Current Report Filing (8-k)

March 21 2018 - 4:06PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of report (Date of earliest event reported): March 19, 2018

FIRST ACCEPTANCE CORPORATION

(Exact Name of Registrant as Specified in Charter)

|

Delaware

|

|

001-12117

|

|

75-1328153

|

|

(State or Other Jurisdiction

of Incorporation)

|

|

(Commission

File Number)

|

|

(I.R.S. Employer

Identification No.)

|

|

3813 Green Hills Village Drive Nashville, Tennessee

|

|

37215

|

|

(Address of Principal Executive Offices)

|

|

(Zip Code)

|

(615) 844-2800

(Registrant’s Telephone Number, Including Area Code)

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (

see

General Instruction A.2. below):

|

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company

☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

☐

Item 3.01

.

Notice of Delisting or Failure to Satisfy a Continued Listing Rule or Standard; Transfer of

Listing

.

On March 19, 2018, First Acceptance Corporation (the “

Company

”) issued a press release announcing that it has submitted written notice to the New York Stock Exchange (the “

NYSE

”) of its intent to voluntarily delist its common stock, $.01 par value per share, from the NYSE. The Company intends to file a Form 25 with the Securities and Exchange Commission (the “

SEC

”) to delist its common stock from the NYSE and deregister its common stock under Section 12(b) of the Securities Exchange Act of 1934 (the “

Exchange Act

”). As a result, the common stock will no longer be listed on the NYSE.

Additionally, the Company intends to file with the SEC certifications on Form 15 under the Exchange Act requesting the deregistration of its common stock under Section 12(g) of the Exchange Act and the suspension of the Company’s reporting obligations under Section 15(d) of the Exchange Act as promptly as practicable.

Forward-Looking Statements

This Current Report on Form 8-K contains forward-looking statements. All statements made other than statements of historical fact are forward-looking statements. You can identify these statements from our use of the words “plan,” “intent,” “intend” or the negative of these terms and similar expressions. These statements, which have been included in reliance on the “safe harbor” provisions of the federal securities laws, involve risks and uncertainties. Investors are hereby cautioned that these statements may be affected by important factors, including, among others, the timing of delisting and deregistration, the possibility that there may not be an active trading market for our securities if we voluntarily delist and deregister, the possibility that delisting and deregistration could adversely affect the price and liquidity of our securities, and the factors set forth under the caption “Risk Factors” in Item 1A. of our Annual Report on Form 10-K for the year ended December 31, 2017 and in our other filings with the SEC. Except as required by law, we undertake no obligation to publicly update or revise any forward-looking statement, whether as a result of new information, future developments or otherwise.

Item 9.01.

Financial Statements and Exhibits

.

(d) Exhibits

EXHIBIT INDEX

-2-

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

FIRST ACCEPTANCE CORPORATION

|

|

Date: March 21, 2018

|

/s/ Brent James Gay

|

|

|

Brent James Gay

Chief Financial Officer

|

-3-

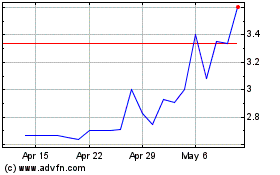

First Acceptance (QX) (USOTC:FACO)

Historical Stock Chart

From Mar 2024 to Apr 2024

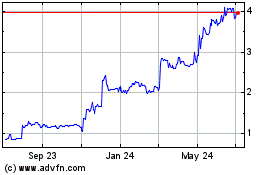

First Acceptance (QX) (USOTC:FACO)

Historical Stock Chart

From Apr 2023 to Apr 2024