- Net revenue of $5,469 million and net

income of $1,675 million

- Industry leading return on average

assets of 1.50% and return on average common equity of 14.9%

- Return on tangible common equity of

19.3%

U.S. Bancorp (NYSE: USB):

1Q18 Key Financial Data

PROFITABILITY

METRICS 1Q18 4Q17 1Q17 Return on average

assets (%) 1.50 1.46 1.35 Return on average common equity (%) 14.9

14.7 13.3 Return on tangible common equity (%) (a) 19.3 18.8 17.2

Net interest margin (%) 3.13 3.11 3.06 Efficiency ratio (%) (a)

55.9 69.8 55.3

INCOME STATEMENT (b) 1Q18 4Q17 1Q17 Net

interest income (taxable-equivalent basis) $3,197 $3,228 $3,030

Noninterest income $2,272 $2,370 $2,259 Net income attributable to

U.S. Bancorp $1,675 $1,682 $1,473 Diluted earnings per common share

$.96 $.97 $.82 Dividends declared per common share $.30 $.30 $.28

BALANCE SHEET

(b) 1Q18 4Q17 1Q17 Average total loans

$279,388 $279,751 $273,158 Average total deposits $334,580 $339,162

$328,433 Net charge-off ratio .49% .46% .50% Book value per common

share (period end) $26.54 $26.34 $25.05 Basel III standardized CET1

(c) 9.0% 9.1% 9.2%

(a) See Non-GAAP Financial Measures reconciliation on pages 16-17

(b) Dollars in millions, except per share data (c) CET1 = Common

equity tier 1 capital ratio, 4Q17 and 1Q17 as if fully implemented

1Q18 Highlights

- Net income of $1,675 million and

diluted earnings per common share of $0.96 in the first quarter of

2018

- Industry leading return on average

assets of 1.50% and return on average common equity of 14.9%

- Returned 68% of 1Q earnings to

shareholders through dividends and share buybacks

- Net interest income grew 5.5%

year-over-year

- Total net revenue grew 3.4% year-over

year

- Payment services revenue grew 6.5%

- Trust and investment management fees

increased 8.2%

- Deposit service charges increased

5.8%

- Net interest margin of 3.13% was 7

basis points higher than 1Q17 and 2 basis points higher than 4Q17

(4 basis points excluding the impact of tax reform)

- Average total loans grew 2.3%

year-over-year

CEO Commentary

“We reported a solid first quarter, highlighted by a 19.3%

return on average tangible common equity. We delivered solid growth

in net interest income and high return fee businesses such as

corporate payments, credit card, and wealth management and

investment services. We continue to invest for the future and I’m

pleased with the progress we are making on initiatives aimed at

advancing our digital offerings and expanding our treasury

management and payment services capabilities. This is a rapidly

evolving banking environment and we are positioning this company to

be a trusted partner to our customers, with the products and

services that enable them to do what they want, when, where and how

they want. As we continue on this journey, I am grateful to our

customers for their trust and to our employees for their commitment

to our continued success.”

— Andy Cecere, Chairman, President

and CEO, U.S. Bancorp

In the Spotlight

Most Admired Super-Regional BankFortune has named U.S.

Bank a World’s Most Admired Company, naming it the world’s most

admired super-regional bank for the eighth consecutive year and

recognizing several of U.S. Bank’s attributes as most admired among

all companies including being #1 in the categories of Management

Quality and Use of Corporate Assets.

Best Employer for DiversityForbes magazine has named U.S.

Bank a Best Employer for Diversity, including the bank in a

first-ever list of top employers based on employee surveys,

reputation research and public diversity leadership data.

One of the World’s Most Ethical CompaniesEthisphere

Institute, the global leader in defining and advancing the

standards of ethical business practices, has recognized U.S. Bank

as a 2018 World's Most Ethical Company®. This marks the fourth

consecutive year U.S. Bank has earned this recognition.

A "Best Place to Work"The Human Rights Campaign

Foundation designated U.S. Bank as a “Best Place to Work” with a

high score of 100 on its LGBTQ rights-focused Corporate Equality

Index. Through its index, the Foundation evaluates businesses from

a diverse set of industries in regards to their policies and

benefits. As of 2018, U.S. Bank has proudly earned a score of 100

percent for 11 years in a row.

INCOME STATEMENT HIGHLIGHTS ($ in

millions, except per-share data)

Percent Change

1Q 4Q 1Q 1Q18 vs 1Q18 vs

2018 2017 2017

4Q17 1Q17 Net interest income

$3,168 $3,175 $2,980 (.2 ) 6.3 Taxable-equivalent adjustment 29

53 50 (45.3 ) (42.0 ) Net

interest income (taxable-equivalent basis) 3,197 3,228 3,030 (1.0 )

5.5 Noninterest income 2,272 2,370

2,259 (4.1 ) .6 Total net revenue 5,469 5,598 5,289 (2.3 )

3.4 Noninterest expense 3,055 3,899

2,909 (21.6 ) 5.0 Income before provision and income taxes

2,414 1,699 2,380 42.1 1.4 Provision for credit losses 341

335 345 1.8 (1.2 ) Income before taxes

2,073 1,364 2,035 52.0 1.9

Income taxes and

taxable-equivalent adjustment

391 (322 ) 549 nm (28.8 ) Net income

1,682 1,686 1,486 (.2 ) 13.2

Net (income) loss attributable

to noncontrolling interests

(7 ) (4 ) (13 ) (75.0 ) 46.2 Net income attributable

to U.S. Bancorp $1,675 $1,682 $1,473

(.4 ) 13.7

Net income applicable to U.S.

Bancorp common shareholders

$1,597 $1,611 $1,387 (.9 ) 15.1

Diluted earnings per common share $.96 $.97

$.82 (1.0 ) 17.1

Net income attributable to U.S. Bancorp was $1,675 million for

the first quarter of 2018, 13.7 percent higher than the $1,473

million for the first quarter of 2017, and 0.4 percent lower than

the $1,682 million for the fourth quarter of 2017. Excluding

notable items in the fourth quarter of 2017, net income

attributable to U.S. Bancorp increased 9.3 percent. Diluted

earnings per common share were $0.96 in the first quarter of 2018.

Results for the first quarter of 2018 included favorable tax

matters partially offset by the impact of a transitional change in

stock-based compensation vesting provisions, that combined,

increased diluted earnings per common share by $0.01. Diluted

earnings per common share were $0.97 in the fourth quarter of 2017,

which included $0.09 of notable items, including a benefit of $910

million related to the estimated impact of tax reform on the

Company’s tax related assets and liabilities, partially offset by a

$608 million accrual for regulatory and legal matters, and $152

million, net of tax, for a charitable contribution to the U.S. Bank

Foundation and a special bonus to certain eligible employees. The

increase in net income year-over-year was primarily due to total

net revenue growth of 3.4 percent (3.9 percent excluding the impact

of tax reform related to taxable-equivalent adjustments for tax

exempt assets), including an increase in net interest income of 5.5

percent, mainly a result of the impact of rising interest rates and

loan growth. Noninterest income increased 0.6 percent principally

due to higher payment services revenue, trust and investment

management fees and deposit service charges, offset by decreases in

mortgage banking revenue and commercial product revenue in addition

to lower equity investment income and securities gains compared

with a year ago. The increase in total net revenue was partially

offset by higher noninterest expense of 5.0 percent (3.7 percent

excluding the impact of stock-based compensation vesting changes),

primarily due to increased compensation expense related to hiring

to support business growth and compliance programs, merit

increases, variable compensation related to revenue growth,

increased expense from a change to a shorter vesting period for new

stock-based compensation grants, and higher employee benefits

expense, partially offset by lower professional services expense

driven by lower consulting costs for risk and compliance programs,

and other expenses.

Excluding the fourth quarter 2017 notable items, net income

increased on a linked quarter basis primarily due to the impact of

the lower corporate tax rate effective in 2018. Total net revenue

decreased 2.3 percent and noninterest expense decreased 0.6

percent. The decrease in total net revenue reflected a decrease in

net interest income of 1.0 percent, due to two fewer days in the

first quarter, and a decrease in noninterest income of 4.1 percent

driven by seasonally lower payment services fees and mortgage

banking revenue and lower equity investment income. The decrease in

noninterest expense was primarily driven by seasonally lower costs

related to investments in tax-advantaged projects, mortgage banking

costs and professional services expense, offset by increased

compensation expense primarily related to the timing of stock-based

compensation grants, and associated vesting period changes, and

seasonally higher employee benefits expense.

NET INTEREST INCOME (Taxable-equivalent basis; $ in

millions)

Change 1Q

4Q 1Q 1Q18 vs 1Q18 vs

2018 2017 2017

4Q17 1Q17 Components of net interest income

Income on earning assets $3,822 $3,785 $3,444 $37 $378 Expense on

interest-bearing liabilities 625 557

414 68 211 Net interest income

$3,197 $3,228 $3,030 $(31

) $167 Average yields and rates paid Earning

assets yield 3.75 % 3.64 % 3.48 % .11 % .27 % Rate paid on

interest-bearing liabilities .81 .72

.57 .09 .24 Gross interest

margin 2.94 % 2.92 % 2.91 % .02 % .03 %

Net interest margin 3.13 % 3.11 % 3.06 % .02 %

.07 % Average balances Investment securities (a)

$113,493 $113,287 $110,764 $206 $2,729 Loans 279,388 279,751

273,158 (363 ) 6,230 Earning assets 411,849 413,510 399,281 (1,661

) 12,568 Interest-bearing liabilities 311,615 308,976 296,170 2,639

15,445 (a) Excludes unrealized gain (loss)

Net interest income on a taxable-equivalent basis in the first

quarter of 2018 was $3,197 million, an increase of $167 million

(5.5 percent) over the first quarter of 2017. The increase was

principally driven by the impact of rising interest rates and loan

growth, partially offset by deposit and funding mix and the impact

of tax reform which reduced the taxable-equivalent adjustment

benefit related to tax exempt assets. Average earning assets were

$12.6 billion (3.1 percent) higher than the first quarter of 2017,

reflecting increases of $6.2 billion (2.3 percent) in average total

loans, $2.7 billion (2.5 percent) in average investment securities

and $4.1 billion (34.9 percent) in average other earning assets.

Net interest income on a taxable-equivalent basis decreased $31

million (1.0 percent) on a linked quarter basis primarily driven by

the impact of two fewer days in the first quarter, tax reform, and

deposit and funding mix, partially offset by the impact of higher

rates. Average earning assets were $1.7 billion (0.4 percent) lower

on a linked quarter basis, reflecting decreases of $363 million

(0.1 percent) in average total loans and $717 million (4.3 percent)

in average other earning assets, partially offset by an increase of

$206 million (0.2 percent) in average investment securities.

The net interest margin in the first quarter of 2018 was 3.13

percent, compared with 3.06 percent in the first quarter of 2017,

and 3.11 percent in the fourth quarter of 2017. Excluding the

impact of tax reform related to tax exempt income, the linked

quarter increase in net interest margin was 4 basis points. The

increase in the net interest margin year-over-year and on a linked

quarter basis was primarily due to higher interest rates, partially

offset by loan mix, higher funding costs and higher cash balances

year-over-year. The first quarter 2018 adoption of a new accounting

standard related to revenue recognition increased net interest

income and the related margin compared with previously reported

results. All periods have been adjusted to reflect this change.

Average investment securities in the first quarter of 2018 were

$2.7 billion (2.5 percent) higher year-over-year and $206 million

(0.2 percent) higher than the prior quarter. The increase

year-over-year was primarily due to purchases of U.S. Treasury and

U.S. government mortgage-backed securities, net of prepayments and

maturities, in support of liquidity management.

AVERAGE LOANS ($ in millions)

Percent Change 1Q 4Q 1Q 1Q18

vs 1Q18 vs 2018

2017 2017 4Q17

1Q17 Commercial $91,933 $92,101 $88,284 (.2 ) 4.1

Lease financing 5,532 5,457 5,455 1.4 1.4 Total

commercial 97,465 97,558 93,739 (.1 ) 4.0 Commercial

mortgages 29,176 29,543 31,461 (1.2 ) (7.3 ) Construction and

development 11,190 11,466 11,697 (2.4 ) (4.3 ) Total

commercial real estate 40,366 41,009 43,158 (1.6 ) (6.5 )

Residential mortgages 60,174 59,639 57,900 .9 3.9 Credit

card 21,284 21,218 20,845 .3 2.1 Retail leasing 7,982 7,982

6,469 -- 23.4 Home equity and second mortgages 16,195 16,299 16,259

(.6 ) (.4 ) Other 32,874 32,856 31,056 .1 5.9 Total

other retail 57,051 57,137 53,784 (.2 ) 6.1

Total loans, excluding covered loans 276,340 276,561

269,426 (.1 ) 2.6 Covered loans 3,048 3,190

3,732 (4.5 ) (18.3 ) Total loans $279,388 $279,751

$273,158 (.1 ) 2.3

Average total loans were $6.2 billion (2.3 percent) higher than

the first quarter of 2017. The increase was due to growth in total

commercial loans (4.0 percent), residential mortgages (3.9

percent), retail leasing (23.4 percent) and other retail loans (5.9

percent). These increases were muted somewhat by a decrease in

total commercial real estate loans (6.5 percent) due to disciplined

underwriting and customers paying down balances. Loan growth was

also muted by continued run-off of the covered loans portfolio

(18.3 percent). Average total loans were $363 million (0.1 percent)

lower than the fourth quarter of 2017. This decrease reflects

continued pay-offs of commercial real estate loans (1.6 percent)

and the run-off of covered loans (4.5 percent), offset by growth in

residential mortgages (0.9 percent). At the end of the first

quarter, approximately $1.5 billion of student loans were

transferred from the loan portfolio to loans held for sale.

AVERAGE DEPOSITS ($ in millions)

Percent Change 1Q 4Q 1Q 1Q18

vs 1Q18 vs 2018

2017 2017 4Q17

1Q17 Noninterest-bearing deposits $79,482 $82,303

$80,738 (3.4 ) (1.6 ) Interest-bearing savings deposits Interest

checking 70,358 70,717 65,681 (.5 ) 7.1 Money market savings

103,367 105,348 108,759 (1.9 ) (5.0 ) Savings accounts 44,388

43,772 42,609 1.4 4.2 Total savings deposits 218,113

219,837 217,049 (.8 ) .5 Time deposits 36,985 37,022

30,646 (.1 ) 20.7 Total interest-bearing deposits 255,098

256,859 247,695 (.7 ) 3.0 Total deposits $334,580

$339,162 $328,433 (1.4 ) 1.9

Average total deposits for the first quarter of 2018 were $6.1

billion (1.9 percent) higher than the first quarter of 2017.

Average noninterest-bearing deposits decreased $1.3 billion (1.6

percent) year-over-year primarily due to a decrease in Corporate

and Commercial Banking, partially offset by increases in Consumer

and Business Banking and Wealth Management and Investment Services.

Average total savings deposits were $1.1 billion (0.5 percent)

higher year-over-year driven by growth in Consumer and Business

Banking, partially offset by a decrease in Corporate and Commercial

Banking. Average time deposits were $6.3 billion (20.7 percent)

higher than the prior year quarter. Changes in time deposits are

largely related to those deposits managed as an alternative to

other funding sources such as wholesale borrowing, based largely on

relative pricing and liquidity characteristics.

Average total deposits decreased $4.6 billion (1.4 percent) from

the fourth quarter of 2017. On a linked quarter basis, average

noninterest-bearing deposits decreased $2.8 billion (3.4 percent)

across all business lines primarily due to seasonality. This

compares with a decline in noninterest-bearing deposits of $4.2

billion (4.9 percent) in the first quarter of 2017 compared with

the fourth quarter of 2016. Average total savings deposits

decreased $1.7 billion (0.8 percent) reflecting a decline in Wealth

Management and Investment Services of $2.1 billion and Corporate

and Commercial Banking of $1.3 billion, partially offset by growth

in average savings balances within Consumer and Business Banking.

The change in Corporate and Commercial Banking balances primarily

reflects seasonality, while the decline in Wealth Management and

Investment Services is the result of seasonally lower trust

balances, timing of escrowed balances, deployment of cash balances

by investment managers and the impact of rising interest rates.

Average time deposits, which are managed based on funding needs,

relative pricing and liquidity characteristics, were flat on a

linked quarter basis.

NONINTEREST INCOME ($ in millions)

Percent Change 1Q 4Q 1Q

1Q18 vs 1Q18 vs 2018

2017 2017 4Q17

1Q17 Credit and debit card revenue $324 $342 $299

(5.3 ) 8.4 Corporate payment products revenue 154 148 137 4.1 12.4

Merchant processing services 363 374 354 (2.9 ) 2.5 ATM processing

services 79 80 71 (1.3 ) 11.3 Trust and investment management fees

398 394 368 1.0 8.2 Deposit service charges 182 194 172 (6.2 ) 5.8

Treasury management fees 150 152 153 (1.3 ) (2.0 ) Commercial

products revenue 220 224 247 (1.8 ) (10.9 ) Mortgage banking

revenue 184 202 207 (8.9 ) (11.1 ) Investment products fees 46 45

42 2.2 9.5 Securities gains (losses), net 5 10 29 (50.0 ) (82.8 )

Other 167 205 180 (18.5 ) (7.2 ) Total

noninterest income $2,272 $2,370 $2,259 (4.1 ) .6

First quarter noninterest income of $2,272 million was $13

million (0.6 percent) higher than the first quarter of 2017

reflecting strong growth in payment services revenue, trust and

investment management fees, and deposit service charges, partially

offset by lower commercial products revenue and mortgage banking

revenue reflecting industry trends in these revenue categories.

Payment services revenue increased 6.5 percent due to stronger

credit and debit card revenue of $25 million (8.4 percent) and an

increase in corporate payment products revenue of $17 million (12.4

percent), and improving merchant processing revenue due to higher

sales volumes. Trust and investment management fees increased $30

million (8.2 percent) due to business growth, net asset inflows and

favorable market conditions. Deposit service charges increased $10

million (5.8 percent) primarily due to higher transaction volumes

and account growth. These increases were partially offset by a

decrease in commercial products revenue of $27 million (10.9

percent) mainly due to lower corporate bond underwriting fees and

syndication fees. Mortgage banking revenue decreased $23 million

(11.1 percent) primarily due to lower margin on mortgage loan

sales.

Noninterest income was $98 million (4.1 percent) lower in the

first quarter of 2018 compared with the fourth quarter of 2017

reflecting seasonally lower payment services revenue, mortgage

banking revenue and deposit service charges. In addition, other

revenue decreased $38 million (18.5 percent) primarily due to lower

equity investment income. Payment services revenue decreased

principally due to seasonally lower sales volume after the

holidays. Credit and debit card revenue declined $18 million (5.3

percent) while merchant processing services revenue declined $11

million (2.9 percent). Corporate payments products revenue

increased from the fourth quarter by 4.1 percent reflecting

stronger corporate and government spending. Mortgage banking

revenue decreased $18 million (8.9 percent) primarily due to lower

margin on mortgage loan sales, partially offset by the valuation of

mortgage servicing rights, net of hedging activities. Deposit

service charges decreased $12 million (6.2 percent) due to

seasonally lower transaction volumes.

NONINTEREST EXPENSE ($ in millions)

Percent Change 1Q 4Q 1Q

1Q18 vs 1Q18 vs 2018

2017 2017 4Q17

1Q17 Compensation $1,523 $1,499 $1,391 1.6 9.5

Employee benefits 330 291 301 13.4 9.6 Net occupancy and equipment

265 259 247 2.3 7.3 Professional services 83 114 96 (27.2 ) (13.5 )

Marketing and business development 97 251 90 (61.4 ) 7.8 Technology

and communications 235 236 217 (.4 ) 8.3 Postage, printing and

supplies 80 79 81 1.3 (1.2 ) Other intangibles 39 44 44 (11.4 )

(11.4 ) Other 403 1,126 442 (64.2 ) (8.8 )

Total noninterest expense $3,055 $3,899 $2,909 (21.6

) 5.0

First quarter noninterest expense of $3,055 million was $146

million (5.0 percent) higher than the first quarter of 2017

primarily due to higher personnel expense, occupancy costs,

technology investment and seasonal marketing and development

expenses, partially offset by lower professional services expense

and other noninterest expense. Compensation expense increased $132

million (9.5 percent) principally due to the impact of hiring to

support business growth and compliance programs, merit increases,

and higher variable compensation related to business production,

and the impact of changes in vesting provisions related to

stock-based compensation programs. Excluding the impact of the

change in vesting provisions, compensation would have increased 6.9

percent from a year ago. Employee benefits expense increased $29

million (9.6 percent) primarily driven by increased medical costs

and staffing. Other noninterest expense decreased $39 million (8.8

percent) due to lower mortgage servicing-related costs and lower

pension-related costs as a result of contributions to the plans in

2017. Professional services expense decreased $13 million (13.5

percent) primarily due to fewer consulting services as compliance

programs near maturity.

Noninterest expense decreased $844 million (21.6 percent) on a

linked quarter basis primarily due to notable items recognized in

the fourth quarter of 2017. Excluding the notable items,

noninterest expense was $19 million (0.6 percent) lower in the

first quarter of 2018 compared with the fourth quarter of 2017

primarily due to seasonally lower costs related to investments in

tax-advantaged projects and professional services expense,

partially offset by higher personnel expense. Compensation expense

increased $82 million (5.7 percent) reflecting the impact of

variable compensation including the timing of stock-based

compensation grants due to the vesting change, and merit increases,

as well as a seasonal increase in employee benefits expense of $48

million (17.0 percent) primarily driven by seasonally higher

payroll taxes.

Provision for Income Taxes

The provision for income taxes for the first quarter of 2018

resulted in a tax rate of 18.9 percent on a taxable-equivalent

basis (effective tax rate of 17.7 percent), compared with 27.0

percent (effective tax rate of 25.1 percent) in the first quarter

of 2017, and a tax benefit of 23.6 percent on a taxable-equivalent

basis (effective tax benefit of 28.6 percent) in the fourth quarter

of 2017. The first quarter of 2018 tax rate reflected the tax

reform legislation enacted during the fourth quarter of 2017,

favorable settlement of tax matters, and the tax benefit of

restricted stock vesting and option exercises.

ALLOWANCE FOR CREDIT LOSSES ($ in millions)

1Q 4Q 3Q

2Q 1Q

2018 % (b) 2017 %

(b) 2017 % (b) 2017

% (b) 2017 % (b)

Balance, beginning of period $4,417 $4,407 $4,377 $4,366 $4,357

Net charge-offs Commercial 56 .25 22 .09 79 .34 75 .33 71

.33 Lease financing 4 .29 6 .44 4 .29 3

.22 4 .30 Total commercial 60 .25 28 .11 83 .34 78 .33 75

.32 Commercial mortgages (4 ) (.06 ) 18 .24 (2 ) (.03 ) (7 ) (.09 )

(1 ) (.01 ) Construction and development 1 .04 -- --

(5 ) (.17 ) (2 ) (.07 ) (1 ) (.03 ) Total commercial real estate (3

) (.03 ) 18 .17 (7 ) (.07 ) (9 ) (.08 ) (2 ) (.02 )

Residential mortgages 7 .05 10 .07 7 .05 8 .05 12 .08 Credit

card 211 4.02 205 3.83 187 3.55 204 3.97 190 3.70 Retail

leasing 3 .15 3 .15 2 .10 2 .11 3 .19 Home equity and second

mortgages (1 ) (.03 ) (2 ) (.05 ) (1 ) (.02 ) (1 ) (.02 ) (1 ) (.02

) Other 64 .79 63 .76 59 .73 58 .75 58

.76 Total other retail 66 .47 64 .44 60 .42 59 .43 60 .45

Total net charge-offs, excluding

covered loans 341 .50 325 .47 330 .48 340 .50 335 .50 Covered loans

-- -- -- -- -- -- -- -- -- --

Total net charge-offs 341 .49 325 .46 330 .47 340 .49 335 .50

Provision for credit losses 341 335 360 350 345 Other changes (a)

-- -- -- 1 (1 ) Balance, end of period

$4,417 $4,417 $4,407 $4,377 $4,366

Components Allowance for loan losses $3,918 $3,925

$3,908 $3,856 $3,816

Liability for unfunded credit

commitments

499 492 499 521 550 Total

allowance for credit losses $4,417 $4,417 $4,407

$4,377 $4,366 Gross charge-offs $453

$464 $433 $437 $417 Gross recoveries $112 $139 $103 $97 $82

Allowance for credit losses as a percentage of

Period-end loans, excluding covered

loans

1.60 1.58 1.59 1.59 1.61

Nonperforming loans, excluding

covered loans

431 438 425 385 338

Nonperforming assets, excluding

covered assets

373 374 359 331 296 Period-end loans 1.59 1.58 1.58 1.58

1.60 Nonperforming loans 431 438 426 383 338 Nonperforming assets

367 368 352 324 292

(a) Includes net changes in credit losses

to be reimbursed by the FDIC and reductions in the allowance for

covered loans where the reversal of a previously recorded

allowance was offset by an associated decrease in the

indemnification asset, and the impact of any loan sales.

(b) Annualized and calculated on average loan balances

The Company’s provision for credit losses for the first quarter

of 2018 was $341 million, which was $6 million (1.8 percent) higher

than the prior quarter and $4 million (1.2 percent) lower than the

first quarter of 2017. Credit quality was relatively stable

compared with the fourth quarter of 2017.

Total net charge-offs in the first quarter of 2018 were $341

million, compared with $325 million in the fourth quarter of 2017,

and $335 million in the first quarter of 2017. Net charge-offs

increased $16 million (4.9 percent) compared with the fourth

quarter of 2017 mainly due to higher total commercial loan net

charge-offs driven by lower recoveries, partially offset by lower

total commercial real estate net charge-offs. Net charge-offs

increased $6 million (1.8 percent) compared with the first quarter

of 2017 primarily due to higher credit card loan net charge-offs,

partially offset by lower total commercial loan net charge-offs

driven by higher recoveries. The net charge-off ratio was 0.49

percent in the first quarter of 2018, compared with 0.46 percent in

the fourth quarter of 2017 and 0.50 percent in the first quarter of

2017.

The allowance for credit losses was $4,417 million at March 31,

2018, and at December 31, 2017, compared with $4,366 million at

March 31, 2017. The ratio of the allowance for credit losses to

period-end loans was 1.59 percent at March 31, 2018, compared with

1.58 percent at December 31, 2017, and 1.60 percent at March 31,

2017. The ratio of the allowance for credit losses to nonperforming

loans was 431 percent at March 31, 2018, compared with 438 percent

at December 31, 2017, and 338 percent at March 31, 2017.

Nonperforming assets were $1,204 million at March 31, 2018,

compared with $1,200 million at December 31, 2017, and $1,495

million at March 31, 2017. The ratio of nonperforming assets to

loans and other real estate was 0.43 percent at March 31, 2018, and

at December 31, 2017, compared with 0.55 percent at March 31, 2017.

The year-over-year decrease in nonperforming assets was driven by

improvements in nonperforming total commercial loans, residential

mortgages and other real estate owned, partially offset by

increases in nonperforming other retail loans and total commercial

real estate loans. Accruing loans 90 days or more past due were

$702 million ($566 million excluding covered loans) at March 31,

2018, compared with $720 million ($572 million excluding covered

loans) at December 31, 2017, and $718 million ($524 million

excluding covered loans) at March 31, 2017.

DELINQUENT LOAN RATIOS AS A PERCENT OF ENDING LOAN

BALANCES (Percent)

Mar 31 Dec 31

Sep 30 Jun 30 Mar 31

2018 2017 2017

2017 2017 Delinquent loan ratios

- 90 days or more past due

excluding nonperforming loans

Commercial .06 .06 .05 .05 .06 Commercial real estate .01 .01 .01

-- .01 Residential mortgages .22 .22 .18 .20 .24 Credit card 1.29

1.28 1.20 1.10 1.23 Other retail .18 .17 .15 .14 .14 Total loans,

excluding covered loans .21 .21 .18 .17 .19 Covered loans 4.57 4.74

4.66 4.71 5.34 Total loans .25 .26 .23 .23 .26 Delinquent

loan ratios - 90 days or more past due

including

nonperforming loans Commercial .37 .31 .33 .39 .52 Commercial real

estate .31 .37 .30 .29 .27 Residential mortgages .93 .96 .98 1.10

1.23 Credit card 1.29 1.28 1.20 1.10 1.24 Other retail .48 .46 .43

.42 .43 Total loans, excluding covered loans .58 .57 .55 .59 .67

Covered loans 4.77 4.93 4.84 5.06 5.53 Total loans .62 .62 .60 .64

.73

ASSET QUALITY (a) ($ in

millions)

Mar 31 Dec

31 Sep 30 Jun 30 Mar 31

2018 2017 2017

2017 2017 Nonperforming loans Commercial $274

$225 $231 $283 $397 Lease financing 27 24 38

39 42 Total commercial 301 249 269 322 439 Commercial

mortgages 86 108 89 84 74 Construction and development 33 34

33 35 36 Total commercial real estate 119 142

122 119 110 Residential mortgages 430 442 474 530 575 Credit

card -- 1 1 1 2 Other retail 168 168 163 158

157 Total nonperforming loans, excluding covered loans 1,018

1,002 1,029 1,130 1,283 Covered loans 6 6 6

12 7 Total nonperforming loans 1,024 1,008 1,035

1,142 1,290 Other real estate 124 141 164 157 155 Covered

other real estate 20 21 26 25 22 Other nonperforming assets 36

30 26 25 28 Total nonperforming

assets $1,204 $1,200 $1,251 $1,349

$1,495 Total nonperforming assets, excluding covered assets

$1,178 $1,173 $1,219 $1,312 $1,466

Accruing loans 90 days or more past

due, excluding covered loans

$566 $572 $497 $477 $524

Accruing loans 90 days or more past due $702 $720

$649 $639 $718

Performing restructured loans, excluding

GNMA and covered loans

$2,190 $2,306 $2,419 $2,473 $2,478

Performing restructured GNMA and covered loans $1,598

$1,713 $1,600 $1,803 $1,746

Nonperforming assets to loans plus

ORE, excluding covered assets (%)

.43 .42 .44 .48 .54 Nonperforming assets to loans plus ORE

(%) .43 .43 .45 .49 .55 (a) Throughout this document,

nonperforming assets and related ratios do not include accruing

loans 90 days or more past due

COMMON

SHARES (Millions)

1Q 4Q

3Q 2Q 1Q

2018 2017 2017

2017 2017 Beginning shares outstanding

1,656 1,667 1,679 1,692 1,697

Shares issued for stock incentive

plans, acquisitions and other corporate purposes

4 1 -- 1 6 Shares repurchased (11 ) (12 ) (12 )

(14 ) (11 ) Ending shares outstanding 1,649

1,656 1,667 1,679

1,692

CAPITAL POSITION ($ in

millions)

Mar 31 Dec 31 Sep

30 Jun 30 Mar 31 2018

2017 2017

2017 2017 Total U.S. Bancorp

shareholders' equity $49,187 $49,040 $48,723 $48,320 $47,798

Basel III Standardized Approach (a) Common equity tier 1

capital $33,539 $34,369 $34,876 $34,408 $33,847 Tier 1 capital

38,991 39,806 40,411 39,943 39,374 Total risk-based capital 46,640

47,503 48,104 47,824 47,279 Fully implemented common equity

tier 1 capital ratio (a) 9.0 % 9.1

% (b)

9.4

% (b)

9.3

% (b)

9.2

% (b)

Tier 1 capital ratio 10.4 10.8 11.1 11.1 11.0 Total risk-based

capital ratio 12.5 12.9 13.2 13.2 13.3 Leverage ratio 8.8 8.9 9.1

9.1 9.1

Basel III Advanced Approaches (a) Fully

implemented common equity tier 1 capital ratio (a) 11.5 11.6 (b)

11.8 (b) 11.7 (b) 11.5 (b)

Tangible common equity to

tangible assets (b) 7.7 7.6 7.7 7.5 7.6

Tangible common

equity to risk-weighted assets (b) 9.3 9.4 9.5 9.4 9.4

Common equity tier 1 capital ratio

calculated under the transitional standardized approach

(a)

-- 9.3 9.6 9.5 9.5

Common equity tier 1 capital ratio

calculated under the transitional advanced approaches (a)

-- 12.0 12.1 12.0 11.8

(a) Beginning January 1, 2018, the

regulatory capital requirements fully reflect implementation of

Basel III. Prior to 2018, the Company's capital ratios reflected

certain transitional adjustments. Basel III includes two

comprehensive methodologies for calculating risk-weighted assets: a

general standardized approach and more risk-sensitive

advanced approaches, with the Company's capital adequacy being

evaluated against the methodology that is most restrictive.

(b) See Non-GAAP Financial Measures reconciliation on page 16

Total U.S. Bancorp shareholders’ equity was $49.2 billion at

March 31, 2018, compared with $49.0 billion at December 31, 2017,

and $47.8 billion at March 31, 2017. During the first quarter, the

Company returned 68 percent of earnings to shareholders through

dividends and share buybacks.

All regulatory ratios continue to be in excess of

“well-capitalized” requirements. The common equity tier 1 capital

to risk-weighted assets ratio using the Basel III standardized

approach was 9.0 percent at March 31, 2018, compared with 9.3

percent at December 31, 2017, and 9.5 percent at March 31, 2017.

The common equity tier 1 capital to risk-weighted assets ratio

using the Basel III advanced approaches method was 11.5 percent at

March 31, 2018, compared with 12.0 percent at December 31, 2017,

and 11.8 percent at March 31, 2017.

Investor Conference Call

On Wednesday, April 18, 2018, at 8:00 a.m. CDT, Andy Cecere,

Chairman, President and Chief Executive Officer, and Terry Dolan,

Vice Chairman and Chief Financial Officer, will host a conference

call to review the financial results. The conference call will be

available online or by telephone. To access the webcast and

presentation, visit U.S. Bancorp’s website at usbank.com and click

on “About US”, “Investor Relations” and “Webcasts &

Presentations.” To access the conference call from locations within

the United States and Canada, please dial 866-316-1409.

Participants calling from outside the United States and Canada,

please dial 706-634-9086. The conference ID number for all

participants is 8771339. For those unable to participate during the

live call, a recording will be available at approximately 11:00

a.m. CDT on Wednesday, April 18 and will be accessible until

Wednesday, April 25 at 11:00 p.m. CDT. To access the recorded

message within the United States and Canada, please dial

855-859-2056. If calling from outside the United States and Canada,

please dial 404-537-3406 to access the recording. The conference ID

is 8771339.

About U.S. Bancorp

Minneapolis-based U.S. Bancorp (NYSE: USB), with $460 billion in

assets as of March 31, 2018, is the parent company of U.S. Bank

National Association, the fifth largest commercial bank in the

United States. The Company operates 3,054 banking offices in 25

states and 4,729 ATMs and provides a comprehensive line of banking,

investment, mortgage, trust and payment services products to

consumers, businesses and institutions. Visit U.S. Bancorp on the

web at www.usbank.com.

Forward-looking Statements

The following information appears in accordance with the Private

Securities Litigation Reform Act of 1995:

This press release contains forward-looking statements about

U.S. Bancorp. Statements that are not historical or current facts,

including statements about beliefs and expectations, are

forward-looking statements and are based on the information

available to, and assumptions and estimates made by, management as

of the date hereof. These forward-looking statements cover, among

other things, anticipated future revenue and expenses and the

future plans and prospects of U.S. Bancorp. Forward-looking

statements involve inherent risks and uncertainties, and important

factors could cause actual results to differ materially from those

anticipated. A reversal or slowing of the current economic recovery

or another severe contraction could adversely affect U.S. Bancorp’s

revenues and the values of its assets and liabilities. Global

financial markets could experience a recurrence of significant

turbulence, which could reduce the availability of funding to

certain financial institutions and lead to a tightening of credit,

a reduction of business activity, and increased market volatility.

Stress in the commercial real estate markets, as well as a downturn

in the residential real estate markets could cause credit losses

and deterioration in asset values. In addition, changes to

statutes, regulations, or regulatory policies or practices could

affect U.S. Bancorp in substantial and unpredictable ways. U.S.

Bancorp’s results could also be adversely affected by deterioration

in general business and economic conditions; changes in interest

rates; deterioration in the credit quality of its loan portfolios

or in the value of the collateral securing those loans;

deterioration in the value of its investment securities; legal and

regulatory developments; litigation; increased competition from

both banks and non-banks; changes in customer behavior and

preferences; breaches in data security; effects of mergers and

acquisitions and related integration; effects of critical

accounting policies and judgments; and management’s ability to

effectively manage credit risk, market risk, operational risk,

compliance risk, strategic risk, interest rate risk, liquidity risk

and reputational risk.

For discussion of these and other risks that could cause actual

results to differ from expectations, refer to U.S. Bancorp’s Annual

Report on Form 10-K for the year ended December 31, 2017, on file

with the Securities and Exchange Commission, including the sections

entitled “Corporate Risk Profile” and “Risk Factors” contained in

Exhibit 13, and all subsequent filings with the Securities and

Exchange Commission under Sections 13(a), 13(c), 14 or 15(d) of the

Securities Exchange Act of 1934. However, factors other than these

also could adversely affect U.S. Bancorp’s results, and the reader

should not consider these factors to be a complete set of all

potential risks or uncertainties. Forward-looking statements speak

only as of the date hereof, and U.S. Bancorp undertakes no

obligation to update them in light of new information or future

events.

Non-GAAP Financial Measures

In addition to capital ratios defined by banking regulators, the

Company considers various other measures when evaluating capital

utilization and adequacy, including:

- Tangible common equity to tangible

assets

- Tangible common equity to risk-weighted

assets

- Return on tangible common equity

These capital measures are viewed by management as useful

additional methods of evaluating the Company’s utilization of its

capital held and the level of capital available to withstand

unexpected negative market or economic conditions. Additionally,

presentation of these measures allows investors, analysts and

banking regulators to assess the Company’s capital position

relative to other financial services companies. These capital

measures are not defined in generally accepted accounting

principles (“GAAP”) or are not defined in federal banking

regulations. As a result, these capital measures disclosed by the

Company may be considered non-GAAP financial measures. In addition,

certain capital measures related to prior periods are presented on

the same basis as those in the current period. The effective

capital ratios defined by banking regulations for these periods

were subject to certain transitional provisions. Management

believes this information helps investors assess trends in the

Company’s capital adequacy.

The Company also discloses net interest income and related

ratios and analysis on a taxable-equivalent basis, which may also

be considered non-GAAP financial measures. The Company believes

this presentation to be the preferred industry measurement of net

interest income as it provides a relevant comparison of net

interest income arising from taxable and tax-exempt sources. In

addition, certain performance measures, including the efficiency

ratio and net interest margin utilize net interest income on a

taxable-equivalent basis.

There may be limits in the usefulness of these measures to

investors. As a result, the Company encourages readers to consider

the consolidated financial statements and other financial

information contained in this press release in their entirety, and

not to rely on any single financial measure. A table follows that

shows the Company’s calculation of these non-GAAP financial

measures.

CONSOLIDATED STATEMENT OF

INCOME (Dollars and Shares in Millions, Except Per Share Data)

Three Months Ended March 31, (Unaudited) 2018

2017

Interest Income Loans $3,095 $2,790 Loans held

for sale 33 35 Investment securities 613 530 Other interest income

50 38 Total interest income 3,791 3,393

Interest Expense Deposits 345 199 Short-term borrowings 75

24 Long-term debt 203 190 Total interest

expense 623 413 Net interest income 3,168

2,980 Provision for credit losses 341 345 Net

interest income after provision for credit losses 2,827 2,635

Noninterest Income Credit and debit card revenue 324 299

Corporate payment products revenue 154 137 Merchant processing

services 363 354 ATM processing services 79 71 Trust and investment

management fees 398 368 Deposit service charges 182 172 Treasury

management fees 150 153 Commercial products revenue 220 247

Mortgage banking revenue 184 207 Investment products fees 46 42

Securities gains (losses), net 5 29 Other 167 180

Total noninterest income 2,272 2,259

Noninterest

Expense Compensation 1,523 1,391 Employee benefits 330 301 Net

occupancy and equipment 265 247 Professional services 83 96

Marketing and business development 97 90 Technology and

communications 235 217 Postage, printing and supplies 80 81 Other

intangibles 39 44 Other 403 442 Total

noninterest expense 3,055 2,909 Income before

income taxes 2,044 1,985 Applicable income taxes 362

499 Net income 1,682 1,486 Net (income) loss attributable to

noncontrolling interests (7 ) (13 ) Net income attributable

to U.S. Bancorp $1,675 $1,473 Net income

applicable to U.S. Bancorp common shareholders $1,597

$1,387 Earnings per common share $.97 $.82 Diluted

earnings per common share $.96 $.82 Dividends declared per common

share $.30 $.28 Average common shares outstanding 1,652 1,694

Average diluted common shares outstanding 1,657

1,701

CONSOLIDATED ENDING BALANCE

SHEET March 31, December 31, March 31,

(Dollars in Millions) 2018 2017 2017

Assets (Unaudited) (Unaudited) Cash and due from banks

$19,246 $19,505 $20,319 Investment securities Held-to-maturity

44,612 44,362 43,393 Available-for-sale 67,125 68,137 67,031 Loans

held for sale 4,777 3,554 2,738 Loans Commercial 98,097 97,561

94,491 Commercial real estate 40,140 40,463 42,832 Residential

mortgages 60,477 59,783 58,266 Credit card 20,901 22,180 20,387

Other retail 55,317 57,324 53,966

Total loans, excluding covered loans 274,932 277,311 269,942

Covered loans 2,979 3,121 3,635

Total loans 277,911 280,432 273,577 Less allowance for loan losses

(3,918 ) (3,925 ) (3,816 ) Net loans 273,993 276,507

269,761 Premises and equipment 2,441 2,432 2,432 Goodwill 9,440

9,434 9,348 Other intangible assets 3,388 3,228 3,313 Other assets

35,097 34,881 31,187 Total

assets $460,119 $462,040 $449,522

Liabilities and Shareholders' Equity Deposits

Noninterest-bearing $82,211 $87,557 $85,222 Interest-bearing

262,315 259,658 251,651 Total

deposits 344,526 347,215 336,873 Short-term borrowings 17,703

16,651 12,183 Long-term debt 33,201 32,259 35,948 Other liabilities

14,877 16,249 16,085 Total

liabilities 410,307 412,374 401,089 Shareholders' equity Preferred

stock 5,419 5,419 5,419 Common stock 21 21 21 Capital surplus 8,438

8,464 8,388 Retained earnings 55,549 54,142 51,069 Less treasury

stock (18,047 ) (17,602 ) (15,660 ) Accumulated other comprehensive

income (loss) (2,193 ) (1,404 ) (1,439 ) Total U.S.

Bancorp shareholders' equity 49,187 49,040 47,798 Noncontrolling

interests 625 626 635 Total

equity 49,812 49,666 48,433

Total liabilities and equity $460,119 $462,040

$449,522

NON-GAAP FINANCIAL

MEASURES March 31, December

31, September 30, June 30, March 31, (Dollars in Millions,

Unaudited) 2018 2017 2017

2017 2017 Total equity $49,812 $49,666

$49,351 $48,949 $48,433 Preferred stock (5,419 ) (5,419 ) (5,419 )

(5,419 ) (5,419 ) Noncontrolling interests (625 ) (626 ) (628 )

(629 ) (635 ) Goodwill (net of deferred tax liability) (1) (8,609 )

(8,613 ) (8,141 ) (8,181 ) (8,186 ) Intangible assets, other than

mortgage servicing rights (608 ) (583 )

(595 ) (634 ) (671 ) Tangible

common equity (a) 34,551 34,425 34,568 34,086 33,522 Total

assets 460,119 462,040 459,227 463,844 449,522 Goodwill (net of

deferred tax liability) (1) (8,609 ) (8,613 ) (8,141 ) (8,181 )

(8,186 ) Intangible assets, other than mortgage servicing rights

(608 ) (583 ) (595 ) (634

) (671 ) Tangible assets (b) 450,902 452,844

450,491 455,029 440,665

Risk-weighted assets, determined in

accordance with the Basel III standardized approach (c)

373,141 * 367,771 363,957 361,164 356,373 Tangible common

equity (as calculated above) 34,425 34,568 34,086 33,522

Adjustments (2) (550 ) (52 ) (51 )

(136 )

Common equity tier 1 capital estimated for

the Basel III fully implemented standardized and advanced

approaches (d)

33,875 34,516 34,035 33,386

Risk-weighted assets, determined in

accordance with prescribed transitional standardized approach

regulatory requirements

367,771 363,957 361,164 356,373 Adjustments (3) 4,473

3,907 3,967 4,731

Risk-weighted assets estimated for the

Basel III fully implemented standardized approach (e)

372,244 367,864 365,131 361,104

Risk-weighted assets, determined in

accordance with prescribed transitional advanced approaches

regulatory requirements

287,211 287,800 287,124 285,963 Adjustments (4) 4,769

4,164 4,231 5,046

Risk-weighted assets estimated for the

Basel III fully implemented advanced approaches (f)

291,980 291,964 291,355 291,009

Ratios * Tangible

common equity to tangible assets (a)/(b) 7.7 % 7.6 % 7.7 % 7.5 %

7.6 % Tangible common equity to risk-weighted assets (a)/(c) 9.3

9.4 9.5 9.4 9.4

Common equity tier 1 capital to

risk-weighted assets estimated for the Basel III fully

implemented standardized approach (d)/(e)

9.1 9.4 9.3 9.2

Common equity tier 1 capital to

risk-weighted assets estimated for the Basel III fully

implemented advanced approaches (d)/(f)

11.6 11.8 11.7 11.5 Three Months Ended March 31,

December 31, September 30, June 30, March 31, 2018

2017 2017 2017 2017

Net income applicable to U.S. Bancorp common shareholders

$1,597 $1,611 $1,485 $1,430 $1,387 Intangibles amortization

(net-of-tax) 31 28 29

28 29

Net income applicable to U.S. Bancorp

common shareholders, excluding intangibles amortization

1,628 1,639 1,514 1,458 1,416

Annualized net income applicable to U.S.

Bancorp common shareholders, excluding intangibles

amortization (g)

6,602 6,503 6,007 5,848 5,743 Average total equity 49,450

49,461 49,447 48,909 48,558 Less: Average preferred stock 5,419

5,419 5,419 5,419 5,706 Less: Average noncontrolling interests 625

627 628 636 635 Less: Average goodwill (net of deferred tax

liability) (1) 8,627 8,154 8,153 8,160 8,175 Less: Average

intangible assets, other than mortgage servicing rights 603

591 615 650

691

Average U.S. Bancorp common shareholders'

equity, excluding intangible assets (h)

34,176 34,670 34,632 34,044 33,351 Return on tangible common

equity (g)/(h) 19.3 % 18.8 %

17.3 % 17.2 % 17.2 %

* Preliminary data. Subject to

change prior to filings with applicable regulatory agencies.

(1) Includes goodwill related to certain investments in

unconsolidated financial institutions per prescribed regulatory

requirements. (2) Includes net losses on cash flow hedges included

in accumulated other comprehensive income (loss) and other

adjustments. (3) Includes higher risk-weighting for unfunded loan

commitments, investment securities, residential mortgages, mortgage

servicing rights and other adjustments. (4) Primarily reflects

higher risk-weighting for mortgage servicing rights.

NON-GAAP FINANCIAL MEASURES Three Months Ended

(Dollars in Millions, Unaudited)

March 31, December 31, September 30, June 30,

March 31, 2018 2017 2017

2017 2017 Net interest income

$3,168 $3,175 $3,176 $3,049 $2,980 Taxable-equivalent adjustment

(1) 29 53 51 51

50 Net interest income, on a taxable-equivalent basis

3,197 3,228 3,227 3,100 3,030 Net interest income, on a

taxable-equivalent basis (as calculated above) 3,197 3,228 3,227

3,100 3,030 Noninterest income 2,272 2,370 2,340 2,348 2,259 Less:

Securities gains (losses), net 5 10 9

9 29 Total net revenue,

excluding net securities gains (losses) (a) 5,464 5,588 5,558 5,439

5,260 Noninterest expense (b) 3,055 3,899 2,998 2,984 2,909

Less: Intangible amortization 39 44 44

43 44 Noninterest expense,

excluding intangible amortization (c) 3,016 3,855 2,954 2,941 2,865

Efficiency ratio (b)/(a) 55.9 % 69.8 % 53.9 % 54.9 % 55.3 %

Tangible efficiency ratio (c)/(a) 55.2 69.0

53.1 54.1 54.5

(1) Interest and rates are presented

on a fully taxable-equivalent basis based on a federal income tax

rate of 21 percent for 2018 and 35 percent for 2017.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20180418005188/en/

U.S. BancorpInvestor contact:Jennifer Thompson,

612-303-0778orMedia contact:Stacey Wempen, 612-303-7620

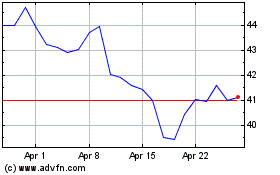

US Bancorp (NYSE:USB)

Historical Stock Chart

From Mar 2024 to Apr 2024

US Bancorp (NYSE:USB)

Historical Stock Chart

From Apr 2023 to Apr 2024