Principal Real Estate Income Fund Announces Board Approval of New Advisory & New Sub-Advisory Agreements & the Annual Shareho...

March 15 2018 - 6:43PM

Business Wire

Principal Real Estate Income Fund (NYSE: PGZ) (the “Fund”)

announces that on March 15, 2018 the Board of Trustees of the Fund

approved a new investment advisory agreement with ALPS Advisors,

Inc. (“ALPS Advisors”), the Fund’s investment adviser, and a new

sub-advisory agreement with Principal Real Estate Investors, LLC

(“PrinREI”), the Fund’s investment sub-adviser, subject to approval

of such agreements by shareholders of the Fund. The new investment

advisory agreement and new sub-advisory agreement were considered

in connection with the recently announced transaction in which DST

Systems, Inc. (“DST”), the parent company of ALPS Advisors, has

entered into a definitive agreement with SS&C Technologies

Holdings, Inc. (“SS&C”) wherein SS&C will acquire DST (the

“Transaction”). The Transaction, when completed, will result in a

change of control of ALPS Advisors, which may be deemed to result

in an “assignment” of the Fund’s existing investment advisory

agreement and sub-advisory agreement, resulting in their automatic

termination. The Transaction is not expected to impact the

day-to-day operations of the Fund and the portfolio managers of the

Fund will remain the same. Except for the commencement dates, the

new advisory and new sub-advisory agreements have materially the

same terms as the corresponding currently effective agreements.

Completion of the Transaction is subject to a number of conditions.

DST and SS&C currently expect to complete the Transaction

before the end of the second quarter of 2018.

To provide for continuity in the operation of the Fund following

the completion of the Transaction, the Board also approved interim

agreements with respect to each of ALPS Advisors and PrinREI that

will allow the firms to continue to serve in their respective roles

as the Fund’s adviser and sub-adviser for a period of up to 150

days or until the date that shareholder approval of the new

agreements is received.

Accordingly, shareholders of the Fund will be asked to approve

the new investment advisory agreement and new sub-advisory

agreement at the annual meeting of shareholders to be held on May

11, 2018. The record date for the Fund’s annual meeting of

shareholders is March 26, 2018.

The Principal Real Estate Income Fund

The investment objective of the Fund is to seek to provide high

current income, with capital appreciation as a secondary objective,

by investing in commercial real estate related securities. The Fund

had approximately $194.76 million of total assets and 6,899,800

common shares outstanding as of October 31, 2017.

The Fund is a closed-end fund and does not continuously issue

shares for sale as open-end mutual funds do. The Fund now trades in

the secondary market. Investors wishing to buy or sell shares need

to place orders through an intermediary or broker. The share price

of a closed-end fund is based on the market's value.

ALPS Advisors, Inc. is the investment adviser to the Fund.

Principal Real Estate Investors, LLC is the investment

sub-adviser to the Fund. PrinREI is not affiliated with ALPS

Advisors or any of its affiliates.

About ALPS Advisors, Inc.

Through its subsidiary companies, ALPS Holdings, Inc. (“ALPS”)

is a leading provider of innovative investment products and

customized servicing solutions to the financial services industry.

Founded in 1985, Denver-based ALPS delivers its asset management

and asset servicing solutions through offices in Boston, New York,

Seattle, and Toronto. ALPS is a wholly owned subsidiary of Kansas

City-based DST Systems, Inc. For more information about ALPS and

its services, visit www.alpsinc.com. Information about ALPS’

products is available at www.alpsfunds.com.

About Principal Real Estate Investors, LLC

Principal Real Estate Investors advises or subadvises $46.5

billion in real estate assets. The firm’s real estate capabilities

include both public and private equity and debt investment

alternatives. Principal Real Estate Investors is the dedicated real

estate group of Principal Global Investors, a diversified asset

management organization and a member of the Principal Financial

Group®.

In connection with the presentation of the new investment

advisory agreement and new sub-advisory agreement to the Fund’s

shareholders for approval, the Fund intends to file relevant

materials with the Securities and Exchange Commission (the “SEC”),

including a preliminary proxy statement on Schedule 14A. Following

the filing of the definitive proxy statement with the SEC, the Fund

will mail the definitive proxy statement and a proxy card to each

shareholder entitled to vote at the annual meeting. Shareholders

are urged to carefully read these materials in their entirety

(including any amendments or supplements thereto) and any other

relevant documents that the Fund will file with the SEC when they

become available because they will contain important

information. The proxy statement and other relevant materials

(when available), and any and all documents filed by the Fund with

the SEC, may be obtained for free at the SEC’s website at

www.sec.gov.

This communication is not a solicitation of a proxy from any

Fund shareholder. The Fund, its investment adviser and sub-adviser

and certain of their respective directors/trustees, officers and

affiliates may be deemed under the rules of the SEC to be

participants in the solicitation of proxies from shareholders in

connection with the proposals. Information about the investment

adviser and sub-adviser, trustees and officers of the Fund may be

found in its annual reports and annual proxy statements previously

filed with the SEC.

ALPS Portfolio Solutions Distributor, Inc., FINRA Member.

NOT FDIC INSURED | May Lose Value | No Bank Guarantee

View source

version on businesswire.com: http://www.businesswire.com/news/home/20180315006520/en/

DST Global Public RelationsLaura M. Parsons,

+1-816-843-9087mediarelations@dstsystems.com

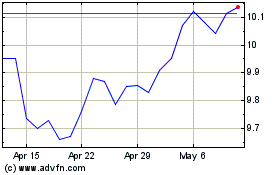

Principal Real Estate In... (NYSE:PGZ)

Historical Stock Chart

From Mar 2024 to Apr 2024

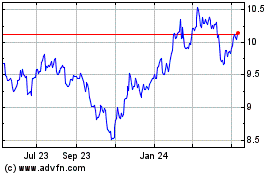

Principal Real Estate In... (NYSE:PGZ)

Historical Stock Chart

From Apr 2023 to Apr 2024