Statement of Changes in Beneficial Ownership (4)

April 10 2018 - 6:05PM

Edgar (US Regulatory)

|

FORM 4

[ ]

Check this box if no longer subject to Section 16. Form 4 or Form 5 obligations may continue.

See

Instruction 1(b).

|

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

STATEMENT OF CHANGES IN BENEFICIAL OWNERSHIP OF SECURITIES

|

OMB APPROVAL

OMB Number:

3235-0287

Estimated average burden

hours per response...

0.5

|

|

Filed pursuant to Section 16(a) of the Securities Exchange Act of 1934 or Section 30(h) of the Investment Company Act of 1940

|

|

|

1. Name and Address of Reporting Person

*

Kinnish Bradley

|

2. Issuer Name

and

Ticker or Trading Symbol

MARIN SOFTWARE INC

[

MRIN

]

|

5. Relationship of Reporting Person(s) to Issuer

(Check all applicable)

_____ Director

_____ 10% Owner

__

X

__ Officer (give title below)

_____ Other (specify below)

VP Finance, CFO

|

|

(Last)

(First)

(Middle)

C/O MARIN SOFTWARE INCORPORATED, 123 MISSION STREET, 25TH FLOOR

|

3. Date of Earliest Transaction

(MM/DD/YYYY)

3/7/2018

|

|

(Street)

SAN FRANCISCO, CA 94105

(City)

(State)

(Zip)

|

4. If Amendment, Date Original Filed

(MM/DD/YYYY)

|

6. Individual or Joint/Group Filing

(Check Applicable Line)

_

X

_ Form filed by One Reporting Person

___ Form filed by More than One Reporting Person

|

Table I - Non-Derivative Securities Acquired, Disposed of, or Beneficially Owned

|

1.Title of Security

(Instr. 3)

|

2. Trans. Date

|

2A. Deemed Execution Date, if any

|

3. Trans. Code

(Instr. 8)

|

4. Securities Acquired (A) or Disposed of (D)

(Instr. 3, 4 and 5)

|

5. Amount of Securities Beneficially Owned Following Reported Transaction(s)

(Instr. 3 and 4)

|

6. Ownership Form: Direct (D) or Indirect (I) (Instr. 4)

|

7. Nature of Indirect Beneficial Ownership (Instr. 4)

|

|

Code

|

V

|

Amount

|

(A) or (D)

|

Price

|

|

Common Stock

|

4/7/2018

|

|

M

(1)

|

|

3572

|

A

|

$0

|

3890

(2)

|

D

|

|

|

Common Stock

|

4/7/2018

|

|

F

(3)

|

|

1564

|

D

|

$6.50

|

2326

|

D

|

|

Table II - Derivative Securities Beneficially Owned (

e.g.

, puts, calls, warrants, options, convertible securities)

|

1. Title of Derivate Security

(Instr. 3)

|

2. Conversion or Exercise Price of Derivative Security

|

3. Trans. Date

|

3A. Deemed Execution Date, if any

|

4. Trans. Code

(Instr. 8)

|

5. Number of Derivative Securities Acquired (A) or Disposed of (D)

(Instr. 3, 4 and 5)

|

6. Date Exercisable and Expiration Date

|

7. Title and Amount of Securities Underlying Derivative Security

(Instr. 3 and 4)

|

8. Price of Derivative Security

(Instr. 5)

|

9. Number of derivative Securities Beneficially Owned Following Reported Transaction(s) (Instr. 4)

|

10. Ownership Form of Derivative Security: Direct (D) or Indirect (I) (Instr. 4)

|

11. Nature of Indirect Beneficial Ownership (Instr. 4)

|

|

Code

|

V

|

(A)

|

(D)

|

Date Exercisable

|

Expiration Date

|

Title

|

Amount or Number of Shares

|

|

Employee Stock Option (right to buy)

|

$7.40

|

3/7/2018

|

|

A

|

|

71000

|

|

(4)

|

3/6/2028

|

Common Stock

|

71000

|

$0

|

71000

|

D

|

|

|

Restricted Stock Units

|

$0

(5)

|

4/7/2018

|

|

M

(1)

|

|

|

3572

|

(6)

|

(6)

|

Common Stock

|

3572

|

$0

|

96428

|

D

|

|

|

Explanation of Responses:

|

|

(1)

|

Vesting of restricted stock units ("RSUs") granted to the Reporting Person on April 7, 2017.

|

|

(2)

|

Includes 318 shares acquired under the issuer's employee stock purchase plan (the "ESPP") on November 14, 2017.

|

|

(3)

|

Exempt transaction pursuant to Section 16b-3(e) - payment of exercise price or tax liability by delivering or withholding securities incident to the receipt, exercise or vesting of a security issued in accordance with Rule 16b-3. All of the shares reported as disposed of in this Form 4 were relinquished by the Reporting Person and cancelled by the Issuer in exchange for the Issuer's agreement to pay federal and state tax withholding obligations of the Reporting Person resulting from the vesting of RSUs. The Reporting Person did not sell or otherwise dispose of any of the shares reported on this Form 4 for any reason other than to cover required taxes.

|

|

(4)

|

25% of the shares subject to the grant vest and become exercisable on January 8, 2019, then 2.0833% of the shares subject to the grant vest and become exercisable each month thereafter, until such time as the option is 100% vested, subject to the continuing employment of the Reporting Person on each vesting date.

|

|

(5)

|

Each RSU represents a contingent right to receive one share of the Issuer's common stock.

|

|

(6)

|

25% of the RSUs vest annually on the anniversary of the grant date, until such time as the RSUs are 100% vested, subject to the continuing employment of the Reporting Person on each vesting date. Shares of the Issuer's common stock will be delivered to the Reporting Person upon vesting.

|

Reporting Owners

|

|

Reporting Owner Name / Address

|

Relationships

|

|

Director

|

10% Owner

|

Officer

|

Other

|

Kinnish Bradley

C/O MARIN SOFTWARE INCORPORATED

123 MISSION STREET, 25TH FLOOR

SAN FRANCISCO, CA 94105

|

|

|

VP Finance, CFO

|

|

Signatures

|

|

/s/ Bradley Kinnish by Jonathan DeGooyer, Attorney-in-Fact

|

|

4/10/2018

|

|

**

Signature of Reporting Person

|

Date

|

|

Reminder: Report on a separate line for each class of securities beneficially owned directly or indirectly.

|

|

*

|

If the form is filed by more than one reporting person,

see

Instruction 4(b)(v).

|

|

**

|

Intentional misstatements or omissions of facts constitute Federal Criminal Violations.

See

18 U.S.C. 1001 and 15 U.S.C. 78ff(a).

|

|

Note:

|

File three copies of this Form, one of which must be manually signed. If space is insufficient,

see

Instruction 6 for procedure.

|

|

Persons who respond to the collection of information contained in this form are not required to respond unless the form displays a currently valid OMB control number.

|

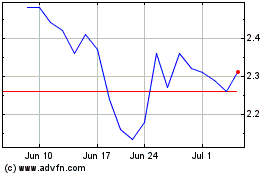

Marin Software (NASDAQ:MRIN)

Historical Stock Chart

From Mar 2024 to Apr 2024

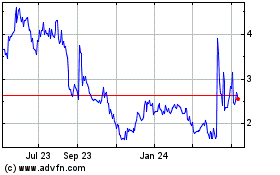

Marin Software (NASDAQ:MRIN)

Historical Stock Chart

From Apr 2023 to Apr 2024