UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE

14D-9

(Amendment No. 1)

SOLICITATION/RECOMMENDATION STATEMENT

UNDER SECTION 14(d)( 4) OF THE

SECURITIES EXCHANGE ACT OF 1934

Cogentix

Medical, Inc.

(Name of Subject Company)

Cogentix

Medical, Inc.

(Name of Persons Filing Statement)

Common Stock, $0.01 par value per share

(Title of Class of Securities)

19243A104

(CUSIP Number

of Class of Securities)

Brett Reynolds

Senior Vice President, Chief Financial Officer and Corporate Secretary

5420 Feltl Road

Minnetonka, MN 55343

United States

(

952)

426-6140

(Name, address and telephone number of person authorized to receive notices

and communications on behalf of filing persons)

With copies to:

Timothy S. Hearn

Jonathan A. Van Horn

Dorsey & Whitney LLP

50 South Sixth Street, Suite 1500

Minneapolis, MN, 55402

USA

(612)

340-2600

☐

Check the box if the filing relates solely to preliminary communications made before the commencement of a tender offer.

This Amendment No. 1 amends and supplements the Solicitation/Recommendation Statement on Schedule

14D-9

filed by Cogentix Medical, Inc. (the “Company”) with the Securities and Exchange Commission (the “SEC”) on March 26, 2018 (as amended and supplemented from time to time, the

“Schedule

14D-9”).

The Schedule

14D-9

relates to the tender offer by Camden Merger Sub, Inc., a Delaware corporation (“Purchaser”) and a wholly owned

subsidiary of LM US Parent, Inc., a Delaware corporation (“Parent”), and an affiliate of Laborie Medical Technologies Canada ULC (“Laborie”), to purchase all of the issued and outstanding shares of common stock, par value $0.01

per share, of the Company at a price of $3.85 per share in cash, net to the seller in cash, without interest thereon and subject to any required tax withholding (the “Offer Price”), upon the terms and subject to the conditions of the Offer

to Purchase, dated March 26, 2018 (together with any amendments or supplements thereto, the “Offer to Purchase”), and in the related Letter of Transmittal (together with any amendments or supplements thereto, the “Letter of

Transmittal” and, together with the Offer to Purchase, the “Offer”). The Offer to Purchase and Letter of Transmittal are filed as Exhibits (a)(1)(i) and (a)(1)(ii), respectively, to the Schedule TO filed by Parent and Purchaser with

the SEC.

Except as otherwise set forth below, the information set forth in the Schedule

14D-9

remains unchanged

and is incorporated by reference as relevant to the items in this Amendment No. 1. Capitalized terms used but not otherwise defined herein have the meanings ascribed to such terms in the Schedule

14D-9.

|

Item 3.

|

Past Contacts, Transactions, Negotiations and Agreements.

|

Item 3. Past Contacts, Transactions,

Negotiations and Agreements—Arrangements with the Company, Parent and Purchaser—

Tender and Support Agreements

is hereby amended as follows:

Amending and restating the sixth paragraph beginning on Page 5

.

The Tender and Support Agreements provide that, in the event of a change in the recommendation of the Company Board or the termination of the

Merger Agreement in certain circumstances related to the entry into an agreement for a superior proposal (a

“Cut-Back

Event”), the number of Shares covered by the Tender Agreement will be reduced so

that the Shares released from the obligations of the Tender and Support Agreements, together with a majority of the then outstanding Shares not held by the Tendering Stockholders, will represent a majority of the Shares.

The formula for determining the number of Shares held by each Tendering Stockholder that would be released from the obligations of the Tender

and Support Agreement upon a

Cut-Back

Event is as follows:

Released Shares =

(

Stockholder Ratio

x

Aggregate Released Shares

) + 1

|

|

|

|

|

|

|

Stockholder Ratio

|

|

=

|

|

|

|

Aggregate Released Shares

|

|

=

|

|

((

Outstanding Shares

÷ 2) + 1)

– ((

Unaffiliated Shares

÷ 2) + 1)

|

|

Outstanding Shares

|

|

=

|

|

the

number of Shares outstanding at the calculation time

|

|

TS

|

|

=

|

|

the

number of Shares beneficially owned by the Tendering Stockholder at the calculation time

|

|

OTS

|

|

=

|

|

the

number of Shares beneficially owned by the other Tendering Stockholder at the calculation time

|

|

Unaffiliated Shares

|

|

=

|

|

Outstanding Shares

- (

TS

+

OTS

)

|

1

For example, as of April 9, 2018, (i) there were 60,925,666 Shares outstanding,

(ii) Mr. Pell beneficially owned 20,051,723 Shares subject to the Tender and Support Agreement executed by Mr. Pell and (iii) Accelmed beneficially owned 16,129,033 Shares subject to the Tender and Support Agreement

executed by Accelmed. In the event that a

Cut-Back

Event had occurred on April 9, 2018, (i) 10,025,862 Shares beneficially owned by Mr. Pell would have been released from the obligations of

the Tender and Support Agreement and 10,025,861 Shares beneficially owned by Mr. Pell (or 16.46% of the outstanding voting power) would have remained subject to the obligations of the Tender and Support Agreement,

(ii) 8,064,517 Shares beneficially owned by Accelmed would have been released from the obligations of the Tender and Support Agreement and 8,064,516 Shares beneficially owned by Accelmed (or 13.24% of the outstanding voting power)

would have remained subject to the obligations of the Tender and Support Agreement and (iii) the aggregate number of Shares released from the obligations of the Tender and Support Agreement, when combined with a majority of the outstanding

Shares not held by the Tendering Stockholders, would have been 30,462,835 Shares or 50.000003% of the outstanding Shares. The aggregate percentage of the Company’s outstanding voting power which would remain subject to the Tender and

Support Agreement in the example above is approximately 29.69%.

In event of the termination of the Merger Agreement under certain

specified circumstances related to a change in the recommendation of the Company Board or the entry into an agreement for a superior proposal, the obligations under each Tender and Support Agreement will, subject to the provisions related to the

reduction in number of Shares subject to that Tender and Support Agreement summarized above, survive for a period of six months following such termination.

|

Item 4.

|

The Solicitation of Recommendation

.

|

Item 4. The Solicitation or

Recommendation—Background and Reasons for the Recommendation of the Company Board—

Background of the Offer

is hereby amended as follows:

Amending and restating the fourth full paragraph on Page 13.

On June 16, 2017, the Company and Laborie executed a mutual confidentiality agreement for the exchange of

non-public

information. The confidentiality agreement the Company entered into with Laborie does not contain any standstill provision. See “Item 3. Past Contacts, Transactions, Negotiations and

Agreements—Arrangements with the Company, Parent and Purchaser—

Confidentiality Agreement and Joinders.

”

Amending and restating

the sixth full paragraph on Page 14.

On February 1, 2018, the Company entered into a confidentiality agreement with

Party A. The confidentiality agreement the Company entered into with Party A does not contain any standstill provision or any other term that would prohibit Party A from making a bona fide, unsolicited, written proposal to acquire the

Company.

Supplementing the first paragraph on Page 18 with the following.

At both the February 9 and February 10 meetings of the Company Board, the Company Board evaluated the following factors, among

others, in assessing the relative certainty of closing a transaction at the prices indicated by the

non-binding

indications of interest received from Laborie and Party A:

|

|

•

|

|

That Laborie’s products are in the urology market, the same industry space as the Company’s products;

|

|

|

•

|

|

That, while Party A is a healthcare products company, its products do not include urology products;

|

2

|

|

•

|

|

That Laborie had performed extensive due diligence on the Company, its products and intellectual property portfolio, dating back to at least

mid-2017;

|

|

|

•

|

|

That the

non-public

information supplied to Party A had been limited to the contents of a confidential management presentation used in the February 8 meeting with

Party A and that, as a result Party A’s due diligence investigation of the Company was not nearly as advanced as Laborie’s due diligence on the Company; and

|

|

|

•

|

|

That Laborie, given its knowledge of the urology products market, its preexisting commercial relationship with the Company (and resulting familiarity with the Company’s products), and the due diligence it had

performed on the Company, including without limitation with respect to its intellectual property portfolio, manufacturing processes and human resources matters, was significantly less likely than Party A to subsequently raise a concern about

(and lower its price as a result of) its view of the Company’s operations.

|

At the February 10 meeting of the

Company Board, in addition to further discussing the factors described in the above paragraph, the Company Board considered, among other matters, Laborie’s statement that its February 10 offer was its best and final offer, and that, if

Laborie was not granted exclusivity on the basis of its proposal, it would cease consideration of a potential acquisition of the Company and that it would not further participate in a competitive process for the acquisition of the Company.

These factors, among others, were the basis on which the Company Board concluded (i) that the Laborie

non-binding

offer of $3.85 per Share represented greater certainty of value than the

non-binding

offer from Party A of $4.05 per Share, (ii) that there was more

risk of Party A subsequently dropping its price (including to levels below the $3.85 per Share proposed by Laborie) than of Laborie dropping its price, (iii) that Party A’s proposal was significantly disadvantaged when compared to

Laborie’s proposal as to certainty of closing and (iv) that Laborie’s proposal was superior to the proposal submitted by Party A.

Item 4. The Solicitation of Recommendation—Opinion of the Company’s Financial Advisor—

Other

is hereby amended as follows:

Amending and restating the first paragraph on Page 41.

In 2016, Duff & Phelps served as independent financial advisor to a special committee of the Company Board and rendered a fairness

opinion to the unaffiliated public stockholders of the Company in connection with Accelmed’s acquisition in November, 2016 of 16,129,033 Shares and the simultaneous conversation of convertible promissory notes held by Mr. Pell into

17,688,423 Shares. See “Item 4. The Solicitation or Recommendation—Background and Reasons for the Company Board’s Recommendation—

Background of the Offer

”. For this prior engagement, Duff & Phelps received a

fee of $100,000 for providing financial advisory services, a fee of $225,000 for providing a fairness opinion, expense reimbursement, and indemnification. Except as described above in this paragraph, in the past three years, Duff & Phelps

has not provided investment banking or other services to the Company, its subsidiaries, Mr. Pell, Accelmed, Laborie, Parent or Purchaser for which it has received compensation.

|

Item 8.

|

Additional Information.

|

Item 8 Additional Information—Legal Proceedings 9 is

Other

is hereby amended as follows:

Amending and restating the fourth full paragraph on Page 49.

On April 6, 2018, a putative class action lawsuit (the “Stockholder Action”), captioned

Adam Franchi, Individually and On

Behalf of All Others Similarly Situated v. Uri Geiger, James A. D’Orta, Darin Hammers, Cheryl Pegus, Lewis C. Pell, Nachum Shamir, Kenneth A. Samet, Howard Zauberman, Laborie Medical Technologies Canada ULC, LM US Parent, Inc., and Camden

Merger Sub, Inc.

, Case No. 2018-0258, was filed in

3

the Court of Chancery of the State of Delaware. The case names as defendants members of the Company Board of Directors, Laborie, Purchaser and Parent. The case alleges, among other things, that

the members of the Company Board breached their fiduciary duties by failing to take steps to maximize stockholder value. In particular, the complaint alleges that the Board breached its fiduciary duties by accepting the Offer Price notwithstanding

the fact that Party A has offered $4.05 per share in cash to acquire the Company and by agreeing to several contractual provisions that the Plaintiff believes will foreclose the possibility that the Company will receive a superior offer from Party A

or any other party. The Plaintiff further alleges that the Schedule 14D-9 Solicitation/Recommendation Statement is deficient and misleading in that it fails to provide adequate disclosure of all material information related to the proposed

transaction. The Plaintiff also asserts an aiding and abetting breach of fiduciary duty claim against Laborie, Parent and Purchaser. Based on these and other allegations the complaint seeks, among other things: (i) declaration as a class

action; (ii) an order enjoining the proposed transaction; (iii) rescission, to the extent implemented, of proposed transaction or rescissory damages; (iv) an accounting of damages sustained from the alleged breaches of fiduciary

duties; and (v) an award of fees and costs of the action, including attorneys’ and experts’ fees. It is possible that additional similar complaints may be filed in the future. If this does occur, absent new or different allegations

which are material, the Company, Laborie, Parent and Purchaser will not necessarily announce the filing of any similar complaints.

The

Company Board continues to unanimously recommend that the holders of Shares accept the Offer and tender their Shares to Purchaser pursuant to the Offer.

Cautionary Note Regarding Forward-Looking Statements.

The Schedule

14D-9

contains forward-looking statements related to the Company, including statements

about the proposed acquisition of the Company by Parent, the parties’ ability to close the proposed transaction and the expected closing date of the proposed transaction. Statements in the Schedule

14D-9

that are not historical or current facts are forward-looking statements. These statements are not guarantees of future performance and involve known and unknown risks, uncertainties and other factors that may cause the Company’s actual results,

performance or achievements to be materially different from any future results, performances or achievements expressed or implied by the forward-looking statements. These forward-looking statements include, but are not limited to: statements

regarding the planned completion of the Offer and the Merger; statements regarding the anticipated timing of filings and approvals relating to the Offer and the Merger; statements regarding the expected timing of the completion of the Offer and the

Merger; statements regarding the ability to complete the Offer and the Merger considering the various closing conditions; and projected financial information. The Company’s actual future results may differ materially from the Company’s

current expectations due to the risks and uncertainties inherent in its business. These risks include, but are not limited to: uncertainties as to the timing of the Offer and the Merger; uncertainties as to the percentage of the Company stockholders

tendering their Shares into the Offer; the possibility that competing offers will be made; the possibility that various closing conditions for the Offer or the Merger may not be satisfied or waived, including that a governmental entity may prohibit,

delay or refuse to grant approval for the consummation of the Merger; the effects of disruption caused by the transaction making it more difficult to maintain relationships with employees, collaborators, vendors and other business partners; the risk

that the Stockholder Action or other potential stockholder litigation in connection with the Offer or the Merger may result in significant costs of defense, indemnification and liability; and risks and uncertainties pertaining to the business of the

Company, including the risks and uncertainties detailed under “Risk Factors” and elsewhere in the Company’s public periodic filings with the SEC, as well as the tender offer materials filed by Parent in connection with the Offer.

Accordingly, no assurances can be given as to whether the Offer and the Merger will be completed or if any of the other events anticipated by

the forward-looking statements will occur or what impact they will have. Forward-looking statements speak only as of the date hereof and you are cautioned not to place undue reliance on these forward-looking statements. All forward-looking

statements are qualified in their entirety by this cautionary statement and the Company undertakes no obligation to revise or update this report to reflect events or circumstances after the date hereof, except as required by law.

4

SIGNATURE

After due inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is true, complete and

correct.

|

|

|

|

|

COGENTIX MEDICAL, INC.

|

|

|

|

|

By:

|

|

/s/ Brett Reynolds

|

|

Name:

|

|

Brett Reynolds

|

|

Title:

|

|

Senior Vice President, Chief Financial

Officer and Corporate Secretary

|

Dated: April 10, 2018

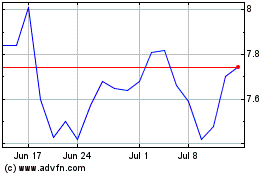

Cognyte Software (NASDAQ:CGNT)

Historical Stock Chart

From Mar 2024 to Apr 2024

Cognyte Software (NASDAQ:CGNT)

Historical Stock Chart

From Apr 2023 to Apr 2024