UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16

of the Securities Exchange Act of 1934

FOR THE MONTH OF MARCH 2018

COMMISSION FILE NUMBER: 001-33863

XINYUAN REAL ESTATE CO., LTD.

27/F, China Central Place, Tower II

79 Jianguo Road, Chaoyang District

Beijing 100025

People’s Republic of China

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will

file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F

x

Form

40-F

o

Indicate by check mark if the registrant is submitting the Form

6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

o

Indicate by check mark if the registrant is submitting the Form

6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

o

Indicate by check mark whether by furnishing the information

contained in this Form, the registrant is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b)

under the Securities Exchange Act of 1934.

Yes

o

No

x

If "Yes" is marked, indicate below the file number

assigned to the registrant in connection with Rule 12g3-2(b): 82-________.

This Form 6-K is hereby incorporated by reference into the registration

statements of Xinyuan Real Estate Co., Ltd. (“Xinyuan” or the “Company”) on Form S-8 (Registration Numbers

333-152637, 333-198525 and 333-205371) and on Form F-3 (Registration Number 333-192046) and any outstanding prospectus, offering

circular or similar document issued or authorized by the Company that incorporates by reference any of the Company’s reports

on Form 6-K that are incorporated into its registration statements filed with the Securities and Exchange Commission, and this

Form 6-K shall be deemed a part of each such document from the date on which this Form 6-K is filed, to the extent not superseded

by documents or reports subsequently filed or furnished by the Company under the Securities Act of 1933, as amended, or the Securities

Exchange Act of 1934, as amended.

TABLE OF CONTENTS

|

|

|

Page

|

|

|

|

|

|

Description of Transaction

|

|

1

|

|

|

|

|

|

Signature

|

|

3

|

|

|

|

|

|

Exhibit

Index

|

|

4

|

|

|

Exhibit 99.1

|

Indenture, dated as of March 19, 2018, between Xinyuan Real Estate Co., Ltd., the entities listed on Schedule I thereto as Subsidiary Guarantors, and Citicorp International Limited, as Trustee and Shared Security Agent

|

|

|

|

Exhibit 99.2

|

Global note representing the 9.875% Senior Notes due 2020 (US$200,000,000 aggregate principal amount)

|

|

DESCRIPTION OF TRANSACTION

On March 19, 2018, the Company issued an

aggregate principal amount of US$200,000,000 of 9.875% Senior Notes due 2020 (the “Notes”) upon completion of an offering

conducted outside the United States pursuant to Regulation S under the Securities Act. The Notes bear interest at 9.875% per annum,

payable semi-annually. Interest will be payable on March 19 and September 19 of each year, commencing September 19, 2018. The Notes

have a two year term maturing on March 19, 2020.

The Notes were issued pursuant to an indenture,

dated March 19, 2018, between the Company, the Subsidiary Guarantors (as defined below) and Citicorp International Limited, as

trustee and shared security agent (the “Indenture”). The Indenture and the global note representing the Notes are attached

hereto as Exhibits 99.1 and 99.2, respectively. The Company’s obligations under the Indenture and the Notes are guaranteed

initially by certain of the Company's wholly-owned subsidiaries, Xinyuan Real Estate, Ltd., Xinyuan International Property Investment

Co., Ltd., Victory Good Development Limited, South Glory International Limited, Elite Quest Holdings Limited and Xinyuan International

(HK) Property Investment Co., Limited (the “Subsidiary Guarantors”) and will be guaranteed by such other future subsidiaries

of the Company as is set forth in and in accordance with the terms of the Indenture. The Company’s obligations under the

Indenture and the Notes are secured by a pledge of the capital stock of the Company's wholly-owned subsidiaries, Xinyuan Real Estate,

Ltd., Xinyuan International Property Investment Co., Ltd., Victory Good Development Limited, South Glory International Limited

and Elite Quest Holdings Limited.

At any time prior to March 19, 2020, the

Company may at its option redeem the Notes, in whole but not in part, at a redemption price equal to 100.0% of the principal amount

of the Notes plus the Applicable Premium as of, and accrued and unpaid interest, if any, to (but not including) the redemption

date. "Applicable Premium" means with respect to any Note at any redemption date, the greater of (i) 1.00% of the principal

amount of such Note and (ii) the excess of (A) the present value at such redemption date of the principal amount of such Note,

plus all required remaining scheduled interest payments due on such Note through the maturity date of the Notes (but excluding

accrued and unpaid interest to the redemption date), computed using a discount rate equal to the Adjusted Treasury Rate (as defined

in the Indenture) plus 100 basis points, over (B) the principal amount of such Note on such redemption date.

At any time prior to March 19, 2020, the

Company may redeem up to 35% of the aggregate principal amount of the Notes with the net cash proceeds of one or more sales of

the Company's common shares in certain equity offerings, within a specified period after the equity offering, at a redemption price

of 109.875% the principal amount of the Notes, plus accrued and unpaid interest, if any, to (but not including) the redemption

date, provided that at least 65% of the aggregate principal amount of the Notes issued on March 19, 2018 remain outstanding after

each such redemption.

Not later than 30 days following a Change

of Control (as defined in the Indenture), the Company must make an offer to purchase all outstanding Notes at a purchase price

equal to 101.0% of the principal amount thereof plus accrued and unpaid interest, if any to (but not including) the offer to purchase

payment date.

The Indenture contains certain covenants

that, among others, restrict the Company's ability and the ability of the Company's Restricted Subsidiaries (as defined in the

Indenture) to incur additional debt or to issue preferred stock, to make certain payments or investments, to pay dividends or purchase

of redeem capital stock, sell assets, or make certain other payment, subject to certain qualifications and exceptions and satisfaction,

in certain circumstances of specified conditions, such as a Fixed Charge Coverage Ratio (as defined in the Indenture) of 2.0 to

1.0.

The foregoing description does not purport

to be a complete description of the terms of the documents, and this description is qualified in its entirety by the terms of the

definitive documents or forms thereof which are attached as exhibits to this Form 6-K and which are incorporated by reference.

The Notes were issued in an offering done

in reliance on the exemption from registration under Regulation S promulgated under the Securities Act. Haitong International Securities

Company Limited, UBS AG Hong Kong Branch, Guotai Junan Securities (Hong Kong) Limited, Morgan Stanley & Co. International plc

and Merrill Lynch (Asia Pacific) Limited acted as joint global coordinators, joint lead managers and joint bookrunners for the

offering and Orient Securities (Hong Kong) Limited acted as joint lead manager and joint bookrunner for the offering. The Notes

are listed and quoted for trading on the Official List of the Singapore Exchange Securities Trading Limited.

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly

authorized.

|

|

Xinyuan Real Estate Co., Ltd.

|

|

|

|

|

|

|

|

|

|

By:

|

/s/ Yuan (Helen) Zhang

|

|

|

Name:

|

Yuan (Helen) Zhang

|

|

|

Title:

|

Chief Financial Officer

|

Date: March 19, 2018

EXHIBIT INDEX

|

Exhibit Number

|

|

Description

|

|

|

|

|

|

99.1

|

|

Indenture, dated as of March 19, 2018, between Xinyuan Real Estate Co., Ltd., the entities listed on Schedule I thereto as Subsidiary Guarantors, and Citicorp International Limited, as Trustee and Shared Security Agent

|

|

|

|

|

|

99.2

|

|

Global note representing the 9.875% Senior Notes due 2020 (US$200,000,000 aggregate principal amount)

|

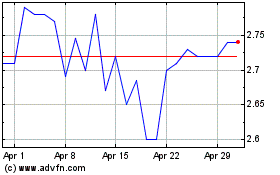

Xinyuan Real Estate (NYSE:XIN)

Historical Stock Chart

From Mar 2024 to Apr 2024

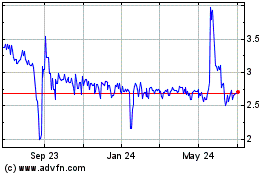

Xinyuan Real Estate (NYSE:XIN)

Historical Stock Chart

From Apr 2023 to Apr 2024