UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported)

April 10, 2018

EBIX, INC.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

|

Delaware

|

|

0-15946

|

|

77-0021975

|

|

(State or other jurisdiction

|

|

(Commission File Number)

|

|

(IRS Employer

|

|

of incorporation)

|

|

|

|

Identification No.)

|

|

|

|

|

|

|

|

1 Ebix Way Johns Creek, Georgia

|

|

30097

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

Registrant's telephone number, including area code

(678) 281-2020

N/A

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

o

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company

o

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

o

Item 5.02

(e)

On April 10, 2018, Ebix, Inc. (the “Company”) entered into a Stock Appreciation Right Award Agreement (the “SAR Agreement”) with Robin Raina, the Company’s Chairman, President and Chief Executive Officer.

The SAR Agreement replaces the Acquisition Bonus Agreement (the “ABA”) between the Company and Mr. Raina, dated July 15, 2009. At the time that Mr. Raina and the Company entered into the ABA, the Board of Directors of the Company (the “Board”) had concluded that Mr. Raina’s retention was critical to the future success and growth of the Company, and consequently, the Board’s intention in entering into the ABA was to ensure that Mr. Raina would be appropriately rewarded for his contributions to the Company prior to an Acquisition Event (as defined below), as well as to further motivate Mr. Raina to maximize the value received by all stockholders of the Company if the Company were to be acquired. Under the terms of the ABA (with some exceptions), if Mr. Raina was then employed by the Company upon an event by which: (a) more the fifty percent (50%) of the voting stock of the Company is sold, transferred, or exchanged; (b) a merger or consolidation of the Company occurs; (c) the sale, exchange, or transfer of substantially all of the Company’s assets occurs; or (d) the Company is acquired or dissolved (each, an “Acquisition Event”), Mr. Raina would have received a cash bonus.

In recent years, three stockholders of the Company have pursued claims in litigation in the Delaware Court of Chancery challenging the validity and interpretation of certain terms of the ABA in a consolidated action captioned

In re Ebix Stockholder Litigation

, C.A. No. 8526 (Del. Ch.). In connection with such litigation, Mr. Raina has asserted a conditional cross-claim against the Company for reformation of the ABA. On November 26, 2017, the non-executive members of the Board asked the Board’s Compensation Committee (the “Committee”) to review the ABA and recommend a course of action. After this review and based on the Committee’s recommendation, the Board directed the Committee to enter into negotiations with Mr. Raina for a new agreement to replace the ABA. As a result of those negotiations, the Committee presented a proposed new agreement to the non-executive members of the Board for their consideration. Upon the unanimous recommendation of the Committee, the Board then directed the Committee to finalize and enter into an agreement substantially in the form of the SAR Agreement. Upon the execution of the SAR Agreement, the ABA was terminated and each party relinquished all rights and benefits under the ABA.

In negotiating and entering into the SAR Agreement, the Board wished to resolve any uncertainty or ambiguities that may exist in the ABA, while preserving the original intent of the ABA of ensuring that Mr. Raina would be appropriately rewarded for his contributions prior to an Acquisition Event, as well as to further motivate Mr. Raina to maximize the value received by all stockholders of the Company if the Company were to be acquired. The SAR Agreement also recognizes Mr. Raina’s critical role in the future success and growth of the Company.

Highlights of SAR Agreement

Mr. Raina received 5,953,975 stock appreciation rights with respect to the Company’s common shares (the “SARs”). Upon an Acquisition Event, each of the SARs entitles Mr. Raina to receive a cash payment from the Company equal to the excess, if any, of the net proceeds per share received in connection with an Acquisition Event over the base price of $7.95. Although the SARs were not granted under the Company’s 2010 Stock Incentive Plan (the “Plan”), the SAR Agreement does incorporate certain provisions of the Plan, including the provisions requiring equitable adjustment of awards and base price in connection with certain corporate events (including stock splits). Mr. Raina will only be entitled to receive a payment with respect to the SARs if he is employed by the Company at the time of an Acquisition Event or was terminated by the Company without cause within the 180-day period immediately preceding an Acquisition Event.

Annually, while Mr. Raina is employed by the Company and prior to an Acquisition Event, the Board shall determine whether a “shortfall” (as defined in the SAR Agreement) existed as of the end of the immediately preceding fiscal year. In the event the Board determines that a shortfall existed, Mr. Raina will be granted additional SARs (or, in the Board’s sole discretion, restricted shares or restricted stock units (each a “Share Grant”)) in an amount sufficient to eliminate such shortfall (each a “Shortfall Grant”). A “shortfall” will exist if the sum of the number of Company’s common shares deemed to be owned by Mr. Raina as of the date hereof (3,676,540), the number of SARs granted to Mr. Raina, and the number of shares underlying any previously granted Shortfall Grant is less than twenty percent (20%) of the sum of the number of SARs and the number of outstanding shares reported by the Company in its audited financial statements as of the end of the immediately preceding fiscal year.

If a Shortfall Grant is made in the form of SARs, such SARs will be subject to the same terms and conditions as the SARs initially granted under the SAR Agreement. If the Board elects to grant a Shortfall Grant as a Share Grant, it will have such terms

and conditions as determined by the Board, but shall generally follow the terms of restricted shares or restricted stock unit awards granted to other executives of the Company at or about the time of such Share Grant; but no Share Grant shall vest more rapidly than one-third of such Share Grant prior to the first anniversary of such Share Grant and the remainder in eight equal quarterly installments following the first anniversary of such Share Grant.

Just like the ABA, the SAR Agreement provides for tax gross-up payments for excise taxes that would be imposed on Mr. Raina in respect of any payments (other than any payments with respect to Share Grants) made in connection with a change in control of the Company under Section 4999 of the Internal Revenue Code.

The foregoing description does not purport to be complete and is qualified in its entirety by reference to the SAR Agreement filed as Exhibit 10.1 to this Current Report on Form 8-K which is incorporated by reference herein

.

Item 9.01 Financial Statements and Exhibits.

Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

EBIX, INC.

|

|

|

|

|

|

|

|

|

By:

|

/s/ Sean T. Donaghy

|

|

|

Name:

|

Sean T. Donaghy

|

|

|

Title:

|

Chief Financial Officer

|

|

|

|

|

|

Dated: April 16, 2018

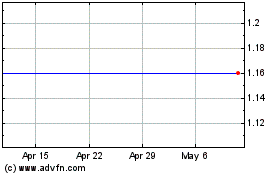

Ebix (NASDAQ:EBIX)

Historical Stock Chart

From Mar 2024 to Apr 2024

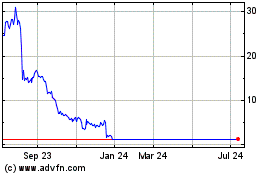

Ebix (NASDAQ:EBIX)

Historical Stock Chart

From Apr 2023 to Apr 2024