Essent Group Ltd. Announces Closing of $424.4 Million Reinsurance Transaction & Related Mortgage Insurance-Linked Notes Offer...

March 23 2018 - 8:00AM

Business Wire

Essent Group Ltd. (NYSE: ESNT) today announced that its wholly

owned subsidiary, Essent Guaranty, Inc., has obtained $424.4

million of fully collateralized excess of loss reinsurance coverage

on mortgage insurance policies written by Essent in 2017 from

Radnor Re 2018-1 Ltd., a newly formed Bermuda special purpose

insurer. Radnor Re is not a subsidiary or an affiliate of Essent

Group Ltd.

Radnor Re 2018-1 Ltd. has funded its reinsurance obligations

through the issuance of three classes of mortgage insurance-linked

notes with 10-year legal maturities, to eligible third party

capital markets investors in an unregistered private offering. The

senior M-1 class notes have received a rating of BBB from

Morningstar Credit Ratings, LLC.

“We are very excited to announce the closing of our inaugural

credit risk transfer transaction,” said Mark Casale, Chairman and

Chief Executive Officer. “This transaction is a significant

milestone for our company, as it expands our capital sources while

also providing a layer of protection against adverse credit losses.

Additionally, we believe that a transaction like this strengthens

our mortgage insurance franchise and enhances the role that Essent

plays in supporting a strong and robust U.S. housing finance

system.”

Forward-Looking Statements

This press release may include “forward-looking statements”

which are subject to known and unknown risks and uncertainties,

many of which may be beyond our control. Forward-looking statements

generally can be identified by the use of forward-looking

terminology such as "may," "plan," "seek," "comfortable with,"

"will," "expect," "intend," "estimate," "anticipate," "believe" or

"continue" or the negative thereof or variations thereon or similar

terminology. Actual events, results and outcomes may differ

materially from our expectations due to a variety of known and

unknown risks, uncertainties and other factors. Although it is not

possible to identify all of these risks and factors, they include,

among others, the following: changes in or to Fannie Mae and

Freddie Mac (the “GSEs”), whether through Federal legislation,

restructurings or a shift in business practices; failure to

continue to meet the mortgage insurer eligibility requirements of

the GSEs; competition for customers or the loss of a significant

customer; lenders or investors seeking alternatives to private

mortgage insurance; an increase in the number of loans insured

through Federal government mortgage insurance programs, including

those offered by the Federal Housing Administration; decline in the

volume of low down payment mortgage originations; uncertainty of

loss reserve estimates; decrease in the length of time our

insurance policies are in force; deteriorating economic conditions;

the definition of "Qualified Mortgage" reducing the size of the

mortgage origination market or creating incentives to use

government mortgage insurance programs; the definition of

"Qualified Residential Mortgage" reducing the number of low down

payment loans or lenders and investors seeking alternatives to

private mortgage insurance; the implementation of the Basel III

Capital Accord discouraging the use of private mortgage insurance;

non-U.S. operations becoming subject to U.S. Federal income

taxation; becoming considered a passive foreign investment company

for U.S. Federal income tax purposes; and other risks and factors

described in Part I, Item 1A “Risk Factors” of our Annual Report on

Form 10-K for the year ended December 31, 2017 filed with the

Securities and Exchange Commission on February 20, 2018. Any

forward-looking information presented herein is made only as of the

date of this press release, and we do not undertake any obligation

to update or revise any forward-looking information to reflect

changes in assumptions, the occurrence of unanticipated events, or

otherwise.

About the Company

Essent Group Ltd. (NYSE: ESNT) is a Bermuda-based holding

company (collectively with its subsidiaries, “Essent”) which,

through its wholly-owned subsidiary Essent Guaranty, Inc., offers

private mortgage insurance for single-family mortgage loans in the

United States. Essent provides private capital to mitigate mortgage

credit risk, allowing lenders to make additional mortgage financing

available to prospective homeowners. Headquartered in Radnor,

Pennsylvania, Essent Guaranty, Inc. is licensed to write mortgage

insurance in all 50 states and the District of Columbia, and is

approved by Fannie Mae and Freddie Mac. Essent also offers

mortgage-related insurance, reinsurance and advisory services

through its Bermuda-based subsidiary, Essent Reinsurance Ltd.

Additional information regarding Essent may be found at

www.essentgroup.com and www.essent.us.

Source: Essent Group Ltd.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20180323005073/en/

Essent Group Ltd.Media

Contact610-230-0556media@essentgroup.comorInvestor Relations

ContactChristopher G. CurranSenior Vice President – Investor

Relations855-809-ESNTir@essentgroup.com

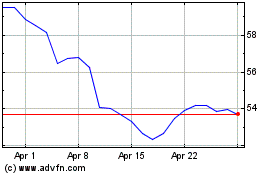

Essent (NYSE:ESNT)

Historical Stock Chart

From Mar 2024 to Apr 2024

Essent (NYSE:ESNT)

Historical Stock Chart

From Apr 2023 to Apr 2024