Additional Proxy Soliciting Materials (definitive) (defa14a)

April 13 2018 - 3:32PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE

COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

(RULE 14a-101)

SCHEDULE 14A INFORMATION

PROXY STATEMENT

PURSUANT TO SECTION 14(A) OF THE SECURITIES

EXCHANGE ACT OF 1934 (AMENDMENT NO. )

Filed by the Registrant

☑

Filed by a Party other than the Registrant

☐

Check the appropriate box:

|

|

|

|

|

☐

|

|

Preliminary Proxy Statement

|

|

|

|

|

☐

|

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

|

|

|

|

☐

|

|

Definitive Proxy Statement

|

|

|

|

|

☑

|

|

Definitive Additional Materials

|

|

|

|

|

☐

|

|

Soliciting Material Pursuant to §240.14a-12

|

TIMKENSTEEL CORPORATION

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement,

if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

|

|

|

|

|

|

|

|

|

|

☑

|

|

No fee required.

|

|

|

|

|

☐

|

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

|

|

|

|

|

|

|

(1)

|

|

Title of each class of securities to which transaction applies:

|

|

|

|

|

|

|

|

(2)

|

|

Aggregate number of securities to which transaction applies:

|

|

|

|

|

|

|

|

(3)

|

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the

amount on which the filing fee is calculated and state how it was determined):

|

|

|

|

|

|

|

|

(4)

|

|

Proposed maximum aggregate value of transaction:

|

|

|

|

|

|

|

|

(5)

|

|

Total fee paid:

|

|

|

|

|

☐

|

|

Fee paid previously with preliminary materials.

|

|

|

|

|

☐

|

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement

number, or the Form or Schedule and the date of its filing.

|

|

|

|

|

|

|

|

(1)

|

|

Amount Previously Paid:

|

|

|

|

|

|

|

|

(2)

|

|

Form, Schedule or Registration Statement No.:

|

|

|

|

|

|

|

|

(3)

|

|

Filing Party:

|

|

|

|

|

|

|

|

(4)

|

|

Date Filed:

|

Executive compensation practices and

performance April 2018

TimkenSteel’s board of directors

recommendation Approval, on an advisory basis, of named executive officer compensation The following pages offer information on that topic supplemental to the company’s Notice of 2018 Annual Meeting of Shareholders and Proxy Statement The

proxy statement also offers information on the board’s recommendations regarding election of directors and ratification of the appointment of our independent auditor. 2

TimkenSteel executive compensation

objectives Align the interests of our executives and shareholders Reward executives for strong business and financial results Attract, retain and motivate the best talent 1EBIT/BIC is defined as earnings before interest and taxes divided by

beginning invested capital 2CEO’s long-term incentive portfolio is comprised of performance-based restricted stock units and non-qualified stock options Award Objective Metrics Employees Time Period Annual Incentive Execution of annual

operational priorities Variable cash compensation based on performance EBIT/BIC(1) Cash flow Key process path sales All salaried, including officers and CEO 1 year Performance-based Restricted Stock Units Long-term shareholder value creation

Alignment with strategic business priorities Reward for accomplishment of mid-term financial performance Average return on invested capital Cumulative sales Cumulative cash flow Share price (metrics in current cycles) Directors and above, including

Officers and CEO(2) 2 to 3 years Cliff Vested Restricted Stock Units Retention of top talent Build ownership Alignment with shareholders Share price Directors and above, including Officers (excludes CEO) 3 years Non-Qualified Stock Options Long-term

shareholder value creation Alignment with shareholders Share price Directors and above, including Officers and CEO(2) 4 years ratable vested 10 year exercise period 3

TimkenSteel CEO compensation Since

TimkenSteel has been a public company, a prolonged economic down cycle has presented considerable challenges in forecasting and establishing achievable goals while also generating expected shareholder returns. Company performance is improving, but

actual compensation to date has been below target as a function of a well-designed compensation structure that includes: With a pay-for-performance philosophy, realized total compensation has been well below targeted and competitive levels 2.

Well-structured compensation program and best practice governance processes Targets median compensation against size-appropriate general industry survey data reflecting TimkenSteel revenue for setting target pay Pay mix heavily weighted with

performance-based compensation and performance-based equity to align with shareholders Updated ownership guidelines and other good-governance, shareholder-friendly policies 1. Highly performance-based incentives with challenging performance criteria

Annual incentives based on earnings and cash flow with targets set such that expected payouts would be below target Performance-based restricted stock units based on ROIC, sales and cash flow over multi-year period reflecting industry uncertainty

and volatility (has not paid since TimkenSteel became an independent company) Non-qualified stock options to align long-term compensation with shareholders 4

Potential target vs. actual realized:

TimkenSteel CEO three-year compensation (2015-2017) CEO’s realized pay over three years is 39% of target compensation 3-year average bonus is 18% of target Assumes all stock awards are below threshold 2015-2017 were below 2016-2018 and

2017-2018 are tracking below threshold through 2017 Stock options at 73% of Black Scholes target (currently, only 2016 award is in the money) 3-year comp target 3-year realized comp 5 Change in pension value is not in this chart. The

Summary Compensation Table in the Proxy Statement includes $1.4m change in pension value, much of which is due to a reduction in the discount rate.

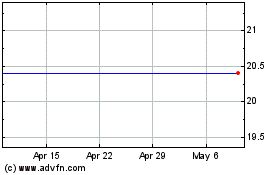

TimkenSteel (NYSE:TMST)

Historical Stock Chart

From Mar 2024 to Apr 2024

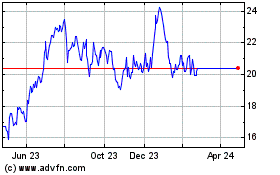

TimkenSteel (NYSE:TMST)

Historical Stock Chart

From Apr 2023 to Apr 2024