Filed Pursuant to Rule 424(b)(7)

Registration No. 333-217636

CALCULATION OF REGISTRATION FEE (1)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Title of each class of securities

to be registered

|

|

Amount to be

Registered

|

|

|

Proposed

Maximum

Offering Price

Per Share

|

|

|

Proposed

Maximum

Aggregate

Offering Price

|

|

|

Amount of

Registration Fee (2)

|

|

|

Common stock, par value $0.001 per share

|

|

|

1,717,789

|

|

|

$

|

101.11

|

|

|

$

|

173,677,056.85

|

|

|

$

|

21,622.79

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1)

|

The information in this Calculation of Registration Fee Table updates, with respect to the securities offered hereby, the information set forth in the Calculation of Registration Fee Table included in the

Registrant’s Registration Statement on

Form S-3

(Registration

No. 333-217636),

originally filed with the Commission on May 3, 2017.

|

|

(2)

|

Estimated solely for purposes of calculating the registration fee in accordance with Rule 457(c) under the Securities Act of 1933, as amended, based on the average of the high and low reported sales prices on the New

York Stock Exchange on March 28, 2018.

|

PROSPECTUS SUPPLEMENT

(To Prospectus dated May 3, 2017)

Centene Corporation

Up to 1,717,789 Shares of Common Stock

This prospectus

supplement will be used from time to time by the selling stockholders to resell certain shares of common stock, par value $0.001 per share, of Centene Corporation, a Delaware corporation (“Centene”). The shares of our common stock that may

be offered by the selling stockholders using this prospectus supplement and the accompanying prospectus represent shares of our common stock that we issued to such selling stockholders in connection with our acquisition of MHM Services, Inc., a

Delaware corporation (“MHM”), on April 2, 2018. We will not receive any proceeds from the shares of common stock sold by the selling stockholders.

Our common stock is listed on the New York Stock Exchange (the “NYSE”) under the symbol “CNC.” On March 29, 2018, the

last reported sale price of our common stock on the NYSE was $106.87 per share.

Investing in our common stock involves risks that are

described in the “

Risk Factors

” section of this prospectus supplement beginning on page

S-3

and such risk factors as may be updated from time to time in our public filings.

The selling stockholders may, from time to time, offer and sell registered shares of our common stock held by them directly or

through agents or broker-dealers on terms to be determined at the time of sale. See “Plan of Distribution” beginning on

page S-23

of this prospectus supplement for more information about how the

selling stockholders may offer and sell their shares of common stock.

The selling stockholders and any agents or broker-dealers that

participate with the selling stockholders in the distribution of registered shares may be deemed to be “underwriters” within the meaning of the Securities Act of 1933, as amended (the “Securities Act”), and any commissions

received by them and any profit on the sale of registered shares may be deemed to be underwriting commissions or discounts under the Securities Act.

Neither the Securities and Exchange Commission (the “SEC”) nor any other regulatory body has approved or disapproved of these

securities or passed upon the adequacy or accuracy of this prospectus supplement or the related prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus supplement is April 2, 2018

TABLE OF CONTENTS

Prospectus Supplement

Prospectus

You should read this document together with additional information described under the heading “Where

You Can Find More Information.” You should rely only on the information contained or incorporated by reference in this prospectus supplement and the accompanying prospectus or any free writing prospectus prepared by or on behalf of us. We have

not, and the selling stockholders have not, authorized anyone to provide you with additional or different information. We and the selling stockholders are not making an offer to sell these securities in any jurisdiction where the offer or sale is

not permitted. You should not assume that the information we have included in this prospectus supplement or the accompanying prospectus is accurate as of any date other than the date of this prospectus supplement or the accompanying prospectus or

that any information we have incorporated by reference is accurate as of any date other than the date of the document incorporated by reference. To the extent that any statement we make in this prospectus supplement is inconsistent with the

statements made in the accompanying prospectus, the statements made in the accompanying prospectus are deemed modified or superseded by the statements made in this prospectus supplement. Neither this prospectus supplement nor the accompanying

prospectus constitutes an offer, or an invitation on our behalf or on behalf of the selling stockholders, to subscribe for and purchase any of the securities and may not be used for or in connection with an offer or solicitation by anyone, in any

jurisdiction in which such an offer or solicitation is not authorized or to any person to whom it is unlawful to make such an offer or solicitation.

S-i

ABOUT THIS PROSPECTUS SUPPLEMENT

This prospectus supplement and the accompanying prospectus are part of a registration statement that we filed with the SEC utilizing a

“shelf” registration process. Under this shelf registration process, we or selling stockholders may sell the securities described in the accompanying prospectus from time to time. In this prospectus supplement, we provide you with specific

information about the shares the selling stockholders are selling in this offering and about the offering itself. Both this prospectus supplement and the accompanying prospectus include or incorporate by reference important information about us and

other information you should know before investing in the shares. This prospectus supplement also adds, updates and changes information contained or incorporated by reference in the accompanying prospectus. You should read both this prospectus

supplement and the accompanying prospectus, as well as the additional information in the documents described below under the heading “Where You Can Find More Information,” before investing in the shares.

Unless the context otherwise requires, the terms the “Company,” “we,” “us,” “our” or similar terms and

“Centene” refer to Centene Corporation, together with its consolidated subsidiaries.

WHERE YOU CAN

FIND MORE INFORMATION

This prospectus supplement and the accompanying prospectus incorporate by reference information from documents

filed with the SEC, which means that we are disclosing important information to you by referring you to those documents. The information we incorporate by reference is an important part of this prospectus supplement and the accompanying prospectus,

and information we subsequently file with the SEC will automatically update and supersede that information. We incorporate by reference the documents listed below and any filings we make with the SEC under Section 13(a), 13(c), 14 or 15(d) of

the Exchange Act (other than any portion provided pursuant to Item 2.02 or Item 7.01 of Form

8-K

or other information “furnished” to the SEC), on or after the date of this prospectus supplement and

before the termination of the offering of the shares pursuant to this prospectus supplement. The documents we incorporate by reference are:

|

|

•

|

|

our Annual Report on Form

10-K

for the year ended December 31, 2017, filed with the SEC on February 20, 2018;

|

|

|

•

|

|

our Current Reports on Form

8-K,

filed with the SEC on March 24, 2016 (as amended on May 10, 2016 (excluding Item 9.01 and Exhibit 99.1 of such amendment) and as further

amended on June 9, 2016), February 5, 2018, February 9, 2018, February 27, 2018, March 13, 2018 (Film No.: 18685313), March 26, 2018, April 2, 2018 and April 2, 2018;

|

|

|

•

|

|

our Definitive Proxy Statement on Schedule 14A, filed with the SEC on March 9, 2018 (solely to the extent incorporated by reference into Part III of our Annual Report on Form

10-K

for the year ended December 31, 2017); and

|

|

|

•

|

|

the description of our common stock contained in our registration statement on Form

8-A

filed with the SEC on October 14, 2003, as amended by our Forms

8-A/A

filed with the SEC on December 17, 2004 and April 26, 2007, including any amendments or reports filed for the purpose of updating such description.

|

The preceding list supersedes and replaces the documents listed in the accompanying prospectus under the heading “Where You Can Find More

Information.” We file annual, quarterly and current reports, proxy statements and other information with the SEC. You may read and copy any document we file at the SEC’s Public Reference Room, 100 F Street, N.E., Washington, D.C. 20549.

Please call the SEC at

1-800-SEC-0330

for further information on their public reference room. Our SEC filings are also available

to the public at the SEC’s website at http://www.sec.gov. Our common stock is listed under the symbol “CNC” and traded on the NYSE. Information about us, including our SEC filings, is also available at our Internet site at

http://www.centene.com. However, the information on our internet site is not a part of this prospectus supplement or the accompanying prospectus.

S-ii

We encourage you to read our SEC reports, as they provide additional important information about

us. For example, we filed the audited financial statements of Health Net, Inc. (“Health Net”) and its subsidiaries as of December 31, 2015 and 2014, and for each of the three years in the three-year period ended December 31,

2015, which are incorporated by reference herein from our Current Report on Form

8-K,

with the SEC on March 24, 2016 (as amended on May 10, 2016 (excluding Item 9.01 and Exhibit 99.1 of such

amendment) and as further amended on June 9, 2016) (the “Health Net Form

8-K”),

and we filed the audited financial statements of New York State Catholic Health Plan, Inc., d/b/a Fidelis Care New

York (“Fidelis Care”) as of December 31, 2017 and 2016, and for each of the years in the

two-year

period ended December 31, 2017, which are incorporated by reference herein from our Current

Report on Form

8-K,

with the SEC on March 26, 2018 (the “Fidelis Form

8-K”).

We will provide to each person, including any beneficial owner, to whom a

prospectus supplement is delivered, a copy of any or all of the information that has been incorporated by reference in the prospectus supplement but not delivered with the prospectus supplement, at no charge upon written or oral request by

contacting us at Centene Corporation, Attn: Corporate Secretary, 7700 Forsyth Boulevard, St. Louis, Missouri 63105, telephone (314)

725-4477.

This prospectus supplement does not contain all of the information set forth in the registration statement or in the exhibits and schedules

thereto, in accordance with the rules and regulations of the SEC, and we refer you to that omitted information. The statements made in this prospectus supplement pertaining to the content of any contract, agreement or other document that is an

exhibit to the registration statement or the documents incorporated by reference in this prospectus supplement necessarily are summaries of their material provisions and we qualify those statements in their entirety by reference to those definitive

agreements and those exhibits for complete statements of their provisions. The documents incorporated by reference in this prospectus supplement and the registration statement and its exhibits and schedules are available at the SEC’s public

reference room or through its website.

S-iii

CAUTIONARY STATEMENT CONCERNING FORWARD-LOOKING STATEMENTS

Statements set forth in this prospectus supplement, the accompanying prospectus and incorporated by reference herein and therein from

documents we have filed with the SEC may contain forward-looking statements within the meaning of Section 27A of the Securities Act, and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). We

intend such forward-looking statements to be covered by the safe-harbor provisions for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995, and we are including this statement for purposes of complying with

these safe-harbor provisions. In particular, these statements include without limitation statements about our market opportunity, our growth strategy, competition, expected activities and future acquisitions, including the proposed acquisition of

Fidelis Care (the “Proposed Fidelis Acquisition”), investments and the adequacy of our available cash resources. Readers are cautioned that matters subject to forward-looking statements involve known and unknown risks and uncertainties,

including economic, regulatory, competitive and other factors that may cause our or our industry’s actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity,

performance or achievements expressed or implied by these forward-looking statements. These statements are not guarantees of future performance and are subject to risks, uncertainties and assumptions.

All forward-looking statements included or incorporated by reference in this prospectus supplement are based on information available to us on

the date of this prospectus supplement. Except as may be otherwise required by law, we undertake no obligation to update or revise the forward-looking statements included or incorporated by reference in this prospectus supplement, whether as a

result of new information, future events or otherwise, after the date of this prospectus supplement. You should not place undue reliance on any forward-looking statements, as actual results may differ materially from projections, estimates or other

forward-looking statements due to a variety of important factors, including but not limited to:

|

|

•

|

|

our ability to accurately predict and effectively manage health benefits and other operating expenses and reserves;

|

|

|

•

|

|

membership and revenue declines or unexpected trends;

|

|

|

•

|

|

changes in healthcare practices, new technologies and advances in medicine;

|

|

|

•

|

|

increased healthcare costs;

|

|

|

•

|

|

changes in economic, political or market conditions;

|

|

|

•

|

|

changes in federal or state laws or regulations, including changes with respect to government healthcare programs as well as changes with respect to the Patient Protection and Affordable Care Act and the Healthcare and

Education Affordability Reconciliation Act and any regulations enacted thereunder that may result from changing political conditions;

|

|

|

•

|

|

rate cuts or other payment reductions or delays by governmental payors and other risks and uncertainties affecting our government business;

|

|

|

•

|

|

our ability to adequately price products on federally facilitated and state based Health Insurance Marketplaces;

|

|

|

•

|

|

disasters or major epidemics;

|

|

|

•

|

|

the outcome of legal and regulatory proceedings;

|

S-iv

|

|

•

|

|

changes in expected contract start dates;

|

|

|

•

|

|

provider, state, federal and other contract changes and timing of regulatory approval of contracts;

|

|

|

•

|

|

the expiration, suspension or termination of our or Fidelis Care’s contracts with federal or state governments (including but not limited to Medicaid, Medicare and TRICARE);

|

|

|

•

|

|

the difficulty of predicting the timing or outcome of pending or future litigation or government investigations;

|

|

|

•

|

|

challenges to our or Fidelis Care’s contract awards;

|

|

|

•

|

|

cyber-attacks or other privacy or data security incidents;

|

|

|

•

|

|

the possibility that the expected synergies and value creation from acquired businesses, including, without limitation, the acquisition (the “Health Net Acquisition”) of Health Net, and the Proposed Fidelis

Acquisition, will not be realized, or will not be realized within the expected time period, including, but not limited to, as a result of any failure to obtain any regulatory, governmental or third party consents or approvals in connection with the

Proposed Fidelis Acquisition (including any such approvals under the New York

Non-For-Profit

Corporation Law) or any conditions, terms, obligations or restrictions

imposed in connection with the receipt of such consents or approvals;

|

|

|

•

|

|

the exertion of management’s time and our resources, and other expenses incurred and business changes required in connection with complying with the undertakings in connection with any regulatory, governmental or

third party consents or approvals for the Health Net Acquisition;

|

|

|

•

|

|

disruption caused by significant completed and pending acquisitions, including the Health Net Acquisition and the Proposed Fidelis Acquisition, making it more difficult to maintain business and operational

relationships;

|

|

|

•

|

|

the risk that unexpected costs will be incurred in connection with the completion and/or integration of acquisition transactions, including among others, the Health Net Acquisition and the Proposed Fidelis Acquisition;

|

|

|

•

|

|

changes in expected closing dates, estimated purchase price and accretion for acquisitions;

|

|

|

•

|

|

the risk that acquired businesses, including Health Net and Fidelis Care, will not be integrated successfully;

|

|

|

•

|

|

the risk that the conditions to the completion of the Proposed Fidelis Acquisition may not be satisfied or completed on a timely basis, or at all;

|

|

|

•

|

|

failure to obtain or receive any required regulatory approvals, consents or clearances for the Proposed Fidelis Acquisition, and the risk that, even if so obtained or received, regulatory authorities impose conditions

on the completion of the transaction that could require the exertion of management’s time and our resources or otherwise have an adverse effect on Centene;

|

|

|

•

|

|

business uncertainties and contractual restrictions while the Proposed Fidelis Acquisition is pending, which could adversely affect our business and operations;

|

|

|

•

|

|

change of control provisions or other provisions in certain agreements to which Fidelis Care is a party, which may be triggered by the completion of the Proposed Fidelis Acquisition;

|

|

|

•

|

|

loss of management personnel and other key employees due to uncertainties associated with the Proposed Fidelis Acquisition;

|

S-v

|

|

•

|

|

the risk that, following completion of the Proposed Fidelis Acquisition, the combined company may not be able to effectively manage its expanded operations;

|

|

|

•

|

|

restrictions and limitations that may stem from the financing arrangements that the combined company will enter into in connection with the Proposed Fidelis Acquisition;

|

|

|

•

|

|

our ability to achieve improvement in the Centers for Medicare and Medicaid Services Star ratings and maintain or achieve improvement in other quality scores in each case that can impact revenue and future growth;

|

|

|

•

|

|

availability of debt and equity financing, on terms that are favorable to us;

|

|

|

•

|

|

foreign currency fluctuations.

|

This list of important factors is not intended to be

exhaustive. We discuss certain of these matters more fully, as well as certain other risk factors that may affect our business operations, financial condition and results of operations, in our filings with the SEC, including our annual reports on

Form

10-K,

quarterly reports on Form

10-Q

and current reports on Form

8-K.

All statements, other than statements of current or historical fact, contained in this filing are forward-looking statements. We have

attempted to identify these statements by terminology including “believe,” “anticipate,” “plan,” “expect,” “estimate,” “intend,” “seek,” “target,” “goal,”

“may,” “will,” “would,” “could,” “should,” “can,” “continue” and other similar words or expressions in connection with, among other things, any discussion of future operating or

financial performance. In particular, these statements include statements about our market opportunity, our growth strategy, competition, expected activities and future acquisitions, investments and the adequacy of our available cash resources.

Because such statements are subject to risks and uncertainties, actual results may differ materially from those expressed or implied by such

forward looking statements. See “Risk Factors” beginning on

page S-3

of this prospectus for reference to the factors that could cause actual results to differ materially.

You should not place undue reliance on such statements, which speak only as of the date that they were made. These cautionary statements

should be considered in connection with any written or oral forward-looking statements that we may issue in the future. We do not undertake any obligation to release publicly any revisions to such forward looking statements to reflect later events

or circumstances or to reflect the occurrence of unanticipated events.

S-vi

SUMMARY

This summary highlights information contained or incorporated by reference in this prospectus supplement and the accompanying prospectus.

Because this is a summary, it may not contain all of the information that is important to you. Before making an investment decision, you should read the entire prospectus supplement, the accompanying prospectus and the documents incorporated by

reference, including the section entitled “Risk Factors” in this prospectus supplement and such risk factors as may be updated from time to time in our public filings.

Overview

Centene is a diversified,

multi-national healthcare enterprise that provides a portfolio of services to government sponsored and commercial healthcare programs, focusing on under-insured and uninsured individuals. Centene provides member-focused services through locally

based staff by assisting in accessing care, coordinating referrals to related health and social services and addressing member concerns and questions. Centene also provides education and outreach programs to inform and assist members in accessing

quality, appropriate healthcare services. Centene believes its local approach, including member and provider services, enables it to provide accessible, quality, culturally-sensitive healthcare coverage to its communities. Centene’s health

management, educational and other initiatives are designed to help members best utilize the healthcare system to ensure they receive appropriate, medically necessary services and effective management of routine, severe and chronic health problems,

resulting in better health outcomes. Centene combines its decentralized local approach for care with a centralized infrastructure of support functions such as finance, information systems and claims processing.

In September 2017, we signed a definitive agreement under which Fidelis Care (as defined herein) will become our health plan in New York

State. Under the terms of the agreement, we will acquire substantially all of the assets of Fidelis Care for $3.75 billion, subject to certain adjustments.

Centene operates in two segments: Managed Care and Specialty Services. Centene’s Managed Care segment provides health plan coverage to

individuals through government subsidized and commercial programs including Medicaid, the State Children’s Health Insurance Program (CHIP), Long-Term Services and Supports (LTSS), Medicare, Foster Care, Supplemental Security Income Program,

also known as the Aged, Blind or Disabled, or collectively ABD, and Medicare-Medicaid Plans (MMP), which cover beneficiaries who are dually eligible for Medicare and Medicaid. In addition, our commercial operations, which include our members through

the Health Insurance Marketplace, are included within the Managed Care segment. Centene’s Specialty Services segment consists of Centene’s specialty companies offering diversified healthcare services and products to state programs,

correctional facilities, healthcare organizations, employer groups, military service members and their families, and other commercial organizations, as well as to its own subsidiaries. For the year ended December 31, 2017, Centene’s

Managed Care and Specialty Services segments accounted for 95% and 5%, respectively, of Centene’s total external revenues.

Centene’s membership totaled 12.2 million as of December 31, 2017. For the year ended December 31, 2017, Centene’s

total revenues and net earnings from continuing operations attributable to Centene were $48.4 billion and $828 million, respectively, and its total cash flow from operations was $1.5 billion.

Our initial health plan commenced operations in Wisconsin in 1984. We were organized in Wisconsin in 1993 as a holding company for our initial

health plan and reincorporated in Delaware in 2001.

The selling stockholders acquired the shares of our common stock which are the

subject of this prospectus supplement in connection with our acquisition of MHM on April 2, 2018. See “Selling Stockholders” below.

The principal executive offices are located at 7700 Forsyth Boulevard, St. Louis, Missouri 63105, and our telephone number is (314)

725-4477.

Centene’s website address is www.centene.com. We do not incorporate the information contained on our website herein, and you should not consider it part of this prospectus supplement or the

accompanying prospectus.

Our common stock is publicly traded on the NYSE under the ticker symbol “CNC.”

S-1

THE OFFERING

The summary below contains basic information about this offering. It does not contain all of the information you should consider in making

your investment decision. You should read the entire prospectus supplement and accompanying prospectus and the information included or incorporated and deemed to be incorporated by reference herein and therein before making an investment decision.

As used in this section, except where otherwise indicated, the terms “us,” “we” and “our” refer to Centene Corporation and not to any of its subsidiaries.

|

|

|

|

|

Issuer

|

|

Centene Corporation, a Delaware corporation.

|

|

|

|

|

Securities offered by selling stockholders

|

|

1,717,789 shares of common stock, par value $0.001 per share.

|

|

|

|

|

Number of shares to be outstanding after this offering

|

|

178,480,756 shares (based on 176,762,967 shares of our common stock outstanding as of March 29, 2018).

|

|

|

|

|

Use of Proceeds

|

|

We will not receive any proceeds from the sale of shares of common stock by the selling stockholders in this offering.

|

|

|

|

|

NYSE Symbol

|

|

“CNC.”

|

|

|

|

|

Transfer agent and registrar

|

|

The transfer agent and registrar for our common stock is Broadridge Corporate Issuer Solutions, Inc.

|

S-2

RISK FACTORS

An investment in our common stock involves a number of risks. You should carefully consider all the information set forth in this

prospectus supplement and the accompanying prospectus and incorporated by reference herein and therein before deciding to invest in the common stock. In particular, we urge you to consider carefully the factors set forth below and such risk factors

as may be updated from time to time in our public filings. Any of these risks could materially and adversely affect our business, financial condition and results of operations and the actual outcome of matters as to which forward-looking statements

are made in this prospectus supplement and the accompanying prospectus. While we believe we have identified and discussed below, in the accompanying prospectus and in the documents incorporated by reference herein and therein, the material risks

affecting our business, there may be additional risks and uncertainties that we do not presently know or that we do not currently believe to be material that may adversely affect such business, financial condition and results of operations in the

future. Unless the context otherwise requires, the terms the “Company,” “we,” “us,” “our” or similar terms and “Centene” refer to Centene Corporation, together with its consolidated subsidiaries.

Risks Related to Ownership of Our Common Stock

Our stock price has fluctuated in the past and may fluctuate in the future. Accordingly, you may not be able to resell your shares at or

above the price at which you purchased them.

The trading price of our common stock has fluctuated in the past. The trading price

of our common stock could fluctuate significantly in the future and could be negatively affected in response to various factors including:

|

|

•

|

|

conditions in the broader stock market in general;

|

|

|

•

|

|

our ability to make investments with attractive risk-adjusted returns;

|

|

|

•

|

|

market perception of our current and projected financial condition, potential growth, future earnings and future cash dividends;

|

|

|

•

|

|

announcements we make regarding dividends;

|

|

|

•

|

|

actual or anticipated fluctuations in our quarterly financial and operating results;

|

|

|

•

|

|

additional offerings of our common stock or equity-linked securities;

|

|

|

•

|

|

actions by rating agencies;

|

|

|

•

|

|

short sales of our common stock;

|

|

|

•

|

|

any decision to pursue a distribution or disposition of a meaningful portion of our assets;

|

|

|

•

|

|

issuance of new or changed securities analysts’ reports or recommendations;

|

|

|

•

|

|

market perception or media coverage of us, other similar companies or the outlook of the markets and industries in which we compete;

|

|

|

•

|

|

major reductions in trading volumes on the exchanges on which we operate;

|

|

|

•

|

|

legislative or regulatory developments, including changes in the status of our regulatory approvals or licenses; and

|

|

|

•

|

|

litigation and governmental investigations.

|

S-3

These and other factors may cause the market price and demand for our common stock to fluctuate

substantially, which may negatively affect the price or liquidity of our common stock. In addition, the market price of our common stock may fluctuate significantly following consummation of the Proposed Fidelis Acquisition if, among other things,

the combined company is unable to achieve the expected growth in earnings, or if the operational cost savings estimates in connection with the integration of our and Fidelis Care’s businesses are not realized, or if the transaction costs

relating to the Proposed Fidelis Acquisition are greater than expected, or if the financing relating to the transaction is on unfavorable terms. The market price also may decline if the combined company does not achieve the perceived benefits of the

Proposed Fidelis Acquisition as rapidly or to the extent anticipated by financial or industry analysts or if the effect of the Proposed Fidelis Acquisition on the combined company’s financial position, results of operations or cash flows is not

consistent with the expectations of financial or industry analysts. In addition, our business differs from that of Fidelis Care, and accordingly, the results of operations of the combined company and the market price of our common stock after the

completion of the Proposed Fidelis Acquisition may be affected by factors different from those currently affecting the independent results of operations of each of our and Fidelis Care’s businesses.

When the market price of a stock has been volatile or has decreased significantly in the past, holders of that stock have, at times,

instituted securities class action litigation against the company that issued the stock. If any of our stockholders brought a lawsuit against us, we could incur substantial costs defending, settling or paying any resulting judgments related to the

lawsuit. Such a lawsuit could also divert the time and attention of our management from our business and hurt our share price.

Shares eligible for future sale may adversely affect our common stock price.

Sales of our common stock or other securities in the public or private market, or the perception that these sales may occur, could cause the

market price of our common stock to decline. This could also impair our ability to raise additional capital through the sale of our equity securities. Under our certificate of incorporation, we are authorized to issue up to 410,000,000 shares of

capital stock, consisting of 400,000,000 shares of common stock, par value $0.001 per share, and 10,000,000 shares of preferred stock, par value $0.001 per share. We cannot predict the size of future issuances of our common stock or other securities

or the effect, if any, that future sales and issuances of our common stock and other securities would have on the market price of our common stock.

Future issuances and sales of additional shares of preferred or common stock, including shares issued in connection with the Proposed

Fidelis Acquisition, could reduce the market price of our shares of common stock.

Subject to market conditions, we intend to fund

the purchase price for the Proposed Fidelis Acquisition with $2.3 billion of new equity, including shares paid as consideration. Any such issuances and sales of our preferred or common stock could have the effect of depressing the market price

for our common stock. Further, any sale of shares to finance a portion of the purchase price for the Proposed Fidelis Acquisition will be subject to market conditions and could be negatively impacted by a decline in the market price for our common

stock. In addition, in the future we may issue additional securities to raise capital or in connection with acquisitions. We often acquire interests in other companies by using a combination of cash and our common stock or just our common stock.

Further, shares of preferred stock may be issued from time to time in one or more series as our Board may from time to time determine each such series to be distinctively designated. The issuance of any such preferred stock could materially

adversely affect the rights of holders of our common stock. Any of these events may dilute your ownership interest in our company and have an adverse impact on the price of our common stock.

Our shares of common stock will rank junior to all of our consolidated liabilities.

In the event of a bankruptcy, liquidation, dissolution or winding up, our assets will be available to pay obligations on the common stock only

after all of our consolidated liabilities have been paid. In the event of a bankruptcy, liquidation, dissolution or winding up, there may not be sufficient assets remaining, after paying our and our subsidiaries’ liabilities, to pay any amounts

with respect to the common stock then outstanding. We have a significant amount of debt, which amounted to $4.7 billion as of December 31, 2017, with $1,500 million of availability under our existing revolving credit facility and

access to an additional $500 million of availability subject to lender commitments. We expect to incur additional debt to fund the Proposed Fidelis Acquisition. On a pro forma basis to give effect to the Proposed Fidelis Acquisition and the

other events described under “Unaudited Pro Forma Condensed Combined Financial Information” herein, we would have had $6.2 billion of outstanding debt on a consolidated basis as of December 31, 2017, with $1,305 million of

availability under our revolving credit facility, and may also take on additional long-term debt and working capital lines of credit to meet future financing needs, subject to certain restrictions under the terms of our existing debt.

S-4

Our corporate documents and provisions of Delaware law may prevent a change in control or

management that stockholders may consider desirable.

Section 203 of the Delaware General Corporation Law, laws of states in

which we operate, and our certificate of incorporation and

by-laws

contain provisions that might enable our management to resist a takeover of our company. These provisions could have the effect of delaying,

deferring, or preventing a change in control of Centene or a change in our management that stockholders may consider favorable or beneficial. These provisions could also discourage proxy contests and make it more difficult for you and other

stockholders to elect directors and take other corporate actions. These provisions could also limit the price that investors might be willing to pay in the future for shares of our common stock.

S-5

USE OF PROCEEDS

We will not receive any proceeds from the shares of common stock sold by the selling stockholders.

S-6

SELLING STOCKHOLDERS

In connection with our acquisition of MHM on April 2, 2018, we issued 1,717,789 shares of our common stock as a portion of the

consideration in a private placement to the selling stockholders. We are registering these shares of common stock in order to permit the selling stockholders to offer the shares for resale from time to time.

The following table sets forth the information about the selling stockholders, including the number of shares of our common stock owned by or

attributable to such selling stockholders immediately prior to this registration (including the shares offered by this prospectus supplement), the number of shares offered hereby and registered by the registration statement of which this prospectus

supplement is a part, and the number of shares of our common stock to be owned by such selling stockholders after this offering. The number of shares to be owned after this offering assumes that all shares covered by this prospectus supplement will

be sold by the selling stockholders and that no additional shares of our common stock are subsequently bought or sold by the selling stockholders.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name

|

|

Ownership Prior to

the Registration

|

|

Shares

Covered by

this

Registration

Statement

|

|

Ownership After the

Shares are Sold

|

|

|

|

Number of

Shares

|

|

Percent

|

|

|

Number

of

Shares

|

|

|

Percent

|

|

All selling stockholders who beneficially own, in the aggregate, less than 1% of our common

stock

|

|

1,723,789

|

|

*

|

|

1,717,789

|

|

|

6,000

|

|

|

*

|

|

*

|

Represents less than 1% of the total outstanding shares of our common stock.

|

S-7

PRICE RANGE OF OUR COMMON STOCK AND DIVIDENDS

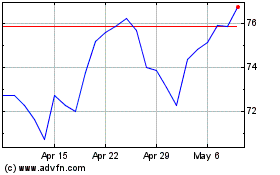

Our common stock is listed and traded on the NYSE under the symbol “CNC.” The following table sets forth, for the periods indicated,

the high and low

intra-day

sale prices of our common stock as reported on the NYSE:

|

|

|

|

|

|

|

|

|

|

|

2016

|

|

High

|

|

|

Low

|

|

|

First Quarter

|

|

$

|

68.42

|

|

|

$

|

47.36

|

|

|

Second Quarter

|

|

$

|

71.53

|

|

|

$

|

55.60

|

|

|

Third Quarter

|

|

$

|

75.57

|

|

|

$

|

63.37

|

|

|

Fourth Quarter

|

|

$

|

67.41

|

|

|

$

|

50.00

|

|

|

|

|

|

|

2017

|

|

High

|

|

|

Low

|

|

|

First Quarter

|

|

$

|

73.23

|

|

|

$

|

56.00

|

|

|

Second Quarter

|

|

$

|

85.80

|

|

|

$

|

69.20

|

|

|

Third Quarter

|

|

$

|

98.72

|

|

|

$

|

79.06

|

|

|

Fourth Quarter

|

|

$

|

104.65

|

|

|

$

|

83.56

|

|

|

|

|

|

|

2018

|

|

High

|

|

|

Low

|

|

|

First Quarter (through March 31, 2018)

|

|

$

|

112.42

|

|

|

$

|

97.61

|

|

The closing sale price of our common stock as reported on the NYSE on March 29, 2018 was $106.87 per

share. For a description of our common stock, see “Description of Capital Stock” in the accompanying prospectus and our certificate of incorporation, which is incorporated herein by reference.

Dividend Policy

We have never declared

any cash dividends on our shares of common stock and currently anticipate that we will retain any future earnings for the development, operation and expansion of our business.

S-8

UNAUDITED PRO FORMA CONDENSED COMBINED FINANCIAL INFORMATION

CENTENE AND FIDELIS CARE

The unaudited pro forma condensed combined statement of operations for the year ended December 31, 2017 combine the historical

consolidated statements of operations of Centene and Fidelis Care, giving effect to the Proposed Fidelis Acquisition and the financing of the Proposed Fidelis Acquisition (the “Acquisition Financing”) as if they each had occurred on

January 1, 2017. The unaudited pro forma condensed combined balance sheet as of December 31, 2017, combines the historical consolidated balance sheets of the Company and Fidelis Care, giving effect to the Acquisition Financing and the

Proposed Fidelis Acquisition as if they each had occurred on December 31, 2017. The historical consolidated financial information has been adjusted in the unaudited pro forma condensed combined financial statements to give effect to pro forma

events that are (i) directly attributable to the Proposed Fidelis Acquisition, (ii) factually supportable and (iii) with respect to the statement of operations, expected to have a continuing impact on the combined results. The

unaudited pro forma condensed combined financial information should be read in conjunction with the accompanying notes to the unaudited pro forma condensed combined financial statements. In addition, the unaudited pro forma condensed combined

financial information was derived from and should be read in conjunction with the following historical consolidated financial statements and accompanying notes:

|

|

•

|

|

separate historical audited financial statements of the Company as of and for the year ended December 31, 2017, and the related notes included in the Company’s Annual Report on Form

10-K

for the year ended December 31, 2017, incorporated by reference herein; and

|

|

|

•

|

|

separate historical audited financial statements of Fidelis Care as of and for the year ended, December 31, 2017, and the related notes, incorporated by reference herein.

|

The unaudited pro forma condensed combined financial information has been prepared by us using the acquisition method of accounting in

accordance with GAAP. We have been treated as the acquirer in the Proposed Fidelis Acquisition for accounting purposes. The acquisition accounting is dependent upon certain valuation and other studies that have yet to commence or progress to a stage

where there is sufficient information for a definitive measurement. The consummation of the Proposed Fidelis Acquisition remains subject to the satisfaction of customary closing conditions, including the receipt of regulatory approvals, and there

can be no assurance that the Proposed Fidelis Acquisition will occur on or before a certain time, on the terms described herein, or at all. The Proposed Fidelis Acquisition or any other financing transaction are not conditioned upon each other. In

addition, under certain relevant laws and regulations, before completion of the Proposed Fidelis Acquisition, there are certain limitations regarding what we can learn about Fidelis Care. Until the Proposed Fidelis Acquisition is completed, we will

not have complete access to all relevant information. The assets and liabilities of Fidelis Care have been measured based on various preliminary estimates using assumptions that we believe are reasonable based on information that is currently

available. Differences between these preliminary estimates and the final acquisition accounting may occur, and those differences could have a material impact on the accompanying unaudited pro forma condensed combined financial statements and the

combined company’s future results of operations and financial position. The pro forma adjustments are preliminary and have been made solely for informational purposes.

We intend to commence the necessary valuation and other studies required to complete the acquisition accounting promptly upon completion of

the Proposed Fidelis Acquisition and will finalize the acquisition accounting as soon as practicable within the required measurement period in accordance with ASC 805, but in no event later than one year following completion of the Proposed Fidelis

Acquisition.

S-9

The unaudited pro forma adjustments are based upon available information and certain assumptions

that our management believes are reasonable. The unaudited pro forma condensed combined financial information has been presented for informational purposes only and is based on assumptions and estimates considered appropriate by our management;

however, it is not necessarily indicative of our financial position or results of operations that would have been achieved had the pro forma events taken place on the dates indicated, or of the future consolidated results of operations or of the

financial position of the combined company. You should not place undue reliance on the summary unaudited pro forma condensed combined financial information in deciding whether or not to purchase our common stock.

Management expects that the strategic and financial benefits of the Proposed Fidelis Acquisition will result in certain cost savings

opportunities. However, given the preliminary nature of those cost savings, they have not been reflected in the accompanying unaudited pro forma condensed combined statement of operations. For a discussion of risks related to anticipated cost

savings, see “Risk Factors—Factors that may affect Future Results and the Trading Price of Our Common Stock—The combined company may be unable to successfully integrate our business with the assets acquired in the Proposed Fidelis

Acquisition and realize the anticipated benefits of the Proposed Fidelis Acquisition” in Item 1A. of Part I of our Annual Report

on Form 10-K for

the year ended December 31,

2017.

S-10

Unaudited Pro Forma Condensed Combined Statement of Operations

For the Year Ended December 31, 2017

(In millions, except per share data in dollars and shares in thousands)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Centene

|

|

|

Fidelis Care

|

|

|

Pro Forma

Adjustments

(Note 6)

|

|

|

Pro

Forma

Combined

|

|

|

Revenues:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Premium

|

|

$

|

43,353

|

|

|

$

|

9,718

|

|

|

$

|

19

|

(a)

|

|

$

|

53,090

|

|

|

Service

|

|

|

2,267

|

|

|

|

—

|

|

|

|

—

|

|

|

|

2,267

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Premium and service revenues

|

|

|

45,620

|

|

|

|

9,718

|

|

|

|

19

|

|

|

|

55,357

|

|

|

Premium tax

|

|

|

2,762

|

|

|

|

—

|

|

|

|

164

|

(a)

|

|

|

2,926

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total revenues

|

|

|

48,382

|

|

|

|

9,718

|

|

|

|

183

|

|

|

|

58,283

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Expenses:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Medical costs

|

|

|

37,851

|

|

|

|

8,878

|

|

|

|

—

|

|

|

|

46,729

|

|

|

Cost of services

|

|

|

1,847

|

|

|

|

—

|

|

|

|

—

|

|

|

|

1,847

|

|

|

Selling, general and administrative expenses

|

|

|

4,446

|

|

|

|

576

|

|

|

|

—

|

|

|

|

5,022

|

|

|

Amortization of acquired intangible assets

|

|

|

156

|

|

|

|

—

|

|

|

|

77

|

(b)

|

|

|

233

|

|

|

Premium tax expense

|

|

|

2,883

|

|

|

|

—

|

|

|

|

183

|

(a)

|

|

|

3,066

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total operating expenses

|

|

|

47,183

|

|

|

|

9,454

|

|

|

|

260

|

|

|

|

56,897

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Earnings from operations

|

|

|

1,199

|

|

|

|

264

|

|

|

|

(77

|

)

|

|

|

1,386

|

|

|

Other income (expense):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Investment and other income

|

|

|

190

|

|

|

|

90

|

|

|

|

(20

|

)(c)

|

|

|

260

|

|

|

Interest expense

|

|

|

(255

|

)

|

|

|

(2

|

)

|

|

|

(82

|

)(d)

|

|

|

(339

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Earnings before income tax expense

|

|

|

1,134

|

|

|

|

352

|

|

|

|

(179

|

)

|

|

|

1,307

|

|

|

Income tax expense

|

|

|

326

|

|

|

|

—

|

|

|

|

69

|

(e)

|

|

|

395

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net earnings

|

|

|

808

|

|

|

|

352

|

|

|

|

(248

|

)

|

|

|

912

|

|

|

Loss attributable to noncontrolling interests

|

|

|

20

|

|

|

|

—

|

|

|

|

—

|

|

|

|

20

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net earnings attributable to common stockholders

|

|

$

|

828

|

|

|

$

|

352

|

|

|

$

|

(248

|

)

|

|

$

|

932

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net earnings per common share:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic earnings per common share

|

|

$

|

4.80

|

|

|

|

|

|

|

|

|

|

|

$

|

4.81

|

|

|

Diluted earnings per common share

|

|

$

|

4.69

|

|

|

|

|

|

|

|

|

|

|

$

|

4.70

|

|

|

Weighted average number of common shares outstanding:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic

|

|

|

172,427

|

|

|

|

|

|

|

|

21,521

|

(f)

|

|

|

193,948

|

|

|

Diluted

|

|

|

176,702

|

|

|

|

|

|

|

|

21,521

|

(f)

|

|

|

198,223

|

|

See the accompanying notes to the unaudited pro forma condensed combined financial statements, which are an

integral part of this statement. The pro forma adjustments are explained in Note 6.

Income Statement Pro Forma Adjustments

, beginning on page

S-17

of this prospectus supplement.

S-11

Unaudited Pro Forma Condensed Combined Balance Sheet

As of December 31, 2017

(In millions, except shares in thousands)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Centene

|

|

|

Fidelis Care

|

|

|

Pro Forma

Adjustments

(Note 7)

|

|

|

Pro Forma

Combined

|

|

|

ASSETS

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Current assets:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents

|

|

$

|

4,072

|

|

|

$

|

1,849

|

|

|

$

|

(728

|

)(a)

|

|

$

|

5,193

|

|

|

Premium and related receivables

|

|

|

3,413

|

|

|

|

210

|

|

|

|

—

|

|

|

|

3,623

|

|

|

Short-term investments

|

|

|

531

|

|

|

|

1,330

|

|

|

|

(125

|

)(a)

|

|

|

1,736

|

|

|

Other current assets

|

|

|

687

|

|

|

|

210

|

|

|

|

31

|

(f)

|

|

|

928

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total current assets

|

|

|

8,703

|

|

|

|

3,599

|

|

|

|

(822

|

)

|

|

|

11,480

|

|

|

Long-term investments

|

|

|

5,312

|

|

|

|

—

|

|

|

|

—

|

|

|

|

5,312

|

|

|

Restricted deposits

|

|

|

135

|

|

|

|

450

|

|

|

|

—

|

|

|

|

585

|

|

|

Property, software and equipment, net

|

|

|

1,104

|

|

|

|

210

|

|

|

|

(139

|

)(a)

|

|

|

1,175

|

|

|

Goodwill

|

|

|

4,749

|

|

|

|

16

|

|

|

|

1,533

|

(b)

|

|

|

6,298

|

|

|

Intangible assets, net

|

|

|

1,398

|

|

|

|

—

|

|

|

|

1,000

|

(c)

|

|

|

2,398

|

|

|

Other long-term assets

|

|

|

454

|

|

|

|

—

|

|

|

|

—

|

|

|

|

454

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total assets

|

|

$

|

21,855

|

|

|

$

|

4,275

|

|

|

$

|

1,572

|

|

|

$

|

27,702

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

LIABILITIES, REDEEMABLE NONCONTROLLING INTERESTS, STOCKHOLDERS’ EQUITY AND NET

ASSETS

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Current liabilities:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Medical claims liability

|

|

$

|

4,286

|

|

|

$

|

1,360

|

|

|

$

|

—

|

|

|

$

|

5,646

|

|

|

Accounts payable and accrued expenses

|

|

|

4,165

|

|

|

|

677

|

|

|

|

117

|

(a),(c),(f)

|

|

|

4,959

|

|

|

Return of premium payable

|

|

|

549

|

|

|

|

—

|

|

|

|

—

|

|

|

|

549

|

|

|

Unearned revenue

|

|

|

328

|

|

|

|

31

|

|

|

|

—

|

|

|

|

359

|

|

|

Current portion of long-term debt

|

|

|

4

|

|

|

|

14

|

|

|

|

(14

|

)(a)

|

|

|

4

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total current liabilities

|

|

|

9,332

|

|

|

|

2,082

|

|

|

|

103

|

|

|

|

11,517

|

|

|

Long-term debt

|

|

|

4,695

|

|

|

|

71

|

|

|

|

1,411

|

(a),(d)

|

|

|

6,177

|

|

|

Other long-term liabilities

|

|

|

952

|

|

|

|

—

|

|

|

|

—

|

|

|

|

952

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total liabilities

|

|

|

14,979

|

|

|

|

2,153

|

|

|

|

1,514

|

|

|

|

18,646

|

|

|

Commitments and contingencies

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Redeemable noncontrolling interests

|

|

|

12

|

|

|

|

—

|

|

|

|

—

|

|

|

|

12

|

|

|

Stockholders’ equity:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Preferred stock

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

Common stock

(1)

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

Additional

paid-in

capital

|

|

|

4,349

|

|

|

|

—

|

|

|

|

2,234

|

(e)

|

|

|

6,583

|

|

|

Accumulated other comprehensive earnings

|

|

|

(3

|

)

|

|

|

—

|

|

|

|

—

|

|

|

|

(3

|

)

|

|

Retained earnings

|

|

|

2,748

|

|

|

|

—

|

|

|

|

(54

|

)(f)

|

|

|

2,694

|

|

|

Treasury stock, at cost

|

|

|

(244

|

)

|

|

|

—

|

|

|

|

—

|

|

|

|

(244

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total stockholders’ equity attributable to common stockholders

|

|

|

6,850

|

|

|

|

—

|

|

|

|

2,180

|

|

|

|

9,030

|

|

|

Noncontrolling interest

|

|

|

14

|

|

|

|

—

|

|

|

|

—

|

|

|

|

14

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total stockholders’ equity

|

|

|

6,864

|

|

|

|

—

|

|

|

|

2,180

|

|

|

|

9,044

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net assets

|

|

|

|

|

|

$

|

2,122

|

|

|

$

|

(2,122

|

)(g)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total liabilities, redeemable noncontrolling interests, stockholders’ equity and net

assets

|

|

$

|

21,855

|

|

|

$

|

4,275

|

|

|

$

|

1,572

|

|

|

$

|

27,702

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1)

|

On a historical basis, share information of the Company is as follows: 400,000 shares authorized; 173,437 shares issued and outstanding. On a pro forma combined basis, share information is as follows: 400,000

shares authorized; 194,958 shares issued and outstanding.

|

See the accompanying notes to the unaudited pro forma

condensed combined financial statements, which are an integral part of this statement. The pro forma adjustments are explained in Note 7.

Balance Sheet Pro Forma Adjustments,

beginning on

page S-18

of this prospectus supplement.

S-12

NOTES TO THE PRO FORMA CONDENSED COMBINED FINANCIAL STATEMENTS

(DOLLARS IN MILLIONS, EXCEPT SHARE DATA)

(UNAUDITED)

1. Description of

Transaction

On September 12, 2017, we entered into an Asset Purchase Agreement (the “Asset Purchase Agreement”) with

Fidelis Care to acquire substantially all of the assets (the “Acquired Assets”) and assume certain liabilities of Fidelis Care. The Asset Purchase Agreement provides, among other things, that upon the terms and subject to the conditions

set forth therein, a newly formed New York health maintenance organization and a wholly owned subsidiary of the Company (the “Buyer”) will purchase the Acquired Assets for a total of $3.75 billion, subject to certain closing and

post-closing adjustments, as described in the Asset Purchase Agreement (the “Acquisition Consideration”). The composition of the Acquisition Consideration, between Cash Consideration (as defined below) and Share Consideration (as defined

below), if any, that Fidelis Care will receive in the Proposed Fidelis Acquisition is variable under the Asset Purchase Agreement, subject to the Share Consideration Election Amount (as defined below).

Under the terms of the Asset Purchase Agreement, no later than five business days prior to the closing of the Proposed Fidelis Acquisition, we

may elect to deliver Acquisition Consideration that consists of (1) solely Cash Consideration or (2) a combination of Cash Consideration and Share Consideration. Subject to certain limitations set forth in the Asset Purchase Agreement, we

have the option to fund up to $500.0 million of the Acquisition Consideration in our common stock, of which (i) up to $125.0 million may be used to fund the Acquisition Consideration payable at the closing of the Proposed Fidelis

Acquisition (such amount, if any, the “Share Consideration Election Amount” and such shares, the “Share Consideration”) and (ii) up to $375.0 million may be used to fund the Escrow Fund (as defined below) (such amount,

the “Escrow Share Amount” and such shares, the “Escrow Shares”). The number of shares of our common stock comprising the Share Consideration Election Amount, if any, and/or the Escrow Share Amount, if any, will be determined by

dividing (i) such amount by (ii) the average price of our common stock over the five consecutive trading days preceding the date that is two trading days prior to the closing of the Proposed Fidelis Acquisition. The amount of Acquisition

Consideration that Fidelis Care will receive in cash (the “Cash Consideration”) is equal to (a) $3.75 billion minus (b) the Share Consideration Election Amount, subject to a working capital adjustment.

The amount of Cash Consideration that Fidelis Care will receive at the closing of the Proposed Fidelis Acquisition will be further reduced by,

among other things, a $375.0 million escrow which will be used to satisfy any of our post-closing indemnification claims (the “Escrow Fund”). No later than five business days prior to the closing of the Proposed Fidelis Acquisition,

we may elect the composition of the Escrow Fund, being any combination of cash and Escrow Shares up to $375.0 million. Any Escrow Shares included in the Escrow Fund will be liquidated prior to final settlement of the Escrow Fund’s proceeds

and will not be delivered to Fidelis Care. Fidelis Care will receive only cash proceeds from the Escrow Fund. To the extent that the value of the Escrow Fund exceeds $375.0 million at final settlement, we will be entitled to retain any such

surplus. Likewise, to the extent that the value of the Escrow Fund is less than $375.0 million at final settlement or the amount due to be delivered to Fidelis Care taking into account post-closing indemnification claims, as applicable, the

Company will be required to fund any such deficit.

For pro forma purposes only, it is assumed that the Acquisition Consideration will

consist solely of Cash Consideration and the Escrow Fund will consist solely of cash. The final value of the Acquisition Consideration for accounting purposes will ultimately be based on our election of Share Consideration and Escrow Shares.

Accordingly, the Acquisition Consideration could change materially.

We cannot assure you that we will be able to consummate the Proposed

Fidelis Acquisition on a timely basis or at all. See “Risk Factors—Factors that may affect Future Results and the Trading Price of Our Common Stock” in Item 1A. of Part I of our Annual Report

on Form 10-K for

the year ended December 31, 2017.

S-13

2. Basis of Presentation

The unaudited pro forma condensed combined financial information was prepared using the acquisition method of accounting and was based on the

historical financial statements of the Company and Fidelis Care. The acquisition method of accounting is based on ASC 805 and uses the fair value concepts defined in ASC 820, Fair Value Measurements.

ASC 805 requires, among other things, that most assets acquired and liabilities assumed be recognized at their fair values as of the

acquisition date. In addition, ASC 805 requires that the consideration transferred be measured at the date the Proposed Fidelis Acquisition is completed at the then-current market price.

ASC 820 defines the term “fair value” and sets forth the valuation requirements for any asset or liability measured at fair value,

expands related disclosure requirements and specifies a hierarchy of valuation techniques based on the nature of the inputs used to develop the fair value measures. Fair value is defined in ASC 820 as “the price that would be received to sell

an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date.” This is an exit price concept for the valuation of the asset or liability. In addition, market participants are assumed to

be buyers and sellers in the principal (or the most advantageous) market for the asset or liability. Fair value measurements for an asset assume the highest and best use by these market participants. As a result of these standards, the Company may

be required to record the fair value of assets which are not intended to be used or sold and/or to value assets at fair value measures that do not reflect the Company’s intended use of those assets. Many of these fair value measurements can be