By Steven Russolillo

The clobbering tech shares have taken in recent days has

magnified not only how influential these companies have become in

people's everyday lives, but how much sway they have gained in

global stock markets.

The NYSE FANG+ Index -- which tracks 10 global tech

heavyweights, including Facebook Inc., Apple Inc. and China's

Alibaba Group Holding -- continued falling Wednesday after

suffering on Tuesday its worst one-day drop in data going back to

September 2014.

Investors' concern is that these companies have in recent years

grown so much and so fast that they now have outsize influence on

broader stock indexes, such as the S&P 500 and the Nasdaq

Composite. Their rapid gains have come alongside heavy inflows into

passive funds that track these indexes, leaving millions of

investors susceptible to greater downside should tech stocks

struggle more.

In the U.S., Facebook has been the worst performer among tech

giants, falling 13% this year amid controversy over how it handles

users' data. Chief Executive Mark Zuckerberg expects to testify

before Congress about the company's privacy and data-use standards,

in what would be his first public testimony before lawmakers.

Shares of Apple Inc. and Google parent Alphabet Inc. are also

down for the year, faltering in recent weeks on concerns that tech

firms face tighter regulation.

Amazon.com Inc. and Tesla Inc., both components of the NYSE

FANG+ Index, were among the weakest performers Wednesday. Amazon

fell 4.7% and is on pace to close in correction territory amid

speculation that the White House wants to clamp down on the

e-commerce giant's growing dominance.

Tesla, meanwhile, slumped 7.2%, extending its Tuesday's tumble,

amid an investigation into a fatal Tesla crash and following a

Moody's Investors Service rating downgrade on the electric auto

maker's debt. Selling in Telsa bonds also intensified, driving

prices to fresh lows.

The tech-heavy Nasdaq Composite has moved at least 2% in four

straight trading sessions through Tuesday, the longest such streak

since October 2011 -- a contrast from last year, when major global

stock indexes like the Nasdaq were unusually calm.

The declines illustrate a rapid shift in investor confidence in

the sector, which until recently had been a reliable generator of

big returns and a major driver of the market's run. It isn't yet

clear whether the selloff marks a permanent shift in the market's

leadership, or a temporary hit to the companies' reputations.

Up until recently "these...names have been as close as one can

get to a stabilizing force in the market," said Mike O'Rourke,

chief market strategist at U.S. brokerage firm JonesTrading.

As of March 12, Facebook, Amazon, Apple, Microsoft Corp. and

Alphabet had accounted for 45% of the S&P 500's year-to-date

gain, he said, indicating just how central they have become to

index moves.

Facebook, Amazon, Netflix Inc. and Alphabet together account for

a 7.8% weighting in the S&P 500, more than double from five

years ago. The overall tech sector now has a 26.8% weight in the

S&P 500, making it by far the largest component. Financial

stocks, in second place, account for 16.8%, according to Thomson

Reuters.

Should big tech stocks falter further, the broader market could

follow suit.

"Due to Facebook's privacy scandal, the techlash theme has been

gaining momentum," Mr. O'Rourke said. "Since consumer privacy data

is the key competitive edge of these companies, it means the level

of risk and uncertainty has risen."

For sure, plenty of investors remain confident tech companies

can maintain strong growth rates.

Nearly 90% of U.S. tech companies beat consensus revenue

estimates in the fourth quarter, noted Toni Sacconaghi, a tech

analyst at Sanford C. Bernstein. That is the best beat rate for any

sector and the highest for tech companies in the past five

years.

And expectations for tech spending growth for 2018 were the

highest in the 14-year history of a Bernstein survey of chief

information officers.

The tech sector's growing clout isn't just a U.S. story. Tech

stocks have become so dominant in emerging markets that for the

first time since 2004, the industry last year overtook finance as

the biggest sector in the MSCI Emerging Markets Index.

Tech had a 28% weighting near the end of 2017, more than double

its level six years ago, according to data provided by MSCI.

Samsung Electronics Co. carries a roughly one-fourth weighting

in South Korea's benchmark Kospi stock index. As the country's

biggest exporter, it has fallen 4.4% this year, largely due to

concerns about heightened global trade tensions.

Asia's most valuable company, Tencent Holdings Ltd., holds

nearly a 10% weighting in Hong Kong's Hang Seng Index. It is close

to slipping into the red for the year after disappointing earnings

last week and news that an early shareholder was selling a stake in

the Chinese internet giant. A two-day selloff last week wiped out

$52 billion of the company's market value.

Tencent had more than doubled last year, catapulting its market

value above $500 billion.

The company's sheer size has prompted caution among some

investors. Eric Moffett, a portfolio manager for T. Rowe Price in

Hong Kong, said his fund has owned shares since he started managing

it in 2014.

But the fund has underweighted Tencent for the past six months

due to valuation concerns, he said. He said shares, trading at 40

times projected earnings, look "priced for perfection" -- which can

prompt sharp pullbacks, like that seen last week.

Write to Steven Russolillo at steven.russolillo@wsj.com

(END) Dow Jones Newswires

March 28, 2018 14:14 ET (18:14 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

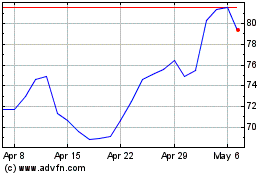

Alibaba (NYSE:BABA)

Historical Stock Chart

From Mar 2024 to Apr 2024

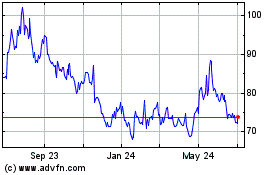

Alibaba (NYSE:BABA)

Historical Stock Chart

From Apr 2023 to Apr 2024