Americas Silver Corporation (TSX:USA) (NYSE American:USAS)

(“Americas Silver” or the “Company”) today announced consolidated

production and operating cost results for the first quarter of 2018

and individually for its Cosalá Operations and Galena Complex. All

figures are in U.S. dollars unless otherwise indicated.

First Quarter Highlights (compared to

Q1, 2017)

- Consolidated silver production of

approximately 400,000 silver ounces and 1.6 million silver

equivalent1 ounces.

- Consolidated cash costs2 were

approximately negative ($2.50) per silver ounce, a decrease of

125%. Consolidated all-in sustaining costs2 (“AISC”) were

approximately $6.40 per silver ounce, a decrease of 50%.

- Cosalá Operations silver production

solely from the Company’s San Rafael mine of approximately 80,000

silver ounces and 950,000 silver equivalent ounces. Cash costs were

approximately negative ($58.45) per silver ounce and all-in

sustaining costs were approximately negative ($35.20) per silver

ounce.

- Galena Complex silver production of

approximately 320,000 silver ounces and 666,000 silver equivalent

ounces representing increases of 16% and 17%, respectively. Cash

costs were approximately $11.45 per silver ounce and all-in

sustaining costs were approximately $16.75 per silver ounce down

28% and 23%, respectively.

- Guidance for 2018 remains unchanged at

1.6 – 2.0 million silver ounces and 7.2 – 8.0 million silver

equivalent ounces at cash costs of negative ($10.00) to negative

($5.00) per silver ounce and all-in sustaining cash costs of

negative ($1.00) to $4.00 per silver ounce. The Company expects to

release its first quarter financial results on or before May 10,

2018.

“The Company had a strong first quarter at both operations as

San Rafael continued to ramp up in terms of mining rate and mill

throughput,” said Americas Silver President and CEO Darren

Blasutti. “Shareholders will be pleased with the significant

reductions in our cash costs and AISC year-over-year as the

benefits of San Rafael begin to be realized. We expect further

reductions into the second half of the year as mill throughput

reaches a steady state at 1,700 tonnes per day and San Rafael

capital expenditures reduce to sustaining levels. Galena also

delivered notable decreases in cash costs while increasing silver

production, supporting the consolidated results.”

Consolidated First Quarter Production

Details

Consolidated silver production for the first quarter of 2018 was

397,035 ounces which represents a decrease of 3% over the previous

quarter and a decrease of 24% year-over-year. Silver equivalent

production was approximately 1.6 million ounces, up 19% over the

previous quarter and 46% year-over-year. Consolidated cash costs

decreased 129% to negative ($2.52) per silver ounce compared to the

previous quarter and 126% year-over-year, and all-in sustaining

costs decreased 55% to $6.38 per silver ounce compared to the

previous quarter and 52% year-over-year.

Table 1 Consolidated Production Highlights

Q1 2018 Q1 2017

Change Q4 2017 Change Processed

Ore (tonnes milled) 163,875 167,493 -2%

168,901 -3% Silver Production (ounces) 397,035

523,747 -24% 409,545 -3% Silver Equivalent

Production (ounces) 1,613,711 1,104,237 46%

1,358,441 19% Silver Grade (grams per tonne)

95 107 -12% 91 4% Cost of Sales ($ per

equiv. ounce silver)1 $8.12 $9.93 -18%

$10.16 -20% Cash Costs ($ per ounce silver)1 ($2.52)

$9.89 -126% $8.75 -129% All-in

Sustaining Costs ($ per ounce silver)1 $6.38 $13.37

-52% $14.20 -55% Zinc Production (pounds)

7,332,978 2,389,133 207% 4,895,670

50% Lead Production (pounds) 7,624,685

6,160,732 24% 7,427,357 3% Copper Production

(pounds) - 308,100 - 78,541 - 1

Cost of sales per silver equivalent ounce, cash costs per

silver ounce, and all-in sustaining costs per silver ounce for Q1,

2017 excludes pre-production of 62,714 silver ounces, and 88,656

silver equivalent ounces mined from El Cajón during its

commissioning period, and for Q4, 2017 excludes pre-production of

45,344 silver ounces, and 405,162 silver equivalent ounces mined

from San Rafael during its commissioning period. Pre-production

revenue and cost of sales from El Cajón and San Rafael are

capitalized as an offset to development costs.

Consolidated silver production was lower compared to prior

quarters as the Company had its first full quarter of operations

from its new San Rafael mine after declaring commercial production

in December 2017. San Rafael will provide lower silver production

compared to the previously mined deposits at the Cosalá Operations

until mining sequences to the higher silver grade areas of the ore

body later next year. The consolidated silver equivalent production

increased substantially and the consolidated cash costs and all-in

sustaining costs decreased when compared to prior quarter and

year-over-year due to the comparatively higher base metal grades

generally present in the San Rafael deposit. Galena is returning to

an acceptable level of profitable operating performance with grades

returning to historical norms with consistent contribution from

production areas.

Cosalá Operations Production

Details

The Cosalá Operations produced 79,382 ounces of silver during

the first quarter of 2018 and 948,081 ounces of silver equivalent

during the same period at cash costs of negative ($58.47) per

silver ounce and all-in sustaining costs of negative ($35.22) per

silver ounce. Silver production decreased 47% over the previous

quarter and 68% year-over-year, while silver equivalent production

increased 25% over the previous quarter and 78% year-over-year.

Cash costs and all-in sustaining costs were down significantly

compared to the previous quarter from negative ($0.28) per silver

ounce and $3.74 per silver ounce, respectively, and down

significantly year-over-year from $1.13 per silver ounce and $1.21

per silver ounce, respectively.

Table 2 Cosalá Operations Highlights

Q1 2018 Q1 2017 Change

Q4 2017 Change Processed Ore (tonnes

milled) 123,285 128,577 -4% 129,098

-5% Silver Production (ounces) 79,382 250,296

-68% 150,235 -47% Silver Equivalent Production

(ounces) 948,081 533,762 78% 759,439

25% Silver Grade (grams per tonne) 42 70

-40% 54 -22% Cost of Sales ($ per equiv. ounce

silver) 1 $5.92 $7.22 -18% $7.39

-20% Cash Costs ($ per ounce silver) 1 ($58.47) $1.13

>-100% ($0.28) >-100%

All-in Sustaining Costs ($ per ounce

silver) 1

($35.22) $1.21 >-100% $3.74

>-100% Zinc Production (pounds) 7,332,978

2,389,133 207% 4,895,670 50% Lead Production

(pounds) 2,679,485 1,124,464 138%

2,348,125 14% Copper Production (pounds) -

308,100 - 78,541 - 1 Cost of sales per

silver equivalent ounce, cash costs per silver ounce, and all-in

sustaining costs per silver ounce for Q1, 2017 excludes

pre-production of 62,714 silver ounces, and 88,656 silver

equivalent ounces mined from El Cajón during its commissioning

period, and for Q4, 2017 excludes pre-production of 45,344 silver

ounces, and 405,162 silver equivalent ounces mined from San Rafael

during its commissioning period. Pre-production revenue and cost of

sales from El Cajón and San Rafael are capitalized as an offset to

development costs.

As previously noted, Cosalá silver production was lower compared

to prior quarters as the Company completed its first full quarter

of operations from its new San Rafael mine after declaring

commercial production in December 2017. San Rafael is expected to

produce lower grade silver compared to the previously mined

deposits at the Cosalá Operations until mining operations move to

higher silver grade areas of the ore body later next year.

Additionally, the initial development in the San Rafael ore body

was in an area closest to the portal where the silver grade is less

than half of the reserve silver grade. As a result, the silver

production was lower in the first quarter compared to prior

quarters. The Cosalá Operations had a significant increase in

silver equivalent production as well as a significant reduction in

cash costs and all-in sustaining costs during Q1, 2018, primarily

due to the by-product metal production from zinc and lead during

the period, which increased by 50% and 14%, respectively, when

compared to prior quarter, and increased by 207% and 138%,

respectively, year-over-year.

Galena Complex Production

Details

The Galena Complex produced 317,653 ounces of silver during the

first quarter of 2018 and 665,630 ounces of silver equivalent

during the same period at cash costs of $11.46 per silver ounce and

all-in sustaining costs of $16.78 per silver ounce. Silver and

silver equivalent production increased 22% and 11%, respectively,

compared to the prior quarter, and increased 16% and 17%,

respectively, year-over-year. Cash costs were down 8% compared to

the prior quarter and 28% year-over-year and all-in sustaining

costs were down 9% compared to the prior quarter and 23%

year-over-year.

Table 3 Galena Complex Highlights

Q1 2018 Q1 2017 Change

Q4 2017 Change Processed Ore (tonnes

milled) 40,590 38,916 4% 39,803

2% Silver Production (ounces) 317,653 273,451

16% 259,310 22% Silver Equivalent Production (ounces)

665,630 570,475 17% 599,002 11%

Silver Grade (grams per tonne) 256 230 11%

213 20% Cost of Sales ($ per equiv. ounce silver)

$11.26 $12.05 -7% $11.79 -5%

Cash Costs ($ per ounce silver) $11.46 $15.89

-28% $12.40 -8% All-in Sustaining Costs ($ per ounce

silver) $16.78 $21.71 -23% $18.43

-9% Lead Production (pounds) 4,945,200

5,036,268 -2% 5,079,232 -3%

The Company is focused on returning Galena to an acceptable

level of operating performance during 2018 by advancing several

planning-related initiatives, including grade optimization, in

order to recapture and build on the gains which were made in 2015

and 2016. Improvements were realized in Q1, 2018 and should

continue throughout the year as grades are returning to targeted

norms with consistent contribution from production areas.

About Americas Silver

Corporation

Americas Silver is a silver mining company focused on growth in

precious metals from its existing asset base and execution of

targeted accretive acquisitions. It owns and operates the Cosalá

Operations in Sinaloa, Mexico and the Galena Mine Complex in Idaho,

USA. The Company holds an option on the San Felipe development

project in Sonora, Mexico.

Daren Dell, Chief Operating Officer and a Qualified Person under

Canadian Securities Administrators guidelines, has approved the

applicable contents of this news release. For further information

please see SEDAR or americassilvercorp.com.

Cautionary Statement on Forward-Looking Information:

This news release contains “forward‐looking information” within

the meaning of applicable securities laws. Forward‐looking

information includes, but is not limited to, the Company’s

expectations intentions, plans, assumptions and beliefs with

respect to, among other things, the realization of exploration,

operational and development plans, the Cosalá Operations and Galena

Complex as well as the Company’s financing efforts. Often, but not

always, forward‐looking information can be identified by

forward‐looking words such as “anticipate”, “believe”, “expect”,

“goal”, “plan”, “intend”, “estimate”, “may”, “assume” and “will” or

similar words suggesting future outcomes, or other expectations,

beliefs, plans, objectives, assumptions, intentions, or statements

about future events or performance. Forward‐looking information is

based on the opinions and estimates of the Company as of the date

such information is provided and is subject to known and unknown

risks, uncertainties, and other factors that may cause the actual

results, level of activity, performance, or achievements of the

Company to be materially different from those expressed or implied

by such forward looking information. This includes the ability to

develop and operate the Cosalá and Galena properties, risks

associated with the mining industry such as economic factors

(including future commodity prices, currency fluctuations and

energy prices), ground conditions and factors other factors

limiting mine access, failure of plant, equipment, processes and

transportation services to operate as anticipated, environmental

risks, government regulation, actual results of current exploration

and production activities, possible variations in ore grade or

recovery rates, permitting timelines, capital expenditures,

reclamation activities, social and political developments and other

risks of the mining industry. Although the Company has attempted to

identify important factors that could cause actual results to

differ materially from those contained in forward-looking

information, there may be other factors that cause results not to

be as anticipated, estimated, or intended. Readers are cautioned

not to place undue reliance on such information. By its nature,

forward-looking information involves numerous assumptions, inherent

risks and uncertainties, both general and specific that contribute

to the possibility that the predictions, forecasts, and projections

of various future events will not occur. The Company undertakes no

obligation to update publicly or otherwise revise any

forward-looking information whether as a result of new information,

future events or other such factors which affect this information,

except as required by law.

_________________________ 1 Silver equivalent production throughout

this press release was calculated based on silver, zinc, lead and

copper realized prices during each respective period. 2 Cash cost

per ounce and all-in sustaining cost per ounce are non-IFRS

performance measures with no standardized definition. For further

information and detailed reconciliations, please refer to the

Company’s 2017 year-end and quarterly MD&A. The performance

measures for the quarter ended March 31, 2018 are preliminary

throughout this press release subject to refinement from the

Company’s first quarter financial results to be released on or

before May 10, 2018.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20180417005566/en/

Americas Silver CorporationDarren Blasutti,

416-848-9503President and CEO

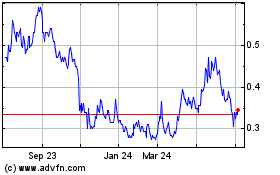

Americas Gold and Silver (TSX:USA)

Historical Stock Chart

From Mar 2024 to Apr 2024

Americas Gold and Silver (TSX:USA)

Historical Stock Chart

From Apr 2023 to Apr 2024