UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934

|

Filed by the Registrant

☑

|

Filed by a Party other than the Registrant

☐

|

Check the appropriate box:

|

☐

|

Preliminary Proxy Statement

|

|

☐

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

|

☑

|

Definitive Proxy Statement

|

|

☐

|

Definitive Additional Materials

|

|

☐

|

Soliciting Material Pursuant to §240.14a-12

|

SOLARIS OILFIELD INFRASTRUCTURE, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

|

☑

|

No fee required.

|

|

|

|

|

☐

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

|

|

|

|

|

|

1)

|

Title of each class of securities to which transaction applies:

|

|

|

|

|

|

|

2)

|

Aggregate number of securities to which transaction applies:

|

|

|

|

|

|

|

3)

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

|

|

|

|

|

|

4)

|

Proposed maximum aggregate value of transaction:

|

|

|

|

|

|

|

5)

|

Total fee paid:

|

|

|

|

|

|

|

|

|

☐

|

Fee paid previously with preliminary materials.

|

|

|

|

|

☐

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

|

|

|

|

|

|

|

1)

|

Amount Previously Paid:

|

|

|

|

|

|

|

2)

|

Form, Schedule or Registration Statement No.:

|

|

|

|

|

|

|

3)

|

Filing Party:

|

|

|

|

|

|

|

4)

|

Date Filed:

|

|

|

|

|

Dear Solaris Stockholders:

2017 was a transformative year for Solaris. We began the year as a private company with a differentiated product and an entrepreneurial team with great ambitions. By the end of 2017, we had completed our Initial Public Offering (“IPO”), garnered the leading market share for new generation well site proppant storage and handling equipment, expanded our product and service offering and more than doubled the size of our business. We are off to a great start to 2018 and look forward to continuing to grow our business.

During 2017, the tailwinds that have driven our business since inception, namely that of increased proppant usage and the industry's focus on reducing costs, drove continued demand for innovative proppant supply chain solutions. That combined with an upturn in North American oil and gas activity allowed us to more than double our fleet of mobile proppant management systems, adding 44 systems for a total of 77 systems by the end of 2017. These trends also helped drive our product and service offering expansion, including the development of our new Kingfisher rail transloading facility in central Oklahoma and the acquisition of Railtronix. We believe our position as an independent logistics solutions company well help us continue to drive efficiencies and reduce logistical costs for our customers.

Our mobile proppant management system is now the industry leader and we continue to grow our fleet with existing and new customers. I am confident that with the guidance of our Board of Directors, management team and remarkable employees, Solaris is equipped to continue to excel.

We set bold goals to enhance our product offering, increase our shareholder value and help our customers be better at what they do, but we never forgot our roots of being good corporate citizens and stewards in the communities where we live and operate.

We also recognize the responsibility we have to our shareholders and stakeholders and gratefully appreciate the support you continue to place in Solaris.

I am pleased to invite you to attend the Annual Meeting of Stockholders of Solaris Oilfield Infrastructure. The meeting will occur on May 14, 2018, at 10:00 a.m. Central Daylight Time. The location will be at our corporate office at 9811 Katy Freeway, Suite 900, Houston, TX.

Please refer to the proxy statement for detailed information on each of the proposals presented this year. The representation of your shares and your vote at the meeting is extremely important and I encourage you to review the proxy materials and submit your vote today. If you attend the meeting, you can vote in person even if you have previously voted.

On behalf of the Solaris team, I want to thank our shareholders for their continued support and trust. I also want to personally thank our employees for their dedication and commitment. We look forward to greeting as many of you as possible at our Annual Meeting.

Sincerely,

Gregory A. Lanham

Chief Executive Officer and Director

Solaris Oilfield Infrastructure

April 4, 2018

SOLARIS OILFIELD INFRASTRUCTURE, INC.

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

The Stockholders of Solaris Oilfield Infrastructure, Inc.:

Notice is hereby given that the Annual Meeting of Stockholders of Solaris Oilfield Infrastructure, Inc. will be held Monday, May 14, 2018, at 10:00 a.m. local time, at Solaris Oilfield Infrastructure, Inc., 9811 Katy Freeway, Suite 900, Houston, Texas 77024, for the following purposes:

|

|

1.

|

To elect two Class I Directors, the names of whom are set forth in the accompanying proxy statement, to serve until the 2021 Annual Meeting of Stockholders.

|

|

|

2.

|

To ratify the appointment of BDO USA, LLP as the Company’s independent registered public accounting firm for the fiscal year ended December 31, 2018.

|

|

|

3.

|

To transact such other business as may properly be brought before the meeting.

|

Stockholders of record at the close of business on March 21, 2018 are the only stockholders entitled to notice of, and to vote at, the Annual Meeting of Stockholders. A complete list of stockholders entitled to vote at the Annual Meeting of Stockholders will be available for examination at the Company’s principal executive offices located at, 9811 Katy Freeway, Suite 900, Houston, Texas 77024, for a period of ten days prior to the Annual Meeting of Stockholders. This list of stockholders will also be available for inspection at the Annual Meeting of Stockholders and may be inspected by any stockholder for any purpose germane to the Annual Meeting of Stockholders.

It is important that your shares be represented at the meeting. Accordingly, even if you plan to attend the meeting in person, please complete, sign, date and promptly return the enclosed proxy card in the postage-prepaid envelope prior to the Annual Meeting of Stockholders or follow the Internet or telephone voting procedures described on the proxy card. If you attend the meeting and wish to vote in person, you may withdraw your proxy and vote in person. Your prompt consideration is greatly appreciated.

|

|

By Order of the Board of Directors,

|

|

|

|

|

|

/s/ Christopher M. Powell

|

|

|

Christopher M. Powell

|

|

|

Chief Legal Officer and Corporate Secretary

|

|

|

|

|

|

|

|

|

April 4, 2018

|

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE

ANNUAL MEETING OF STOCKHOLDERS TO BE HELD ON MAY 14, 2018: The Proxy Statement

and Annual Report to Stockholders are available at

www.proxyvote.com

.

TABLE OF CONTENTS

|

INFORMATION CONCERNING SOLICITATION AND VOTING

|

|

1

|

|

|

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

|

|

2

|

|

|

ELECTION OF DIRECTORS (PROPOSAL NO. 1)

|

|

6

|

|

|

BOARD OF DIRECTORS, COMMITTEES OF THE BOARD OF DIRECTORS AND MEETING ATTENDANCE

|

|

11

|

|

|

RELATED PARTY TRANSACTIONS

|

|

14

|

|

|

COMPENSATION COMMITTEE INTERLOCKS AND INSIDER PARTICIPATION

|

|

14

|

|

|

CODE OF BUSINESS CONDUCT AND ETHICS

|

|

14

|

|

|

DIRECTOR COMPENSATION

|

|

15

|

|

|

EXECUTIVE OFFICERS

|

|

16

|

|

|

COMPENSATION OF EXECUTIVE OFFICERS

|

|

17

|

|

|

EQUITY COMPENSATION PLAN INFORMATION

|

|

20

|

|

|

STOCK PERFORMANCE GRAPH

|

|

21

|

|

|

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

|

|

21

|

|

|

REPORT OF THE AUDIT COMMITTEE

|

|

22

|

|

|

RATIFICATION OF APPOINTMENT OF THE COMPANY’S INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM (PROPOSAL NO. 2)

|

|

23

|

|

|

OTHER MATTERS

|

|

23

|

|

SOLARIS OILFIELD INFRASTRUCTURE, INC.

9811 Katy Freeway, Suite 900

Houston, Texas 77024

PROXY STATEMENT

INFORMATION CONCERNING SOLICITATION AND VOTING

The enclosed proxy is solicited on behalf of the Board of Directors (the “Board”) of Solaris Oilfield Infrastructure, Inc. (the “Company”) for use at the Company’s Annual Meeting of Stockholders (the “Annual Meeting”) to be held May 14, 2018, at 10:00 a.m. local time, or at any adjournment or postponement thereof, for the purposes set forth herein and in the accompanying Notice of Annual Meeting of Stockholders. The Annual Meeting will be held at the principal executive offices of Solaris Oilfield Infrastructure, Inc., located at 9811 Katy Freeway, Suite 900, Houston, Texas 77024. The telephone number at that address is (281) 501.3070.

Most stockholders have a choice of granting their proxies by telephone, over the Internet or by using a traditional proxy card. You should refer to your proxy or voting instruction card to see which options are available to you and how to use them. The Internet and telephone voting procedures are designed to authenticate stockholders’ identities and to confirm that their instructions have been properly recorded.

The cost of preparing, assembling and mailing the proxy material and of reimbursing brokers, nominees and fiduciaries for the out-of-pocket and clerical expenses of transmitting copies of the proxy material to the beneficial owners of shares held of record by such persons, will be borne by the Company. The Company has retained Broadridge Financial Solutions (“Broadridge”) to aid in the solicitation of proxies. The cost of Broadridge’s services are estimated not to exceed $10,000. In addition to the solicitation of proxies by mail, proxies may also be solicited by telephone, electronic communication, or personal communication by employees of Broadridge and the Company. These proxy solicitation materials are being mailed and made available at www.proxyvote.com on or about April 4, 2018 to all stockholders entitled to vote at the Annual Meeting.

A stockholder giving a proxy pursuant to this solicitation (including via telephone or via the Internet) may revoke it at any time before the Annual Meeting by delivering to the Secretary of the Company a written notice of revocation or a valid proxy (including via telephone or via the Internet) bearing a later date or by attending the Annual Meeting and voting in person.

Deadline for Receipt of Stockholder Proposals

Pursuant to regulations of the Securities and Exchange Commission (the “SEC”), in order to be included in the Company’s Proxy Statement for its 2019 Annual Meeting, stockholder proposals must meet all the requirements of Rule 14a-8 and be received at the Company’s principal executive offices, 9811 Katy Freeway, Suite 900, Houston, Texas 77024, Attention: Corporate Secretary, no later than December 4, 2018, and must comply with additional requirements established by the SEC. In addition, the Company’s Amended and Restated Bylaws provide that any stockholder who desires either to bring a stockholder proposal before an annual meeting of stockholders or to present a nomination for Director at an annual meeting of stockholders must give advance notice to the Secretary of the Company with respect to such proposal or nominee. The Company’s Amended and Restated Bylaws generally require that written notice be delivered to the Secretary of the Company at the Company’s principal executive offices not less than 90 days nor more than 120 days prior to the anniversary of the preceding year’s annual meeting of stockholders and contain certain information regarding the stockholder desiring to present a proposal or make a nomination and, in the case of a nomination, information regarding the proposed Director nominee. For the 2019 Annual Meeting, the Secretary of the Company must receive written notice on or after January 14, 2019, and on or before February 13, 2019. A copy of the Company’s Amended and Restated Bylaws is available upon request from the Secretary of the Company.

Record Date, Shares Outstanding and Voting

The Company’s Class A common stock, par value $0.01 per share (the “Class A Common Stock”), and Class B common stock, zero par value per share (the “Class B Common Stock,” and together with the Class A Common Stock, the “Common Stock”), are the only classes of securities that entitle holders to vote generally at meetings of the Company’s stockholders. Only stockholders of record at the close of business on March 21, 2018 are entitled to notice of, and to vote at, the Annual Meeting. At the record date, 26,366,577 shares of our Class A Common Stock and 20,906,844 shares of our Class B Common Stock were issued and outstanding and entitled to be voted at the meeting. The presence, in person or by proxy, of stockholders holding a majority of the shares of the Company’s Common Stock entitled to vote will constitute a quorum for the Annual Meeting.

Every stockholder is entitled to one vote for each share held with respect to each matter, including the election of Directors, which comes before the Annual Meeting. Stockholders do not have the right to cumulate their votes in the election of Directors. If a stockholder specifies how the proxy is to be voted with respect to any of the proposals for which a choice is provided, the proxy will be voted in accordance with such specifications. If a stockholder fails to specify a choice with respect to such proposals, the proxy will be voted (i) FOR all Director nominees and (ii) FOR the ratification of the appointment of BDO USA, LLP (“BDO USA”) as the Company’s independent registered public accounting firm for the fiscal year ended December 31, 2018.

The affirmative vote of holders of a plurality of the shares of Common Stock present in person or represented by proxy at the meeting and entitled to vote is required to elect each Director nominee. The affirmative vote of a majority of the shares of Common Stock present in person or represented by proxy at the meeting and entitled to vote is required to ratify the appointment of BDO USA as the Company’s independent registered public accounting firm for the fiscal year ended December 31, 2018.

New York Stock Exchange (“NYSE”) rules permit brokers to vote for routine matters such as the ratification of the appointment of BDO USA without receiving instructions from the beneficial owner of the shares. NYSE rules prohibit brokers from voting on the election of Directors and other non-routine matters without receiving instructions from the beneficial owner of the shares. In the absence of instructions, the shares are viewed as being subject to “broker non-votes.” “Broker non-votes” will be counted for quorum purposes (as they are present and entitled to vote on the ratification of BDO USA’s appointment) but will not affect the outcome of any other matter being voted upon at the Annual Meeting. A broker or other nominee holding shares for a beneficial owner may not vote these shares in regard to the election of Directors (Proposal 1) without specific instructions from the beneficial owner. Abstentions are treated as present and entitled to vote and thus, will be counted in determining whether a quorum is present. Abstentions will have the effect of a vote cast against Proposal 2, but otherwise will not be counted as a vote cast and will not have an effect on the outcome of Proposal 1.

“Householding” of Proxy Materials

The SEC has adopted rules that permit companies and intermediaries such as brokers to satisfy delivery requirements for proxy statements with respect to two or more stockholders sharing the same address by delivering a single proxy statement addressed to those stockholders. This process, which is commonly referred to as “householding,” potentially provides extra convenience for stockholders and cost savings for companies. The Company and some brokers use this process for proxy materials, delivering a single proxy statement to multiple stockholders sharing an address unless contrary instructions have been received from the affected stockholders. Once you have received notice from your broker or the Company that they will be householding materials to your address, householding will continue until you are notified otherwise or until you revoke your consent. If, at any time, you no longer wish to participate in householding and would prefer to receive a separate proxy statement, or if you are receiving multiple copies of the proxy statement and wish to receive only one, please notify your broker if your shares are held in a brokerage account or the Company if you hold shares registered in your name, and the Company will promptly undertake to carry out your request. You can notify the Company by sending a written request to the Company at 9811 Katy Freeway, Suite 900, Houston, Texas 77024, or by telephone at (281) 501.3070.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table lists as of March 21, 2018, with respect to each person who is known to the Company to be the beneficial owner of more than 5% of the outstanding shares of Class A Common Stock or Class B Common Stock of the Company, the name and address of such owner, the number of shares of Common Stock beneficially owned and the percentage such shares comprised of the outstanding shares of Common Stock of the Company. Except as indicated, each holder has sole voting and dispositive power over the listed shares. Percentage of beneficial ownership is based on 26,366,577 shares of our Class A Common Stock and 20,906,844 shares of our Class B Common Stock outstanding on March 21, 2018.

|

|

|

Shares Beneficially Owned by Certain Beneficial Owners

|

|

|

|

|

Class A Common Stock

|

|

|

Class B Common Stock(1)

|

|

|

Combined Voting Power(2)

|

|

|

Name and Address of Beneficial Owner

|

|

Number

|

|

|

% of class

|

|

|

Number

|

|

|

% of class

|

|

|

Number

|

|

|

%

|

|

|

Yorktown Energy Partners X, L.P.(3)(4)

|

|

|

—

|

|

|

|

—

|

|

|

|

10,954,234

|

|

|

|

52.4

|

%

|

|

|

10,954,234

|

|

|

|

23.2

|

%

|

|

410 Park Avenue, 19

th

Floor

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

New York, New York 10022

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

William A. Zartler(5)(6)

|

|

|

77,911

|

|

|

|

*

|

|

|

|

5,140,315

|

|

|

|

24.6

|

%

|

|

|

5,218,226

|

|

|

|

11.0

|

%

|

|

9811 Katy Freeway, Suite 900

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Houston, Texas 77024

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Solaris Energy Capital, LLC(6)(7)

|

|

|

—

|

|

|

|

—

|

|

|

|

4,413,496

|

|

|

|

21.1

|

%

|

|

|

4,413,496

|

|

|

|

9.3

|

%

|

|

9811 Katy Freeway, Suite 900

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Houston, Texas 77024

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gilder, Gagnon, Howe & Co. LLC(8)

|

|

|

1,705,799

|

|

|

|

6.5

|

%

|

|

|

—

|

|

|

|

—

|

|

|

|

1,705,799

|

|

|

|

3.6

|

%

|

|

475 10

th

Avenue

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

New York, NY 10018

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1)

|

Subject to the terms of the Solaris Oilfield Infrastructure, LLC (“Solaris LLC”) limited liability company agreement (as amended and restated, the “Solaris LLC Agreement”), certain of our officers and directors and the other members of Solaris LLC (collectively, the “Original Investors”) have, subject to certain limitations, the right to cause Solaris LLC to acquire all or a portion of their membership interests in Solaris LLC (“Solaris LLC Units”) for shares of our Class A Common Stock at a redemption ratio of one share of Class A Common Stock for each Solaris LLC Unit redeemed. In connection with such acquisition, the corresponding number of shares of Class B Common Stock will be cancelled. Pursuant to Rule 13d-3 under the Exchange Act, a person has beneficial ownership of a security as to which that person, directly or indirectly, through any contract, arrangement, understanding, relationship, or otherwise has or shares voting power and/or investment power of such security and as to which that person has the right to acquire beneficial ownership of such security within 60 days. The Company has the option to deliver cash in lieu of shares of Class A Common Stock upon exercise by a Solaris Unit Holder of its redemption right. As a result, beneficial ownership of Class B Common Stock and Solaris LLC Units is not reflected as beneficial ownership of shares of our Class A Common Stock for which such units and stock may be redeemed.

|

|

(2)

|

Represents percentage of voting power of our Class A Common Stock and Class B Common Stock voting together as a single class. Each share of Class B Common Stock has no economic rights, but entitles the holder thereof to one vote for each Solaris Unit held by such holder. Accordingly, the holders of our Class B Common Stock collectively have a number of votes in Solaris equal to the number of Solaris LLC Units that they hold.

|

|

(3)

|

Based on a Schedule 13G filing with the SEC on February 14, 2018, as of December 31, 2017, Yorktown Partners X, L.P. reported sole voting and dispositive power as to 10,954,234 shares of Class B Common Stock.

|

|

(4)

|

Yorktown X Company L.P. is the sole general partner of Yorktown Energy Partners X, L.P. Yorktown X Associates LLC is the sole general partner of Yorktown X Company L.P. As a result, Yorktown X Associates LLC may be deemed to share the power to vote or direct the vote or to dispose or direct the disposition of the shares owned by Yorktown Energy Partners X, L.P. Yorktown X Company L.P. and Yorktown X Associates LLC disclaim beneficial ownership of the shares held by Yorktown Energy Partners X, L.P. in excess of their pecuniary interest therein. W. Howard Keenan, Jr. is a manager of Yorktown X Associates LLC. Mr. Keenan disclaims beneficial ownership of the shares held by Yorktown Energy Partners X, L.P.

|

|

(5)

|

Based on a Schedule 13G filed with the SEC on February 14, 2018, as of December 31, 2017, Mr. Zartler reported sole voting and dispositive power as to 77,911 shares of Class A Common Stock subject to previously granted restricted stock awards that remain subject to vesting and 5,140,315 shares of Class B Common Stock, which includes 4,413,496 shares held through Solaris Energy Capital, LLC where Mr. Zartler is the sole member and has authority to vote or dispose of those shares in his sole discretion.

|

|

(6)

|

Mr. Zartler is the sole member of Solaris Energy Capital, LLC and has the authority to vote or dispose of the shares held by Solaris Energy Capital, LLC in his sole discretion. Mr. Zartler disclaims beneficial ownership of the shares held by Solaris Energy Capital, LLC in excess of his pecuniary interest therein.

|

|

(7)

|

Based on a Schedule 13G filing with the SEC on February 14, 2018, as of December 31, 2017, Solaris Energy Capital, LLC reported sole voting and dispositive power as to 4,413,496 shares of Class B Common Stock.

|

|

(8)

|

Based on a Schedule 13G/A filing with the SEC on February 14, 2018, as of December 31, 2017, Gilder, Gagnon, Howe & Co. LLC reported sole voting power as to 40,489 shares of Class A Common Stock and sole dispositive power as to 1,665,310 shares of Class A Common Stock.

|

The following table sets forth the number of shares of Class A Common Stock and Class B Common Stock of the Company beneficially owned by (i) each Director (and nominee) of the Company, (ii) each named executive officer of the Company, and (iii) Directors and all executive officers of the Company as a group, as of March 21, 2018. For purposes of this proxy statement, William A. Zartler, Greg A. Lanham, Kyle S. Ramachandran and Kelly L. Price are referred to as the Company’s “named executive officers.” Except as indicated, each holder has sole voting and dispositive power over the listed shares. No current Director, nominee Director or executive officer has pledged any of the shares of Common Stock disclosed below. Percentage of beneficial ownership is based on 26,366,577 shares of our Class A Common Stock and 20,906,844 shares of our Class B Common Stock outstanding on March 21, 2018. The number and percentage of shares of Common Stock beneficially owned is determined under the rules of the SEC and is not necessarily indicative of beneficial ownership for any other purpose. Under these rules, beneficial ownership includes any shares of Common Stock for which a person has sole or shared voting power or investment power and also any shares of Common Stock that may be acquired by that person within 60 days of March 21, 2018. Unless otherwise indicated in the footnotes, the address for each executive officer and Director is c/o Solaris Oilfield Infrastructure, Inc., 9811 Katy Freeway, Suite 900, Houston, Texas 77024.

|

|

|

Shares Beneficially Owned by

Directors and Executive Officers

|

|

|

|

|

Class A Common Stock

|

|

|

Class B Common Stock(1)

|

|

|

Combined Voting Power(2)

|

|

|

Name and Address of Beneficial Owner

|

|

Number

|

|

|

% of class

|

|

|

Number

|

|

|

% of class

|

|

|

Number

|

|

|

%

|

|

|

Directors

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

James R. Burke(3)

|

|

|

17,799

|

|

|

|

*

|

|

|

|

92,734

|

|

|

|

*

|

|

|

|

110,533

|

|

|

|

*

|

|

|

Edgar R. Giesinger(4)

|

|

|

7,170

|

|

|

|

*

|

|

|

|

—

|

|

|

|

—

|

|

|

|

7,170

|

|

|

|

*

|

|

|

W. Howard Keenan, Jr(4).

|

|

|

7,170

|

|

|

|

*

|

|

|

|

—

|

|

|

|

—

|

|

|

|

7,170

|

|

|

|

*

|

|

|

Gregory A. Lanham(4)

|

|

|

301,886

|

|

|

|

1.1

|

%

|

|

|

—

|

|

|

|

—

|

|

|

|

301,886

|

|

|

|

*

|

|

|

F. Gardner Parker(4)

|

|

|

7,170

|

|

|

|

*

|

|

|

|

—

|

|

|

|

—

|

|

|

|

7,170

|

|

|

|

*

|

|

|

A. James Teague(4)

|

|

|

7,170

|

|

|

|

*

|

|

|

|

—

|

|

|

|

—

|

|

|

|

7,170

|

|

|

|

*

|

|

|

William A. Zartler(5)

|

|

|

77,911

|

|

|

|

*

|

|

|

|

5,140,315

|

|

|

|

24.6

|

%

|

|

|

5,218,226

|

|

|

|

11.0

|

%

|

|

Other Named Executive Officers

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Kelly L. Price(6)

|

|

|

114,207

|

|

|

|

*

|

|

|

|

—

|

|

|

|

—

|

|

|

|

114,207

|

|

|

|

*

|

|

|

Kyle S. Ramachandran(7)

|

|

|

154,427

|

|

|

|

*

|

|

|

|

546,677

|

|

|

|

2.6

|

%

|

|

|

701,104

|

|

|

|

1.5

|

%

|

|

Directors and All Executive Officers as a Group (12 persons)

(8)

|

|

|

879,915

|

|

|

|

3.0

|

%

|

|

|

5,944,764

|

|

|

|

28.4

|

%

|

|

|

6,824,679

|

|

|

|

14.3

|

%

|

|

(1)

|

Subject to the terms of the Solaris LLC Agreement, each Original Investor has, subject to certain limitations, the right to cause Solaris LLC to acquire all or a portion of its Solaris LLC Units for shares of our Class A Common Stock at a redemption ratio of one share of Class A Common Stock for each Solaris LLC Unit redeemed. In connection with such acquisition, the corresponding number of shares of Class B Common Stock will be cancelled. Pursuant to Rule 13d-3 under the Exchange Act, a person has beneficial ownership of a security as to which that person, directly or indirectly, through any contract, arrangement, understanding, relationship, or otherwise has or shares voting power and/or investment power of such security and as to which that person has the right to acquire beneficial ownership of such security within 60 days. The Company has the option to deliver cash in lieu of shares of Class A Common Stock upon exercise by a Solaris Unit Holder of its redemption right. As a result, beneficial ownership of Class B Common Stock and Solaris LLC Units is not reflected as beneficial ownership of shares of our Class A Common Stock for which such units and stock may be redeemed.

|

|

(2)

|

Represents percentage of voting power of our Class A Common Stock and Class B Common Stock voting together as a single class. Each share of Class B Common Stock has no economic rights, but entitles the holder thereof to one vote for each Solaris Unit held by such holder. Accordingly, the holders of our Class B Common Stock collectively have a number of votes in Solaris equal to the number of Solaris LLC Units that they hold.

|

|

(3)

|

Includes 7,170 shares of unvested restricted Class A Common Stock for which the holder has sole voting but no dispositive power, options to purchase 10,629 shares of our Class A Common Stock at an exercise price of $2.87 per share exercisable by James R. Burke within the next 60 days and 92,734 shares of Class B Common Stock.

|

|

(4)

|

Shares shown above represent shares of unvested restricted Class A Common Stock for which the holder has sole voting but no dispositive power.

|

|

(5)

|

Includes 77,911 shares of unvested restricted Class A Common Stock for which the holder has sole voting but no dispositive power and 5,140,315 shares of Class B Common Stock. Mr. Zartler is the sole member of Solaris Energy Capital, LLC and has the authority to vote or dispose of the shares held by Solaris Energy Capital, LLC in his sole discretion. Mr. Zartler disclaims beneficial ownership of the shares held by Solaris Energy Capital, LLC in excess of his pecuniary interest therein.

|

|

(6)

|

Includes 113,207 shares of unvested restricted Class A Common Stock for which the holder has sole voting but no dispositive power and 1,000 shares of Class A Common Stock purchased through a directed share program in connection with the initial public offering, which closed on May 17, 2017. The shares were purchased at the initial public offering price of $12.00 per share.

|

|

(7)

|

Includes 154,427 shares of unvested restricted Class A Common Stock for which the holder has sole voting but no dispositive power, 489,511 shares of Class B Common Stock held directly by the holder and 57,166 shares of Class B Common Stock held indirectly by the Equity Trust Company, Custodian FBO Kyle Ramachandran IRA. Mr. Ramachandran has the authority to vote or dispose of the shares held by the Equity Trust Company, Custodian FBO Kyle Ramachandran IRA in his sole discretion. Mr. Ramachandran disclaims beneficial ownership of the shares held by the Equity Trust Company, Custodian FBO Kyle Ramachandran IRA in excess of his pecuniary interest therein.

|

|

(8)

|

Includes 797,541 shares of Class A Common Stock that remain subject to vesting and options to purchase 80,374 shares of our Class A Common Stock at an exercise price of $2.87 per share exercisable by certain of our executive officers and directors within the next 60 days.

|

ELECTION OF DIRECTORS (PROPOSAL NO. 1)

Nominees

. The two Class I Directors are to be elected at the meeting.

Our directors are divided into three classes serving staggered three-year terms. Class I, Class II and Class III directors serve until our annual meetings of stockholders in 2018, 2019 and 2020, respectively. Messrs. Burke and Parker are assigned to Class I and are standing for election at the Annual Meeting. Messrs. Keenan and Lanham are assigned to Class II and Messrs. Giesinger, Teague and Zartler are assigned to Class III. At each annual meeting of stockholders, directors will be elected to succeed the class of directors whose terms have expired. This classification of our board of directors could have the effect of increasing the length of time necessary to change the composition of a majority of the board of directors. In general, at least two annual meetings of stockholders will be necessary for stockholders to effect a change in a majority of the members of the board of directors

. Each Director elected to the Board will hold office until his or her term expires or until his or her successor has been elected and qualified. Unless otherwise instructed, the proxy holders will vote the proxies received by them for the two Class I nominees named below, each of whom is presently a Director of the Company. In the event that either nominee is unable or declines to serve as a Director at the time of the Annual Meeting, the proxies will be voted for any nominee who shall be designated by the present Board to fill the vacancy, unless the size of the Board is reduced. The proxies cannot be voted for a greater number of persons than the number of nominees named in this proxy statement. It is not expected that any nominee will be unable or will decline to serve as a Director. Biographical information regarding each nominee and each other Director is set forth below, as well as a summary of the experiences, qualifications, attributes or skills that caused the Nominating and Governance Committee and the Board to determine that each should serve as a Director of the Company. Each Director’s experience and understanding is evaluated in determining the overall composition of the Board.

|

Name (Age)

|

|

Business Experience During Past 5 Years and Other Information

|

|

Director

Since

|

|

Director

Class

|

|

William A. Zartler (52)

|

|

William A. Zartler is our Chairman and has served as a member of our board of directors since February 2017 and a manager of our predecessor since October 2014. Mr. Zartler founded Loadcraft Site Services, LLC and served as its Executive Chairman from February 2014 to September 2014. Mr. Zartler served as our predecessor’s Chief Executive Officer and Chairman from October 2014 through our initial public offering in May 2017. Mr. Zartler has extensive experience in both energy industry investing and managing growth businesses. Prior to founding our predecessor, in January 2013 Mr. Zartler founded Solaris Energy Capital, a private investment firm focused on investing in and managing emerging, high growth potential businesses primarily in midstream energy and oilfield services, including Solaris LLC, and Mr. Zartler continues to serve as the sole member and manager of Solaris Energy Capital. Prior to founding Solaris Energy Capital, Mr. Zartler was a founder and Managing Partner of Denham Capital Management (“Denham”), a $7 billion global energy and commodities private equity firm, from its inception in 2004 to January 2013. Mr. Zartler led Denham’s global investing activity in the midstream and oilfield services sectors and served on the firm’s Investment and Executive Committees. Previously, Mr. Zartler held the role of Senior Vice President and General Manager at Dynegy Inc., building and managing the natural gas liquids business. Mr. Zartler also served as a director of the general partner of NGL Partners LP (NYSE: NGL) from its inception in September 2012 to August 2013. Mr. Zartler began his career at Dow Hydrocarbons and Resources. Mr. Zartler received a Bachelor of Science in Mechanical Engineering from the University of Texas at Austin and a Masters of Business Administration from Texas A&M University. Mr. Zartler serves on the Engineering Advisory Board of the Cockrell School of Engineering at the University of Texas at Austin.

We believe that Mr. Zartler’s industry experience and deep knowledge of our business makes him well suited to serve as a member of our board of directors

.

|

|

2017

|

|

Class III

|

|

|

|

|

|

|

|

|

|

James R. Burke (80)

|

|

James R. Burke has served as a member of our board of directors since May 2017 and served as a manager of our predecessor from October 2014 to May 2017. Since July 2013 Mr. Burke has served on the board of Centurion, a private equity sponsored oilfield services company based in Aberdeen, Scotland. Mr. Burke served as the Chief Executive Officer and President of Forum Energy Technologies (“Forum”) from May 2005 to October 2007 and as Chairman of Forum from 2007 to 2010. Mr. Burke retired from his position as Chairman of Forum in 2010, subsequent to which he evaluated potential opportunities prior to becoming a director of Centurion. Prior to joining Forum, Mr. Burke served as Chief Executive Officer of Access Oil Tools Inc. (“Access”) from April 2000 to May 2005. Before joining Access, Mr. Burke held various positions with Weatherford International Ltd. from January 1991 to August 1999, including Executive Vice President responsible for all manufacturing operations and engineering at its Compressor Division. Prior to joining Weatherford, Mr. Burke was employed by Cameron Iron Works from 1967 to 1989, where he held positions of increasing seniority, including Vice President of Cameron’s Ball Valve division. Mr. Burke holds a Bachelor of Science in Electrical Engineering from University College, Dublin, Ireland, and a Master of Business Administration from Harvard University.

Mr. Burke has broad knowledge of the energy industry and significant operating experience. We believe his skills and industry experience qualify him to serve as a member of our board of directors.

|

|

2017

|

|

Class I

|

|

Name (Age)

|

|

Business Experience During Past 5 Years and Other Information

|

|

Director

Since

|

|

Director

Class

|

|

Edgar R. Giesinger (61)

|

|

Edgar R. Giesinger has served as a member of our board of directors since May 2017. Mr. Giesinger retired as a managing partner from KPMG LLP in 2015. Since November of 2015, Mr. Giesinger has served on the board of Geospace Technologies Corporation, a publicly traded company primarily involved in the design and manufacture of instruments and equipment utilized in oil and gas industries and since August of 2017, Newfield Exploration Company, a publicly traded crude oil and natural gas exploration and production company. He has 35 years of accounting and finance experience working mainly with publicly traded corporations. Over the years, he has advised a number of clients in accounting and financial matters, capital raising, international expansions and in dealings with the Securities and Exchange Commission. While working with companies in a variety of industries, his primary focus has been energy and manufacturing clients. Mr. Giesinger is a Certified Public Accountant in the State of Texas and member of the American Institute of Public Accountants. He has lectured and led seminars on various topics dealing with financial risks, controls and financial reporting.

We believe that Mr. Giesinger’s extensive financial and accounting experience, including that related to energy and manufacturing industries, qualifies him to effectively serve as a director.

|

|

2017

|

|

Class III

|

|

|

|

|

|

|

|

|

|

W. Howard Keenan, Jr. (67)

|

|

W. Howard Keenan, Jr. has served as a member of our board of directors since May 2017 and served as a manager of our predecessor from November 2014 to May 2017. Mr. Keenan has over 40 years of experience in the financial and energy businesses. Since 1997, he has been a Member of Yorktown Partners LLC, a private investment manager focused on the energy industry. From 1975 to 1997, he was in the Corporate Finance Department of Dillon, Read & Co. Inc. and active in the private equity and energy areas, including the founding of the first Yorktown Partners fund in 1991. Mr. Keenan also serves on the Boards of Directors of the following public companies: Antero Resources Corporation, Antero Midstream Partners LP, Antero Midstream GP LP and Ramaco Resources, Inc. In addition, he is serving or has served as a director or manager of multiple Yorktown Partners portfolio companies. Mr. Keenan holds a Bachelor of Arts degree cum laude from Harvard College and a Masters of Business Administration degree from Harvard University.

Mr. Keenan has broad knowledge of the energy industry and significant experience with energy companies. We believe his skills and background qualify him to serve as a member of our board of directors.

|

|

2017

|

|

Class II

|

|

|

|

|

|

|

|

|

|

Greg A. Lanham (53)

|

|

Gregory A. Lanham was named our Chief Executive Officer and Director in February 2017. From December 2015 to January 2017, Mr. Lanham was co-founder and Chief Executive Officer of Accendo Services LLC, where he advised private equity firms and credit investors on various investment opportunities in the oilfield services sector. From November 2012 to November 2015, Mr. Lanham served as Chief Executive Officer and Director of FTS International, the then largest private oilfield service company in North America. From 2008 to October 2012, Mr. Lanham served as Managing Director at Temasek Holdings (PTE.) Ltd, an investment holding company with $200 billion of assets under management. Mr. Lanham began his career at Anadarko Petroleum Corporation, where he spent twenty years in increasing roles of global responsibility. In 2015, Mr. Lanham was selected as the EY Entrepreneur Of The Year® Southwest in the Energy category. Mr. Lanham serves on the board of directors of Stallion Oilfield Services. Mr. Lanham received his B.S. in Petroleum Engineering from the University of Oklahoma.

Mr. Lanham has broad knowledge of the energy industry and significant experience with energy companies. We believe his skills and background qualifies to serve as a member of our board of directors.

|

|

2017

|

|

Class II

|

|

Name (Age)

|

|

Business Experience During Past 5 Years and Other Information

|

|

Director

Since

|

|

Director

Class

|

|

F. Gardner Parker (76)

|

|

F. Gardner Parker has served as a member of our board of directors since May 2017. Mr. Parker has been a private investor since 1984 and a director of Carrizo Oil & Gas, Inc. (“Carrizo”) (NASDAQ: CRZO) since 2000. He currently serves as Chairman of Carrizo’s Audit Committee and as Lead Independent Director. Mr. Parker also serves on the board and is Chairman of the Audit Committee of Sharps Compliance Corp. (NASDAQ: SMED), a medical waste management services provider. Mr. Parker served as a Trust Director of Camden Property Trust (NYSE: CPT) from 1993 until his mandatory retirement in 2017. Previously, Mr. Parker was a director of Triangle Petroleum Corporation from November 2009 to July 2015 and a director of Hercules Offshore Inc. from 2005 to November 2015. Mr. Parker was a founding director for Camden in 1993 and also served as the Lead Independent Trust Manager from 1998 to 2008. In the private sector, Mr. Parker is Chairman of the Board of Edge Resources LTD, Enterprise Offshore Drilling and Norton Ditto. He was a partner at Ernst & Ernst (now Ernst & Young LLP) from 1978 to 1984. Mr. Parker is a graduate of the University of Texas and is a certified public accountant in Texas. Mr. Parker is board certified by the National Association of Corporate Directors (the “NACD”), where he serves as a NACD Board Leadership Fellow.

Mr. Parker has broad knowledge of the energy industry and significant experience as a director on the boards and audit, compensation and corporate governance committees of numerous public and private companies. We believe his skills and experience qualify him to serve as a member of our board of directors.

|

|

2017

|

|

Class I

|

|

|

|

|

|

|

|

|

|

A. James Teague (73)

|

|

A. James Teague has served as a member of our board of directors since May 2017. Mr. Teague has served as the Chief Executive Officer of Enterprise Products Holdings LLC since January 2016 and has been a Director of Enterprise Products Holdings LLC since July 2008. Mr. Teague previously served as the Chief Operating Officer of Enterprise Products Holdings LLC from November 2010 to December 2015 and served as an Executive Vice President of Enterprise Products Holdings from November 2010 until February 2013. Mr. Teague joined Enterprise in connection with its purchase of certain midstream energy assets from affiliates of Shell Oil Company in 1999. From 1998 to 1999, Mr. Teague served as President of Tejas Natural Gas Liquids, LLC, then an affiliate of Shell. From 1997 to 1998, he was President of Marketing and Trading for MAPCO, Inc. Prior to 1997 he spent 22 years with Dow Chemical in various roles including Vice President, Hydrocarbon Feedstocks.

Mr. Teague has broad knowledge of the energy industry and significant operating experience. We believe his skills and industry experience qualify him to serve as a member of our board of directors

.

|

|

2017

|

|

Class III

|

The Board of Directors recommends a vote “FOR” the election of each of the Class I nominees for Director named in this proxy statement.

Board Independence

The Board has determined that each of the following Directors is independent within the meaning of the applicable rules of the SEC and the listing standards of the NYSE:

James R. Burke

Edgar R. Giesinger

W. Howard Keenan, Jr.

F. Gardner Parker

A. James Teague

Under the independence standards promulgated by the NYSE, the Board must have a majority of independent directors. The Board has evaluated the independence of the members of the Board under the independence standards promulgated by the NYSE. For a director to qualify as independent, the Board must affirmatively determine that the director has no material relationship with the Company, either directly or as a partner, stockholder or officer of an organization that has a relationship with the Company. In addition, the Board must assess each director’s independence under the bright-line tests set forth in the NYSE standards. In conducting this evaluation, the Board and Audit Committee considered transactions and relationships between each Director nominee or his immediate family and the Company to determine whether any such transactions or relationships were material and, therefore, inconsistent with a determination that each such Director nominee is independent. With respect to Mr. Keenan, the Board considered the fact that he is a manager of Yorktown X Associates LLC, the sole general partner of Yorktown X Company L.P., which is the sole general partner of Yorktown Energy Partners X, L.P., a significant Company stockholder. Mr. Keenan disclaims beneficial ownership of the shares held by Yorktown Energy Partners X, L.P., and the Board determined that this relationship is not inconsistent with a determination that Mr. Keenan is independent.

Stockholder Communications

Interested parties may contact the Board, or the non-management Directors as a group, at the following address:

Board of Directors

or

Non-Management Directors

c/o Solaris Oilfield Infrastructure, Inc.

9811 Katy Freeway

Suite 900

Houston, Texas 77024

Communications may also be sent to individual Directors at the above address. Communications to Directors will be reviewed and referred in compliance with the Company’s Corporate Governance Guidelines to the addressee to the extent appropriate. Communications to the Board, the non-management Directors or any individual Director that relate to the Company’s accounting, internal accounting controls or auditing matters will also be referred to the Chairman of the Audit Committee. Other communications will be referred to the appropriate Committee chairman and may also be sent, as appropriate, to the Company’s Chief Administrative Officer or Chief Legal Officer.

BOARD OF DIRECTORS, COMMITTEES OF THE BOARD OF DIRECTORS AND MEETING ATTENDANCE

The Board met six times during the last fiscal year. Each Director attended at least 75% of all meetings of the Board and the Committees of which such Director was a member during the last fiscal year. Pursuant to the Company’s Corporate Governance Guidelines, directors are encouraged to attend the annual meeting of stockholders.

The primary function of the Board is oversight, which includes among other matters, oversight of the principal risk exposures to the Company. To assist the Board in this role, the Audit Committee periodically requests the Company’s internal auditor to conduct a review of enterprise risks associated with the Company. The internal audit firm reports its findings and assessments to the Audit Committee, which then reports the findings to the Board as a whole.

Pursuant to the Company’s Corporate Governance Guidelines, the offices of Chairman of the Board and Chief Executive Officer are currently separated. The positions of the Chairman of the Board and the Chief Executive Officer are not held by the same person and the Chairman of the Board is not an employee of the Company. The Board views this separation as a means to allow the Board to fulfill its role in risk oversight through a collaborative, yet independent, interaction with Company management.

The Board has an Audit Committee, Compensation Committee and Nominating & Governance Committee, each of which is currently comprised of three members. The charters of each of these Committees and the Company’s Corporate Governance Guidelines are available free of charge on the Company’s website at www.solarisoilfield.com or by writing to the Company at: Solaris Oilfield Infrastructure, Inc., c/o Corporate Secretary, 9811 Katy Freeway, Suite 900, Houston, Texas 77024. The Board votes annually on the membership and chairmanship of all Committees.

Audit Committee.

The Audit Committee currently consists of Edgar R. Giesinger (Chairman), F. Gardner Parker and A. James Teague. The Committee met four times during the last fiscal year. The Board has determined that all of the members of the Audit Committee are independent within the meaning of the applicable rules of the SEC and the listing standards of the NYSE. The Board has also determined that Edgar R. Giesinger meets the requirements for being an “audit committee financial expert,” as that term is defined by applicable SEC and NYSE rules. The Audit Committee appoints and retains the Company’s independent registered public accounting firm, approves the fee arrangement and scope of the audit, reviews the financial statements and the independent registered public accounting firm’s report, considers comments made by the independent registered public accounting firm with respect to the Company’s internal control structure and reviews internal accounting procedures and controls with the Company’s financial and accounting staff. The Audit Committee also conducts the review of the non-audit services provided by the independent registered public accounting firm to determine their compatibility with its independence. The Audit Committee reviews the independent registered public accounting firm’s performance, qualification and quality control procedures and establishes policies for: (i) the pre-approval of audit and permitted non-audit services by the independent registered public accounting firm; (ii) the hiring of former employees of the independent registered public accounting firm; and (iii) the submission and confidential treatment of concerns from employees or others about accounting, internal controls, auditing or other matters.

The Audit Committee reviews with management the Company’s disclosure controls and procedures and internal control over financial reporting and the processes supporting the certifications of the Chief Executive Officer and Chief Financial Officer. It also reviews with management and the Company’s independent registered public accounting firm the Company’s critical accounting policies. The Audit Committee reviews the Company’s annual and quarterly SEC filings and other related Company disclosures. The Audit Committee reviews the Company’s compliance with the Code of Business Conduct and Ethics as well as other legal and regulatory matters. The Committee reviews related person transactions in accordance with the Company’s Related Persons Transactions Policy and applicable SEC guidelines. Such reviews are conducted periodically, but no less frequently than annually, and are reflected in the minutes of the Audit Committee. Each of our directors and executive officers is instructed and periodically reminded to inform the Chief Legal Officer or Chief Financial Officer of any potential related party transactions. In addition, each such director and executive officer completes a questionnaire on an annual basis designed to elicit information about any potential related party transactions. Moreover, through its accounting department, management conducts an annual review of accounting records for potential related party transactions. Based on the information provided from all relevant sources, the Chief Legal Officer evaluates the potential conflict. The Chief Financial Officer or Chief Legal Officer, as the case may be, brings relevant transactions to the attention of the Audit Committee. The Audit Committee then considers those transactions in accordance with its charter and reports to the Board on its conclusions and recommendations, with any members involved in the subject transaction abstaining from discussion and voting. The Audit Committee takes into account, among other things, the details of the transaction, whether the transaction was voluntarily disclosed in advance or as soon as the conflict became apparent, whether the terms are fair to the Company, whether there are genuine business reasons for the Company to enter into the transaction, and the opinion of counsel whether the transaction represents an improper conflict for any director or executive officer.

In performing these duties, the Audit Committee has full authority to: (i) investigate any matter brought to its attention with full access to all books, records, facilities and personnel of the Company; (ii) retain outside legal, accounting or other consultants to advise the Committee; and (iii) request any officer or employee of the Company, the Company’s in-house or outside counsel, internal audit service providers or independent registered public accounting firm to attend a meeting of the Committee or to meet with any members of, or consultants to, the Committee.

Compensation Committee.

The Compensation Committee currently consists of F.Gardner Parker (Chairman), W. Howard Keenan, Jr. and William A. Zartler. The Committee met three times during the last fiscal year. The Board has determined that all of the members of the Compensation Committee, other than Mr. Zartler, are independent within the meaning of the listing standards of the NYSE. Pursuant to NYSE Rules, Mr. Zartler will be required to step down from the Compensation Committee effective May 12, 2018 and will be replaced, at that time, by A. James Teague. The Compensation Committee (i) establishes policies relating to the compensation of the non-employee Directors, officers and key management employees of the Company; (ii) reviews and approves the compensation of the non-employee Directors, officers and the Chief Executive Officer; (iii) reviews payment estimates with respect to cash incentive compensation awards for non-officer employees; (iv) oversees the administration of the Company’s equity compensation plans; and (v) reviews and approves periodically, but no less than annually, the Company’s compensation goals and objectives with respect to its officers, including oversight of the risks associated with the Company’s compensation programs. The Compensation Committee has determined that none of the Company's compensation policies and practices are reasonably likely to have a material adverse effect on the Company. The Compensation Committee also evaluates and approves post-service arrangements with management and establishes and reviews periodically the Company’s perquisite policies for management and Directors.

In performing its duties, the Compensation Committee has ultimate authority and responsibility to engage and terminate any compensation consultant, legal counsel or other adviser (together “advisers”) to assist in determining appropriate compensation levels for the Chief Executive Officer or any other member of the Company’s management and to approve the terms of any such engagement and the fees of any such adviser. In addition, the Committee has full access to any relevant records of the Company and may also request that any officer or other employee of the Company (including the Company’s senior compensation or human resources executives), the Company’s in-house or outside counsel, or any other person meet with any members of, or consultant to, the Committee. In addition to information provided by outside compensation consultants, the officers of the Company may also collect peer group compensation data for review by the Committee.

The Committee sets the compensation policy for the Company as a whole and specifically decides all compensation matters related to the executive officers of the Company.

Nominating and Governance Committee.

The Nominating and Governance Committee currently consists of William A. Zartler (Chairman), James R. Burke and W. Howard Keenan, Jr. The Nominating and Governance Committee acted unanimously in recommending the nomination of the Class I Directors in Proposal No. 1. The Committee met three times during the last fiscal year. The Board has determined that all of the members of the Nominating and Governance Committee, other than Mr. Zartler, are independent within the meaning of the listing standards of the NYSE. Pursuant to NYSE Rules, Mr. Zartler will be required to step down from the Nominating and Governance Committee effective May 12, 2018 and will be replaced, at that time, on the Committee by Edgar R. Giesinger and Mr. Burke will become the Chairman of the Committee. The Nominating and Governance Committee establishes the Company’s corporate governance principles and guidelines. These principles and guidelines address, among other matters, the size, composition and responsibilities of the Board and its Committees, including their oversight of management. The Committee also advises the Board with respect to the charter, structure and operation of each Committee of the Board. The Nominating and Governance Committee oversees the evaluation of the Board and officers of the Company and reviews and periodically reports to the Board on matters concerning Company succession planning. The Committee has full access to any relevant records of the Company and may retain outside consultants to advise it. The Committee has the ultimate authority and responsibility to engage or terminate any outside consultant to identify Director candidate(s) and to approve the terms and fees of such engagement of any such consultant. The Committee may also request that any officer or other employee of the Company, the Company’s outside counsel, or any other person meet with any members of, or consultants to, the Committee.

The Company’s Board has charged the Nominating and Governance Committee with identifying individuals qualified to become members of the Board and recommending Director nominees for each Annual Meeting, including the recommendation of nominees to fill any vacancies on the Board. The Nominating and Governance Committee considers Director candidates suggested by its members, other Directors, officers and stockholders. Stockholders desiring to make such recommendations should timely submit the candidate’s name, together with biographical information and the candidate’s written consent to be nominated and, if elected, to serve to: Chairman, Nominating and Governance Committee of the Board of Directors of Solaris Oilfield Infrastructure, Inc., 9811 Katy Freeway, Suite 900, Houston, Texas 77024. To assist it in identifying Director candidates, the Committee is also authorized to retain, at the expense of the Company, third party search firms and legal, accounting, or other advisors, including for purposes of performing background reviews of potential candidates. The Committee provides guidance to search firms it retains about the particular qualifications the Board is then seeking.

All Director candidates, including those recommended by stockholders, are evaluated on the same basis. Candidates are selected for their character, judgment, business experience and specific areas of expertise, among other relevant considerations, such as the requirements of applicable law and listing standards (including independence standards) and diversity of membership. While the Company’s Corporate Governance Guidelines do not prescribe diversity standards, as a matter of practice, the Nominating and Governance Committee considers diversity in the context of the Board as a whole, taking into account personal characteristics and experience of current and prospective Directors in order to facilitate Board deliberations that reflect an appropriate range of perspective. The Board of Directors recognizes the importance of soliciting new candidates for membership on the Board of Directors and that the needs of the Board of Directors, in terms of the relative experience and other qualifications of candidates, may change over time. In determining the needs of the Board of Directors and the Company, the Nominating and Governance Committee considers the qualifications of sitting Directors and consults with the Board of Directors, the Chief Executive Officer and certain other officers and, where appropriate, external advisors. All Directors are expected to exemplify the highest standards of personal and professional integrity and to assume the responsibility of challenging management through their active and constructive participation and questioning in meetings of the Board of Directors and its various Committees, as well as in less formal contacts with management. Director candidates, other than sitting Directors, are interviewed at the direction of the Committee, which may include (at the Committee’s direction) interviews by the Chairman of the Board of Directors, other Directors, the Chief Executive Officer and certain other officers, and the results of those interviews are considered by the Committee in its deliberations.

The members of the Nominating and Governance Committee constitute three of the non-management Directors on the Company’s Board of Directors. As the Chairman of the Nominating and Governance Committee, William A. Zartler currently serves as the presiding Director for non-management executive sessions of these Directors.

RELATED PARTY TRANSACTIONS

Our Board of Directors has adopted a written related party transactions policy, pursuant to which a “Related Party Transaction” is defined pursuant to Item 404 of Regulation S-K. Pursuant to this policy, our Audit Committee will review all material facts of all Related Party Transactions and either approve or disapprove entry into the Related Party Transaction, subject to certain limited exceptions. In determining whether to approve or disapprove entry into a Related Party Transaction, our Audit Committee shall take into account, among other factors, the following: (i) whether the Related Party Transaction is on terms no less favorable than terms generally available to an unaffiliated third-party under the same or similar circumstances and (ii) the extent of the Related Person’s interest in the transaction. Furthermore, the policy requires that all Related Party Transactions required to be disclosed in our filings with the SEC be so disclosed in accordance with applicable laws, rules and regulations. There have been no Related Party Transactions since January 1, 2017, where the procedures described above did not require review, approval or ratification or where these procedures were not followed.

During 2017, we engaged in the following Related Party Transactions: (i) in connection with the closing of the IPO, the Company entered into agreements with the Original Investors, that include (a) a registration rights agreement in which we agreed to register the sale of shares of our Class A common stock under certain circumstances, (b) the Solaris LLC Agreement pursuant to which under certain circumstances we are required to redeem Solaris LLC Units, together with an equal number of Class B shares, for Class A Common Stock, (c) a tax receivable agreement that generally provides for the payment by the Company to the Original Investors and their permitted transferees of 85% of the net cash savings, if any, in U.S. federal, state and local income tax and franchise tax that the Company actually realizes (computed using simplifying assumptions to address the impact of state and local taxes) or is deemed to realize in certain circumstances in periods after the IPO; (ii) the repayment and termination of approximately $5,300,000 of promissory notes issued to certain members of management prior to our initial public offering, and (iii) an administrative services arrangement with Solaris Energy Management LLC (“SEM”), a company partially-owned by William A. Zartler, the Chairman of our board of directors, for the provision of certain personnel and administrative services to us at cost which totaled approximately $910,000 for fiscal year 2017 for these services.

COMPENSATION COMMITTEE INTERLOCKS AND INSIDER PARTICIPATION

None of our executive officers currently serves, nor served at any time during 2017, as a member of the board of directors or compensation committee of any entity that has one or more executive officers serving on our Board of Directors.

CODE OF BUSINESS CONDUCT AND ETHICS

The Company has adopted a Corporate Code of Business Conduct and Ethics that applies to its Directors and employees, including its Chief Executive Officer, Chief Financial Officer and Chief Accounting Officer. The Code of Business Conduct and Ethics, including future amendments, is available free of charge on the Company’s website at www.solarisoilfield.com or by writing to the Company at: Solaris Oilfield Infrastructure, Inc., c/o Corporate Secretary, 9811 Katy Freeway, Suite 900, Houston, Texas 77024. The Company will also post on its website any amendment to or waiver under the Code of Business Conduct and Ethics granted to any of its Directors or executive officers. No such waivers were requested or granted in 2017.

DIRECTOR COMPENSATION

We believe that attracting and retaining qualified non-employee directors will be critical to the future value growth and governance of our company. We also believe that a significant portion of the total compensation package for our non-employee directors should be equity-based to align the interest of directors with our stockholders.

As a result, we implemented the following non-employee director compensation program in August 2017:

|

|

·

|

an annual cash retainer, valued at approximately $82,000 for the chairman of our board, $75,000 for the chairman of the audit committee, $65,000 for the chairman of the compensation committee and $55,000 for all other non-employee directors, in each case, payable quarterly in arrears; and

|

|

|

·

|

an annual equity-based award with an aggregate fair market value (determined on the date of grant) of approximately $142,000 for the chairman of our board and $95,000 for all other non-employee directors.

|

We do not pay any additional fees for attendance at board or committee meetings, but we do reimburse each director for reasonable travel and out-of-pocket expenses incurred to attend meetings and activities of our board or its committees. Directors who are also our employees will not receive any additional compensation for their service on our board of directors.

The following table sets forth information regarding the compensation of the Company’s non-employee directors. Mr. Lanham, our Chief Executive Officer, did not receive any additional compensation for his service on the Board in 2017. Compensation received by Mr. Lanham in his capacity as Chief Executive Officer is disclosed under “Compensation of Executive Officers” below.

|

Name

|

|

Fees

Earned

or Paid in

Cash

($)

|

|

|

Stock

Awards

($)(2)

|

|

|

Total

($)

|

|

|

James R. Burke

(3)

|

|

|

35,206

|

|

|

|

95,289

|

|

|

|

130,495

|

|

|

Edgar R. Giesinger

|

|

|

48,008

|

|

|

|

95,289

|

|

|

|

143,297

|

|

|

W. Howard Keenan, Jr.

|

|

|

35,206

|

|

|

|

95,289

|

|

|

|

130,495

|

|

|

F. Gardner Parker

|

|

|

41,607

|

|

|

|

95,289

|

|

|

|

136,896

|

|

|

A. James Teague

|

|

|

35,206

|

|

|

|

95,289

|

|

|

|

130,515

|

|

|

William A. Zartler

(1)

|

|

|

52,489

|

|

|

|

142,429

|

|

|

|

194,918

|

|

|

(1)

|

From January 1, 2017 through our initial public offering in May 2017, Mr. Zartler received compensation as the Chief Executive Officer of our predecessor Company. Upon completion of our initial public offering in May 2017, Mr. Zartler resigned as Chief Executive Officer and became Chairman of the Board of Directors, at which time the only compensation paid to him was director fees.

|

|

(2)

|

Amounts shown in this column reflect the aggregate grant date fair value of the restricted stock awards granted under the Solaris Oilfield Infrastructure, Inc. 2017 Long Term Incentive Plan (the “LTIP”) in August 2017 to our non-employee directors, calculated in accordance with Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) Topic 718, disregarding estimated forfeitures. For additional information about the assumptions used in the valuation of these awards, see Note 10 to Consolidated Financial Statements included in our Form 10-K for the year ended December 31, 2017. As of December 31, 2017, our non-employee directors, other than Mr. Zartler, held 7,170 unvested shares of restricted stock. As of December 31, 2017, Mr. Zartler held 77,911 unvested shares of restricted stock.

|

|

(3)

|

As of December 31, 2017, Mr. Burke held 10,629 unexercised stock options to purchase our Class A Common Stock.

|

EXECUTIVE OFFICERS

Set forth below are the name, age, position and description of the business experience of our executive officers (other than those who are also directors) as of April 2, 2018.

|

Name

|

|

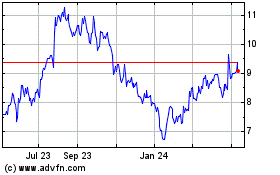

Age