Myomo, Inc. (NYSE American: MYO) (“Myomo” or the “Company”), a

commercial stage medical robotics company, today announced that it

is updating its previous release that was made on March 7, 2018 to

incorporate certain disclosures that are required under the NYSE

AMERICAN Company Guide Sections 401(h) and 610(b). Included below

are these additional disclosures along with the previously

disclosed financial results for the fourth quarter and year end

December 31, 2017. This announcement does not represent any

change or amendment to the Company’s financial statements, reported

results or to its Annual Report on Form 10-K for the fiscal year

ended December 31, 2017.

Recent Highlights and Accomplishments:

- Total revenue for the fourth quarter

2017 increased 22% year-over-year to $547,000, from $448,000 in the

fourth quarter of 2016. For the full year 2017, total revenue

increased 41% to $1,559,000. Gross margin for the full year 2017

and 2016 was 68% and 74%, respectively.

- Raised $10.4 million, net of financing

costs, in our follow-on public offering.

- Subsequent to December 31, 2017 and as

March 6, 2018, the Company raised $3.5 million for the issuance

1,193,556 shares of common stock upon the exercise of 1,193,556

warrants at an exercise price of $2.95 per share.

- During the fourth quarter, we repaid

our Notes Payable with the Massachusetts Life Sciences Center and

also issued 193,509 shares of common stock to repay the Notes

Payable with a former shareholder.

- We obtained a Medical Device License in

Canada, which enables us to sell the MyoPro in Canada.

- Expanded sales and marketing team and

increased marketing activity to promote MyoPro accessibility to

more individuals in the U.S. and internationally. This includes

joint patient screening events with clinical and rehabilitation

partners.

- Continued the roll out of MyoPro

Centers of Excellence at O&P practice organizations. We

currently have 36 U.S. locations offering the MyoPro line of

powered orthosis.

- Announced publication of peer-reviewed

clinical research conducted by the Ohio State University School of

Medicine. The study concluded that upper extremity impairment is

significantly reduced and subjects improved their ability to

perform activities of daily living with use of the MyoPro. These

results exceeded the clinically important difference threshold of

standard impairment tests.

- Increased recognition by the clinical

community. This includes recent presentations made at the American

Society of Hand Therapists (”ASHT”), American Academy Physical

Medicine & Rehab (“AAPM&R”) Assembly and the American

Congress of Rehabilitation and Medicine (“ACRM”).

Paul R. Gudonis, Chairman & CEO of Myomo, stated: “2017

was an important year for Myomo as we continued to build our

operational and commercial capabilities for the MyoPro product

line. During the year, we completed our IPO and follow-on offering

to raise growth capital to fund our transition from our controlled

launch phase to now scaling up operations. In 2018, we look forward

to continued execution of our business plan, and our mission to

restore functionality to the many individuals with upper limb

paralysis. We continue our efforts to bring awareness to veterans

and the broader clinical and patient communities, as we target this

large unmet need.”

Financial Highlights for the Fourth Quarter and Year End

December 31, 2017

Three monthsended

Period-to-period

Twelve months

ended

Period-to-

period

December 31, change December 31, change

2017 2016 $ % 2017 2016

$ % Revenue $ 547,412 $ 448,093 $ 99,319 22 % $

1,558,866 $ 1,103,277 $ 455,589 41 % Cost of revenue 203,972

95,830 108,142 113 % 505,280 282,164

223,116 79 % Gross margin $ 343,440 $ 352,263 $

(8,823 ) (3 )% $ 1,053,586 $ 821,113 $ 232,473 28 % Gross

margin% 63 % 79 % (16 )% 68 % 74

% (6 )%

Quarter Ended December 31, 2017 Financial

Results

Total revenue was $547,000 for the three months ended

December 31, 2017; an increase of $99,000, or 22%, as compared

to the three months ended December 31, 2016.

Gross margin was 63% for the quarter ended December 31,

2017, as compared to 79% for the three months ended

December 31, 2016. The change in gross margin was primarily

due to revenue recognized in the fourth quarter of 2016 relating to

payments received for minimum purchase requirements under our

distribution agreement for which there were no units required to be

shipped.

Research and development expenses were $357,000, a decrease of

$50,000, or 12%, during the three months ended December 31,

2017, as compared to the three months ended December 31,

2016.

Selling, general and administrative costs of $1,803,000

increased $760,000, or 73%, during the three months ended

December 31, 2017, as compared to the three months ended

December 31, 2016. The increased costs were primarily due to

increased employee compensation costs and professional fees as we

transitioned to a publicly traded company in 2017.

Interest and other expense, net was $84,000 during the three

months ended December 31, 2017, as compared with a net expense

of $114,000 in the three months ended December 31, 2016.

The Company’s net loss for the quarter ended December 31,

2017 amounted to $1,900,000, compared with a net loss of $1,211,000

for the corresponding 2016 period. Net loss available to common

stockholders for the quarter ended December 31, 2017 was

$1,900,000 or ($0.25) per share, compared with a net loss available

to common stockholders of $1,404,000, or ($1.25) per share, for the

corresponding year ago period.

Adjusted EBITDA 1 for the quarter ended December 31, 2017

was a loss of $1,770,000, compared with a loss of $1,073,000 for

the corresponding 2016 period. A reconciliation of GAAP to this

non-GAAP financial measure has been provided in the financial

statement tables included in this press release. An explanation of

this measure is also included below under the heading “Non-GAAP

Financial Measures.”

Twelve Months Ended December 31, 2017 Financial

Results

Total revenue increased by $456,000, or 41%, during the year

ended December 31, 2017, as compared to the year ended

December 31, 2016. During the year ended December 31,

2017, product revenue increased $358,000, or 33%, versus the

comparable period of 2016. We recognized $118,000 of grant revenue

during the year ended December 31, 2017 as compared to $21,000

for the year ended December 31, 2016.

Gross margin decreased to 68% for the year ended

December 31, 2017, as compared to 74% in the comparable 2016

period, reflecting $104,000 more in revenue recognized in 2016

relating to payments received for minimum purchase requirements

under our distribution agreement for which there were no units

required to be shipped, inventory reserves recorded as a result of

introduction of our MyoPro 2 products and lower margins on

demonstration units sold in 2017. These reductions were partially

offset by an increase in grant revenue in the 2017 period

associated with research projects, without incurring any additional

incremental costs.

Research and development expenses were $1,752,000, an increase

of $631,000 or 56%, primarily due to increased compensation related

expense, which included an incentive bonus to an engineering

executive and additional engineering personnel costs.

Selling, general, and administrative expenses were $5,850,000,

an increase of $2,875,000 or 97%, primarily due to increases in

personnel and other headcount related costs for additional

administrative and sales staff hired, increased professional and

other public company costs, as we prepared for our initial public

offering and transitioned to a publicly traded company and

additional expenses for marketing and clinical research to support

our sales and reimbursement efforts.

Interest and other expense was $5,549,000 in the twelve months

ended December 31, 2017 as compared with a net expense of

$342,000 in the twelve months ended December 31, 2016. This

change was due primarily to the debt discount on convertible

notes.

The Company’s net loss for the twelve months ended

December 31, 2017 amounted to $12,097,000, compared with a net

loss of $3,617,000 for the corresponding 2016 period. Net loss

available to common stockholders for the twelve months ended

December 31, 2017 was $12,659,000 or ($2.93) per share,

compared with a net loss available to common stockholders of

$4,384,000 or ($4.13) per share, for the corresponding year ago

period.

Adjusted EBITDA for the twelve months ended December 31,

2017 was a loss of $6,257,000, compared with a loss of $3,173,177

for the corresponding 2016 period. A reconciliation of GAAP to this

non-GAAP financial measure has been provided in the financial

statement tables included in this press release.

Cash and Cash Equivalents

Cash on hand at December 31, 2017 was $12,959,000, compared

to $797,000 at December 31, 2016. The increase in cash

reflects the $14.8 million in net proceeds from our public

offerings in 2017, $2.9 million from our concurrent private

placement and $1.8M of additional convertible notes issued during

the year. This was partially offset by cash used in operating

activities and by $1.2 million in principal and interest

payments made to repay our Note Payable with the Massachusetts Life

Sciences Center.

Conference Call and Webcast Information

Myomo hosted a conference call on, March 7, 2018 at 4:30

p.m. EST. A replay of the conference call will be available

approximately one hour after completion of the live conference call

at the Investor Relations page. A

dial-in replay of the call will be available until March 21,

2018; please dial 1-877-344-7529 from the U.S. or 1-412-317-0088

internationally and provide the passcode of 10117217.

Receipt of Audit Opinion with Going Concern

Qualification

As previously disclosed in its Annual Report on Form 10-K for

the fiscal year ended December 31, 2017, which was filed with the

Securities and Exchange Commission on March 12, 2018, the Company’s

audited financial statements contained a going concern explanatory

paragraph in the audit opinion from its independent registered

public accounting firm. This announcement does not represent any

change or amendment to the Company’s financial statements or to its

Annual Report on Form 10-K for the fiscal year ended December 31,

2017.

About Myomo

Myomo, Inc. is a commercial stage medical robotics company that

offers expanded mobility for those suffering from neurological

disorders and upper limb paralysis. Myomo develops and markets the

MyoPro product line. MyoPro is a powered upper limb orthosis

designed to support the arm and restore function to the weakened or

paralyzed arms of patients suffering from CVA stroke, brachial

plexus injury, traumatic brain or spinal cord injury, ALS or other

neuromuscular disease or injury. It is currently the only marketed

device that, sensing a patient’s own EMG signals through

non-invasive sensors on the arm, can restore an individual’s

ability to perform activities of daily living, including feeding

themselves, carrying objects and doing household tasks. Many are

able to return to work, live independently and reduce their cost of

care. Myomo is headquartered in Cambridge, Massachusetts, with

sales and clinical professionals across the U.S. For more

information, please visit www.myomo.com.

Forward Looking Statements

This press release contains forward-looking statements regarding

the Company’s future business expectations, including the scale-up

of commercial operations, the expansion of our MyoPro line to

Canada, and the therapeutic potential of our products, which are

subject to the safe harbor provisions of the Private Securities

Litigation Reform Act of 1995. These forward-looking statements are

only predictions and may differ materially from actual results due

to a variety of factors.

These factors include, among other things:

- our sales and commercialization

efforts;

- our ability to achieve reimbursement

from third-party payers for our products;

- our dependence upon external sources

for the financing of our operations;

- our ability to effectively execute our

business plan; and

- our expectations as to our clinical

research program and clinical results.

More information about these and other factors that potentially

could affect our financial results is included in Myomo’s filings

with the Securities and Exchange Commission, including those

contained in the risk factors section of the Company’s quarterly

reports on Form 10-Q filed with the Commission. The Company

cautions readers not to place undue reliance on any such

forward-looking statements, which speak only as of the date made.

Although the forward-looking statements in this release of

financial information are based on our beliefs, assumptions and

expectations, taking into account all information currently

available to us, we cannot guarantee future transactions, results,

performance, achievements or outcomes. No assurance can be made to

any investor by anyone that the expectations reflected in our

forward-looking statements will be attained, or that deviations

from them will not be material and adverse. The Company disclaims

any obligation subsequently to revise any forward-looking

statements to reflect events or circumstances after the date of

such statements or to reflect the occurrence of anticipated or

unanticipated events.

Non-GAAP Financial Measures

Myomo has provided in this release of financial information that

has not been prepared in accordance with generally accepted

accounting principles in the United States, or GAAP. This

information includes Adjusted EBITDA. This non-GAAP financial

measure is not in accordance with, or an alternative for, GAAP and

may be different from similar non-GAAP financial measures used by

other companies. Myomo believes that the use of this non-GAAP

financial measures provides supplementary information for investors

to use in evaluating operating performance and in comparing its

financial measures with other companies in Myomo’s industry, many

of which present similar non-GAAP financial measures. Adjusted

EBITDA is EBITDA adjusted for the impact of the write off of

unamortized debt discount associated with conversion of convertible

notes into common stock and warrants, stock based-compensation the

impact of the fair value revaluation of our derivative liabilities

and the loss on early extinguishment of debt. Non-GAAP financial

measures that Myomo uses may differ from measures that other

companies may use. This non-GAAP financial measure disclosed by

Myomo is not meant to be considered superior to or a substitute for

results of operations prepared in accordance with GAAP, and should

be viewed in conjunction with, GAAP financial measures. Investors

are encouraged to review the reconciliation of this non-GAAP

measure to its most directly comparable GAAP financial measure. A

reconciliation of GAAP to the non-GAAP financial measures has been

provided in the tables included as part of this press release.

MYOMO, INC.

CONDENSED STATEMENTS OF

OPERATIONS

Three months endedDecember 31, Twelve

months endedDecember 31, 2017 2016

2017 2016 Revenue $ 547,412 $ 448,093 $

1,558,866 $ 1,103,277

Cost of revenue 203,972

95,830 505,280 282,164

Gross margin

343,440 352,263 1,053,586 821,113

Operating expenses: Research and development 356,867

406,618 1,751,731 1,120,951 Selling, general and administrative

1,802,584 1,042,642 5,849,969 2,975,164

Total operating expenses 2,159,451

1,449,260 7,601,700 4,096,115

Loss from

operations (1,816,011 ) (1,096,997 ) (6,548,114 ) (3,275,002 )

Other expense (income) Loss on early extinguishment of debt

135,244 — 135,244 — Change in fair value of derivative liabilities

(52,429 ) — (116,795 ) — Debt discount on convertible notes — —

5,172,000 — Interest and other expense, net 1,450

114,300 358,916 342,020 84,265

114,300 5,549,365 342,020

Net loss

(1,900,276 ) (1,211,297 ) (12,097,479 ) (3,617,022 ) Deemed

discount – accreted preferred stock discount — (27,185 ) (274,011 )

(108,739 ) Cumulative dividend to Series B-1 preferred stockholders

— (165,473 ) (287,779 ) (658,293 )

Net loss available to common stockholders $

(1,900,276 ) $ (1,403,955 ) $ (12,659,269 ) $ (4,384,054 )

Weighted average number of common shares outstanding: Basic

and diluted 7,559,309 1,124,080 4,317,864

1,060,892

Net loss per share available to common

stockholders: Basic and diluted $ (0.25 ) $ (1.25 ) $ (2.93 ) $

(4.13 )

MYOMO, INC.

CONDENSED BALANCE SHEETS

December 31, 2017 2016

(revised) ASSETS Current Assets: Cash and cash

equivalents $ 12,959,373 $ 797,174 Accounts receivable 297,039

114,506 Inventories 201,155 82,435 Prepaid expenses and other

388,275 152,337 Total Current Assets

13,845,842 1,146,452 Restricted cash 52,000 52,000 Deferred

offering costs — 438,237 Equipment, net 77,150 21,563

Total Assets $ 13,974,992 $ 1,658,252

LIABILITIES,

REDEEMABLE AND CONVERTIBLE PREFERRED STOCK AND STOCKHOLDERS’ EQUITY

(DEFICIENCY) Current Liabilities: Notes payable, shareholder $

— $ 876,458 Notes payable, MLSC, current — 1,193,984 Accounts

payable and other accrued expenses 1,277,236 714,010 Accrued

interest — 149,580 Derivative liabilities 39,930 — Deferred revenue

168,006 67,263 Total Current Liabilities

1,485,172 3,001,295 Convertible promissory notes, net of debt

discount — 2,204,235 Convertible promissory notes, related party —

1,180,000 Accrued interest — 130,937 Deferred revenue, net of

current portion 44,042 — Total Liabilities

1,529,214 6,516,467 Redeemable and Convertible

Preferred Stock: Series B-1 convertible preferred stock — 8,174,693

Series A-1 convertible preferred stock — 4,497,548

Total Redeemable and Convertible Preferred Stock —

12,672,241 Commitments and Contingencies — —

Stockholders’ Equity (Deficiency) Common stock 1,114 112

Undesignated preferred stock — — Additional paid-in capital

47,423,915 5,351,204 Accumulated deficit (34,972,787 ) (22,875,308

) Treasury stock (6,464 ) (6,464 ) Total

Stockholders’ Equity (Deficiency) 12,445,778

(17,530,456 ) Total Redeemable and Convertible Preferred

Stock and Stockholders’ Equity (Deficiency) 12,445,778

(4,858,215 ) Total Liabilities, Redeemable and

Convertible Preferred Stock and Stockholders’ Equity(Deficiency) $

13,974,992 $ 1,658,252

MYOMO, INC.

CONDENSED STATEMENTS OF CASH

FLOWS

For the years ended December 31, 2017

2016 CASH FLOWS FROM OPERATING ACTIVITIES Net loss $

(12,097,479 ) $ (3,617,022 ) Adjustments to reconcile net loss to

net cash used in operations: Depreciation 11,415 7,731 Stock-based

compensation 279,508 94,094 Amortization of debt discount 17,765

5,347 Debt discount on convertible notes 5,172,000 — Inventory

reserve 42,355 — Common stock issued for services and software

license 31,845 — Change in fair value of derivative liabilities

(116,795 ) — Changes in operating assets and liabilities: Accounts

receivable (182,533 ) 1,136 Inventories (161,075 ) 120,588 Prepaid

expenses and other (235,938 ) (38,461 ) Restricted cash — (52,000 )

Deferred offering costs — (431,961 ) Accounts payable and other

accrued expenses 563,225 364,165 Accrued interest 377,503 299,175

Deferred revenue 144,785 44,538 Net cash used

in operating activities (6,153,419 ) (3,202,670 )

CASH FLOWS FROM INVESTING ACTIVITIES Purchases

of equipment (67,002 ) (1,865 ) Net cash used

in investing activities (67,002 ) (1,865 )

CASH FLOWS FROM FINANCING ACTIVITIES Proceeds from

IPO, net of offering costs 4,368,315 — Proceeds from private

placement, net of offering costs 2,922,885 — Proceeds from FPO, net

of offering costs 10,407,706 — Proceeds from convertible promissory

notes, net 1,770,000 2,956,218 Repayment of note payable, MLSC

(1,215,900 ) — Proceeds from exercise of stock options 26,954 2,873

Proceeds from exercise of warrants 102,660 —

Net cash provided by financing activities 18,382,620

2,959,091 Net increase (decrease) in cash and cash

equivalents 12,162,199 (245,444 ) Cash and cash equivalents,

beginning of period 797,174 1,042,618 Cash and

cash equivalents, end of period $ 12,959,373 $ 797,174

MYOMO, INC.

RECONCILIATION OF GAAP NET LOSS TO

ADJUSTED EBITDA

(unaudited)

Three months endedDecember 31, Twelve

months endedDecember 31, 2017 2016

2017 2016 GAAP net loss $ (1,900,276 ) $ (1,211,298 )

$ (12,097,479 ) $ (3,617,022 ) Adjustments to reconcile to Adjusted

EBITDA: Loss on early extinguishment of debt 135,244 — 135,244 —

Interest expense 27,037 117,356 357,122 342,140 Other (income)

expense (25,587 ) (3,056 ) 1,793 (120 ) Depreciation expense 4,430

1,868 11,415 7,731 Stock-based compensation 41,286 21,906 279,508

94,094 Debt discount on convertible notes — — 5,172,000 — Change in

fair value of derivative liabilities (52,429 ) —

(116,795 ) — Adjusted EBITDA $ (1,770,295 ) $

(1,073,224 ) $ (6,257,192 ) $ (3,173,177 )

1 Adjusted EBITDA is earnings before interest, taxes,

depreciation and amortization adjusted the impact of the write-off

of unamortized debt discount associated with conversion of

convertible notes into common stock and warrants, stock

based-compensation, the impact of the fair value revaluation of our

derivative liabilities and the loss on early extinguishment of

debt.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20180316005769/en/

For Myomo:ir@myomo.comorInvestor Relations:PCG

AdvisoryVivian Cervantes,

646-863-6274vivian@pcgadvisory.comorPublic

Relations:GreenoughRachel Robbins,

617-275-6521rrobbins@greenough.biz

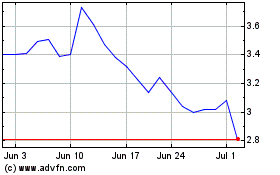

Myomo (AMEX:MYO)

Historical Stock Chart

From Mar 2024 to Apr 2024

Myomo (AMEX:MYO)

Historical Stock Chart

From Apr 2023 to Apr 2024