Current Report Filing (8-k)

April 06 2018 - 6:08AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): April 5, 2018

SPIRIT REALTY CAPITAL, INC.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

|

Maryland

(Spirit Realty Capital, Inc.)

|

|

001-36004

|

|

20-1676382

(Spirit Realty Capital, Inc.)

|

|

(State or other jurisdiction

of incorporation)

|

|

(Commission File Number)

|

|

(I.R.S. Employer

Identification No.)

|

2727 North Harwood Drive, Suite 300

Dallas, Texas 75201

(Address of principal executive offices) (Zip Code)

Registrant’s telephone number, including area code: (972) 476-1900

Not Applicable

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (

see

General Instruction A.2. below):

|

|

|

|

|

|

Œ

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

|

|

Œ

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

|

|

Œ

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

|

|

Œ

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934

Emerging growth company

o

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

o

|

|

|

|

|

|

ITEM 5.02

|

DEPARTURE OF DIRECTORS OR CERTAIN OFFICERS; ELECTION OF DIRECTORS;APPOINTMENT OF CERTAIN OFFICERS; COMPENSATORY ARRANGEMENTS OF CERTAIN OFFICERS

|

On April 3, 2018, Spirit Realty Capital, Inc. (the "Company" or "Spirit") entered into an amended and restated employment agreement (the "Young Employment Agreement") with Mr. Jay Young, Executive Vice President, General Counsel and Secretary on the terms summarized below. The Young Employment Agreement amends and restates the employment agreement between the Company and Mr. Young that became effective in connection with hiring Mr. Young in April 2016 as the Company's General Counsel.

Employment Agreement

Mr. Young's Employment Agreement provides for an initial term of three years commencing on April 3, 2018 with automatic one-year extension periods absent prior written notice electing not to extend the Young Employment Agreement by the Company or Mr. Young.

During the employment term, Mr. Young will receive a base salary at an annual rate not less than $355,000 ("Base Salary"). Mr. Young is eligible to receive an annual cash discretionary incentive payment under the Company’s annual bonus plan as may be in effect from time to time based on a target bonus opportunity equal to 125% of Mr. Young's Base Salary and a maximum bonus opportunity of 200% of Mr. Young's Base Salary upon attainment of one or more pre-established performance goals established by the Company's Board of Directors or a committee thereof. It is expected that such performance criteria will be based on both financial and non-financial goals and may be set at any point during the calendar year, it being intended that such criteria will be established during the Company’s annual budgeting process, subject to adjustment.

Mr. Young shall be eligible to receive equity and other long-term incentive awards under any applicable plan adopted by the Company. It is expected that beginning in 2019 the target date-of-grant value of Mr. Young's annual long-term incentive awards will be 200% of his Base Salary granted in equal portions of one-half as time-vesting restricted stock grants, vesting ratably over three years (one-third per year from the date of grant) and one-half as performance shares, cliff vesting after three years from the beginning of the performance period based on the achievement of applicable performance goals.

During Mr. Young's employment term, Mr. Young will be entitled to certain employee benefits of the Company including, but not limited to, participation in Company employee benefit plans, subject to meeting applicable eligibility requirements, four weeks of paid vacation per calendar year and reimbursement of business and travel expenses pursuant to the Company's expense reimbursement policy. In addition, during the employment term, the Company shall (i) pay for the premium payments incurred in providing Mr. Young with a Company-paid term life insurance policy in the amount of $1,000,000 and (ii) pay or reimburse Mr. Young for actual, properly substantiated expenses incurred by Mr. Young in connection with an annual physical examination in an amount not to exceed $2,000 per year. The Company will also reimburse Mr. Young up to $10,000 in legal costs in connection with the negotiations of his Employment Agreement.

If Mr. Young's employment is terminated during the term of the Young Employment Agreement (i) by the Company without “Cause,” (ii) for “Good Reason” (each, as defined in the Young Employment Agreement) or (iii) by reason of the Company’s failure to extend the term of the Young Employment Agreement at the end of the initial term or at the one-year extension period(s) thereafter, Mr. Young will be entitled to receive: (a) accrued compensation and benefits, (b) an amount equal to two times the Base Salary, (c) an amount equal to the target bonus of 125% of Base Salary, (d) an amount equal to Mr. Young’s prior year bonus (to the extent unpaid), (d) an amount equal to the pro-rata portion of his annual bonus for the year in which the termination occurs, based on actual results (e) full vesting of outstanding time-based vesting Company equity and/or long-term incentive awards held by Mr. Young on the date of termination, (f) vesting at “target” of any outstanding performance-based Company equity and/or long-term incentive awards held by Mr. Young on the date of termination and (g) continuing health care coverage for up to 12 months under certain circumstances.

In the event that the Mr. Young is terminated during the term of the Young Employment Agreement by reason of his death or disability, he will be entitled to receive (a) accrued compensation and benefits, (b) an amount equal to the pro-rata portion of his annual bonus for the year in which the termination occurs, based on actual results (c) his prior year’s annual bonus if not yet paid in the year of termination), (d) full vesting of outstanding time-based vesting Company equity and/or long-term incentive awards held by Mr. Young on the date of termination and (e) vesting at “target” of any outstanding performance-based Company equity and/or long-term incentive awards held by Mr. Young on the date of termination.

The payments described in the two preceding paragraphs, other than accrued compensation and benefits, would be subject to Mr. Young’s timely execution and, if applicable, non-revocation of a general release of claims.

Mr. Young's Employment Agreement includes 12 month restrictive covenants regarding non-solicitation following its termination as well as confidentiality and non-disparagement obligations.

The foregoing description of the terms of Mr. Young's Employment Agreement is a summary which does not purport to be complete and is subject to and qualified in its entirety by reference to the Young Employment Agreement, a copy of which is filed herewith as Exhibit 10.1.

On April 3, 2018, Spirit Realty Capital, Inc. entered into an employment agreement (the "Heimlich Employment Agreement") with Mr. Ken Heimlich on the terms summarized below, pursuant to which he will now serve as Executive Vice President, Asset Management.

Employment Agreement

Mr. Heimlich's Employment Agreement provides for an initial term of three years commencing on April 3, 2018 with automatic one-year extension periods absent prior written notice electing not to extend the Heimlich Employment Agreement by the Company or Mr. Heimlich.

During the employment term, Mr. Heimlich will receive a base salary at an annual rate not less than $377,400 ("Base Salary"). Mr. Heimlich, is eligible to receive an annual cash discretionary incentive payment under the Company’s annual bonus plan as may be in effect from time to time based on a target bonus opportunity equal to 125% of Mr. Heimlich's Base Salary and a maximum bonus opportunity of 200% of Mr. Heimlich's Base Salary upon attainment of one or more pre-established performance goals established by the Company's Board of Directors or a committee thereof. It is expected that such performance criteria will be based on both financial and non-financial goals and may be set at any point during the calendar year, it being intended that such criteria will be established during the Company’s annual budgeting process, subject to adjustment.

Mr. Heimlich shall be eligible to receive equity and other long-term incentive awards under any applicable plan adopted by the Company. It is expected that beginning in 2019 the target date-of-grant value of Mr. Heimlich's annual long-term incentive awards will be 200% of his Base Salary granted in equal portions of one-half as time-vesting restricted stock grants, vesting ratably over three years (one-third per year from the date of grant) and one-half of the award as performance shares, cliff vesting after three years from the beginning of the performance period based.

During Mr. Heimlich's employment term, Mr. Heimlich will be entitled to certain employee benefits of the Company including, but not limited to, participation in Company employee benefit plans, subject to meeting applicable eligibility requirements, four weeks of paid vacation per calendar year and reimbursement of business and travel expenses pursuant to the Company's expense reimbursement policy. In addition, during the employment term, the Company shall (i) pay for the premium payments incurred in providing Mr. Heimlich with a Company-paid term life insurance policy in the amount of $1,000,000 and (ii) pay or reimburse Mr. Heimlich for actual, properly substantiated expenses incurred by Mr. Heimlich in connection with an annual physical examination in an amount not to exceed $2,000 per year. The Company will also reimburse Mr. Heimlich up to $10,000 in legal costs in connection with the negotiations of the Heimlich Employment Agreement.

If Mr. Heimlich's employment is terminated during the term of the Heimlich Employment Agreement (i) by the Company without “Cause,” (ii) for “Good Reason” (each, as defined in the Heimlich Employment Agreement) or (iii) by reason of the Company’s failure to extend the term of the Heimlich Employment Agreement at the end of the initial term or at the one-year extension period(s) thereafter, Mr. Heimlich will be entitled to receive: (a) accrued compensation and benefits, (b) an amount equal to two times the Base Salary, (c) an amount equal to the target bonus of 125% of Base Salary, (d) an amount equal to Mr. Heimlich’s prior year bonus (to the extent unpaid), (d) an amount equal to the pro-rata portion of his annual bonus for the year in which the termination occurs, based on actual results (e) full vesting of outstanding time-based vesting Company equity and/or long-term incentive awards held by Mr. Heimlich on the date of termination, (f) vesting at “target” of any outstanding performance-based Company equity and/or long-term incentive awards held by Mr. Heimlich on the date of termination and (g) continuing health care coverage for up to 12 months under certain circumstances.

In the event that the Mr. Heimlich is terminated during the term of the Heimlich Employment Agreement by reason of his death or disability, he will be entitled to receive (a) accrued compensation and benefits, (b) an amount equal to the pro-rata portion of his annual bonus for the year in which the termination occurs, based on actual results (c) his prior year’s annual bonus if not yet paid in the year of termination), (d) full vesting of outstanding time-based vesting Company equity and/or long-term incentive

awards held by Mr. Heimlich on the date of termination and (e) vesting at “target” of any outstanding performance-based Company equity and/or long-term incentive awards held by Mr. Heimlich on the date of termination.

The payments described in the two preceding paragraphs, other than accrued compensation and benefits, would be subject to Mr. Heimlich’s timely execution and, if applicable, non-revocation of a general release of claims.

Mr. Heimlich's Employment Agreement includes 12 month restrictive covenants regarding non-competition and non-solicitation following its termination as well as confidentiality and non-disparagement obligations.

The foregoing description of the terms of Mr. Heimlich's Employment Agreement is a summary which does not purport to be complete and is subject to and qualified in its entirety by reference to the Heimlich Employment Agreement, a copy of which is filed herewith as Exhibit 10.2.

|

|

|

|

|

|

ITEM 9.01

|

FINANCIAL STATEMENTS AND EXHIBITS

|

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Date: April 5, 2018

|

|

|

|

|

|

|

|

|

|

|

SPIRIT REALTY CAPITAL, INC.

|

|

|

|

|

By:

|

|

/s/ Jay Young

|

|

|

|

Jay Young

Executive Vice President, General Counsel and Secretary

|

Spirit Realty Capital (NYSE:SRC)

Historical Stock Chart

From Mar 2024 to Apr 2024

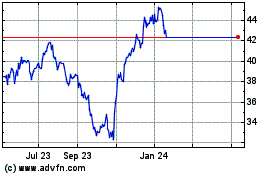

Spirit Realty Capital (NYSE:SRC)

Historical Stock Chart

From Apr 2023 to Apr 2024