UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE

13D/A

Under the Securities Exchange Act of 1934

(Amendment No. 4)*

Clear Channel

Outdoor Holdings, Inc.

(Name of issuer)

Class A

Common Stock, par value $0.01 per share

(Title of class of securities)

18451C109

(CUSIP number)

Robert H. Walls, Jr.

Executive Vice President, General Counsel and Secretary

iHeartMedia, Inc.

20880

Stone Oak Parkway

San Antonio, Texas 78258

(210) 822-2828

with a

copy to:

James S. Rowe

Brian D. Wolfe

Kirkland

& Ellis LLP

300 North LaSalle

Chicago, Illinois 60654

Telephone: (312) 862-2000

(Name, Address and Telephone Number of Person Authorized to Receive Notices and Communications)

March 15, 2018

(Date of

Event which Requires Filing of this Statement)

If the filing person has

previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because of §§ 240.13d-1(e), 240.13d-1(f) or 240.13d-1(g), check the following

box. ☐

Note

: Schedules filed in paper format shall include a signed original and five copies of the schedule, including all exhibits. See Rule 13d-7 for other

parties to whom copies are to be sent.

|

*

|

The remainder of this cover page shall be filled out for a reporting person’s initial filing on this form with respect to the subject class of securities, and for any subsequent amendment containing information

which would alter disclosures provided in a prior cover page.

|

The information required on the remainder of this cover page shall not be

deemed to be “filed” for the purpose of section 18 of the Securities Exchange Act of 1934 (“Act”) or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act

(however, see the Notes).

|

|

|

|

|

|

|

|

|

SCHEDULE 13D

|

|

Page

2

of 14

|

|

CUSIP No. 18451C109

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1)

|

|

Names of

reporting persons

iHeartMedia, Inc.

|

|

(2)

|

|

Check the appropriate box if a member

of a group (see instructions)

(a) ☐ (b) ☐

|

|

(3)

|

|

SEC use only

|

|

(4)

|

|

Source of funds (see instructions)

OO

|

|

(5)

|

|

Check if Disclosure of Legal

Proceedings Is Required Pursuant to Items 2(d) or 2(e) ☐

|

|

(6)

|

|

Citizenship or place of

organization

Delaware

|

|

Number of

shares

beneficially

owned by

each

reporting

person

with:

|

|

(7)

|

|

Sole voting power

325,726,917 (see item 5)

|

|

|

(8)

|

|

Shared voting power

0

|

|

|

(9)

|

|

Sole dispositive power

325,726,917 (see item 5)

|

|

|

(10)

|

|

Shared dispositive power

0

|

|

(11)

|

|

Aggregate amount beneficially owned by each reporting person

325,726,917 (see item 5)

|

|

(12)

|

|

Check if the aggregate amount in Row

(11) excludes certain shares (see instructions) ☐

|

|

(13)

|

|

Percent of class represented by amount

in Row (11)

89.5% (see item 5)

|

|

(14)

|

|

Type of reporting person (see

instructions)

CO

|

|

|

|

|

|

|

|

|

|

SCHEDULE 13D

|

|

Page

3

of 14

|

|

CUSIP No. 18451C109

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1)

|

|

Names of

reporting persons

iHeartMedia Capital II, LLC

|

|

(2)

|

|

Check the appropriate box if a member

of a group (see instructions)

(a) ☐ (b) ☐

|

|

(3)

|

|

SEC use only

|

|

(4)

|

|

Source of funds (see instructions)

OO

|

|

(5)

|

|

Check if Disclosure of Legal

Proceedings Is Required Pursuant to Items 2(d) or 2(e) ☐

|

|

(6)

|

|

Citizenship or place of

organization

Delaware

|

|

Number of

shares

beneficially

owned by

each

reporting

person

with:

|

|

(7)

|

|

Sole voting power

325,726,917 (see item 5)

|

|

|

(8)

|

|

Shared voting power

0

|

|

|

(9)

|

|

Sole dispositive power

325,726,917 (see item 5)

|

|

|

(10)

|

|

Shared dispositive power

0

|

|

(11)

|

|

Aggregate amount beneficially owned by each reporting person

325,726,917 (see item 5)

|

|

(12)

|

|

Check if the aggregate amount in Row

(11) excludes certain shares (see instructions) ☐

|

|

(13)

|

|

Percent of class represented by amount

in Row (11)

89.5% (see item 5)

|

|

(14)

|

|

Type of reporting person (see

instructions)

OO

|

|

|

|

|

|

|

|

|

|

SCHEDULE 13D

|

|

Page

4

of 14

|

|

CUSIP No. 18451C109

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1)

|

|

Names of

reporting persons

iHeartMedia Capital I, LLC

|

|

(2)

|

|

Check the appropriate box if a member

of a group (see instructions)

(a) ☐ (b) ☐

|

|

(3)

|

|

SEC use only

|

|

(4)

|

|

Source of funds (see instructions)

OO

|

|

(5)

|

|

Check if Disclosure of Legal

Proceedings Is Required Pursuant to Items 2(d) or 2(e) ☐

|

|

(6)

|

|

Citizenship or place of

organization

Delaware

|

|

Number of

shares

beneficially

owned by

each

reporting

person

with:

|

|

(7)

|

|

Sole voting power

325,726,917 (see item 5)

|

|

|

(8)

|

|

Shared voting power

0

|

|

|

(9)

|

|

Sole dispositive power

325,726,917 (see item 5)

|

|

|

(10)

|

|

Shared dispositive power

0

|

|

(11)

|

|

Aggregate amount beneficially owned by each reporting person

325,726,917 (see item 5)

|

|

(12)

|

|

Check if the aggregate amount in Row

(11) excludes certain shares (see instructions) ☐

|

|

(13)

|

|

Percent of class represented by amount

in Row (11)

89.5% (see item 5)

|

|

(14)

|

|

Type of reporting person (see

instructions)

OO

|

|

|

|

|

|

|

|

|

|

SCHEDULE 13D

|

|

Page

5

of 14

|

|

CUSIP No. 18451C109

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1)

|

|

Names of

reporting persons

iHeartCommunications, Inc.

|

|

(2)

|

|

Check the appropriate box if a member

of a group (see instructions)

(a) ☐ (b) ☐

|

|

(3)

|

|

SEC use only

|

|

(4)

|

|

Source of funds (see instructions)

OO

|

|

(5)

|

|

Check if Disclosure of Legal

Proceedings Is Required Pursuant to Items 2(d) or 2(e) ☐

|

|

(6)

|

|

Citizenship or place of

organization

Texas

|

|

Number of

shares

beneficially

owned by

each

reporting

person

with:

|

|

(7)

|

|

Sole voting power

325,726,917 (see item 5)

|

|

|

(8)

|

|

Shared voting power

0

|

|

|

(9)

|

|

Sole dispositive power

325,726,917 (see item 5)

|

|

|

(10)

|

|

Shared dispositive power

0

|

|

(11)

|

|

Aggregate amount beneficially owned by each reporting person

325,726,917 (see item 5)

|

|

(12)

|

|

Check if the aggregate amount in Row

(11) excludes certain shares (see instructions) ☐

|

|

(13)

|

|

Percent of class represented by amount

in Row (11)

89.5% (see item 5)

|

|

(14)

|

|

Type of reporting person (see

instructions)

CO

|

|

|

|

|

|

|

|

|

|

SCHEDULE 13D

|

|

Page

6

of 14

|

|

CUSIP No. 18451C109

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1)

|

|

Names of

reporting persons

Clear Channel Holdings, Inc.

|

|

(2)

|

|

Check the appropriate box if a member

of a group (see instructions)

(a) ☐ (b) ☐

|

|

(3)

|

|

SEC use only

|

|

(4)

|

|

Source of funds (see instructions)

OO

|

|

(5)

|

|

Check if Disclosure of Legal

Proceedings Is Required Pursuant to Items 2(d) or 2(e) ☐

|

|

(6)

|

|

Citizenship or place of

organization

Nevada

|

|

Number of

shares

beneficially

owned by

each

reporting

person

with:

|

|

(7)

|

|

Sole voting power

325,726,917 (see item 5)

|

|

|

(8)

|

|

Shared voting power

0

|

|

|

(9)

|

|

Sole dispositive power

325,726,917 (see item 5)

|

|

|

(10)

|

|

Shared dispositive power

0

|

|

(11)

|

|

Aggregate amount beneficially owned by each reporting person

325,726,917 (see item 5)

|

|

(12)

|

|

Check if the aggregate amount in Row

(11) excludes certain shares (see instructions) ☐

|

|

(13)

|

|

Percent of class represented by amount

in Row (11)

89.5% (see item 5)

|

|

(14)

|

|

Type of reporting person (see

instructions)

CO

|

|

|

|

|

|

|

|

|

|

SCHEDULE 13D

|

|

Page

7

of 14

|

|

CUSIP No. 18451C109

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1)

|

|

Names of

reporting persons

CC Finco, LLC

|

|

(2)

|

|

Check the appropriate box if a member

of a group (see instructions)

(a) ☐ (b) ☐

|

|

(3)

|

|

SEC use only

|

|

(4)

|

|

Source of funds (see instructions)

OO

|

|

(5)

|

|

Check if Disclosure of Legal

Proceedings Is Required Pursuant to Items 2(d) or 2(e) ☐

|

|

(6)

|

|

Citizenship or place of

organization

Delaware

|

|

Number of

shares

beneficially

owned by

each

reporting

person

with:

|

|

(7)

|

|

Sole voting power

10,726,917 (see item 5)

|

|

|

(8)

|

|

Shared voting power

0

|

|

|

(9)

|

|

Sole dispositive power

10,726,917 (see item 5)

|

|

|

(10)

|

|

Shared dispositive power

0

|

|

(11)

|

|

Aggregate amount beneficially owned by each reporting person

10,726,917 (see item 5)

|

|

(12)

|

|

Check if the aggregate amount in Row

(11) excludes certain shares (see instructions) ☐

|

|

(13)

|

|

Percent of class represented by amount

in Row (11)

21.9% (see item 5)

|

|

(14)

|

|

Type of reporting person (see

instructions)

OO

|

|

|

|

|

|

|

|

|

|

SCHEDULE 13D

|

|

Page

8

of 14

|

|

CUSIP No. 18451C109

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1)

|

|

Names of

reporting persons

Broader Media, LLC

|

|

(2)

|

|

Check the appropriate box if a member

of a group (see instructions)

(a) ☐ (b) ☐

|

|

(3)

|

|

SEC use only

|

|

(4)

|

|

Source of funds (see instructions)

OO

|

|

(5)

|

|

Check if Disclosure of Legal

Proceedings Is Required Pursuant to Items 2(d) or 2(e) ☐

|

|

(6)

|

|

Citizenship or place of

organization

Delaware

|

|

Number of

shares

beneficially

owned by

each

reporting

person

with:

|

|

(7)

|

|

Sole voting power

100,000,000 (see item 5)

|

|

|

(8)

|

|

Shared voting power

0

|

|

|

(9)

|

|

Sole dispositive power

100,000,000 (see item 5)

|

|

|

(10)

|

|

Shared dispositive power

0

|

|

(11)

|

|

Aggregate amount beneficially owned by each reporting person

100,000,000 (see item 5)

|

|

(12)

|

|

Check if the aggregate amount in Row

(11) excludes certain shares (see instructions) ☐

|

|

(13)

|

|

Percent of class represented by amount

in Row (11)

27.5%

(1)

(see item

5)

|

|

(14)

|

|

Type of reporting person (see

instructions)

OO

|

|

(1)

|

This percentage represents Broader Media, LLC’s fully diluted ownership assuming all of the 315,000,000 outstanding shares of Class B Common Stock are converted into Class A Common Stock. Broader Media, LLC’s

ownership calculated in accordance with Rule 13d-3 under the Act, assuming that the 100,000,000 shares of Class B Common Stock owned by Broader Media, LLC are converted to Class A Common Stock and that no other shares of Class B Common Stock are

converted to Class A Common Stock, is 67.1%.

|

|

|

|

|

|

|

|

|

|

SCHEDULE 13D

|

|

Page

9

of 14

|

|

CUSIP No. 18451C109

|

|

|

|

|

|

Item 1.

|

Security and Issuer.

|

This Amendment No. 4 (this “

Amendment

”) to

Schedule 13D amends and supplements the Schedule 13D filed with the Securities and Exchange Commission (the “

Commission

”) on April 14, 2015 by the Reporting Persons named therein, as amended by Amendment No. 1 filed with

the Commission on December 10, 2015, Amendment No. 2 filed with the Commission on March 15, 2017 and Amendment No. 3 filed with the Commission on December 11, 2017 (the “

Schedule 13D

”). Unless set forth

below, all previous Items set forth in the Schedule 13D remain unchanged. Capitalized terms used herein and not defined have the meanings given to them in the Schedule 13D, as amended to the date hereof.

This Amendment is being filed to supplement and amend the prior disclosure by the Reporting Persons regarding their plans or proposals with

respect to certain securities of Clear Channel Outdoor Holdings, Inc. (the “Issuer”) held by certain of the Reporting Persons.

The last sentence of Item 1 of the Schedule 13D is hereby amended and restated as set forth below:

The address of the principal executive offices of the Issuer is 20880 Stone Oak Parkway, San Antonio, Texas 78258.

|

Item 2.

|

Identity and Background.

|

The second paragraph of Item 2 of the Schedule 13D is hereby

amended and restated as set forth below:

The principal business offices of each Reporting Person is located at 20880 Stone Oak Parkway,

San Antonio, Texas 78258.

|

Item 4.

|

Purpose of the Transaction.

|

Item 4 of the Schedule 13D is hereby amended and restated

in its entirety as set forth below:

Separation or

Spin-off

of the Issuer

On March 14, 2018, iHeartMedia, Inc., the indirect parent of the Issuer (“

iHeartMedia

”), and certain of

iHeartMedia’s subsidiaries (collectively, the “

Company Parties

”) filed voluntary petitions for reorganization under Chapter 11 of the United States Bankruptcy Code (the “

Bankruptcy Petitions

”) in the United

States Bankruptcy Court for the Southern District of Texas, Houston Division (the “

Bankruptcy Court

”). On March 16, 2018, the Company Parties entered into a Restructuring Support Agreement (the “

RSA

”) with

certain creditors of iHeartCommunications, Inc. (“

iHeartCommunications

”) and its equityholders (collectively, the “

Consenting Stakeholders

”). The RSA relates to the restructuring and recapitalization of the Company

Parties (the “

Restructuring Transactions

”), which will be implemented in the Chapter 11 proceedings. Pursuant to the RSA, the Consenting Stakeholders have agreed to, among other things, support the Restructuring Transactions and

vote in favor of the Chapter 11 plan of reorganization to effect the Restructuring Transactions (the “

Plan

”).

The RSA

contemplates that, on the effective date of the Plan, the Issuer will be separated or

spun-off

from the Company Parties and the holders of claims with respect to iHeartCommunications’ term loan credit

facilities and priority guarantee notes will become the holders of the economic interests in the Issuer currently held by the Reporting Persons.

Termination of Exchange Offers, Consent Solicitations and Term Loan Offers

On March 15, 2017, iHeartCommunications announced the commencement of private offers (the “

Exchange Offers

”) to holders

of certain series of iHeartCommunications’ outstanding debt securities (the “

Existing Notes

”) to exchange the Existing Notes for new securities and the related solicitation of consents (the “

Consent

Solicitations

”) and private offers (the “

Term Loan Offers

”) to lenders under its Term Loan D and Term Loan E facilities (the “

Existing Term Loans

”) to amend the Existing Term Loans. The Exchange Offers and

Term Loan Offers contemplated transactions which could have resulted in the disposition of the securities of the Issuer held by the Reporting Persons. On March 15, 2018, the Exchange Offers, Consent Solicitations and Term Loan Offers were

terminated prior to their scheduled expiration time because of the filing of the Bankruptcy Petitions.

Prior Transactions

From the time of the initial public offering until December 3, 2015, Clear Channel Holdings, Inc. (“

CC

Holdings

”) owned all 315,000,000 shares of outstanding Class B Common Stock, and held those shares for investment purposes. On December 3, 2015, CC Holdings contributed 100,000,000 shares of Class B Common Stock to Broader

Media, LLC (“

Broader Media

”) as an additional contribution to its capital account in Broader Media, in connection with an investment that was intended to benefit iHeartCommunications and all of its subsidiaries (including CC

Holdings) by facilitating future financing transactions.

|

|

|

|

|

|

|

|

|

SCHEDULE 13D

|

|

Page

10

of 14

|

|

CUSIP No. 18451C109

|

|

|

|

|

From August 2011 through April 2015, CC Finco, LLC (“

CC Finco

”) acquired

10,726,917 shares of Class A Common Stock for investment purposes.

No Other Current Plans or Proposals; Future Plans or

Proposals

Other than the above, the Reporting Persons have no plans or proposals that relate to or would result in any of the

events described in paragraphs (a) through (j) of this Item.

The Reporting Persons reserve the right to change their purpose and to

formulate and implement plans or proposals with respect to the Issuer at any time and from time to time, subject to the approval of the Bankruptcy Court. Any such action may be made by the Reporting Persons alone or in conjunction with other

shareholders, potential acquirers, financing sources and/or other third parties and could include one or more purposes, plans or proposals that relate to or would result in actions required to be reported herein in accordance with Item 4 of Schedule

13D.

|

Item 6.

|

Contracts, Arrangements, Understandings or Relationships with Respect to Securities of the Issuer.

|

The information set forth in Item 4 of this Schedule 13D is incorporated herein by reference.

|

Item 7.

|

Material to be Filed as Exhibits.

|

|

|

|

|

|

|

|

|

Exhibit A:

|

|

Joint Filing Agreement dated as of March 19, 2018, by and among the Reporting Persons.

|

|

|

|

|

Exhibit B:

|

|

Master Agreement dated November 16, 2005 between Clear Channel Outdoor Holdings, Inc. and iHeartCommunications, Inc. (Incorporated by reference to Exhibit 10.1 to the Clear Channel Outdoor Holdings, Inc. Annual Report on Form

10-K

for the year ended December 31, 2005).

|

|

|

|

|

Exhibit C:

|

|

Registration Rights Agreement dated November 16, 2005 between Clear Channel Outdoor Holdings, Inc. and iHeartCommunications, Inc. (Incorporated by reference to Exhibit 10.2 to the Clear Channel Outdoor Holdings, Inc. Annual

Report on Form

10-K

for the year ended December 31, 2005).

|

|

|

|

|

Exhibit D:

|

|

Corporate Services Agreement dated November 16, 2005 between Clear Channel Outdoor Holdings, Inc. and Clear Channel Management Services, L.P. (Incorporated by reference to Exhibit 10.3 to the Clear Channel Outdoor Holdings,

Inc. Annual Report on Form

10-K

for the year ended December 31, 2005).

|

|

|

|

|

Exhibit E:

|

|

Tax Matters Agreement dated November 10, 2005 between Clear Channel Outdoor Holdings, Inc. and iHeartCommunications, Inc. (Incorporated by reference to Exhibit 10.4 to the Clear Channel Outdoor Holdings, Inc. Annual Report on

Form

10-K

for the year ended December 31, 2005).

|

|

|

|

|

Exhibit F:

|

|

Employee Matters Agreement dated November 10, 2005 between Clear Channel Outdoor Holdings, Inc. and iHeartCommunications, Inc. (Incorporated by reference to Exhibit 10.5 to the Clear Channel Outdoor Holdings, Inc. Annual Report

on Form

10-K

for the year ended December 31, 2005).

|

|

|

|

|

Exhibit G:

|

|

Amended and Restated License Agreement dated November 10, 2005 between Clear Channel Identity, L.P. and Outdoor Management Services, Inc. (Incorporated by reference to Exhibit 10.6 to the Clear Channel Outdoor Holdings, Inc.

Annual Report on Form

10-K

for the year ended December 31, 2005).

|

|

|

|

|

Exhibit H:

|

|

First Amendment to Amended and Restated License Agreement dated January 14, 2014 between iHM Identity, Inc. and Outdoor Management Services, Inc. (Incorporated by reference to Exhibit 10.17 to the Clear Channel Outdoor

Holdings, Inc. Annual Report on Form

10-K

for the year ended December 31, 2013).

|

|

|

|

|

Exhibit I:

|

|

Contribution Agreement, dated December 3, 2015, between Clear Channel Holdings, Inc. and Broader Media, LLC (Incorporated by reference to Exhibit I to the Schedule 13D/A relating to the Class A Common Stock, par value

$0.01 per share, of Clear Channel Outdoor Holdings, Inc., filed with the Commission on December 10, 2015 by Clear Channel Holdings, Inc. and the other reporting persons named therein).

|

|

|

|

|

Exhibit J:

|

|

Restructuring Support Agreement, dated March 16, 2018, by and among iHeartMedia, Inc., the subsidiaries party thereto, and the creditors and equityholders party thereto. (Incorporated by reference to Exhibit 10.1 to the

iHeartMedia, Inc. Current Report on Form

8-K,

filed with the Commission on March 19, 2018).

|

SIGNATURE

After reasonable inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is true,

complete and correct.

Date: March 19, 2018

|

|

|

|

|

|

|

Clear Channel Holdings, Inc.

|

|

|

|

|

By:

|

|

/s/ Lauren E. Dean

|

|

|

|

Name:

|

|

Lauren E. Dean

|

|

|

|

Title:

|

|

Vice President, Associate General Counsel and

|

|

|

|

|

|

Assistant Secretary

|

|

|

|

iHeartCommunications, Inc.

|

|

|

|

|

By:

|

|

/s/ Lauren E. Dean

|

|

|

|

Name:

|

|

Lauren E. Dean

|

|

|

|

Title:

|

|

Vice President, Associate General Counsel and

|

|

|

|

|

|

Assistant Secretary

|

|

|

|

iHeartMedia Capital I, LLC

|

|

|

|

|

By:

|

|

/s/ Lauren E. Dean

|

|

|

|

Name:

|

|

Lauren E. Dean

|

|

|

|

Title:

|

|

Vice President, Associate General Counsel and

|

|

|

|

|

|

Assistant Secretary

|

|

|

|

iHeartMedia Capital II, LLC

|

|

|

|

|

By:

|

|

/s/ Lauren E. Dean

|

|

|

|

Name:

|

|

Lauren E. Dean

|

|

|

|

Title:

|

|

Vice President, Associate General Counsel and

|

|

|

|

|

|

Assistant Secretary

|

|

|

|

iHeartMedia, Inc.

|

|

|

|

|

By:

|

|

/s/ Lauren E. Dean

|

|

|

|

Name:

|

|

Lauren E. Dean

|

|

|

|

Title:

|

|

Vice President, Associate General Counsel and

|

|

|

|

|

|

Assistant Secretary

|

|

|

|

CC Finco, LLC

|

|

|

|

|

By:

|

|

/s/ Lauren E. Dean

|

|

|

|

Name:

|

|

Lauren E. Dean

|

|

|

|

Title:

|

|

Vice President, Associate General Counsel and

|

|

|

|

|

|

Assistant Secretary

|

|

|

|

Broader Media, LLC

|

|

|

|

|

By:

|

|

/s/ Lauren E. Dean

|

|

|

|

Name:

|

|

Lauren E. Dean

|

|

|

|

Title:

|

|

Vice President, Associate General Counsel and

|

|

|

|

|

|

Assistant Secretary

|

EXHIBIT INDEX

|

|

|

|

|

Exhibit

|

|

Description

|

|

|

|

|

Exhibit A:

|

|

Joint Filing Agreement dated as of March 19, 2018, by and among the Reporting Persons

|

|

|

|

|

Exhibit B:

|

|

Master Agreement dated November 16, 2005 between Clear Channel Outdoor Holdings, Inc. and iHeartCommunications, Inc. (Incorporated by reference to Exhibit 10.1 to the Clear Channel Outdoor Holdings, Inc. Annual Report on Form

10-K

for the year ended December 31, 2005).

|

|

|

|

|

Exhibit C:

|

|

Registration Rights Agreement dated November 16, 2005 between Clear Channel Outdoor Holdings, Inc. and iHeartCommunications, Inc. (Incorporated by reference to Exhibit 10.2 to the Clear Channel Outdoor Holdings, Inc. Annual

Report on Form

10-K

for the year ended December 31, 2005).

|

|

|

|

|

Exhibit D:

|

|

Corporate Services Agreement dated November 16, 2005 between Clear Channel Outdoor Holdings, Inc. and Clear Channel Management Services, L.P. (Incorporated by reference to Exhibit 10.3 to the Clear Channel Outdoor Holdings,

Inc. Annual Report on Form

10-K

for the year ended December 31, 2005).

|

|

|

|

|

Exhibit E:

|

|

Tax Matters Agreement dated November 10, 2005 between Clear Channel Outdoor Holdings, Inc. and iHeartCommunications, Inc. (Incorporated by reference to Exhibit 10.4 to the Clear Channel Outdoor Holdings, Inc. Annual Report on

Form

10-K

for the year ended December 31, 2005).

|

|

|

|

|

Exhibit F:

|

|

Employee Matters Agreement dated November 10, 2005 between Clear Channel Outdoor Holdings, Inc. and iHeartCommunications, Inc. (Incorporated by reference to Exhibit 10.5 to the Clear Channel Outdoor Holdings, Inc. Annual Report

on Form

10-K

for the year ended December 31, 2005).

|

|

|

|

|

Exhibit G:

|

|

Amended and Restated License Agreement dated November 10, 2005 between Clear Channel Identity, L.P. and Outdoor Management Services, Inc. (Incorporated by reference to Exhibit 10.6 to the Clear Channel Outdoor Holdings, Inc.

Annual Report on Form

10-K

for the year ended December 31, 2005).

|

|

|

|

|

Exhibit H:

|

|

First Amendment to Amended and Restated License Agreement dated January 14, 2014 between iHM Identity, Inc. and Outdoor Management Services, Inc. (Incorporated by reference to Exhibit 10.17 to the Clear Channel Outdoor

Holdings, Inc. Annual Report on Form

10-K

for the year ended December 31, 2013).

|

|

|

|

|

Exhibit I:

|

|

Contribution Agreement, dated December 3, 2015, between Clear Channel Holdings, Inc. and Broader Media, LLC (Incorporated by reference to Exhibit I to the Schedule 13D/A relating to the Class A Common Stock, par value

$0.01 per share, of Clear Channel Outdoor Holdings, Inc., filed with the Commission on December 10, 2015 by Clear Channel Holdings, Inc. and the other reporting persons named therein).

|

|

|

|

|

Exhibit J:

|

|

Restructuring Support Agreement, dated March 16, 2018, by and among iHeartMedia, Inc., the subsidiaries party thereto, and the creditors and equityholders party thereto. (Incorporated by reference to Exhibit 10.1 to the

iHeartMedia, Inc. Current Report on Form

8-K,

filed with the Commission on March 19, 2018).

|

Exhibit A

AGREEMENT REGARDING THE JOINT FILING OF SCHEDULE 13D

In accordance with Rule 13d–1(k)(l) under the Securities Exchange Act of 1934, as amended, each of the undersigned hereby agrees to the joint filing,

along with such other undersigned, on behalf of the Reporting Persons (as defined in the joint filing), of a statement on Schedule 13D (including amendments thereto) with respect to the Class A Common Stock, par value $0.01 per share, of the

Issuer, and agrees that this agreement be included as an Exhibit to such joint filing. This agreement may be executed in any number of counterparts, all of which taken together shall constitute one and the same instrument.

IN WITNESS WHEREOF, each of the undersigned has executed this Joint Filing Agreement as of this 19th day of March 2018.

|

|

|

|

|

|

|

Clear Channel Holdings, Inc.

|

|

|

|

|

By:

|

|

/s/ Lauren E. Dean

|

|

|

|

Name:

|

|

Lauren E. Dean

|

|

|

|

Title:

|

|

Vice President, Associate General Counsel and

|

|

|

|

|

|

Assistant Secretary

|

|

|

|

iHeartCommunications, Inc.

|

|

|

|

|

By:

|

|

/s/ Lauren E. Dean

|

|

|

|

Name:

|

|

Lauren E. Dean

|

|

|

|

Title:

|

|

Vice President, Associate General Counsel and

|

|

|

|

|

|

Assistant Secretary

|

|

|

|

iHeartMedia Capital I, LLC

|

|

|

|

|

By:

|

|

/s/ Lauren E. Dean

|

|

|

|

Name:

|

|

Lauren E. Dean

|

|

|

|

Title:

|

|

Vice President, Associate General Counsel and

|

|

|

|

|

|

Assistant Secretary

|

|

|

|

iHeartMedia Capital II, LLC

|

|

|

|

|

By:

|

|

/s/ Lauren E. Dean

|

|

|

|

Name:

|

|

Lauren E. Dean

|

|

|

|

Title:

|

|

Vice President, Associate General Counsel and

|

|

|

|

|

|

Assistant Secretary

|

[Continues on Next Page]

|

|

|

|

|

|

|

iHeartMedia, Inc.

|

|

|

|

|

By:

|

|

/s/ Lauren E. Dean

|

|

|

|

Name:

|

|

Lauren E. Dean

|

|

|

|

Title:

|

|

Vice President, Associate General Counsel and

|

|

|

|

|

|

Assistant Secretary

|

|

|

|

CC Finco, LLC

|

|

|

|

|

By:

|

|

/s/ Lauren E. Dean

|

|

|

|

Name:

|

|

Lauren E. Dean

|

|

|

|

Title:

|

|

Vice President, Associate General Counsel and

|

|

|

|

|

|

Assistant Secretary

|

|

|

|

Broader Media, LLC

|

|

|

|

|

By:

|

|

/s/ Lauren E. Dean

|

|

|

|

Name:

|

|

Lauren E. Dean

|

|

|

|

Title:

|

|

Vice President, Associate General Counsel and

|

|

|

|

|

|

Assistant Secretary

|

[Signature Page to Joint Filing Agreement]

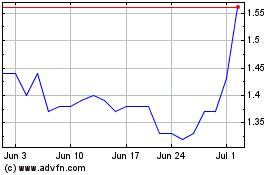

Clear Channel Outdoor (NYSE:CCO)

Historical Stock Chart

From Mar 2024 to Apr 2024

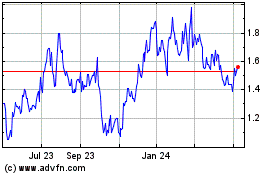

Clear Channel Outdoor (NYSE:CCO)

Historical Stock Chart

From Apr 2023 to Apr 2024