As filed with the Securities and Exchange Commission on March 23, 2018

Registration No. 333-

UNITED STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

S-8

REGISTRATION STATEMENT

Under

The

Securities Act of 1933

Adverum Biotechnologies, Inc.

(Exact name of Registrant as specified in its charter)

|

|

|

|

|

Delaware

|

|

20-5258327

|

|

(State or other jurisdiction of

incorporation or organization)

|

|

(I.R.S. Employer

Identification Number)

|

1035 O’Brien Drive

Menlo Park, California 94025

(Address, including zip code, of Registrant’s principal executive offices)

2014 Equity Incentive Award Plan

2014 Employee Stock Purchase Plan

Inducement Restricted Stock Unit Awards

(Full title of the plans)

Jennifer Cheng

Vice President and General Counsel

Adverum Biotechnologies, Inc.

1035 O’Brien Drive

Menlo Park, CA 94025

(650)

272-6269

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

Jodie

Bourdet

Cooley LLP

101 California Street, 5th Floor

San Francisco, CA 94111-5800

(415)

693-2000

Indicate by

check mark whether the registrant is a large accelerated filer, an accelerated filer, a

non-accelerated

filer, a smaller reporting company, or an emerging growth company. See definitions of “large

accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in

Rule 12b-2

of the Exchange Act.

|

|

|

|

|

|

|

|

|

Large accelerated filer

|

|

☐

|

|

Accelerated filer

|

|

☒

|

|

Non-accelerated filer

|

|

☐ (Do not check if a smaller reporting company)

|

|

Smaller reporting company

|

|

☐

|

|

|

|

|

|

Emerging growth company

|

|

☒

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period

for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☒

CALCULATION OF REGISTRATION FEE

|

|

|

|

|

|

|

|

|

|

|

|

|

Title of Securities

to be Registered

|

|

Amount

to be

Registered(1)

|

|

Proposed

Maximum

Offering Price

Per Share(2)

|

|

Proposed

Maximum

Aggregate

Offering Price

|

|

Amount of

Registration Fee

|

|

Common Stock, par value $0.0001 per share

|

|

|

|

|

|

|

|

|

|

2014 Equity Incentive Award Plan

|

|

1,960,613 shares

|

|

$6.364

|

|

$12,477,341

|

|

$1,553.43

|

|

2014 Employee Stock Purchase Plan

|

|

490,153 shares

|

|

$6.364

|

|

$3,119,334

|

|

$388.36

|

|

Inducement Restricted Stock Unit Awards (3)

|

|

225,000 shares

|

|

$6.364

|

|

$1,431,900

|

|

$178.27

|

|

TOTAL

|

|

2,675,766 shares

|

|

|

|

$17,028,575

|

|

$2,120.06

|

|

|

|

|

|

(1)

|

Pursuant to Rule 416 promulgated under the Securities Act of 1933, as amended (the “Securities Act”), this Registration Statement shall also cover any additional shares of the Registrant’s Common Stock

that become issuable under the plan or inducement award set forth herein by reason of any stock dividend, stock split, recapitalization or other similar transaction effected without receipt of consideration that increases the number of outstanding

shares of the Registrant’s Common Stock.

|

|

(2)

|

Estimated solely for the purpose of calculating the amount of the registration fee pursuant to Rule 457(h) and Rule 457(c) promulgated under the Securities Act. The offering price per share and the aggregate offering

price are based upon the average of the high and low prices of the Registrant’s Common Stock as reported on The Nasdaq Global Select Market on March 21, 2018.

|

|

(3)

|

Consists of shares of the Registrant’s Common Stock underlying restricted stock units granted to employees as an inducement material to acceptance of employment with the Registrant, in accordance with the

inducement grant exception under Nasdaq Rule 5635(c)(4). These shares are being offered for resale by two selling stockholders named in the prospectus included in and filed with this Registration Statement.

|

Explanatory Note

This Registration Statement on Form

S-8

(this “Registration Statement”) registers an

aggregate of: 1,960,613 shares of the common stock, par value $0.0001 per share, of Adverum Biotechnologies, Inc. (“Common Stock”) that may be issued and sold under the Adverum Biotechnologies, Inc. 2014 Equity Incentive Award Plan

(“2014 EIAP”); 490,153 shares of the Common Stock that may be issued and sold under the Adverum Biotechnologies, Inc. 2014 Employee Stock Purchase Plan (“2014 ESPP”); and 225,000 shares of the Common Stock that may be issued and

sold pursuant to restricted stock units granted to employees as an inducement material to acceptance of employment with the Registrant, in accordance with the inducement grant exception under Nasdaq Rule 5635(c)(4).

This Registration Statement also includes a prospectus (the “Reoffer Prospectus”) prepared in accordance with General Instruction C

of Form

S-8

and in accordance with the requirements of Part I of Form

S-3.

This Reoffer Prospectus may be used for reofferings and resales of shares of Common Stock that

may be deemed to be “restricted securities” under the Securities Act of 1933, as amended (the “Securities Act”), and the rules and regulations promulgated thereunder that have been or may be acquired by certain of our officers

pursuant to outstanding restricted stock units, being the Selling Stockholders identified in the Reoffer Prospectus. The number of shares of Common Stock included in the Reoffer Prospectus represents the total number of shares of Common Stock that

may be acquired by the Selling Stockholders pursuant to inducement awards made to the Selling Stockholders in accordance with the inducement grant exception under Nasdaq Rule 5635(c)(4), and does not necessarily represent a present intention to sell

any or all such shares of Common Stock.

REOFFER PROSPECTUS

Adverum Biotechnologies, Inc.

1035 O’Brien Drive

Menlo

Park, CA 94025

(650)

272-6269

225,000 SHARES OF COMMON STOCK

This

reoffer prospectus relates to 225,000 shares of our common stock, par value $0.0001 per share (“Common Stock”), that may be offered and resold from time to time by the selling stockholders named in this reoffer prospectus for their own

account. Eligible Participants in our Plans consist of employees, directors, officers and consultants of our company or its related entities. The selling stockholders are “affiliates” of our company (as defined in Rule 405 under the

Securities Act of 1933, as amended (the “Securities Act”)).

The selling stockholders may offer and sell their shares of Common Stock at various

times and in various types of transactions, including sales in the open market, sales in negotiated transactions and sales by a combination of these methods. Shares may be sold at the market price of the Common Stock at the time of a sale, at prices

relating to the market price over a period of time, or at prices negotiated with the buyers of shares. The shares may be sold through underwriters or dealers which the selling stockholders may select. If underwriters or dealers are used to sell the

shares, we will name them and describe their compensation in a prospectus supplement. For a description of the various methods by which the selling stockholders may offer and sell their Common Stock described in this prospectus, see the section

entitled “Plan of Distribution” of this prospectus. We will receive no part of the proceeds from sales made under this prospectus. The selling stockholders will bear all sales commissions and similar expenses. Any other expenses incurred

by us in connection with the registration and offering and not borne by the selling stockholders will be borne by us.

The shares of Common Stock will be

issued pursuant to awards granted to the selling stockholders and will be “restricted securities” under the Securities Act before their sale under this prospectus. This prospectus has been prepared for the purposes of registering the

shares under the Securities Act to allow for future sales by selling stockholders on a continuous or delayed basis to the public without restriction.

Our

Common Stock is traded on The Nasdaq Global Market under the symbol “ADVM.” On March 22, 2018, the last reported sale price for our Common Stock was $6.40 per share.

Our business and an investment in our securities involve a high degree of risk. Before making any investment in our securities, you should read and

carefully consider risks described in the “

Risk Factors

” section beginning on page 3 of this prospectus.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this

prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is

March 23, 2018

You should rely only on the information contained in this prospectus. We have not authorized any other person

to provide you with information that is different from that contained in this prospectus. If anyone provides you with different or inconsistent information, you should not rely on it. We take no responsibility for, and can provide no assurance as to

the reliability of, any other information that others may give you. The selling stockholders are offering to sell and seeking offers to buy these securities only in jurisdictions where offers and sales are permitted. You should assume that the

information contained in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or of any sale of our Common Stock. Our business, financial condition, results of operations and

prospects may have changed since that date. We are not making an offer of any securities in any jurisdiction where the offer is not permitted.

TABLE OF CONTENTS

PROSPECTUS SUMMARY

The following summary highlights information contained elsewhere in this prospectus. This summary is not complete and does not contain all of the

information that should be considered before investing in our Common Stock. Potential investors should read the entire prospectus carefully, including the more detailed information regarding our business provided below in the “Description of

Business” section and the risks of purchasing our Common Stock discussed under the “Risk Factors” section.

Except as otherwise

indicated herein or as the context otherwise requires, references in this prospectus to “Adverum,” “the company,” “we,” “us,” “our” and similar references refer to Adverum Biotechnologies, Inc., a

corporation under the laws of the State of Delaware, and its wholly owned subsidiaries.

All brand names or trademarks appearing in this prospectus are

the property of their respective holders. Use or display by us of other parties’ trademarks, trade dress, or products in this prospectus is not intended to, and does not, imply a relationship with, or endorsements or sponsorship of, us by the

trademark or trade dress owners.

Overview

We are a

clinical-stage gene therapy company targeting unmet medical needs in serious rare and ocular diseases. Leveraging our next-generation adeno-associated virus (“AAV”)-based directed evolution platform, we generate gene therapy product

candidates designed to provide durable efficacy by inducing sustained expression of a therapeutic protein. Our core capabilities include clinical development and

in-house

manufacturing expertise, specifically

in process development, assay development, and current Good Manufacturing Practices (“cGMP”) quality control. Our leadership team has significant drug development and gene therapy expertise.

We are advancing our robust pipeline of gene therapy product candidates designed to treat rare diseases,

alpha-1

antitrypsin (“A1AT”) deficiency and hereditary angioedema (“HAE”), as well as wet

age-related

macular degeneration (“wAMD”).

Our earlier-stage research programs include gene therapy product candidates targeting cardiomyopathy associated with Friedreich’s ataxia (“FA”)

and severe allergy.

Our partnered programs include vectors we are developing under collaboration agreements. Under an agreement with Editas Medicine,

Inc. (“Editas”) we are leveraging our

AAV-vectors

for use with Editas’ leading Clustered Regularly Interspaced Short Palindromic Repeats (“CRISPR”)-based genome editing technologies to

treat up to five inherited retinal diseases. Our agreement with Regeneron Pharmaceuticals, Inc. (“Regeneron”) provides for development of up to eight distinct ocular therapeutic targets, and includes

AVA-311

for the treatment of juvenile

X-Linked

Retinoschisis (“XLRS”).

About This Offering

This prospectus relates to the

public offering, which is not being underwritten, by the selling stockholders listed in this prospectus, of up to 225,000 shares of our Common Stock. Of the shares being offered, none of which are currently issued and outstanding. The shares offered

by this prospectus may be sold by the selling stockholders from time to time in the open market, through negotiated transactions or otherwise at market prices prevailing at the time of sale or at negotiated prices. We will receive none of the

proceeds from the sale of the shares by the selling stockholders. We will bear all expenses of registration incurred in connection with this offering, but all selling and other expenses incurred by the selling stockholders will be borne by them.

Selected Risks Associated with an Investment in Shares of Our Common Stock

Our business is subject to numerous risks. You should read these risks before you invest in our common stock. In particular, our risks include, but are

not limited to, the following:

|

•

|

|

We have incurred significant operating losses since inception, and we expect to incur significant losses for the foreseeable future. We may never become profitable or, if achieved, be able to sustain profitability;

|

1

|

•

|

|

We will need to raise additional funding, which may not be available on acceptable terms, or at all. If we fail to obtain additional capital necessary to fund our operations, we will be unable to successfully develop

and commercialize our product candidates;

|

|

•

|

|

Our business will depend substantially on the success of one or more of our lead product candidates:

ADVM-043,

which is in early clinical development; and

ADVM-053

and

ADVM-022,

which are still in preclinical development. If we are unable to obtain regulatory approval for, or successfully commercialize, any or all of our lead

product candidates, our business will be materially harmed;

|

|

•

|

|

We have relied, and expect to rely, on third parties to conduct some or all aspects of our vector production, product manufacturing, protocol development, research and preclinical testing, and these third parties may

not perform satisfactorily;

|

|

•

|

|

We may not be successful in our efforts to identify or discover additional product candidates;

|

|

•

|

|

Except for our recently-initiated ADVANCE Phase 1/2 trial, we have not tested any of our internally-developed viral vectors or product candidates in clinical trials;

|

|

•

|

|

Preliminary and interim data from our clinical trials that we may announce or publish from

time-to-time

may change as patient data becomes

available;

|

|

•

|

|

The results of preclinical studies and early clinical trials are not always predictive of future results. Any product candidate we or any of our future development partners advance into clinical trials may not have

favorable results in later clinical trials, if any, and may not receive regulatory approval;

|

|

•

|

|

Our product candidates are subject to extensive regulation, compliance with which is costly and time consuming, and such regulation may cause unanticipated delays or prevent the receipt of the required approvals to

commercialize our product candidates; and

|

|

•

|

|

We may not be successful in establishing and maintaining development or other strategic collaborations, which could adversely affect our ability to develop and commercialize product candidates and receive potential

milestone payments.

|

Corporate Information

We were incorporated in Delaware in 2006 under the name “Avalanche Biotechnologies, Inc.” We completed the initial public offering of our common

stock in August 2014. On May 11, 2016, upon the completion of our acquisition of Annapurna, we changed our name to “Adverum Biotechnologies, Inc.” Our common stock is currently listed on The Nasdaq Global Market under the symbol

“ADVM.” We are an “emerging growth company” under the Jumpstart Our Business Startups Act of 2012 (JOBS Act), and therefore we are subject to reduced public company reporting requirements.

Our principal executive offices are located at 1035 O’Brien Drive, Menlo Park, CA 94025, and our telephone number is

(650) 272-6269.

Our internet address is www.adverum.com. The information on our website is not incorporated by reference into this prospectus and should not be considered to be a part of this prospectus.

Our internet address is included in this prospectus as an inactive textual reference only.

2

RISK FACTORS

An investment in shares of our Common Stock is highly speculative and involves a high degree of risk. We face a variety of risks that may affect our

operations or financial results and many of those risks are driven by factors that we cannot control or predict. Before investing in our Common Stock, you should carefully consider the risks set forth under the caption “Risk Factors” in

our Annual Report on Form

10-K

for the year ended December 31, 2017, filed with the Securities and Exchange Commission on March 6, 2018, and subsequent reports on Form

10-Q,

together with the financial and other information contained or incorporated by reference in this prospectus. If any of these risks actually occurs, our business, prospects, financial condition and

results of operations could be materially adversely affected. In that case, the trading price of our Common Stock would likely decline and you may lose all or a part of your investment. Only those investors who can bear the risk of loss of their

entire investment should invest in our Common Stock.

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

Some of the statements in this prospectus and the documents incorporated by reference are forward-looking statements within the meaning of

Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These statements are based on our current expectations, assumptions, estimates and projections about our business

and our industry and involve known and unknown risks, uncertainties and other factors that may cause our company’s or our industry’s results, levels of activity, performance or achievements to be materially different from any future

results, levels of activity, performance or achievements expressed or implied in, or contemplated by, the forward-looking statements. Forward-looking statements may include, but are not limited to, statements about:

|

•

|

|

the initiation, progress, timing, costs and results of preclinical studies and any clinical trials for our product candidates;

|

|

•

|

|

our ability to further improve our process development capabilities and viral vector technology;

|

|

•

|

|

the timing or likelihood of regulatory filings and approvals;

|

|

•

|

|

our plans to explore potential applications of our gene therapy platform in other indications in ophthalmology and rare diseases;

|

|

•

|

|

our expectations regarding the clinical effectiveness and safety and tolerability of our product candidates;

|

|

•

|

|

our commercialization, marketing and manufacturing capabilities and strategy;

|

|

•

|

|

the pricing and reimbursement of our product candidates, if approved;

|

|

•

|

|

our expectation regarding the potential market sizes for our product candidates;

|

|

•

|

|

our intellectual property position;

|

|

•

|

|

the potential benefits of our strategic collaborations, our plans with respect to our strategic collaborations and our plans with respect to and our ability to enter into strategic arrangements;

|

|

•

|

|

developments and projections relating to our competitors and our industry;

|

|

•

|

|

our expectations regarding the time during which we will be an “emerging growth company” under the JOBS Act;

|

|

•

|

|

our estimates regarding expenses, future revenue, capital requirements and needs for additional financing; and

|

|

•

|

|

the safety, efficacy and projected development timeline and commercial potential of any product candidates.

|

In some cases, you can identify forward-looking statements by terms such as “may,” “will,” “should,” “could,”

“would,” “expects,” “plans,” “anticipates,” “believes,” “estimates,” “projects,” “predicts,” “potential” and similar expressions intended to identify

forward-looking statements. These statements reflect our current views with respect to future events and are based on assumptions and are subject to risks and uncertainties. Given these uncertainties, you should not place undue reliance on these

forward-looking statements. We discuss in greater detail many of these risks under the heading “Risk Factors” contained, or incorporated by reference, in this prospectus. Also, these forward-looking statements represent our estimates and

assumptions only as of the date of the document containing the applicable statement. Unless required by law, we undertake no obligation to update or revise any forward-looking statements to reflect new information or future events or developments.

Thus, you should not assume that our silence over time means that actual events are bearing out as expressed or implied in such forward-looking statements. You should read this prospectus together with the documents we have filed with the SEC that

are incorporated by reference completely and with the understanding that our actual future results may be materially different from what we expect. We qualify all of the forward-looking statements in the foregoing documents by these cautionary

statements.

3

In addition, statements that “we believe” and similar statements reflect our beliefs and opinions on

the relevant subject. These statements are based upon information available to us as of the date of this prospectus, and while we believe such information forms a reasonable basis for such statements, such information may be limited or incomplete,

and our statements should not be read to indicate that we have conducted an exhaustive inquiry into, or review of, all potentially available relevant information. These statements are inherently uncertain and investors are cautioned not to unduly

rely upon these statements.

DETERMINATION OF OFFERING PRICE

There currently is a limited public market for our Common Stock. The selling stockholders will determine at what price they may sell the offered shares, and

such sales may be made at prevailing market prices or at privately negotiated prices. See “Plan of Distribution” below for more information.

USE OF PROCEEDS

The shares of Common Stock offered hereby are being registered for the account of the selling stockholders named in this prospectus. As a result, all proceeds

from the sales of the Common Stock will go to the selling stockholders and we will not receive any proceeds from the resale of the Common Stock by the selling stockholders.

DESCRIPTION OF CAPITAL STOCK

The following description of our capital stock is intended as a summary only and therefore is not a complete description of our capital stock. This

description is based upon, and is qualified by reference to, our amended and restated certificate of incorporation, our amended and restated bylaws and applicable provisions of Delaware corporate law. You should read our amended and restated

certificate of incorporation and amended and restated bylaws, which have been publicly filed with the SEC, for the provisions that are important to you.

Authorized Capital Stock

Our authorized capital stock

consists of 305,000,000 shares, of which 300,000,000 shares are common stock, par value $0.0001 per share and 5,000,000 shares are preferred stock, par value $0.0001 per share.

Common Stock

Each holder of our common stock is entitled

to one vote for each share on all matters submitted to a vote of the stockholders, including the election of directors. In the election of directors, a plurality of the votes cast at a meeting of stockholders is sufficient to elect a director. Our

stockholders do not have cumulative voting rights in the election of directors. Accordingly, holders of a majority of the voting shares are able to elect all of the directors. In all other matters, except as noted below under “—Amendment

of our Amended and Restated Certificate of Incorporation or our Amended and Restated Bylaws” and “—Election and Removal of Directors” and except where a higher threshold is required by law, a majority of the votes cast

affirmatively or negatively (excluding abstentions and broker

non-votes)

will decide such matters.

Subject to

preferences that may be applicable to any then outstanding preferred stock, holders of our common stock are entitled to receive dividends, if any, as may be declared from time to time by our board of directors out of legally available funds.

In the event of our liquidation, dissolution or winding up, holders of our common stock will be entitled to share ratably in the net assets legally available

for distribution to stockholders after the payment of all of our debts and other liabilities and the satisfaction of any liquidation preference granted to the holders of any then outstanding shares of preferred stock.

Holders of our common stock have no preemptive, conversion, subscription or other rights, and there are no redemption or sinking fund provisions applicable to

our common stock. The rights, preferences and privileges of the holders of our common stock are subject to and may be adversely affected by the rights of the holders of shares of any series of preferred stock that we may designate in the future.

4

Preferred Stock

Our amended and restated certificate of incorporation authorizes our board of directors, without further action by our stockholders, to issue up to 5,000,000

shares of preferred stock in one or more series and to fix the rights, preferences, privileges and restrictions thereof. These rights, preferences and privileges could include dividend rights, conversion rights, voting rights, terms of redemption,

liquidation preferences, sinking fund terms and the number of shares constituting any series or the designation of such series, any or all of which may be greater than the rights of common stock. The issuance of our preferred stock could adversely

affect the voting power of holders of common stock and the likelihood that such holders will receive dividend payments and payments upon liquidation. In addition, the issuance of preferred stock could have the effect of delaying, deferring or

preventing a change of control of our company or other corporate action.

Anti-Takeover Effects of Provisions of our Amended and Restated Certificate

of Incorporation, our Amended and Restated Bylaws and Delaware Law

Delaware law and our restated certificate of incorporation and our amended and

restated bylaws contain provisions that could have the effect of delaying, deferring or discouraging another party from acquiring control of us. These provisions, which are summarized below, are expected to discourage coercive takeover practices and

inadequate takeover bids. These provisions are also designed to encourage persons seeking to acquire control of us to first negotiate with our board of directors.

Undesignated Preferred Stock

The ability to

authorize undesignated preferred stock makes it possible for our board of directors to issue preferred stock with voting or other rights or preferences that could impede the success of any attempt to change control of us. These and other provisions

may have the effect of deterring hostile takeovers or delaying changes in control or management of our company.

Stockholder Meetings

Our charter documents provide that a special meeting of stockholders may be called only by our board of directors, the chairman of our board of directors, our

Chief Executive Officer or, in the absence of a Chief Executive Officer, our President.

Requirements for Advance Notification of Stockholder

Nominations and Proposals

Our amended and restated bylaws establish advance notice procedures with respect to stockholder proposals and the

nomination of candidates for election as directors, other than nominations made by or at the direction of the board of directors or a committee of the board of directors.

Elimination of Stockholder Action by Written Consent

Our amended and restated certificate of incorporation eliminates the right of stockholders to act by written consent without a meeting.

Election and Removal of Directors

Our board of

directors is divided into three classes. The directors in each class will serve for a three-year term, one class being elected each year by our stockholders. This system of electing and removing directors may tend to discourage a third party from

making a tender offer or otherwise attempting to obtain control of us, because it generally makes it more difficult for stockholders to replace a majority of the directors. Our charter documents provide that directors may be removed only for cause

with the vote of holders of 66 2/3% of the voting power of all the then-outstanding shares of our voting stock.

Delaware Anti-Takeover Statute

We are subject to Section 203 of the Delaware General Corporation Law. Section 203 provides that, subject to certain exceptions, a

corporation shall not engage in any business combination with any “interested stockholder” for a three-year period following the time that such stockholder becomes an interested stockholder unless:

|

•

|

|

prior to such time, the board of directors of the corporation approved either the business combination or the transaction which resulted in the stockholder becoming an interested stockholder; or

|

5

|

•

|

|

upon consummation of the transaction which resulted in the stockholder becoming an interested stockholder, the interested stockholder owned at least 85% of the voting stock of the corporation outstanding at the time the

transaction commenced (excluding certain shares); or

|

|

•

|

|

at or subsequent to such time, the business combination is approved by the board of directors of the corporation and by the affirmative vote of at least 66 2/3% of the outstanding voting stock which is not owned by the

interested stockholder.

|

|

•

|

|

Except as specified in Section 203, an interested stockholder is generally defined as:

|

|

•

|

|

any person that is the owner of 15% or more of the outstanding voting stock of the corporation, or is an affiliate or associate of the corporation and was the owner of 15% or more of the outstanding voting stock of the

corporation, at any time within the three-year period immediately prior to the relevant date; and

|

|

•

|

|

the affiliates and associates of any such person.

|

Section 203 may make it more difficult for a person

who would be an “interested stockholder” to effect various business combinations with a corporation for a three-year period. We have not elected to be exempt from the restrictions imposed under Section 203. The provisions of

Section 203 may encourage persons interested in acquiring us to negotiate in advance with the board of directors, since the stockholder approval requirement would be avoided if a majority of the directors then in office approves either the

business combination or the transaction which results in any such person becoming an interested stockholder. Such provisions also may have the effect of preventing changes in our management. It is possible that such provisions could make it more

difficult to accomplish transactions which our stockholders may otherwise deem to be in their best interests.

Amendment of our Amended and Restated

Certificate of Incorporation or our Amended and Restated Bylaws

The amendment of any of the above provisions in our amended and restated

certificate of incorporation, except for the provision making it possible for our board of directors to issue preferred stock, or the amendment of any provision in our amended and restated bylaws (other than by action of the board of directors),

would require approval by holders of at least 66 2/3% of our then outstanding voting stock.

The provisions of the Delaware General Corporation Law, our

amended and restated certificate of incorporation and our amended and restated bylaws could have the effect of discouraging others from attempting hostile takeovers and, as a consequence, they may also inhibit temporary fluctuations in the market

price of our common stock that often result from actual or rumored hostile takeover attempts. These provisions may also have the effect of preventing changes in our management. It is possible that these provisions could make it more difficult to

accomplish transactions that stockholders may otherwise deem to be in their best interests.

Delaware as Sole and Exclusive Forum

Our amended and restated certificate of incorporation provide, that unless we consent in writing to an alternative forum, the Court of Chancery of the State of

Delaware shall, to the fullest extent permitted by law, be the sole and exclusive forum for (i) any derivative action or proceeding brought on behalf of us, (ii) any action asserting a claim of breach of a fiduciary duty owed by, or

otherwise wrongdoing by, any of our directors, officers or other employees to us or our stockholders, (iii) any action asserting a claim against us arising pursuant to any provision of the Delaware General Corporation Law or our amended and

restated certificate of incorporation or amended and restated bylaws, (iv) any action to interpret, apply, enforce or determine the validity of our amended and restated certificate of incorporation or the bylaws, or (v) any action

asserting a claim against us or any of our directors, officers or employees governed by the internal affairs doctrine.

Transfer Agent and Registrar

American Stock Transfer & Trust Company, LLC is the transfer agent for our common stock. The transfer agent and registrar’s address is

American Stock Transfer & Trust Company, LLC, Attn: Client Service Center, 3

rd

Floor, 6201 15

th

Avenue, Brooklyn, NY 11219.

Listing on The Nasdaq Global Market

Our common stock is

listed on The Nasdaq Global Market under the symbol “ADVM.”

6

SELLING STOCKHOLDERS

The table below sets forth information concerning the resale of the shares by the selling stockholders. We will not receive any proceeds from the resale of

the shares by the selling stockholders.

The table below sets forth, as of March 21, 2018, (i) the name of each person who is offering the resale of

shares by this prospectus and their position with us; (ii) the number of shares (and the percentage, if 1% or more) of Common Stock beneficially owned (as such term is defined in Rule

13d-3

under the

Exchange Act) by each person; (iii) the number of shares that each selling stockholder may offer for sale from time to time pursuant to this prospectus, whether or not such selling stockholder has a present intention to do so; and (iv) the

number of shares (and the percentage, if 1% or more) of Common Stock each person will own after the offering, assuming they sell all of the shares offered. Unless otherwise indicated, beneficial ownership is direct and the person indicated has sole

voting and investment power. Unless otherwise indicated, the address for each selling stockholder listed in the table below is c/o Adverum Biotechnologies, Inc., 1035 O’Brien Drive, Menlo Park, CA 94025.

The table below has been prepared based upon the information furnished to us by the selling stockholders as of March 21, 2018, and we have not

independently verified this information. The selling stockholders identified below may have sold, transferred or otherwise disposed of some or all of their shares since the date on which the information in the following table is presented in

transactions exempt from or not subject to the registration requirements of the Securities Act. Information concerning the selling stockholders may change from time to time and, if necessary, we will amend or supplement this prospectus accordingly.

We cannot give an estimate as to the number of shares of Common Stock that will actually be held by the selling stockholders upon termination of this offering because the selling stockholders may offer some or all of their Common Stock under the

offering contemplated by this prospectus or acquire additional shares of Common Stock. The total number of shares that may be sold hereunder will not exceed the number of shares offered hereby. Please read the section entitled “Plan of

Distribution” in this prospectus.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Selling Stockholder

|

|

Shares of

Common

Stock

Beneficially

Owned Prior

to this

Offering (1)

|

|

|

Percentage

of Common

Stock

Beneficially

Owned

Before

Resale

(1)(4)

|

|

|

Shares of

Common

Stock

Offered for

Resale in this

Offering(2)

|

|

|

Shares of

Common

Stock

Beneficially

Owned After

this Offering

(3)

|

|

|

Percentage

of Common

Stock

Beneficially

Owned

After

Resale

(1)(4)

|

|

|

Leone Patterson

|

|

|

143,875

|

(5)

|

|

|

|

*

|

|

|

75,000

|

|

|

|

143,875

|

(5)

|

|

|

|

*

|

|

Athena Countouriotis

|

|

|

—

|

|

|

|

|

*

|

|

|

150,000

|

|

|

|

—

|

|

|

|

|

*

|

|

Total

|

|

|

|

|

|

|

|

|

|

|

225,000

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1)

|

Beneficial ownership is determined in accordance with the rules of the SEC and generally includes voting or investment power with respect to securities. Shares of Common Stock underlying options currently exercisable,

or exercisable, or restricted stock units that vest, within 60 days after March 21, 2018, (as used in this section, the “Determination Date”), are deemed outstanding for purposes of computing the beneficial ownership of the person

holding such options and/or restricted stock units but are not deemed outstanding for computing the beneficial ownership of any other person. Except where we had knowledge of such ownership, the number presented in this column may not include shares

held in street name or through other entities over which the selling stockholder has voting and dispositive power.

|

|

(2)

|

The shares being offered are issuable pursuant to restricted stock units outstanding on the Determination Date, and may be acquired more than 60 days from the Determination Date. As a result, the shares are not

beneficially owned as of the Determination Date.

|

|

(3)

|

Assumes all of the shares of Common Stock being offered are sold in the offering, that shares of Common Stock beneficially owned by such selling stockholder on the Determination Date but not being offered pursuant to

this prospectus (if any) are not sold, and that no additional shares are purchased or otherwise acquired other than pursuant to the RSUs relating to the shares being offered.

|

|

(4)

|

Percentages are based on the 62,224,609 shares of Common Stock issued and outstanding as of the Determination Date.

|

|

(5)

|

Includes 132,083 shares that may be acquired upon exercise of stock options.

|

7

PLAN OF DISTRIBUTION

The shares of Common Stock covered by this reoffer prospectus are being registered by Adverum for the account of the selling stockholders. The shares of

Common Stock offered may be sold from time to time directly by or on behalf of each selling stockholder in one or more transactions on The Nasdaq Global Market or any other stock exchange on which the Common Stock may be listed at the time of sale,

in privately negotiated transactions, or through a combination of such methods, at market prices prevailing at the time of sale, at prices related to such prevailing market prices, at fixed prices (which may be changed) or at negotiated prices. The

selling stockholders may sell shares through one or more agents, brokers or dealers or directly to purchasers. Such brokers or dealers may receive compensation in the form of commissions, discounts or concessions from the selling stockholders and/or

purchasers of the shares or both. Such compensation as to a particular broker or dealer may be in excess of customary commissions.

In connection with

their sales, a selling stockholder and any participating broker or dealer may be deemed to be “underwriters” within the meaning of the Securities Act, and any commissions they receive and the proceeds of any sale of shares may be deemed to

be underwriting discounts and commissions under the Securities Act. We are bearing all costs relating to the registration of the shares of Common Stock. Any commissions or other fees payable to brokers or dealers in connection with any sale of the

shares will be borne by the selling stockholders or other party selling such shares. Sales of the shares must be made by the selling stockholders in compliance with all applicable state and federal securities laws and regulations, including the

Securities Act. In addition to any shares sold hereunder, selling stockholders may sell shares of Common Stock in compliance with Rule 144. There is no assurance that the selling stockholders will sell all or a portion of the Common Stock offered

hereby. The selling stockholders may agree to indemnify any broker, dealer or agent that participates in transactions involving sales of the shares against certain liabilities in connection with the offering of the shares arising under the

Securities Act. We have notified the selling stockholders of the need to deliver a copy of this reoffer prospectus in connection with any sale of the shares.

The anti-manipulation rules of Regulation M under the Exchange Act may apply to sales of our Common Stock and activities of the selling stockholders, which

may limit the timing of purchases and sales of any of the shares of Common Stock by the selling stockholders and any other participating person. Regulation M may also restrict the ability of any person engaged in the distribution of the shares of

Common Stock to engage in passive market-making activities with respect to the shares of Common Stock. Passive market making involves transactions in which a market maker acts as both our underwriter and as a purchaser of our Common Stock in the

secondary market. All of the foregoing may affect the marketability of the shares of Common Stock and the ability of any person or entity to engage in market-making activities with respect to the shares of Common Stock.

Once sold under the registration statement of which this prospectus forms a part, the shares of Common Stock will be freely tradable in the hands of persons

other than our affiliates.

LEGAL MATTERS

The validity of the shares of Common Stock offered pursuant to this prospectus will be passed upon for us by Cooley LLP.

EXPERTS

Our

consolidated financial statements incorporated in this prospectus by reference from our Annual Report on Form

10-K

for the year ended December 31, 2017, have been audited by Deloitte & Touche

LLP, an independent registered public accounting firm, as stated in their report, which is incorporated herein by reference. Such consolidated financial statements have been so incorporated in reliance upon the report of such firm given upon their

authority as experts in accounting and auditing.

WHERE YOU CAN FIND ADDITIONAL INFORMATION

This prospectus is part of the registration statement on Form

S-8

we filed with the SEC under the Securities Act and

does not contain all the information set forth in the registration statement. Whenever a reference is made in this prospectus to any of our contracts, agreements or other documents, the reference may not be complete and you should refer to the

exhibits that are a part of the registration statement or the exhibits to the reports or other documents incorporated by reference into this prospectus for a copy of such contract, agreement or other document. Because we are subject to the

information and reporting requirements of the Exchange Act, we file annual, quarterly and current reports, proxy statements and other information with the SEC. Our SEC filings are available to the public over the Internet at the SEC’s website

at http://www.sec.gov. You may also read and copy any document we file at the SEC’s Public Reference Room at 100 F Street, N.E., Washington, D.C. 20549. Please call the SEC at

1-800-SEC-0330

for further information on the operation of the Public Reference Room.

8

INCORPORATION OF CERTAIN INFORMATION BY REFERENCE

The SEC allows us to “incorporate by reference” information from other documents that we file with it, which means that we can disclose important

information to you by referring you to those documents. The information incorporated by reference is considered to be part of this prospectus. Information in this prospectus supersedes information incorporated by reference that we filed with the SEC

prior to the date of this prospectus, while information that we file later with the SEC will automatically update and supersede the information in this prospectus. We incorporate by reference into this prospectus and the registration statement of

which this prospectus is a part the information or documents listed below that we have filed with the SEC (Commission File

No. 001-36579),

excluding any portions of any Form

8-K

that are not deemed “filed” pursuant to the General Instructions of Form

8-K:

|

•

|

|

our Annual Report on Form

10-K

for the year ended December 31, 2017, which was filed with the SEC on March 6, 2018, including the information to be incorporated by

reference in the Form

10-K

by our proxy statement for our 2018 Annual Meeting of Stockholders;

|

|

•

|

|

our Current Reports on Form

8-K

filed with the SEC on January 25, 2018, January 26, 2018, February 7, 2018 (other than the information in Item 2.02 thereof),

February 9, 2018, and February 22, 2018, and Form

8-K/A

filed on March 22, 2018; and

|

|

•

|

|

the description of our common stock contained in our Registration Statement on Form

8-A

filed with the SEC on July 28, 2014, including any amendments or reports filed for the

purpose of updating such description.

|

We also incorporate by reference any future filings (other than current reports furnished under Item

2.02 or Item 7.01 of Form

8-K

and exhibits filed on such form that are related to such items unless such Form

8-K

expressly provides to the contrary) made with the SEC

pursuant to Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act. Information in such future filings updates and supplements the information provided in this prospectus. Any statements in any such future filings will automatically be deemed to

modify and supersede any information in any document we previously filed with the SEC that is incorporated or deemed to be incorporated herein by reference to the extent that statements in the later filed document modify or replace such earlier

statements.

You can request a copy of these filings, at no cost, by writing or telephoning us at the following address or telephone number:

Adverum Biotechnologies, Inc.

1035 O’Brien Drive

Menlo

Park, CA 94025

(650)

272-6269

Attn: Secretary

9

PART I

INFORMATION REQUIRED IN THE SECTION 10(A) PROSPECTUS

Item

1.

Plan Information

.*

Item

2.

Registration Information and Employee Plan Annual Information

.*

|

*

|

Information required by Part I to be contained in the Section 10(a) prospectus is omitted from this Registration Statement in accordance with Rule 428 under the Securities Act and the “Note” to Part I of

Form

S-8.

|

I-1

PART II

INFORMATION REQUIRED IN THE REGISTRATION STATEMENT

Item 3. Incorporation of Documents by Reference.

The following documents have been filed by us with the Securities and Exchange Commission (the “Commission”) and are incorporated

herein by reference:

|

|

•

|

|

our Annual Report on Form

10-K

for the year ended December 31, 2017, which was filed with the SEC on March 6, 2018, including the information to be incorporated by

reference in the Form

10-K

by our proxy statement for our 2018 Annual Meeting of Stockholders;

|

|

|

•

|

|

our Current Reports on Form

8-K

filed with the SEC on January 25, 2018, January 26, 2018, February 7, 2018 (other than the information in Item 2.02 thereof),

February 9, 2018, and February 22, 2018, and Form

8-K/A

filed on March 22, 2018; and

|

|

|

•

|

|

the description of our common stock contained in our Registration Statement on Form

8-A

filed with the SEC on July 28, 2014, including any amendments or reports filed for the

purpose of updating such description.

|

All documents subsequently filed by the us pursuant to Sections 13(a), 13(c), 14 and

15(d) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), other than current reports furnished under Item 2.02 or Item 7.01 of

Form 8-K

and exhibits furnished on such form

that relate to such items, prior to the filing of a post-effective amendment to this Registration Statement which indicates that all of the shares of Common Stock offered have been sold or which deregisters all of such shares then remaining unsold,

shall be deemed to be incorporated by reference in this Registration Statement and to be a part hereof from the date of the filing of such documents.

For purposes of this Registration Statement, any statement contained in a document incorporated or deemed to be incorporated by reference

herein shall be deemed to be modified or superseded to the extent that a statement contained herein or in any other subsequently filed document which also is or is deemed to be incorporated by reference herein modifies or supersedes such statement.

Any such statement so modified or superseded shall not be deemed, except as so modified or superseded, to constitute a part of this Registration Statement.

Item 4. Description of Securities.

Not

applicable.

Item 5. Interests of Named Experts and Counsel.

Not applicable.

Item 6. Indemnification

of Directors and Officers.

As permitted by Section 102 of the Delaware General Corporation Law, we have adopted provisions in our

amended and restated certificate of incorporation and bylaws that limit or eliminate the personal liability of our directors for a breach of their fiduciary duties of care as directors. The duty of care generally requires that, when acting on behalf

of the corporation, directors exercise an informed business judgment based on all material information reasonably available to them. Consequently, a director will not be personally liable to us or our stockholders for monetary damages for breach of

fiduciary duty as a director, except for liability for:

|

|

•

|

|

any breach of the director’s duty of loyalty to us or our stockholders;

|

|

|

•

|

|

any act or omission not in good faith or that involves intentional misconduct or a knowing violation of law;

|

|

|

•

|

|

any act related to unlawful stock repurchases, redemptions or other distributions or payment of dividends; or

|

|

|

•

|

|

any transaction from which the director derived an improper personal benefit.

|

II-1

These limitations of liability do not affect the availability of equitable remedies such as

injunctive relief or rescission. Our amended and restated certificate of incorporation also authorizes us to indemnify our officers, directors and other agents to the fullest extent permitted under Delaware law.

As permitted by Section 145 of the Delaware General Corporation Law, our amended and restated bylaws provide that:

|

|

•

|

|

we may indemnify our directors, officers and employees to the fullest extent permitted by the Delaware General Corporation Law, subject to limited exceptions;

|

|

|

•

|

|

we may advance expenses to our directors, officers and employees in connection with a legal proceeding to the fullest extent permitted by the Delaware General Corporation Law, subject to limited exceptions; and

|

|

|

•

|

|

the rights provided in our amended and restated bylaws are not exclusive.

|

Our amended and

restated certificate of incorporation and our amended and restated bylaws provide for the indemnification provisions described above and elsewhere herein. We have also entered into separate indemnification agreements with our directors and officers

which may be broader than the specific indemnification provisions contained in the Delaware General Corporation Law. These indemnification agreements generally require us, among other things, to indemnify our officers and directors against

liabilities that may arise by reason of their status or service as directors or officers, other than liabilities arising from willful misconduct. These indemnification agreements also generally require us to advance any expenses incurred by the

directors or officers as a result of any proceeding against them as to which they could be indemnified. In addition, we have purchased a policy of directors’ and officers’ liability insurance that insures our directors and officers against

the cost of defense, settlement or payment of a judgment in some circumstances. These indemnification provisions and the indemnification agreements may be sufficiently broad to permit indemnification of our officers and directors for liabilities,

including reimbursement of expenses incurred, arising under the Securities Act.

Item 7. Exemption from Registration Claimed.

Not Applicable.

Item 8. Exhibits.

Exhibit Index

II-2

Item 9. Undertakings.

|

1.

|

The undersigned Registrant hereby undertakes:

|

(a) To file, during any

period in which offers or sales are being made, a post-effective amendment to this Registration Statement:

(i) To

include any prospectus required by section 10(a)(3) of the Securities Act of 1933;

(ii) To reflect in the

prospectus any facts or events arising after the effective date of the Registration Statement (or the most recent post-effective amendment thereof) which, individually or in the aggregate, represent a fundamental change in the information set forth

in the Registration Statement. Notwithstanding the foregoing, any increase or decrease in volume of securities offered (if the total dollar value of securities offered would not exceed that which was registered) and any deviation from the low or

high end of the estimated maximum offering range may be reflected in the form of prospectus filed with the Commission pursuant to Rule 424(b) if, in the aggregate, the changes in volume and price represent no more than a 20 percent change in

the maximum aggregate offering price set forth in the “Calculation of Registration Fee” table in the effective Registration Statement.

(iii) To include any material information with respect to the plan of distribution not previously disclosed in the

Registration Statement or any material change to such information in the Registration Statement;

Provided

,

however

, that

paragraphs (a)(i) and (a)(ii) do not apply if the information required to be included in a post-effective amendment by those paragraphs is contained in reports filed with or furnished to the Commission by the Registrant pursuant to section 13 or

section 15(d) of the Securities Exchange Act of 1934 that are incorporated by reference herein.

(b) That, for the

purpose of determining any liability under the Securities Act of 1933, each such post-effective amendment shall be deemed to be a new registration statement relating to the securities offered herein, and the offering of such securities at that time

shall be deemed to be the initial

bona fide

offering thereof.

II-3

(c) To remove from registration by means of a post-effective amendment any

of the securities being registered which remain unsold at the termination of the offering.

|

2.

|

The undersigned Registrant hereby undertakes that, for purposes of determining any liability under the Securities Act of 1933, each filing of the Registrant’s annual report pursuant to section 13(a) or section

15(d) of the Securities Exchange Act of 1934 (and, where applicable, each filing of an employee benefit plan’s annual report pursuant to section 15(d) of the Securities Exchange Act of 1934) that is incorporated by reference in the Registration

Statement shall be deemed to be a new registration statement relating to the securities offered herein, and the offering of such securities at that time shall be deemed to be the initial

bona fide

offering thereof.

|

|

3.

|

Insofar as indemnification for liabilities arising under the Securities Act of 1933 may be permitted to directors, officers and controlling persons of the Registrant pursuant to the foregoing provisions, or otherwise,

the Registrant has been advised that in the opinion of the Securities and Exchange Commission such indemnification is against public policy as expressed in the Securities Act of 1933 and is, therefore, unenforceable. In the event that a claim for

indemnification against such liabilities (other than the payment by the Registrant of expenses incurred or paid by a director, officer or controlling person of the Registrant in the successful defense of any action, suit or proceeding) is asserted

by such director, officer or controlling person in connection with the securities being registered, the Registrant will, unless in the opinion of its counsel the matter has been settled by controlling precedent, submit to a court of appropriate

jurisdiction the question whether such indemnification by it is against public policy as expressed in the Securities Act of 1933 and will be governed by the final adjudication of such issue.

|

II-4

SIGNATURES

Pursuant to the requirements of the Securities Act of 1933, as amended, the Registrant certifies that it has reasonable grounds to believe

that it meets all of the requirements for filing on Form

S-8

and has duly caused this Registration Statement to be signed on its behalf by the undersigned, thereunto duly authorized, in the City of Menlo Park,

State of California on March 23, 2018.

|

|

|

|

|

Adverum Biotechnologies, Inc.

|

|

|

|

|

By:

|

|

/s/ Leone Patterson

|

|

|

|

Leone Patterson

|

|

|

|

Chief Financial Officer

|

POWER OF ATTORNEY

KNOW ALL PERSONS BY THESE PRESENTS, that each person whose signature appears below constitutes and appoints Amber Salzman, Ph.D., Leone

Patterson and Jennifer Cheng, or any of them, his or her true and lawful

attorney-in-fact

and agent, with full power of substitution and resubstitution, for him or her

and in his or her name, place and stead, in any and all capacities, to sign any and all amendments (including post-effective amendments) to this Registration Statement on Form

S-8,

and to file the same, with

all exhibits thereto, and other documents in connection therewith, with the Securities and Exchange Commission (the “SEC”), and generally to do all such things in their names and behalf in their capacities as officers and directors to

enable the registrant to comply with the provisions of the Securities Act of 1933, as amended, and all requirements of the SEC, granting unto said

attorneys-in-fact

and

agents, and each of them, full power and authority to do and perform each and every act and thing requisite and necessary to be done in connection therewith, as fully to all intents and purposes as he or she might or could do in person, hereby

ratifying and confirming all that said

attorneys-in-fact

and agents, or any of them, or their or his substitutes or substitute, may lawfully do or cause to be done by

virtue hereof.

Pursuant to the requirements of the Securities Act of 1933, as amended, this Registration Statement has been signed by the

following persons in the capacities indicated.

|

|

|

|

|

|

|

Signature

|

|

Title

|

|

Date

|

|

|

|

|

|

/s/ Amber Salzman,

Ph.D.

Amber Salzman, Ph.D.

|

|

President, Chief Executive Officer and Director

(

Principal

Executive Officer

)

|

|

March 23, 2018

|

|

|

|

|

|

/s/ Leone

Patterson

Leone Patterson

|

|

Chief Financial Officer

(

Principal Accounting and Financial Officer

)

|

|

March 23, 2018

|

|

|

|

|

|

/s/ Paul B.

Cleveland

Paul B. Cleveland

|

|

Chairman of the Board, Director

|

|

March 23, 2018

|

|

|

|

|

|

/s/ Eric G. Carter, M.D., Ph.D.

Eric G. Carter, M.D., Ph.D.

|

|

Director

|

|

March 23, 2018

|

|

|

|

|

|

Mitchell H. Finer, Ph.D.

|

|

Director

|

|

March , 2018

|

|

|

|

|

|

/s/ Patrick

Machado

Patrick Machado

|

|

Director

|

|

March 23, 2018

|

|

|

|

|

|

/s/ Richard N. Spivey, Pharm.D., Ph.D.

Richard N. Spivey, Pharm.D., Ph.D.

|

|

Director

|

|

March 23, 2018

|

|

|

|

|

|

/s/ Thomas Woiwode, Ph.D.

Thomas Woiwode, Ph.D.

|

|

Director

|

|

March 23, 2018

|

II-5

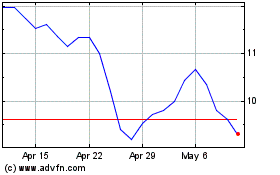

Adverum Biotechnologies (NASDAQ:ADVM)

Historical Stock Chart

From Mar 2024 to Apr 2024

Adverum Biotechnologies (NASDAQ:ADVM)

Historical Stock Chart

From Apr 2023 to Apr 2024