Use these links to rapidly review the document

Table of Contents

Table of Contents

SCHEDULE 14A INFORMATION

Proxy

Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

(Amendment

No. )

|

|

|

|

|

Filed by the Registrant

ý

|

Filed by a Party other than the Registrant

o

|

Check the appropriate box:

|

o

|

|

Preliminary Proxy Statement

|

o

|

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

ý

|

|

Definitive Proxy Statement

|

o

|

|

Definitive Additional Materials

|

o

|

|

Soliciting Material under §240.14a-12

|

|

|

|

|

|

|

|

CF INDUSTRIES HOLDINGS, INC.

|

(Name of Registrant as Specified In Its Charter)

|

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

|

Payment of Filing Fee (Check the appropriate box):

|

ý

|

|

No fee required.

|

o

|

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

|

|

|

(1)

|

|

Title of each class of securities to which transaction applies:

|

|

|

|

(2)

|

|

Aggregate number of securities to which transaction applies:

|

|

|

|

(3)

|

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

|

|

|

(4)

|

|

Proposed maximum aggregate value of transaction:

|

|

|

|

(5)

|

|

Total fee paid:

|

o

|

|

Fee paid previously with preliminary materials.

|

o

|

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration

statement number, or the Form or Schedule and the date of its filing.

|

|

|

(1)

|

|

Amount Previously Paid:

|

|

|

|

(2)

|

|

Form, Schedule or Registration Statement No.:

|

|

|

|

(3)

|

|

Filing Party:

|

|

|

|

(4)

|

|

Date Filed:

|

Table of Contents

Proxy Statement

2018 Annual Meeting of

Stockholders

Table of Contents

March 29, 2018

To

Our Stockholders:

On

behalf of your board of directors, it is our privilege to invite you to attend the 2018 annual meeting of stockholders of CF Industries Holdings, Inc. The annual meeting will be held on

Thursday, May 10, 2018, at 10:00 a.m., local time, adjacent to our corporate headquarters at 3 Parkway North, Deerfield, Illinois 60015. At the annual meeting, stockholders will vote on

the matters set forth in the accompanying Notice of Annual Meeting and Proxy Statement and any other business matters properly brought before the annual meeting. Whether or not you are able to attend

the meeting, we encourage you to read the enclosed materials and submit your proxy.

We

will meet to discuss a year of outstanding performance in all parts of our business and strong progress on our strategic objectives. In 2017, your company delivered strong financial results in a

challenging market environment. We set company production and sales volumes records while achieving our lowest 12-month total recordable injury rate. We reduced our long-term debt by approximately

$1.1 billion and lowered our controllable expenses per product ton as a result of targeted cost reduction initiatives and production cost efficiencies supported by increased volume.

These

are exceptional results in one of the weakest global nitrogen pricing environments of the last two decades. This reflects the enduring strengths of our company—manufacturing and

distribution excellence built on safe and reliable operations; a customer focus that can serve both long-time purchasers and grow new opportunities inside and outside North America; and prudent

capital stewardship to optimize our cost structure. We have achieved these results because of our talented, dedicated employees and their commitment to our success.

We

continue to adhere to best principles of corporate governance in order to deliver long-term value to you. During 2017, we elected two new members to the board of directors, John W. Eaves and

Michael J. Toelle, who have already made significant contributions to the company through their leadership, knowledge of commodity cycles and special expertise—the global coal industry for

John and agriculture for Mike.

We

want to take this opportunity to thank our two retiring directors for their tireless commitment to the company and to you, our stockholders. Edward Schmitt has been on the board since the company's

IPO in 2005 and has brought a wealth of operational experience to the board. Robert Kuhbach has been a member of our board since 2011, was the chairman of our audit committee from 2012 through 2017,

and brought a rigorous financial focus. Ed and Rob, we thank you for your many years of dedicated service and wish you the best in retirement.

We

are proud of the progress we have made as a company and look forward to reviewing what we have achieved and the opportunities ahead at the annual meeting. Thank you for your continued trust in CF

Industries and we hope to see you on May 10, 2018.

Sincerely,

|

|

|

|

|

|

|

|

Stephen A. Furbacher

|

|

W. Anthony Will

|

|

Chairman of the Board

|

|

President and Chief Executive Officer

|

Table of Contents

NOTICE OF ANNUAL MEETING OF

STOCKHOLDERS

|

|

|

|

|

|

|

Date and Time:

|

|

Thursday, May 10, 2018, at 10:00 a.m., local time

|

|

Place:

|

|

Adjacent to CF Industries Corporate Headquarters

3 Parkway North

Deerfield, Illinois 60015

|

|

Items of Business:

|

|

At the Annual Meeting, stockholders will be asked to:

|

|

|

|

1.

|

|

Elect the ten directors named in this Proxy Statement;

|

|

|

|

2.

|

|

Consider and approve an advisory resolution regarding the compensation of our named executive officers;

|

|

|

|

3.

|

|

Ratify provisions in our certificate of incorporation and bylaws granting stockholders the ability to call special meetings of

stockholders;

|

|

|

|

4.

|

|

Ratify the selection of KPMG LLP as our independent registered public accounting firm for 2018; and

|

|

|

|

5.

|

|

Consider any other business properly brought before the Annual Meeting.

|

|

Record Date:

|

|

You may vote at the Annual Meeting if you were a stockholder of record of our company as of the close of business on March 19,

2018

|

|

Internet Availability of Proxy Materials

|

|

Important Notice Regarding the Availability of Proxy Materials for the 2018 Annual Meeting of Stockholders to be held on Thursday,

May 10, 2018

: Our Proxy Statement and 2017 Annual Report are available free of charge at

www.proxyvote.com

.

|

Your

vote is important. Please vote your shares promptly so that your shares will be represented whether or not you attend the Annual Meeting. To vote your shares, you may use the Internet as

described on your Notice of Internet Availability of Proxy Materials and proxy card, call the toll-free telephone number listed on your proxy card or complete, sign, date, and return your proxy card.

By

order of the board of directors,

Douglas

C. Barnard

Senior Vice President, General Counsel, and Secretary

March 29, 2018

Table of Contents

Table of Contents

Table of Contents

PROXY STATEMENT SUMMARY

This summary provides certain key information about CF Industries' business and strategy and highlights information contained elsewhere in

this Proxy Statement. This summary does not contain all of the information that you should consider, and you should read the entire proxy statement carefully before voting. These proxy materials were

first sent or made available to stockholders on or about March 29, 2018.

2018 ANNUAL MEETING OF STOCKHOLDERS INFORMATION

|

|

|

|

|

Date and Time:

|

|

Thursday, May 10, 2018, at 10:00 a.m. (local time)

|

|

Place:

|

|

Adjacent to CF Industries Corporate Headquarters

3 Parkway North, Deerfield, Illinois 60015

|

|

Record Date:

|

|

March 19, 2018

|

VOTING MATTERS

|

|

|

|

|

|

|

|

|

|

|

Proposals

|

|

Board

Recommendation

|

|

Page Number for

Additional

Information

|

|

|

1.

|

|

Election of Directors

|

|

FOR

|

|

|

6

|

|

|

2.

|

|

Advisory Vote on Executive Compensation ("Say on Pay")

|

|

FOR

|

|

|

31

|

|

|

3.

|

|

Ratification of Provisions in Our Certificate of Incorporation and Bylaws Granting Stockholders the Ability to Call Special Meetings of

Stockholders

|

|

FOR

|

|

|

76

|

|

|

4.

|

|

Ratification of Selection of Independent Auditor for 2018

|

|

FOR

|

|

|

79

|

|

OUR BUSINESS

CF Industries is a leading global fertilizer and chemical company with outstanding operational capabilities and a highly cost advantaged production and

distribution platform. Our 3,000 employees operate world-class manufacturing complexes in Canada, the United Kingdom and the United States. Our customers include both agricultural and industrial users

of our products. Our principal nitrogen products are ammonia, granular urea, urea ammonium nitrate solution, and

ammonium nitrate. We also manufacture diesel exhaust fluid, urea liquor, nitric acid, and aqua ammonia, which are sold primarily to industrial customers, and compound fertilizer products, which are

solid granular fertilizer products for which the nutrient content is a combination of nitrogen, phosphorus, and potassium. We serve our customers in North America through an unparalleled production,

storage, transportation and distribution network. We also reach a global customer base with exports from our Donaldsonville, Louisiana, plant, the world's largest and most flexible nitrogen complex.

Additionally, we move product to international destinations from our Yazoo City, Mississippi, facility, our Billingham and Ince facilities in the United Kingdom, and from a joint venture ammonia

facility in the Republic of Trinidad and Tobago in which we own a 50 percent interest.

For

more information on our business, see "Item 1.—Business" and "Item 7.—Management's Discussion and Analysis of Financial Condition and Results of Operations"

in our 2017 Annual Report.

1

Table of Contents

OUR STRATEGY

Our strategy, reviewed and endorsed annually by our Board, has remained largely unchanged for the past decade. Our execution of initiatives aligned with that

strategy helped us achieve our vision—delivering superior shareholder returns over the cycle.

Core Organizational Capabilities

We want to highlight a few of our core organizational capabilities as evidenced by several of our more notable accomplishments:

Leader in the safe and responsible production, storage and handling of chemicals, achieving best in class

performance

-

•

-

Achieved industry leading recordable injury rate of 0.67 (industry average: 2.2), our lowest rate, while being the largest nitrogen producer in

the world (2017)

-

•

-

Multi-year winner of the Rail Safety—Grand Slam Award for safe rail shipments of hazardous products (2014 and 2016)

-

•

-

Reduced CO2-equivalent emissions by more than 25% per product ton of manufactured product (2012 - 2016)

Exceptional process engineering and plant operations and maintenance, to drive superior asset utilization

-

•

-

Ammonia production capacity utilization at 98% across 17 ammonia plants globally (2017)

-

•

-

New capacity expansion plants started up safely and have achieved 15 - 20% higher output than original nameplate capacity

(2016 - 2017)

-

•

-

Decreased capital expenditures per product ton by 63% and ongoing maintenance capital expenditures per product ton by 36%,

(1)

while maintaining safe and reliable operations (2013 - 2017)

-

•

-

Decreased cost of sales per product ton by 8% and controllable cost of sales per product ton

(2)

by 19%

(2015 - 2017)

High performance culture, focused on safety, ethics and compliance, creating a world-class, scalable

corporate platform:

-

•

-

SG&A among the lowest in the industry at $10 per product ton or 4.6% of sales (2017)

-

•

-

Highly scalable corporate platform as product tons increased 45% while SG&A cost per product ton decreased 22% (2015 - 2017)

-

(1)

-

"Ongoing maintenance capital expenditures" is defined as capital expenditures adjusted for amounts related to our capacity

expansion projects, our divested phosphate business, and improvement projects. See Appendix A for a reconciliation of ongoing maintenance capital expenditures and ongoing maintenance capital

expenditures per ton to the most directly comparable GAAP measures.

-

(2)

-

"Controllable

cost of sales" is defined as non-gas cash costs (maintenance, labor, electricity, other raw materials, transportation and distribution, and other plant

costs), which excludes the impact of natural gas, derivatives and depreciation and amortization. See Appendix A for a reconciliation of controllable cost of sales and controllable cost of sales

per ton to the most directly comparable GAAP measures.

2

Table of Contents

Creative, disciplined portfolio management, increasing shareholder value:

-

•

-

Terra Industries post-merger-integration captured synergies in excess of $120 million annually (2010 - 2012)

-

•

-

Sold our Phosphate Business for $1.4 billion in a tax-efficient transaction and also entered into a long-term ammonia supply agreement

with the buyer, which de-risked the capacity expansion projects (2013 - 2014)

-

•

-

CF Fertilisers UK (formerly known as GrowHow) post-merger-integration increased asset utilization by nearly 20% and delivered synergies in

excess of $35 million annually (2014 - 2017)

-

•

-

Formed a strategic venture with CHS where CF Industries received $2.8 billion in a tax-efficient structure and also entered into a

long-term supply agreement with CHS, which further de-risked the capacity expansion projects (2015 - 2016)

-

•

-

Deployed approximately $6.7 billion in value-creating growth initiatives while also returning more than $5 billion of cash to

shareholders through share repurchases and dividends (2013 - 2017)

Our Corporate Strategy

Our vision, given the cyclical nature of our business, is to deliver superior shareholder returns over the cycle. Our strategy, in support of our vision, is

built upon a foundation of distinct core capabilities and core values that we live each and every day. We leverage our capabilities to drive business results that create long-term value for our

shareholders.

CF's Strategy

3

Table of Contents

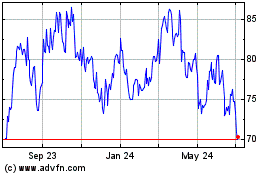

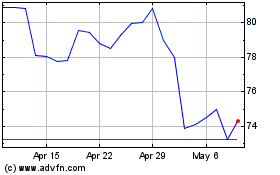

Strong Shareholder Returns Over the Cycle

We firmly believe that, due to the cyclical nature of the commodity chemical industry in which we operate, it is important to view performance over a longer

time horizon than just one year. The execution of our strategy has delivered strong shareholder value creation over the cycle:

Total Shareholder Return (TSR)

STOCKHOLDER ENGAGEMENT

We believe that building positive relationships with our stockholders is critical to CF Industries' success. We value the views of, and regularly communicate

with, our stockholders on a variety of topics, such as our financial performance, corporate governance, executive compensation, and related matters. Management shares the feedback received from

stockholders with the Board. Our chairman or other members of the Board may also be available to participate in meetings with stockholders as appropriate. Requests for such a meeting are considered on

a case-by-case basis. Our engagement activities have resulted in valuable feedback that has contributed to our decision-making with respect to these matters. We welcome your input and feedback and

look forward to continued engagement with our stockholders.

In

connection with the 2018 Annual Meeting, we contacted the holders of over 60% of our outstanding shares to solicit feedback on our governance and executive compensation practices and other matters

to be considered at the Annual Meeting. We engaged on those topics with the holders of approximately 45% of our outstanding shares. The feedback received during these meetings indicated that investors

are supportive of our compensation and governance practices.

4

Table of Contents

OUR BOARD COMPOSITION

Our corporate governance and nominating committee regularly reviews the overall composition of our Board and its committees to assess whether each reflects

the appropriate mix of experience, qualifications, attributes, and skills that are relevant to CF Industries' current and future global strategy, business, and governance.

Our Director Nominees

CORPORATE GOVERNANCE FACTS

|

|

|

|

|

ü

|

|

All Directors are Independent, except CEO

|

|

ü

|

|

Independent Chairman of the Board and Separate Chief Executive Officer

|

|

ü

|

|

Regular Assessment of Board Composition and Attributes, Including Diversity; Women Comprise 20% of Director Nominees

|

|

ü

|

|

Annual Election of Directors

|

|

ü

|

|

Majority Voting for Directors in Uncontested Elections

|

|

ü

|

|

Proxy Access

|

|

|

|

|

|

ü

|

|

Policy on Adoption of a Stockholder Rights Plan

|

|

ü

|

|

Independent Directors Meet Regularly in Executive Session

|

|

ü

|

|

Stock Ownership Requirements for Directors and Executive Officers

|

|

ü

|

|

Annual Board and Committee Self-Evaluations, Including Peer Evaluations

|

|

ü

|

|

Stockholder Ability to Call Special Meetings

|

|

ü

|

|

No Supermajority Voting Provisions in Charter or Bylaws

|

5

Table of Contents

PROPOSAL 1: ELECTION OF DIRECTORS

DIRECTOR NOMINEES

Our directors are elected each year for one-year terms expiring at the next annual meeting of stockholders. The Board has nominated ten current directors for

re-election at the 2018 Annual Meeting. Robert G. Kuhbach and Edward A. Schmitt will retire from the Board effective as of the date of the Annual Meeting and will not stand for re-election. Each

director elected at the 2018 Annual Meeting will serve a one-year term and until his or her successor is duly elected and qualified.

Each

nominee has consented to being named in this Proxy Statement and to serve if elected. If any nominee becomes unavailable to serve, an event that the Board does not presently expect, we will vote

the shares represented by proxies for the election of directors for the election of such other person as the Board may recommend. Unless otherwise instructed, we will vote all proxies we receive FOR

the directors listed below.

Majority Vote Standard for Election of Directors

Our directors are elected by a majority of the votes cast in uncontested elections (the number of shares voted "for" a director nominee must exceed the number

of votes cast "against" that director nominee). An "uncontested election of directors" means an election of directors in which, as of the date that is fourteen days in advance of the date we file our

definitive proxy statement with the Securities and Exchange Commission ("SEC"), the number of nominees for election does not exceed the number of directors to be elected by the stockholders at that

election. In a contested election (a situation where the number of nominees for election exceeds the number of directors to be elected), the standard for election would be a plurality of the shares

represented in person or by proxy at any such meeting and entitled to vote on the election of directors.

Director Resignation Policy

In accordance with procedures set forth in the company's corporate governance guidelines, any incumbent director (including the ten nominees standing for

election at the Annual Meeting) who fails to receive a majority of votes cast in an uncontested election will be required to tender his or her resignation for consideration by the company's corporate

governance and nominating committee. The corporate governance and nominating committee will consider the resignation and, within 45 days following the date of the applicable annual meeting,

make a recommendation to the Board concerning the acceptance or rejection of the resignation. The Board will then take formal action on the corporate governance and nominating committee's

recommendation no later than 90 days following the date of the annual meeting. Following the Board's decision on the committee's recommendation, we will publicly disclose the Board's decision,

together with an explanation of the process by which the decision was made and, if applicable, the Board's reason or reasons for rejecting the tendered resignation.

DIRECTOR SUCCESSION PLANNING AND NOMINATION PROCESS

The Board is responsible for nominating members for election to the Board and for filling vacancies on the Board that may occur between annual meetings of

stockholders. The corporate governance and nominating committee is responsible for identifying, screening, and recommending candidates to the Board for Board membership.

Regular Assessment of our Board Composition and Succession Planning

The chairman of the board and chair of the corporate governance and nominating committee lead an active process to regularly review the overall composition of

the Board and each Board committee and assess whether each reflects the appropriate mix of experience, qualifications, attributes, and skills that

6

Table of Contents

are

relevant to CF Industries' current and future global strategy, business, and governance. Board composition and succession planning is a standing item on the agenda for each regular corporate

governance and nominating committee meeting. The review process incorporates the results of the annual Board and committee self-assessment process in assessing and determining whether any gaps in

experience, qualifications, attributes, and skills exist and the characteristics and critical skills required of prospective candidates for election to the Board.

In

order to maintain a Board with an appropriate mix of experience and qualifications and to permit time for orientation, the succession planning process generally considers the development of the

Board over the next five year time horizon. In the case of an anticipated change in the composition of the Board, whether as a result of a retirement consistent with our general aged-based retirement

policy described below or otherwise, the Board generally prefers to recruit and add new directors such that there is time for the new directors to learn in detail our strategy, business, and

governance sufficiently in advance of expected departures. The Board has also concluded that the appropriate number of directors is generally no fewer than eight nor more than twelve. The Board

believes this range permits diversity of experience without hindering effective discussion or diminishing individual accountability. Therefore, the Board attempts to coordinate director additions and

departures to maintain this size while allowing orientation time for new members as discussed above. Consistent with this process, the Board has added four new members over the past four years

(Ms. Wagler in 2014, Ms. Noonan in 2015, and Messrs. Eaves and Tolle in 2017), and two directors (Messrs. Kuhbach and Schmitt) are retiring effective as of the date of the

Annual Meeting.

Identifying and Evaluating Candidates for Director

The corporate governance and nominating committee generally identifies potential nominees by engaging firms that specialize in identifying director

candidates. Current directors and executive officers may also notify the committee if they become aware of persons meeting the criteria for Board membership discussed below. The committee will also

consider candidates recommended by stockholders as described below.

Once

a person has been identified by the corporate governance and nominating committee as a potential candidate, the committee may collect and review publicly available information regarding the

person to assess whether the person should be considered further. If the corporate governance and nominating committee determines that the candidate warrants further consideration, the committee chair

or another member of the committee will contact the person. Generally, if the person expresses a willingness to be considered and to serve on the Board, the corporate governance and nominating

committee will request information from the candidate, review the person's accomplishments and

qualifications, including in light of any other candidates that the committee might be considering, and conduct one or more interviews with the candidate. In certain instances, committee members may

contact one or more references provided by the candidate or may contact other members of the business community or other persons who may have greater first-hand knowledge of the candidate's

accomplishments. The committee's evaluation process will not vary based on whether or not a candidate is recommended by a stockholder, although, as stated below, the committee may take into

consideration the number of shares held by the recommending stockholder and the length of time that such shares have been held.

Recent Director Searches

As a result of our active succession planning and candidate evaluation processes, directors Eaves, Noonan, Toelle, and Wagler were identified as candidates

and added to the Board over the last four years. Each of these directors brings important skills and experience to our company that have further strengthened and complemented our Board. Each of these

four individuals was recommended for consideration to the corporate governance and nominating committee by a third party search firm, and

7

Table of Contents

none

of these four individuals was known to our chairman of the board or chief executive officer prior to the candidate evaluation process.

Stockholder Recommendations of Director Candidates

The corporate governance and nominating committee will consider director candidates recommended by stockholders. In considering candidates submitted by

stockholders, the committee will take into consideration the needs of the Board and the qualifications of the candidate. To have a candidate considered by the committee, a stockholder must submit the

recommendation in writing and include the following information:

-

•

-

the name of the stockholder and evidence of the person's ownership of our stock, including the number of shares owned and the length of time of

ownership; and

-

•

-

the name of the candidate, the candidate's resume or a listing of his or her qualifications to be a director of CF Industries, and the person's

consent to be named as a director if selected by the committee and nominated by the Board.

The

stockholder recommendation and information described above must be sent c/o the corporate secretary at the address on the Notice of Annual Meeting accompanying this Proxy Statement and must be

received by the corporate secretary not less than 120 days prior to the anniversary date of our most recent annual meeting of stockholders.

Proxy Access

Our bylaws allow eligible stockholders to include their own nominees for director in our proxy materials along with the Board-nominated candidates. Subject to

applicable procedural and other requirements under our bylaws, the proxy access provisions of our bylaws permit any stockholder or group of up to 20 stockholders who have maintained continuous

qualifying ownership of 3% or more of our outstanding common stock for at least the previous three years to nominate and include in our proxy materials director nominees constituting not more than 25%

of the number of the directors in office at the time of the nomination.

CRITERIA FOR BOARD MEMBERSHIP

Director Qualifications and Attributes

The corporate governance and nominating committee takes into consideration a number of factors and criteria in reviewing candidates for potential nomination

to the Board. The corporate governance and nominating committee believes that the minimum qualifications for serving as a director of CF Industries are that a nominee demonstrate, by significant

accomplishment in his or her field, an ability to make a meaningful contribution to the Board's oversight of our business and affairs and have an impeccable record and reputation for honest and

ethical conduct in both his or her professional and personal activities.

In

addition, the committee will examine a candidate's specific experiences and skills, relevant industry background and knowledge, time availability in light of other commitments, potential conflicts

of interest, material relationships with CF Industries, and independence from management and the company.

Diversity

Our corporate governance guidelines and corporate governance and nominating committee charter reflect the intention of the Board that the board of directors

represent a diversity of backgrounds. In accordance with the corporate governance and nominating committee charter and our corporate

8

Table of Contents

governance

guidelines, the corporate governance and nominating committee considers diversity in identifying nominees for director, including personal characteristics such as race, gender and age, and

the experiences and skills relevant to the Board's performance of its responsibilities in the oversight of the company. In furtherance of this objective, the corporate governance and nominating

committee has determined that it will incorporate recruitment protocols that seek to identify candidates in any future director search who meet these diversity characteristics.

Retirement Age

As set forth in the company's corporate governance guidelines, it is the general policy of the company that no director having attained the age of

74 years shall be nominated for re-election or reappointment to the Board. However, the Board may determine to waive this policy in individual cases.

Director Tenure

To ensure that the Board maintains an appropriate balance of experience, continuity, and an openness to new ideas and a willingness to critically re-examine

the status quo, the corporate governance and nominating committee considers the issue of continuing director tenure in connection with each director nomination recommendation.

Four

director nominees, comprising 40% of the nominees, have served more than 10 years and one director nominee, comprising 10% of the nominees, has served between 5 and 10 years. These

directors bring a wealth of experience and knowledge concerning CF Industries.

The

remaining five director nominees, comprising 50% of the nominees, have joined the Board over the past five years and bring fresh perspective to Board deliberations.

Service on Other Public Company Boards

CF Industries does not have a policy limiting the number of other public company boards of directors upon which a director may sit, in general. However, the

corporate governance and nominating committee considers the number of other public company boards and other boards (or comparable governing bodies) on which a prospective nominee is a member.

Although

we do not impose a limit on outside directorships, we do recognize the substantial time commitments attendant to Board membership and expect that the members of our Board be fully committed

to devoting all such time as is necessary to fulfill their Board responsibilities, both in terms of preparation for and attendance and participation at meetings.

In

addition, in recognition of the enhanced time commitments associated with membership on a public company's audit committee, the Board has adopted a policy that no member of the audit committee may

serve simultaneously on the audit committees of more than two other public companies unless the Board determines that such simultaneous service would not impair the ability of such director to

effectively serve on the company's audit committee.

9

Table of Contents

Summary of Director Core Competencies

We consider the depth and diversity of experience on our Board a key strength. Our ten director nominees offer a diverse set of qualifications and

perspectives and possess a wealth of leadership and professional experience in areas relevant to CF Industries' business and strategy.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Public Company Governance

|

|

|

|

A deep understanding of the Board's duties and responsibilities enhances board effectiveness and ensures independent oversight that is aligned with stockholder interests.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Senior Executive Leadership

|

|

|

|

We believe that directors who have served as CEOs or senior executives are in a position to challenge management and contribute practical insight into business strategy and operations.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operations

|

|

|

|

As a global manufacturing and distribution company, we benefit from the experience of our directors who have served in senior executive roles of global manufacturing companies.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Accounting and Finance Expertise

|

|

|

|

A strong understanding of accounting and finance is important for ensuring the integrity of our financial reporting and critically evaluating our performance. Our directors have significant accounting experience and

corporate finance expertise.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Industry Focus

|

|

|

|

As one of the world's largest manufacturers and distributors of nitrogen fertilizer and other nitrogen products, we seek directors who are knowledgeable about the chemical, energy, and agriculture industries. These

directors help guide the company in assessing trends and external forces in these industries.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

International Business

|

|

|

|

Directors with international business experience help us as we develop and grow our international manufacturing operations and global product distribution.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Strategic Initiatives

|

|

|

|

Experience with major strategic initiatives, including mergers and acquisitions, divestitures, joint ventures and partnerships, substantial capital projects, and integration helps our company identify, pursue and

consummate the right major initiatives that achieve our strategic objectives and realize synergies and optimal growth.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Risk Management

|

|

|

|

Directors with significant risk oversight and management experience provide valuable insight as we make decisions on our strategic plan.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Environmental & Safety

|

|

|

|

As core values, we put safety first and act as stewards for the environment. We take guidance from our directors who have served in executive or operating positions at industrial manufacturing companies.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

10

Table of Contents

The

following chart summarizes the competencies represented by our director nominees; the details of each director's competencies are included in each director's biography.

BOARD RECOMMENDATION

In connection with the Annual Meeting and in accordance with the above guidelines, the corporate governance and nominating committee recommended that the

Board nominate the ten directors named in this Proxy Statement for re-election to the Board. The Board believes these nominees provide CF Industries with the combined depth and breadth of skills,

experience and qualities required to contribute to an effective and well-functioning Board. Our ten

director nominees offer a diverse set of qualifications and perspectives and possess a wealth of leadership and professional experience in areas relevant to our current and future global strategy,

business, and governance.

The Board unanimously recommends that you vote FOR the election of the nominees presented in Proposal 1.

11

Table of Contents

DIRECTOR NOMINEE BIOGRAPHIES

The

following biographical information about each of our director nominees highlights the particular experiences, qualifications, attributes, and skills possessed by each director nominee that led the

Board to determine that he or she is qualified to serve as a public company director and that he or she should serve as member of our Board. All director nominee biographical information is as of

March 29, 2018.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Robert C. Arzbaecher served as chief executive officer of Actuant Corporation, a diversified manufacturer and marketer of industrial products and systems with operations in more than 30 countries, from 2000 until January 2014 and as interim

president and chief executive officer of Actuant from August 2015 until March 2016. He served as a director of Actuant from 2000 until January 2017 and as chairman of the board of Actuant from 2001 until March 2016. From 1992 until 2000, he held

various financial positions with Applied Power, Inc., Actuant's predecessor, the most recent of which was chief financial officer. Prior to 1992, Mr. Arzbaecher held various financial positions with Grabill Aerospace, Farley Industries, and

Grant Thornton, a public accounting firm. Mr. Arzbaecher is a certified public accountant and he is also a director of Fiduciary Management, Inc. mutual funds.

Qualifications

As the former chairman and chief executive officer of Actuant, Mr. Arzbaecher brings public company

governance, international business, strategic initiative, and risk management expertise to the Board. As a certified public accountant who has served as a financial executive, he is an "audit committee financial expert" within the meaning of SEC

rules.

Other Public Company Directorships (within the past 5 years)

•

Actuant Corporation (2000 – Jan. 2017) (Chairman from 2001 – Mar. 2016)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

William Davisson served as the chief executive officer of GROWMARK, Inc., a large agricultural cooperative system providing agronomy, energy, facility planning, and logistics products and services, as well as grain marketing and risk management

services, in the United States and Canada, from 1998 through 2010. He worked in the GROWMARK system his entire career, from 1970 through 2010, and the positions he held prior to becoming to chief executive officer included chief financial officer and

vice president, member services. GROWMARK was an owner of our predecessor company before our initial public offering ("IPO") in August 2005, and GROWMARK remains one of our largest customers. From 1998 to 2005, Mr. Davisson served as a director

of our predecessor company and as chairman of its board from 2002 to 2004. Mr. Davisson is a certified public accountant.

Qualifications

As the former chief executive officer and chief financial officer of GROWMARK, Mr. Davisson brings accounting and

finance, agriculture industry, and strategic initiative expertise to the Board. Mr. Davisson has a deep understanding of our business, as demonstrated by his more than 20 year association with our company. Mr. Davisson is a certified

public accountant with substantial executive experience in risk management and he is an "audit committee financial expert" within the meaning of SEC rules.

Other Public Company Directorships (within the past 5 years)

•

None

|

|

|

|

|

|

|

|

|

12

Table of Contents

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

John W. Eaves has served as president and chief executive officer of Arch Coal, Inc., a top coal producer for the global steel and power generation industries, since 2012 and has been a member of its board of directors since 2006. He has more

than 30 years of experience in the coal industry. During his tenure with Arch Coal, he has held positions of president and chief operating officer; senior vice president of marketing; and vice president of marketing and president of Arch Coal

Sales, the company's marketing subsidiary. Mr. Eaves joined Arch Coal in 1987 after serving in various marketing-related positions at Diamond Shamrock Coal Company and Natomas Coal Company. He serves on the boards of the National Association of

Manufacturers and the National Mining Association. On January 11, 2016, Arch Coal filed a voluntary petition for reorganization under the provisions of Chapter 11 of the United States Bankruptcy Code in the United States Bankruptcy Court

for the Eastern District of Missouri. On October 5, 2016, Arch Coal's reorganization plan became effective and it emerged from Chapter 11.

Qualifications

As the president and chief executive officer and former chief operating and marketing officer of Arch Coal, Mr. Eaves

brings substantial energy industry, operations, strategic initiative, and environmental and safety expertise to the Board. Mr. Eaves has extensive experience in risk management and accounting and finance expertise through his active supervision

of those performing financial accounting and reporting at Arch Coal.

Other Public Company Directorships (within the past 5 years)

•

Arch Coal (2006 – present)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Stephen A. Furbacher served as president and chief operating officer of Dynegy Inc., a provider of wholesale power, capacity, and ancillary services to utilities, cooperatives, municipalities, and other energy companies, from August 2005 until

December 2007. Prior to that, he served as executive vice president of Dynegy's previously owned natural gas liquids business segment, which was engaged in the gathering and processing of natural gas and the fractionation, storage, transportation,

and marketing of natural gas liquids, from September 1996 to August 2005. Mr. Furbacher joined Dynegy in May 1996, just prior to Dynegy's acquisition of Chevron's midstream business. Before joining Dynegy, he served as president of Warren

Petroleum Company, the natural gas liquids division of Chevron U.S.A. Mr. Furbacher began his career with Chevron in August 1973 and served in positions of increasing responsibility before being named president of Warren Petroleum Company in

July 1994. Mr. Furbacher serves as chief executive officer and president of GTBC, LLC, which operates Grand Teton Brewing Company.

Qualifications

Mr. Furbacher brings substantial senior executive leadership, refinery and petro-chemical operations, energy industry,

and strategic initiative expertise to the Board as a result of his leadership positions at Dynegy, Warren Petroleum, and Chevron. Mr. Furbacher has extensive experience with risk management and environmental and safety matters.

Other Public Company Directorships (within the past 5 years)

•

None

|

|

|

|

|

|

|

|

|

13

Table of Contents

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Stephen J. Hagge served as the president and chief executive officer of AptarGroup, Inc., a leading global supplier of a broad range of innovative dispensing systems for the beauty, personal care, home care, prescription drug, consumer health

care, injectables, food and beverage markets with manufacturing facilities in North America, Europe, Asia and Latin America, from 2012 until January 2017 and as special advisor to the chief executive officer from February 2017 to March 2017. He

served as chief operating officer of AptarGroup from 2008 to 2011, as chief financial officer of AptarGroup from 1993 to 2011 and as an executive vice president and secretary of AptarGroup from 1993 to 2011. Mr. Hagge has served as a director of

AptarGroup since 2001.

Qualifications

Through his

experience as a director, chief executive officer, chief financial officer, and chief operating officer of AptarGroup, Mr. Hagge brings substantial public company governance, operations, international business, strategic initiative, and risk

management expertise to the Board. Mr. Hagge has served as a financial executive and is an "audit committee financial expert" within the meaning of SEC rules.

Other Public Company Directorships (within the past 5 years)

•

AptarGroup (2001 – Present)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

John D. Johnson served as the president and chief executive officer of CHS Inc. ("CHS"), a Fortune 100 company and leading global agribusiness that is diversified in energy, grains, and foods, from 2000 through 2010. CHS was an owner of our

predecessor company before our IPO in August 2005 and remains one of our largest customers. From 2000 to 2005, Mr. Johnson served as a director of our predecessor company and as chairman of its board from 2004 to 2005. Mr. Johnson joined

Harvest States Cooperative in 1976, and served as president and chief executive officer of Harvest States from 1995 until it merged with Cenex, Inc. to form CHS in 1998. From 1998 to 2000, Mr. Johnson served as general manager and president

of CHS. Mr. Johnson served as a director of Gold Kist Holdings Inc., which operated a fully integrated chicken production business, from 2004 until its acquisition by Pilgrim's Pride Corp. in 2007.

Qualifications

As the former president and chief executive officer of

CHS and its predecessor company, Mr. Johnson brings substantial operations, agriculture industry, energy industry, international business, strategic initiative, risk management, and environmental and safety expertise to the Board.

Mr. Johnson has a deep understanding of CF Industries' business, as demonstrated by his 18 year association with our company.

Other Public

Company Directorships (within the past 5 years)

•

None

|

|

|

|

|

|

|

|

|

14

Table of Contents

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Anne P. Noonan has served as president and chief executive officer and as a director of OMNOVA Solutions, a global provider of emulsion polymers, specialty chemicals, and engineered surfaces for a variety of commercial, industrial, and residential

end uses with manufacturing, technical, and other facilities located in North America, Europe, China, and Thailand, since December 2016. She previously served as OMNOVA's president, performance chemicals, from 2014 until December 2016.

Ms. Noonan previously held several positions of increasing responsibility with Chemtura Corporation, a global specialty chemicals company, from 1987 through 2014, including most recently as senior vice president and president of Chemtura's

Industrial Engineered Products business and Corporate Development function. She serves on the boards of the American Chemistry Council and the Greater Cleveland Partnership.

Qualifications

As the president and chief executive officer of OMNOVA Solutions and previous executive operating

positions at both OMNOVA Solutions and Chemtura Corp., Ms. Noonan brings public company governance, operations, chemical industry, international business, strategic initiative, and environmental and safety expertise to the Board. Ms. Noonan

has extensive experience in risk management and accounting and finance expertise through her active supervision of those performing financial accounting and reporting at OMNOVA Solutions.

Other Public Company Directorships (within the past 5 years)

•

OMNOVA Solutions (Dec.

2016 – Present)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Michael J. Toelle is the owner of T & T Farms, a diversified farming company. He has been a member of the board of Nationwide Mutual Insurance Company, one of the largest insurance and financial services companies in the world, since 2013.

He is a former board chairman and longtime board member of CHS. He also served as a board member for Cenex, Inc., before it merged with Harvest States Cooperatives to create CHS in 1998. Mr. Toelle is past chairman of the CHS Foundation and

previously served as a director for the Agricultural Council of America and Country Partners Cooperative. He is a member of the National Association of Corporate Directors.

Qualifications

As the owner and operator of a major diversified farming company, a director of Nationwide Mutual

Insurance Co. and former chairman and director of CHS, Mr. Toelle brings agricultural industry, operations, strategic initiative, risk management, and environmental and safety expertise to the Board.

Other Public Company Directorships (within the past 5 years)

•

None

|

|

|

|

|

|

|

|

|

15

Table of Contents

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Theresa E. Wagler has served as chief financial officer and executive vice president of Steel Dynamics, Inc., one of the largest domestic steel producers and metals recyclers in the United States, since 2007 and 2009, respectively. She also

serves as Steel Dynamics' principal accounting officer. She has held various positions of increasing responsibility since joining Steel Dynamics in 1998. Prior to joining Steel Dynamics, she served as assistant corporate controller for Fort Wayne

National Bank and as a certified public accountant with Ernst & Young LLP.

Qualifications

As the chief financial officer of Steel Dynamics, Ms. Wagler brings substantial public company governance, accounting and finance, strategic initiative, and risk management expertise to the

Board. Ms. Wagler is a certified public accountant and an "audit committee financial expert" within the meaning of SEC rules.

Other Public

Company Directorships (within the past 5 years)

•

None

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

W. Anthony Will has served as our president and chief executive officer and as a member of the Board since January 2014. He was previously our senior vice president, manufacturing and distribution, from January 2012 to January 2014, our vice

president, manufacturing and distribution, from March 2009 to December 2011, and our vice president, corporate development, from April 2007 to March 2009. Mr. Will has also served in the comparable officer positions with Terra

Nitrogen GP Inc. ("TNGP") as he has held with CF Industries since April 2010. TNGP is our indirect, wholly-owned subsidiary and the sole general partner of Terra Nitrogen Company, L.P., a publicly-traded producer of nitrogen fertilizer

products. Mr. Will served as a director of TNGP from June 2010 until February 2016 and as chairman of the board of TNGP from January 2014 to February 2016. Before joining CF Industries, Mr. Will was a partner at Accenture Ltd., a

global management consulting, technology services, and outsourcing company. Earlier in his career, he held positions as vice president, business development at Sears, Roebuck and Company and vice president, strategy and corporate development at Fort

James Corporation. Prior to that, Mr. Will was a manager with the Boston Consulting Group, a global management consulting firm.

Qualifications

As the president and chief executive officer of CF Industries and with his previous executive operations and corporate

development positions, Mr. Will brings public company governance, operations, fertilizer and chemical industry, international business, strategic initiative, and environmental and safety expertise to the Board. Mr. Will has extensive

experience in risk management and accounting and finance expertise through his active supervision of those performing those functions at CF Industries.

Other Public Company Directorships (within the past 5 years)

•

Terra Nitrogen Company, L.P. (2010 – Jan. 2017)

(Chairman from 2001 – Mar. 2016)

|

|

|

|

|

|

|

|

|

16

Table of Contents

CORPORATE GOVERNANCE

CF Industries is committed to implementing sound corporate governance practices that enhance the effectiveness of the Board and our

management. Our corporate governance and nominating committee periodically reviews corporate governance developments and best practices along with our policies and business strategies. The committee

advises the Board and management in an effort to strengthen existing governance practices and develop new policies that make CF Industries a better company. We are proud of the steps we have taken and

the progress we have made to further strengthen our corporate governance practices and demonstrate our responsiveness to stockholder concerns. Highlights of our corporate governance

include:

-

•

-

Independent chairman of the Board and separate chief executive officer. Nine of our ten director nominees are considered independent.

-

•

-

In accordance with our corporate governance and nominating committee charter and our corporate governance guidelines, the corporate governance

and nominating committee considers diversity in identifying nominees for director. Women comprise 20% of our director nominees.

-

•

-

All of our directors are elected annually.

-

•

-

We have a majority vote standard for the election of directors in uncontested elections.

-

•

-

Eligible stockholders can utilize the proxy access provisions of our bylaws to include their own nominees for director in our proxy materials

along with Board-nominated candidates. For further information, see the discussion in Proposal 1 under the heading "Proxy Access."

-

•

-

The Board has adopted a policy whereby, if the Board adopts a stockholder rights plan without prior stockholder approval, the Board will submit

the stockholder rights plan to the company's stockholders for ratification, or the stockholder rights plan must expire, within one year of such adoption.

-

•

-

Stockholders representing not less than 25% of our outstanding common stock can call a special meeting of stockholders. At the Annual Meeting,

we are asking stockholders to ratify the provisions in our certificate of incorporation and bylaws granting stockholders the ability to call special meetings of stockholders. See Proposal 3 for

additional information.

-

•

-

All supermajority voting provisions have been eliminated from our certificate of incorporation and our bylaws.

CORPORATE GOVERNANCE GUIDELINES

The Board has adopted corporate governance guidelines to document its overall management governance philosophy. According to these guidelines, the business

and affairs of CF Industries shall be managed by or under the direction of the Board. The Board's goal is to build long-term value for our stockholders and assure the vitality of the company for our

customers and employees and the other individuals and organizations who depend on us. A copy of our corporate governance guidelines is available to stockholders at our corporate website,

www.cfindustries.com, or by writing to our corporate secretary at the address on the Notice of Annual Meeting accompanying this Proxy Statement.

DIRECTOR INDEPENDENCE

The experience and diversity of our directors has been, and continues to be, critical to our success. Our corporate governance guidelines require that the

Board be composed of at least a majority of directors who qualify as independent directors under the listing standards of the New York Stock Exchange (the "NYSE"). Additionally, in accordance with

NYSE listing standards, the members of our audit, compensation, and corporate governance and nominating committees must be independent. The Board

17

Table of Contents

has

made an affirmative determination that all eleven of our non-employee directors have no material relationship with CF Industries or any of its subsidiaries (other than being a director and

stockholder of CF Industries) and, accordingly, meet the applicable requirements for "independence" set forth in the NYSE's listing standards.

LEADERSHIP OF THE BOARD

Separate Independent Board Chairman and Chief Executive Officer

The Board has determined that the most effective leadership structure is to maintain an independent Board chair role separate from the chief executive

officer. In making this determination, the Board takes into account a number of factors, including (1) that separating these positions allows our Board chairman to focus on the Board's role of

providing advice to, and independent oversight of, management and (2) the time and effort our chief executive officer needs to devote to the management and operation of CF Industries and the

development and implementation of our business strategies. Although our governance documents provide the Board with the flexibility to select the leadership structure in the way that it deems best for

CF Industries at any given point in time, it is the Board's intention to continue to maintain an independent Board chair separate from the chief executive officer. In addition, according to our

corporate governance guidelines, if the chairman of the Board is not an independent director, our independent directors will designate one of their number to serve as a lead independent director.

Otherwise, if the chairman of the Board is an independent director, he or she will serve as the lead independent director.

Stephen

A. Furbacher has served as our lead independent director since 2010 and as Board chairman since May 2014. Mr. Furbacher was selected to serve as chairman because of his contributions to

the leadership of the Board through his position as our lead independent director prior to becoming chairman. Because Mr. Furbacher is an independent director, he continues to serve as our lead

independent director. The lead independent director's duties include coordinating the activities of the independent directors, coordinating the agenda for and moderating sessions of the independent

directors, and facilitating communications between the other members of the Board. Unless otherwise provided in a short-term succession plan approved by the

Board:

-

•

-

in the event that our chief executive officer should unexpectedly become unable to perform his or her duties, the chairman of the Board (if the

chairman is an independent director or else the lead independent director) shall allocate the duties of the chief executive officer among our other senior officers; and

-

•

-

in the event that the chairman of the Board should unexpectedly become unable to perform his or her duties, the chief executive officer (if the

chairman of the Board is an independent director or else the lead independent director) shall temporarily assume the duties of the chairman of the Board,

in

each case, until the Board has the opportunity to consider the situation and take action.

Executive Sessions

At each regularly scheduled meeting, the Board conducts executive sessions, which are discussions that involve only the non-employee directors. Our corporate

governance guidelines state that the lead independent director or, in such director's absence, another independent director designated by the lead independent director will preside at the executive

sessions of the Board.

Annual Board and Committee Self-Evaluations and Director Peer Evaluations

Our corporate governance and nominating committee sponsors an annual self-assessment of the Board's performance and the performance of each committee of the

Board as

well as director peer evaluations. The assessment includes a review of any areas in which the Board or management believes

18

Table of Contents

the

Board can make a better contribution to CF Industries. The results of the assessments are discussed with the full Board and each committee. The corporate governance and nominating committee

considers the results of this self-evaluation process as applicable in assessing and determining the characteristics and critical skills required of prospective candidates for election to the Board

and making recommendations to the Board with respect to assignments of Board members to various committees.

Management Development and Succession Planning

Our Board plays an integral oversight role in talent development by recognizing the importance of succession planning for the CEO and other key executives at

CF Industries. To assist the Board, the chief executive officer prepares and distributes to the Board an annual report on succession planning for all senior officers of the company with an assessment

of senior managers and their potential to succeed the chief executive officer and other senior management positions. In addition, the chief executive officer prepares, on a continuing basis, a

short-term succession plan which delineates a temporary delegation of authority to certain officers of the company, if all or a portion of the senior officers should unexpectedly become unable to

perform their duties.

COMMITTEES OF THE BOARD

The Board has established three separate standing committees: the audit committee, the compensation committee, and the corporate governance and nominating

committee. The Board has adopted written charters for each of these committees and copies of these charters are available to stockholders at our corporate website, www.cfindustries.com, or by writing

to our corporate secretary at the address on the Notice of Annual Meeting accompanying this Proxy Statement.

Audit

Committee

. Our audit committee is a separately designated standing committee established in accordance with Section 3(a)(58)(A) of the Securities Exchange Act

of 1934, as amended (the "Exchange Act"). The committee currently consists of Theresa E. Wagler (chair), Robert C. Arzbaecher, William Davisson, John W. Eaves, Stephen J. Hagge, and Robert G. Kuhbach.

During 2017, the audit committee members were Theresa E. Wagler (chair from May 2017 through present), Robert C. Arzbaecher, William Davisson, John W. Eaves (effective July 2017), Stephen J. Hagge,

and Robert G. Kuhbach (chair from January through May 2017). The Board has affirmatively determined that all of the directors who served on the audit committee during 2017 and who presently serve on

the committee are independent within the meaning of the corporate governance standards of the NYSE applicable to audit committee members. The Board has also determined all of these directors are

"audit committee financial experts," as defined by the SEC. The audit committee assists the Board in fulfilling its oversight responsibility for (1) the integrity of our financial statements

and financial reporting process and our systems of internal accounting and financial controls, (2) the performance of our internal audit function, (3) the annual independent integrated

audit of our consolidated financial statements and internal control over financial reporting, and (4) our compliance with legal and regulatory requirements, including our disclosure controls

and procedures. The duties and responsibilities of the audit committee include the engagement of our independent registered public accounting firm and the evaluation of our accounting firm's

qualifications, independence, and performance. The audit committee's report to stockholders appears elsewhere in this Proxy Statement.

Compensation

Committee

. Our compensation committee currently consists of Stephen J. Hagge (chair), Stephen A. Furbacher, John D. Johnson, Anne P. Noonan, Edward A.

Schmitt, Michael J. Toelle, and Theresa E. Wagler. During 2017, the compensation committee members were Stephen J. Hagge (chair from May 2017 through present), Robert C. Arzbaecher (from January

through May 2017), Stephen A. Furbacher, John D. Johnson (chair from January through May 2017), Anne P. Noonan, Edward A. Schmitt, Michael J. Toelle (effective July 2017), and Theresa E. Wagler. The

Board has affirmatively determined that all of the directors who served on the compensation committee during 2017 and who

19

Table of Contents

presently

serve on the committee are independent under the corporate governance standards of the NYSE. The Board has also determined that all of the members of the committee qualify as "non-employee

directors," within the meaning of Rule 16b-3 promulgated under the Exchange Act, and "outside directors," within the meaning of Section 162(m) of the Internal Revenue Code of 1986, as

amended (the "Internal Revenue Code"). The compensation committee oversees our compensation and employee benefit plans and practices, including our executive compensation plans, director compensation

plans, and incentive-compensation and equity-based plans. The compensation committee's report to stockholders appears elsewhere in this Proxy Statement. Additional information regarding the processes

and procedures of the compensation committee in recommending and determining compensation for our directors and executive officers is set forth below under the heading "Compensation Discussion and

Analysis—Role of the Compensation Committee."

Corporate

Governance and Nominating Committee

. Our corporate governance and nominating committee currently consists of Robert C. Arzbaecher (chair), William Davisson, John

W. Eaves, Stephen A. Furbacher, John D. Johnson, Robert G. Kuhbach, Anne P. Noonan, Edward A. Schmitt, and Michael J. Toelle. During 2017, the corporate governance and nominating committee members

were Robert C. Arzbaecher (effective May 2017 and chair from May 2017 through present), William Davisson, John W. Eaves (effective July 2017), Stephen A. Furbacher, John D. Johnson, Robert G. Kuhbach,

Anne P. Noonan, Edward A. Schmitt (chair from January through May 2017), and Michael J. Toelle (effective July 2017). The Board has affirmatively determined that all of the directors who served on the

corporate governance and nominating committee during 2017 and who presently serve on the committee are independent under the corporate governance standards of the NYSE. The corporate governance and

nominating committee's responsibilities include identifying and recommending to the Board individuals qualified to serve as directors and on committees of the Board; advising the directors with

respect to the Board's composition, procedures, and committees; developing and recommending to the Board a set of corporate governance principles; and overseeing the evaluation of the Board and the

president and chief executive officer.

ATTENDANCE OF DIRECTORS AT MEETINGS

Directors are expected to attend meetings of the Board and the committees on which they serve, as well as our annual meeting of stockholders. A director who

is unable to attend a meeting (which it is understood will occur on occasion) is expected to notify the chairman of the Board or the chair of the appropriate committee in advance of such meeting.

During

2017, the Board held six meetings, our audit committee held nine meetings, our compensation committee held seven meetings, and our corporate governance and nominating committee held five

meetings. All of our directors attended 100% of the meetings of the Board and those committees of which they were members, except (i) one director was unable to attend one in-person Board

meeting due to jury duty service but did participate by teleconference for a portion of the meeting, (ii) one director was unable to attend one in-person meeting of the board and of each of the

two committees on which the director served, and (iii) one compensation committee member was unable to attend one telephonic compensation committee meeting. All of our directors attended the

2017 Annual Meeting, which was held on May 12, 2017.

ROLE OF THE BOARD IN RISK OVERSIGHT

In fulfilling its risk oversight role, the Board focuses on the adequacy of our risk management process and the effectiveness of our overall risk management

system. The goal of this oversight by the Board is to ensure that our employees who are responsible for risk management (i) adequately identify the material risks that the company faces in a

timely manner; (ii) implement appropriate risk management strategies that are responsive to the company's risk profile, business strategies, and specific material risk exposures;

(iii) integrate consideration of risk and risk management into business decision-making

20

Table of Contents

throughout

the company; and (iv) include policies and procedures that adequately transmit necessary information with respect to material risks to senior executives and, as appropriate, to the

Board or relevant committees. During 2017, the Board reviewed with key members of management responsible for management of risk the process by which management had identified the material risks to the

company's strategic, operating, financial reporting, and compliance objectives, as well as the likelihood of occurrence, the potential impact, and the mitigating measures in each instance.

CODE OF CORPORATE CONDUCT

The Board has adopted a code of corporate conduct that is applicable to all of our directors, officers, and employees. A copy of the code is available to

stockholders at our corporate website, www.cfindustries.com, or by writing to our corporate secretary at the address on the Notice of Annual Meeting accompanying this Proxy Statement. We intend to

disclose on our corporate website any amendment to any provision of the code that relates to any element of the definition of "code of ethics" enumerated in Item 406(b) of Regulation S-K

under the Exchange Act, and any waiver from any such provision granted to our principal executive officer, principal financial officer, principal accounting officer or controller or persons performing

similar functions.

STOCKHOLDER ENGAGEMENT

We believe that building positive relationships with our stockholders is critical to CF Industries' success. We value the views of, and regularly communicate

with, our stockholders on a variety of topics, such as our financial performance, corporate governance, executive compensation, and related matters. Management shares the feedback received from

stockholders with the Board. Our chairman or other members of the Board may also be available to participate in meetings with stockholders as appropriate. Requests for such a meeting are considered on

a case-by-case basis. Our engagement activities have resulted in valuable feedback that has contributed to our decision-making with respect to these matters. We welcome your input and feedback and

look forward to continued engagement with our stockholders.

COMMUNICATIONS WITH DIRECTORS

The Board has established a process to receive communications from stockholders and other interested parties. Stockholders and other interested parties may