How to Vote

|

|

|

|

|

|

|

|

|

|

|

By Internet

|

|

By Telephone

|

|

By Mail

|

|

In Person

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Vote your shares at www.proxyvote.com.

Have your Notice of Internet Availability or proxy card in hand for the 16-digit control number.

|

|

Call toll-free number

1-800-690-6903.

|

|

Sign, date, and return

the enclosed proxy card

or voting instruction form.

|

|

To attend the

meeting in person,

you will need proof of

your share ownership

and valid picture I.D.

|

|

|

|

|

|

|

|

|

|

For 2018,

there is an annual meeting website to make it even easier to access our annual meeting materials. At the annual meeting website, you can find an overview of the items for voting, our Proxy Statement and annual report to read online or to download, and a link to vote your shares.

|

|

www.sciannualmeeting.com

|

1

www.sciannualmeeting.com

Q&A WITH OUR CHAIRMAN AND CEO

Q&A WITH OUR CHAIRMAN AND CEO

|

|

|

|

|

|

|

|

|

|

Tom Ryan answers questions received from shareholders over the course of 2017.

|

|

|

How has the business performed over the last 12 months?

For the full year 2017, we reported over 20% growth in adjusted earnings per share and approximately 11% growth in adjusted operating cash flows excluding recurring cash taxes, while we expanded comparable funeral and cemetery segment profit margin by 70 and 140 basis points, respectively. The resulting cash flows allowed us to deploy capital of $402 million to acquisition and new build opportunities, dividends, and share repurchases.

During 2017, we generated an impressive $1.55 of adjusted earnings per share, which exceeded the top end of our adjusted guidance range. This amount included a little more than $0.09 of excess tax benefits from a new accounting standard for share-based compensation that was not reflected in the prior

year and had the effect of lowering our tax rate in 2017. We also enjoyed further tax benefits in 2017, primarily as a result of additional tax planning by our tax team, which improved earnings per share by an additional $0.05.

We generated $554 million in adjusted operating cash flows for 2017, which is $46 million over the prior year and surpassed the high end of our guidance range of $515 million. Cash flow results during 2017 benefited by $20 million of non-earnings and nonrecurring cash flow from our endowment care trust funds offset by about $20 million of higher anticipated cash tax payments.

Adjusted Earnings Per Share and Adjusted Operating Cash Flow are non-GAAP financial measures. Please see Annex A for disclosures and reconciliations to the appropriate GAAP measure.

2

www.sciannualmeeting.com

Q&A WITH OUR CHAIRMAN AND CEO

What are Service Corporation International’s strategies for growth?

Our three core strategies are centered around our customer and competitive advantages. The first core strategy is

revenue growth,

which we plan to achieve by remaining relevant to our customers and driving preneed sales. Second, is

leveraging our scale

through the development of our sales force, optimum management of our $10.7 billion backlog, and the utilization of technology during customer interactions. Our third core strategy is

capital deployment,

which is a blended approach of deploying capital to the highest relative return opportunity.

Remaining relevant to our customers is key to generating revenue growth in a changing consumer environment. When we say remaining relevant, we mean staying ahead of trends in our business. These include an increasing preference for cremation, serving a growing ethnic population, particularly Hispanic and Asian, and a shift away from traditional mourning to contemporary celebrations of life.

These changing trends require us to be much more flexible, providing products and services that meet the modern needs of our customer. In the funeral segment, we deploy capital strategically to meet the needs of the customer by changing or updating our physical locations for event rooms or through customer-facing technology. We are focusing on unique celebration services, counseling, estate planning, and adherence to religious and ethnic traditions. We provide quality, simplicity, various location preferences, and specific cultural preferences. We are embracing cremation opportunities within both the funeral home and non-funeral home channels.

In the cemetery business, we provide property and merchandise options that meet the baby-boomer generation desires for exclusivity, privacy, elevation, or scenic views. We also strive to meet the specific needs of our growing custom-conscious consumers.

Driving preneed sales provides several benefits. Offering preneed merchandise and services provides our customers peace of mind, allowing them to express their wishes about funeral and cemetery arrangements, which relieves their loved ones of the emotional and financial burden at the time of need. We believe preneed sales increase our future market share and create brand awareness, while allowing us to address varying customer needs and preferences.

We are growing our business while embracing technology that our customers have come to expect in their daily lives, with a focus on visualization and simplification of the selection process.

Our second core strategy is

leveraging scale

. Our scale gives us tremendous competitive advantages helping to drive future revenue and cost efficiencies.

Network Optimization

We have invested in the development of our sales organization through the use of new tools and capabilities. We are continuously improving our customer-facing technology to ensure our customers have meaningful experiences that are efficient and seamless, whether in an atneed arrangement or during a preneed presentation or even online. Additionally, we leverage a world-class customer relationship management system, which helps drive improvements in productivity and sales production through enhanced analytics.

SCI recently completed a redesign of almost 2,000 Dignity Memorial

®

location websites. Featuring a modern, user-friendly design, the Company’s websites have been optimized for mobile use and updated with enhanced search engine optimization capability. In addition to the contemporary and sophisticated design, client families now experience new features like a streamlined obituary process, social media sharing capabilities, and the ability to create and share personalized content in memory of their loved one.

We are also continuously driving down costs through the maximization of purchasing power and utilizing economies of scale through our supply chain team.

Preneed Backlog

Our preneed backlog, which includes both insurance and trust-funded products, allows us the opportunity to grow future revenue in a more stable and efficient manner than selling at the time of need. Our insurance-funded products benefit from favorable terms with our insurance partner allowing for enhanced immediate as well as long-term earnings and cash flow benefits. The scale of our trust portfolios allows us to leverage access to preeminent money managers with favorable fee structures that generate superior returns.

Our blended funding approach between insurance and trust funded products allows us to combine the positive cash flow and predictability of the insurance product with the upside of future returns from our trusted products. This results in cash flow neutral preneed funeral funding and favorable contracts coming out of the backlog today to be serviced with growth rates that are superior to inflationary at-need pricing.

3

www.sciannualmeeting.com

Q&A WITH OUR CHAIRMAN AND CEO

Our third core strategy of

deploying capital

reflects our disciplined approach to target capital deployment opportunities with the best return for our shareholders. The foundation of our strategy is our strong liquidity and favorable debt maturity profile.

We believe the opportunities with the highest current returns are in acquisition and growth capital. We expect to spend $50 to $100 million a year on acquisitions that generally have internal rates of return (IRR) in the mid to high teens. We anticipate investing another $20 to $25 million on new builds, which have returns in the low to mid teens, but have nice long-term growth trajectories. Finally, as it relates to growth capital, we expect to invest another $80 million on cemetery property development, which takes existing undeveloped cemetery property and creates tiered property options - everything from roads, drainage, and irrigation to mausoleums or private estates. These incremental investments generate some of our strongest internal rates of return.

We feel strongly that as the Company grows we will distribute an incremental amount to our shareholders in the form of a dividend. We currently target a payout ratio of 30% to 40% of adjusted net income.

Additionally, any excess cash flow is then available for share repurchases, which have been an important aspect to our capital deployment strategy. We utilize a value-weighted share repurchase approach that is based on our view of the discount our shares are trading at compared to our intrinsic value. Lastly, we actively manage our near-term liquidity profile and leverage targets as a foundation to our deployment strategy. We target a favorable debt maturity profile and a 3.5x to 4.0x leverage ratio.

We believe the execution of these strategies should enable SCI to consistently grow adjusted earnings per share in the 8% to 12% range.

What is Service Corporation International doing to engage shareholders?

We believe communicating regularly to solicit feedback on key business and corporate governance topics with our shareholders is important to our long-term success. We strive for a collaborative approach to shareholder outreach and value the variety of investors’ perspectives received, which helps deepen our understanding of their areas of focus and motivations. Items discussed typically cover a wide range of topics, including executive compensation, Board composition including tenure and diversity, and simple versus supermajority voting, among other topics. We share investor feedback directly with our Corporate Governance Committee and full Board. Investors may communicate their comments to the Lead Independent Director by e-mail or letter. Our engagement activities take place throughout the year. Although shareholder outreach is primarily a function of management, members of our Board will also participate when appropriate. In addition to speaking with our institutional investors, we also are responsive to our retail investors and other stakeholders when the opportunity arises.

In February 2018, we held an Investor Day to take a deeper dive into our strategy and to discuss key topics with investors. From January through March 2018, we also engaged directly with 62% of our shareholders to discuss the three proposals included in this Proxy to understand their positions on each.

The proposals are listed below:

|

|

|

|

•

|

Proposal 4: Proposal to declassify the board

|

|

|

|

|

•

|

Proposal 5: Proposal to eliminate certain supermajority vote requirements

|

|

|

|

|

•

|

Proposal 6: Proposal to reduce the supermajority vote requirements to approve business combinations with interested shareholders

|

These shareholder friendly proposals were the result of prior year discussions and feedback received from shareholders, including Amalgamated Bank, who previously proposed the Simple Majority Voting Requirement advisory vote in our 2017 proxy. As a result of these discussions with our shareholders, we also updated our Corporate Governance Guidelines to enhance our focus on diversity of our Board of Directors and strengthen our Lead Independent Director role.

For 2018, you will notice a change in our performance unit and performance based incentive compensation plans. This change removes return on equity from the short term incentive plan, reducing these metrics from four to three, and includes it as a modifying metric along with total shareholder return in our long term performance unit plan. The performance unit plan will be denominated in Company shares starting in 2018 to further link share performance of the Company with the participants of the plan. These changes were made based on shareholder feedback received during our outreach discussions.

Can you talk about the emphasis on tenure and diversity for the Board of Directors?

We are committed to selecting highly qualified nominees from diverse backgrounds as candidates for the Board of Directors. Our Board plays a critical role in creating an organization that prioritizes, supports, and invests in diversity, inclusion, and equity.

We believe that the Company benefits from a Board that blends a mix of directors that have a deep understanding of the industry and those who bring fresh business or consumer perspectives.

4

www.sciannualmeeting.com

Q&A WITH OUR CHAIRMAN AND CEO

While we believe we have assembled a highly effective Board, we are committed to continuous succession planning and assembling a diverse group of individuals to serve on our Board of Directors. This diversity results in a broader perspective as a whole and provides a healthy environment for innovation and risk mitigation. Diversity has multiple dimensions, including personal factors such as gender, ethnicity, and age, as well as professional characteristics in education, areas of expertise, and professional experience. I believe we are developing a Board with the right composition to bring an impressive blend of experience and perspectives for the Company and its investors with a secondary focus on reducing the average tenure of our Board members.

We updated our Corporate Governance Guidelines to reflect our commitment to diversity. The Corporate Governance

Guidelines outline the standards and qualifications we consider for our members of our Board of Directors and are located on our corporate website under About SCI - Corporate Governance. Now included in the Director Qualification Standards as part of the guidelines, we discuss our commitment to diversity and added diverse experiences and backgrounds as a core competency for our Directors.

I am pleased to present our two new Board nominees for consideration, Ms. Jakki Haussler and Ms. Sara Martinez Tucker. I believe that they bring broad and diverse experience and expertise which will best represent the long-term interests of our shareholders.

How is the Company planning to spend tax savings from the 2017 Tax Cuts and Job Act ("Tax Act")?

Our adjusted effective tax rate is expected to be reduced to a range of 24% to 26% in 2018 from 29% in 2017 as a result of the Tax Act. From a cash flow perspective, we anticipate almost $20 million of cash tax savings over 2017 related to the Tax Act. We have announced our plan to invest approximately $7 million into nearly 10,000 critical field customer-facing

positions at both our funeral and cemetery operating locations. This is a permanent increase to the pay of these individuals and not a one time bonus reflecting the commitment we have to our valuable associates. We plan to deploy any excess future tax savings toward opportunities with the best return for our shareholders.

What accomplishment are you most proud of in

2017

?

While it was an exceptional year from a financial perspective, from a SCI family perspective, it was an incredibly challenging one. Without a doubt, I am most proud of the incredible family culture SCI associates displayed during one of the most challenging times in our Company's history. Despite multiple hurricanes, extensive wildfires, and the tragic shootings in Las Vegas our team proved how much can be accomplished when we all come together. I was so proud to watch how our team responded by supporting each other and our local communities. Vendors, members of our Board, and employees all across Canada and the U.S. showed unwavering support through countless hours of hard work, monetary donations, and the gifting of personal items to help our impacted SCI family

members get back on their feet. Our employees spent countless hours of their own personal time working side by side with their fellow teammates as they cleaned up homes, delivered and sorted personal supplies, and drove thousands of miles to provide a helping hand. We raised approximately $1 million for our employees and communities that were affected. While hundreds of employees experienced personal loss of homes, cars, and personal effects, we never lost sight of serving our client families. Our SCI family is made up of tremendous caregivers, fabulous leaders, and real professionals, and I am so proud to be part of our extraordinary team.

5

www.sciannualmeeting.com

MESSAGE FROM OUR BOARD OF DIRECTORS

MESSAGE FROM OUR BOARD OF DIRECTORS

Dear Shareholders,

We take seriously the trust you place in us by your purchase of Service Corporation International shares, and we are honored to be stewards of your Company. Below we share with you a few key highlights for

2017

.

2017

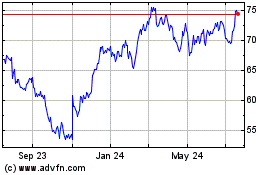

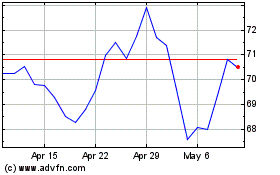

Company Performance and Compensation Alignment

We are fully committed to helping SCI deliver excellent operating results and create attractive shareholder returns. The Company’s performance in 2017 resulted in increased adjusted earnings per share, cash flows, and continued growth in return on equity. During 2017, we delivered total shareholder return of 34%, which exceeded the S&P 500 return of 22%. Over the medium to long term (3 to 10 years), we continue to significantly outperform the major indices. As we look ahead to 2018, our focus continues to be on enhancing shareholder value.

The Compensation Committee understands the focus on aligning executive pay with performance and strongly believes the Company currently aligns pay and performance. At last

year’s annual meeting, our advisory “say-on-pay” proposal received the support of over 90% of the votes cast.

Effective in 2018, we made changes to the performance unit plan to add return on equity as a modifier to the total shareholder return metric in response to shareholder feedback. Additionally, we changed the performance units to be denominated in SCI shares rather than units, which we believe will further link share performance of the Company with the payouts from of the plan.

We believe these changes are responsive to your feedback and reinforce the link between our executive team and our shareholders.

Board Refreshment

Self-Assessment Process

As part of the regular self-assessment process, we consider the current composition and the unique contributions of each current or prospective Director. We attempt to recruit Directors with specialized experience, such as in technology or financial services, as well as Directors whose experience is not represented or is underrepresented on the Board. Mixing new and longer-tenured Directors with different skill sets adds valuable perspectives and knowledge to the Board.

Succession Planning

Succession planning is a vitally important concern. We strategically focus on Board composition and make the most of the opportunities to refresh the Board with desired experience and diversity.

Shareholder Engagement

The Company maintains dialogue with large institutional investors and proxy advisory firms. Key shareholders have a vested interest and valuable insight into the competency and contribution of the Board members.

As a part of the succession planning process, we considered shareholder feedback and our commitment to tenure and diversity. We strengthened our Lead Director responsibilities by making revisions to the Company's Bylaws to permit the Lead Director to call a special meeting of the Board and preside over Board meetings in the absence of the Board Chair. We have enhanced our policies, specifically our Corporate Governance Guidelines, to clearly outline our policies and expectations for diversity and inclusion.

Board Tenure, Diversity, and Corporate Governance Guidelines

Board recruitment and diversity are priorities for us. The Nominating and Corporate Governance Committee strives to maintain an engaged, independent Board with broad and diverse experience and judgment that is committed to representing the long-term interests of our shareholders. The Nominating and Corporate Governance Committee is charged with reviewing the composition of the Board and refreshing the members as appropriate. With this in mind, the committee continuously reviews potential candidates and recommends nominees to the Board for approval.

The majority of the Board of Directors of SCI will be comprised of independent Directors, meaning Directors who

have no material relationship with SCI (either directly or as a partner, shareholder, or officer of an organization that has a material relationship with SCI). In addition, the Audit, Compensation, and Nominating and Corporate Governance Committees of SCI will be composed entirely of independent Directors.

As part of our succession planning efforts, we have considered shareholder feedback on the tenure and diversity of Directors. In response, we have two new Director nominees; Ms. Jakki Haussler and Ms. Sara Martinez Tucker. After 56 years of meaningful contributions, in order to recruit the next generation of leaders for our Board, Mr. R.L. Waltrip has decided not to

6

www.sciannualmeeting.com

MESSAGE FROM OUR BOARD OF DIRECTORS

seek another term as an elected member of our Board of Directors. As Mr. Waltrip is an icon and pioneer in our industry he will continue to serve in his capacity as Founder and Chairman Emeritus for the Company. Citing the same reasons as Mr. Waltrip, and after over 35 years of service, Mr. John W. Mecom, Jr. has also informed the Board of his intention not to seek reelection once his term ends in May 2019. Therefore, the Board will temporarily increase its size to twelve members for one year.

Service Corporation International believes in a strong corporate culture that invests in diversity and inclusion, creating one of the greatest competitive advantages a company can maintain. In no area of business is corporate leadership more essential to generating progress than in guiding our Company through the culture shift of embracing diversity and inspiring inclusiveness. We are creating a Board that is a direct reflection of our Company’s values.

|

|

|

|

|

|

Lead Independent Director - Tony Coelho

|

|

|

Key Duties and Responsibilities of Lead Independent Director:

●

Preside over independent executive sessions held on a regular basis

●

Serve as liaison to the Chairperson

●

Engage in performance evaluation of directors and CEO

●

Interview Director candidates

●

Communicate with shareholders

●

Consult with committee chairpersons

●

Authorized to call a special meeting of the Directors*

|

*Enhanced Lead Director responsibilities effective in 2018.

Communicating Your Viewpoints with the Board

We value dialogue with our shareholders. We believe our ongoing shareholder outreach efforts have allowed us to better understand the viewpoints of our shareholders as well as providing an opportunity to communicate with transparency about what the Board is doing and why our decisions are aligned with business goals.

Shareholders and other interested parties may communicate with any of the independent Directors, including Committee

Chairs and the Lead Independent Director, by using the following address:

Service Corporation International

Lead Independent Director c/o Office of Corporate Secretary

1929 Allen Parkway

Houston, TX 77019

Email:

leaddirector@sci-us.com

Thank you for the trust you place in us and for your continued investment in Service Corporation International.

Sincerely,

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Anthony L. Coelho

Lead Independent Director

|

|

Thomas L. Ryan

Chairman and CEO

|

|

Alan R. Buckwalter, III

|

|

Victor L. Lund

|

|

|

|

|

|

|

|

|

|

John W. Mecom, Jr.

|

|

Clifton H. Morris, Jr.

|

|

Ellen Ochoa

|

|

Robert L. Waltrip

|

|

|

|

|

|

|

|

|

|

W. Blair Waltrip

|

|

Marcus A. Watts

|

|

Edward E. Williams

|

|

|

7

www.sciannualmeeting.com

PROXY STATEMENT SUMMARY

This summary highlights information contained in this Proxy Statement. This summary does not contain all of the information you should consider. Please read the entire Proxy Statement carefully before voting.

|

|

|

|

|

Corporate Governance Highlights and Changes

|

|

|

|

|

•

|

The Nominating and Corporate Governance Committee has presented two new nominees for the Board of Directors. The Committee has considered the background and experience of Ms. Sara Martinez Tucker and Ms. Jakki Haussler. We believe each individually will bring valuable experience and diverse skills to our Board.

|

|

|

|

|

•

|

After 56 years of meaningful contributions, in order to recruit the next generation of leaders for our Board, Mr. R.L. Waltrip has decided not to seek another term as an elected member of our Board of Directors. As Mr. Waltrip is an icon and pioneer in our industry he will continue to serve in his capacity as Founder and Chairman Emeritus for the Company. Citing the same reasons as Mr. Waltrip and after over 35 years of service, Mr. John W. Mecom, Jr. has also informed the Board of his intention not to seek reelection once his term ends in May 2019.

|

|

|

|

|

•

|

If Proposal 4 is approved by shareholders then directors will be elected to a one-year term of office starting at the 2019 Annual Meeting of Shareholders, except Ms.

|

Haussler who has a one year term and is nominated to join the class of directors whose term expires in 2019. Currently, the Board is divided into three classes, with directors elected to staggered three-year terms. This proposal is in response to shareholder feedback.

|

|

|

|

•

|

The Board made changes to the Company's Bylaws to permit the Lead Director to call a special meeting of the Board and preside over Board meetings in the absence of the Board Chair.

|

|

|

|

|

•

|

The Board made changes to the Company's Bylaws to permit the Chair of the Nominating and Corporate Governance Committee of the Board to preside over the Board meetings in the absence of the Board Chair, Lead Director and the Chief Executive Officer.

|

|

|

|

|

•

|

The Board, in response to shareholder feedback, approved changes to the performance unit plan to add a return on equity modifier to the total shareholder return metric and changed the award denomination to share units rather than cash, which will be effective beginning January 1, 2018.

|

Shareholder and Proxy Advisor Outreach

We regularly communicate with a large portion of shareholders throughout the year and solicit feedback on key business and corporate governance topics. Additionally, beginning in 2015, we began a process of formal outreach to our top shareholders prior to our annual meeting to address our corporate governance practices, including executive compensation programs. The results of these conversations are discussed with both the SCI Board and our management. The Board then decides whether any action should be taken.

As part of our normal procedures, we also proactively engage with proxy advisors who represent the interests of certain of our shareholders. We continue to have an open dialogue with Glass Lewis and ISS and use their constructive feedback to continuously enhance our disclosures.

In April and May of 2017, we engaged with shareholders representing approximately 44% of the Company’s common stock prior to our 2017 Annual Shareholder Meeting. We specifically discussed executive compensation programs and as a result of feedback received, we added a return on equity

modifier to the performance unit plan beginning in 2018. We also changed the denomination of the award to share units rather than cash units.

We also discussed the shareholder proposal brought forth in the 2017 Proxy Statement to require an independent Board Chair. The strong majority favored our leadership structure of having Tom Ryan, current CEO, as Chairman given the appointment of an effective Independent Lead Director and given the success of the Company. The minority that expressed concern of this structure pointed to Board tenure and diversity issues. As part of its ongoing efforts to enhance the composition of the Board, our Chairman and the Nominating and Corporate Governance Committee spent a considerable time reviewing candidates to serve on our Board of Directors. We are presenting two new nominees in this 2018 Proxy Statement. These two nominees, if elected, would significantly enhance the tenure and diversity of the Board.

Shareholder Proposal to Adopt Simple Majority

During the April and May 2017 conversations with top shareholders, we also discussed the shareholder proposal regarding the adoption of the simple majority voting. We received valuable feedback, which we used to prepare our planned response presented in this 2018 Proxy Statement. In early 2018, we then went back to our largest owners to discuss our response.

8

www.sciannualmeeting.com

In January through March of 2018, we proactively engaged with our top holders to discuss our planned response to the 2017 shareholder proposal regarding the adoption of the simple majority voting requirement. As part of this process, we spoke to shareholders representing approximately 62% of the Company’s outstanding common stock.

Of the shareholders contacted, all agreed with declassifying the Board of Directors and adopting a simple majority voting requirement in our Bylaws and Articles of Incorporation except for business combinations. For business combinations, we are proposing the reduction of a supermajority voting requirement to at least two-thirds. Of the shareholders

contacted in early 2018, the strong majority felt that this was in line with their expectations, while the minority felt business combinations should also be at a simple majority level. However, the minority who held this view agreed that moving from a supermajority voting requirement of 80% to two-thirds reflected a positive movement for the Company.

We also consulted with Amalgamated Bank, who submitted the shareholder proposal for the adoption of simple majority voting at the last annual meeting and discussed our opinion and proposed solutions. Amalgamated Bank had no objection to our proposal.

|

|

|

|

|

|

|

|

|

|

|

Key Highlights

|

|

Detail

|

|

Reference Page

|

|

|

Executive Compensation

|

|

l

|

We moved the return on equity metric from the short term compensation plan to a modifier in the long-term performance unit plan, which was previously solely based on total shareholder return.

|

|

33

|

|

|

|

l

|

We eliminated the Umbrella Plan starting in 2018 due to certain changes in the Tax Act.

|

|

|

|

|

|

l

|

We illustrated our alignment of pay and performance.

|

|

|

|

|

Board-Related

|

|

l

|

Board composition and refreshment remains a priority for us. We also present two new nominees in this Proxy Statement. Ms. Sara Martinez Tucker and Ms. Jakki Haussler will bring diverse perspectives and experience to our Board of Directors. Mr. John W. Mecom, Jr. has communicated to the Company that he will not seek reelection for his seat next year. And lastly, in 2018, Mr. R.L. Waltrip decided not to seek another term as an elected member of our Board of Directors, but will still actively participate as Founder and Chairman Emeritus.

|

|

|

|

|

|

l

|

We continue our annual Board and Committee evaluation process.

|

|

|

|

|

|

l

|

Strong Lead Independent Director. We created the role in 2016 with enhanced authority to call special Board meetings and to preside over Board meetings in the absence of the Chairman.

|

|

|

|

|

|

l

|

Independent Audit, Compensation, and Nominating and Corporate Governance Committees

|

|

|

|

|

|

l

|

We made changes to the Director's compensation.

|

|

|

|

|

Shareholder Rights

|

|

l

|

Shareholder questions and concerns are communicated to and considered by the Board. Shareholders are allowed to call special meetings.

|

|

|

|

|

|

|

l

|

We conduct an annual "Say-on-Pay" vote

|

|

|

|

|

Accounting White Paper

|

|

l

|

In response to shareholders' questions regarding the complexities of the Company's accounting for preneed sales, management published a white paper on its website in the fall of 2015, which has now been updated for the recent revenue recognition accounting standard change.

|

|

You can view the

white paper at

under Featured Documents

|

|

Communication with Directors

We value dialogue with our shareholders and believe our ongoing outreach efforts, which are in addition to other communication channels available to our stockholders and interested parties, help us to continue to evolve our corporate governance practices in a way that reflects the insights and perspectives of our many

stakeholders. Shareholders and other interested parties may communicate with any of the independent Directors, including Committee

Chairs and the Lead Independent Director, by using the following address: Service Corporation International, Lead Independent Director c/o Office of Corporate Secretary, 1929 Allen Parkway, Houston, TX 77019 or by email to

leaddirector@sci-us.com

.

9

www.sciannualmeeting.com

|

|

|

|

|

|

|

|

|

Experience

|

|

Skills

|

|

Commitment

|

|

With extensive experience in leadership positions and a proven record of success, our Board is qualified to oversee the Company’s strategy and management. The

Nominating and Corporate Governance Committee continually reviews and recommends enhancements to the Board’s leadership structure as

evidenced by the nominations of Jakki Hausler and Sara Martinez Tucker this year and Ellen Ochoa in 2015.

|

|

Each Director brings a particular range of skills and expertise to the deliberations of the SCI Board, which facilitates constructive and challenging debate around the boardroom table (see page 13 for overview).

|

|

The calendar of Board and Committee meetings is established to support the Board’s focus on strategic and long-term matters, while ensuring the discharge of its monitoring and oversight role effectively through high quality discussions and briefings.

|

|

Director Age

|

|

Meeting Attendance

|

|

Personal Qualities

|

|

The average age of our Board is 70. Including our two proposed nominees, the average decreases to 67. While this average age may be higher than some companies, we believe this gives our Board a unique perspective and understanding of SCI’s consumer base. SCI’s average age of preneed cemetery consumers is the early sixties. The average age of preneed funeral consumers is the early seventies.

|

|

During 2017, our Board had a 97% meeting attendance record. We also had two executive meetings to address specific items related to a litigation settlement and an acquisition. Please see page 20 for more information about our Board meetings and Director attendance.

|

|

Our Directors bring innate personal qualities to the SCI boardroom that enable our Board to function effectively. Personal qualities exhibited in the boardroom include self-awareness, respect, integrity, independence, and the capacity to function effectively in challenging situations.

|

|

|

|

|

|

|

10

www.sciannualmeeting.com

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Independent

|

|

Age

|

|

Director

Since

|

|

Other

Public

Boards*

|

|

Board Committee

Composition

|

|

Name

Occupation

|

|

A

|

|

C

|

|

E

|

|

N&

CG

|

|

I

|

|

Anthony L. Coelho, Lead Independent Director

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Former Majority Whip of the U. S. House of Representatives

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Independent business and political consultant

|

|

YES

|

|

75

|

|

1991

|

|

2

|

|

|

|

●

|

|

●

|

|

●

|

|

|

|

Jakki L. Haussler **

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Founder and CEO, Opus Capital Management

|

|

YES

|

|

60

|

|

-

|

|

2

|

|

-

|

|

-

|

|

-

|

|

-

|

|

-

|

|

Sara Martinez Tucker **

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Former Chief Executive Officer, National Math + Science

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Initiative, a non-profit organization to improve student

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

performance in STEM subjects

|

|

YES

|

|

62

|

|

-

|

|

3

|

|

-

|

|

-

|

|

-

|

|

-

|

|

-

|

|

Marcus A. Watts

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

President, The Friedkin Group, an umbrella company

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

overseeing various business interests that are principally

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

automotive related

|

|

YES

|

|

59

|

|

2012

|

|

1

|

|

|

|

●

|

|

●

|

|

C

|

|

|

|

Edward E. Williams

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Professor Emeritus of Entrepreneurship, Rice University,

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Doctorate in Finance and Accounting

|

|

YES

|

|

72

|

|

1991

|

|

None

|

|

●

|

|

|

|

|

|

|

|

C

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Independent

|

|

Age

|

|

Director

Since

|

|

Other

Public

Boards*

|

|

Board Committee

Composition

|

|

Name

Occupation

|

|

A

|

|

C

|

|

E

|

|

N&

CG

|

|

I

|

|

Alan R. Buckwalter

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Former Chairman and CEO, Chase Bank of Texas

|

|

YES

|

|

71

|

|

2003

|

|

None

|

|

●

|

|

C

|

|

●

|

|

|

|

|

|

Victor L. Lund

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

President and CEO, Teradata

|

|

YES

|

|

70

|

|

2000

|

|

1

|

|

C

|

|

|

|

●

|

|

●

|

|

|

|

John W. Mecom, Jr. ***

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Independent businessman who bought, developed, managed,

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

and sold a variety of real estate and other business interests

|

|

YES

|

|

78

|

|

1983

|

|

None

|

|

|

|

●

|

|

|

|

|

|

●

|

|

Clifton H. Morris, Jr.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Chairman and CEO of JBC Funding, a corporate lending

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

and investment firm

|

|

YES

|

|

82

|

|

1990

|

|

None

|

|

●

|

|

|

|

|

|

●

|

|

|

|

Ellen Ochoa

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Director, NASA Johnson Space Center

|

|

YES

|

|

59

|

|

2015

|

|

None

|

|

|

|

●

|

|

|

|

|

|

●

|

|

Thomas L. Ryan

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Chairman and CEO, Service Corporation International

|

|

NO

|

|

52

|

|

2004

|

|

2

|

|

|

|

|

|

C

|

|

|

|

|

|

W. Blair Waltrip

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Independent consultant, family and trust investments,

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

and former senior executive of the Company

|

|

NO

|

|

63

|

|

1986

|

|

None

|

|

|

|

|

|

|

|

|

|

●

|

|

|

|

|

|

|

|

A:

Audit Committee

|

|

●

:

Member

|

|

C:

Compensation Committee

|

|

C

:

Chair

|

|

E:

Executive Committee

|

|

|

|

N&CG:

Nominating & Corporate Governance Committee

|

|

|

|

I:

Investment Committee

|

|

|

* See Director Bios on pages 13 to 16, which includes other public Boards for each Director.

** New Director nominee - committee positions will be determined after the annual meeting.

*** John W. Mecom, Jr. has informed the Company he will not run for re-election when his term expires at the annual meeting in 2019.

11

www.sciannualmeeting.com

|

|

|

|

|

Overview of Director Skills and Experience

|

We value the following skills and experiences within our Board of Directors to create a balance of diverse viewpoints and expertise:

|

|

|

|

|

|

|

|

CEO Experience/Senior Leadership.

We believe Directors who have held significant leadership positions over an extended period, especially CEO positions, possess extraordinary leadership qualities and demonstrate a practical understanding of organizations, processes, strategy and risk management, and know how to drive change and growth.

|

|

|

Industry.

The funeral and cemetery industry is unique and Directors with prior experience can help to shape and develop all aspects of the Company’s strategy.

|

|

|

Financial.

Service Corporation International uses a broad set of financial metrics to measure its performance, and accurate financial reporting and robust auditing are critical to our success. We have added a number of Directors who qualify as Audit Committee financial experts, and we expect all of our Directors to have an understanding of finance, financial reporting processes, and internal controls.

|

|

|

Marketing/Brand Management.

We employ a multi-brand strategy and also rely heavily on marketing our products and services on a preneed basis. Directors with marketing experience and/or brand management experience can provide expertise and guidance as we seek to expand brand awareness, enhance our reputation, and increase preneed sales.

|

|

|

Investments/Financial Services.

Knowledge of financial markets, investment activities, and trust and insurance operations assists our Directors in understanding, advising on, and overseeing our investment strategies.

|

|

|

Real Estate.

We own a significant amount of real estate. Directors with experience in real estate can provide insight into our tiered product/pricing strategy for our cemeteries as well as advice on best uses of our real estate.

|

|

|

Technology or e-Commerce.

Directors with education or experience in relevant technology are useful for understanding our efforts to enhance the customer experience as well as improve our internal processes and operations.

|

|

|

Business Development/Mergers and Acquisitions (M&A).

We seek to grow through acquisitions and development of new business operations. Directors with a background in business development and in M&A provide insight into developing and implementing strategies for growing our business.

|

|

|

Government/Legal.

We operate in a heavily regulated industry. Directors who have a background in law or have served in government positions provide experience and insights that assist us in legal and regulatory compliance and help us work constructively with governmental and regulatory organizations in the areas we operate.

|

Although the members of our Board embody a broad range of backgrounds, experience and expertise, the table below is intended to highlight only the top three areas of expertise for each member:

Overview of Director Skills and Experience

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Buckwalter

|

|

Coelho

|

|

(New) Haussler

|

|

Lund

|

|

Mecom

|

|

Morris

|

|

Ochoa

|

|

Ryan

|

|

(New) Tucker

|

|

W.B. Waltrip

|

|

Watts

|

|

Williams

|

|

|

CEO Experience/Senior

Leadership

|

|

|

|

|

|

ü

|

|

ü

|

|

|

|

ü

|

|

ü

|

|

ü

|

|

ü

|

|

|

|

|

|

|

|

|

Industry

|

|

|

|

|

|

|

|

|

|

|

|

ü

|

|

|

|

|

|

|

|

ü

|

|

|

|

ü

|

|

|

Financial

|

|

ü

|

|

ü

|

|

|

|

ü

|

|

|

|

ü

|

|

|

|

|

|

|

|

|

|

|

|

ü

|

|

|

Marketing/Brand

Management

|

|

|

|

|

|

|

|

|

|

ü

|

|

|

|

|

|

|

|

|

|

|

|

ü

|

|

|

|

|

Investments/Financial

Services

|

|

ü

|

|

ü

|

|

ü

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ü

|

|

|

|

ü

|

|

|

Real Estate

|

|

|

|

|

|

|

|

|

|

ü

|

|

|

|

|

|

ü

|

|

|

|

|

|

|

|

|

|

|

Technology or e-Commerce

|

|

|

|

|

|

|

|

ü

|

|

|

|

|

|

ü

|

|

|

|

ü

|

|

|

|

|

|

|

|

|

Business Development/M&A

|

|

ü

|

|

|

|

ü

|

|

|

|

ü

|

|

|

|

|

|

ü

|

|

|

|

ü

|

|

ü

|

|

|

|

|

Government/Legal

|

|

|

|

ü

|

|

|

|

|

|

|

|

|

|

ü

|

|

|

|

ü

|

|

|

|

ü

|

|

|

12

www.sciannualmeeting.com

CORPORATE GOVERNANCE AT SERVICE CORPORATION INTERNATIONAL

CORPORATE GOVERNANCE AT SERVICE CORPORATION INTERNATIONAL

|

|

|

|

|

Proposal 1 : Election of Directors

|

|

|

|

|

|

|

The Board of Directors will temporarily have 12 members. John W. Mecom, Jr. has communicated to the Company that he will not seek reelection for his seat next year. The Directors will be divided into three classes, each with a staggered term of three years. At this year’s Annual Meeting, shareholders will be asked to elect five Directors to the Board; four with three-year terms expiring in 2021, and a one year

|

term for Ms. Haussler, who is nominated to join the class of Directors whose term expires in 2019. Set forth below are profiles for each of the five candidates nominated by the Nominating and Corporate Governance Committee of the Board of Directors for election by shareholders at this year’s Annual Meeting. Directors are elected by a majority of votes cast.

|

|

|

|

|

|

The Board of Directors recommends that Shareholders vote “FOR” the following five nominees.

|

|

|

|

|

|

|

|

|

|

|

|

|

Director nominees

|

|

Anthony L.

Coelho

|

|

Independent

|

Director Since:

1991

|

Age:

75

|

If Elected

Term Expires:

2021

|

Primary Qualifications:

|

|

|

|

|

Occupation

●

Former Majority Whip of the U.S. House of Representatives

●

Independent business and political consultant

Prior Political Experience

●

Chairman of the President’s Committee on Employment of People with Disabilities (1994-2001)

●

General Chairman of Al Gore’s Presidential campaign (1999-2000)

|

●

Majority Whip (1987-1989)

●

Member of U.S. House of Representatives (1978-1989); original sponsor/author of the Americans With Disabilities Act

Prior Business Experience

●

President/CEO of Wertheim Schroder Financial Services, grew $800 million firm to $4.5 billion over 6 years (1990-1995)

Current Public Board Positions

●

Vice Chairman, Esquire Financial Holdings, Inc.

●

AudioEye, Inc.

|

Select Past Public Board Positions

●

Chairman, Cyberonics

●

Chairman, Circus Circus Enterprises (now MGM Mirage)

●

Chairman, ICF Kaiser International, Inc.

●

Warren Resources, Inc.

Other Positions

●

Former Chairman and current Board member of the Epilepsy Foundation

Education

●

Loyola University Los Angeles

|

|

Lead Independent

Director

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Jakki L. Haussler

|

|

Independent

|

New Nominee

|

Age: 60

|

If Elected

Term Expires: 2019

|

Primary Qualifications:

|

|

|

|

|

Occupation

● Founder and CEO, Opus Capital Management (since 1996), an

independent registered investment

advisor, providing investment

solutions to institutions and high-

net worth individuals

Prior Business Experience

● Managing Director, Capvest

Venture Fund, LP (2000 - 2011) a

private equity fund for growth and

expansion stage companies

● Partner, Adena Ventures, LP

(1999 - 2010) a private equity fund targeting underserved markets

|

Current Public Board Positions

● Cincinnati Bell Inc.

● Morgan Stanley Funds

Other Positions

● Member, Board of Directors, The Victory Funds

● Member, Board of Directors, Best Transportation, a transportation management software company

● Member/Founder, Chase College of Law, Transaction Law Practice Center

● Board of Visitors, Chase College of Law

● Member, Northern Kentucky University Foundation Investment Committee

|

Education

● University of Cincinnati

● Salmon P. Chase College of Law, Northern Kentucky University

|

13

www.sciannualmeeting.com

CORPORATE GOVERNANCE AT SERVICE CORPORATION INTERNATIONAL

|

|

|

|

|

|

|

|

|

|

|

|

Sara Martinez Tucker

|

|

Independent

|

New Nominee

|

Age: 62

|

If Elected

Term Expires: 2021

|

Primary Qualifications:

|

|

|

|

|

Occupation

● Former Chief Executive Officer, National Math + Science Initiative, a non-profit organization to improve student performance in STEM (Science, Technology, Engineering, and Math) subjects

Prior Business Experience

● Vice President, AT&T (1997-2006)

|

Current Public Board Positions

● Sprint Corporation

● Xerox Corporation

● American Electric Power

Other Positions

● Chairman, University of Texas System Board of Regents

● Member, University of Notre Dame’s Board of Trustees

● Former Under Secretary of Education in the U.S. Department of Education

|

Education

● University of Texas at Austin

● McCombs School of Business (MBA) - University of Texas at Austin

|

|

|

|

|

|

|

|

|

|

|

|

|

Marcus A.

Watts

|

|

Independent

|

Director Since:

2012

|

Age:

59

|

If Elected

Term Expires:

2021

|

Primary

Qualifications:

|

|

|

|

|

Occupation

●

President, The Friedkin Group (since 2011), an umbrella company overseeing various business interests that are principally automotive related

Prior Business Experience

●

Vice Chairman and Managing Partner-Houston, Locke Lord LLP (1984-2010) with a focus on corporate and securities law, governance, and related matters

|

Current Public Board Positions

●

Cabot Oil & Gas Corporation

Current Other Board Positions

●

Board Chair, Federal Reserve Bank of Dallas (Houston Branch)

●

Board member, Highland Resources, Inc. (private real estate company)

●

Chairman, Greater Houston Partnership

●

Chairman, Board of Trustees, United Way of Greater Houston

|

Past Public Company Boards

●

Complete Production Services, Inc. (2007-2012) acquired by Superior Energy Services

●

Cornell Companies (2001-2005)

Education

●

Texas A&M University

●

Harvard Law School

|

|

|

|

|

|

|

|

|

|

|

|

|

Edward E.

Williams

|

|

Independent

|

Director Since:

1991

|

Age:

72

|

If Elected

Term Expires:

2021

|

Primary

Qualifications:

|

|

|

|

|

Occupation

●

Professor Emeritus of Entrepreneurship (since 2014), Rice University, Houston, TX

Prior Academic Experience

●

Henry Gardiner Symonds Professor, Professor of Statistics and Administrative Science (1978-2014)

●

Founded Rice University’s Entrepreneurship program in 1978, now one of the top such programs in the world

●

Associate Professor of Finance, McGill University (1970-1973)

●

Assistant Professor of

Economics, Rutgers University

(1968-1970)

|

Prior Business Experience

●

Founder and CEO, First Texas Venture Capital Corporation (1983-1992)

●

Texas Capital Investment Advisors, Inc. (1980-1995)

●

Trust Corporation International (1979-1986)

Other Academic Experience

●

2016 Entrepreneurship Educator of the Year Award, lifetime award presented by the U.S. Association for Small Business and Entrepreneurship

|

●

Author or co-author of 13 books and over 50 scholarly articles in Entrepreneurship, Finance, Economics, and Accounting including seminal critical analyses of the Efficient Market Hypothesis (initiated 45 years ago)

Education

●

Wharton School, University of Pennsylvania

●

PhD, (Finance and Accounting) University of Texas at Austin

|

14

www.sciannualmeeting.com

CORPORATE GOVERNANCE AT SERVICE CORPORATION INTERNATIONAL

|

|

|

|

|

|

|

|

|

|

|

|

Continuing Directors

|

|

|

|

|

|

|

Alan R. Buckwalter

|

|

Independent

|

Director Since:

2003

|

Age:

71

|

Term Expires:

2019

|

Primary Qualifications:

|

|

|

|

|

Occupation

●

Former Chairman and CEO, Chase Bank of Texas

Prior Business Experience

●

Chairman, J.P. Morgan Chase Bank, South Region (1995-2003)

●

President of Texas Commerce Bank (1990-1995)

●

Held various positions at Chemical Bank in corporate division (1970-1990)

|

Other Positions

●

Board member, Texas Medical Center

●

Chairman Emeritus and Board member, Central Houston, Inc.

Past Public Company Boards

●

Freeport-McMoRan, Inc. (2013-2015)

●

Plains Exploration and Production (2003-2013); subsequently acquired by Freeport-McMoRan, Inc.

|

Other Prior Positions

●

Board of Directors, Federal Reserve Bank of Dallas (Houston Branch)

Education

●

Fairleigh Dickinson University

|

|

|

|

|

|

|

|

|

|

|

|

|

Victor L.

Lund

|

|

Independent

|

Director Since:

2000

|

Age:

70

|

Term Expires:

2019

|

Primary Qualifications:

|

|

|

|

|

Occupation

●

President and CEO (May 2016), Teradata Corporation

Prior Business Experience

●

Chairman, DemandTec, a software company (2006-2012)

●

Chairman, Mariner Healthcare, Inc. (2002-2004)

●

Vice Chairman, Albertsons, Inc. (1999-2002)

|

●

22-year career with American Stores Company in various positions including Chairman, CEO, CFO and Corporate Controller 1977-1999

●

Audit CPA, Ernst & Ernst 1972-1977

Current Public Board Positions

●

Teradata Corporation, an information technology company

|

Past Public Company Boards

●

DemandTec

●

Delta Airlines

●

Del Monte Foods, Inc.

●

Mariner Healthcare, Inc.

●

Albertsons, Inc.

●

American Stores Company

●

NCR Corporation

Education

●

The University of Utah

●

MBA The University of Utah

|

|

|

|

|

|

|

|

|

|

|

|

|

John W.

Mecom, Jr.

|

|

Independent

|

Director Since:

1983

|

Age:

78

|

Term Expires:

2019*

|

Primary Qualifications:

|

|

|

|

|

Occupation

●

Independent businessman who bought, developed, managed, and sold a variety of real estate and other business interests

Prior Business Experience

●

Principal owner, John Gardiner’s Tennis Ranch (2000-2011)

●

Owner, Rhino Pak, a contract blender and packer for the petroleum industry (2003-2007)

|

●

Chairman, John W. Mecom Company, primarily an oil and gas company (1976-2003)

●

Owner of New Orleans Saints NFL team (1967-1985)

●

Owner of Mecom Racing Team, which managed several Formula One racing teams - Indianapolis and Cam Am Series (1960-1967)

●

Hotel management, Houston International Hotels and Preferred Hotels Organization (1964-1985)

|

Education

●

University of Oklahoma

|

*

John W. Mecom, Jr. has informed the Company he will not run for re-election when his term expires at the annual meeting in 2019.

15

www.sciannualmeeting.com

CORPORATE GOVERNANCE AT SERVICE CORPORATION INTERNATIONAL

|

|

|

|

|

|

|

|

|

|

|

|

Clifton H.

Morris, Jr.

|

|

Independent

|

Director Since:

1990

|

Age:

82

|

Term Expires:

2020

|

Primary

Qualifications:

|

|

|

|

|

Occupation

●

Chairman and CEO of JBC Funding, a corporate lending and investment firm

Prior Business Experience

●

Founder and Chairman, AmeriCredit Corp., financing of automotive vehicles (1988-2010); sold in 2010 and now GM Financial

●

CFO, Cash America International (1984-1988)

|

●

VP of Treasury and other financial positions at SCI (1966-1971)

Other Positions

●

CPA, 56 years

●

Lifetime member of the Texas Society of Certified Public Accountants

●

Honorary member of the American Institute of Certified Public Accountants

|

Past Public Company Boards

●

AmeriCredit Corp.

●

Cash America International

Education

●

University of Texas at Austin

|

|

|

|

|

|

|

|

|

|

|

|

|

Ellen

Ochoa

|

|

Independent

|

Director Since:

2015

|

Age:

59

|

Term Expires:

2019

|

Primary Qualifications:

|

|

|

|

|

Occupation

●

Director of NASA Johnson Space Center (since 2013)

Prior Business Experience

●

Government Executive, Astronaut at NASA Johnson Space Center (1990-2012); first Hispanic female astronaut with nearly 1,000 hours in space

●

Branch Chief and Research Engineer, NASA Ames Research Center (1988-1990), led a group working primarily on optical systems for automated space exploration

|

●

Researcher, Sandia National Laboratories (1985-1988), investigated optical systems for performing information processing

Other Positions

●

Member, Board of Directors, Federal Reserve Bank of Dallas

●

Member, National Science Board

●

Chair, Nomination Committee, National Medal of Technology & Innovation

●

Fellow, American Institute of Aeronautics and Astronautics

●

Member, Board of Directors, Mutual of America

|

●

Fellow, American Association for the Advancement of Science

●

Director Emerita, former Vice Chair, Manned Space Flight Education Foundation

●

Former Board of Trustees, Stanford University

Education

●

San Diego State University

●

MS, PhD (Electrical Engineering), Stanford University

|

|

|

|

|

|

|

|

|

|

|

|

|

Thomas L.

Ryan

|

|

Non-Independent

|

Director Since:

2004

|

Age:

52

|

Term Expires:

2020

|

Primary Qualifications:

|

|

|

|

|

Occupation

●

Chairman (since 2016) and CEO (since 2005) of SCI

Prior Business Experience

●

President, SCI (2002-2015)

●

CEO European Operations, SCI (2000-2002)

●

Variety of financial management roles, SCI (1996-2000)

|

Current Public Board Positions

●

Weingarten Realty Investors

●

Chesapeake Energy

Other Positions

●

Board of Trustees, United Way of Greater Houston

●

Board of Directors, Genesys Works

●

Board member, University of Texas McCombs Business School Advisory Council

|

Past Public Company Boards

●

Texas Industries

Education

●

University of Texas at Austin

|

|

|

|

|

|

|

|

|

|

|

|

|

W. Blair

Waltrip

|

|

Non-Independent

|

Director Since:

1986

|

Age:

63

|

Term Expires:

2020

|

Primary

Qualifications:

|

|

|

|

|

Occupation

●

Independent Consultant, Family and Trust Investments, and Former Senior Executive of SCI

Prior Business Experience

●

Various positions at SCI including VP of Corporate Development, SVP of Funeral Operations, EVP of SCI’s real estate division, Chairman and CEO of SCI Canada, and EVP of SCI (1977-2000)

|

Other Positions

●

Treasurer, National Museum of Funeral History

●

Active real estate broker

Past Public Company Boards

●

Sanders Morris Harris Group, Inc (Edelman Financial)

|

Education

●

Sam Houston State University

|

16

www.sciannualmeeting.com

CORPORATE GOVERNANCE AT SERVICE CORPORATION INTERNATIONAL

|

|

|

|

|

Director Ownership of SCI Stock

|

Stock ownership has a critical role in aligning the interests of Directors with those of our shareholders. The Company's Corporate Governance Guidelines contain a policy to encourage the Directors to own SCI stock. Under the guidelines presently in effect, each Director’s SCI stock ownership should be at least a value of $500,000 within five years of the Director’s initial election to the Board. Measurement of stock ownership against the guidelines will be calculated once a year based on valuation of the

shares held at year end utilizing the closing price of SCI common stock on the last trading day of the year ($37.32 per share at December 29, 2017 or a minimum shareholding of 13,398 shares). All members of the Board are above the minimum guideline. The following graphic presents the current holdings, excluding stock options, for our Directors as of March 26, 2018. (Further details are provided in the tables of Director and officer shareholdings listed under “Voting Securities and Principal Holders”).

|

|

|

|

|

Consideration of Director Nominees

|

The Nominating and Corporate Governance Committee considers candidates for Board membership suggested by its members and other Board members, as well as management and shareholders. In the past, the Committee has retained a third-party executive search firm to identify candidates. A shareholder who wishes to recommend a prospective nominee for the Board should notify the Company’s Secretary in writing with whatever supporting material the shareholder considers appropriate. To be considered, the written recommendation from a shareholder must be received by the Company’s Secretary at least 120 calendar days prior to the anniversary of the release date of the Company’s prior year Proxy Statement for the Annual Meeting of Shareholders.

The Committee also considers such other relevant factors as it deems appropriate, including the current composition of the Board, the balance of management and independent Directors, the need for particular areas of expertise, and the evaluations of other prospective nominees. After completing this process, the Committee makes nomination recommendations to the full Board. The Board determines the nominees after considering the recommendation and report of the Committee.

Once the Nominating and Corporate Governance Committee has identified a prospective nominee, the

Committee will consider the available information concerning the nominee, including the Committee’s own knowledge of the prospective nominee, and may seek additional information or an interview. If the Committee determines that further consideration is warranted, the Committee will then evaluate the prospective nominee against the standards and qualifications set out in the Company’s Corporate Governance Guidelines. The Company’s Corporate Governance Guidelines include personal characteristics and collective core competencies. The personal characteristics sought in prospective candidates include the following:

|

|

|

|

•

|

Integrity, character, and accountability

|

|

|

|

|

•

|

Ability to provide wise and thoughtful counsel on a broad range of issues

|

|

|

|

|

•

|

Financial literacy and ability to read and understand financial statements and other indices of financial performance

|

|

|

|

|

•

|

Ability to work effectively with mature confidence as part of a team

|

|

|

|

|

•

|

Ability to provide counsel to management in developing creative solutions and in identifying innovative opportunities

|

|

|

|

|

•

|

Commitment to prepare for and attend meetings and to be accessible to management and other Directors

|

17

www.sciannualmeeting.com

CORPORATE GOVERNANCE AT SERVICE CORPORATION INTERNATIONAL

The core competencies of the Board as a whole should be aligned with the corporate strategy of SCI and may change over time. Currently the collective competencies considered include:

•

Accounting and finance

•

Industry knowledge

•

Strategic insight

•

Understanding and fostering leadership

•

Business judgment and management expertise

•

Diverse experiences and backgrounds

The Board conducted an annual review and affirmatively determined that 8 of the current 11 Directors are “independent” as defined by the standards of the NYSE and SCI’s Corporate Governance Guidelines. Two of the Directors, Tom Ryan and R.L. Waltrip, are considered non-

independent because of their employment as senior executives of the Company. Blair Waltrip is considered a non-independent Director because he is the son of the founder and Chairman Emeritus, R.L. Waltrip.

|

|

|

|

|

Change in Leadership Structure

|

Effective January 1, 2016, we implemented a new leadership structure. After 53 years, Mr. R.L. Waltrip stepped aside as Chairman and the Board appointed current CEO, Mr. Tom Ryan, as Chairman. Simultaneously, the Board appointed Mr. Tony Coelho as Lead Independent Director in a newly created role. In 2018, we strengthened our Lead Director responsibilities by making provisions to the Company's Bylaws to permit the Lead Director to call a special meeting of the Board and preside over Board meetings in the absence of the Board Chair.