Grupo Aeroportuario del Pacífico, S.A.B. de C.V. (NYSE:PAC;

BMV:GAP) (“the Company” or “GAP”) addressed today the following

letter to its shareholders.

Esteemed Shareholders of Grupo Aeroportuario del Pacífico,

S.A.B. de C.V.:

We are writing to keep you properly informed in anticipation of

our April 25, 2018, General Ordinary and Extraordinary

Shareholders’ Meetings (together, the “Shareholders’

Meetings”).

2017 was an exceptional year for the Company. It was a year of

evolution and strengthening of our leadership in the airport

sector. 2017 was a year that was characterized by growth. Growth in

the number of passengers, once again reaching record numbers during

2017; growth in profitability, reaching an EBITDA of Ps.7,725

million, with a margin of 69.9%; and finally, the improvement and

growth in our infrastructure, centered around big actions to

improve capacity and security in our terminal buildings.

In this manner, GAP has responded to the challenge of rapid

passenger growth by providing better service and comfort to users.

We can say that the balanced portfolio of airports and correct

decision making, have not only allowed for the delivery of

favorable results, but have also increased the value to

shareholders. Consequently, if the distribution proposals included

in the Shareholders’ Meetings are approved, shareholders shall

receive during 2018 a total distribution of Ps.10.00 per share in

2018, which represents an increase of 10.5% over the distribution

paid in 2017.

In line with our commitment to ensure that our shareholders have

access to timely and transparent information with regards to the

items of our shareholders’ meetings, we would like to take this

opportunity to provide our perspective to you and to all our

shareholders in regard to the agenda for the Shareholder’s Meetings

that was published on March 9, 2018 (the “Agenda”) and that can be

found on our web site at:

https://www.aeropuertosgap.com.mx/en/shareholders-meeting/2710-asamblea.html.

Ordinary General Annual Shareholders’

Meeting

I. Board and CEO reports

This Agenda item includes six points; however, these points will

be voted on together in a single vote. The matters to be addressed

are routine and related to the Chief Executive Officer’s report and

corporate governance reports in compliance with the Mexican

Securities Market Law.

II. Liability release

The release of directors and officers of the Company from

liability for the performance of their duties is subject to certain

exceptions in accordance with Mexican law and corporate governance

rules, including our bylaws (the “Liability Release Proposal”). The

Liability Release Proposal, however, is a common practice in Mexico

and mirrors the releases contained in our bylaws (Art. 25). In

addition, the liability release minimizes frivolous lawsuits that

impose an unnecessary cost on the Company and its shareholders.

This liability release has fulfilled an ongoing objective of

ensuring directors’ and management’s independence in their

decision-making to the benefit of our shareholders since our

initial public offering on the Mexican Stock Exchange in 2006.

III. Request for approval of our 2017 audited financial

statements

In compliance with Mexican fiscal regulations, we present

unconsolidated annual financial statements, prepared under Mexican

Financial Reporting Standards (“MFRS”), which will be used to

determine taxes corresponding to fiscal year 2017. In addition, in

compliance with Mexican and U.S. securities regulations, we prepare

consolidated annual financial statements under International

Financial Reporting Standards (“IFRS”), which we file with the

Mexican National Banking and Securities Commission (“CNBV”) and the

U.S. Securities and Exchange Commission (“SEC”).

IV. Request for approval of our 2017 legal reserve

Net income for the year was Ps.4,533,604,331.00 under MFRS.

Pursuant to the Mexican General Law of Commercial Corporations (Ley

General de Sociedades Mercantiles), management proposes to allocate

Ps.226,680,217.00 to increase the legal reserve fund and to

transfer the remaining Ps.4,306,924,114.00 to the account for net

income pending allocation.

V. Request for approval of dividend payments

From the account for net income pending allocation amounting to

Ps.4,307,743,840.00, management proposes to pay dividends of

Ps.7.62 per share outstanding, an increase of 33.2% as compared to

dividends paid in 2017. This amount represents the maximum amount

of dividends that can be paid without generating additional taxes.

The Company’s positive results allow for this outstanding

reimbursement to shareholders.

VI. Request for approval of an increase to our share repurchase

fund

Additionally, in order to complete the application of the net

income for the period, management proposes to increase the

authorized amount allocated to the share repurchase fund in 2017 by

Ps.255 million during 2018, from Ps.995 million of unexercised

repurchase funds in 2017 to Ps.1,250 million for the 12-month

period after April 25, 2018.

The Company’s performance in 2017 permits the approval of these

proposals: EBITDA and net income increased by 17.3% and 41.1%,

respectively.

VII. Designation of directors representing the Series “BB”

shareholders

As established in our bylaws (Article 15), Aeropuertos Mexicanos

del Pacífico, S.A.P.I. de C.V. (“AMP”), our strategic shareholder,

is entitled to designate four proprietary members of our Board of

Directors and their respective alternate members. Mrs. Laura Díez

Barroso Azcárraga and Messrs. Juan Gallardo Thurlow, Carlos Laviada

Ocejo and José Manuel Fernández Bosch were designated as a

proprietary members, and Messrs. Carlos Alberto Rohm Campos,

Eduardo Sánchez Navarro Redo, Carlos Manuel Porrón Suárez and Juan

José Álvarez Gallego, were designated as their respective

alternates. This is not an item that needs to be voted on by

shareholders at our Ordinary Annual Shareholders’ Meeting.

VIII. Ratification and/or designation of director(s)

representing any 10% shareholder(s)

Our bylaws (Art. 15) entitle any individual or group of

shareholders who own a 10% or more equity stake in us with the

right to designate a director. To date, no proposal for the

designation or ratification of a director has been received. If we

receive a 10% shareholder’s proposal prior to the Ordinary Annual

Shareholders’ Meeting, the proposal will be presented during the

meeting. In case this right is not exercised, Mr. Francisco Javier

Moguel Gloria will be proposed as an independent director.

IX. Ratification and designation of independent directors

representing the Series “B” shareholders

Our Nomination and Compensation Committee proposes the

ratification of the current slate of directors for one year in

accordance with our bylaws (Art. 15). Messrs. Joaquín Vargas

Guajardo, Álvaro Fernández Garza, Juan Diez-Canedo Ruíz, Ángel

Losada Moreno and Carlos Cárdenas Guzmán are proposed for

ratification. Each of these nominees is a well-respected

businessman or executive employed by leading Mexican companies.

Furthermore, Mr. Roberto Servitje Achutegui tendered his

resignation as a member of our board of directors during January of

this year. Consequently, Mr. Luis Tellez Kuenzler, who holds a

bachelor’s degree in Economics from the Instituto Tecnologico

Autonomo de Mexico and a PhD in Economics from the Massachusetts

Institute of Technology, is proposed as his replacement.

Mr. Tellez has a trajectory spanning more than 30 years in both

the private and public sectors. In the private sector, he has been

a member of the board of directors of leading Mexican companies

such as, FEMSA, Grupo Mexico, BBVA Bancomer, Cultiva and Global

Industries. He was President and CEO of the Mexican Stock Exchange

(Grupo Bolsa Mexicana de Valores) for more than five years. He is a

member of the board of directors of GEPP, the sole bottler of

Pepsico in Mexico, Banco Interacciones and McLarty Associates, in

addition to serving as a Special Advisor to KKR in New York, and

President of Everis Mexico, an NTT Data company that provides

banking and financial consulting services, employing more than 600

consultants in the country.

Mr. Tellez has performed various functions in the Mexican

government. Mr. Tellez played a central role in key decisions to

improve Mexico’s economy in the areas of macroeconomics, public

finances, energy and agriculture. He was part of the team that put

into practice the rescue package for the financial system between

1995 and 1997; he lead the expansion of the generation and

transmission infrastructure during the 1990s; he directed the

reform of the pension system for the Mexican Social Security System

(IMSS); he directly participated in the constitutional changes that

led to the agrarian distribution through which individual property

rights were given to communal lands (ejidos). Mr. Tellez was also

responsible for negotiating the agriculture sector agreements of

the North American Free Trade Agreement with the United States and

Canada.

GAP’s management is convinced that Mr. Tellez’s experience and

knowledge in the public and private sectors will reinforce the

value that independent directors provide to ensuring the proper

functioning of the Company.

The resumes of the proposed board members including that of Mr.

Francisco Javier Moguel Gloria, are available on our website.

X. Designation of the chairman of the board

As established in our bylaws (Art. 16), the chairman of the

board is to be designated by the vote of a majority of the

shareholders. We received a report from our strategic partner

proposing that Mrs. Laura Díez Barroso Azcárraga, a shareholder of

our strategic partner AMP, be ratified as chairwoman of the

board.

XI. Request for approval of the directors’ compensation for 2018

and ratification of the directors’ compensation for 2017

The Nomination and Compensation Committee proposes that for 2018

compensation remain unchanged from that of 2017 but proposes that

payment be made exclusively for attendance. The Nomination and

Compensation also ratifies the directors’ compensation in 2017.

Attendance in 2017 by the members of our corporate governance

bodies was 93.1%.

XII. Ratification and/or designation of a director to serve as a

member of the Nomination and Compensation Committee

Our Series B shareholders annually designate an independent

director to serve as a member of our Nomination and Compensation

Committee. Mr. Álvaro Fernández Garza is proposed for ratification

to the position.

XIII. Ratification and/or designation of an independent director

to serve as chairman of the Audit and Corporate Practices

Committee

The Nomination and Compensation Committee proposes the

ratification of Mr. Carlos Cárdenas Guzmán for the position of

chairman of the Audit and Corporate Practices Committee, as

established in our bylaws (Art. 32).

XIV. Report regarding acquisitions

As established in our bylaws (Art. 29), the Company informs our

shareholders regarding acquisitions of goods or services,

contracting of work services or sales of assets for an amount equal

to or greater than U.S.$3,000,000.00 (THREE MILLION UNITED STATES

DOLLARS) or the equivalent in Mexican currency or other legal

currency used outside of Mexico, or such operations with

significant shareholders, if applicable. This is not an item that

needs to be voted on by shareholders.

XV. Ratification of designation of special delegates

Proposal to designate Messrs. Fernando Bosque Mohíno, Sergio

Enrique Flores Ochoa, Carlos Efrén Torres Flores or Mrs. Erica

Barba Padilla to appear before a notary public to formalize the

resolutions approved at this Ordinary Shareholders’ Meeting.

Extraordinary General Shareholders’

Meeting

I. Approval of a reduction in shareholder equity

As per the terms of our concession, our subsidiaries are

required to comply with the Master Development Program (“MDP”)

approved by the Mexican airport authority every five years. The

investments required by the MDP are those necessary to maintain and

expand the airports as well as to comply with required quality

standards.

To date, our subsidiaries have complied with the level of

investments required by the MDP, and maintained Ps.7,700 million in

surplus cash as of December 31, 2017. In accordance with our

dividend policies, this surplus cash at the subsidiary level can be

distributed to GAP without incurring additional taxes, and without

putting our subsidiaries’ operations at risk or compromising our

ability to cover operating expenses, capital investments or other

corporate obligations. Thus, taking into consideration the

availability of excess funds, we are proposing a capital reduction

equal to Ps.2.38 per share to be paid before May 31, 2018, and a

resolution to amend Article 6 of our bylaws accordingly.

II. Ratification of designation of special delegates

Proposal to designate Messrs. Fernando Bosque Mohíno, Sergio

Enrique Flores Ochoa, Carlos Efrén Torres Flores or Mrs. Erica

Barba Padilla to appear before a notary public to formalize the

resolutions approved at this Extraordinary Shareholders’

Meeting.

The board of directors and the officers of the Company wish to

emphasize our commitment to providing all shareholders with timely

and transparent information in advance of our General Ordinary and

Extraordinary Shareholders’ Meetings, and to foster an inclusive,

balanced and cohesive voting process for all of our shareholders.

We are confident that by sharing our perspective with you, each

shareholder will be able to make better-informed decisions to the

individual and collective benefit of all of GAP’s shareholders. In

light of the information above, we strongly encourage you to vote

in favor of all agenda

items.

I have the pleasure of giving thanks for having had the

opportunity to serve as CEO of GAP since 2011, a period during

which the Company has experienced a great transformation to the

benefit of its shareholders and the users of our 13 airports.

Respectfully,

_______________________________

Lic. Fernando Bosque Mohíno

Chief Executive Officer

Grupo Aeroportuario del Pacífico, SAB de CV

Company Description:

Grupo Aeroportuario del Pacífico, S.A.B. de C.V. (GAP) operates

12 airports throughout Mexico’s Pacific region, including the major

cities of Guadalajara and Tijuana, the four tourist destinations of

Puerto Vallarta, Los Cabos, La Paz and Manzanillo, and six other

mid-sized cities: Hermosillo, Guanajuato, Morelia, Aguascalientes,

Mexicali and Los Mochis. In February 2006, GAP’s shares were listed

on the New York Stock Exchange under the ticker symbol “PAC” and on

the Mexican Stock Exchange under the ticker symbol “GAP”. In April

2015 GAP acquired 100% of Desarrollo de Concesiones Aeroportuarias,

S.L., which owns a majority stake of MBJ Airports Limited, a

company operating the Sangster International Airport in Montego

Bay, Jamaica.

This press release may contain forward-looking statements. These

statements are not historical facts, and are based on management’s

current view and estimates of future economic circumstances,

industry conditions, company performance and financial results. The

words “anticipates,” “believes,” “estimates,” “expects,” “plans”

and similar expressions, as they relate to the company, are

intended to identify forward-looking statements. Statements

regarding the declaration or payment of dividends, the

implementation of principal operating and financing strategies and

capital expenditure plans, the direction of future operations and

the factors or trends affecting financial conditions, liquidity or

results of operations are examples of forward-looking statements.

Such statements reflect the current views of management and are

subject to a number of risks and uncertainties. There is no

guarantee that the expected events, trends or results will actually

occur. The statements are based on many assumptions and factors,

including general economic and market conditions, industry

conditions, and operating factors. Any changes in such assumptions

or factors could cause actual results to differ materially from

current expectations.

In accordance with Section 806 of the Sarbanes-Oxley Act of 2002

and article 42 of the “Ley del Mercado de Valores”, GAP has

implemented a “whistleblower” program, which allows

complainants to anonymously and confidentially report suspected

activities that may involve criminal conduct or violations. The

telephone number in Mexico, facilitated by a third party that is in

charge of collecting these complaints, is 01-800-563-0047. The web

site is http://www.lineadedenuncia.com/gap. GAP’s Audit Committee

will be notified of all complaints for immediate investigation.

For more information please visit

www.aeropuertosgap.com.mx

View source

version on businesswire.com: https://www.businesswire.com/news/home/20180409005651/en/

In MéxicoGrupo Aeroportuario del Pacífico, S.A.B. de

C.V.Saúl Villarreal García, Chief Financial Officersvillarreal@aeropuertosgap.com.mxorPaulina

Sánchez, Investor Relations Officerpsanchez@aeropuertosgap.com.mxTel: 01 (33)

38801100 ext 20151orIn the U.S.i-advize Corporate

CommunicationsMaria Barona, 212 406 3691/94gap@iadvize.com

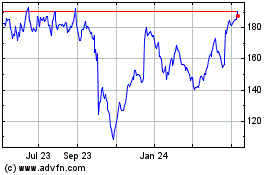

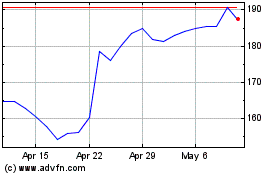

Grupo Aeroportuario Del ... (NYSE:PAC)

Historical Stock Chart

From Mar 2024 to Apr 2024

Grupo Aeroportuario Del ... (NYSE:PAC)

Historical Stock Chart

From Apr 2023 to Apr 2024