Table of Contents

|

UNITED STATES

|

|

SECURITIES AND EXCHANGE COMMISSION

|

|

Washington, D.C. 20549

|

|

|

|

SCHEDULE 14A

|

|

|

|

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

|

|

|

|

Filed by the Registrant

x

|

|

|

|

Filed by a Party other than the Registrant

o

|

|

|

|

Check the appropriate box:

|

|

o

|

Preliminary Proxy Statement

|

|

o

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

|

x

|

Definitive Proxy Statement

|

|

o

|

Definitive Additional Materials

|

|

o

|

Soliciting Material Pursuant to §240.14a-12

|

|

|

|

West Pharmaceutical Services, Inc.

|

|

(Name of Registrant as Specified In Its Charter)

|

|

|

|

|

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

|

|

|

|

Payment of Filing Fee (Check the appropriate box):

|

|

x

|

No fee required.

|

|

o

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

|

|

(1)

|

Title of each class of securities to which transaction applies:

|

|

|

|

|

|

|

(2)

|

Aggregate number of securities to which transaction applies:

|

|

|

|

|

|

|

(3)

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

|

|

|

|

|

|

(4)

|

Proposed maximum aggregate value of transaction:

|

|

|

|

|

|

|

(5)

|

Total fee paid:

|

|

|

|

|

|

o

|

Fee paid previously with preliminary materials.

|

|

o

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

|

|

|

(1)

|

Amount Previously Paid:

|

|

|

|

|

|

|

(2)

|

Form, Schedule or Registration Statement No.:

|

|

|

|

|

|

|

(3)

|

Filing Party:

|

|

|

|

|

|

|

(4)

|

Date Filed:

|

|

|

|

|

|

|

|

|

|

|

|

Persons who are to respond to the collection of information contained in this form are not required to respond unless the form displays a currently valid OMB control number.

|

|

|

|

|

|

Table of Contents

West Pharmaceutical Services, Inc.

Notice of 2018 Annual Meeting

530 Herman O. West Drive

Exton, Pennsylvania 19341

March 21, 2018

The 2018 Annual Meeting of Shareholders of West Pharmaceutical Services, Inc. will be held at our corporate headquarters on:

|

Tuesday, May 1, 2018

|

|

9:30 AM, local time

|

|

530 Herman O. West Drive

|

|

Exton, Pennsylvania 19341

|

The items of business are:

1.

Election of nominees named in the Proxy Statement as directors, each for a term of one year.

2.

Consideration of an advisory vote to approve named executive officer compensation.

3.

Ratification of the appointment of PricewaterhouseCoopers LLP (“PwC”) as our independent registered public accounting firm for 2018.

4.

Transaction of other business as may properly come before the meeting and any adjournments or postponements thereof.

Shareholders of record of West common stock at the close of business on March 6, 2018 are entitled to notice of, and to vote at, the meeting and any postponements or adjournments thereof.

|

|

George L. Miller

|

|

|

Sr. Vice President, General Counsel and

|

|

|

Corporate Secretary

|

Important Notice Regarding the Internet Availability of Proxy Materials for the Shareholder Meeting on May 1, 2018

This Notice of Annual Meeting and Proxy Statement (“Notice”) and the 2017 Annual Report on Form 10-K (“2017 Annual Report”) are available on our website at:

|

|

http://investor.westpharma.com/phoenix.zhtml?c=118197&p=irol-reportsannual

|

Your Vote is Important

Please vote as promptly as possible electronically via the Internet or by completing, signing, dating and returning the proxy card or voting instruction card.

Table of Contents

GENERAL INFORMATION

Proxy Summary

Below is a summary of important information you will find in this Proxy Statement. This summary does not contain all the information that you should consider, and you should read the entire Proxy Statement carefully before voting.

Summary of Shareholder Voting Matters

|

|

|

|

|

|

Recommended

|

|

|

|

|

|

|

|

|

Proposal 1

: Election of Directors

|

|

|

Page

61

|

|

ü

FOR

|

|

|

|

|

|

|

|

|

Mark A. Buthman

William F. Feehery

Eric M. Green

Thomas W. Hofmann

Paula A. Johnson

|

Deborah L. V. Keller

Myla P. Lai-Goldman

Douglas A. Michels

Paolo Pucci

John H. Weiland

Patrick J. Zenner

|

|

|

|

Each Nominee

|

|

|

|

|

|

|

|

|

Proposal 2

: Advisory Vote to Approve Named Executive Officer Compensation

|

|

Page

68

|

|

ü

FOR

|

|

|

|

|

|

|

|

Proposal 3

: Ratification of the Appointment of PricewaterhouseCoopers LLP as our Independent Registered Public Accounting Firm for 2018

|

|

Page

69

|

|

ü

FOR

|

Our Director Nominees

You are being asked to vote on the directors nominated below. All directors are elected annually by a majority of votes cast, except in the case of a contested election where the number of nominees exceeds the number of open positions, in which case plurality voting is used. Detailed information about each director’s background and areas of expertise can be found beginning on page 62. All directors, except Mr. Green, are independent.

|

|

|

|

|

Director

|

|

|

|

Current Committee

Memberships

|

|

Other

Current

Public

|

|

Name

|

|

Age

|

|

Since

|

|

Current/Previous Occupation

|

|

AC

|

|

CC

|

|

FC

|

|

ITC

|

|

NCGC

|

|

Boards

|

|

Mark A. Buthman

|

|

57

|

|

2011

|

|

Retired EVP & CFO, Kimberly-Clark

|

|

C

|

|

|

|

|

|

|

|

M

|

|

1

|

|

William F. Feehery

|

|

47

|

|

2012

|

|

President, Industrial Biosciences, DowDuPont

|

|

M

|

|

|

|

|

|

|

|

C

|

|

—

|

|

Eric M. Green

|

|

48

|

|

2015

|

|

President & CEO, West Pharmaceutical Services, Inc.

|

|

|

|

|

|

|

|

|

|

|

|

—

|

|

Thomas W. Hofmann

|

|

66

|

|

2007

|

|

Retired Sr. VP & CFO, Sunoco, Inc.

|

|

M

|

|

M

|

|

M

|

|

|

|

|

|

—

|

|

Paula A. Johnson

|

|

58

|

|

2005

|

|

President, Wellesley College

|

|

|

|

|

|

|

|

C

|

|

|

|

—

|

|

Deborah L. V. Keller

|

|

55

|

|

2017

|

|

Principal, Black Frame Advisors, LLC & Retired CEO, Covance Drug Development

|

|

|

|

|

|

M

|

|

M

|

|

|

|

—

|

|

Myla P. Lai-Goldman

|

|

60

|

|

2014

|

|

CEO and President of GeneCentric Therapeutics, Inc.

|

|

|

|

|

|

M

|

|

M

|

|

|

|

1

|

|

Douglas A. Michels

|

|

61

|

|

2011

|

|

President & CEO, OraSure Technologies, Inc.

|

|

|

|

C

|

|

|

|

M

|

|

|

|

1

|

|

Paolo Pucci

|

|

56

|

|

2016

|

|

CEO, ArQule, Inc.

|

|

M

|

|

M

|

|

|

|

|

|

|

|

2

|

|

John H. Weiland

|

|

62

|

|

2007

|

|

Retired Vice-Chairman, President & Chief Operating Officer, C. R. Bard, Inc., which was acquired by Becton, Dickinson and Company in 2017

|

|

|

|

M

|

|

C

|

|

|

|

|

|

—

|

|

Patrick J. Zenner

|

|

71

|

|

2002

|

|

Chairman, West; Retired Pres. & CEO, Hoffmann-La Roche Inc.

|

|

|

|

|

|

|

|

|

|

M

|

|

2

|

LEGEND

: M — Member; C — Chairperson; AC — Audit Committee; CC — Compensation Committee; ITC — Innovation and Technology Committee; FC — Finance Committee; NCGC — Nominating and Corporate Governance Committee

2018 Annual Meeting and Proxy Statement

2

Table of Contents

|

Corporate Governance and Board Highlights

|

|

Vital Board Statistics

|

|

|

|

|

·

90.9% of the Board is independent

·

27.3% of the Board is Female

|

·

Average Tenure: 7.4 years

·

Average Age: 58.3 years

|

|

·

Annual director elections with majority voting in uncontested elections

|

|

·

Active shareholder engagement program on corporate governance and compensation matters

|

|

·

Significant risk management oversight by the Board, including an enhanced enterprise risk management process

|

|

·

Board is led by an Independent Non-Executive Chairman

|

|

·

Commitment to corporate responsibility, including Diversity, Safety, Sustainability and Environment

|

|

·

New directors appointed in each of the past four years

|

|

·

Effective self-assessment and evaluation procedures that include individual discussions

|

|

·

Annual evaluation of all directors to ensure the right mix of experience and diversity of opinion and background

|

|

·

Robust succession planning and committee rotation

|

|

·

Maintain and enforce effective executive and board stock ownership guidelines

|

|

·

All directors attended more than 75% of the Board and Committee meetings

|

2017 Performance and Compensation Highlights

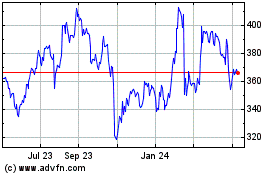

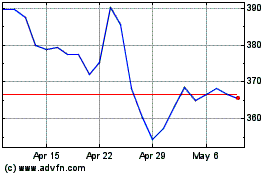

We believe that Mr. Green and the other named executive officers (“NEOs”) performed satisfactorily in 2017 compared to established goals and that their compensation is appropriate in relation to that performance. Under their leadership, our Company achieved a total shareholder return (“TSR”) of 17.0% in 2017 and a cumulative three-year TSR of 89.3%. Those returns reflect our growing sales and profitability. Compared to 2016: net sales grew 5.2% (at constant currency exchange rates), gross profit increased 2.3%, and adjusted operating profit margin grew 20 basis points to 15.0%. As discussed in our 2017 Annual Report, proprietary products sales growth was slower than in 2016, primarily due to customers working down inventory purchased in 2016, but contract manufacturing sales growth was still robust due primarily to the ramp-up of projects in the latter half of 2016. Adjusted earnings per share (“Adjusted EPS”) as reported in our 2017 Earnings Release filed on February 15, 2018 (the “Earnings Release”), also improved 28% year-over-year, as described in footnote 3 below.

(1)

See page 23 of our 2017 Annual Report for discussion of the impact of foreign currency rates on reported net sales.

(2)

Gross profit and adjusted operating margin are discussed on page 24 and page 27, respectively, of our 2017 Annual Report.

(3)

A meaningful comparison on EPS growth for Annual Incentive Plan (“AIP”) purposes is best explained by reconciling the results used for calculating AIP payments to U.S. GAAP and the Earnings Release. Please see below.

|

|

|

2017

|

|

2016

|

|

|

US GAAP Diluted EPS

|

|

$

|

1.99

|

|

$

|

1.91

|

|

|

Venezuela deconsolidation and currency devaluation

|

|

0.15

|

|

0.04

|

|

|

Tax law changes

|

|

0.64

|

|

0.01

|

|

|

Restructuring related charges

|

|

—

|

|

0.23

|

|

|

Pension curtailment gain

|

|

—

|

|

(0.01

|

)

|

|

Adjusted Diluted EPS per Earnings Release

|

|

$

|

2.78

|

|

$

|

2.18

|

|

|

Impact of foreign exchange rates

|

|

—

|

|

0.04

|

|

|

Tax benefit from stock-based compensation accounting change

|

|

(0.44

|

)

|

—

|

|

|

Share repurchase

|

|

(0.01

|

)

|

—

|

|

|

Adjusted Diluted EPS for AIP Purposes

|

|

$

|

2.33

|

|

$

|

2.22

|

|

The following table shows the components of 2017 compensation paid to our NEOs, including total “realizable” pay. Realizable pay takes a retrospective look at pay and performance. Realizable pay is the

3

Table of Contents

sum of: (1) base salary paid; (2) annual incentive plan amounts actually earned for 2017 performance; (3) the in-the-money value of stock option grants made in 2017; (4) the December 2017 estimate for payouts for the 2017 Performance Share Unit award (82.09% of target); and (5) the 2017 year-end value of any time-vesting restricted stock or restricted stock units (“RSUs”) granted in 2017. The table is not a substitute for our 2017 Summary Compensation Table set forth on page 45.

2017 Summary Compensation and Realizable Pay

(all amounts in U.S. Dollars)

|

Name and

Principal Position

|

|

Salary

|

|

Stock

Awards

|

|

Option

Awards

|

|

Non-Equity

Incentive Plan

Compensation

|

|

Change in Pension

Value & Nonqualified

Deferred

Compensation

Earnings

|

|

All Other

Compensation

|

|

SEC

Total

|

|

SEC Total

Without

Change in

Pension (1)

|

|

Total

Realizable

Pay

|

|

|

Eric M. Green

President & CEO

|

|

824,038

|

|

1,526,814

|

|

1,500,071

|

|

748,808

|

|

95,660

|

|

61,172

|

|

4,756,563

|

|

4,660,903

|

|

4,344,181

|

|

|

William J. Federici

Sr. VP, CFO & Treasurer

|

|

535,462

|

|

349,990

|

|

350,045

|

|

340,424

|

|

270,150

|

|

31,333

|

|

1,877,404

|

|

1,607,254

|

|

1,515,445

|

|

|

Karen A. Flynn

Sr. VP & CCO

|

|

469,615

|

|

500,069

|

|

499,952

|

|

281,904

|

|

112,801

|

|

38,306

|

|

1,902,647

|

|

1,789,846

|

|

1,665,161

|

|

|

George L. Miller

Sr. VP, GC & Corp. Secretary

|

|

409,808

|

|

356,496

|

|

300,029

|

|

226,320

|

|

47,280

|

|

27,753

|

|

1,367,686

|

|

1,320,406

|

|

1,248,448

|

|

|

David A. Montecalvo

Sr. VP, Global Ops & Supply Chain

|

|

377,846

|

|

202,251

|

|

199,923

|

|

166,399

|

|

27,403

|

|

140,522

|

|

1,114,344

|

|

1,086,941

|

|

912,169

|

|

(1)

This column is each officer’s total compensation, as determined under applicable Securities and Exchange Commission (“SEC”) rules, minus the change in pension value reported in the Change in Pension Value and Nonqualified Deferred Compensation Earnings column of the Summary Compensation Table. It shows the impact that change in pension values had on total compensation, as determined under applicable SEC rules, which vary substantially due to actuarial calculations. The amounts reported in the SEC Total Without Change in Pension column may differ substantially from the amounts reported in the Total column of the Summary Compensation Table required under SEC rules and are not a substitute for total compensation as described above and in the 2017 Summary Compensation Table on page 45.

Key 2017 Compensation-Related Actions

·

Reaffirmed compensation philosophy to target our executive compensation at the median (50

th

percentile) of comparator group companies.

·

Further refined the Company’s AIP, including: (1) providing that all metrics except revenue would be based on actual foreign-exchange rates rather than budgeted rates; (2) consolidation of our Innovation and Technology and Commercial functional plans to drive focus on sales; (3) providing additional guidelines for managers to adjust bonuses for non-officers based on individual performance; and (4) providing that a prorated bonus would be paid in the event of an involuntary termination due to job elimination or redundancy.

·

Updated the change-in-control (“CIC”) agreements for a majority of our officers (including three of our five NEOs) to bring them more in line with market practices and to further ensure focus on creating and maintaining shareholder value in the event of a proposed change-in-control.

·

Reaffirmed the use of two comparator groups and determined that no changes were necessary given the significant update and changes made in 2016.

·

Conducted formal: (1) pay-for-performance review of CEO compensation versus peers; and (2) realizable pay analysis to assess whether Company performance and CEO realizable pay are aligned over a given period.

4

Table of Contents

Auditors

Set forth below is summary information with respect to PwC’s fees for services provided in 2017 and 2016.

|

Type of Fees

|

|

2017

|

|

2016

|

|

|

|

|

|

|

|

|

|

Audit Fees

|

|

$

|

2,127,000

|

|

$

|

1,935,280

|

|

|

Audit-Related Fees

|

|

196,799

|

|

1,500

|

|

|

Tax Fees

|

|

150,404

|

|

224,014

|

|

|

All Other Fees

|

|

9,500

|

|

8,600

|

|

|

Total

|

|

$

|

2,483,703

|

|

$

|

2,169,394

|

|

General Information About the Meeting

Proxy Solicita

tion

Our Board of Directors is soliciting your vote on matters that will be presented at our 2018 Annual Meeting of Shareholders and at any adjournment or postponement. This Proxy Statement contains information on these matters to assist you in voting your shares.

The Notice, the accompanying proxy card or voting instruction card and our 2017 Annual Report, including our annual report wrapper, are being mailed starting on or about March 21, 2018.

Shareholders Entitled to Vote

All shareholders of record of our common stock, par value $.25 per share, at the close of business on March 6, 2018, are entitled to receive the Notice and to vote their shares at the meeting.

As of that date, 73,951,222 shares of our common stock were outstanding. Each share is entitled to one vote on each matter properly brought to the meeting.

How You Can Vote

If you are a registered shareholder, you may vote at the Annual Meeting by delivering a proxy card in person or you may cast your vote in any of the following ways:

·

Logging on to www.ProxyVote.com.

·

Mailing your signed proxy card or voting instruction card to the address provided.

·

Calling toll-free from the United States, U.S. territories and Canada to 1-800-690-6903.

If you hold shares of the Company in “Street name,” please follow the voting instructions of the financial institution at which you have an account holding shares of the Company.

5

Table of Contents

Deadline for Voting

. Mailed proxy and voting instruction cards must be received before the meeting. If you are a registered shareholder and attend the meeting, you may deliver your completed proxy card in person. “Street name” shareholders who wish to vote at the meeting will need to obtain a proxy form from the institution that holds their shares. The deadline for voting by telephone or Internet is 11:59 PM Eastern Time on April 30, 2018.

How Your Shares Will Be Voted

In each case, for registered shareholders, your shares will be voted as you instruct. If you return a signed card, but do not provide voting instructions, your shares will be voted FOR each of the proposals. You may revoke or change your vote any time before the proxy is exercised by filing with our Corporate Secretary a notice of revocation or a duly executed proxy bearing a later date. You may also vote in person at the meeting, although attendance at the meeting will not by itself revoke a previously granted proxy. If you hold shares in the Company in “Street name” or through a broker, please refer to “Broker Voting and Votes Required” below.

Plan Participants.

Any shares you may hold in the West Pharmaceutical Services, Inc. 401(k) Plan or the West Contract Manufacturing Savings and Retirement Plan have been added to your other holdings on your proxy card.

Your completed proxy card serves as voting instructions to the trustee of those plans. You may direct the trustee how to vote your plan shares by submitting your proxy vote for those shares, along with the rest of your shares, by Internet, phone or mail, all as described on the enclosed proxy card.

If you do not instruct the trustee how to vote, your plan shares will be voted by the trustee in the same proportion that it votes shares in other plan accounts for which it received timely voting instructions.

Broker Voting and Votes Required

If your shares are held in a stock brokerage account or by a bank or other holder of record, you are considered the “beneficial owner” of shares held in “Street name.” The Notice would have been made available to you by your broker, bank or other holder of record who is considered the shareholder of record of those shares. As the beneficial owner, you may direct your broker, bank or other holder of record on how to vote your shares by using the proxy card included in the materials made available to you or by following their instructions for voting on the Internet. A broker non-vote occurs when a broker or other nominee that holds shares for another does not vote on a particular item because the nominee does not have discretionary voting authority for that item and has not received instructions from the owner of the shares. Although there is no controlling precedent under Pennsylvania law regarding the treatment of broker non-votes in certain circumstances, we intend to apply the principles outlined in the table below:

6

Table of Contents

|

Proposal

|

|

Votes Required

|

|

Treatment of Abstentions

and Broker Non-Votes

|

|

Broker

Discretionary

Voting

|

|

Proposal 1 -

Election of Directors

|

|

As this is an uncontested election, the number of votes for a director must exceed the number of votes against a director

|

|

Abstentions and broker non-votes will not be taken into account in determining the outcome of the proposal

|

|

No

|

|

Proposal 2 -

Advisory Vote to Approve Named Executive Officer Compensation

|

|

Majority of the shares present and entitled to vote on the proposal in person or represented by proxy

|

|

Abstentions will have the effect of negative votes and broker non-votes will not be taken into account in determining the outcome of the proposal

|

|

No

|

|

Proposal 3

- Ratification of the Appointment of PricewaterhouseCoopers LLP as our Independent Registered Public Accounting Firm for 2018

|

|

Majority of the shares present and entitled to vote on the proposal in person or represented by proxy

|

|

Abstentions and broker non-votes will have the effect of negative votes

|

|

Yes

|

Proxy Solicitation

. We have not retained a proxy solicitation company with respect to the proxy being solicited by this Proxy Statement.

Quorum

We must have a quorum to conduct business at the 2018 Annual Meeting. A quorum consists of the presence at the meeting either in person or represented by proxy of the holders of a majority of the outstanding shares of our common stock entitled to vote. For the purpose of establishing a quorum, abstentions, including brokers holding customers’ shares of record who cause abstentions to be recorded at the meeting, and broker non-votes are considered shareholders who are present and entitled to vote, and count toward the quorum.

Mailings to Multiple Shareholders at the Same Address

We have adopted a procedure called “householding” for making the Proxy Statement and the 2017 Annual Report available. Householding means that shareholders who share the same last name and address will receive only one copy of the materials, unless we are notified that one or more of these shareholders wishes to continue receiving additional copies.

We will continue to make a proxy card available to each shareholder of record. If you prefer to receive multiple copies of the proxy materials at the same address, please contact us in writing or by telephone: Corporate Secretary, West Pharmaceutical Services, Inc., 530 Herman O. West Drive, Exton, PA 19341, (610) 594-3319.

7

Table of Contents

Electronic Availability of Proxy Statement and Annual Report

We are pleased to be distributing our proxy materials to certain shareholders via the Internet under the “notice and access” approach permitted by the rules of the SEC. This method conserves natural resources and reduces our costs of printing and mailing while providing a convenient way for shareholders to review our materials and vote their shares.

On March 21, 2018, we mailed a “Notice of Internet Availability” to participating shareholders, which contains instructions on how to access the proxy materials on the Internet.

If you would like to receive a printed copy of our proxy materials, we will send you one free of charge. Instructions for requesting such materials are included in the Notice.

This Proxy Statement and our 2017 Annual Report are available at:

http://investor.westpharma.com/phoenix.zhtml?c=118197&p=irol-reportsannual.

Corporate Governance and Board Matters

During 2017, our Board met six times. Each director attended at least 75% of the Board meetings and the meetings of the Board committees on which he or she served. All directors are expected to attend the 2018 Annual Meeting, and all our directors attended the 2017 Annual Meeting.

Our principal governance documents are our Corporate Governance Principles, Board Committee Charters, director qualification standards and Code of Business Conduct. Aspects of our governance documents are summarized below. We encourage our shareholders to read our governance documents, as they present a comprehensive picture of how the Board addresses its governance responsibilities to ensure our vitality and success. The documents are available in the “

Investors

—

Corporate Governance

” section of our website at

www.westpharma.com

and copies of these documents may be requested by writing to our Corporate Secretary, West Pharmaceutical Services, Inc., 530 Herman O. West Drive, Exton, PA 19341.

Corporate Governance Principles

Our Board has adopted Corporate Governance Principles to provide guidance to our Board and its committees on their respective roles, director qualifications and responsibilities, Board and committee composition, organization and leadership. Our Nominating and Corporate Governance Committee reviewed and significantly updated our Corporate Governance Principles to meet best practices in corporate governance in 2016 and, in 2017, the Committee confirmed that the Corporate Governance Principles address our current and long-term business needs. The only change made after this review was to increase our mandatory retirement age from 72 to 75, which is discussed in more detail below. Our Corporate Governance Principles address, among other things:

·

Statements of the Board’s commitment to high ethical standards, principles of fair dealing and high ethical standards;

·

The requirement to hold separate executive sessions of the independent directors;

·

The importance of robust executive succession planning and the role of directors in succession planning;

·

The Board’s policy on setting director

8

Table of Contents

CORPORATE GOVERNANCE AND BOARD MATTERS

compensation and director share-ownership guidelines;

·

Guidelines on Board organization and leadership, including the number and structure of committees and qualifications of committee members;

·

Guidelines on outside board memberships;

·

Policies on making charitable contributions and prohibition of political contributions;

·

Policies on access to Management;

·

Requirements fostering leadership development by senior executives;

·

Statements of our executive compensation philosophy and our independent auditor standards;

·

Director orientation and education; and

·

Self-assessments of Board and Committee performance to determine their effectiveness.

Code of Business Conduct

All our employees, officers and directors are required to comply with our Code of Business Conduct as a condition of employment. The Code of Business Conduct covers fundamental ethical and compliance-related principles and practices such as accurate accounting records and financial reporting, avoiding conflicts of interest, protection and proper use of our property and information and compliance with legal and regulatory requirements. The Board has adopted a comprehensive Compliance and Ethics Program, which was substantially updated in 2016, and was reviewed and reaffirmed in 2017 as meeting the needs of our Company, its shareholders and other stakeholders. Mr. Miller is our Chief Compliance Officer. Mr. Miller delivers regular reports on program developments and initiatives to the Audit Committee and the Board.

Board Leadership Structure

The current governance structure of the Board follows:

·

The offices of Chairman and CEO are separate;

·

The Board has established and follows robust corporate governance guidelines;

·

All the members of the Board, other than Mr. Green, are independent;

·

All Board Committees are composed solely of independent directors;

·

Our independent directors meet regularly in executive session both at the Board and Board committee levels; and

·

Our directors as a group possess a broad range of skills and experience sufficient to provide the leadership and strategic direction the Company requires as it seeks to enhance long-term value for shareholders.

Our Board took steps to enrich our diversity during 2017, including the addition of another female director and the increase of our mandatory retirement age.

While the offices of Chairman and CEO are currently separate, the Board takes a flexible approach to the issue of whether the offices of Chairman and CEO should be separate or combined. This approach allows the Board to regularly evaluate whether it is in the best interests of the Company for the CEO or another director to hold the position of Chairman.

9

Table of Contents

The Board does not currently have a lead independent director, although the Board believes it may be useful and appropriate to designate a lead independent director if the offices of Chairman and CEO are combined in the future.

We believe the current Board leadership structure is appropriate now because it allows the Chairman to focus on corporate governance and management of the Board priorities and allows the CEO to focus directly on managing our operations and growing the Company.

Chairman of the Board of Directors

The responsibilities of the Chairman include:

·

Chairing Board meetings, including executive sessions of the independent directors;

·

Approving agendas and schedules for each Board meeting in consultation with the CEO; and

·

Serving as principal liaison between the CEO and the independent directors.

Each independent director may add items to the agenda. Independent directors meet in regularly scheduled executive sessions and in special executive sessions called by the Chairman.

Our current Chairman, Mr. Zenner, has been serving on the Board since 2002, and as our Chairman since 2015. Each year the Board considers the role of the Chairman and who is sitting in that role. We believe Mr. Zenner’s experience as a top executive, his independence plus his history with the Company makes him a valuable asset for the Company and provides significant leadership to our Board.

We believe continuing his Chairmanship has been beneficial to Management and enhanced shareholder value especially in light of the appointment of four new board members since 2014, and significant changes in our corporate officers since 2015, with a new CEO and new leaders in Global Operations and Supply Chain, Legal, Human Resources, Corporate Development, Strategy and Investor Relations, and Innovation and Technology.

Committees

The Board has five standing committees:

·

Audit Committee;

·

Compensation Committee;

·

Finance Committee;

·

Innovation & Technology Committee; and

·

Nominating and Corporate Governance Committee.

From time to time, the Board may form ad hoc committees to address specific situations as they may arise. Each committee consists solely of independent directors. Each standing committee has a written charter, which is posted in the

“Investors—Corporate Governance”

section of our website at

www.westpharma.com

.

You may request a copy of each committee’s charter from our Corporate Secretary.

Audit Committee

|

Mark A. Buthman (Chair)

William F. Feehery

Thomas W. Hofmann

Paolo Pucci

|

|

The Audit Committee assists our Board in its oversight of: (1) the integrity of our financial statements; (2) the independence and qualifications of our independent auditors; (3) the performance of our internal audit function and independent auditors; and (4) our compliance with legal and regulatory requirements. In carrying out these responsibilities, the Audit Committee, among other things:

|

10

Table of Contents

|

|

|

·

Reviews and discusses our annual and quarterly financial statements with Management and the independent auditors;

·

Manages our relationship with the independent auditors, including having sole authority for their appointment, retention and compensation; reviewing the scope of their work; approving non-audit and audit services; and confirming their independence; and

·

Oversees Management’s implementation and maintenance of disclosure controls and procedures and internal control over financial reporting.

|

|

|

|

|

|

|

|

The Board has affirmatively determined that Mr. Buthman and Mr. Hofmann are each an “Audit Committee financial expert” as defined in SEC regulations. In 2017, the Audit Committee met seven times. All members of the Audit Committee are independent as defined in the listing standards of the New York Stock Exchange (“NYSE”) and the Company’s Corporate Governance Principles.

|

|

|

|

|

|

Compensation Committee

|

|

|

|

|

|

|

|

Douglas A. Michels (Chair)

Thomas W. Hofmann

Paolo Pucci

John H. Weiland

|

|

The Compensation Committee develops our overall compensation philosophy, and determines and approves our executive compensation programs, makes all decisions about the compensation of our executive officers, reviews our talent management and succession planning for key positions and oversees our cash and equity-based incentive compensation plans.

|

|

|

|

|

|

|

|

Additional information about the roles and responsibilities of the Compensation Committee can be found under the heading “Compensation Discussion and Analysis.” In 2017, the Compensation Committee met four times. All members of the Compensation Committee are independent as defined in the listing standards of the NYSE and the Company’s Corporate Governance Principles.

|

|

|

|

|

|

Finance Committee

|

|

|

|

|

|

John H. Weiland (Chair)

Thomas W. Hofmann

Deborah L. V. Keller

Myla P. Lai-Goldman

|

|

The Finance Committee reviews proposals made by Management and recommends to the full Board optimal capital structure of the Company and adjustments and the way capital is allocated and deployed by the Company. The Finance Committee analyzes and makes recommendations to the full Board with respect to potential opportunities for business combinations, acquisitions, mergers, dispositions, divestitures and similar strategic transactions involving the Company. The Finance Committee also ensures all strategic transactions are in alignment with the Company’s strategic business plan and oversees the process of reviewing, negotiating, consummating and/or integrating potential strategic transactions. In 2017, the Finance Committee met seven times. All members of the Finance Committee are independent as defined in the listing standards of the NYSE and the Company’s Corporate Governance Principles.

|

|

|

|

|

|

Innovation and Technology Committee

|

|

|

|

|

|

Paula A. Johnson (Chair)

Deborah L. V. Keller

Myla P. Lai-Goldman

Douglas A. Michels

|

|

The Innovation and Technology Committee provides guidance to our Board on technical and commercial innovation strategies, reviews emerging technology trends that may affect our business, reviews our major innovation and technological programs and overall patent strategies, and assists our Board in making well-informed choices about investments in new technology. In 2017, the Innovation and Technology Committee met three times.

|

11

Table of Contents

|

Nominating and Corporate Governance Committee

|

|

|

|

William F. Feehery (Chair)

Mark A. Buthman

Patrick J. Zenner

|

|

The Nominating and Corporate Governance Committee identifies qualified individuals to serve as board members; recommends nominees for director and officer positions; determines the appropriate size and composition of our Board and its committees; monitors a process to assess Board effectiveness; reviews related-party transactions; and considers matters of corporate governance. The Committee also reviews and makes recommendations to the Board regarding compensation for non-employee directors and administers director equity-based compensation plans. In 2017, the Nominating and Corporate Governance Committee met three times. All members of the Committee are independent as defined in the listing standards of the NYSE and the Company’s Corporate Governance Principles.

|

Board Matters

During 2017, our Board and each of its Committees played pivotal roles in helping to develop and approve our corporate strategy. The major issues debated and decided by the Board during 2017 included:

·

Actively updating our enterprise strategic plan and monitoring progress, including through our Finance Committee, which had its first full year of meetings during 2017;

·

Conducting a significant talent and succession planning review for key positions with Management as an integral part of our annual enterprise strategic planning meeting;

·

Reviewing potential targets for mergers and acquisitions and potential licensing opportunities and improving our merger and acquisition evaluation process;

·

Strengthening our enterprise risk management (“ERM”) process, including significant review of cybersecurity risks, protections and recovery plans;

·

Publishing our inaugural Corporate Responsibility report, which outlines our initiatives in five areas critical to our culture and success: Compliance and Ethics, Philanthropy, Diversity, Health and Safety and Environmental Sustainability;

·

Revising the director mandatory retirement age in our Corporate Governance Principles;

·

Adding a new female director with a healthcare background; and

·

Reviewing the Company’s capital allocation strategy, increasing the annual dividend and continuing our strategic share buyback program.

The Board’s Role in Risk Oversight

The Board’s role in risk oversight is consistent with our leadership structure, with Management having day-to-day responsibility for assessing and managing our risk exposure and the Board actively overseeing management of our risks—both at the Board and committee level.

The Board regularly reviews and monitors the risks associated with our financial condition and operations and specifically reviews the enterprise risks associated with our five-year plan. In particular, the Board reviews our risk portfolio, confirms that Management has established risk-management processes that are functioning effectively and efficiently and are consistent with our corporate strategy, reviews the most significant risks and determines whether Management is responding appropriately.

12

Table of Contents

The Board performs its risk oversight role by using several different levels of review. Each Board meeting begins with a strategic overview by the CEO that describes the most significant issues, including risks, affecting the Company and includes business updates from each reportable segment. In addition, the Board reviews in detail the business and operations of each reportable segment quarterly, including the primary risks associated with that segment.

During 2017, with Board oversight and review, we substantially enhanced our ERM process. This expanded ERM process helps us reduce and manage the risk inherent in our business, gain a greater understanding and awareness of risks facing the business, ensure risk-appropriate mitigation efforts are in place and regularly monitored and ensure the Company meets or exceeds the expectation of investors and regulators.

The Board focuses on the overall risks affecting the Company. For example, the Board and each committee assesses cybersecurity risks and Management’s plan for defending against and responding to these risks. Additionally, each committee has been delegated the responsibility for the oversight of specific risks that fall within its areas of responsibility, which were cataloged through our ERM process, including:

·

The Audit Committee oversees management of financial reporting, compliance and litigation risks as well as the steps Management has taken to monitor and control such exposures.

·

The Compensation Committee is responsible for overseeing the management of risks relating to our executive compensation policies, plans and arrangements and the extent to which those policies or practices increase or decrease risk for the Company.

·

The Finance Committee assesses the risks associated with allocation of our capital, potential acquisitions, divestitures and major business partnerships.

·

The Innovation and Technology Committee reviews risks associated with intellectual property, innovation efforts and our technology strategy.

·

The Nominating and Corporate Governance Committee manages risks associated with the independence of the Board, potential conflicts of interest and the effectiveness of the Board.

Although each Committee is responsible for evaluating certain risks and overseeing the management of those risks, the full Board is regularly informed about those risks through committee reports.

Director Independence

Our Board has adopted a formal set of categorical director independence determination standards (“Standards”). The Standards meet or exceed the independence requirements of the NYSE corporate governance listing standards. Under the Standards, a director must have no material relationship with us other than as a director. The Standards specify the criteria for determining director independence, including strict guidelines for directors and their immediate families regarding employment or affiliation with us, members of our senior Management or their affiliates. The full text of the Standards may be found under the “

Investors — Corporate Governance

” section on our website at

www.westpharma.com

.

The Board undertook its annual review of director independence in February 2018. As a result of this review, the Board did not substantively revise the Standards. Subsequently, the Board considered whether any relationships described under the Standards between the Company and each individual director existed. The Board affirmatively determined that each of its non-employee directors is independent of the Company and its Management team as defined under the Standards.

13

Table of Contents

Executive Sessions of Independent Directors

Our Board also holds regular executive sessions of only independent directors to review the Company’s strategy and Management’s operating plans, the criteria by which our CEO and other senior executives are measured, Management’s performance against those criteria and other related issues and to conduct a self-assessment of its performance. Last year, our independent directors held six executive sessions.

Board Refreshment and Retirement Age

We review our Board refreshment policies and retirement age annually, and we continue to monitor trends in this area.

The Board does not have term limits on the service of our directors, because we believe that term limits may lead to loss of valuable director insight into our business and operations that is enhanced with continuity. The Board believes that a diverse mix of long-tenured and new Board members provides a good and appropriate balance of experience to enhance shareholder value.

In 2017, we revised our Corporate Governance Principles to increase the mandatory retirement age from 72 to 75. This means that a non-employee director must retire on the date of the Annual Meeting of Shareholders immediately following his or her 75th birthday. The Board revised the retirement age because the Board believes that directors may continue to provide meaningful, independent oversight and advice past age 72.

An employee director must submit his or her resignation upon the date he or she ceases to be an executive of the Company.

Director Evaluation

Each year the Board and each committee review their performance as a committee during executive sessions. This review centers around questions directors are asked to contemplate before the meeting. These questions include topics such as the relationship between members, quality of the materials provided, the relationship with management, their calendar and topics that they would like to see added or deleted to meeting agendas.

Additionally, the Nominating and Corporate Governance Committee reviews the evaluation process annually and makes suggested changes when necessary. Beginning in 2016, the Chairman of this Committee reaches out to each director individually to discuss any concerns and relays them to the Board using an interview template approved by the Committee.

We believe this evaluation system, coupled with our strong Chairman of the Board and open-door policy, which encourage sharing of ideas among all directors, makes for a robust process that ensures the Board’s effectiveness.

Director Education

The Board believes shareholders are best served by Board members who are well versed in corporate governance principles and other subject matters relevant to board service. Therefore, all directors are encouraged to attend any director education programs they consider appropriate to stay informed about developments in corporate governance and the markets we serve. The Company reimburses directors for the reasonable costs of attending director education programs. To encourage continuing director education, the Board also arranges for a series of annual educational presentations on its calendar.

14

Table of Contents

Share Ownership Goals for Directors and Executive Management

To encourage significant share ownership by our directors and further align their interests with the interests of our shareholders, directors are expected to acquire within three years of appointment, and to retain during their Board tenure, shares of our common stock equal in value to at least five times their annual retainer. All directors meet this requirement or are within the three-year period to obtain the necessary shares. The Board has also set share ownership goals for senior executive Management, which are described under “Compensation Discussion and Analysis — Other Compensation Policies.”

2017 Shareholder Outreach

To ensure that the Board considers shareholder views on compensation, corporate governance and business matters, we maintain an active shareholder engagement program. Throughout the year, Management meets with our actively-managed, institutional shareholders, which own a majority of our shares. Management discusses topics of interest from our shareholders, solicits their input on these topics and provides our own views on these topics. The Board receives regular updates on investor feedback.

The Board remains committed to aligning pay and performance in a manner that enhances shareholder value. Our shareholders have historically expressed support for our long-term performance goals, including return on invested capital and top line sales growth.

Additionally, Management heard our shareholders express support for our corporate governance framework, Board membership and Board policies, including our tenure policies.

During 2017, we also addressed director attendance and its importance with these shareholders. Our Board is committed to ensuring that directors attend meetings and that the Board and its Committees devote sufficient time necessary for the effective oversight of the Company and its Management.

Communicating with the Board

You may communicate with the Chairman of the Board or the independent directors as a group by sending a letter addressed to the Board of Directors, c/o Corporate Secretary, West Pharmaceutical Services, Inc., 530 Herman O. West Drive, Exton, Pennsylvania 19341. Communications to a particular director should be addressed to that director at the same address.

Our Corporate Secretary maintains a log of all communications received through this process. Communications to specific directors are forwarded to those directors. All other communications are given directly to the Chairman of the Board who decides whether they should be forwarded to a Board committee or to Management for further handling.

Director Nominations, Criteria and Diversity

Candidates for nomination to our Board are selected by the Nominating and Corporate Governance Committee in accordance with the Committee’s charter, our Articles of Incorporation, our Bylaws and our Corporate Governance Principles. All persons recommended for nomination to our Board, regardless of the source of the recommendation, are evaluated by the Committee.

15

Table of Contents

The Board and the Nominating and Corporate Governance Committee consider, at a minimum, the following factors in recommending potential new Board members or the continued service of existing members:

·

A director is nominated based on his or her professional experience. A director’s traits, expertise and experience add to the skill-set of the Board as a whole and provide value in areas needed for the Board to operate effectively.

·

A director must have high standards of integrity and commitment, and exhibit independence of judgment, a willingness to ask hard questions of Management and the ability to work well with others.

·

A director should be willing and able to devote sufficient time to the affairs of the Company and be free of any disabling conflict.

·

All the non-employee directors should be “independent” as outlined in our Standards.

·

A director should exhibit confidence and a willingness to express ideas and engage in constructive discussion with other Board members, Management and relevant persons.

·

A director should actively participate in the decision-making process, be willing to make difficult decisions, and demonstrate diligence and faithfulness in attending Board and committee meetings.

·

The Board generally seeks active or former senior executives of public companies, particularly those with international operations, leaders in healthcare or public health fields, with science or technology backgrounds, and individuals with financial expertise.

When reviewing nominees, the Nominating and Corporate Governance Committee considers whether the candidate possesses the qualifications, experience and skills it considers appropriate in the context of the Board’s overall composition and needs. The Nominating and Corporate Governance Committee also values diversity on the Board in the director nominee identification and nomination process.

Our Corporate Governance Principles include a statement of the importance of board diversity to ensure that the director nomination process considers a diverse mix of background, age, gender, sexual orientation, as well as cultural and ethnic composition. Accordingly, the Committee’s evaluation of director nominees includes consideration of their ability to contribute to the diversity of personal and professional experiences, opinions, perspectives and backgrounds on the Board. The Committee regularly assesses the effectiveness of this approach as part of its review of the Board’s composition.

In 2017, we appointed a new Board member, Ms. Keller, who has experience leading a multinational drug development business that partners with leading pharmaceutical and biotechnology companies like our Company. In addition, we increased our mandatory retirement age from 72 to 75. Each of these actions help to ensure we have a diversity of perspectives and experience levels on the Board.

To assist it with its evaluation of the director nominees for election at the 2018 Annual Meeting, the Committee considered the factors listed above and used a skills matrix highlighting the experience of our directors in areas such as industry experience, international background, leadership, financial literacy, risk management expertise and independence.

Under the heading “Director Qualifications and Biographies,” we provide an overview of each nominee’s principal occupation, business experience and other directorships of publicly-traded companies, together with the qualifications, experience, key attributes and skills the Committee and the Board believe will best serve the interests of the Board, the Company and our shareholders.

Shareholders who wish to recommend or nominate director candidates must provide information about themselves and their candidates and comply with procedures and timelines contained in our Bylaws. These procedures are described under “Other Information

—

2019 Shareholder Proposals or Nominations” in this Proxy Statement.

16

Table of Contents

Related Person Transactions and Procedures

The Board has adopted written policies and procedures relating to the Nominating and Corporate Governance Committee’s review and approval of transactions with related persons that are required to be disclosed in proxy statements under SEC regulations. A “related person” includes our directors, officers, 5% shareholders and immediate family members of these persons.

Under the policy, the Nominating and Corporate Governance Committee reviews the material facts of all related-person transactions, determines whether the related person has a material interest in the transaction and may approve, ratify, rescind or take other action with respect to the transaction.

In approving a transaction, the Committee will consider, among other factors, whether the transaction is on terms no less favorable than terms generally available to an unaffiliated third party under the same or similar circumstances and the extent of the related person’s interest in the transaction.

The Committee reviews and pre-approves certain types of related person transactions, including certain transactions with companies at which the related person is an employee only, and charitable contributions that would not disqualify a director’s independent status. The policy and procedures can be found in the “

Investors—Corporate Governance — Governance Documents

” section of our website,

www.westpharma.com

.

We have no related person transactions required to be reported under applicable SEC rules.

17

Table of Contents

DIRECTOR COMPENSATION

Director Compensation

2017 Non-Employee Director Compensation

The compensation structure was reviewed in 2017 by the Board of Directors in consultation with Pay Governance LLC (“Pay Governance”), our independent compensation consultant. After this review, it was determined that no changes were necessary to the compensation structure. The structure that was in effect for all of 2017 is set forth below.

|

Compensation Item

|

|

Amount

|

|

|

|

|

|

|

|

Annual Retainers and Chair Fees

|

|

|

|

|

Board membership

|

|

$

|

80,000

|

|

|

Chairman of the Board

|

|

100,000

|

*

|

|

Audit Committee Chair

|

|

20,000

|

|

|

Compensation Committee Chair

|

|

20,000

|

|

|

All Other Committee Chairs

|

|

10,000

|

|

|

Restricted Stock Units

|

|

160,000

|

|

|

|

|

|

|

|

* Payable in cash or restricted stock, which vests 25% per quarter, as elected annually by the Chairman.

The following table shows the total 2017 compensation of our non-employee directors.

2017 Non-Employee Director Compensation

|

Name

|

|

Fees Earned or

Paid in Cash

($)

|

|

Stock Awards

($)

|

|

All Other

Compensation

($)

|

|

Total

($)

|

|

|

Mark A. Buthman

|

|

100,000

|

|

159,976

|

|

13,875

|

|

273,851

|

|

|

William F. Feehery

|

|

90,000

|

|

159,976

|

|

8,520

|

|

258,496

|

|

|

Thomas W. Hofmann

|

|

80,000

|

|

159,976

|

|

17,947

|

|

257,923

|

|

|

Paula A. Johnson

|

|

90,000

|

|

159,976

|

|

21,371

|

|

271,347

|

|

|

Deborah L. V. Keller

|

|

46,667

|

|

146,654

|

|

551

|

|

193,872

|

|

|

Myla P. Lai-Goldman

|

|

80,000

|

|

159,976

|

|

3,632

|

|

243,608

|

|

|

Douglas A. Michels

|

|

100,000

|

|

159,976

|

|

31,073

|

|

291,049

|

|

|

Paolo Pucci

|

|

80,000

|

|

159,976

|

|

1,644

|

|

241,620

|

|

|

John H. Weiland

|

|

90,000

|

|

159,976

|

|

31,073

|

|

281,049

|

|

|

Patrick J. Zenner

|

|

130,000

|

|

209,751

|

|

28,676

|

|

368,427

|

|

Fees Earned or Paid in Cash

The amounts in the “Fees Earned or Paid in Cash” column are retainers earned for serving on our Board, its committees and as committee chairs and Chairman, Independent Directors or Chairman, as applicable. All annual retainers are paid quarterly. For Mr. Zenner this amount includes his cash fees for serving as Chairman of the Board.

The amounts are not reduced to reflect elections to defer fees under the Nonqualified Deferred Compensation Plan for Non-Employee Directors (“Director Deferred Compensation Plan”). During 2017, Mr. Buthman, Ms. Keller, Mr. Michels, and Mr. Weiland deferred 100% of their fees paid in 2017. Dr. Lai-Goldman deferred 50% of these fees.

18

Table of Contents

Stock Awards

The amounts in the “Stock Awards” column reflect the

grant date fair value of stock-settled RSU awards made in 2017 and the grant date fair value is determined under Financial Accounting Standards Board Accounting Standards Codification (“FASB ASC”) Topic 718. In 2017, each continuing non-employee director was awarded 1,697 RSUs, with a grant date fair market value of $94.27 per share based on the closing price of our common stock on the award date, May 2, 2017. These awards had a grant date fair value of $159,976. Ms. Keller was awarded a prorated grant on the commencement of her service on June 1, 2017. Her award was for 1,483 shares at $98.89 per share, which had a grant date fair value of $146,654. For a discussion on RSU grant date fair value, refer to Note 12 of the consolidated financial statements in our 2017 Annual Report.

RSUs are granted on the date of our Annual Meeting (or, as in the case with Ms. Keller, upon commencement of service) and fully vest on the date of the next Annual Meeting so long as a director remains on the Board as of that date. Generally, all unvested grants of equity forfeit upon termination. However, if a director retires during the calendar year that he or she reaches our mandatory retirement age, the award will vest on a monthly basis through retirement.

Stock-settled RSUs are distributed upon vesting, unless a director elects to defer the award under the Director Deferred Compensation Plan. In 2017, all directors elected to defer their RSU awards. All awards are distributed as shares of common stock, as described below. When dividends are paid on common stock, additional shares are credited to each director’s deferred stock account as if those dividends were used to purchase additional shares.

For Mr. Zenner this column also includes the 528 shares of restricted stock he elected to receive in lieu of cash for his additional $100,000 Chairman’s annual retainer. The restricted stock, which had a grant date fair value of $94.27, vests 25% per quarter and was equivalent to approximately 50% of his Chairman’s retainer, or $49,775. These restricted shares are issued and outstanding, and, therefore, earn dividends. They are not eligible to be deferred or credited to the Director Deferred Compensation Plan. The remainder of this retainer was paid in cash.

The table below shows the number of outstanding stock awards held by each director at year-end. No directors have any outstanding options.

Outstanding Director Stock Awards at Year-End 2017

|

Name

|

|

Unvested Restricted

Stock Awards

(#)

|

|

Vested Annual

Deferred Stock

Awards

(#)

|

|

Unvested Annual

Deferred Stock and

Stock-Settled RSU

Awards

(#)

|

|

Total Outstanding

Stock Awards

(#)

|

|

|

Mark A. Buthman

|

|

-0-

|

|

22,114

|

|

1,702

|

|

23,816

|

|

|

William F. Feehery

|

|

-0-

|

|

17,171

|

|

1,702

|

|

18,873

|

|

|

Thomas W. Hofmann

|

|

-0-

|

|

34,878

|

|

1,702

|

|

36,580

|

|

|

Paula A. Johnson

|

|

-0-

|

|

34,028

|

|

1,702

|

|

35,730

|

|

|

Deborah L. V. Keller

|

|

-0-

|

|

-0-

|

|

1,487

|

|

1,487

|

|

|

Myla P. Lai-Goldman

|

|

-0-

|

|

7,865

|

|

1,702

|

|

9,567

|

|

|

Douglas A. Michels

|

|

-0-

|

|

22,114

|

|

1,702

|

|

23,816

|

|

|

Paolo Pucci

|

|

-0-

|

|

1,287

|

|

1,702

|

|

2,989

|

|

|

John H. Weiland

|

|

-0-

|

|

41,893

|

|

1,702

|

|

43,595

|

|

|

Patrick J. Zenner

|

|

265

|

|

39,404

|

|

1,702

|

|

41,371

|

|

19

Table of Contents

All Other Compensation

The amounts in the “All Other Compensation” column are Dividend Equivalent Units (“DEUs”) credited to accounts under the Director Deferred Compensation Plan. No charitable matching contributions were made on behalf of any directors in 2017.

Director Deferred Compensation Plan

All non-employee directors may participate in the Director Deferred Compensation Plan, which permits participants to defer all or a part of their annual cash compensation until their Board service terminates. Deferred fees may be credited to a “stock-unit” account that is deemed invested in our common stock or to an account that earns interest at the prime rate of our principal commercial bank. Stock-unit accounts are credited with DEUs based on the number of stock units credited on the dividend record date.

The value of a director’s account balance is distributed on termination of Board service. The value of a director’s stock-unit account is determined by multiplying the number of units credited to the account by the fair market value of our common stock on the termination date.

RSUs that a director elects to defer (and all shares of deferred stock) are distributed in shares of stock. Pre-2014 stock units may be distributed in cash in lieu of stock, if a director made an election in 2013. All post-2013 stock units are only distributable in stock. Partial shares are distributed in cash.

Directors may receive their distribution as a lump sum or in up to ten annual installments. Separate elections apply to amounts earned and vested before January 1, 2005 and amounts earned and vested after December 31, 2004, which solely applies to Mr. Zenner. If a director elects the installment option, the cash balance during the distribution period will earn interest at the prime rate of our principal commercial bank and deferred stock and stock-settled units will be credited with DEUs until paid.

Director Deferred Compensation Plan at Year-End 2017

The following table summarizes the amounts credited to each Director Deferred Compensation Plan account as of December 31, 2017:

|

Name

|

|

Cash-Settled Stock

Units Value(1)

($)

|

|

Vested Stock-

Settled Unit and

Deferred Stock

Value (1)

($)

|

|

Unvested

Deferred Stock

and RSU Value (1)

($)

|

|

Total Account

Balance

($)

|

|

|

Mark A. Buthman

|

|

-0-

|

|

3,062,322

|

|

167,925

|

|

3,230,247

|

|

|

William F. Feehery

|

|

-0-

|

|

2,117,853

|

|

167,925

|

|

2,285,778

|

|

|

Thomas W. Hofmann

|

|

-0-

|

|

3,441,412

|

|

167,925

|

|

3,609,337

|

|

|

Paula A. Johnson

|

|

-0-

|

|

4,083,754

|

|

167,925

|

|

4,251,679

|

|

|

Deborah L. V. Keller

|

|

-0-

|

|

47,362

|

|

146,748

|

|

194,110

|

|

|

Myla P. Lai-Goldman

|

|

-0-

|

|

946,936

|

|

167,925

|

|

1,114,861

|

|

|

Douglas A. Michels

|

|

619,083

|

|

2,743,788

|

|

167,925

|

|

3,530,796

|

|

|

Paolo Pucci

|

|

-0-

|

|

132,514

|

|

167,925

|

|

300,439

|

|

|

John H. Weiland

|

|

1,778,242

|

|

4,762,987

|

|

167,925

|

|

6,709,154

|

|

|

Patrick J. Zenner

|

|

-0-

|

|

5,507,957

|

|

167,925

|

|

5,675,882

|

|

(1)

Value is determined by multiplying the number of stock units or shares of deferred stock, as applicable, by $98.67, the fair market value of a share of stock on December 29, 2017. A portion of the stock units may relate to deferred compensation that has previously been reported in the “Fees Earned or Paid in Cash” column for the year the compensation was earned by the director.

20

Table of Contents

EXECUTIVE COMPENSATION

Executive Compensation

Executive Summary

Our Compensation Philosophy and Goals

We believe that our long-term success is directly related to our ability to attract, motivate and retain highly talented individuals committed to driving innovation in our products and services improving financial performance, achieving profitable growth on a sustainable basis and enhancing shareholder value.

To that end, our Compensation Committee (all subsequent references to “Committee” in this Executive Compensation section are to the Compensation Committee) has developed and implemented a pay-for-performance compensation philosophy that closely aligns our executives’ incentive compensation with Company performance and shareholder interests on a short- and long-term basis without promoting excessive risk. When we deliver expected performance, our pay should approximate the market median. Actual compensation, however, varies with our performance.

For our Corporate function participants and Ms. Flynn, our annual cash incentive bonus plan, the Annual Incentive Plan (“AIP”), is based on our performance on three financial measures: Adjusted Diluted EPS, Adjusted Operating Cash Flow (“OCF”) and Adjusted Consolidated Revenue (“Adjusted Revenue”).

Mr. Montecalvo, who leads our Global Operations and Supply Chain function, has goals based 50% on the aforementioned Corporate metrics and 50% based on performance against goals for Gross Profit for our proprietary products (“Proprietary GP”) and OCF for our proprietary products (“Proprietary OCF”).

All goals are set using a rigorous process to ensure sufficient stretch and encourage achievement of our committed growth targets. Our annual incentive plan targets and our incentive compensation philosophy are reviewed annually by the Committee to ensure alignment with our organizational structure and enterprise strategy. This, in turn, drives alignment between pay and performance.

Annual awards are paid only if performance meets or exceeds 85% of the target. At the 85% threshold only 50% of the AIP target is paid with increasing amounts for improved performance.

We believe our long-term incentive awards are aligned with shareholder interests with targets based on the achievement of the three-year compound annual growth rate (“CAGR”) and the return on invested capital (“ROIC”) targets. Both focused on delivering value over the long term and encouraging share ownership and help in the retention of key talent.

To ensure our long-term goals are delivering shareholder value we undergo an annual review of the correlation between our long-term incentive plan (“LTIP”) payouts and our TSR over the performance period. As in prior years, our review indicates that our LTIP is highly correlated to our TSR and that our TSR outpaces our peers and the market as a whole.

Finally, to ensure direct linkage to business performance and pay, a significant portion of the total compensation opportunity for each of our executives, including the NEOs, is directly dependent on the achievement of pre-established corporate goals — more than 82% for our CEO and more than 68% for our other NEOs.

21

Table of Contents

2017 Say-on-Pay Results