3.1 to the November 3, 2017 Form 8-K).

|

|

|

|

|

Exhibit 6

:

|

Form of December 2017 Warrant (incorporated by reference to Exhibit 4.1 to the December 19, 2017 Form 8-K).

|

|

|

|

|

Exhibit 7

:

|

Form of December 2017 Registration Rights Agreement (incorporated by reference to Exhibit 10.2 to the December 19, 2017 Form 8-K).

|

|

CUSIP No. 767292105

|

SCHEDULE 13D/A

|

Page

8

of 9 Pages

|

SIGNATURES

After reasonable inquiry and to the best

of his or its knowledge and belief, the undersigned certifies that the information set forth in this statement is true, complete

and correct.

Date: April 18, 2018

|

|

|

|

|

|

|

/s/ Barry Honig

|

|

|

BARRY HONIG

|

|

|

|

|

|

|

|

|

|

CUSIP No. 767292105

|

SCHEDULE 13D/A

|

Page

9

of 9 Pages

|

SCHEDULE A

Transactions in the Shares of Common Stock

of the Issuer From the Filing of Amendment No. 5 to the Filing of Amendment No. 6

The following table sets forth all transactions

in the shares of Common Stock effected from the filing of Amendment No. 5 to the filing of Amendment No. 6 by the Reporting Person.

Except as noted below, all such transactions were effected in the open market through brokers and the price per share is net of

commissions.

|

Trade Date

|

Shares Purchased (Sold)

|

Price Per Share ($)

|

|

|

|

|

|

03/29/2017

|

35,000*

|

2.25

|

|

03/31/2017

|

(4,200)

|

4.10

|

|

04/05/2017

|

(800)

|

4.10

|

|

04/13/2017

|

(3,300)

|

4.07

|

|

04/13/2017

|

(800)

|

4.08

|

|

04/18/2017

|

(4,900)

|

4.16

|

|

04/25/2017

|

(1,200)

|

3.99

|

|

04/26/2017

|

(100)

|

3.90

|

|

04/28/2017

|

(2,100)

|

3.60

|

|

05/01/2017

|

(4,000)

|

3.70

|

|

05/09/2017

|

(5,500)

|

3.82

|

|

05/10/2017

|

(2,500)

|

3.80

|

|

05/16/2017

|

(1,000)

|

3.63

|

|

05/23/2017

|

(1,800)

|

3.75

|

|

05/31/2017

|

(7,000)

|

3.82

|

|

05/31/2017

|

(1,900)

|

3.83

|

|

05/31/2017

|

(500)

|

3.86

|

|

05/31/2017

|

(500)

|

3.83

|

|

06/02/2017

|

(1,971)

|

3.85

|

|

06/05/2017

|

(1,429)

|

3.94

|

|

06/05/2017

|

(4,871)

|

3.94

|

|

06/08/2017

|

(11,301)

|

3.99

|

|

06/12/2017

|

(1,300)

|

3.94

|

|

06/13/2017

|

(400)

|

4.02

|

|

06/14/2017

|

(3,251)

|

4.00

|

|

06/15/2017

|

(1,307)

|

4.05

|

|

06/19/2017

|

(7,412)

|

3.91

|

|

06/20/2017

|

(2,027)

|

3.97

|

|

06/22/2017

|

(744)

|

3.96

|

|

06/22/2017

|

(8,000)

|

4.07

|

|

06/22/2017

|

(1,000)

|

3.95

|

|

06/23/2017

|

(5,000)

|

3.94

|

|

06/30/2017

|

(3,000)

|

3.97

|

|

07/01/2017

|

(1,000)

|

4.10

|

|

07/10/2017

|

(1,200)

|

3.95

|

|

07/13/2017

|

1,502

|

3.77

|

|

07/17/2017

|

(1,200)

|

4.01

|

|

07/18/2017

|

(975)

|

4.05

|

|

07/19/2017

|

(1,114)

|

4.05

|

|

08/04/2017

|

(7)

|

3.90

|

|

10/04/2017

|

(47,520)

|

8.92

|

|

10/05/2017

|

(11,400)

|

7.47

|

|

10/05/2017

|

235,960**

|

3.56

|

|

10/06/2017

|

(10,000)

|

7.29

|

|

10/06/2017

|

58,990**

|

3.56

|

|

10/09/2017

|

(136,028)

|

8.62

|

|

10/10/2017

|

(55,459)

|

9.32

|

|

10/10/2017

|

(11,070)

|

8.43

|

|

10/11/2017

|

(130,000)

|

10.10

|

|

10/11/2017

|

(128,916)

|

10.00

|

|

10/11/2017

|

(35,000)

|

10.00

|

|

10/11/2018

|

128,988**

|

3.56

|

|

10/11/2017

|

505,124***

|

2.50

|

|

10/12/2017

|

(26,600)

|

8.25

|

|

10/12/2017

|

(15,000)

|

8.44

|

|

10/17/2017

|

(4,000)

|

8.47

|

|

10/18/2017

|

(3,088)

|

7.68

|

|

10/19/2017

|

(3,700)

|

8.17

|

|

10/20/2017

|

(45,000)

|

8.20

|

|

11/07/2017

|

(3,800)

|

8.42

|

|

11/09/2017

|

(800)

|

7.75

|

|

11/10/2017

|

(3,972)

|

7.25

|

|

11/13/2017

|

(9,500)

|

7.25

|

|

11/14/2017

|

(1,032)

|

7.20

|

|

11/14/2017

|

(3,968)

|

7.10

|

|

11/15/2017

|

(5,268)

|

7.64

|

|

11/16/2017

|

(61,000)

|

8.31

|

|

11/17/2017

|

(18,588)

|

8.81

|

|

11/17/2017

|

1,500

|

8.26

|

|

11/20/2017

|

(262,293)

|

9.85

|

|

11/21/2017

|

(143,475)

|

11.64

|

|

11/21/2017

|

202,050***

|

2.50

|

|

11/24/2017

|

(10,000)

|

11.77

|

|

11/24/2017

|

(64,235)

|

11.77

|

|

11/24/2017

|

(64,235)

|

11.77

|

|

11/24/2017

|

(64,235)

|

11.77

|

|

11/24/2017

|

(64,236)

|

14.19

|

|

11/28/2017

|

(27,907)

|

16.61

|

|

11/28/2017

|

(1,500)

|

16.64

|

|

11/28/2017

|

(58,593)

|

16.64

|

|

11/29/2017

|

15,000

|

12.54

|

|

11/29/2017

|

(36,587)

|

16.94

|

|

11/29/2017

|

(9,248)

|

13.29

|

|

11/30/2017

|

(5,752)

|

13.13

|

|

12/19/2017

|

22,222****

|

22.50

|

|

|

|

|

* Represents shares of Common Stock acquired in a private transaction.

** Represents shares of Common Stock acquired from the Issuer upon

exercise of the Reporting Person's March 2017 Warrants at an exercise price of $3.56 per share.

*** Represents shares of Common Stock acquired from the Issuer upon

conversion of the Reporting Person's Series A Preferred Shares at a conversion price of $2.50 per share.

**** Represents shares of Common Stock acquired from the Issuer

pursuant to the Securities Purchase Agreement as described in Item 6.

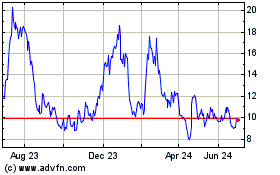

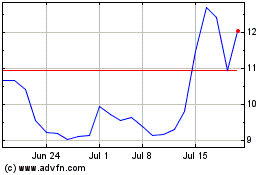

Riot Platforms (NASDAQ:RIOT)

Historical Stock Chart

From Mar 2024 to Apr 2024

Riot Platforms (NASDAQ:RIOT)

Historical Stock Chart

From Apr 2023 to Apr 2024